Overview

This article emphasizes the critical importance of identifying the best property research platforms for title professionals, showcasing their features and benefits. It thoroughly examines various platforms, including:

- Parse AI

- CoStar

- Trepp

- Others

It illustrates how these tools significantly enhance efficiency, accuracy, and decision-making in property research. Through advanced analytics, comprehensive data access, and user-friendly interfaces, these platforms empower professionals to navigate the complexities of title research with confidence and precision.

Introduction

The landscape of property research is undergoing a significant transformation, propelled by the urgent demand for efficiency and accuracy within a competitive real estate market. Title professionals are increasingly adopting advanced platforms that harness cutting-edge technology to optimize their research processes. This article delves into the ten premier property research platforms available in 2025, showcasing their distinctive features and benefits that empower title experts to adeptly navigate the intricacies of ownership verification and market analysis. However, with a plethora of options at their disposal, how can professionals judiciously select the right tools to enhance their workflows and ensure dependable outcomes?

Parse AI: Advanced Machine Learning for Title Research Automation

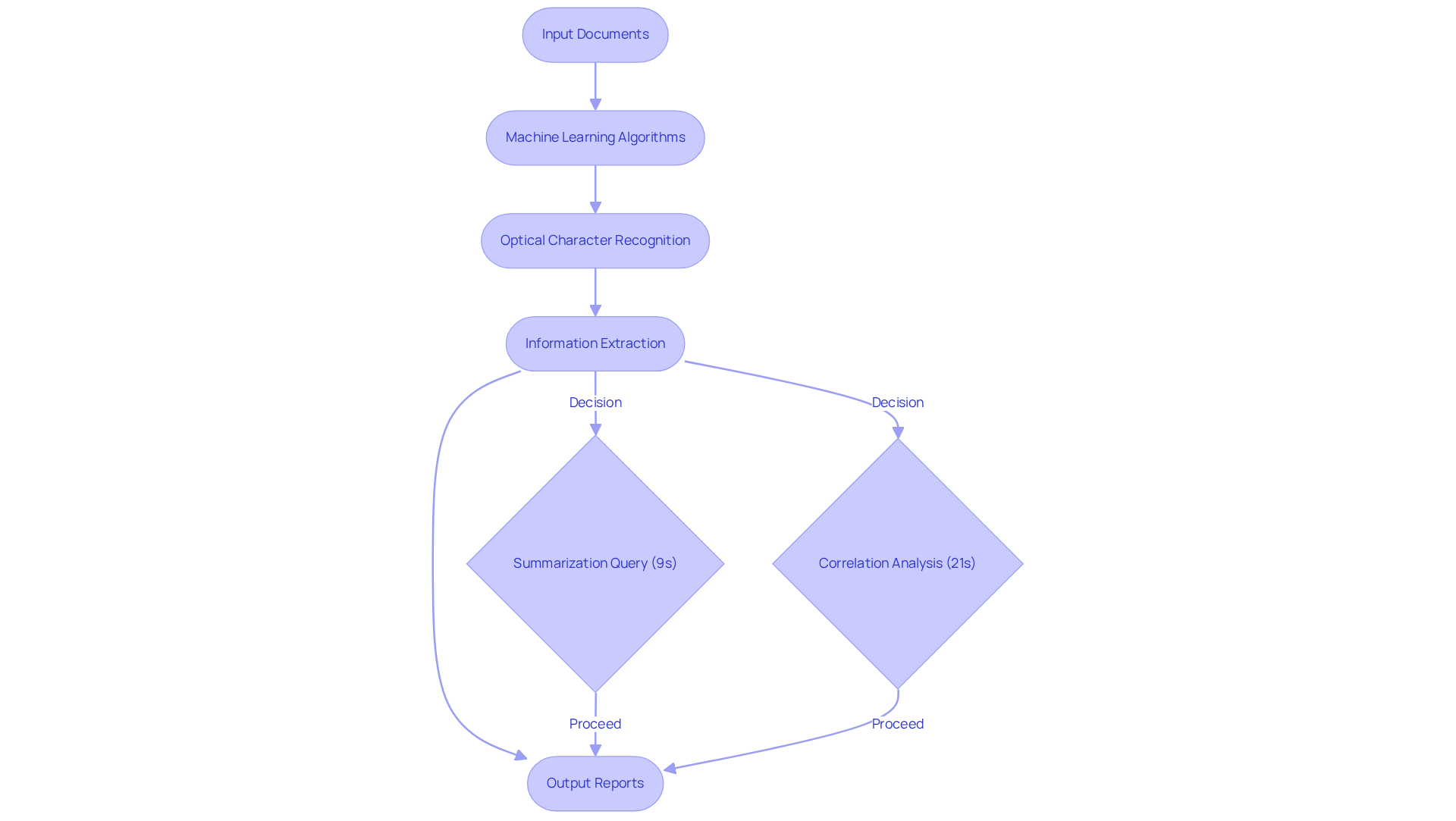

Parse AI harnesses advanced machine learning algorithms and optical character recognition (OCR) to optimize the extraction of essential information from document titles. This groundbreaking technology significantly reduces the time required for ownership research, enabling experts to generate abstracts and reports with enhanced precision.

For instance, summarization queries are processed within an average response time of just 9 seconds, while correlation analyses take approximately 21 seconds per query. Furthermore, by continuously refining its algorithms in collaboration with land service specialists, Parse AI positions itself among the best property research platforms by effectively addressing prevalent challenges in property research, such as navigating incomplete records and deciphering complex legal terminology.

Consequently, users benefit from substantial cost savings and improved workflow efficiency. Real estate professionals have observed that the integration of OCR into the best property research platforms not only accelerates the research process but also enhances the reliability of the information retrieved, establishing it as an invaluable tool in the industry.

As Andrew Carnegie famously stated, 'Ninety percent of all millionaires achieve this through owning real estate,' underscoring the critical nature of effective ownership research in the real estate sector.

CoStar: Comprehensive Commercial Real Estate Data and Analytics

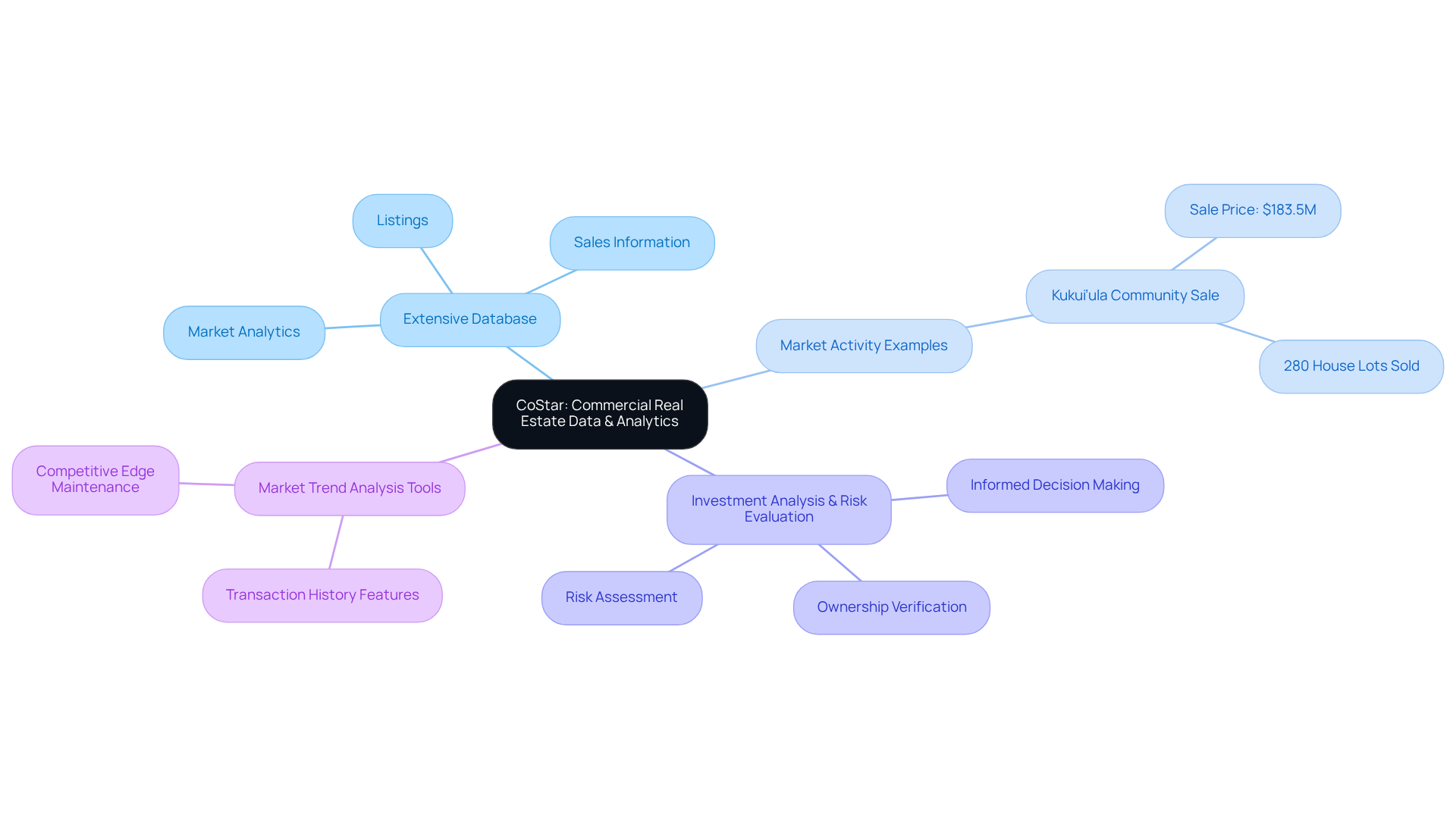

CoStar is renowned for its extensive database, which encompasses listings, sales information, and market analytics. This platform is considered one of the best property research platforms for professionals in the field, offering critical insights into real estate values, market trends, and transaction histories.

For example, the Kukui’ula master-planned community was sold for $183.5 million, a clear illustration of significant market activity that title specialists can analyze through CoStar's comprehensive tools.

Furthermore, with features dedicated to investment analysis and risk evaluation, CoStar empowers users to make informed decisions, enhancing their ability to verify ownership and assess potential risks in real estate transactions.

RCLCO's involvement in analyzing market conditions further underscores the necessity of utilizing such analytics. Consequently, title experts can leverage CoStar's robust analytics to navigate the complexities of property ownership verification with greater accuracy and efficiency.

To fully capitalize on the advantages offered by CoStar, industry professionals should focus on utilizing its market trend analysis tools and transaction history features, as these are considered some of the best property research platforms to maintain a competitive edge in the evolving commercial real estate landscape.

Trepp: Insights into Commercial Mortgage-Backed Securities

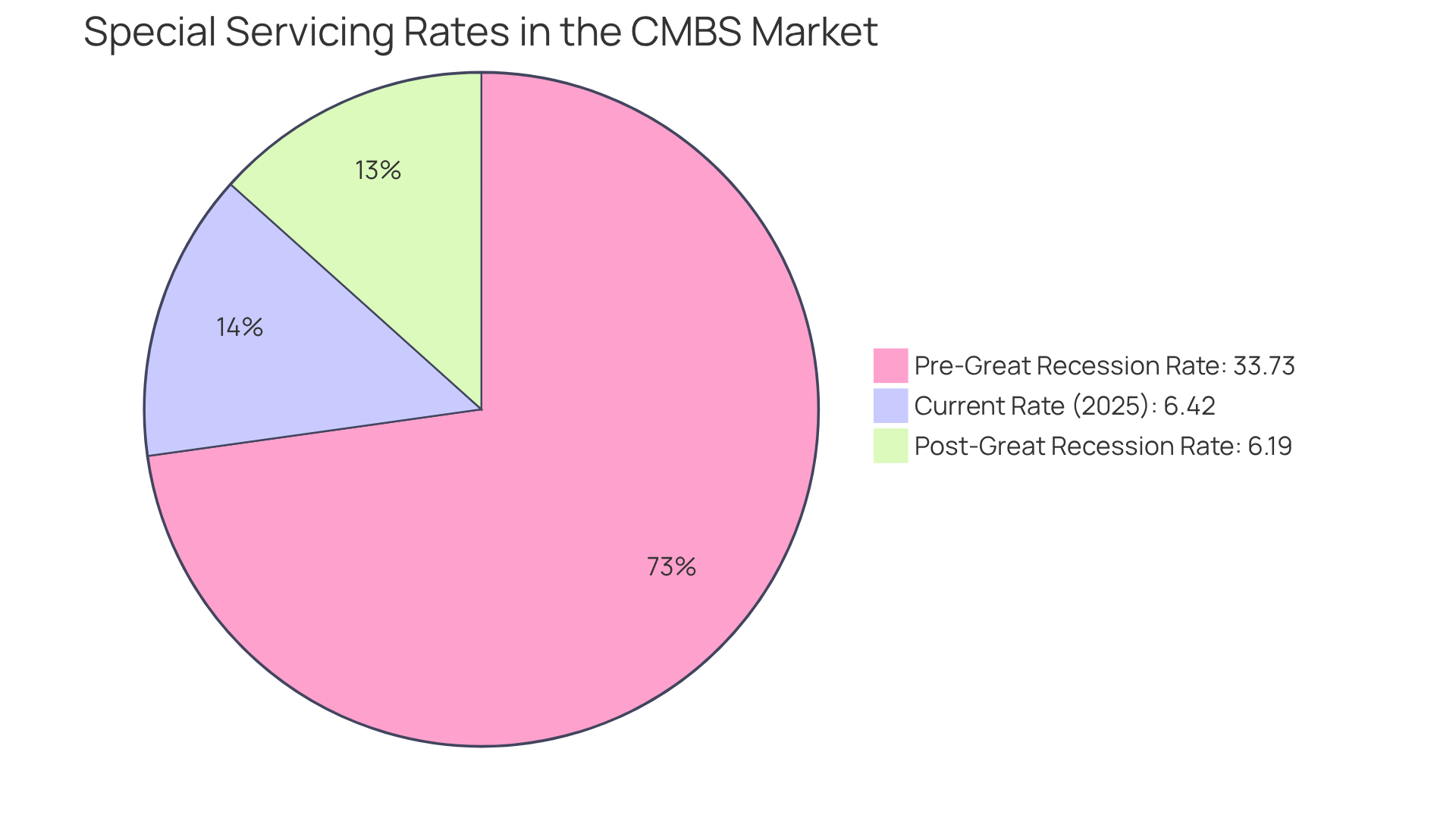

Trepp provides crucial information and analytics on commercial mortgage-backed securities (CMBS), delivering valuable insights into loan performance and market dynamics. For specialists in real estate, a comprehensive understanding of the CMBS environment is essential for assessing the financial stability of assets.

In 2025, the CMBS market continues to demonstrate resilience, with significant loan performance statistics indicating a special servicing rate of 6.42%. This rate is notably lower than the 33.73% for loans originated before the Great Recession and 6.19% for those after, underscoring the necessity of monitoring delinquencies and recovery efforts.

Trepp's platform empowers users to examine loan information, monitor delinquencies, and evaluate market conditions—crucial elements for precise ownership verification and efficient risk evaluation. Furthermore, the Pooling and Servicing Agreement (PSA) regulates the actions of servicers in loan recovery processes, providing a framework that property experts must navigate.

As industry experts increasingly depend on CMBS information, utilizing the best property research platforms can enhance their decision-making procedures and improve overall efficiency in real estate research. According to Trepp, understanding these special servicing rates is essential for effective risk management in the current market.

CRED iQ: Market Intelligence and Property Analytics

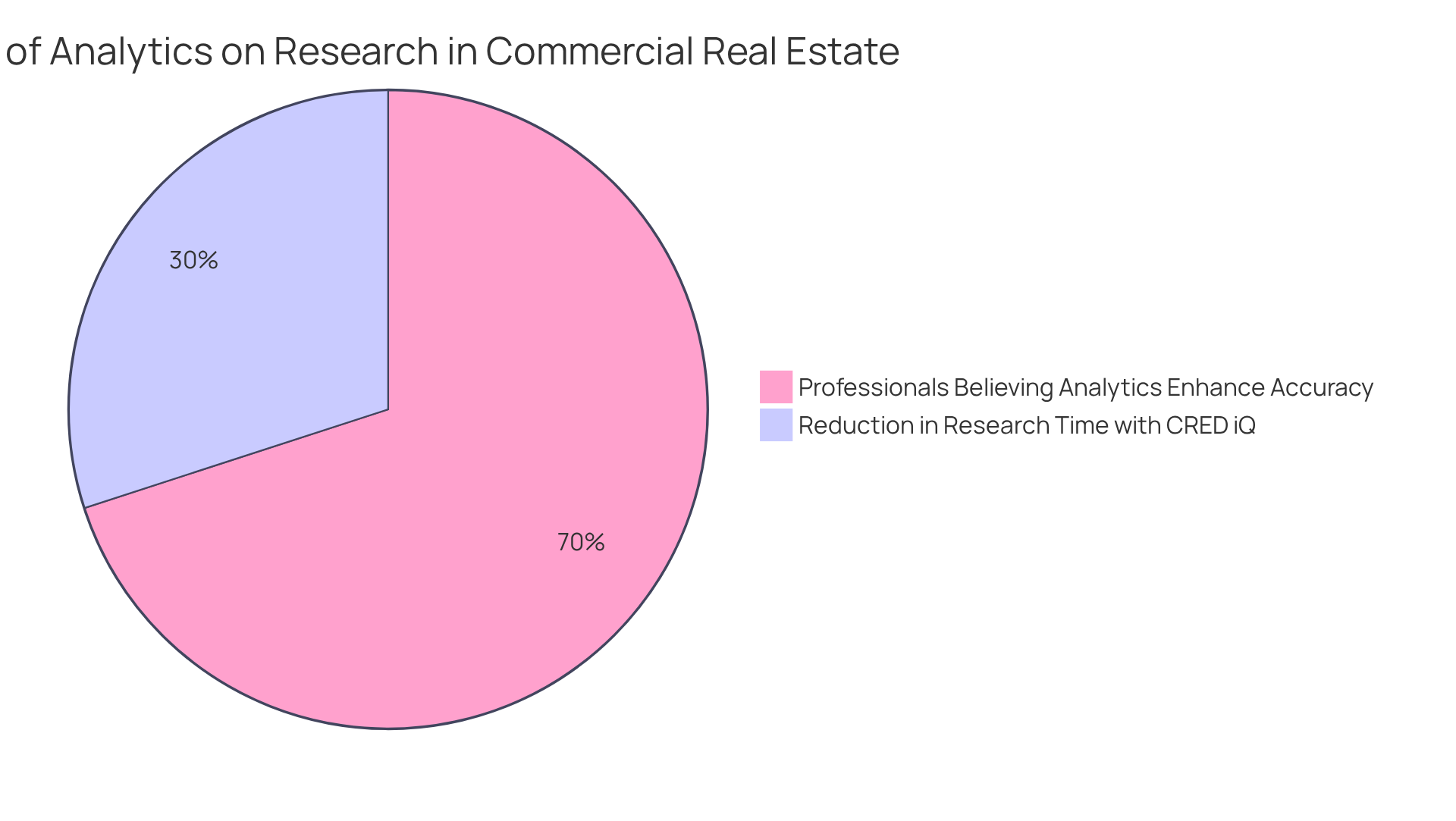

CRED iQ establishes itself as one of the best property research platforms, delivering extensive market intelligence and asset analytics specifically designed for the commercial real estate sector. By providing access to comprehensive data sets—including property valuations, market trends, and investment opportunities—CRED iQ stands out as one of the best property research platforms, empowering industry experts to deepen their understanding of property dynamics.

Recent studies indicate that nearly 70% of professionals in the field assert that detailed analytics significantly enhance their research accuracy. This improved comprehension facilitates more thorough and informed research on titles, ultimately boosting the precision and productivity of their workflows.

As Klaus Philipsen, Board President, noted, "The incorporation of advanced analytics into research processes is vital for recognizing potential risks and opportunities in today's competitive environment."

The platform's analytics features not only streamline the research process but also enable professionals to pinpoint potential risks and opportunities, establishing it as one of the best property research platforms in the competitive landscape of real estate.

A pertinent case study involving a major real estate company revealed that leveraging CRED iQ's analytics resulted in a 30% reduction in research time while simultaneously enhancing the precision of asset evaluations. This underscores how CRED iQ not only optimizes individual workflows but also contributes to overall operational efficiency in title research.

Reonomy: Property Intelligence and Ownership Insights

Reonomy is recognized as one of the best property research platforms, offering a robust platform for real estate intelligence and delivering extensive ownership insights and detailed information across the United States. Its advanced search features empower specialists to swiftly access ownership records, transaction histories, and vital real estate data.

By leveraging Reonomy's comprehensive database, which integrates large-scale information and collaborations to bridge the fragmented commercial real estate market, researchers can significantly enhance their efficiency in verifying property ownership and conducting thorough due diligence using the best property research platforms. This efficiency is crucial, as a Qualia survey indicates that 84% of industry experts express optimism regarding AI's potential to improve operational workflows.

Furthermore, industry leaders underscore the essential role of precise ownership records in ownership research, highlighting the necessity for reliable data sources such as the best property research platforms, including Reonomy.

As of 2025, with total funding reaching $128.4 million and an estimated revenue of $4.5 million, Reonomy remains at the forefront of providing the latest ownership insights, enabling industry experts to make informed decisions and streamline their processes effectively.

In addition, Parse AI addresses challenges in verifying ownership, further enhancing the resources available to real estate professionals.

Crexi: Marketplace with Data-Driven Insights

Crexi emerges as a premier marketplace for commercial real estate, effectively integrating listings with invaluable data-driven insights. This platform equips industry experts with comprehensive information on market trends, pricing dynamics, and real estate availability, enabling them to navigate transaction complexities with precision. By leveraging Crexi's extensive analytics, researchers can attain a holistic view of the market landscape, significantly enhancing their ability to verify ownership and evaluate potential investments.

With millions of users and over 500,000 listings, Crexi is rapidly establishing itself as an essential resource for individuals aiming to make informed decisions in a competitive environment. As Warren Buffett wisely stated, 'Real estate is a long-term game. Don't try to get rich quick.' This perspective emphasizes the necessity of utilizing the best property research platforms, such as Crexi, to lay a strong foundation for investment success.

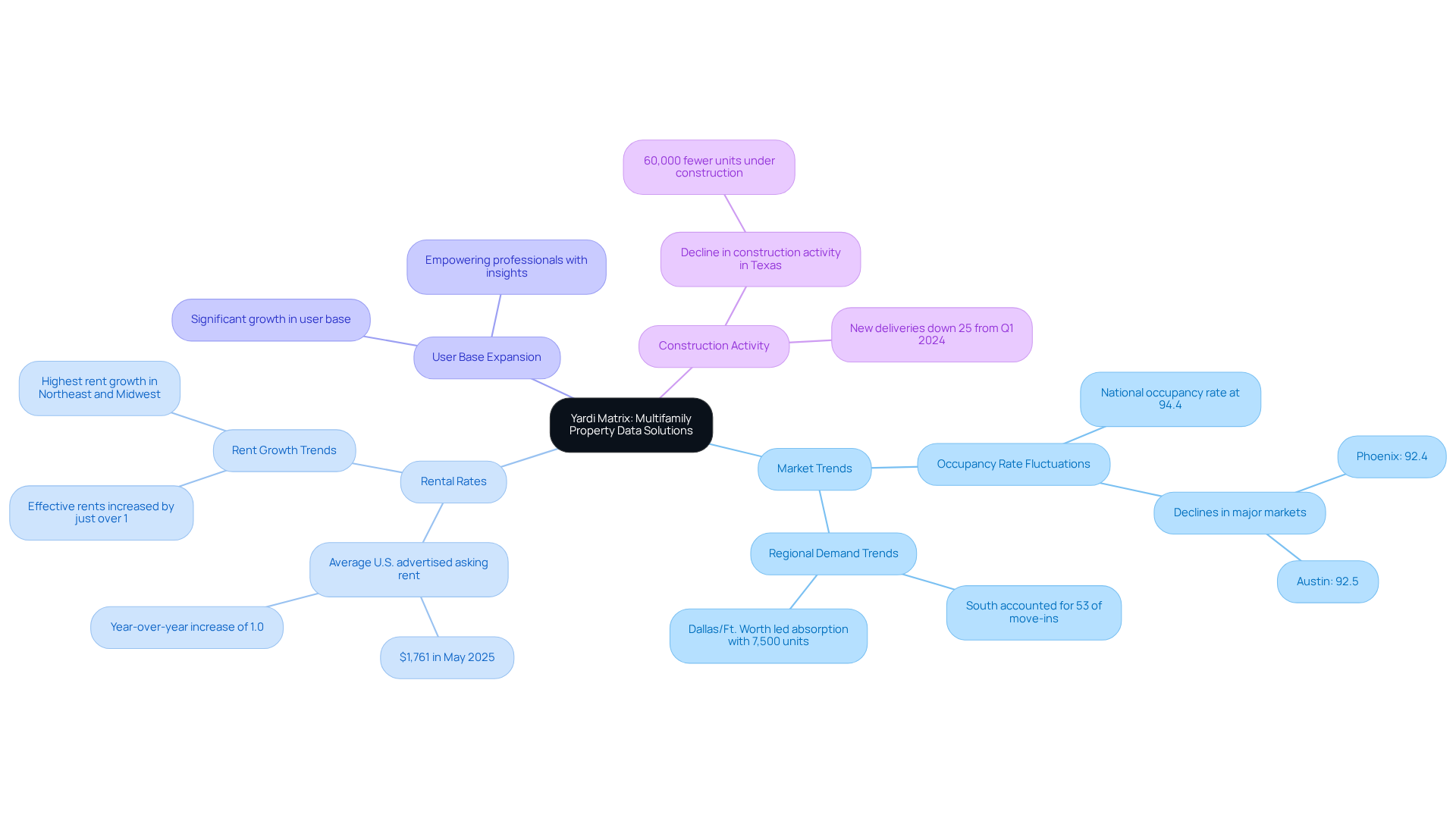

Yardi Matrix: Multifamily Property Data Solutions

Yardi Matrix is recognized as one of the best property research platforms, providing comprehensive information solutions tailored for multifamily residences and empowering professionals with crucial insights into market trends, rental rates, and asset performance. The Q1 2025 U.S. Multifamily MarketBeat report indicates that the average U.S. advertised asking rent reached $1,761 in May 2025, marking a year-over-year increase of 1.0%.

With a significantly expanding user base, Yardi Matrix has established itself as one of the best property research platforms for navigating the multifamily landscape, particularly as occupancy rates in major markets exhibit fluctuations, with certain areas facing declines. This platform equips title researchers to conduct thorough title examinations, facilitating informed decisions regarding ownership and investment opportunities.

As Sam Tenenbaum aptly observes, "The market is always evolving, and the best choices are those based on accurate, current information." The importance of precise rental rate data cannot be overstated; it is vital for assessing property values and identifying lucrative investment prospects on the best property research platforms.

Furthermore, the notable decline in construction activity within major Texas markets may impact market dynamics, underscoring the necessity for experts utilizing the best property research platforms to adeptly navigate the complexities of the market, ensuring they remain competitive and well-informed in their evaluations.

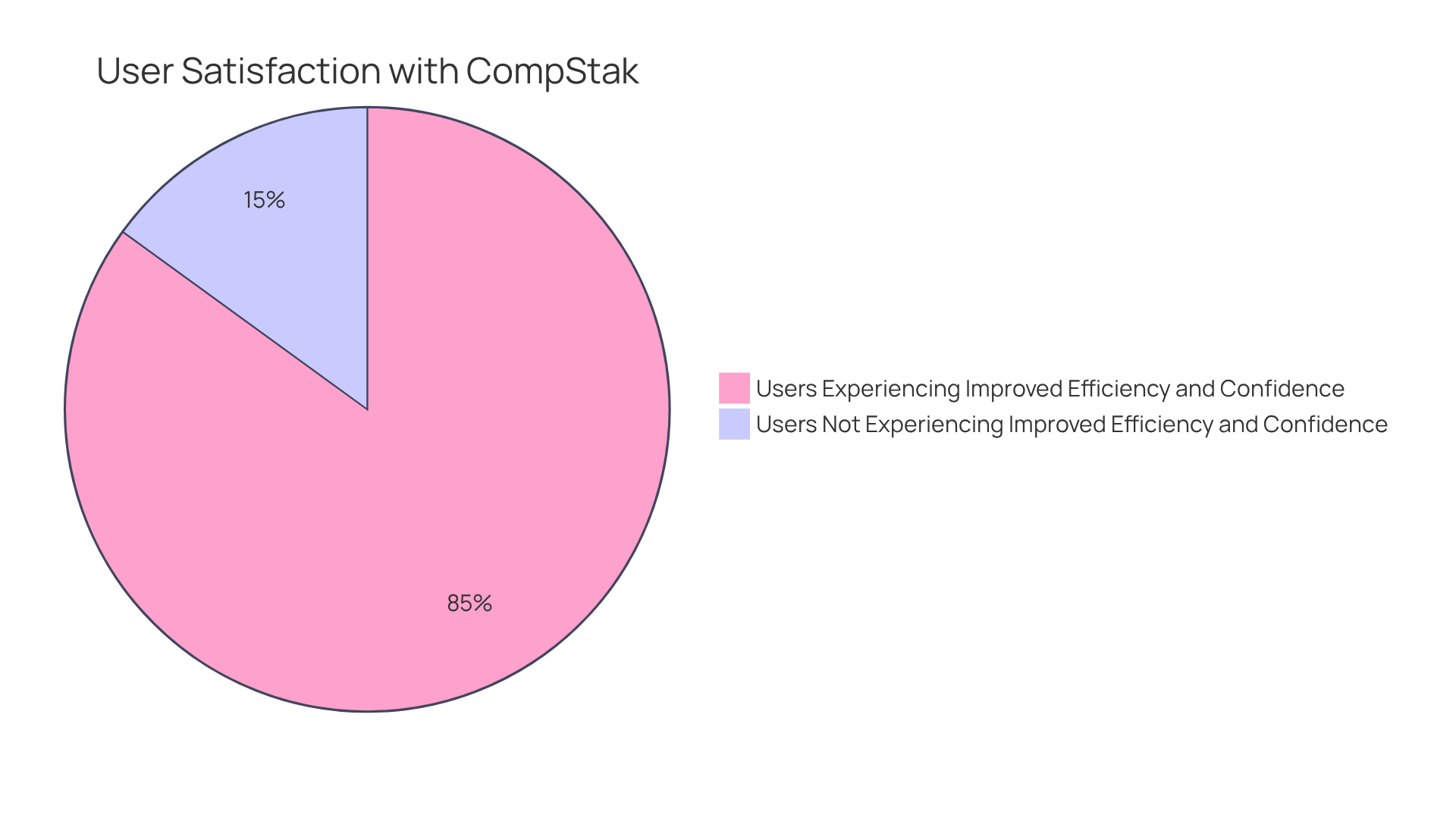

CompStak: Commercial Lease Data Insights

CompStak stands as an innovative platform that consolidates commercial lease information, offering critical insights into lease transactions and market dynamics. For industry experts, access to CompStak's extensive database significantly enhances their ability to verify ownership and assess associated risks. Utilizing this information allows title researchers to achieve greater precision in evaluating asset values and understanding ownership frameworks. User satisfaction data indicates that approximately 85% of CompStak users experience improved efficiency and confidence in their evaluations.

As data scientist Nico Lassaux articulates, "the only issue is, in 2024, there are so many sources of real estate information available that it can be difficult to identify the best property research platforms to meet your needs."

As the landscape of real estate ownership verification evolves in 2025, the role of crowdsourced information, such as that provided by CompStak, becomes increasingly vital, enabling experts to navigate the complexities of commercial leases with enhanced accuracy. Researchers have effectively leveraged CompStak to analyze lease transaction data, leading to more informed decisions regarding ownership verification.

Moody's Analytics: Economic and Property Data Analytics

Moody's Analytics delivers comprehensive economic and real estate analytics, equipping specialists with vital insights into market trends, asset values, and economic projections. With over 4 million content users benefiting from its analytics, Moody's empowers researchers to enhance their assessments of property ownership and efficiently evaluate potential risks.

As Dan Heath asserts, information alone lacks significance without context and evaluation—an essential consideration for industry experts aiming to make informed decisions grounded in robust economic insights. Furthermore, W. Edwards Deming's assertion that 'In God we trust, all others bring evidence' underscores the importance of employing reliable information in decision-making.

By leveraging Moody's data, title experts can navigate the complexities of title research in 2025, ensuring more accurate evaluations of real estate while remaining cognizant of the challenges associated with information usage, such as the need for organized methodologies and data cleansing.

PropertyShark: Detailed Property Reports and Ownership Information

PropertyShark serves as an indispensable platform for professionals in the real estate sector, delivering comprehensive reports and ownership information. By aggregating data from public records, it offers valuable insights into real estate history, sales data, and ownership specifics.

For title professionals, the significance of accurate title research cannot be overstated, as it enables them to verify ownership and assess property values with confidence. Consequently, PropertyShark stands out as one of the best property research platforms, empowering users to conduct thorough research and make informed decisions.

Conclusion

The exploration of the best property research platforms for title professionals underscores the transformative impact of technology in the real estate sector. By leveraging advanced tools such as Parse AI, CoStar, Trepp, and others, title professionals can significantly enhance their research capabilities, streamline workflows, and make informed decisions. These platforms not only automate tedious processes but also provide comprehensive data analytics, ensuring accuracy and efficiency in ownership verification.

Key insights throughout the article highlight how each platform addresses specific challenges faced by title professionals. From Parse AI's machine learning capabilities that optimize document processing to Moody's Analytics' economic insights that guide market evaluations, each tool offers unique features that contribute to a more effective research process. Furthermore, the importance of reliable data is underscored, as it forms the foundation for sound decision-making in real estate transactions.

In conclusion, embracing these innovative property research platforms is essential for title professionals aiming to stay competitive in a rapidly evolving market. As the industry continues to adapt to technological advancements, utilizing the best tools available will not only enhance operational efficiency but also empower professionals to navigate the complexities of property ownership with confidence. Investing in these resources is a strategic move that can lead to greater success in the real estate domain.

Frequently Asked Questions

What is Parse AI and how does it assist in title research automation?

Parse AI utilizes advanced machine learning algorithms and optical character recognition (OCR) to optimize the extraction of essential information from document titles, significantly reducing the time required for ownership research and enhancing the precision of generated abstracts and reports.

How quickly does Parse AI process summarization and correlation analysis queries?

Summarization queries are processed within an average response time of 9 seconds, while correlation analyses take approximately 21 seconds per query.

What challenges in property research does Parse AI address?

Parse AI effectively addresses challenges such as navigating incomplete records and deciphering complex legal terminology, improving workflow efficiency and reliability of information.

What benefits do real estate professionals gain from using Parse AI?

Users benefit from substantial cost savings and improved workflow efficiency, as the integration of OCR accelerates the research process and enhances the reliability of the information retrieved.

What is CoStar and what data does it provide?

CoStar is a comprehensive commercial real estate data and analytics platform known for its extensive database, which includes listings, sales information, and market analytics, offering critical insights into real estate values, market trends, and transaction histories.

How does CoStar support investment analysis and risk evaluation?

CoStar provides features dedicated to investment analysis and risk evaluation, empowering users to make informed decisions and enhancing their ability to verify ownership and assess potential risks in real estate transactions.

What role does Trepp play in the analysis of commercial mortgage-backed securities (CMBS)?

Trepp provides crucial information and analytics on CMBS, delivering valuable insights into loan performance and market dynamics, which are essential for assessing the financial stability of assets.

What is the significance of the special servicing rate reported by Trepp?

The special servicing rate of 6.42% in 2025 indicates the performance of loans, which is notably lower than past rates, highlighting the importance of monitoring delinquencies and recovery efforts for effective risk management.

How can industry experts utilize the information provided by Trepp?

Industry experts can use Trepp's platform to examine loan information, monitor delinquencies, and evaluate market conditions, which are crucial for precise ownership verification and efficient risk evaluation.

Why is it important for real estate professionals to leverage advanced property research platforms?

Utilizing advanced property research platforms like Parse AI, CoStar, and Trepp enhances decision-making procedures, improves overall efficiency in real estate research, and helps professionals maintain a competitive edge in the evolving commercial real estate landscape.