Overview

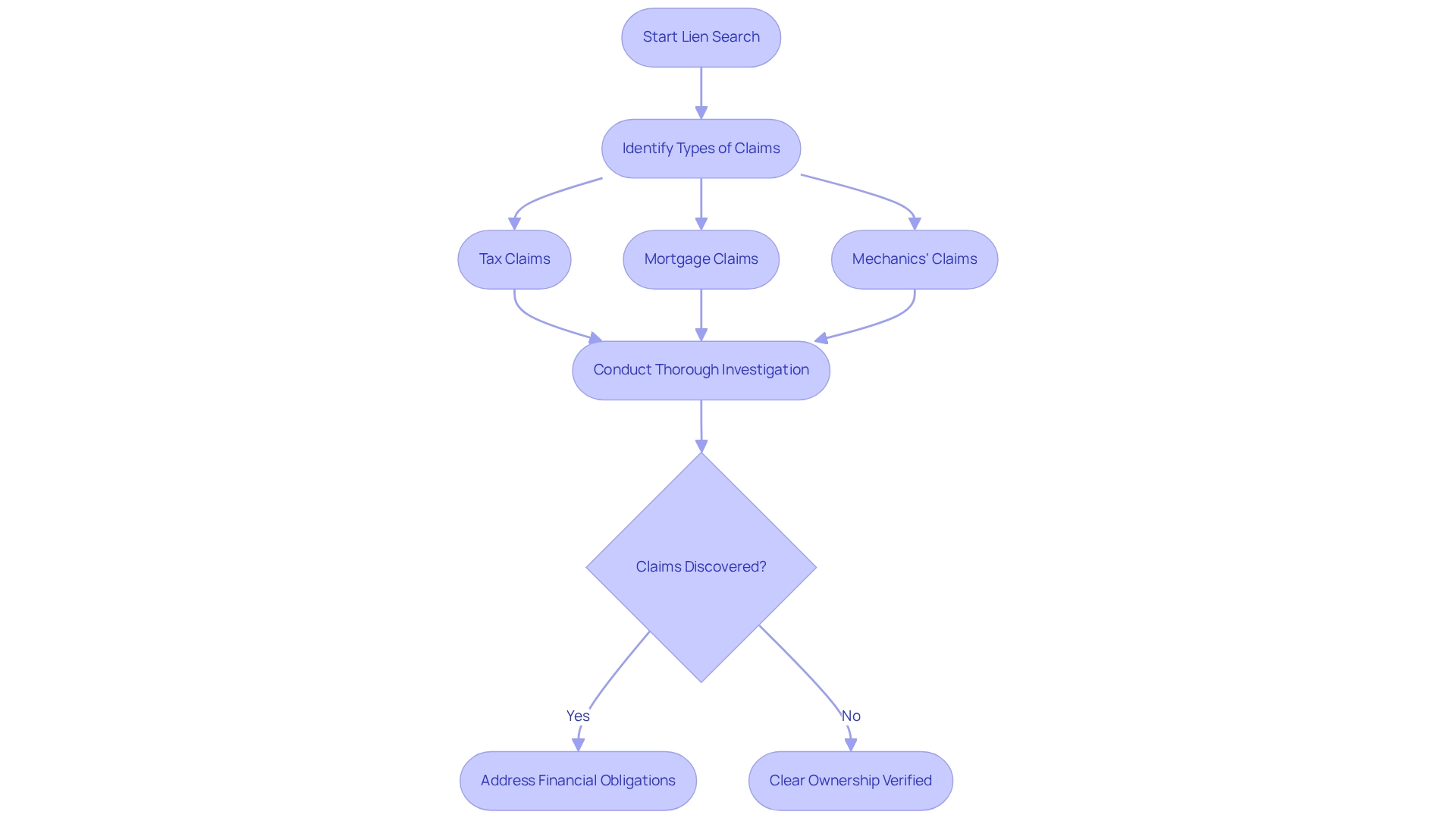

The article delineates a three-step process for executing a successful lien search on a property, highlighting the critical nature of gathering property information, accessing public records, and searching for liens to avert financial pitfalls. It further details common challenges encountered in lien searches and presents practical solutions, thereby emphasizing the necessity of thorough investigations to ensure clear ownership and mitigate risks in real estate transactions.

Introduction

In the intricate world of real estate, the importance of conducting a lien search is paramount. This essential step in property acquisition acts as a safeguard against unexpected financial burdens and legal complications that may arise from undisclosed claims on a property.

With the potential for tax liens, mortgage liens, and mechanics' liens lurking in the shadows, understanding how to navigate this process is vital for any prospective buyer.

By delving into the nuances of lien searches, individuals can protect their investments and ensure a smooth transaction experience. From identifying existing obligations to troubleshooting common search challenges, this guide aims to illuminate the path to secure and informed property ownership.

Understand the Importance of a Lien Search

A , essential for the , often includes a to reveal any existing claims—legal assertions against a property due to unpaid debts. These claims may encompass tax claims, mortgage claims, or . Understanding the importance of a claim inquiry can significantly assist you in performing a lien search property to avoid , as discovering a claim post-purchase can result in unforeseen financial obligations, such as settling debts that were not disclosed. Recent data indicate that approximately 30% of real estate transactions encounter issues related to hidden claims, underscoring the necessity for . Furthermore, the reached 15% in the latest sale, highlighting of these claims.

- Ensure Clear Ownership: A meticulous claim investigation verifies that the property is devoid of encumbrances, thus safeguarding your title and ownership rights. This is particularly vital given recent cases where buyers faced significant financial repercussions due to undisclosed claims, emphasizing the need for vigilance in this domain, particularly through a lien search property to identify any potential issues. For instance, case studies have illustrated that proactive s can prevent costly disputes and delays, ultimately protecting your investment.

Conducting a claims investigation transcends mere procedural formality; it embodies a that mitigates financial risks and ensures compliance with regulations, thereby enhancing the overall integrity of real estate transactions.

Follow Step-by-Step Procedures for Conducting a Lien Search

To carry out a , follow these steps:

-

Gather : Begin by collecting essential details about the property, such as the legal description, parcel number, and . This foundational information is critical for ensuring accurate searches.

-

: Visit your local county recorder's office or utilize their online portal. Most counties preserve public records that contain information about claims. Utilize the gathered details to look for the property.

-

: Investigate any recorded liens against the property, which may include:

- Tax Liens: Verify if there are any unpaid property taxes.

- Mortgage Liens: Identify existing mortgages that could impact ownership.

- Judgment Liens: Look for any court judgments filed against the property owner.

-

Review Findings: Analyze the results of your search meticulously. If claims are found, record their specifics, including the amount and the creditor involved. Be aware that transcription of a claim can occur between counties or from a county to the Office of the Minnesota Secretary of State if the property is located in another county or if the owner relocates.

-

Utilize Advanced Tools: Improve your claim investigation process with . By leveraging and machine learning models, you can upload documents and allow the software to efficiently read, label, and extract vital information. This streamlines the creation of runsheets, ensuring that every detail is readily available for quick human review and verification.

-

Consult Experts: For complicated claims or legal terminology, seek assistance from a title company or a . Their expertise can help interpret findings and guide you on the appropriate next steps.

Statistics indicate that the COVID-19 pandemic has led to and operational delays, significantly affecting due diligence timelines. In difficult markets, like Miami-Dade County, businesses may charge twice for inquiries, highlighting the significance of efficiency in the process of examining claims. By adhering to these steps and utilizing expert knowledge, you can improve the success rate of your across different types of real estate.

Troubleshoot Common Issues in Lien Searches

Conducting can present several challenges. Here’s how to effectively troubleshoot common issues:

- Incomplete Records: Public records may sometimes be missing or incomplete. Statistics indicate that a substantial portion of public records may be lacking, underscoring the necessity of conducting a . If you suspect this, reach out directly to the county office for additional information or clarification.

- : Liens can be misfiled under incorrect names or property descriptions. Ensure you double-check the spelling of names and perform a lien search property using all possible variations to avoid missing critical information.

- : Records may not always reflect the most current status. Verify the date of the last update on the records you are reviewing. If necessary, consult local authorities to obtain the latest information.

- Unrecorded Liens: Some liens may not be recorded in public databases, which is why is important. To uncover these, conduct a thorough investigation, including inquiries with local municipalities or utility companies regarding any outstanding obligations.

- Terminology: Facing intricate terms can be intimidating. If you find terminology difficult to interpret, seek assistance from a title professional or expert to ensure accurate understanding and interpretation of the information.

Addressing these frequent problems is essential for guaranteeing a smooth transfer of property ownership, and conducting a lien search property can help prevent considerable complications from unresolved claims. may uncover various issues, such as unpaid taxes or legal judgments, which should be resolved before closing. A case study titled 'Uncovering Title Issues' illustrates how addressing these issues proactively can prevent complications during the closing process. Engaging with experienced professionals can streamline this process and mitigate risks associated with incomplete public records. Keep in mind, as an expert pointed out, that investing in certainty and security significantly surpasses the possible expenses of ignoring it. Furthermore, staying informed about changes in local lien laws can help mitigate future risks, ensuring that your searches remain thorough and effective.

Conclusion

Conducting a lien search is an indispensable step in the property acquisition journey, serving as a critical safeguard against unexpected financial responsibilities and legal entanglements. By understanding the different types of liens—such as tax, mortgage, and mechanics' liens—prospective buyers can avoid financial surprises, ensure clear ownership, and facilitate smoother transactions. Statistics underscore the importance of this process, revealing that a significant percentage of property transactions encounter issues related to undisclosed liens.

Following a systematic approach to conducting lien searches not only enhances the likelihood of uncovering potential issues but also empowers buyers with the knowledge needed to make informed decisions. From gathering essential property information to utilizing advanced tools and consulting professionals, each step plays a vital role in mitigating risks. Furthermore, being prepared to troubleshoot common challenges, such as incomplete records or misfiled documents, is essential for ensuring a seamless transfer of property ownership.

Ultimately, engaging in thorough lien searches is an investment in both financial security and peace of mind. By prioritizing this crucial step, buyers can protect their investments and navigate the complexities of real estate transactions with confidence, paving the way for successful property ownership.

Frequently Asked Questions

What is a claim review in the property acquisition process?

A claim review is an essential part of the property acquisition process that often includes a lien search to reveal any existing claims against a property, such as tax claims, mortgage claims, or mechanics' claims due to unpaid debts.

Why is a lien search important?

A lien search is important because it helps avoid financial surprises by uncovering any claims on the property before purchase. Discovering a claim post-purchase can result in unforeseen financial obligations, such as settling undisclosed debts.

What percentage of real estate transactions encounter issues related to hidden claims?

Approximately 30% of real estate transactions encounter issues related to hidden claims, highlighting the necessity for thorough investigations.

What are the potential financial ramifications of tax claims?

The interest rate of return for tax claims reached 15% in the latest sale, indicating significant potential financial implications for buyers if such claims are not addressed.

How does a claims investigation safeguard ownership rights?

A meticulous claims investigation ensures that the property is free of encumbrances, thereby safeguarding your title and ownership rights and preventing significant financial repercussions from undisclosed claims.

What are the benefits of conducting a claims investigation?

Conducting a claims investigation mitigates financial risks, ensures compliance with regulations, and enhances the overall integrity of real estate transactions, ultimately protecting your investment.

How can proactive claims investigations prevent issues?

Proactive claims investigations can prevent costly disputes and delays by identifying potential issues early, thereby protecting your investment in the property.