Overview

AI is revolutionizing real estate investing today by streamlining processes, enhancing property valuations, and improving customer engagement through advanced technologies such as machine learning and predictive analytics. This transformation is exemplified through various companies, demonstrating how AI applications result in more efficient operations, informed decision-making, and increased profitability within the real estate sector.

Introduction

AI is not merely a passing trend; it is fundamentally reshaping the landscape of real estate investing. By integrating advanced technologies, industry leaders are unlocking unprecedented levels of efficiency, accuracy, and profitability. This article explores ten transformative ways AI is revolutionizing real estate investing today, from enhancing property valuations to streamlining title research and improving customer service. As the sector navigates the complexities of modern investment strategies, the pressing question remains: how can investors leverage these AI advancements to outpace their competitors and secure their financial futures?

Parse AI: Revolutionizing Title Research with Machine Learning

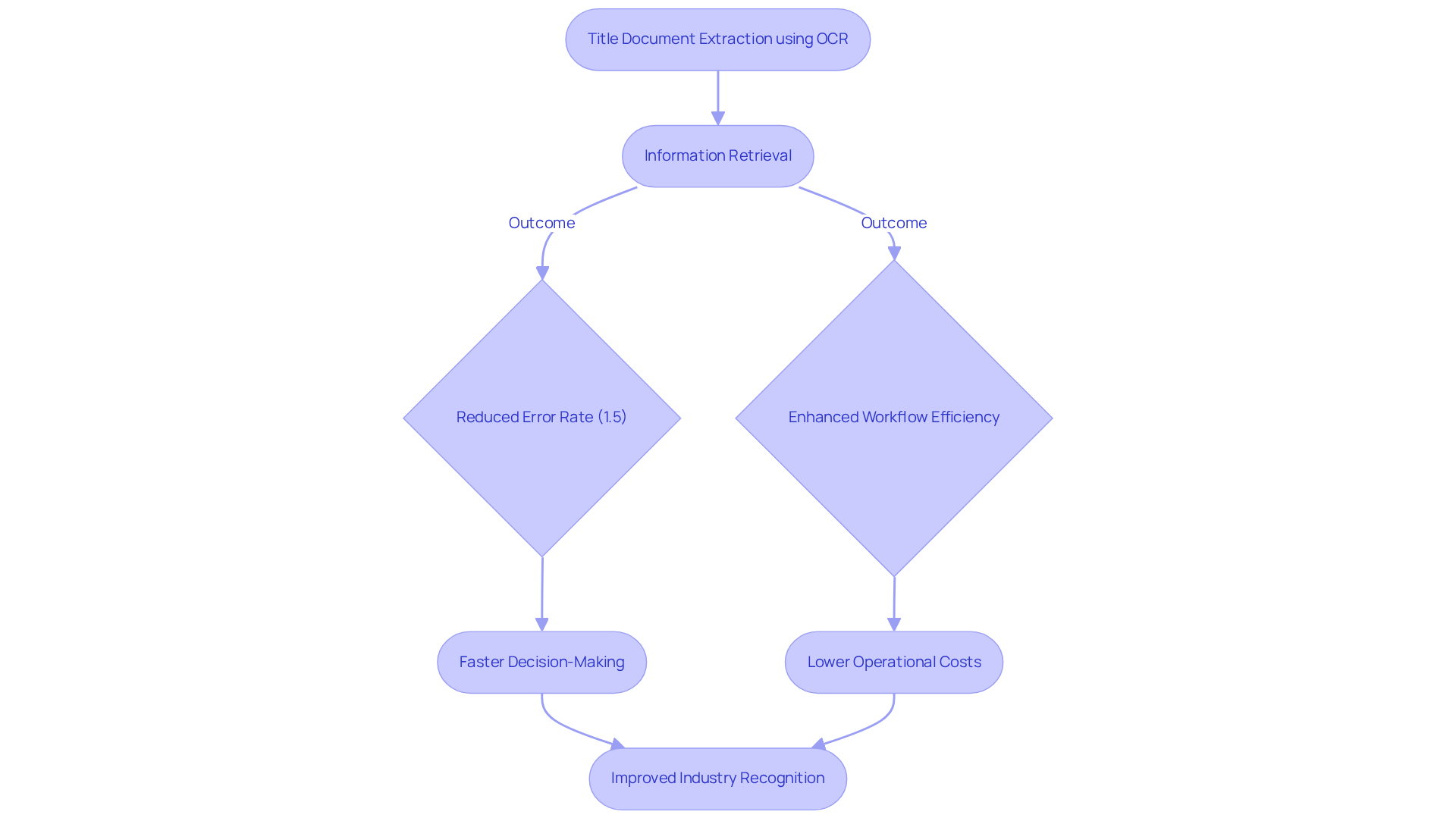

Parse AI harnesses advanced machine learning algorithms and optical character recognition (OCR) to extract essential information from extensive title documents, significantly streamlining the process of confirming property ownership. This accelerates the production of abstracts and reports while enhancing their accuracy, thus dramatically reducing the time and capital traditionally required for title research.

Studies indicate that the observed error rate in OCR processes can be as low as 1.5%, with retrieval accuracy significantly impacted starting at a 5% error rate. Furthermore, by collaborating with land service experts, Parse AI effectively addresses prevalent industry challenges, resulting in improved workflow efficiency for property professionals.

Case studies demonstrate how this automation has revolutionized title research, facilitating faster decision-making and lowering operational costs. As real estate experts increasingly recognize the importance of AI in their operations, the platform continues to evolve, ensuring it meets the changing demands of the industry.

Quotes from industry leaders underscore the transformative impact of AI, reinforcing the significance of these advancements in title research.

Zillow: Enhancing Property Valuation through AI Innovations

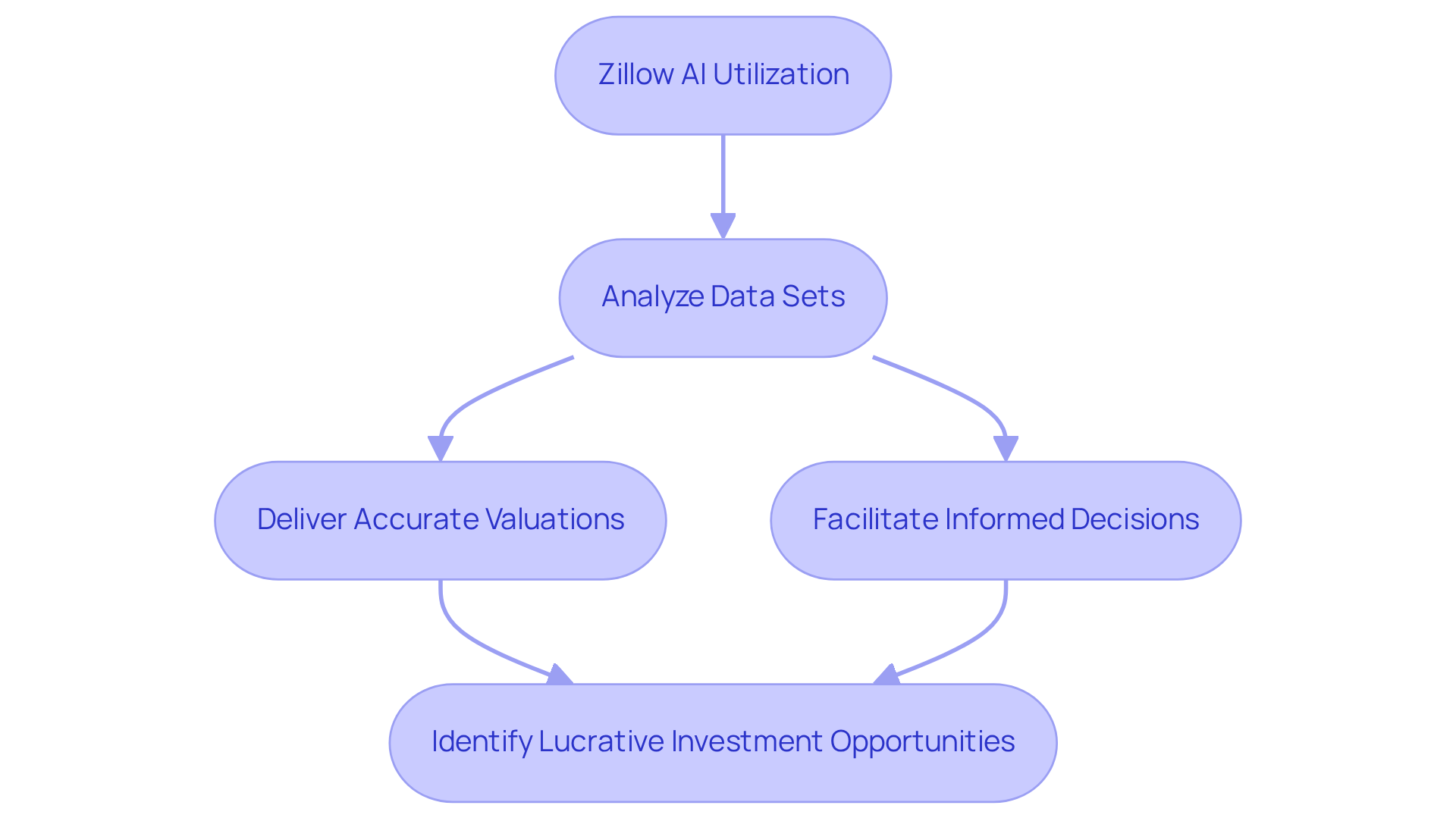

Zillow employs by utilizing algorithms to analyze extensive data sets, including historical sales, industry trends, and neighborhood statistics, thereby delivering accurate real estate valuations. This technology empowers investors to make informed, data-driven decisions regarding asset values across various sectors. Furthermore, by leveraging AI in real estate investing, Zillow significantly enhances the efficiency of property valuation, facilitating the identification of lucrative investment opportunities.

BlackRock: Leveraging AI for Strategic Real Estate Investments

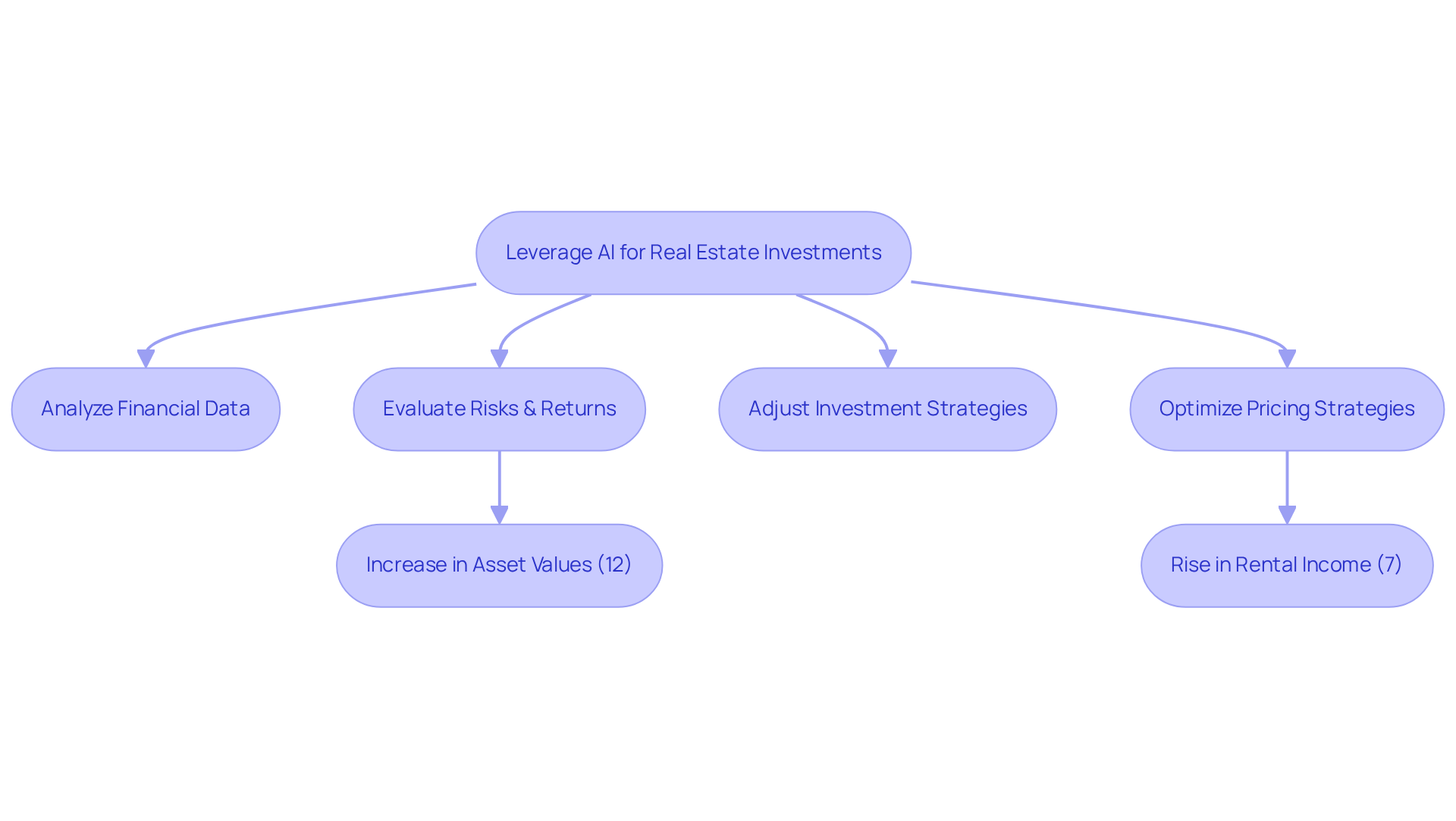

BlackRock harnesses the power of AI in real estate investing to meticulously analyze financial data, revealing lucrative investment opportunities. By leveraging predictive analytics and machine learning, the firm adeptly evaluates risks and potential returns, facilitating informed strategic decision-making. This methodology not only but also improves portfolio management precision, ultimately delivering substantial benefits to investors.

For instance, predictive models empower BlackRock to monitor shifting economic conditions, such as interest rates and buyer sentiment, which are crucial for adjusting investment strategies. AI's capability to predict market trends with 90% accuracy further underscores the effectiveness of these analytics.

Moreover, case studies illustrate that the use of AI in real estate investing can lead to a 12% increase in asset values through optimized pricing strategies and a 7% rise in rental income, highlighting the tangible impact of these technologies on investment outcomes.

Furthermore, with 70% of real estate management firms adopting AI for predictive maintenance and risk evaluation, the broader implications of AI in the industry become evident. As the landscape of property investing evolves, BlackRock's commitment to integrating advanced analytics positions it at the forefront of the industry, enabling investors to navigate complexities with confidence.

JLL: Driving Operational Efficiency with AI in Real Estate

JLL has effectively harnessed AI in real estate investing to revolutionize its operations, particularly in real estate management, leasing, and tenant engagement. By automating routine tasks and leveraging data analytics, JLL significantly enhances operational efficiency, allowing real estate professionals to focus on strategic initiatives. This transformation results in and improved service delivery, ultimately benefiting clients and stakeholders alike.

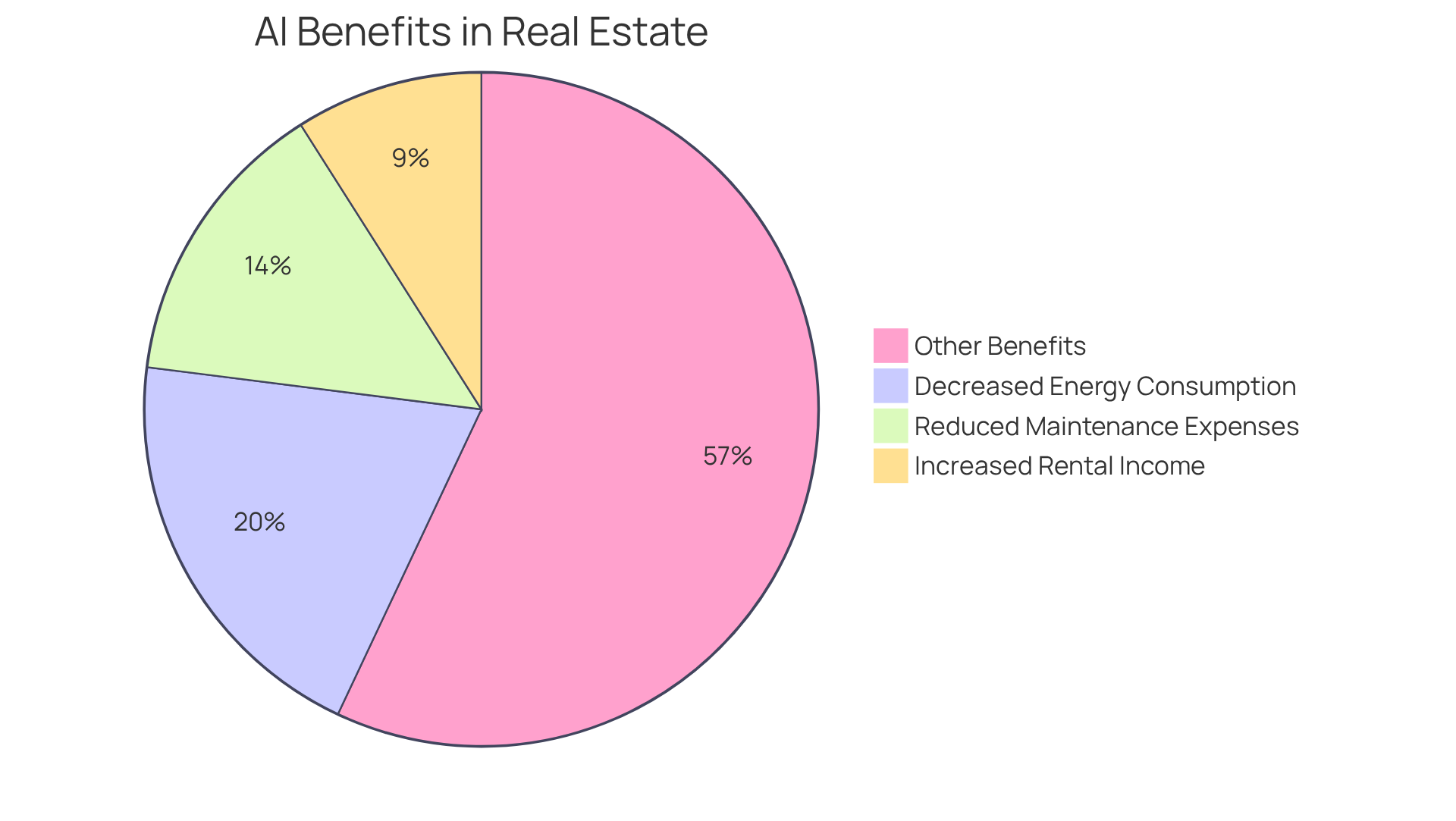

For instance, utilizing AI in real estate investing can boost rental income by up to 9% while simultaneously reducing maintenance expenses by as much as 14%. Furthermore, the use of AI in real estate investing can decrease energy consumption by up to 20%, underscoring the cost-saving advantages of AI in property management. Automated systems streamline lease management, ensuring compliance and enhancing transparency.

JLL leaders emphasize that the use of AI in real estate investing not only refines workflows but also fosters a more adaptive and client-centric strategy, aligning with the evolving needs of the property sector. As Lee Daniels, Global Growth and Innovation Lead at JLL, remarked, "The built environment is no longer just a backdrop - it’s an active participant in people’s lives."

As the industry continues to adopt AI in real estate investing, JLL remains at the forefront, demonstrating how AI can enhance operational effectiveness and deliver value for all stakeholders.

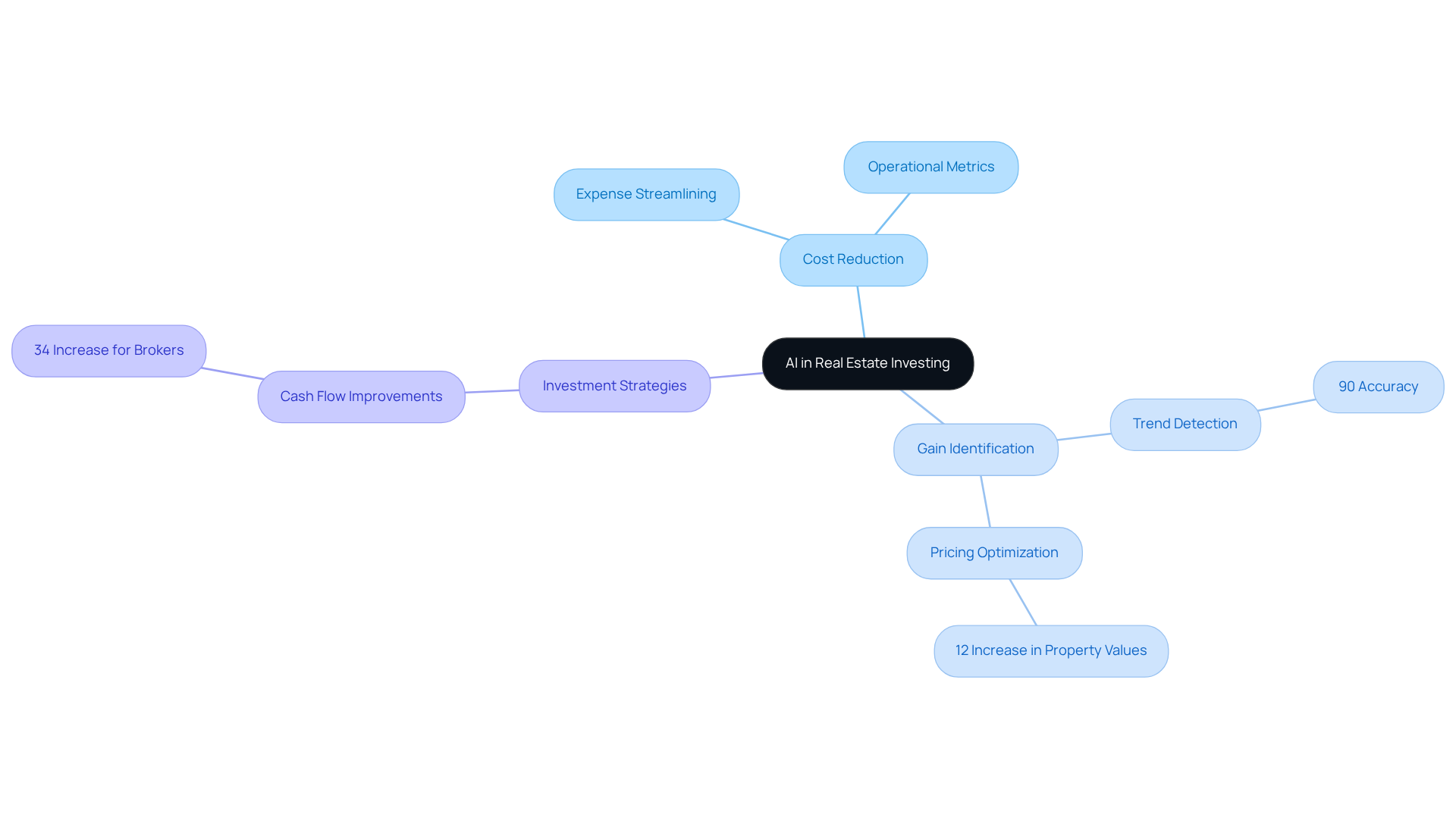

Morgan Stanley: Cost Reduction and Gain Identification through AI

Morgan Stanley effectively employs AI in real estate investing to uncover cost-saving opportunities and refine investment strategies within the sector. By meticulously analyzing industry data and operational metrics, the firm identifies critical areas for enhancement, ultimately enhancing profitability. The in real estate investing not only streamlines expenses but also unveils potential gains, establishing it as an indispensable asset for investors.

For instance, AI in real estate investing includes analysis tools that can detect emerging trends with up to 90% accuracy and forecast real estate price trends with 95% precision, empowering investors to make informed decisions. Furthermore, case studies illustrate that AI can optimize pricing strategies, potentially elevating property values by 12%, ensuring competitive pricing and facilitating quicker transactions. Notably, brokers and services could experience a 34% increase in operating cash flow due to the advanced adoption of GenAI tools.

As the property market continues to evolve, the integration of AI in real estate investing is proving essential for optimizing investment returns and navigating market complexities.

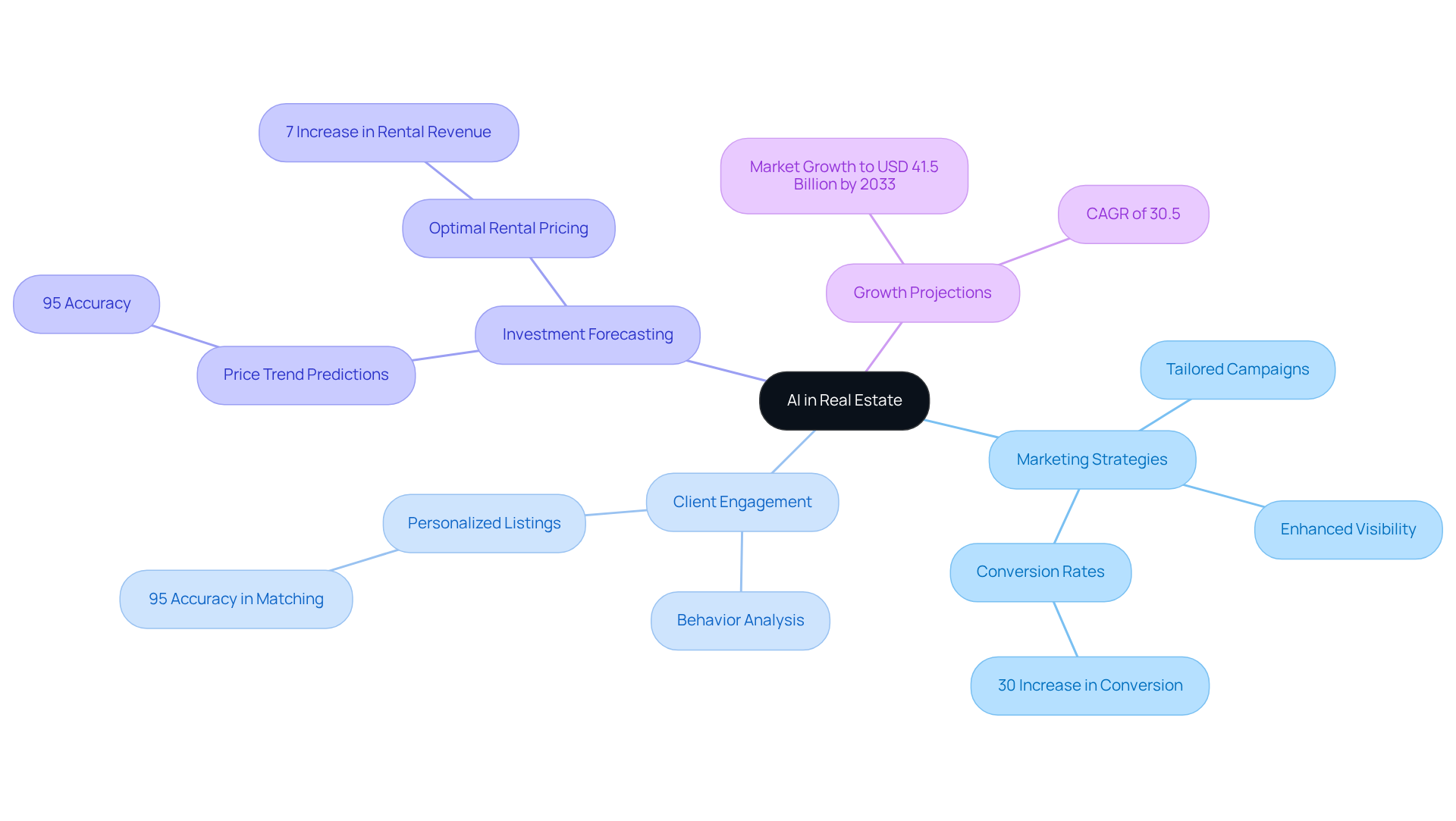

Netguru: AI-Driven Marketing and Customer Engagement in Real Estate

Netguru leverages AI in real estate investing to enhance marketing strategies and client engagement within the property sector. By employing data analytics and machine learning, the company tailors marketing campaigns to specific audiences, thereby improving conversion rates and client satisfaction. This targeted approach not only boosts visibility but also fosters between property professionals and their clients.

For example, AI-enhanced real estate marketplaces can connect buyers to listings with an impressive 95% accuracy based on their preferences, significantly increasing the likelihood of successful transactions. Such a statistic underscores the effectiveness of AI in personalizing the home-buying experience. Furthermore, AI tools can forecast real estate price trends with 95% accuracy, assisting industry professionals in making informed investment decisions and mitigating risks associated with market fluctuations.

The impact of data analytics on customer engagement is substantial. By analyzing buyer behavior trends, AI can recommend tailored listings, enhancing conversion rates by as much as 30%. Additionally, AI-driven property management platforms can increase rental income by up to 9% while simultaneously reducing maintenance costs by 14%, highlighting the dual benefits of integrating advanced analytics into customer engagement strategies.

As the property sector evolves, reliance on AI-driven tools is expected to rise significantly, with AI in real estate investing projected to reach USD 41.5 billion by 2033, reflecting a CAGR of 30.5%. This growth signifies a broader trend towards personalized customer experiences and predictive analytics, essential for maintaining a competitive edge in the industry.

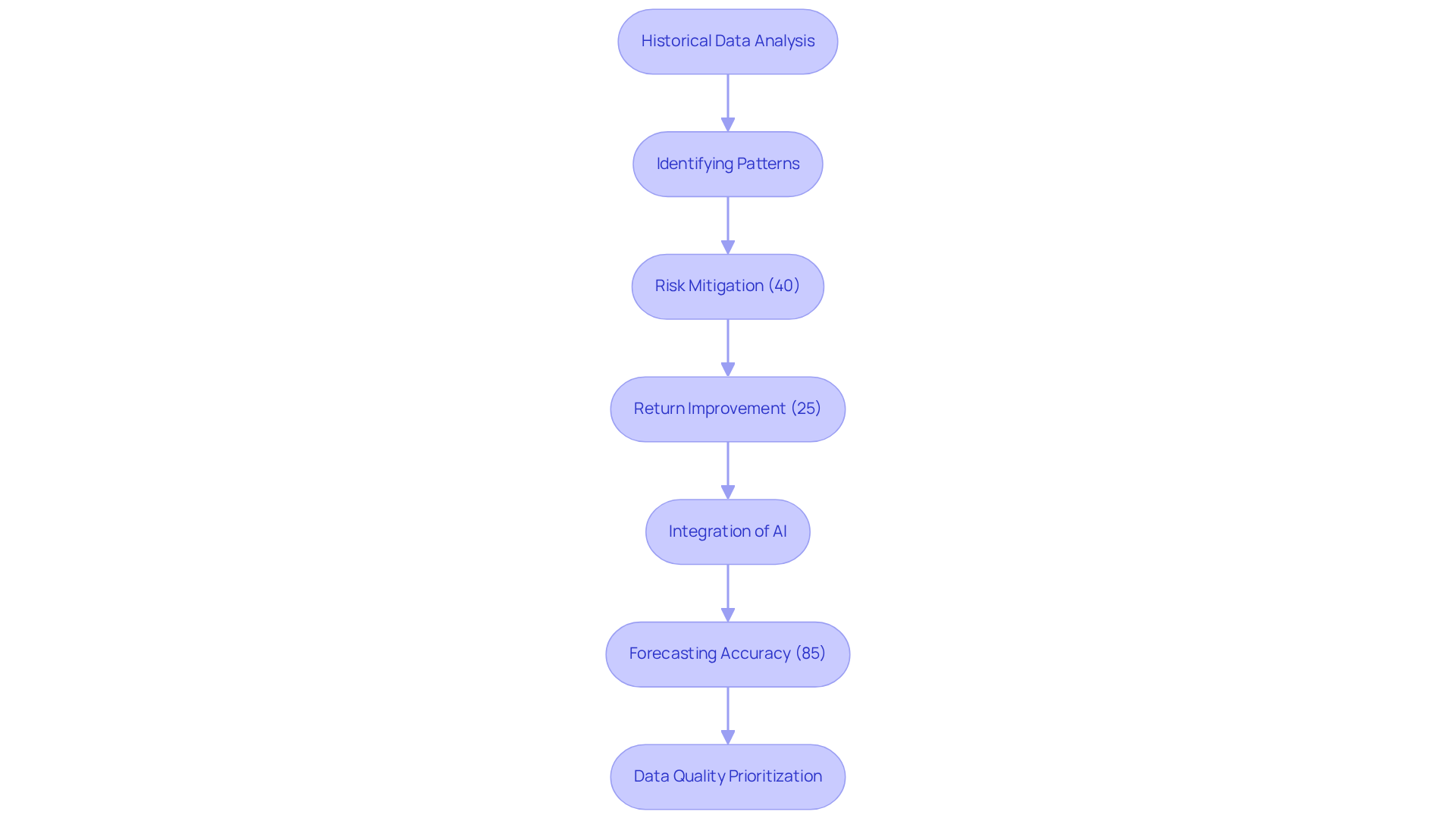

Predictive Analytics: Anticipating Market Trends in Real Estate Investing

Predictive analytics employs historical data and advanced machine learning algorithms to forecast future market trends in property. By meticulously analyzing patterns and behaviors, investors gain critical insights that inform their decisions regarding AI in real estate investing. This proactive strategy not only mitigates risks—reducing investment risk by up to 40%—but also enhances potential returns, with predictive analytics yielding an average improvement of 25% in returns.

Establishing predictive analytics as an essential tool for property investors, the integration of AI in real estate investing allows models that assess economic indicators, such as interest rates and employment figures, to significantly influence investment strategies. As industry specialist Gombos Atila Robert notes, incorporating predictive insights into strategic planning allows firms to outperform competitors, particularly in volatile environments.

Furthermore, case studies reveal that effective predictive models can enhance forecasting accuracy by up to 85%, enabling investors to pinpoint lucrative opportunities and avoid underperforming assets. By comprehending historical trends and leveraging machine learning, property professionals can navigate market complexities with greater confidence and precision.

To implement predictive analytics effectively, investors should and integrate insights into their decision-making processes.

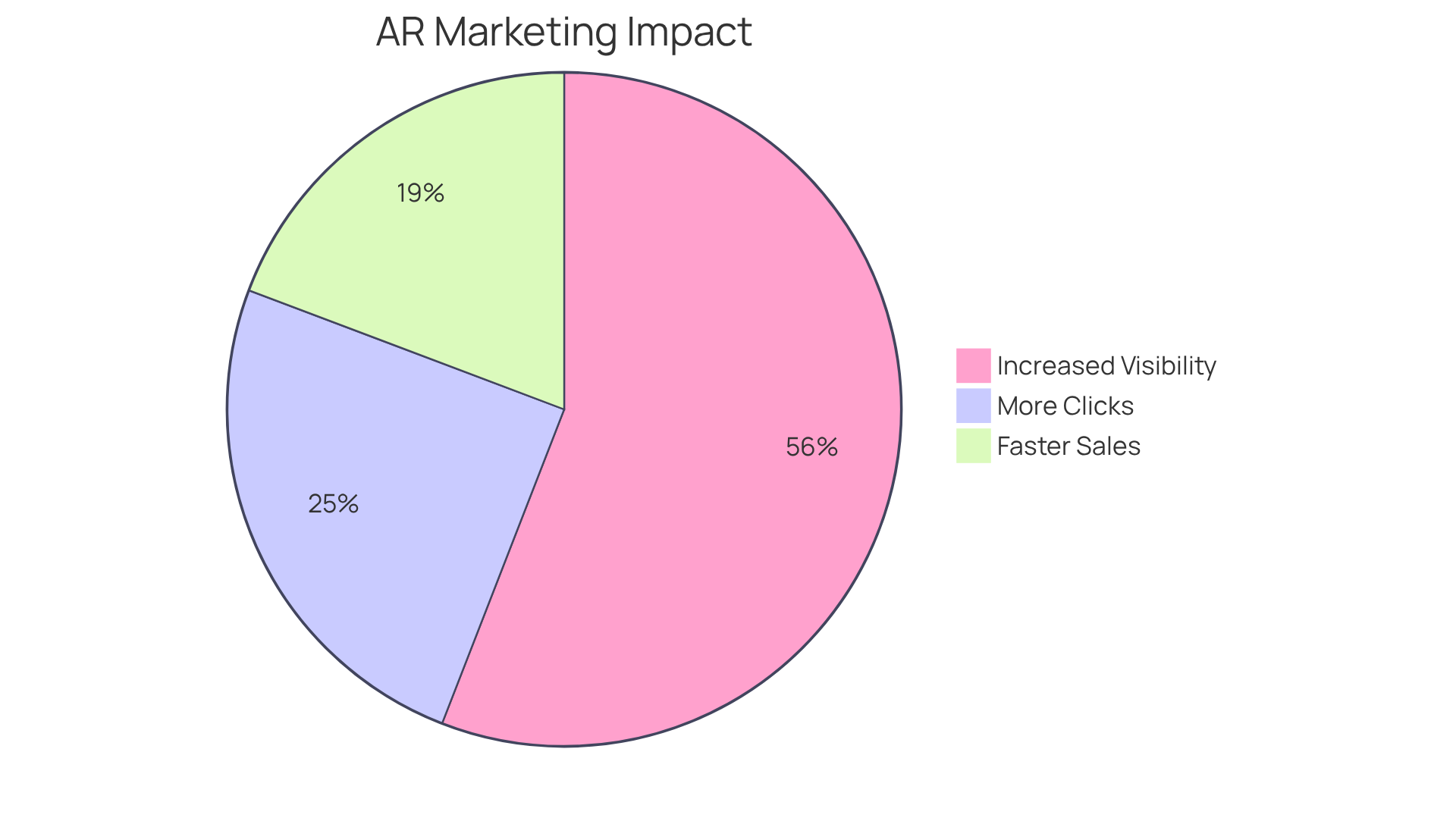

Virtual and Augmented Reality: Transforming Property Showcasing with AI

Augmented reality (AR) is fundamentally transforming property presentation in the housing market by offering immersive experiences that empower prospective buyers to explore properties remotely. This cutting-edge technology not only boosts engagement but also significantly heightens the chances of closing deals.

Properties marketed with AR virtual tours tend to sell approximately 31% faster than those without, while homes featuring a 3D tour are likely to sell even more quickly, underscoring the effectiveness of this strategy in attracting serious buyers. Furthermore, virtual tours provide a lifelike viewing experience, allowing clients to visualize layouts and features without needing physical visits. This efficiency saves time for both buyers and sellers, establishing AR as a in the competitive property landscape.

Successful case studies reveal that property websites utilizing virtual tours have experienced up to a 90% increase in visibility and over 40% more clicks on their listings, emphasizing the importance of integrating AR into marketing strategies. As the sector continues to evolve, the incorporation of AI in real estate investing alongside AR is expected to yield hyper-personalized experiences, further enhancing buyer engagement and streamlining the real estate purchasing process.

As Jake aptly states, "Try to spell the word marketing without AR - it won’t work." However, it is crucial to recognize the challenges in implementing AR, such as high development costs and consumer adoption hurdles, which must be addressed for widespread acceptance.

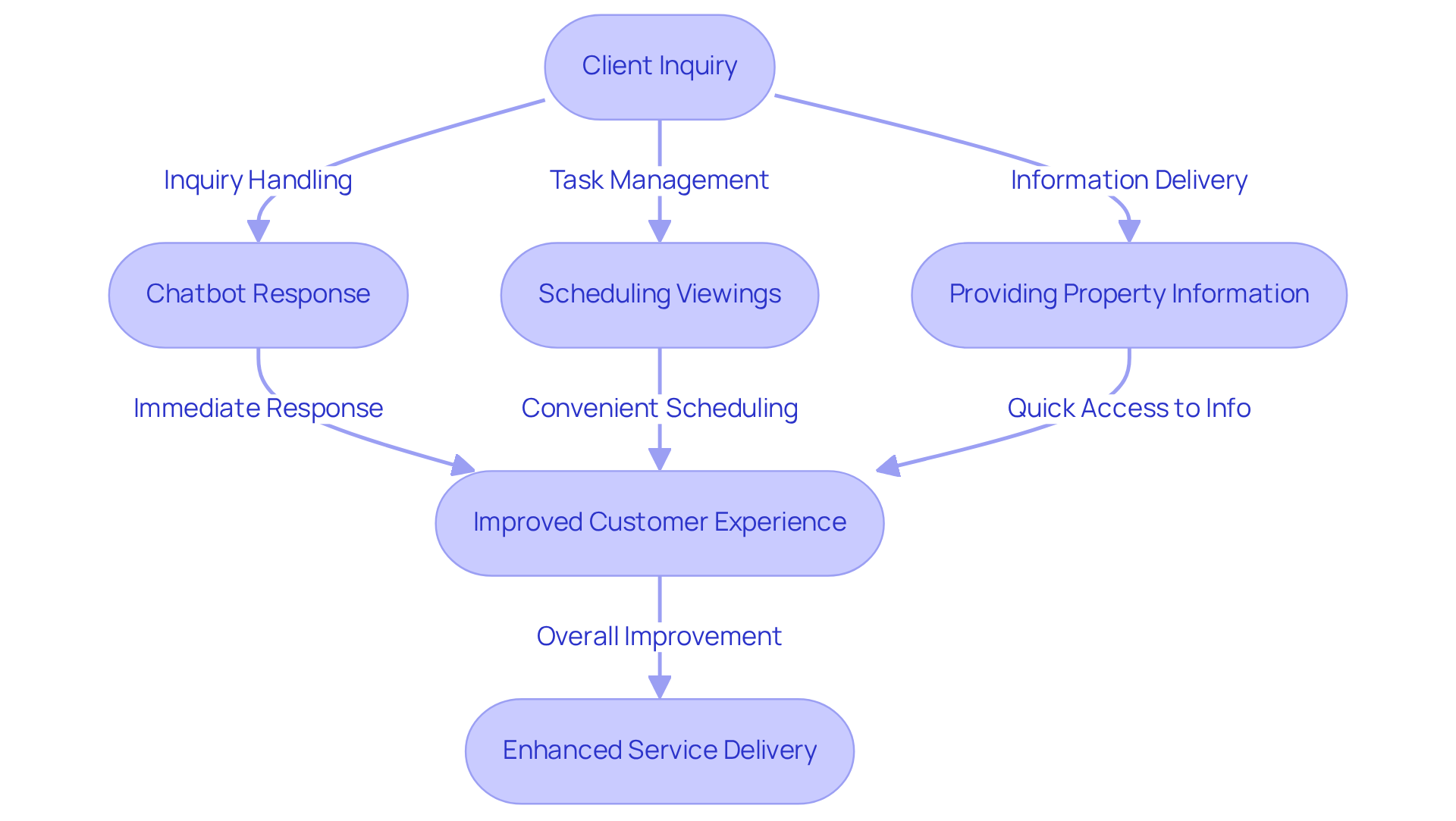

AI Chatbots: Enhancing Customer Service in Real Estate Transactions

AI in real estate investing is transforming customer support in property management by delivering immediate responses to inquiries and facilitating interactions between clients and agents. These chatbots are adept at managing routine questions, scheduling viewings, and providing essential property information, thereby . By automating these processes, property professionals can focus on more complex tasks, which ultimately leads to improved service delivery and heightened client satisfaction.

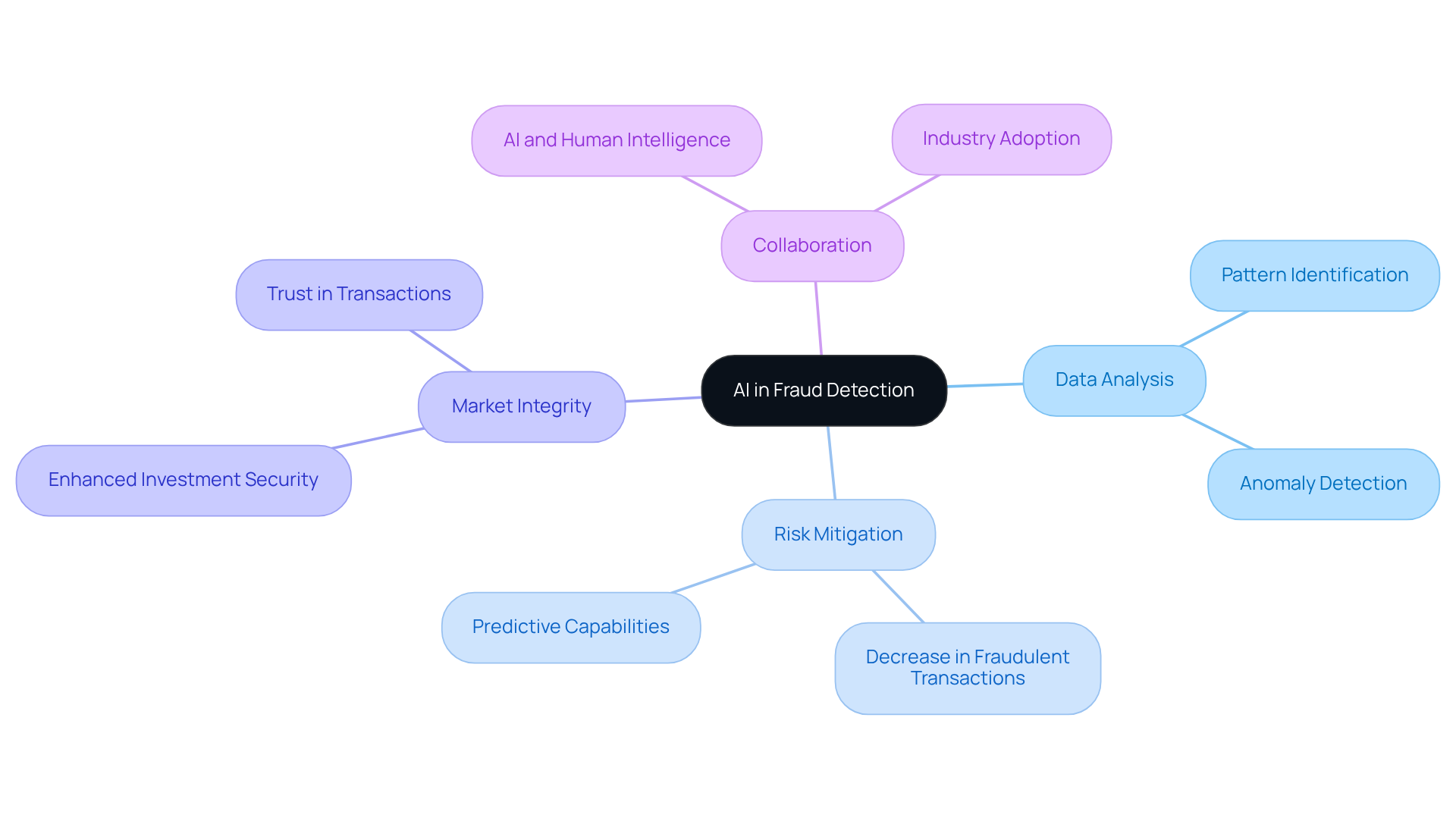

Fraud Detection: Utilizing AI for Risk Mitigation in Real Estate Investing

[AI technologies are revolutionizing fraud detection](https://time.com/partner-article/7279245/15-quotes-on-the-future-of-ai) in property transactions by leveraging advanced data analysis to identify patterns and anomalies indicative of fraudulent activities. This proactive approach enables investors to effectively mitigate risks, safeguarding their investments and enhancing the overall integrity of the property sector.

For example, AI-driven platforms have shown a remarkable decrease in fraudulent transactions, fostering a more secure investment landscape. With the projected to reach USD 4.26 trillion by 2025, the integration of AI into risk reduction strategies is becoming increasingly vital.

By employing machine learning algorithms, real estate professionals can not only detect potential fraud but also predict and prevent it, ensuring a more reliable and trustworthy environment. Furthermore, with 75% of leading U.S. brokerages embracing AI technologies, this trend underscores the escalating dependence on AI for bolstering market integrity.

Bernard Marr asserts that AI will augment human intelligence rather than replace it, emphasizing the collaborative potential of technology and human expertise in risk mitigation.

Conclusion

The integration of artificial intelligence into real estate investing is fundamentally reshaping the industry landscape, presenting innovative solutions that significantly enhance efficiency, accuracy, and profitability. By leveraging advanced technologies such as machine learning, predictive analytics, and augmented reality, real estate professionals are increasingly equipped to navigate market complexities and make informed decisions that drive success.

Throughout this article, we have highlighted various applications of AI, including:

- Parse AI's transformative approach to title research

- Zillow's data-driven property valuation methods

- BlackRock's strategic investment analytics

- JLL's operational efficiency improvements

- Morgan Stanley's cost reduction strategies

- Netguru's customer engagement enhancements

Furthermore, the growing reliance on predictive analytics and AR for property showcasing underscores the industry's commitment to adopting cutting-edge technologies.

As AI continues to evolve, its potential to revolutionize real estate investing becomes increasingly evident. Embracing these advancements not only positions investors for greater success but also fosters a more secure and efficient market. The future of real estate investing is undoubtedly intertwined with AI, emphasizing the importance of staying informed and adaptable in an ever-changing environment. Engaging with these technologies will be crucial for stakeholders seeking to maintain a competitive edge and achieve sustainable growth in the years to come.

Frequently Asked Questions

What is Parse AI and how does it improve title research?

Parse AI utilizes advanced machine learning algorithms and optical character recognition (OCR) to extract essential information from title documents, streamlining the process of confirming property ownership. This technology accelerates the production of abstracts and reports while enhancing their accuracy, significantly reducing the time and costs associated with title research.

What is the error rate associated with OCR processes used by Parse AI?

Studies indicate that the error rate in OCR processes can be as low as 1.5%, with retrieval accuracy being significantly impacted starting at a 5% error rate.

How does Parse AI collaborate with industry experts?

Parse AI collaborates with land service experts to effectively address prevalent industry challenges, resulting in improved workflow efficiency for property professionals.

What benefits have been demonstrated through case studies of Parse AI?

Case studies show that automation through Parse AI has revolutionized title research, facilitating faster decision-making and lowering operational costs for property professionals.

How is Zillow utilizing AI in real estate?

Zillow employs advanced AI algorithms to analyze extensive data sets, including historical sales and neighborhood statistics, to deliver accurate real estate valuations, which empowers investors to make informed, data-driven decisions.

What advantages does Zillow's AI technology provide for property valuation?

By leveraging AI, Zillow enhances the efficiency of property valuation, allowing for the identification of lucrative investment opportunities.

How does BlackRock use AI in its real estate investments?

BlackRock uses AI to analyze financial data, revealing lucrative investment opportunities through predictive analytics and machine learning, which aids in evaluating risks and potential returns.

What are the benefits of BlackRock's AI-driven investment strategies?

AI enhances investment performance and improves portfolio management precision. Predictive models help monitor economic conditions, allowing for adjustments in investment strategies.

How accurate are BlackRock's predictive models in forecasting market trends?

BlackRock's predictive models have shown to predict market trends with 90% accuracy.

What tangible impacts has AI had on investment outcomes according to BlackRock's case studies?

Case studies illustrate that AI can lead to a 12% increase in asset values through optimized pricing strategies and a 7% rise in rental income.

What is the broader trend of AI adoption in real estate management?

Approximately 70% of real estate management firms are adopting AI for predictive maintenance and risk evaluation, highlighting the growing implications of AI in the industry.