Introduction

A property title report is a crucial document in real estate transactions that provides detailed information about a property's ownership history, legal description, and any encumbrances or liens. This report is essential for real estate professionals to assess ownership status and identify potential risks before proceeding with a transaction. In recent years, the importance of thorough and accurate title reports has been amplified by advancements in technology, such as blockchain and tokenization, which require robust legal safeguards.

Additionally, regulatory developments, like the real estate geographic targeting order (GTO) program, have increased transparency and accountability in the industry. The integration of title reports in real estate transactions, backed by companies like First American Financial Corporation, underscores the industry's evolution and the growing emphasis on digital transformation. Property title reports serve as a beacon, guiding stakeholders through the complexities of real estate transactions and ensuring clarity of ownership and mitigating risks.

Understanding the components of a title report, the title search process, and the role of professionals in conducting title research are vital for successful real estate endeavors.

What is a Property Title Report?

A title report stands as a cornerstone document delineating the intricate details of a real estate's ownership lineage, precise legal description, and any encumbrances or liens that may bear upon it. This report is essential for professionals in the housing industry who need to determine the ownership status and identify any possible risks before proceeding with a transaction. Strengthened by years of industry experience, the importance of such a report is further demonstrated by its role in resolving boundary disputes, establishing precise boundaries, and serving as a crucial tool in the dynamics of the housing market.

Using a wide range of real-world applications, reports on ownership have played a crucial role in situations like assisting Americans in acquiring Akiya properties in Japan, where an initial payment helped in finding suitable countryside homes, in accordance with client requirements. The complexity of accessing tax data across the 3,144 counties in the United States with their disparate policies further underscores the significance of a comprehensive ownership report in navigating the land terrain.

With the introduction of and the tokenization of real-world assets, the significance of guaranteeing that report on ownership rights are comprehensive and precise has never been more pronounced. Since digital tokens symbolize economic and ownership rights, the legal protections and verification procedures encompassed in ownership documentation become even more crucial to safeguard against a range of risks, including deceptive activities by owners of land or buildings.

In recent advancements, the geographic targeting order (GTO) program by FinCEN has expanded to include properties of any worth throughout the country, requiring obligatory reports on transactions without the aid of a loan. The proposed rules also entail the disclosure of beneficial ownership, thus enhancing the transparency and accountability within the industry.

Referring to the significant role of First American Financial Corporation as a prominent supplier of settlement, risk, and ownership solutions, with a reported revenue of $7.6 billion in 2022, the incorporation of such reports in property transactions is crucial. It underscores the industry's evolution and the growing emphasis on digital transformation. The knowledge and skills of agents in the housing industry, supported by their extensive understanding of the market, still have a crucial part to play in utilizing these reports to enable well-informed decision-making and seamless transitions in sales of properties.

In summary, reports on ownership serve as a guiding light, leading stakeholders through the intricacies of real estate transactions, ensuring clarity of ownership, and mitigating transactional risks. Their role in the market is not only practical but fundamental, as they encompass the thorough research and long-term planning necessary for successful property ventures.

Why You Need a Property Title Report

Obtaining a report on the ownership status of a real estate is an essential step in transactions for various reasons. It serves as a pivotal tool in uncovering any possible contention over ownership, including unresolved liens or conflicting claims. This report not only illuminates the marketability of the asset by disclosing any encumbrances that could affect its worth or usability but also serves as a requirement for obtaining insuranceâproviding protection against financial consequences arising from imperfections in the ownership.

For example, in the process of acquiring an Akiya in Chiba Prefecture, Japan, a comprehensive report on the ownership of the real estate played a crucial part for an American client in identifying and comprehending the complete extent and potential risks linked with the rural property they desired. Moreover, according to the First American Financial Corporation, a frontrunner in offering settlement, risk solutions, and property ownership reports, the significance of precise and all-inclusive reports on property ownership cannot be emphasized enough, as it directly affects the security and contentment of all parties involved in real estate transactions.

Navigating through the intricacies of tax records across 3,144 counties in the United States can be challenging, with access to these records varying significantly from state to state, and sometimes requiring an in-person visit. A document summarizing the ownership status streamlines this procedure by compiling essential details and offering a clear understanding of the property's legal position. Moreover, with the advent of blockchain technology, the integration of real-world assets through tokenization has introduced new dimensions of risk that must be addressed, further emphasizing the necessity for thorough ownership reporting to ensure the protection of all parties involved.

Recent regulatory proposals by FinCEN demonstrate the changing landscape of land transactions, with enhanced transparency requirements for transfers across the country. These measures mandate the disclosure of advantageous ownership and other significant details, underscoring the value of a comprehensive ownership report in meeting legal obligations and promoting a transparent real property market.

To sum up, whether it's a land survey to establish accurate boundaries or reducing risks in a digitized housing market, a is essential. It enables informed decision-making, compliance with evolving regulations, and ultimately, the successful navigation of the intricate landscape of ownership.

What Information is Included in a Property Title Report

Understanding the complexities of a is crucial for those engaged in the field of real estate. This document serves as a historical record and provides a snapshot of the premises' current legal standing. It includes important details such as the name of the rightful owner, the precise legal description of the premises, and a list of any liens, encumbrances, or easements that may be attached. Additionally, it discloses any covenants or conditions that could impact the utilization of the premises.

For instance, think about a scenario where an individual is looking to acquire a rural estate in Japan. They would undertake a thorough search, investing both time and financial resources to identify suitable assets that align with their criteria. The report for such properties would be crucial in determining the legitimacy of ownership, identifying any outstanding debts, and ensuring there are no legal hindrances that could jeopardize the investment.

Likewise, in a contentious dispute over ownership of a possession, where two parties assert rights over an asset due to unclear legal ownership, a comprehensive examination of the title report can clarify the legal position and assist in resolving the issue effectively.

Moreover, recent developments in real estate regulations emphasize the importance of transparency in transactions. New rules require the disclosure of all cash purchases, regardless of the value of the asset, and necessitate comprehensive reports to unveil beneficial ownership to prevent illicit activities.

To differentiate between a name and a document of ownership - the name indicates legal possession, while the document is a tangible record that transfers ownership of assets from one party to another. It's important to grasp that having a title is equivalent to legal ownership, and without it, one cannot assert legal ownership of a possession.

A land survey, often initiated during a sale, is a systematic process of measuring and delineating land boundaries. It is conducted by a certified surveyor and is crucial for establishing boundaries and comprehending the land's physical characteristics. This meticulous process is essential for avoiding conflicts between neighbors and ensuring clarity in ownership rights. As highlighted by experts, this examination is essential to confirming the exact location of lines, which is often a crucial concern for prospective buyers.

In essence, an ownership document is more than just a record; it is a comprehensive guide that reveals the past and present legal status of a real estate, enabling informed decision-making and safeguarding against potential risks associated with ownership and transfer.

Understanding the Components of a Title Report

Comprehending the complexities of ownership in the domain of landed possessions is crucial, as the differentiation between titles and deeds plays a significant part. Unlike a deed, which is a document that lists the owner of a possession, the term 'title' signifies legal ownership. It is an abstract concept that confirms one's legitimate claim to a piece of real estate, whether as an individual, business, or nonprofit entity. Owning the rights to a piece of land is crucial as it is the ultimate proof of one's legal ownership. In the absence of a name's ownership document, the legal ownership is not established, which may hinder any intentions to improve or boost the asset.

A title report is a compilation of crucial information that reveals the legal status and history of ownership. Key elements of this report include Schedule A, which details the current owners and their interest in the land; Schedule B, listing any existing encumbrances such as liens or easements; and Schedule C, which provides a precise legal description of the property's boundaries and dimensions. This data is vital for identifying any possible problems that could impact a transaction, guaranteeing that property professionals are well-informed.

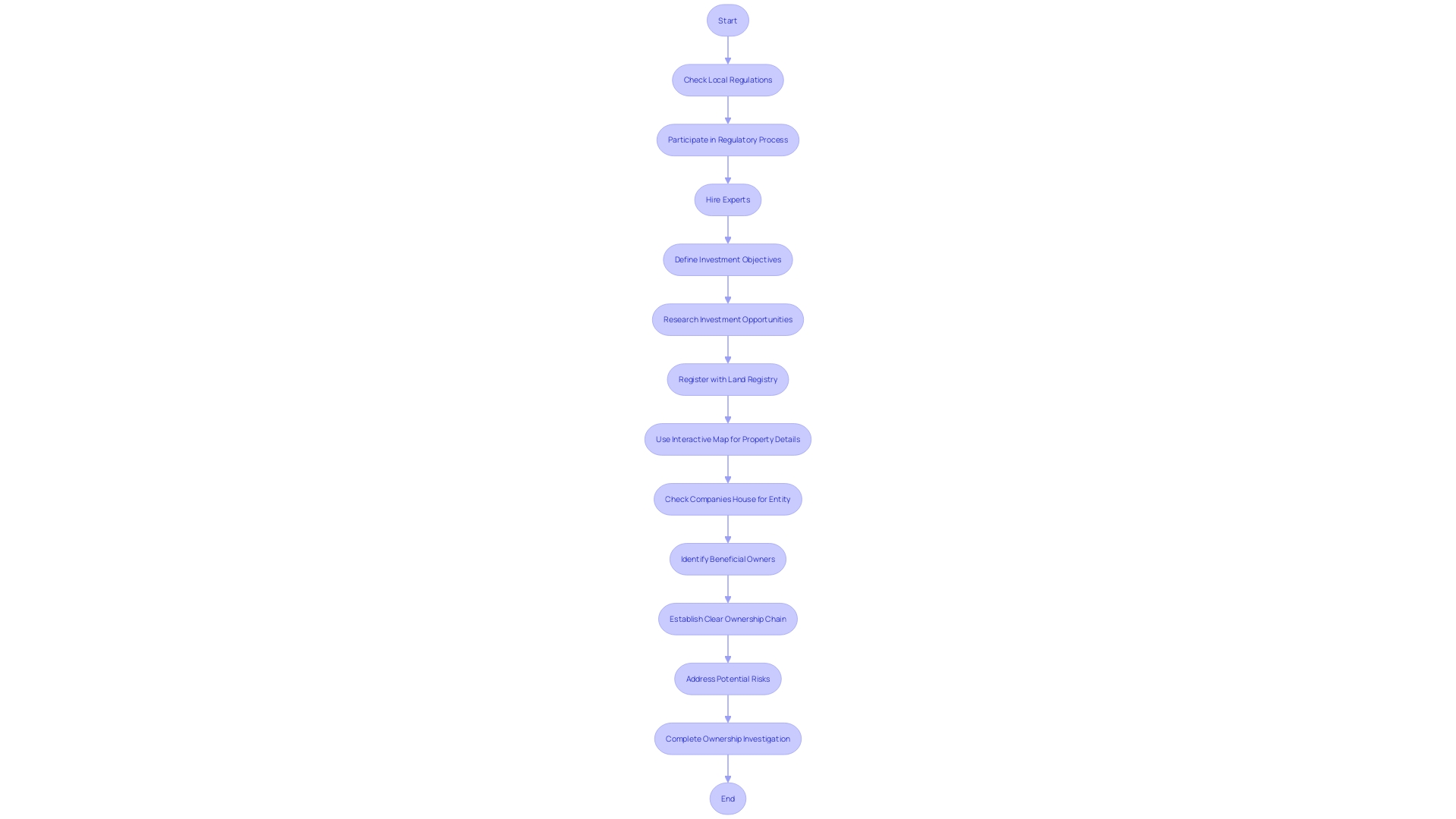

Recent regulatory developments emphasize the significance of thorough reporting on property ownership. The expansion of the GTO program by FinCEN now requires detailed reporting for all real estate transactions regardless of value, emphasizing the significance of accurate name examination and reporting. This includes identifying beneficial owners and any changes in property ownership, whether through sale, gift, or inheritance. The thoroughness of a report on property ownership, therefore, becomes a crucial element in adhering to these regulations and avoiding legal pitfalls.

Property transactions depend on the clarity and accuracy of the information within reports about ownership. With the industry's digital transformation led by companies like First American Financial Corporation, which reported revenues of $7.6 billion in 2022, the integration of such as GIS and database systems has made research on property ownership more precise and efficient. These technologies enable a deeper comprehension of jurisdictional, asset, and environmental data, empowering professionals with the knowledge necessary to navigate the intricacies of ownership and guarantee adherence to laws like Daniel's Law that safeguard personal information.

To sum up, a document on ownership is not merely a compilation of legal papers -- it is a thorough resource that clarifies the possession and legal condition of land. It provides a foundation for secure real estate transactions, compliance with regulatory requirements, and the assurance that comes with confirmed ownership of a piece of land.

The Title Search Process

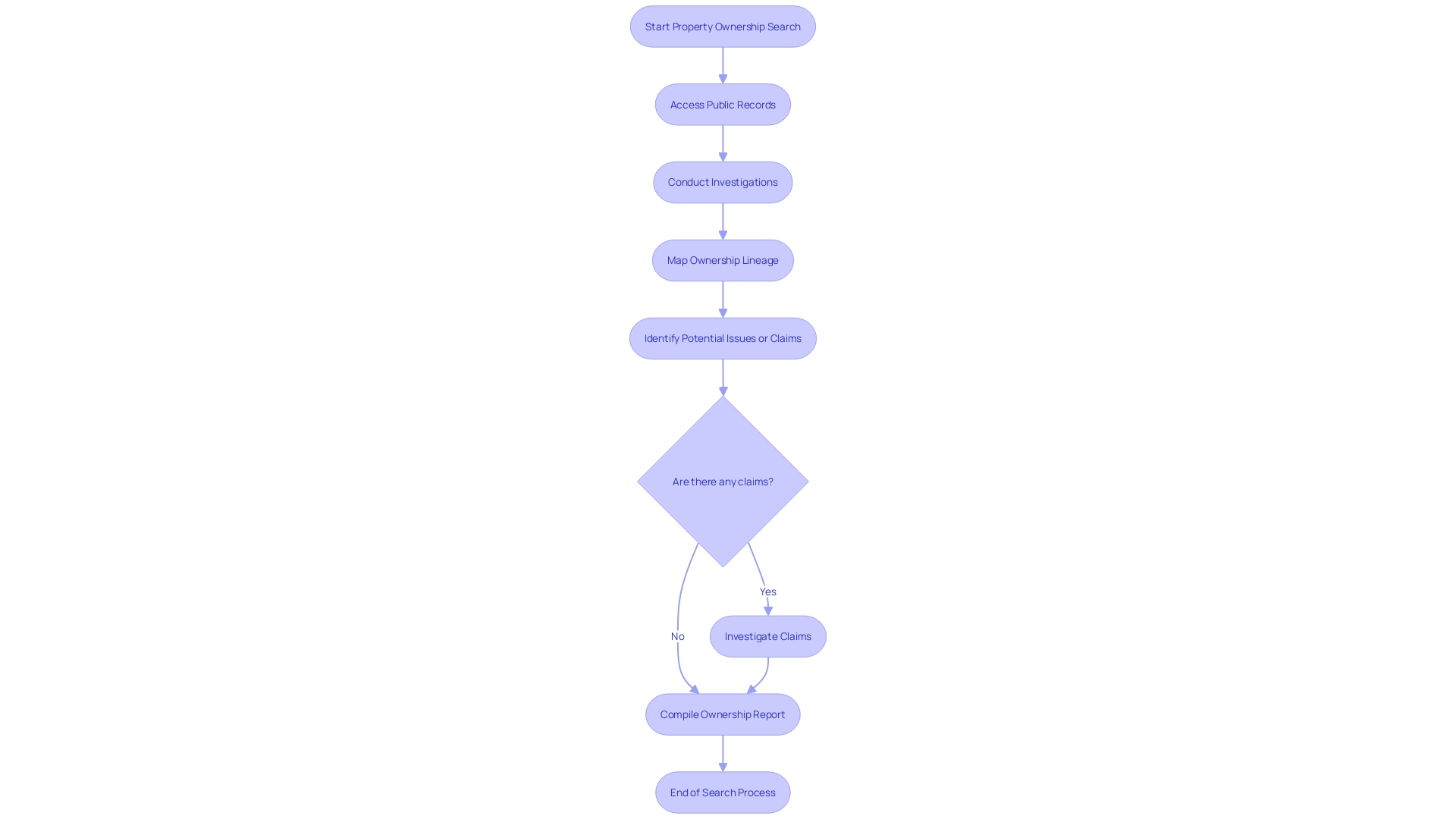

Starting a search for a name is a complex procedure, crucial to generating a thorough report on a property's ownership. This thorough investigation delves into public records, encompassing deeds, mortgages, and court documents, to meticulously map out the ownership's lineage and pinpoint any lurking issues or claims that could jeopardize the transaction. Mastery of this process is not just about expertise but also hinges on having access to extensive databases that provide the necessary depth of historical information.

An ownership document, distinct from a deed, is the cornerstone of possession. It denotes legal ownership without the need for a physical contract. Having legal control over an asset indicates that a person, corporation, or entity has legitimate authority, which is important because without the ownership document being in the correct name, legal possession is uncertain. First American Financial Corporation, a leader in the field of title and settlement solutions, champions the significance of precise research of property ownership, leveraging its vast resources and expertise to support real estate professionals in navigating these complexities.

The significance of a cannot be overstated, as it empowers owners to make informed decisions about updates or improvements. It assures that any future actions are grounded on a clear understanding of ownership boundaries. As emphasized by Curtis Sumner, executive director emeritus of the National Society of Professional Surveyors, comprehending limits of land is essential, whether setting new boundaries or verifying existing ones. In the fast-paced real estate sector, where professionals are increasingly seeking impactful and meaningful work, tools that streamline and enhance the efficiency of processes like document search are invaluable. The integration of advanced solutions such as Fifth Dimension Ai's Ellie is transforming the industry by significantly reducing the time spent on repetitive tasks, allowing professionals to focus on their core expertise and drive the industry forward.

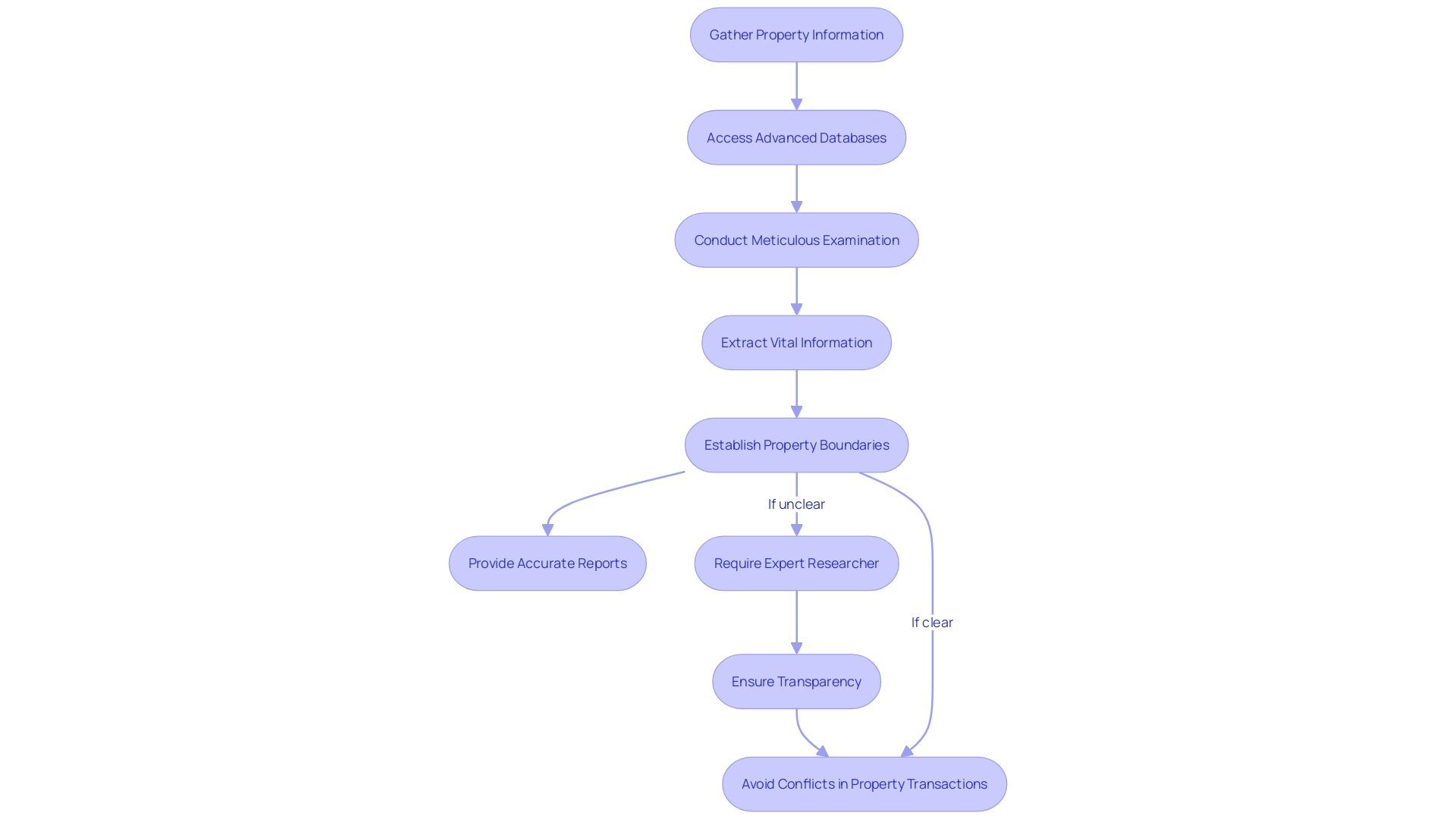

Hiring a Professional

Opting for a can be a strategic move that not only saves time but also ensures the meticulous examination of property titles. These experts bring a wealth of knowledge and have access to advanced databases that can expedite the search process. Their skill in sorting through extensive records allows them to extract vital information efficiently. The accuracy of a professional in establishing distinct property lines is reflected in the insights from property experts, who highlight the importance of precisely identifying property boundaries to avoid conflicts and ensure transparency for transactions. For example, Schroder, a seasoned investor in properties, emphasizes the significance of an agent's deep understanding of the market, which is mirrored in the researcher's expertise in navigating the complexities of document titles. The significance of such precision is highlighted by the reality that prominent companies in the sector, such as First American Financial Corporation, recorded a revenue of $7.6 billion in 2022, demonstrating the crucial function of dependable data in property transactions. As companies in the investment sector for properties increasingly place importance on recruiting individuals with extensive knowledge of the product, the significance of a researcher who can provide accurate and reliable reports on ownership becomes even more crucial.

Investigating Ownership History (Chain of Title)

'Investigating the ownership history of a real estate asset is a crucial component of a title search, often referred to as the chain of ownership.'. This meticulous process involves retracing ownership transfers from the present holder to the original recorded transaction. Examining the sequence of ownership is essential for real estate experts, as it aids in uncovering any inconsistencies or abnormalities that may indicate potential disputes or inadequacies in the ownership. The importance of a clear and unbroken chain of ownership cannot be emphasized enough, as shown by a case study involving an American client looking to acquire real estate in the Chiba Prefecture. The client's journey started with an initial investment and a detailed consultation to identify ideal assets, illustrating the complex steps involved in guaranteeing a solid ownership history.

Property transactions are not merely about buying and selling; they encompass a broad spectrum of activities including land development and construction. As such, it's crucial for these transactions to be transparent and secure, especially considering the Canadian real estate sector's susceptibility to money laundering and tax evasion, as outlined in Canada's Updated Assessment of Inherent Risks of Money Laundering and Terrorist Financing. The process of maintaining an untarnished chain of ownership is further complicated by the potential for fraudulent actions, as highlighted by real-world asset tokenization on blockchain platforms. Tokenization introduces a new layer of complexity, with risks of network failures and cyber threats, necessitating robust legal frameworks to protect token holders.

The significance of a clear chain of title is underscored by the challenges faced when a piece of real estate is inherited without a will, known as heirs' property. This situation can lead to complications in establishing clear ownership, particularly impacting low- to moderate-income communities. According to the American Land Title Association, it is crucial to address heirs' assets for wealth building. Moreover, recent news articles, like the one covered by Newsweek, demonstrate the dangers unmarried couples encounter when co-owning assets without formal legal agreements, emphasizing the significance of transparent and legally enforceable ownership arrangements.

Considering these aspects, experts in the housing industry need to be attentive in their investigation of ownership rights to avoid deceit and guarantee the consistency of the ownership sequence. With the real estate industry undergoing , as evidenced by First American Financial Corporation's innovation in investigation and settlement solutions, the necessity for careful investigation continues to grow. This transformation is not only reshaping the industry but also reaffirming the crucial function that a thorough search plays in safeguarding real estate transactions.

Looking for Easements or Restrictions

Recognizing easements and restrictions is a crucial part of the title search procedure as they are legal conditions that can greatly impact a property's usefulness and worth. For example, easements may grant utilities the right to use parts of the land for their infrastructure needs, which could affect future development plans. Restrictions, on the other hand, can stem from zoning laws or homeowners association rules, imposing specific conditions on occupancy, such as requiring that a resident works a certain number of hours within the local community or limiting lease durations.

Take, for example, a recent case in Eagle County where housing units mandated continuous occupation by a 'qualified resident,' defined as someone engaged in local business for a set number of hours or earning a majority of their income from within the county. This restriction not only dictated the nature of tenancy but also placed a cap on the length of lease terms, highlighting the can introduce into real estate transactions.

Moreover, the importance of understanding conservation easements cannot be overstated. Often, these easements are less financially lucrative than the potential development of the land. They are dealt with by establishing the value of the asset as if it were developed, and then compensating the landowner for not pursuing such opportunities. This compensation may be through direct financial payment or tax benefits, with conservation-focused organizations typically providing the necessary funds.

Past instances, such as the censure of Bruce's Beach in California, highlight the enduring effect of legal actions on ownership rights and demonstrate the crucial importance of thorough research in protecting against such eventualities. A thorough understanding of the land's history and current encumbrances is indispensable in these scenarios.

In essence, a property survey is indispensable in delineating precise boundaries and identifying the physical characteristics of the land, which is essential to resolve or prevent disputes over property lines. Collectively, these examples and considerations underscore the complexity and significance of identifying easements and restrictions during the search process.

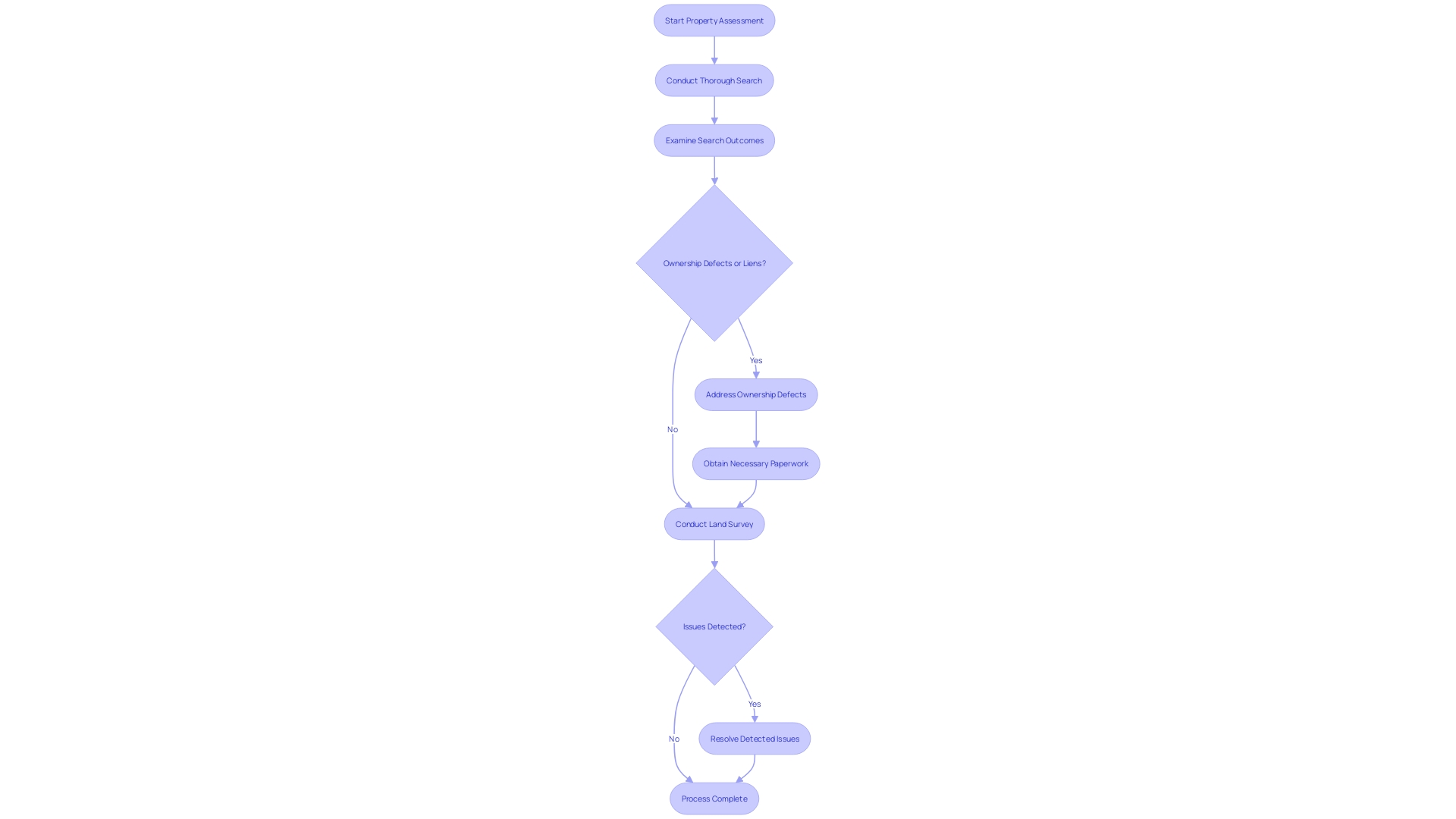

Reviewing and Resolving Issues

After finishing a thorough search of the document, it's crucial to carefully examine the outcomes, dealing with any identified issues that have come up. Addressing any defects in the ownership documentation, resolving any outstanding liens, or obtaining the necessary paperwork to confirm clear ownership are crucial steps in this process. The process is similar to a survey, as described by experienced Realtors, which is crucial in identifying the exact boundaries of your linesâvital information for potential buyers. Such a survey, carried out by a qualified land surveyor, maps out the land's boundaries and features, using specialized tools to provide accurate data.

The significance of precise information about the ownership of a property cannot be emphasized enough, especially considering recent events where the Venezuelan crime gang Tren de Aragua's activities in Colorado and Texas have highlighted the potential for real estate to be exploited for illicit activities. This emphasizes the need for to prevent such misuse.

A thorough examination of the search results can prevent conflicts regarding property boundaries, guaranteeing that all parties are informed of their rights and limitations. This is backed by the insights of First American Financial Corporation, a top provider of settlement and closing solutions, which highlights the crucial importance of precise information in property transactions.

When issues are detected during the inspection phase, such as those identified during home inspections that can reveal costly concerns like roof or HVAC issues, addressing these findings promptly and effectively is crucial. The average cost of roof replacement, for example, can be around $10,000—a significant expense that underscores the necessity for thorough inspections and resolutions.

Considering these factors, this part will guide you through the procedure of assessing search results and provide you with suggestions to handle any problems that may arise, utilizing both the practical expertise of professionals in the field and the most recent advancements in the property sector.

The Role of Title Insurance

Title insurance is a necessary protection in transactions involving land, offering a shield against possible monetary damages arising from defects in ownership, disagreements about ownership of land, or undisclosed legal claims. It's the bedrock that ensures the protection of one's real estate investment. Exploring the complexities of insurance for ownership, we acknowledge its crucial function in reducing the hazards linked to real estate transactions. Insurance policies are crafted to offer both buyers and lenders assurance against past discrepancies and future legal issues regarding titles.

The industry, strengthened by organizations like First American Financial Corporation, has developed to incorporate advanced proprietary technologies and comprehensive data assets, driving a digital transformation across the sector. With a rich heritage exceeding 130 years, in this sphere have also expanded their offerings to include valuation products and services, mortgage subservicing, and home warranty products, generating revenues upwards of $7.6 billion in 2022 alone. This sector not only guarantees transparent ownership rights but also works diligently to resolve potential property issues before they escalate into claims, as shown by the significantly lower claim rates compared to other forms of insurance.

In the dynamic landscape of real estate, where Americans annually spend around $100 billion on real estate commissions alone, the industry stands as a crucial player in the transaction process. The knowledge and guidance offered by professionals in this field is invaluable, especially in intricate transactions like the Akiya purchase case in Chiba Prefecture, where a deep understanding of the intricacies of property ownership is crucial. As we navigate through the complexities of starting and operating a successful company, it's clear that meticulous planning, attention to detail, and a robust understanding of the market are the cornerstones of establishing a reputable and reliable enterprise in this field.

How to Read and Understand a Title Report

Understanding the intricacies of a report on property ownership is a vital skill for professionals in the real estate industry. Having a name representing legal acknowledgment of ownership, it is different from a deed which is simply a document indicating the owner. Understanding the intricacies of , document formats, and the intricacies within the information given is essential for assessing the viability and marketability of a real estate asset. This extensive guide will explain how to analyze a report, highlight possible warning signs, and assess the marketability of real estate assets.

A document known as a title report is a pivotal instrument that reveals the legal ownership of a possession, and it is fundamental to verify that the ownership is correctly recorded in the name of the individual, business, or nonprofit that claims ownership. The absence of a legally recognized document invalidates the claim of ownership. Given the spectrum of records storage policies across 3,144 counties in the United States and the varying degrees of access to property tax information, the task of title research can be daunting. It involves meticulous scrutiny of data that may span over a century, as companies like First American Financial Corporation, with a robust history and revenue of $7.6 billion in 2022, have mastered.

The rise of property tokenization, with an estimated market expansion from US$ 3.8 Billion in 2024 to US$ 26 Billion by 2034, demonstrates the industry's digital revolution. Tokenization provides a resolution to the historically illiquid property market by allowing partial ownership and improving data transparency. This contemporary method of property transactions is different from the traditional, frequently burdensome procedure filled with documentation and substantial financial investment.

Incorporating insights from real-world applications, such as the Akiya acquisition in Chiba Prefecture, provides a tangible framework for understanding the research process. These case studies underscore the importance of clear communication and client-oriented service to navigate complex transactions, reflecting the value of expertise in the evolving landscape of real estate.

Encumbrances on Title

Encumbrances on title encompass a variety of claims, liens, or limitations that may impact ownership of a real estate. Unpaid taxes, existing mortgages, easements, and restrictive covenants are examples of such burdens that must be identified and understood to evaluate the marketability and associated risks of an estate. Titles are pivotal, as they are the definitive representation of legal ownership, distinct from a property deed, which is the document that lists the owner. The name itself is not a physical document but a concept signifying legal ownership by an individual or entity. Without the designation in one's name, legal ownership is not established. For this reason, the complexities of reports concerning ownership are important in verifying a clear transfer of rights.

From the historical perspective, ownership is often assumed to be documented in a government database similar to bank records. However, this is not the situation in the United States, where producing a conclusive document as evidence of ownership is not operationally feasible. This distributed versus centralized database design in ownership rights is an intriguing detail that highlights the intricacy of research on legal ownership. The ownership claim comprises rights, commitments, and contracts, including the sometimes challenging interpretation of easements versus encroachments and restrictive covenants from bygone eras.

Recognizing the importance of accurate information about the names or labels of things, companies like First American Financial Corporation have positioned themselves as leaders in providing title, settlement, and risk solutions for real estate transactions. With a history spanning over 130 years and revenues reaching $7.6 billion in 2022, First American exemplifies the industry's digital transformation, offering services directly and through agents both domestically and internationally. The comprehension and control of encumbrances are therefore crucial in protecting the integrity of ownership and guaranteeing the smooth transfer of ownership rights.

Liens

Liens represent one of the most critical elements to be aware of during a search for property ownership. They are claims or charges on an asset that arise due to various obligations or debts not being met. These can include, but are not limited to, unpaid taxes, outstanding mortgages, court judgments, or mechanic's liens. The existence and kind of lien can greatly affect the marketability of a piece of land as well as a potential buyer's ability to obtain a clean title.

Understanding the specifics of the lien is essential, and begins with recognizing that liens can be , such as those taken out by a homeowner in the form of a mortgage, or in. Involuntary liens, such as those resulting from unpaid contractor work or tax delinquencies, can be particularly troublesome. For example, a mechanic's lien is a claim made by contractors or subcontractors who have performed work on a real estate and have not received payment. This type of lien is relatively easy to file and can become a legal obligation for the new property owner if not properly addressed.

Undisclosed liens are particularly troublesome as they may not be immediately apparent during standard searches for ownership. These can occur due to oversight or intentional fraud, leaving the new owner liable for old debts. The frequency of such problems is emphasized by alarming statistics; for instance, insurance company FCT noted that insurance or mortgage fraud attempts happen approximately every four business days in Canada, declining to insure $539 million in transactions considered suspicious over a two to three-year period.

To navigate these complexities, professionals in the field leverage comprehensive reports and services. Companies like First American Financial Corporation, with a history of over 130 years, offer robust title and settlement solutions. They've been recognized for their innovation and workplace excellence, affirming their role in guiding industry standards.

The process of resolving liens typically involves paying the outstanding debt or challenging the lien's validity. However, the approach may vary depending on the type of lien and the jurisdiction. It is crucial for those involved in real estate transactions to be aware of the potential for liens and have a strategy for addressing them to ensure the security and legality of the transfer.

Easements

Easements represent a crucial element in land law, granting the right to use land owned by someone else for a specific purpose. These legal rights can considerably affect the use and development of land. For instance, a conservation easement is an agreement that limits the use of land to safeguard its ecological, aesthetic, or cultural attributes, ensuring its preservation for future generations. Such easements are individually customized, taking into account the unique characteristics of the premises and the owner's intentions, while potentially providing tax benefits and incentives.

In the realm of real estate, varying forms of easements exist, like utility easements that allow for infrastructure such as power lines, or right-of-way easements granting passage across land. Understanding these rights is not only about recognizing the but also the restrictions they impose. For instance, a right-of-way easement suggests that the holder cannot regulate the landowner's land but can hinder specific uses of it by the landowner, guaranteeing the easement's usefulness is preserved.

The importance of easements and their influence on ownership and value is highlighted by recent legal disputes, like the case involving the City of Eagle, where owners contested a development agreement they were unaware of, which had not been properly recorded. Furthermore, the conviction of individuals for fraud related to conservation easements highlights the importance of due diligence in these legal agreements.

Real estate professionals, such as Realtors, highlight the significance of surveys to ascertain accurate boundaries of the premises, which is crucial for any potential transaction. Surveys establish legal boundaries, record land characteristics, and help mitigate disputes between neighbors. These surveys become especially important when easements are involved, ensuring all parties are aware of the rights and limitations affecting the premises.

In general, easements are a vital aspect of the law related to properties that demands thorough evaluation during the title search procedure, as they can determine the scope of rights associated with a piece of land and impact choices concerning land development, conservation, and ownership.

Restrictions and CC&Rs

Comprehending limitations and covenants, conditions, and restrictions (CC&Rs) is essential for real estate professionals when evaluating a real estate's marketability and ensuring compliance with all relevant regulations. These legal limitations can greatly impact how a real estate can be utilized, maintained, or developed. For example, homeowner associations or zoning regulations may impose specific constraints that affect the valuation and potential usage of real estate. A practical understanding of common limitations and CC&Rs found in title reports is crucial for navigating the complexities of property transactions.

A case in point involves a property in Drexel Hill, Philadelphia, which, while possessing character and potential due to recent upgrades and a waterproofed but unfinished basement, still required careful consideration of local zoning laws and potential CC&Rs that could affect renovation plans or future development. Similarly, the zoning reform efforts in Minneapolis showcase how engagement with diverse community voices can lead to more inclusive and less restrictive zoning policies, which may have a significant impact on building and housing prices. In contrast, in the Netherlands, stringent housing regulations have led to a shortage of housing, affecting affordability and availability.

Recent legislative changes, such as those introduced under the Trust in Property Services Act (TRESA) in Ontario, aim to enhance consumer protection by improving disclosure requirements, updating the Code of Ethics for property practitioners, and granting new powers to regulatory bodies. These within the property sector.

Considering the prevailing market conditions for properties, which have witnessed the biggest increase in transactions compared to last year since August, experts must stay alert to the constantly changing environment. Property markets have demonstrated resilience, but with significant decreases in actual house prices across different economies, it's evident that a profound comprehension of market dynamics and regulatory frameworks is vital. While some countries still experience growth in housing prices, others face declines, emphasizing the importance of market-specific knowledge.

Thus, professionals in the property industry must remain updated on legislative changes, market trends, and the complexities of development agreements to successfully navigate the market. With the right balance of knowledge and skill, real estate professionals can leverage these tools to their advantage, ensuring successful transactions and satisfied clients.

Special Exceptions and Part II Schedule B

Exceptional exclusions are an essential component of policy coverage, as they outline the specific rights or interests that are not included. These could range from tenants' rights and mineral rights to various other encumbrances. The exclusions are meticulously listed in Part II Schedule B of a report. For real estate professionals, grasping the nature and implications of these exceptions is imperative for evaluating the risks associated with a property and ascertaining its marketability. This part explores the .

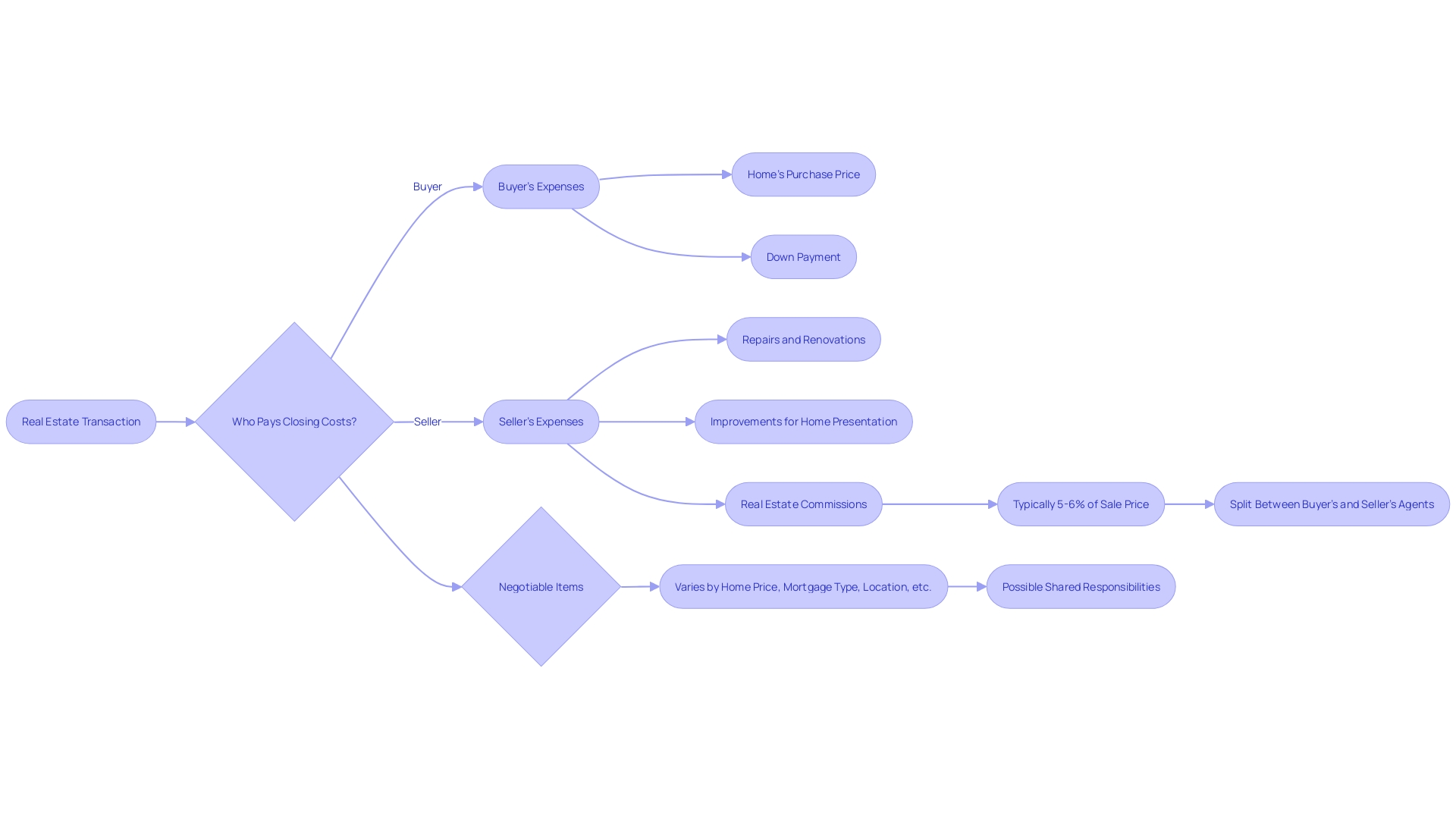

Who Pays for the Preliminary Title Report?

Deciding the party accountable for the expenses linked to a preliminary report can be influenced by local customs and the specific terms agreed upon in the purchase contract. In certain instances, the expense falls on the buyer, while at other times, there may be room for negotiation between the buyer and seller. It's crucial for those involved in real estate transactions to comprehend these nuances to facilitate a seamless exchange. Scenarios can differ greatly, and it is not unusual for the purchaser to assume this financial obligation, particularly considering the significance of and guaranteeing the absence of any legal problems with the property deed. On the flip side, sellers might also assume this cost to guarantee a clear ownership rights to prospective buyers, thereby expediting the sale process. Given the complexity and the high stakes involved in property transactions, which are underscored by the expansive services and solutions provided by industry leaders like First American Financial Corporation, understanding who covers the initial document outlining ownership rights is more than a mere formality; it's a fundamental step in safeguarding the interests of all parties involved. Significantly, First American, with a reported total revenue of $7.6 billion in 2022, showcases the importance of thorough examination of property ownership and the worth such careful investigation contributes to the property process. This thorough method of verification for property ownership is not just an indicator of the norms in the field but also a demonstration of the attention and accuracy that professionals in the housing industry need to use in order to guarantee successful deals.

Common Ways a Title Report Can Be Held

Comprehending ownership structures is essential for efficiently managing real estate assets and maneuvering through the intricacies of title reports. Different types of possession, like exclusive possession, co-tenancy, and shared tenancy, have clear consequences for the management, transferability, and financial obligations linked to a possession. Sole ownership is straightforward, where a single individual holds complete control over the asset. Tenancy in common allows multiple individuals to own together, with each having an undivided interest that can be transferred independently. Joint tenancy, on the other hand, features a right of survivorship, meaning that upon the death of one owner, their interest automatically passes to the remaining joint tenants. These various ownership types not only affect the day-to-day management of a property but also have a significant impact on and can affect the legal and financial results for the owners. Thus, a clear understanding of each structure is essential when analyzing title reports to ensure accurate and compliant real estate transactions.

Conclusion

In conclusion, property title reports are essential in real estate transactions. They provide crucial information about a property's ownership history, legal description, and any encumbrances or liens. These reports are vital for assessing ownership status and identifying potential risks before proceeding with a transaction.

Advancements in technology, like blockchain and tokenization, have increased the need for accurate and thorough title reports. These technologies require robust legal safeguards to protect against risks and fraudulent actions. Regulatory developments, such as the real estate geographic targeting order (GTO) program, have also enhanced transparency and accountability in the industry.

The integration of title reports in real estate transactions, supported by companies like First American Financial Corporation, signifies the industry's evolution and the growing emphasis on digital transformation. Property title reports serve as a guiding beacon, navigating stakeholders through the complexities of real estate transactions and ensuring clarity of ownership while mitigating risks.

Understanding the components of a title report, the title search process, and the role of professionals in conducting title research are crucial for successful real estate endeavors. Professionals in the field play a vital role in utilizing these reports to facilitate informed decision-making and smooth property sales.

In summary, property title reports are comprehensive tools that illuminate the ownership and legal status of real estate. They provide a solid foundation for secure transactions, compliance with regulations, and the assurance of confirmed property ownership. As the industry continues to undergo digital transformation and reliable data becomes increasingly important, meticulous title investigation remains essential to uphold the integrity of property transactions.

Frequently Asked Questions

What is a Property Title Report?

A Property Title Report is a document that provides detailed information about the ownership history of a real estate property, including the legal description, ownership lineage, and any encumbrances or liens affecting the property. It is essential for real estate professionals to assess ownership status and identify potential risks before a transaction.

Why do I need a Property Title Report?

Obtaining a Property Title Report is crucial to uncover any ownership disputes, unresolved liens, or conflicting claims. The report also helps determine the marketability of the asset and is often required for obtaining insurance, protecting against financial repercussions from ownership imperfections.

What information is included in a Property Title Report?

A Property Title Report typically includes the name of the rightful owner, legal description of the property, any liens, encumbrances, or easements, and covenants or conditions impacting property use.

How is a Property Title Report created?

A Property Title Report is generated through a title search, which involves examining public records like deeds, mortgages, and court documents to trace ownership history and identify any issues that may affect the property.

What are the key components of a Title Report?

Key components of a Title Report include Schedule A (current owners and their interests), Schedule B (existing encumbrances like liens or easements), and Schedule C (legal description of property boundaries).

What are encumbrances on title?

Encumbrances are claims or limitations on a property that can affect ownership rights, including unpaid taxes, mortgages, or easements. They must be identified to assess the property’s marketability and associated risks.

What are liens?

Liens are legal claims on a property due to unpaid debts, such as taxes or mortgages. They can significantly impact the marketability of the property and the buyer’s ability to obtain a clear title.

What are easements?

Easements are legal rights to use another person's land for a specific purpose, which can greatly affect property use and development. Examples include utility easements or conservation easements.

What are restrictions and CC&Rs?

Restrictions and Covenants, Conditions, and Restrictions (CC&Rs) are legal limitations that can affect how a property can be used or developed, often imposed by homeowner associations or zoning laws.

Who pays for the Preliminary Title Report?

The party responsible for the costs associated with the Preliminary Title Report can vary based on local customs and the terms of the purchase contract. It may be the buyer or seller, depending on negotiations.

What are the common ownership structures reflected in title reports?

Common ownership structures include Sole Ownership (one individual holds full control), Tenancy in Common (multiple individuals own undivided interests), and Joint Tenancy (features a right of survivorship).

How does blockchain technology impact Property Title Reports?

Blockchain technology introduces new dimensions of risk and verification in property ownership documentation, emphasizing the need for comprehensive ownership reports to protect against fraudulent activities.

What role does title insurance play in real estate transactions?

Title insurance protects against financial losses arising from defects in ownership or undisclosed legal claims, ensuring the security of real estate investments. It is essential for both buyers and lenders in transactions.

How do I read and understand a Title Report?

Reading a Title Report requires familiarity with legal terms and document formats. Key elements to analyze include the names of owners, any encumbrances listed, and the legal description of the property to assess its marketability.

What should I do if issues are identified in a Title Report?

If issues are identified, it’s critical to address them promptly, which may involve resolving outstanding liens, correcting ownership documentation, or conducting further legal inquiries to ensure clear ownership.

How can I hire a professional for a Property Title Report?

Hiring a professional title researcher can save time and ensure thorough examination. These experts possess extensive knowledge and access to advanced databases, streamlining the title search process.