Overview

The article titled "10 Essential Steps for Your Property Title Verification Checklist" primarily focuses on delineating the critical steps necessary for effectively verifying property titles. It underscores the significance of employing a property title verification checklist to ensure accurate ownership claims, identify potential legal issues, and protect against disputes. Consequently, this approach facilitates smoother real estate transactions and enhances the reliability of ownership verification.

Introduction

In the intricate world of real estate, the verification of property titles is a critical pillar that ensures smooth transactions and safeguards investments. With the advent of advanced automation technologies, such as Parse AI, traditional processes of title verification are being transformed, making them faster and more accurate than ever before. As the real estate market continues to evolve, professionals increasingly recognize the importance of leveraging these innovations to streamline workflows and effectively manage risks.

From confirming ownership to understanding the chain of title, navigating liens, encumbrances, and zoning regulations, each step in the title verification process is essential for preventing disputes and enhancing transaction efficiency. This article delves into the multifaceted aspects of title verification, exploring how modern tools and diligent practices can empower buyers and title researchers alike in the pursuit of secure and informed real estate dealings.

Parse AI: Streamline Property Title Verification with Advanced Automation

Parse AI revolutionizes the property ownership verification process through advanced automation technologies. By harnessing sophisticated machine learning algorithms and optical character recognition (OCR), the platform adeptly extracts critical data from . This rapid data processing not only accelerates verification but also significantly improves accuracy, enabling researchers to concentrate on more complex tasks.

As the real estate sector increasingly adopts AI—projected to reach $988.59 billion by 2029, with a CAGR of 34.4%—experts can leverage this technology to reduce the time and resources traditionally associated with ownership research. The outcome is a streamlined workflow that enhances transaction efficiency and bolsters informed decision-making.

Furthermore, as industry leaders acknowledge the necessity of managing risks linked to technology adoption, the advantages of machine learning in title research become even more evident, fostering a more effective and responsive real estate environment.

In 2023, the emphasis was on utilizing AI, while 2024 is expected to focus on optimizing AI utilization. Additionally, the increasing penetration of the internet is driving the adoption of AI in , rendering automation essential for improving operational efficiencies and enriching customer experiences.

Verify Current Ownership: Confirm the Legitimacy of Property Claims

To confirm the legitimacy of asset claims, utilizing is essential to verify current ownership through public records. Start by reviewing the most recent deed filed with the county clerk's office, which outlines the present owner's name along with relevant information about the land. This deed must include an effective date and identification details of both the vendor and purchaser, as these are critical requirements for its validity.

Cross-referencing this data with tax records, as outlined in a property title verification checklist, is advisable; it helps confirm that ownership is both current and accurate. This verification step, as detailed in the property title verification checklist, is crucial in preventing disputes that may arise from claims by previous owners or other parties. In fact, a significant percentage of real estate disputes arise from inaccuracies in ownership records, underscoring the necessity of thorough verification.

As noted by industry experts, using a property title verification checklist along with diligent examination of county clerk records can reveal potential issues before they escalate, facilitating smoother transactions and safeguarding investments. Aaron Winston emphasizes that dedicating time to verify ownership can prevent disputes and lead to successful outcomes. Furthermore, embracing the potential of asset ownership records can reveal untapped opportunities.

To remain up-to-date, consider utilizing the most recent information on public records for claims in 2025, and investigate tools that simplify the verification process.

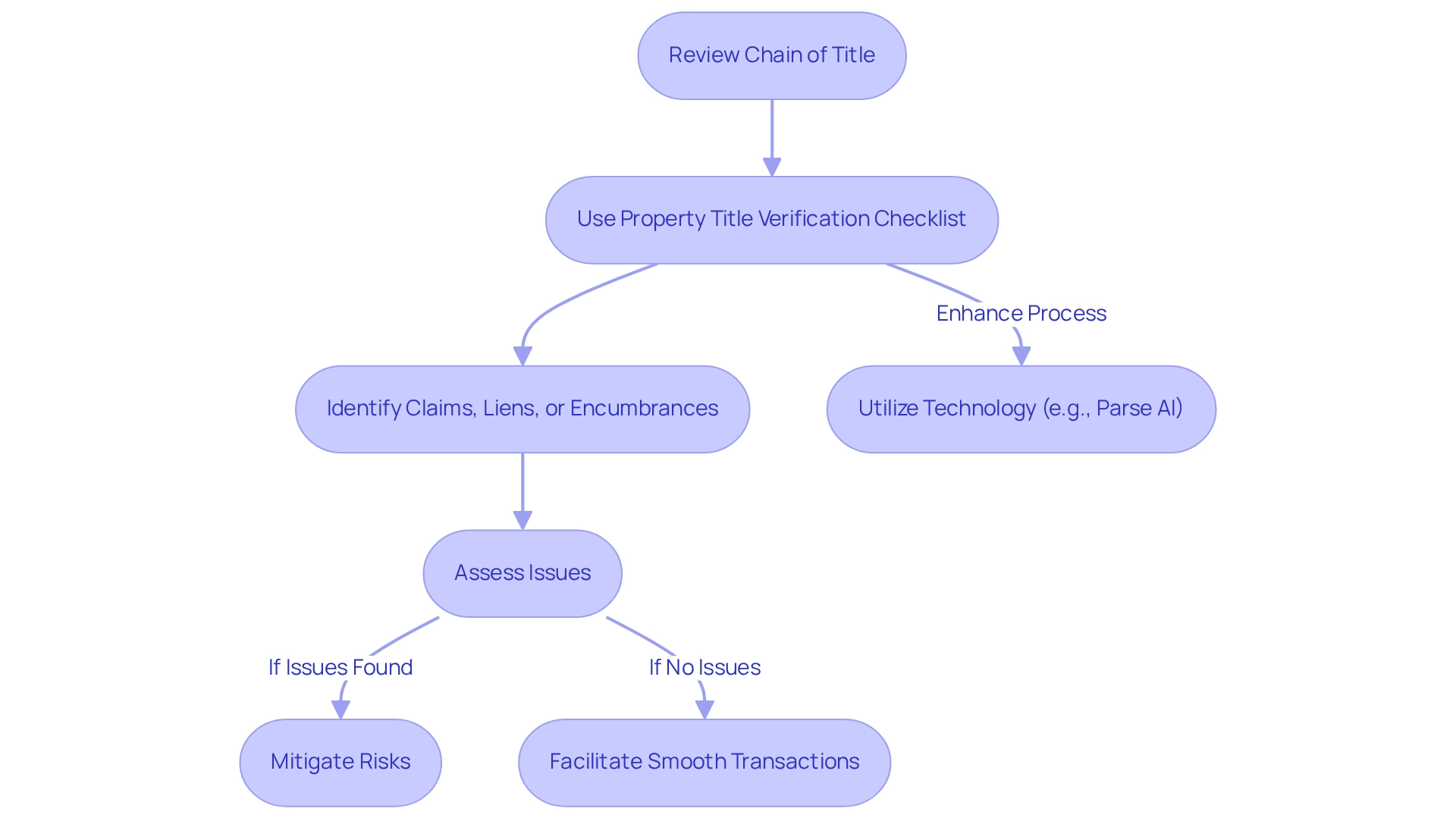

Review the Chain of Title: Understand Ownership History and Issues

The chain of ownership serves as a comprehensive historical record that traces land possession from to the current holder. A meticulous review of this chain with a property title verification checklist is essential for identifying any breaks or inconsistencies that may indicate potential legal issues. Title researchers must utilize a property title verification checklist to scrutinize each transfer of ownership, searching for claims, liens, or encumbrances that could impact the property.

Recent data reveals that approximately 30% of real estate transactions encounter problems related to the chain of ownership, underscoring the significance of this review process. Furthermore, a substantial settlement of $22.7 million was awarded to consumers by Fidelity National Financial and First American Title Insurance Co. concerning alleged rebate activities, illustrating the financial repercussions of ownership disputes.

By ensuring a thorough examination with a property title verification checklist, researchers can mitigate the risk of future conflicts and facilitate smoother transactions. As legal experts have noted, understanding ownership history is not merely a procedural step; it is a fundamental aspect of safeguarding property rights and ensuring the integrity of real estate dealings, which is why a property title verification checklist is essential.

As Douglas Adams aptly stated, 'To give real service, you must add something which cannot be bought or measured with money, and that is sincerity and integrity.' This perspective resonates profoundly in the domain of title research. In addition, the innovative application of technology, such as Parse AI's machine learning and optical character recognition, exemplifies how modern tools can enhance the efficiency and accuracy of the chain of title review process.

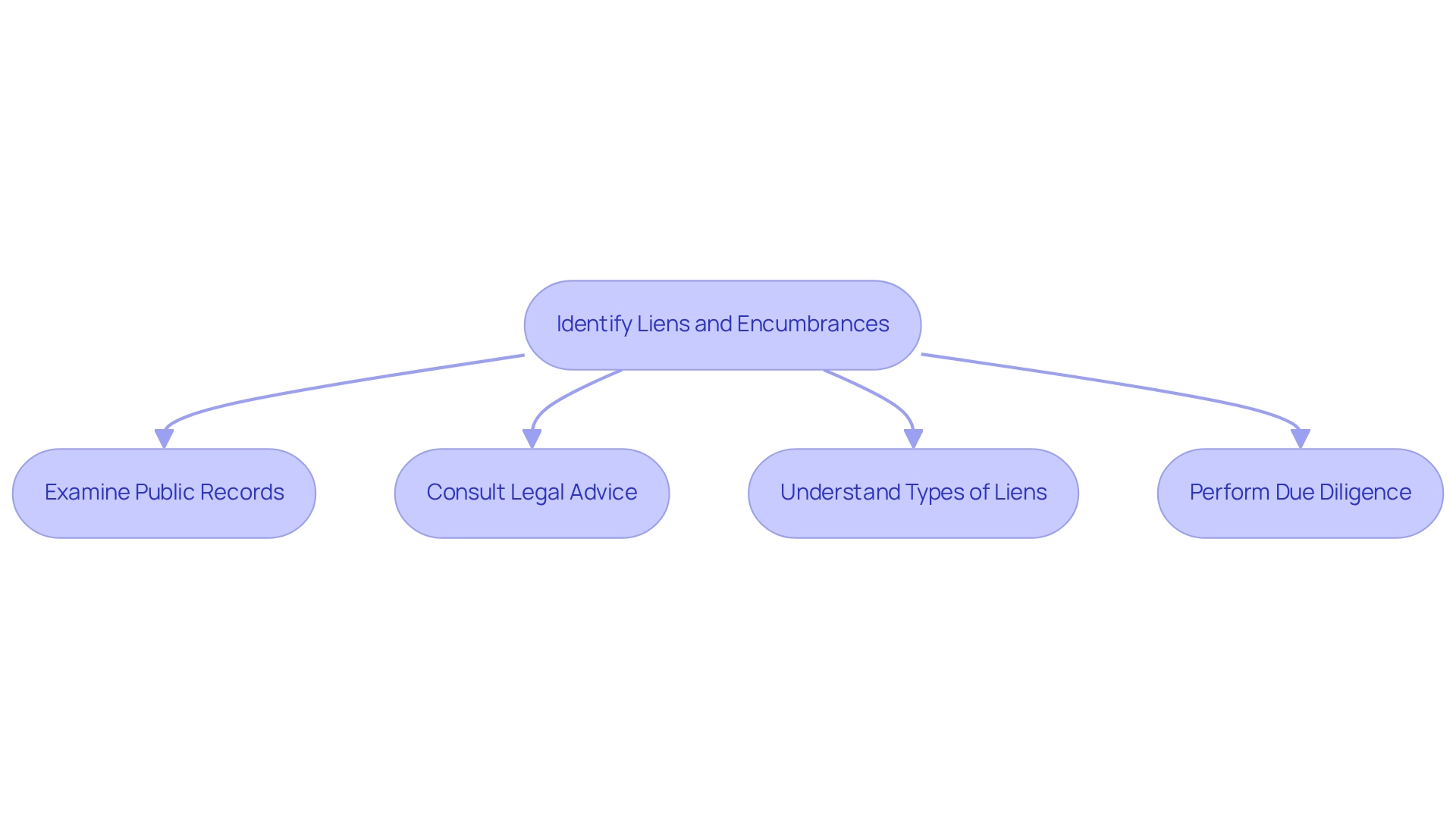

Identify Liens and Encumbrances: Assess Financial Claims on the Property

Before concluding a real estate deal, it is essential to recognize or encumbrances. These can include mortgages, tax liens, or judgments against the owner, which may significantly affect the transaction. A thorough examination of public records is crucial to reveal any financial claims that could influence the asset. Notably, a substantial percentage of assets have existing liens, underscoring the significance of this step.

Understanding these obligations is vital for buyers, as they may inherit these debts if not properly addressed before closing the sale. A lien on a home is typically settled if the home is paid off or sold, emphasizing the need for buyers to address these issues beforehand. Consulting legal advice is recommended if there is uncertainty regarding encumbrances, ensuring that buyers are fully informed of their rights and responsibilities.

As Bill Gassett notes, recognizing the types of liens and their implications can help mitigate potential delays or complications in the selling process. Furthermore, judgment liens are involuntary claims imposed on assets after a creditor secures a victory in a lawsuit against the debtor, which can further complicate dealings.

Case studies indicate that both financial and non-financial encumbrances can influence management and ownership; understanding these encumbrances is vital for homeowners to navigate their rights and responsibilities effectively. Thus, performing comprehensive due diligence and using a property title verification checklist, along with obtaining expert advice, are crucial measures in facilitating a seamless real estate transaction.

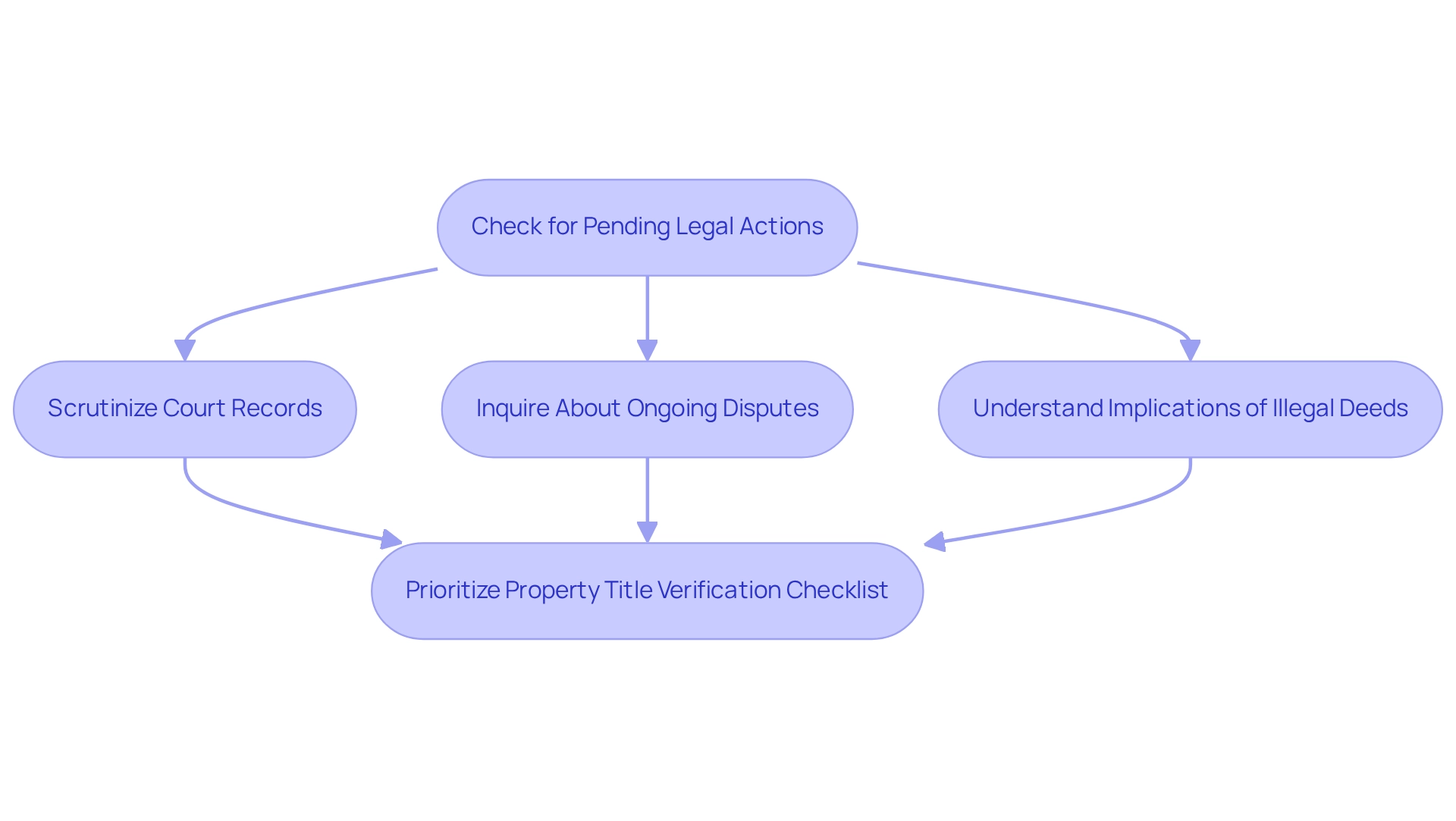

Check for Pending Legal Actions: Safeguard Against Title Disputes

To effectively protect against , it is crucial to scrutinize any ongoing legal matters related to the asset. This entails a comprehensive search of court records for lawsuits involving the property or its current owner. Title researchers should proactively inquire about ongoing disputes that may not yet be reflected in public records. Such diligence can significantly mitigate the risk of costly legal battles post-purchase.

Rande Yeager, president of the American Land Association, underscores, "This clearly demonstrates the importance of a professional search in all real estate transactions, whether buying a new home or refinancing an existing mortgage."

Recent statistics indicate that unresolved ownership disputes can lead to prolonged legal proceedings, with some cases necessitating years to settle, thereby highlighting the necessity for thorough inspections. Furthermore, understanding the implications of illegal deeds—such as those involving minors or undocumented individuals—can further safeguard ownership rights. Possession of a real estate asset may become complicated if it was previously held by individuals in these categories, potentially affecting the enforceability of prior deeds.

By prioritizing the property title verification checklist, title researchers can ensure a smoother transaction and maintain the integrity of ownership. Moreover, a loan policy of ownership insurance is mandated by lenders before granting a loan to ensure that the ownership is clear, further emphasizing the significance of a property title verification checklist in comprehensive ownership verification.

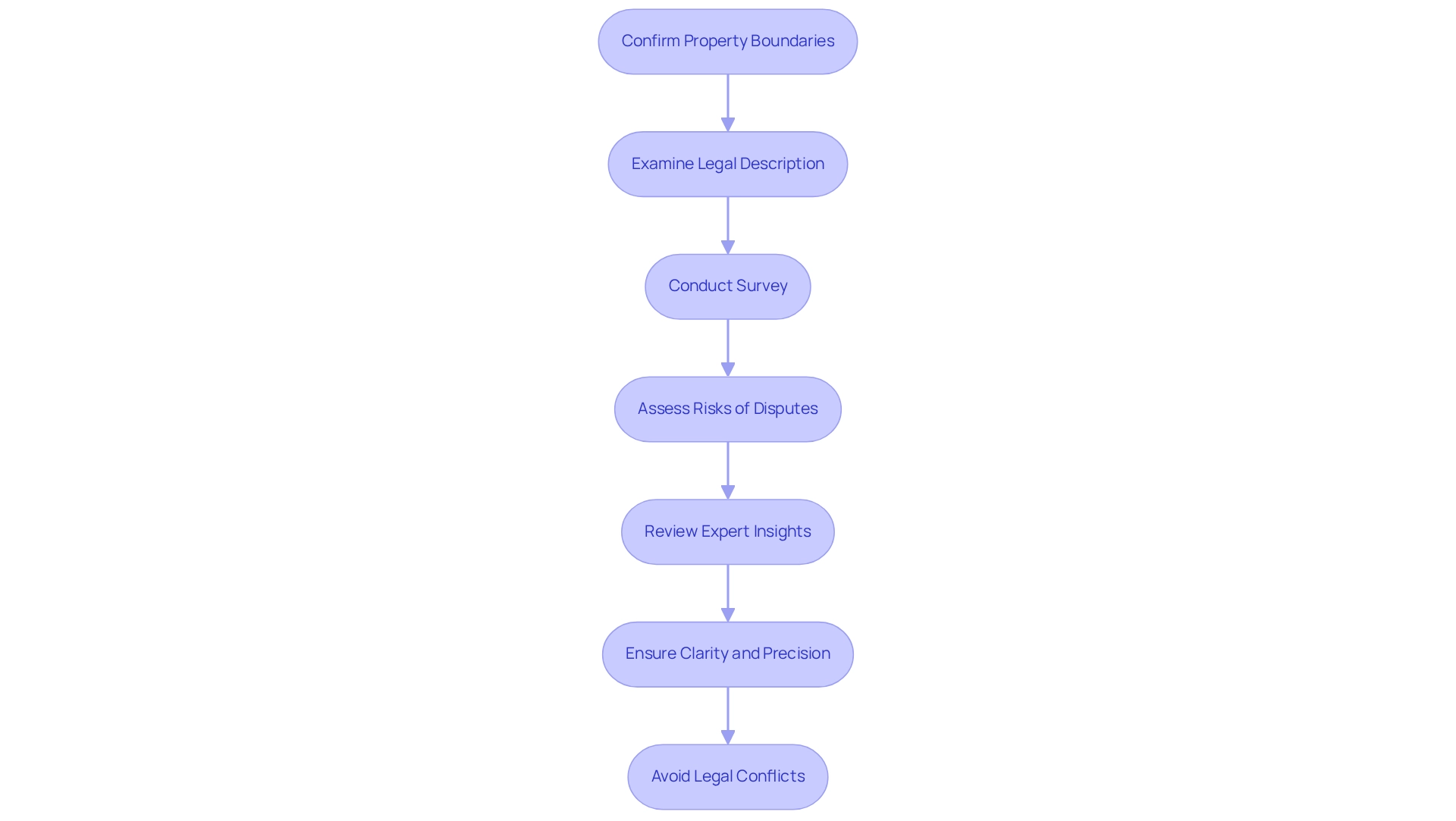

Confirm Property Boundaries and Descriptions: Ensure Accurate Delineation

Confirming land boundaries is a crucial step in the title verification process. Purchasers must meticulously examine the legal description of the asset, typically found in the deed, to ensure clarity and precision. A recent survey proves invaluable, providing precise measurements and delineations of borders, thereby significantly reducing the risk of disputes with neighboring areas.

Flawed descriptions of real estate can lead to costly legal disputes; statistics indicate that boundary disagreements rank among the most prevalent legal challenges faced by homeowners. Furthermore, with median home values assessed across more than 3,100 counties, the financial repercussions of these disputes can be substantial, underscoring the necessity for precision in land delineation.

For instance, a well-executed survey not only enhances marketability but also assures buyers of the asset's legal status, as evidenced by case studies where clear boundary definitions positively influenced resale value. One such case study highlighted that assets with precise assessments commanded higher prices, reinforcing the importance of expert evaluations in real estate transactions.

Expert insights underscore that precise boundary definition is essential for avoiding misunderstandings and ensuring a seamless exchange process. As Eric Harvey, J.D., points out, professional surveyors play a pivotal role in addressing common issues such as encroachments and party walls, which can complicate real estate transactions.

Understanding the nuances of can save time and money while averting legal conflicts, making it imperative for purchasers to prioritize this verification step. Moreover, recent reports suggest that grasping land surveys can conserve time and finances for homeowners and business proprietors in Utah, further emphasizing the significance of thorough verification of real estate in today's market.

Examine Easements and Restrictions: Understand Property Use Limitations

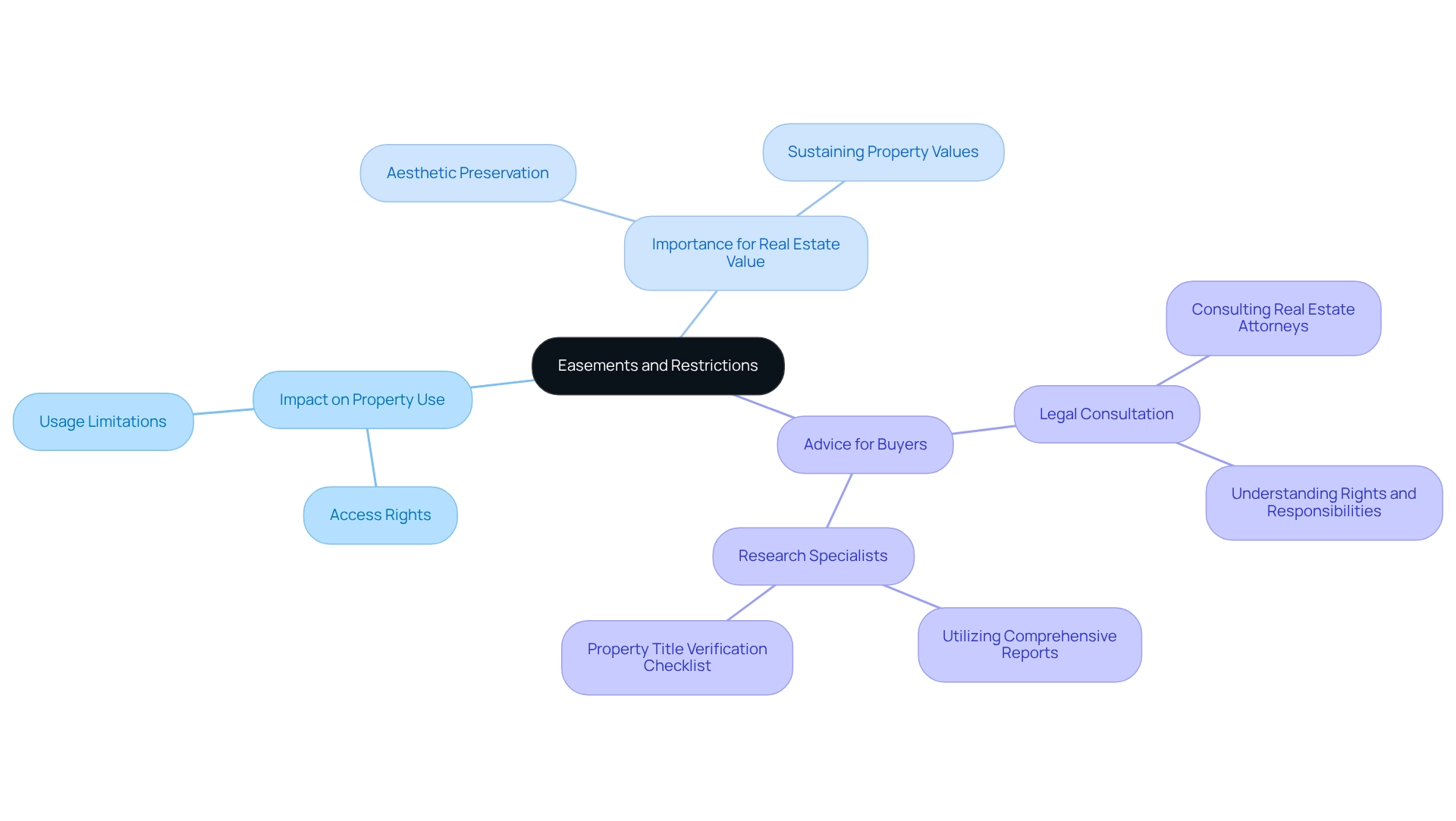

Easements and restrictions can significantly limit how a piece of real estate is utilized, making it crucial to thoroughly examine any recorded easements that may allow others access to specific areas or impose restrictions on certain activities. This information is typically accessible through title reports or public records. Comprehending these limitations is essential for purchasers, as they can greatly influence future development strategies and overall enjoyment of the premises.

For instance, usage limitations can sustain by preserving aesthetics and standards, which is particularly important in residential areas. According to recent statistics, these restrictions play a vital role in sustaining real estate values. A recent case study titled 'Managing Utility Easement Challenges' highlighted the difficulties landowners encounter concerning utility easements. It emphasized that effective communication with utility providers is vital to minimize damage during modifications. In disputes, consulting a real estate lawyer can protect ownership rights and aid in resolution.

Mary Estes Haggin, a member of McBrayer law, noted, "With the help of a seasoned professional, you can feel at ease with easements." This underscores the significance of reviewing the property title verification checklist, which includes easements and restrictions, prior to acquiring real estate. Real estate professionals emphasize that a thorough understanding of the property title verification checklist can help prevent costly surprises down the line. As the landscape of real estate development evolves in 2025, being informed about easements and restrictions will be increasingly critical for making sound investment decisions. Consequently, to navigate these complexities, potential buyers should consider seeking advice from research specialists and utilizing comprehensive reports to ensure they are fully aware of any limitations that may affect their use of the land.

Review Tax Records and Assessments: Uncover Financial Obligations

Reviewing tax records and assessments is a vital component of the title verification process. Potential purchasers must examine any outstanding taxes or assessments that may not be readily apparent. This information is typically accessible through the local tax assessor's office. Comprehending these financial responsibilities is crucial, as unpaid taxes can lead to liens against the asset, endangering ownership.

Recent statistics indicate that unpaid property taxes in the U.S. have reached alarming levels, with the IRS recommending an additional $31.9 billion in tax from closed audits in FY 2023, underscoring the significance of thorough financial assessments. Furthermore, case studies demonstrate that utilizing advanced tools like Parse AI can streamline the process of reviewing tax records, enabling title researchers to efficiently identify financial obligations. By prioritizing the examination of tax records and utilizing the property title verification checklist, buyers can take actionable steps to protect their investments, such as ensuring all taxes are paid and confirming the absence of liens. Consequently, this fosters .

Investigate Zoning and Land Use Regulations: Determine Permissible Uses

Examining zoning and land use regulations is paramount for potential buyers, as these rules dictate allowable activities on a site—be it residential, commercial, or agricultural. Buyers must diligently review local zoning ordinances to ensure that their intended use aligns with these regulations. This careful scrutiny not only mitigates potential disputes with local authorities but also ensures that the asset can be utilized as intended.

Richard Cushing underscores the necessity of planning ahead, akin to the foresight required in Noah's ark, particularly relevant when navigating the complexities of zoning. Understanding these regulations is vital; non-compliance can lead to costly adjustments or legal challenges. Furthermore, recent changes in land use regulations in 2025 have accentuated the importance of this investigation, highlighting the need for buyers to remain informed about local zoning laws.

The World Health Organisation's strategy advocates for walking and cycling, illustrating the broader implications of zoning regulations on urban livability and land use. By proactively addressing zoning issues, buyers can safeguard their investments and enhance the property's value.

As Jan Gehl aptly states, "My work is not anti-car but pro-people," a reminder that zoning should prioritize community needs. For inquiries about the zoning process, the Planner of the Day can be reached at 703-324-1290, TTY 711, while questions regarding Site Plan or engineering/grading processes can be directed to the Engineer of the Day at 703-324-1575, TTY 711.

Additionally, the case study on the cost of making cities livable reveals that investing in is often more cost-effective than maintaining car-focused infrastructure, reinforcing the argument for a thorough investigation of zoning regulations.

Obtain Title Insurance: Protect Against Unforeseen Title Issues

Obtaining ownership insurance is a critical step in safeguarding your real estate investment. This insurance protects against potential losses stemming from ownership flaws that may not have been disclosed during the ownership examination. It provides buyers with peace of mind, ensuring protection against claims from previous owners or other parties.

The financial ramifications of ownership defects can be significant; for example, the combined ratio for insurance in the United States is 103.6%, indicating that losses can surpass premiums collected. Investing in property insurance is a prudent choice, as it can avert substantial financial burdens in the future, making it an essential component of .

Furthermore, innovations from Parse AI demonstrate how technology can enhance research processes, aiding in the identification and mitigation of risks associated with ownership defects.

As Mark Fleming, Chief Economist, aptly stated, "When the price of maintaining a smooth-functioning real estate economy is just pennies on the risk-dollar, do we really want to jeopardize that and risk diminishing the economic benefits it provides?" This statement underscores the necessity of title insurance in protecting investments.

Conclusion

The significance of property title verification is paramount in the real estate landscape. As explored throughout this article, advancements in automation technologies, such as Parse AI, are revolutionizing the verification process, enhancing both efficiency and accuracy. Confirming current ownership, scrutinizing the chain of title, identifying liens and encumbrances, and understanding zoning regulations are all crucial steps for preventing disputes and ensuring smooth transactions.

Furthermore, the integration of modern tools streamlines workflows and empowers professionals to navigate complex legal landscapes more effectively. The emphasis on thorough due diligence—whether through reviewing tax records, examining easements, or obtaining title insurance—acts as a safeguard against potential financial pitfalls and legal complications. As the real estate market continues to evolve, leveraging technology and maintaining diligent practices becomes increasingly evident.

Ultimately, securing a property transaction hinges on meticulous title verification. By embracing innovative solutions and adhering to best practices, buyers and title researchers can significantly reduce risks and foster a more secure and informed real estate environment. With the stakes high in property investments, prioritizing comprehensive verification processes will undoubtedly lead to more successful and sustainable outcomes in the dynamic world of real estate.

Frequently Asked Questions

How does Parse AI improve the property ownership verification process?

Parse AI uses advanced automation technologies, including machine learning algorithms and optical character recognition (OCR), to extract critical data from document title collections quickly and accurately. This enhances the speed of verification and allows researchers to focus on more complex tasks.

What is the projected growth of AI in the real estate sector?

The AI market in the real estate sector is projected to reach $988.59 billion by 2029, with a compound annual growth rate (CAGR) of 34.4%.

What are the benefits of using AI in title research?

AI reduces the time and resources needed for ownership research, streamlining workflows, enhancing transaction efficiency, and supporting informed decision-making in real estate.

What is the focus of the real estate industry regarding AI in 2024?

In 2024, the focus is expected to be on optimizing the utilization of AI technologies within the real estate industry.

Why is a property title verification checklist important?

A property title verification checklist is essential for confirming current ownership through public records and helps prevent disputes arising from inaccuracies in ownership records.

What should be included in the most recent deed filed with the county clerk's office?

The most recent deed should include the present owner's name, the effective date, and identification details of both the vendor and purchaser.

How can reviewing tax records aid in the verification process?

Cross-referencing ownership data with tax records helps confirm that the ownership is current and accurate, which is crucial in preventing disputes.

What percentage of real estate disputes arise from inaccuracies in ownership records?

A significant percentage of real estate disputes arise from inaccuracies in ownership records, emphasizing the necessity of thorough verification.

What is the significance of the chain of ownership in property title verification?

The chain of ownership is a historical record that traces land possession, and reviewing it with a property title verification checklist is essential for identifying potential legal issues.

What recent data highlights the importance of reviewing the chain of ownership?

Approximately 30% of real estate transactions encounter problems related to the chain of ownership, highlighting the need for careful review to mitigate risks.

How can technology like Parse AI enhance the chain of title review process?

Parse AI's machine learning and optical character recognition technologies improve the efficiency and accuracy of the chain of title review process, facilitating smoother real estate transactions.