Introduction

In title theory states, the role of a trustee is pivotal, acting as a crucial intermediary in property transactions between lenders and borrowers. Unlike lien theory states, where the borrower retains ownership until the mortgage is settled, trustees hold the legal title, ensuring compliance with mortgage terms and facilitating foreclosure when necessary. This unique arrangement not only enhances security for lenders but also streamlines processes for borrowers, fostering a balanced power dynamic in real estate dealings.

As the legal landscape evolves, understanding the responsibilities and challenges faced by trustees becomes essential for all stakeholders involved, ensuring smoother transactions and mitigating potential disputes.

Understanding the Role of a Trustee in Title Theory States

In title theory states, a third party is designated to hold the legal ownership of a property for the lender and the debtor. This arrangement is fundamentally different from , where the borrower retains the title until the mortgage is paid off.

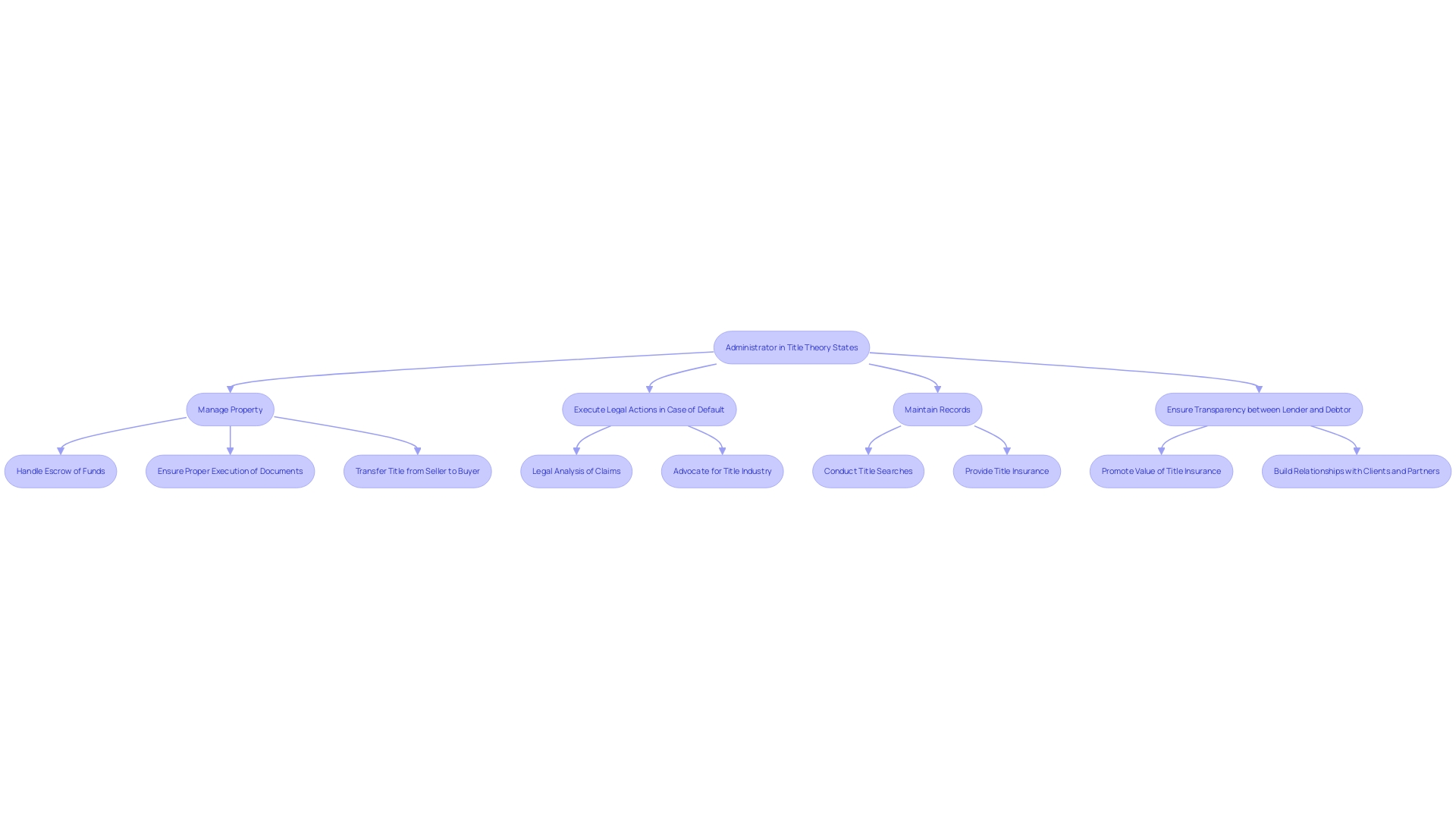

The administrator's primary role is to ensure that the terms of the mortgage are upheld and to facilitate the foreclosure process if necessary. This involves:

- Managing the property in accordance with the trust deed

- Executing the necessary legal actions in case of default

Their responsibilities also include:

- Maintaining accurate records

- Providing transparency to both parties involved in the transaction, thereby fostering trust and accountability in the process.

The Trustee's Impact on Property Financing and Ownership

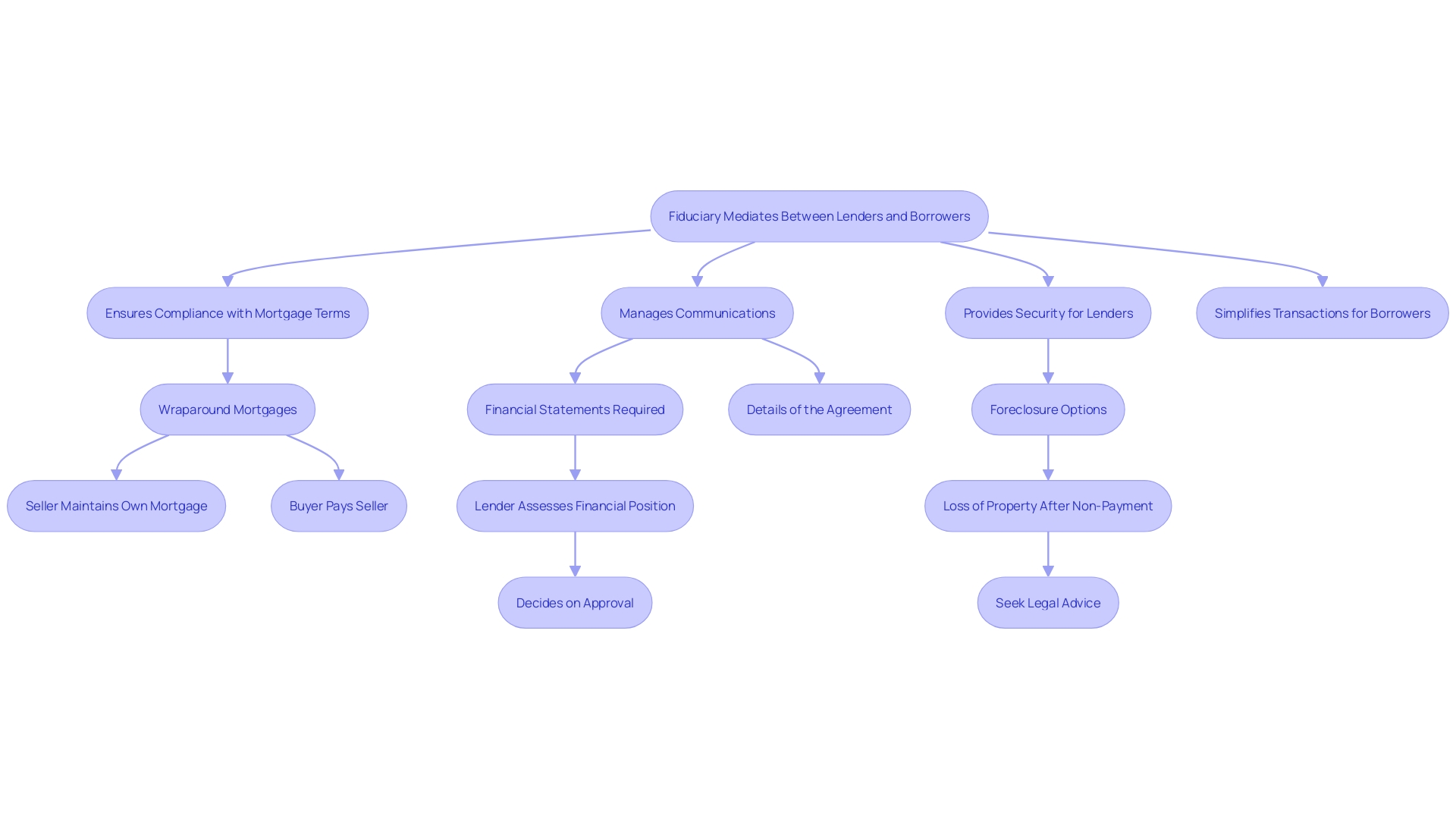

The fiduciary plays a vital part in property financing by serving as a mediator that protects the interests of both lenders and those receiving funds. In title theory states, the representative facilitates transactions by ensuring compliance with the terms of the mortgage agreement.

For lenders, the representative offers an additional layer of security, as they can commence foreclosure actions if the individual fails to meet the loan obligations, thereby reducing the lender's risk.

For borrowers, having an overseer can simplify the transaction process, as they are responsible for managing communications and ensuring that all regulatory requirements are met.

This dual role helps to maintain a , ultimately fostering a more stable market environment.

Legal Framework Governing Trustees in Title Theory States

In title theory states, administrators function within specific regulatory frameworks that outline their powers and responsibilities. Although these laws can differ by state, individuals in charge are generally mandated to act in the best interests of all parties involved, adhering closely to the terms outlined in the trust deed. This document functions as a formal agreement that outlines the rights and responsibilities of the administrator, lender, and recipient.

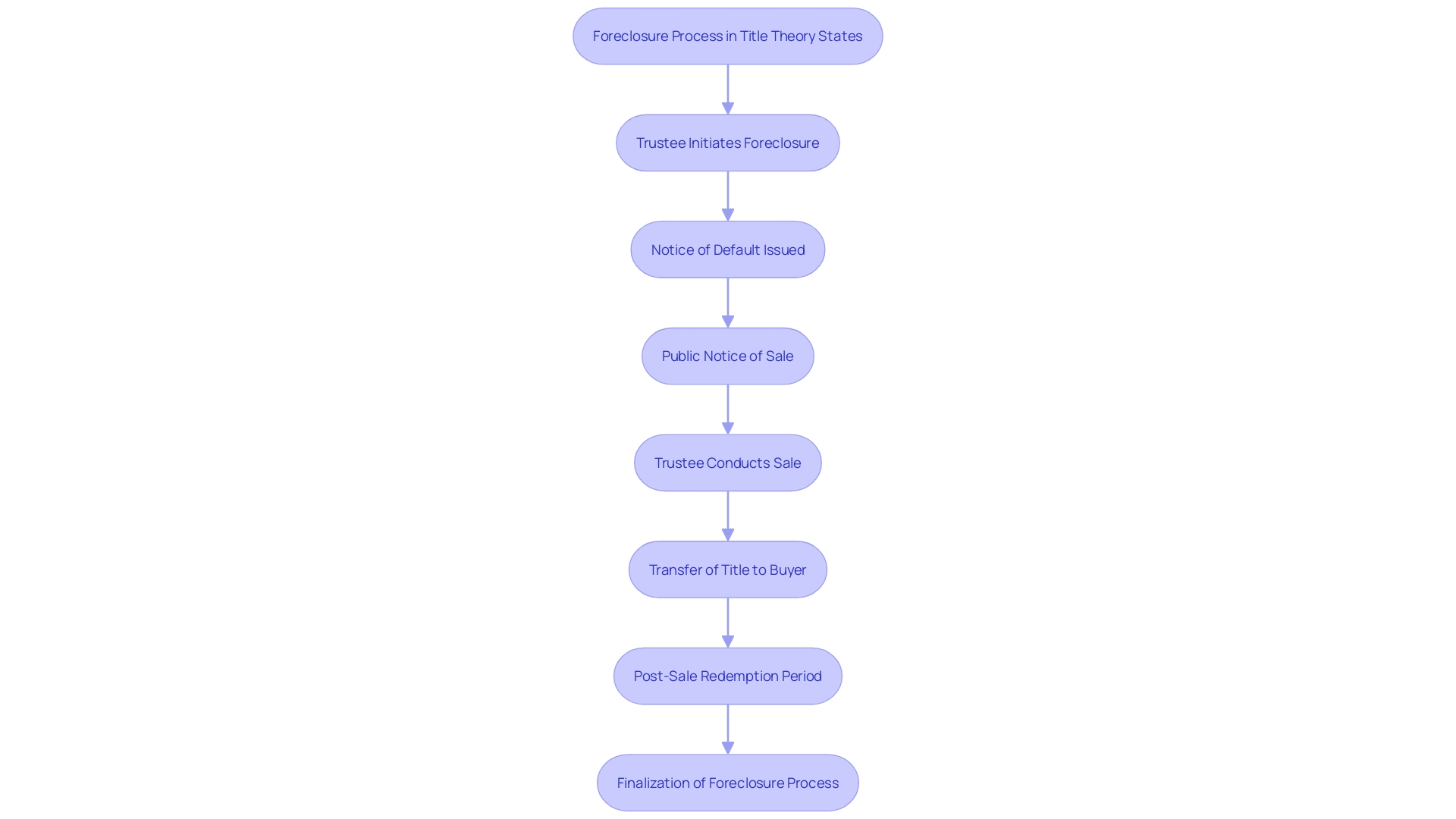

In instances of foreclosure, trustees must comply with state-specific procedures, which typically involve:

- Notifying the borrower

- Conducting a public auction of the property

Understanding these legal parameters is crucial for real estate professionals and consumers alike, as it ensures compliance and helps mitigate potential disputes during transactions.

At Harbinger Land, we enhance this understanding by leveraging our expertise in mineral leasing and acquisitions. Our thorough property research empowers clients to confidently acquire land rights, while our commitment to diligent research and effective communication educates all parties about the benefits of domestic energy production. This strengthens our position as a reliable partner in navigating the complexities of property theory and ensures that our clients are well-informed and prepared.

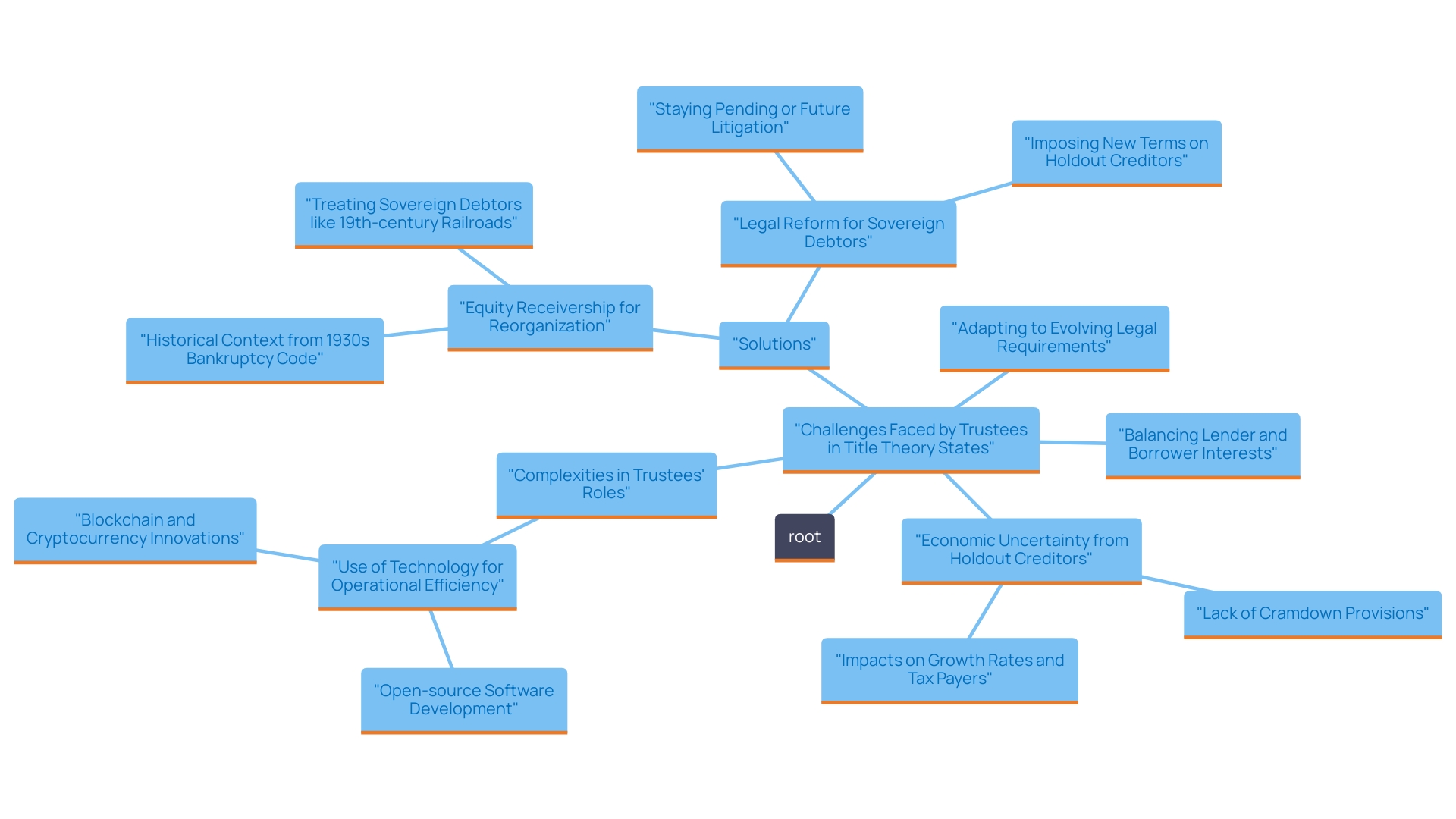

Challenges Facing Trustees in Title Theory States

Trustees in title theory states face several challenges that can impact the efficiency and effectiveness of their role. One significant challenge is the need to balance the interests of both lenders and borrowers, particularly in . Additionally, the evolving legal landscape can present hurdles, as individuals in similar roles must stay informed about changes in laws and regulations that affect their duties.

They may also encounter difficulties with incomplete or inconsistent property records, which can complicate title verification processes. By addressing these challenges proactively and leveraging technology, such as machine learning and optical character recognition, trustees can enhance their operational efficiency and minimize risks associated with property transactions.

Conclusion

The role of a trustee in title theory states is integral to the stability and security of property transactions. By serving as the legal intermediary, trustees uphold the terms of mortgage agreements and facilitate the foreclosure process when necessary. This unique position not only protects lenders by allowing for swift action in the event of borrower default but also aids borrowers by streamlining the transaction and ensuring compliance with legal requirements.

Navigating the legal frameworks governing trustees is essential for both real estate professionals and consumers. Understanding the responsibilities outlined in the trust deed, along with the specific laws of each state, is crucial for maintaining transparency and accountability. This knowledge helps to mitigate potential disputes and fosters trust between all parties involved in the transaction.

Despite the advantages, trustees face significant challenges, including the need to balance the interests of lenders and borrowers amid evolving legal landscapes. Addressing these challenges through proactive measures and technological advancements can enhance operational efficiency and improve outcomes for all stakeholders.

In conclusion, the role of trustees in title theory states is not merely administrative; it is foundational to the integrity of real estate transactions. By recognizing the importance of this role and the complexities involved, all parties can engage more effectively in property dealings, ultimately contributing to a more secure and balanced real estate market.

Frequently Asked Questions

What is the primary role of an administrator in title theory states?

The primary role of an administrator in title theory states is to ensure that the terms of the mortgage are upheld and to facilitate the foreclosure process if necessary, which includes managing the property according to the trust deed and executing legal actions in case of default.

How does the administrator maintain accountability in title theory states?

The administrator maintains accountability by keeping accurate records and providing transparency to both the lender and borrower, fostering trust in the transaction process.

What is the function of a fiduciary in property financing within title theory states?

The fiduciary serves as a mediator that protects the interests of both lenders and borrowers, ensuring compliance with the mortgage agreement and facilitating transactions, which helps maintain a balance of power in real estate transactions.

What are the legal frameworks governing administrators in title theory states?

Administrators operate within specific regulatory frameworks that outline their powers and responsibilities, requiring them to act in the best interests of all parties and adhere closely to the terms of the trust deed.

What steps must trustees follow in the foreclosure process in title theory states?

Trustees must comply with state-specific procedures during foreclosure, which typically involve notifying the borrower and conducting a public auction of the property.

What challenges do trustees face in title theory states?

Trustees face challenges such as balancing the interests of lenders and borrowers, staying informed about evolving legal regulations, and dealing with incomplete or inconsistent property records.

How can trustees enhance their operational efficiency in title theory states?

Trustees can enhance their operational efficiency by proactively addressing challenges and leveraging technology, such as machine learning and optical character recognition, to minimize risks associated with property transactions.