Overview

The article titled "10 Essential Oil and Gas Leasing Basics for Mineral Owners" delves into the fundamental aspects that mineral owners must comprehend regarding oil and gas leasing agreements. It underscores the significance of grasping key elements such as:

- Royalty rates

- Lease duration

- The operator-mineral owner relationship

These components are crucial for negotiating favorable agreements and maximizing the value of mineral rights. Understanding these basics not only empowers mineral owners but also enhances their ability to navigate the complexities of leasing, ultimately leading to more advantageous outcomes.

Introduction

Navigating the intricate world of oil and gas leasing presents a significant challenge for mineral owners, particularly as the industry undergoes constant evolution through new regulations and technologies. Understanding the fundamental aspects of leasing agreements is essential for maximizing the value of mineral rights and ensuring fair compensation.

However, given the complexities of negotiations, environmental considerations, and legal compliance, how can mineral owners effectively protect their interests while seizing potential opportunities? This article explores ten essential oil and gas leasing basics that every mineral owner must know, offering valuable insights and strategies to successfully navigate this challenging landscape.

Parse AI: Streamline Title Research for Mineral Owners

Parse AI employs advanced machine learning and optical character recognition (OCR) technologies to revolutionize the title research process for resource holders. By efficiently extracting critical information from extensive collections of title documents, Parse AI significantly enhances the efficiency of property ownership verification. This advancement not only accelerates the research timeline but also improves accuracy, empowering resource holders to make informed decisions regarding their agreements.

According to industry insights, businesses leveraging AI can save up to $35,000 annually, highlighting the financial advantages of adopting such technologies. The platform's continuous collaboration with land service professionals ensures it evolves with the industry's changing needs, ultimately leading to substantial time savings and cost reductions.

As Paul Holbein observes, "With OCR, that's exactly what you can do," underscoring the pivotal role of OCR technology in streamlining traditionally labor-intensive processes. This integration facilitates pre-populated applications and instant renewal pricing, enhancing operational efficiency and customer satisfaction.

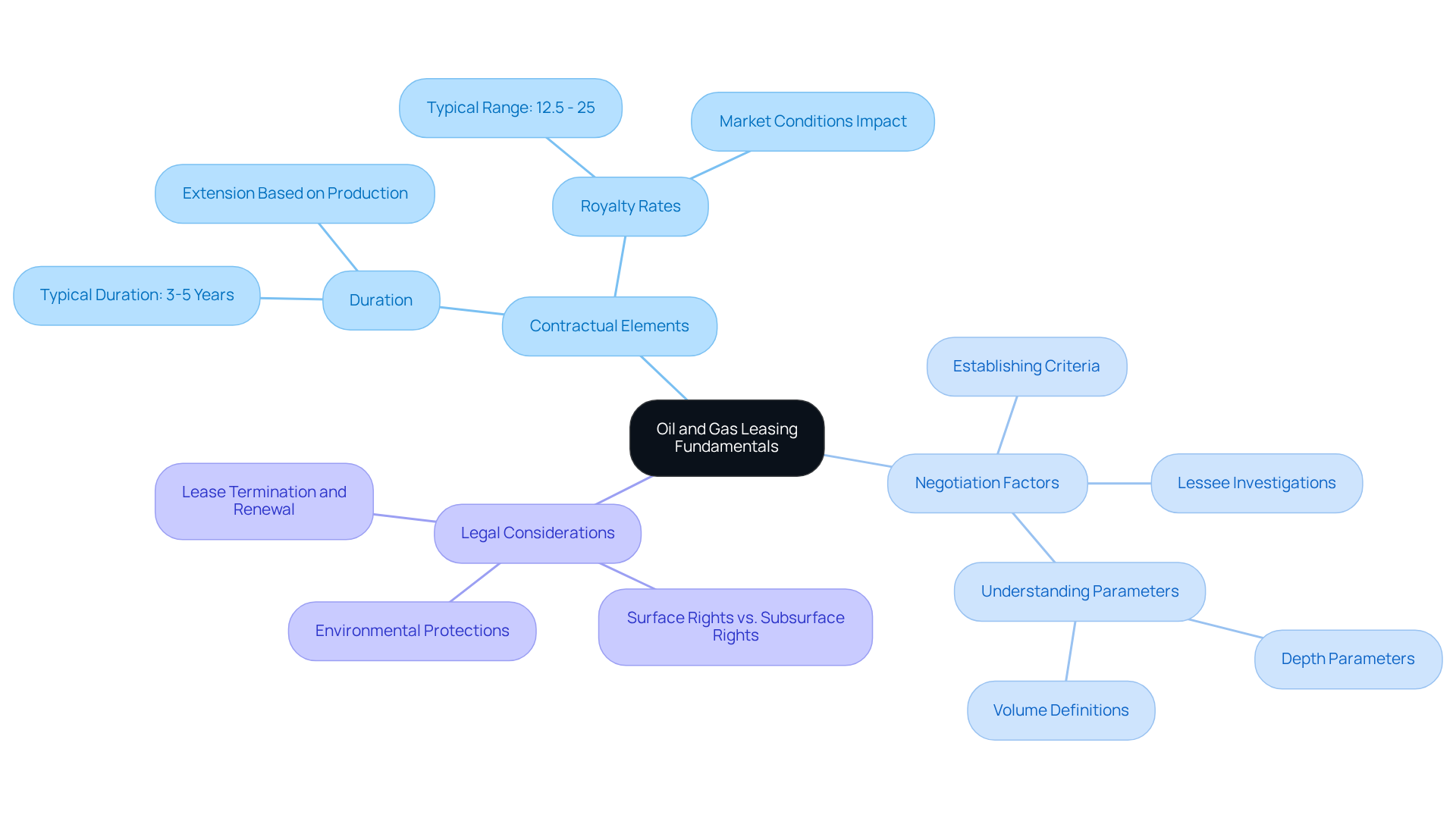

Understanding Oil and Gas Leasing Fundamentals

Oil and gas leasing basics represent a critical legal contract between a resource possessor (lessor) and an oil and gas firm (lessee), empowering the lessee to explore and extract resources from the property. The key elements of these agreements encompass:

- Duration, typically ranging from 3 to 5 years, extendable based on production.

- Royalty rates, which generally fluctuate between 12.5% and 25%, contingent upon market conditions and negotiations.

Legal experts underscore the necessity of grasping the oil and gas leasing basics to protect mineral owners' interests and maximize the value of their mineral rights.

Effective negotiations hinge on clarity regarding rental conditions. This includes:

- Thorough investigations of the lessee.

- Establishing specific criteria.

- Understanding depth parameters and volume definitions, all of which can significantly impact financial outcomes.

Furthermore, recent modifications in rental terms have introduced more stringent drilling commitments and enhanced environmental protections, reflecting an increased focus on responsible resource development.

Resource rights holders must remain vigilant, as multiple rights holders may share royalties, influencing both negotiations and financial results. Staying informed about the oil and gas leasing basics and these evolving legal landscapes is essential for negotiating favorable agreements and ensuring equitable compensation for their resources.

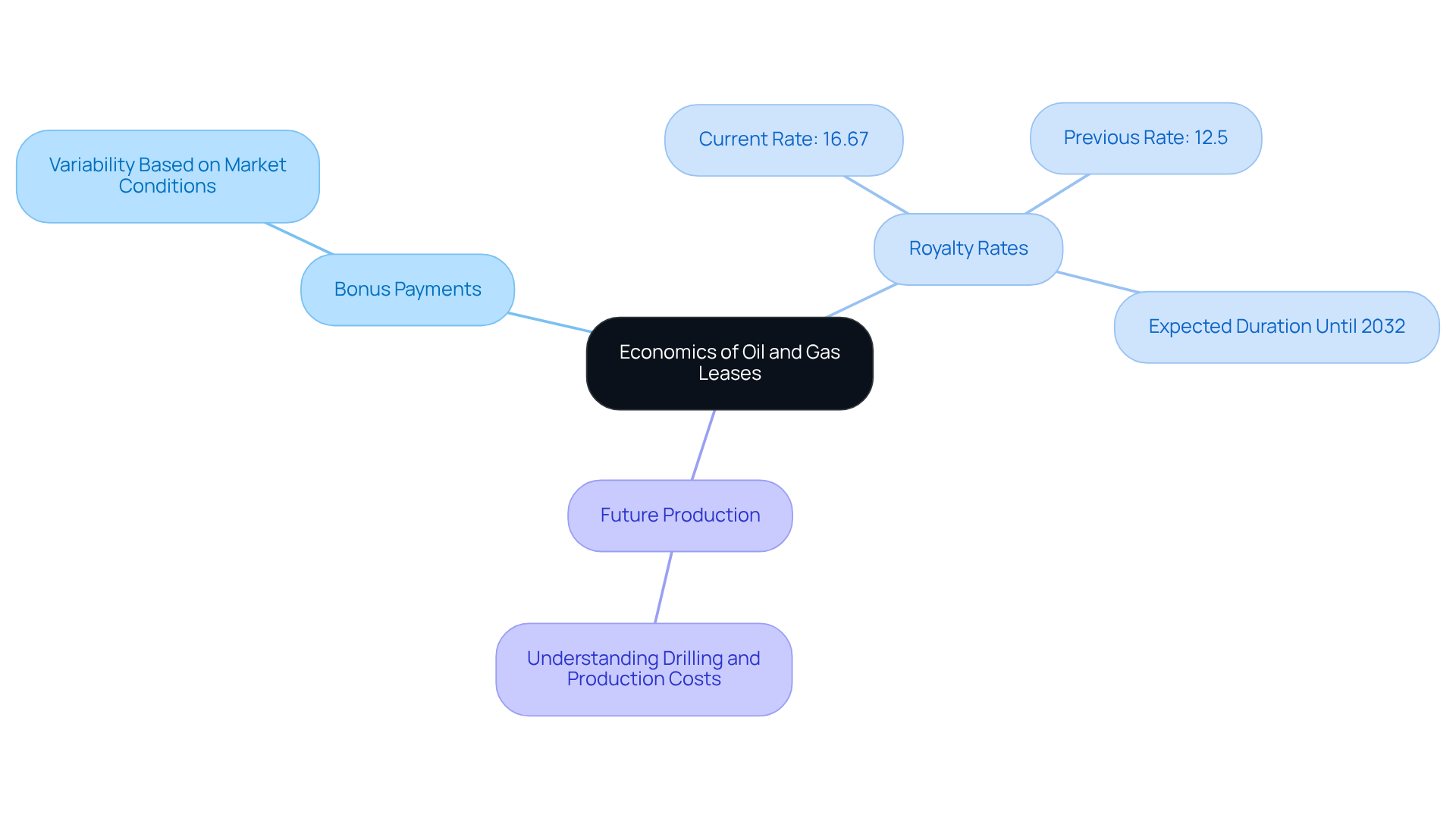

Evaluating the Economics of Oil and Gas Leases

When analyzing the financial aspects of oil and gas leasing basics, property holders must thoroughly consider several crucial elements, including:

- Bonus payments

- Royalty rates

- The possibility of future production

Recently, royalty rates have undergone a significant adjustment, with the new standard set at 16.67%, up from the previous 12.5%. This modification is expected to persist until August 2032, indicating a broader trend aimed at ensuring equitable compensation for resource stakeholders while enhancing public returns from energy production. Furthermore, bonus payments, typically paid upfront for the right to lease, can vary widely based on market conditions and negotiation outcomes, often ranging from a few dollars to several thousand per acre.

Understanding the oil and gas leasing basics related to the expenses linked to drilling and production is essential for resource holders to accurately evaluate the overall profitability of an agreement. For instance, the Bureau of Land Management's recent reforms have introduced more equitable bonding rates and elevated minimum leasing bonds to $150,000 from $10,000, which can significantly influence the financial landscape for both lessees and resource proprietors. Consulting with financial specialists can provide valuable insights into the oil and gas leasing basics, assisting resource holders in navigating the complexities of rental agreements and making informed investment decisions. As highlighted by industry experts, these modifications are anticipated to enhance the economic feasibility of agreements for resource holders, ensuring they receive a fair return on their assets.

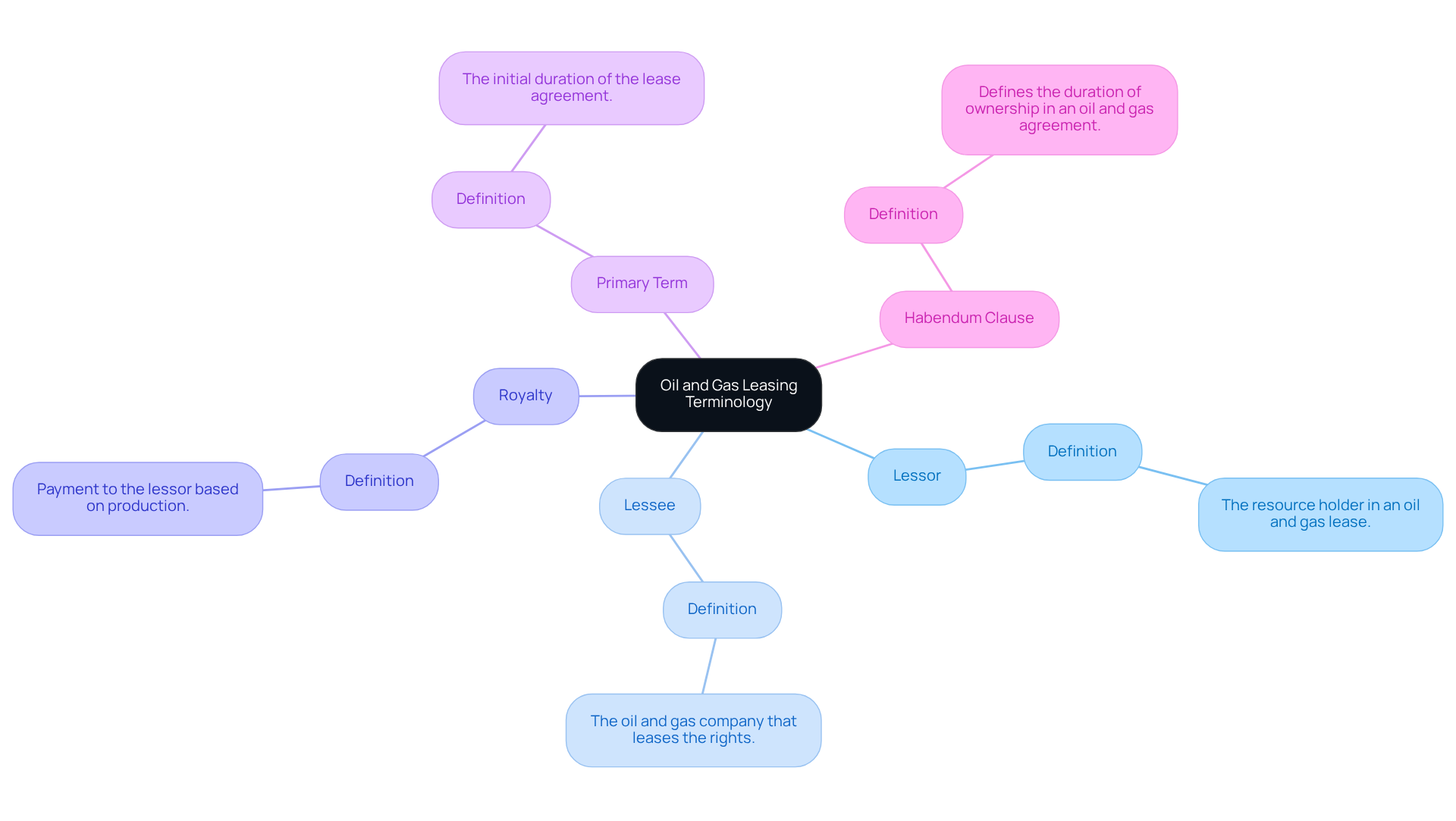

Mastering Oil and Gas Lease Terminology

It is essential for resource holders to master the oil and gas leasing basics. Key terms related to oil and gas leasing basics include:

- 'lessor' (the resource holder)

- 'lessee' (the oil and gas company)

- 'royalty' (the payment to the lessor based on production)

- 'primary term' (the initial duration of the agreement)

- 'habendum clause' (which defines the duration of ownership in an oil and gas agreement)

Understanding oil and gas leasing basics enables resource holders to comprehend their rights and duties more clearly, promoting more efficient negotiations and ensuring they are not exploited during discussions.

Furthermore, having a grasp of oil and gas leasing basics, especially regarding clear terms for royalty payments, is essential to avoid disputes, as misunderstandings can lead to significant financial implications for lessors.

Hiring skilled legal advisors is advised to negotiate beneficial rental conditions and resolve conflicts efficiently. Industry experts stress that a clear understanding of oil and gas leasing basics and effective communication of rental conditions between mineral owners and lessees is essential to ensure equitable agreements.

For example, landowners should be aware of their rights under oil and gas agreements to safeguard themselves if problems occur. As noted by Texas oil and gas lawyers, 'Landowners must comprehend their rights under oil and gas leasing basics,' emphasizing the significance of being knowledgeable and prepared.

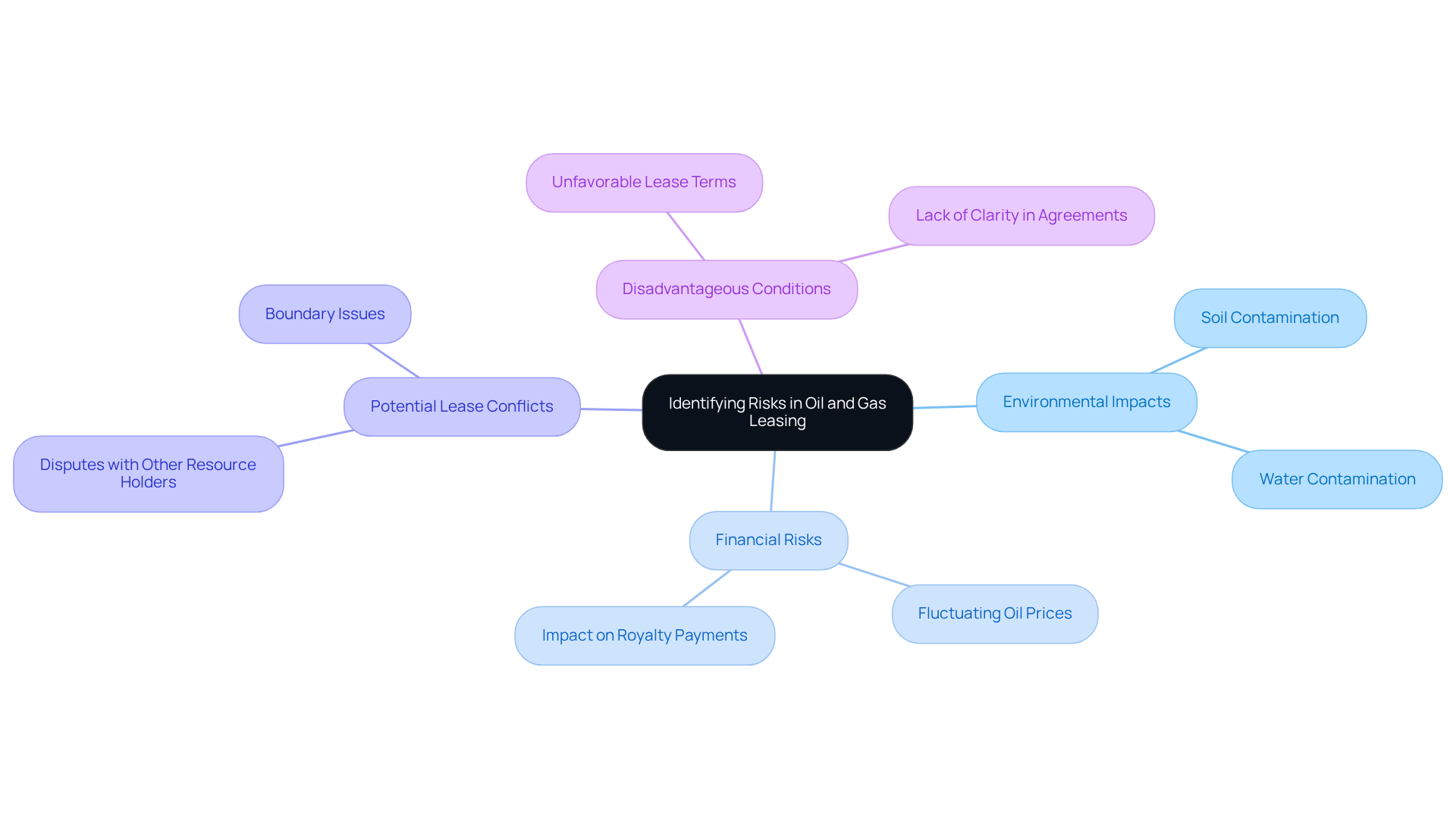

Identifying Risks in Oil and Gas Leasing

Recognizing risks in oil and gas leasing basics is crucial for resource holders. In the context of oil and gas leasing basics, common risks include:

- Environmental impacts, such as soil and water contamination

- Financial risks, including fluctuating oil prices that can affect royalty payments

- Potential lease conflicts

- Consequences of agreeing to disadvantageous conditions

Conducting thorough due diligence—encompassing accurate title research and preliminary title checks—is essential for confident land rights acquisition.

Harbinger Land's title curative services, coupled with their expertise, empower property holders to remain informed and secure. Their commitment to effective communication and educational outreach regarding the benefits of domestic energy production further aids in mitigating these risks. Additionally, seeking legal counsel can safeguard the resource holder's interests, ensuring a clear chain of title.

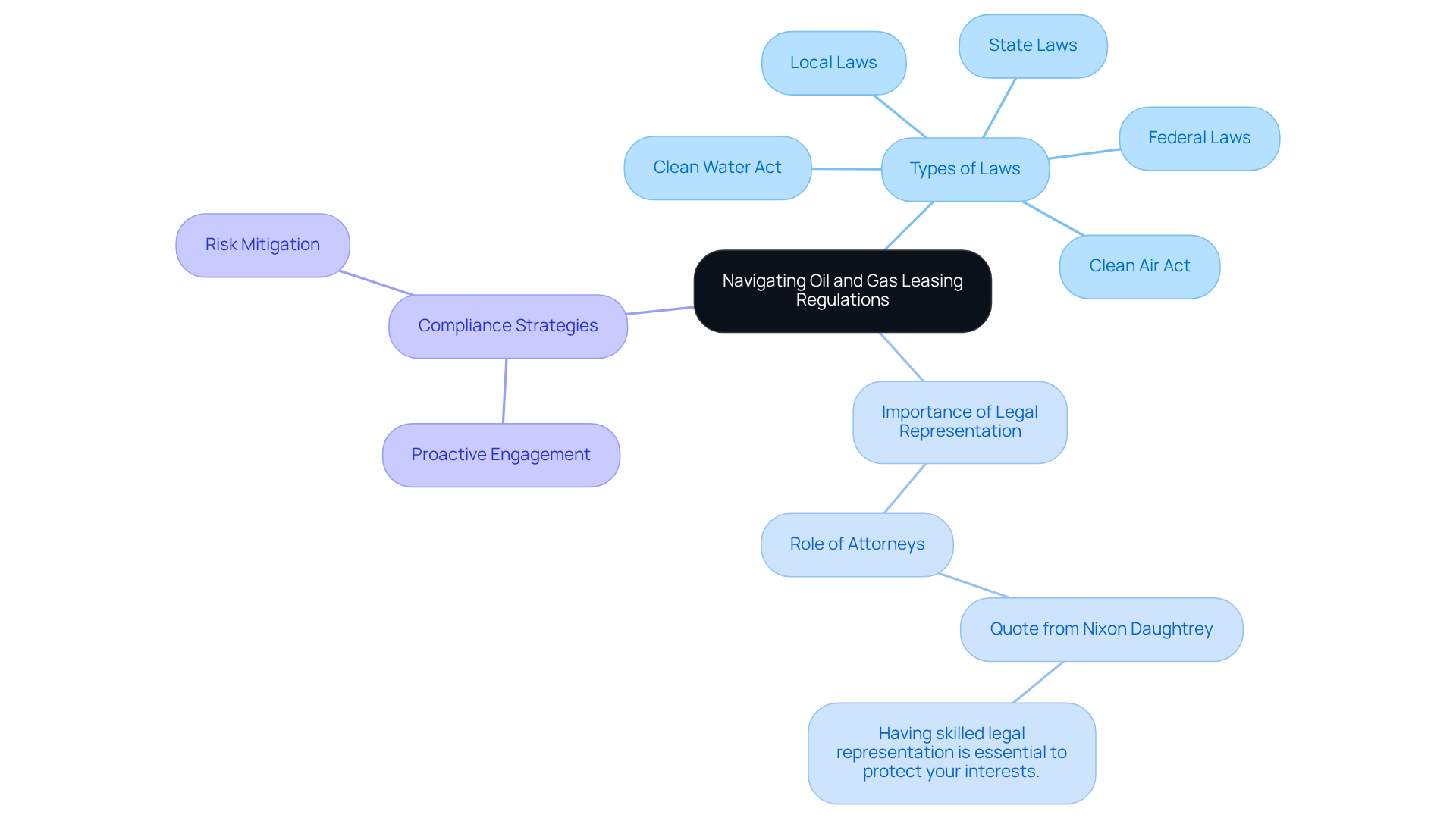

Navigating Regulations in Oil and Gas Leasing

Navigating the complex landscape of oil and gas leasing basics necessitates a comprehensive understanding of federal, state, and local laws regulating resource rights and leasing agreements. Mineral rights holders must remain vigilant regarding regulations that govern environmental protection, land use, and royalty payments. The Clean Water Act and the Clean Air Act, for instance, impose stringent standards that rights holders must adhere to, impacting both operational practices and financial outcomes. Staying informed about legislative changes is essential, as non-compliance can result in severe legal consequences, including fines and the revocation of permits.

Legal experts emphasize the importance of skilled representation for mineral stakeholders to safeguard their interests. As Nixon Daughtrey asserts, "Having skilled legal representation is essential to protect your interests." Consulting attorneys who specialize in oil and gas law offers invaluable insights into effectively navigating these regulations. Grasping the nuances of oil and gas leasing basics, such as lease agreements and the legal implications of royalty payments, can avert costly disputes and ensure equitable compensation.

Moreover, compliance with both federal and state laws transcends mere legal obligation; it is a strategic imperative. Individuals holding mineral rights who proactively engage with legal advisors can enhance asset management and mitigate risks associated with evolving regulations. This proactive approach is crucial in a landscape where heightened environmental controls can escalate extraction costs and affect profitability. By leveraging professional advice, including the title curative services provided by Harbinger Land, resource holders can adeptly navigate the oil and gas leasing basics along with the intricacies of leasing contracts and regulatory compliance, ultimately protecting their financial interests and bolstering operational success.

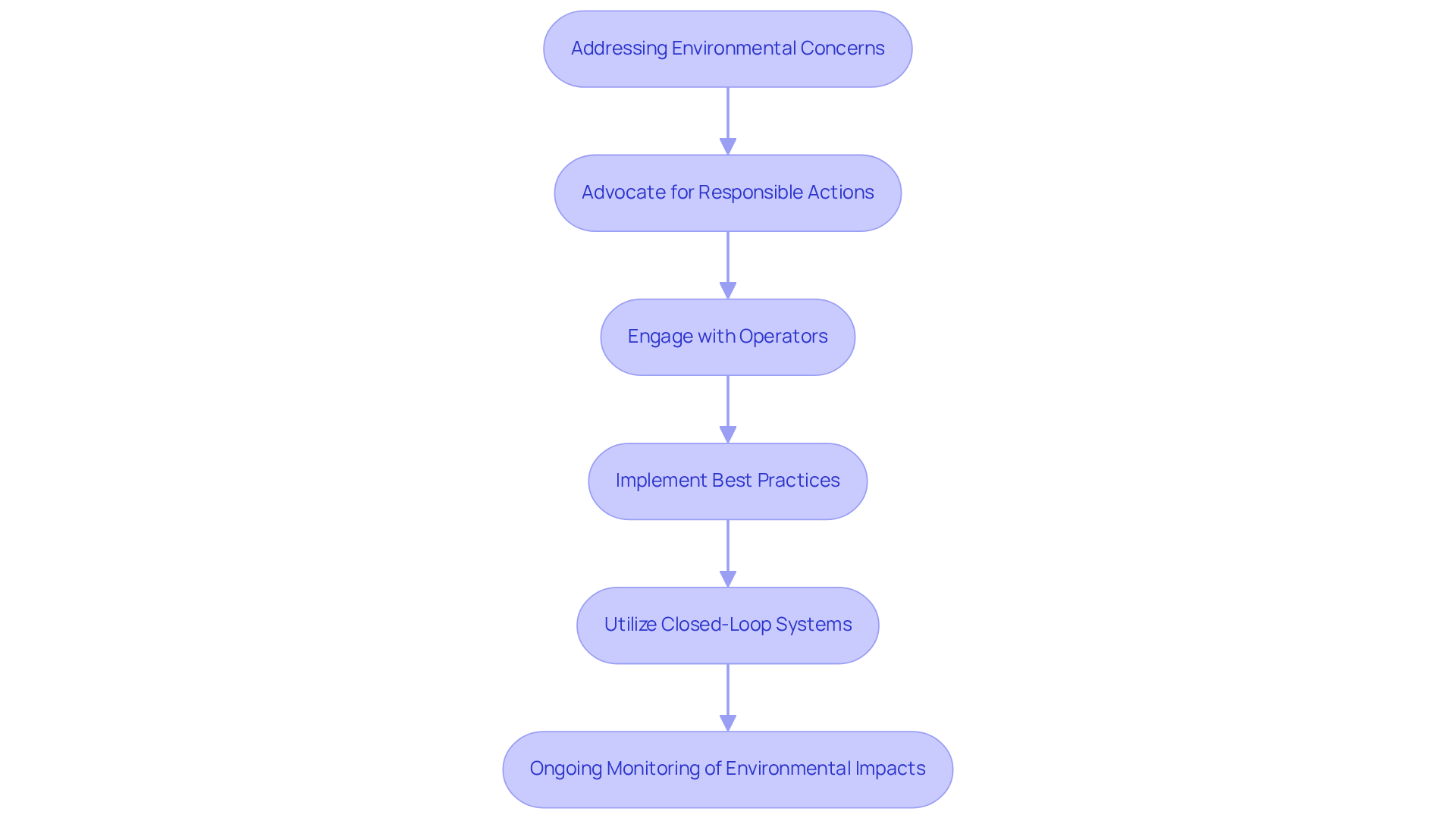

Addressing Environmental Concerns in Leasing

Addressing environmental issues in oil and gas leasing basics is paramount for resource holders, as the extraction process can result in habitat destruction, water contamination, and air pollution. To promote sustainable practices, resource holders must advocate for environmentally responsible actions within their lease contracts. This involves integrating specific provisions that compel operators to comply with stringent environmental standards, such as minimizing habitat disruption and implementing effective waste management strategies.

Engaging with operators regarding their environmental policies is essential. Mineral rights holders should seek clarity about operators' practices and their commitment to sustainability. For example, operators can be encouraged to adopt best practices, including the use of advanced drilling technologies that reduce emissions and prevent spills, as well as conducting regular environmental impact assessments.

Sustainable practices in oil and gas extraction include the utilization of closed-loop systems for wastewater management and the implementation of restoration plans that ensure land is returned to its original state post-extraction. Furthermore, incorporating provisions for ongoing monitoring of environmental impacts can significantly help safeguard local ecosystems.

Statements from environmental proponents underscore the importance of these practices: "Sustainable resource extraction is not merely an option; it's essential for safeguarding our planet's future." By prioritizing environmental protection in the oil and gas leasing basics, resource holders can align their interests with sustainable development objectives, thereby ensuring that both economic advantages and ecological integrity are preserved.

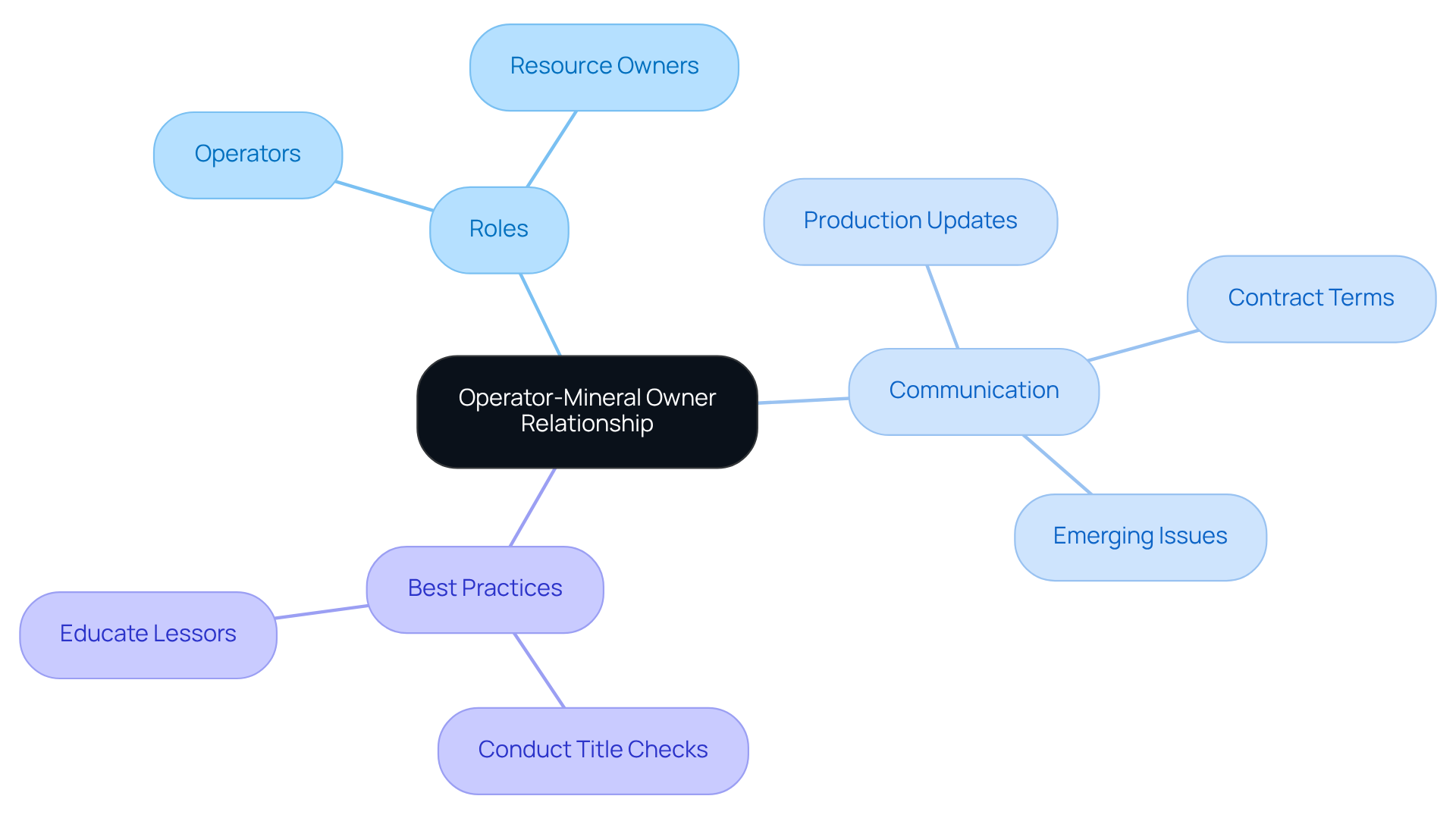

Understanding the Operator-Mineral Owner Relationship

Understanding the operator-mineral rights holder relationship is crucial for mastering the oil and gas leasing basics. Operators are responsible for exploring and extracting resources, while resource owners retain ownership of the rights. Clear communication and mutual respect are vital for cultivating a positive relationship.

Furthermore, consistent interaction between resource owners and operators is necessary for discussing:

- Production updates

- Contract terms

- Addressing any emerging issues

Harbinger Land underscores the importance of conducting thorough title checks to verify ownership of mineral rights, which is essential for understanding oil and gas leasing basics and for effective management and financial returns from these assets. This highlights the need for transparency and clarity in communication to mitigate misunderstandings and disputes.

By educating potential lessors about the benefits of domestic energy production, Harbinger Land fosters a collaborative relationship that can lead to improved outcomes for both parties. Establishing regular meetings or updates can serve as a practical approach to enhance this partnership.

Negotiating Oil and Gas Leases Effectively

Successful negotiation of agreements in the oil and gas sector hinges on a solid understanding of oil and gas leasing basics, as well as comprehensive preparation and strategic planning. Mineral stakeholders must investigate current market conditions, as these factors can significantly influence rental agreements. Recognizing that royalty rates typically range from 18.75% to 25% enables proprietors to negotiate advantageous terms; securing a higher royalty percentage can substantially enhance financial rewards. Key negotiation points encompass not only royalty rates but also bonus payments and rental duration, which can profoundly impact long-term financial outcomes.

Engaging a knowledgeable landman or attorney provides invaluable insights, ensuring that mineral owners are well-informed about their rights and the nuances of the negotiation process. As Victor Kiam aptly noted, knowledge and preparation are crucial in negotiations. Successful rental negotiations often require patience and the willingness to walk away from unfavorable terms, a strategy that can bolster bargaining power. Carrie Fisher wisely stated, everything is negotiable; approaching discussions with a mindset of possibility can unlock opportunities for better agreements. Furthermore, considering the Pugh clause can offer additional strategic benefits in rental negotiations. By concentrating on these tactics, property holders can adeptly navigate the intricacies of oil and gas leasing basics and secure favorable conditions.

Key Takeaways for Mineral Owners in Oil and Gas Leasing

To maximize the value of mineral rights through effective leasing, mineral owners should consider the following key takeaways:

-

Understand Leasing Fundamentals: Familiarize yourself with essential leasing terminology and concepts. This foundational knowledge is crucial for navigating negotiations and agreements.

-

Evaluate Rental Economics: Carefully assess the financial implications of rental offers. For instance, a Texas property owner successfully negotiated a royalty rate of 25%, considerably higher than the industry standard of 18.75%, leading to an extra USD 1.2 million throughout the duration of the agreement. Furthermore, royalty rates in the Marcellus and Utica areas usually vary from 14% to 20%, offering a wider perspective for assessing economic aspects.

-

Identify and Mitigate Risks: Recognize potential risks, including market fluctuations and regulatory challenges. A landowner in Oklahoma diversified their investments by leasing resource rights to multiple companies, effectively reducing exposure to market fluctuations and ensuring a steady stream of revenue. Diversifying investments and staying informed about industry trends can help mitigate these risks effectively.

-

Stay Informed on Regulations: Compliance with relevant laws and environmental regulations is essential. Regular audits and consultations with qualified professionals can ensure adherence and minimize legal exposure. Conducting environmental impact assessments is also crucial for understanding potential risks.

-

Foster Positive Relationships with Operators: Building strong relationships with operators can lead to better communication and more favorable lease terms. Effective relationship management involves clear communication and responsiveness to concerns.

-

Negotiate Effectively: Utilize negotiation strategies to secure advantageous terms. For example, including clauses for pooling and unitization can enhance operational efficiency and profitability.

By applying these best practices, mineral owners can navigate the complexities of oil and gas leasing basics with greater confidence, ultimately maximizing the value of their mineral rights.

Conclusion

Understanding the intricacies of oil and gas leasing is essential for mineral owners aiming to maximize the value of their resources. This article delves into the fundamental aspects of leasing agreements, emphasizing the importance of awareness regarding the legal, economic, and environmental factors that influence these contracts. By grasping the basics of oil and gas leasing, mineral owners can navigate negotiations more effectively and secure favorable terms that protect their interests.

Key insights highlighted throughout the article include:

- The significance of mastering essential terminology

- Evaluating the economic implications of leases

- Recognizing potential risks associated with leasing agreements

- Fostering positive relationships with operators

- Staying informed about legal regulations

These are crucial strategies for ensuring equitable compensation and sustainable practices. The evolution of royalty rates and the role of advanced technologies like AI in title research further underscore the dynamic nature of the oil and gas industry.

Ultimately, mineral owners are encouraged to take proactive steps in their leasing endeavors. By applying the best practices outlined in this article—such as thorough research, effective negotiation strategies, and a commitment to environmental stewardship—resource holders can confidently navigate the complexities of oil and gas leasing. Embracing these principles not only enhances financial outcomes but also contributes to responsible resource management, ensuring a balance between economic benefits and environmental integrity.

Frequently Asked Questions

What is Parse AI and how does it benefit mineral owners?

Parse AI utilizes advanced machine learning and optical character recognition (OCR) technologies to streamline the title research process for mineral owners. It enhances property ownership verification by efficiently extracting critical information from title documents, which accelerates research timelines and improves accuracy.

How much can businesses save by using AI technologies like Parse AI?

Businesses leveraging AI can save up to $35,000 annually, highlighting the financial advantages of adopting such technologies.

What role does OCR technology play in the title research process?

OCR technology facilitates the extraction of information from documents, allowing for pre-populated applications and instant renewal pricing, which enhances operational efficiency and customer satisfaction.

What are the key elements of oil and gas leasing agreements?

The key elements of oil and gas leasing agreements include the duration of the lease (typically 3 to 5 years, extendable based on production) and royalty rates, which generally range from 12.5% to 25% depending on market conditions and negotiations.

Why is it important for mineral owners to understand oil and gas leasing basics?

Understanding oil and gas leasing basics is crucial for mineral owners to protect their interests and maximize the value of their mineral rights. It helps in effective negotiations and ensures equitable compensation for their resources.

What recent changes have been made to rental terms in oil and gas leasing?

Recent changes in rental terms have introduced more stringent drilling commitments and enhanced environmental protections, indicating a focus on responsible resource development.

What should property holders consider when evaluating the economics of oil and gas leases?

Property holders should consider bonus payments, royalty rates, and the possibility of future production when evaluating the financial aspects of oil and gas leases.

What is the new standard for royalty rates, and how does it compare to previous rates?

The new standard for royalty rates is set at 16.67%, an increase from the previous rate of 12.5%. This change is expected to last until August 2032.

How have bonding rates and minimum leasing bonds changed recently?

Recent reforms have introduced more equitable bonding rates and increased minimum leasing bonds to $150,000 from $10,000, significantly influencing the financial landscape for both lessees and resource proprietors.

How can consulting with financial specialists help resource holders?

Consulting with financial specialists can provide valuable insights into oil and gas leasing basics, assisting resource holders in navigating rental agreements and making informed investment decisions.