Overview

The article outlines three pivotal security considerations for title company software:

- Regulatory compliance

- Data protection measures

- Continuous improvement through employee training

It underscores the importance of adhering to regulations such as GLBA and FCRA, implementing robust encryption and access controls, and cultivating a culture of ongoing education. These elements are essential for mitigating risks and enhancing the security of sensitive information in title firms.

Introduction

Navigating the intricate landscape of title company software security is increasingly crucial, particularly as regulatory compliance and data protection take center stage in the industry. Title firms encounter the dual challenge of safeguarding sensitive information while adhering to stringent laws such as the Gramm-Leach-Bliley Act and the Fair Credit Reporting Act. This article explores three essential security considerations that can not only fortify a title company’s defenses against cyber threats but also enhance operational integrity and client trust.

How can firms effectively balance compliance, robust data protection, and continuous employee training to mitigate risks and foster a secure environment?

Understand Regulatory Compliance Requirements

Title firms must remain vigilant as they navigate the complex landscape of regulatory compliance, particularly in relation to the (GLBA) and the Fair Credit Reporting Act (FCRA). The GLBA imposes strict requirements for safeguarding consumer financial data, whereas the FCRA regulates the collection and use of consumer credit information.

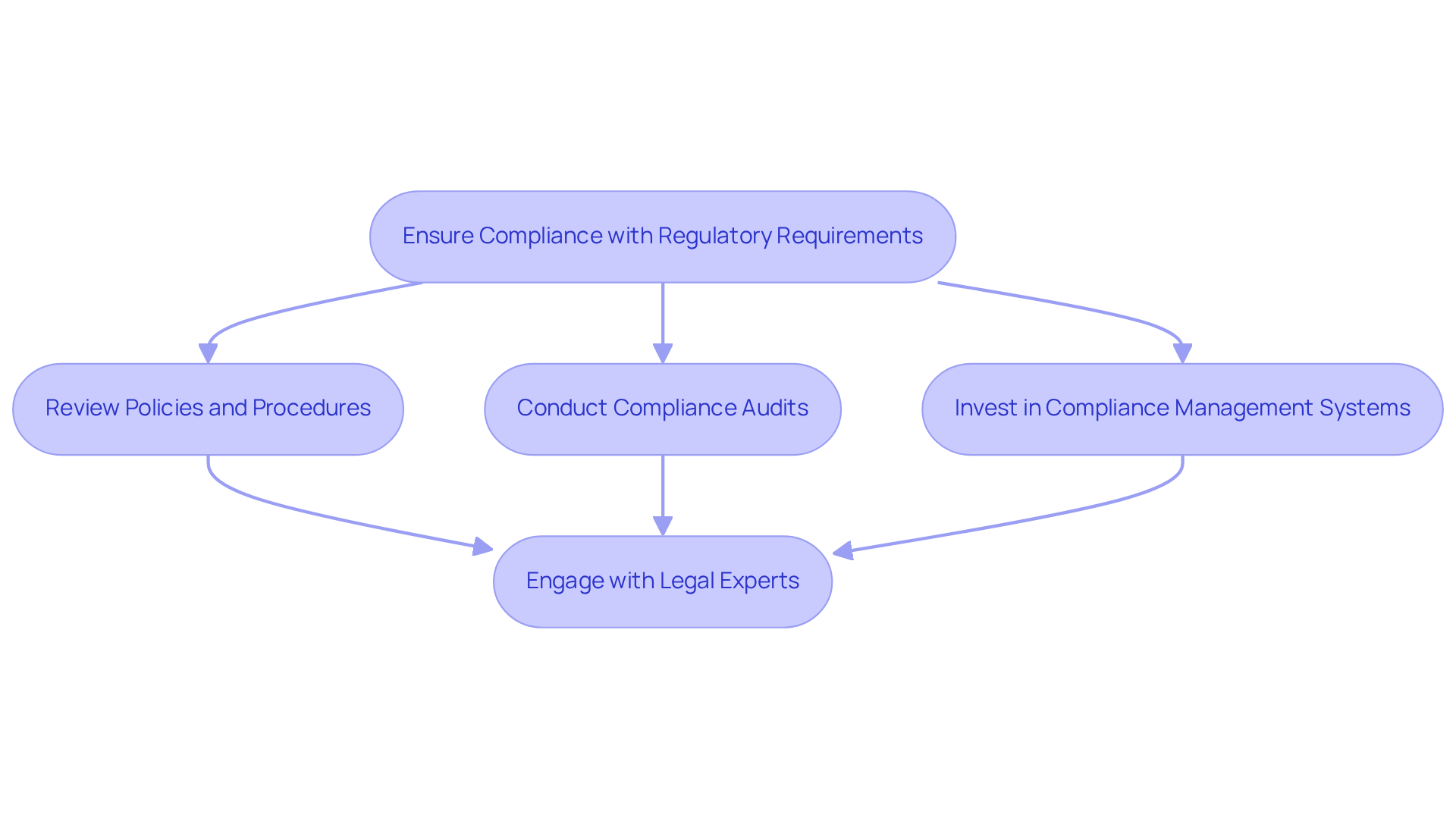

To ensure compliance with these regulations, title firms should:

- Regularly review their policies and procedures

- Conduct thorough compliance audits

- Invest in robust compliance management systems

Furthermore, engaging with legal experts can yield essential insights into the intricacies of these laws, empowering firms to accurately interpret complex regulations and implement necessary adjustments. By prioritizing compliance, title firms not only mitigate potential risks but also enhance trust with clients and stakeholders, thereby cultivating a more secure operational environment.

Implement Robust Data Protection Measures

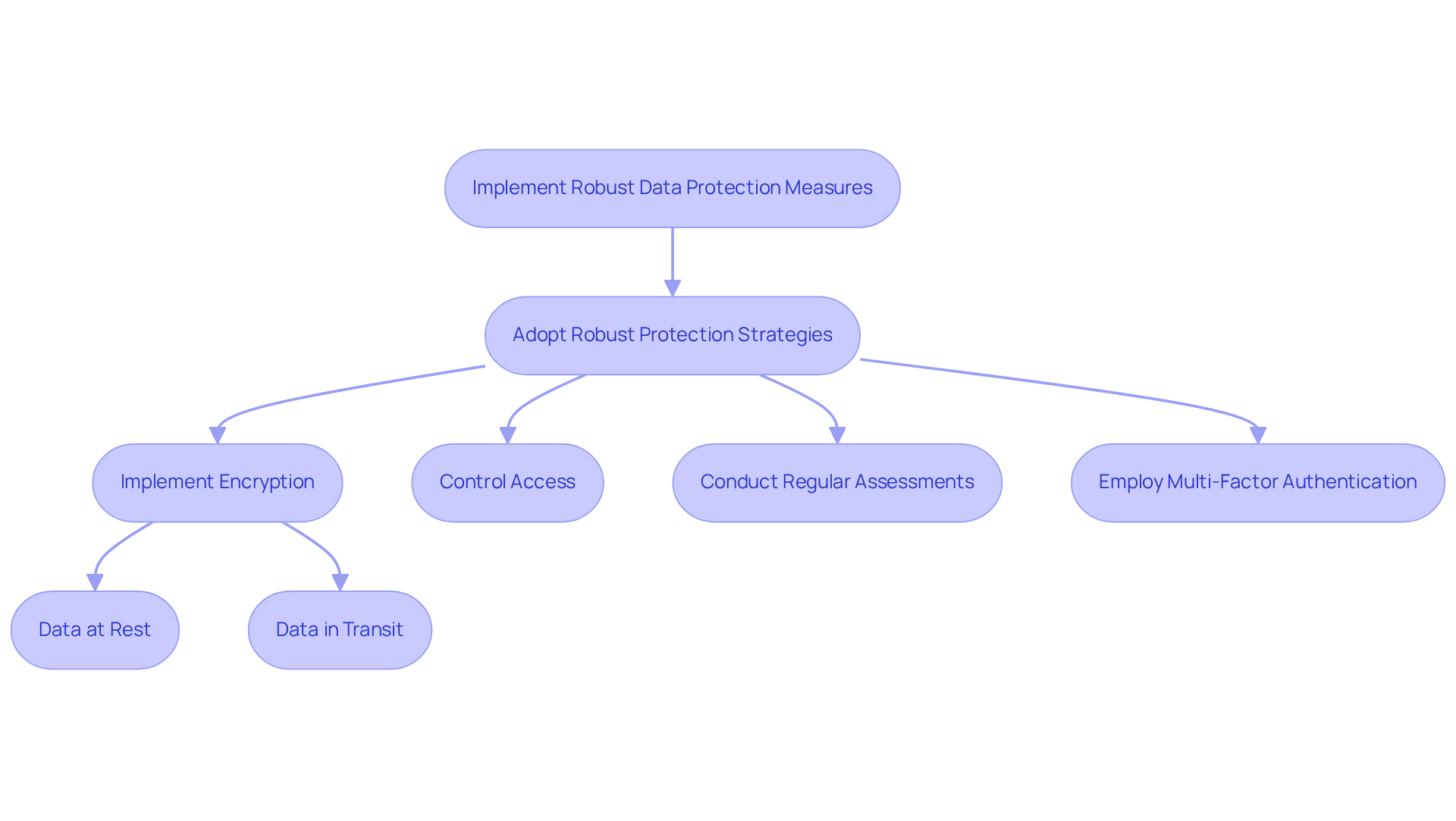

To safeguard sensitive information, title firms must adopt robust protection strategies that incorporate security considerations in , with encryption as a fundamental element. Implementing encryption for data both at rest and in transit is crucial, ensuring that confidential documents are securely stored, whether in cloud-based solutions or on-premises servers. Access to sensitive information should be meticulously controlled, granting permissions exclusively to authorized personnel.

Furthermore, regular assessments are essential for identifying vulnerabilities and verifying the effectiveness of protection measures; indeed, 86% of organizations reported engaging in mitigation activities in 2023, a notable increase from 63% in 2022. Additionally, employing multi-factor authentication and enforcing stringent password policies can significantly bolster protection.

By prioritizing these information protection practices, including security considerations in title company software, title companies can mitigate the risk of breaches, which may lead to identity theft and financial loss, while also fostering client trust and enhancing operational integrity.

For instance, effectively integrated AI-powered tools that reduced processing times by 42% and error rates by 33%, demonstrating the efficiency of enhanced protective measures. Moreover, True Concept Title underscores its commitment to advancing information protection practices, reinforcing the critical role of encryption in safeguarding sensitive details.

Adopt Continuous Improvement and Training Strategies

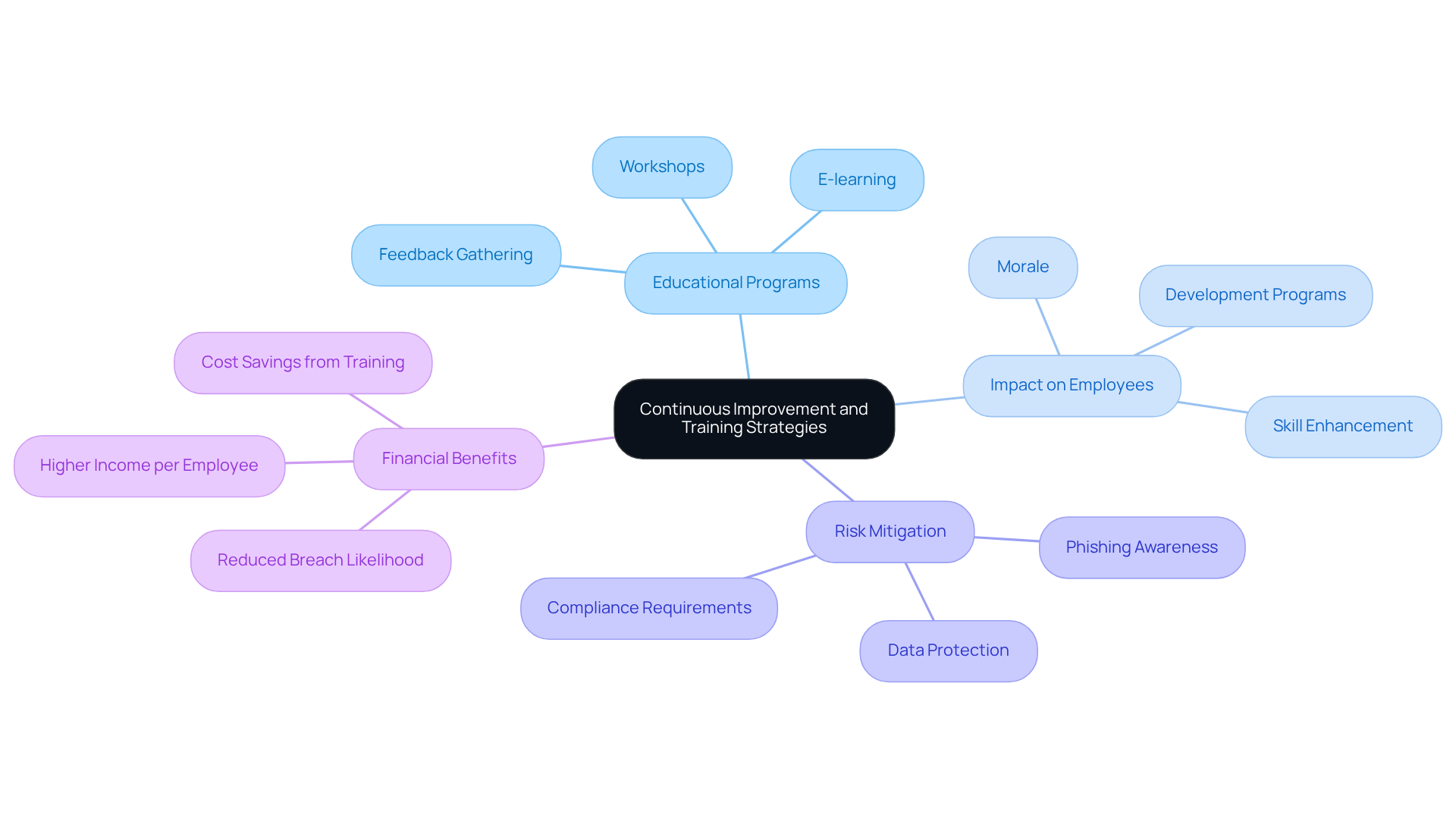

Title firms must cultivate an environment of continuous improvement by regularly updating their educational programs to address the latest risks and best practices. This involves conducting frequent workshops and e-learning sessions that focus on critical areas such as data protection, phishing awareness, and compliance requirements. Involving employees in safety education not only enhances their understanding but also fosters a proactive mindset towards identifying and mitigating risks. For instance, organizations with robust security education programs have demonstrated a 65% reduction in breach likelihood, underscoring the effectiveness of such initiatives. Furthermore, companies with comprehensive employee development programs report 218% greater income per employee compared to those lacking structured education, highlighting the financial benefits of investing in employee growth.

Gathering feedback from staff regarding the program's effectiveness is essential for refining initiatives and ensuring they align with the evolving needs of the organization. Statistics reveal that 39% of employees feel disheartened about their career development prospects, emphasizing the necessity for programs that promote growth and skill enhancement. Significantly, social engineering and phishing account for 70% to 90% of data breaches, reinforcing the critical need for effective educational programs. By prioritizing employee development and committing to ongoing enhancement, title companies can substantially bolster their overall protective posture and resilience against cyber threats, ultimately safeguarding their operations and preserving client trust by integrating security considerations in title company software. As Roger Grimes from KnowBe4 states, "Effective security awareness training, with , educates employees and significantly reduces the human risk of cybersecurity threats.

Conclusion

In the realm of title companies, where security and compliance are non-negotiable, prioritizing effective software strategies is essential. By comprehensively understanding regulatory compliance requirements, implementing robust data protection measures, and committing to continuous improvement and training, title firms can significantly enhance their operational security and cultivate stronger relationships with clients.

This article underscores the critical importance of adhering to regulations such as the GLBA and FCRA, which are designed to safeguard consumer data. It also highlights the necessity of employing encryption, access controls, and conducting regular assessments to protect sensitive information. Furthermore, fostering a culture of ongoing education equips employees with the essential knowledge needed to combat prevalent cyber threats, ultimately reducing the likelihood of data breaches.

In a landscape where cyber threats are continually evolving, title companies must not only adopt these best practices but also remain proactive in their security approach. By investing in compliance, data protection, and employee training, firms can ensure a secure environment that not only protects their operations but also reinforces client trust. Embracing these strategies transcends mere compliance; it embodies a commitment to excellence and integrity within the title industry.

Frequently Asked Questions

What are the key regulatory compliance requirements for title firms?

Title firms must comply with the Gramm-Leach-Bliley Act (GLBA) and the Fair Credit Reporting Act (FCRA). The GLBA requires safeguarding consumer financial data, while the FCRA governs the collection and use of consumer credit information.

What steps should title firms take to ensure compliance with regulations?

Title firms should regularly review their policies and procedures, conduct thorough compliance audits, and invest in robust compliance management systems.

How can legal experts assist title firms with regulatory compliance?

Engaging with legal experts can provide essential insights into the complexities of regulatory laws, helping firms accurately interpret regulations and implement necessary adjustments.

What are the benefits of prioritizing compliance for title firms?

Prioritizing compliance helps title firms mitigate potential risks and enhances trust with clients and stakeholders, leading to a more secure operational environment.