Overview

The impact of tax liens on land titles in Canada is profound. They establish legal claims against properties due to unpaid taxes, which can significantly hinder an owner's ability to sell or refinance until the debt is resolved. Furthermore, tax liens not only affect property ownership and marketability but also influence creditworthiness. This underscores the necessity for real estate professionals to conduct thorough due diligence. By advising clients on effectively managing tax obligations, they can navigate these challenges successfully.

Introduction

Understanding the intricate relationship between tax liens and land titles in Canada is crucial for anyone involved in real estate transactions. Tax liens serve as a powerful government tool to secure unpaid taxes, and their implications extend far beyond financial penalties. This article delves into the complexities of how tax liens can hinder property ownership, affect creditworthiness, and complicate real estate dealings.

Furthermore, what strategies can property owners employ to prevent or resolve these tax encumbrances? In addition, how can real estate professionals navigate the challenges posed by tax liens to safeguard their clients' interests?

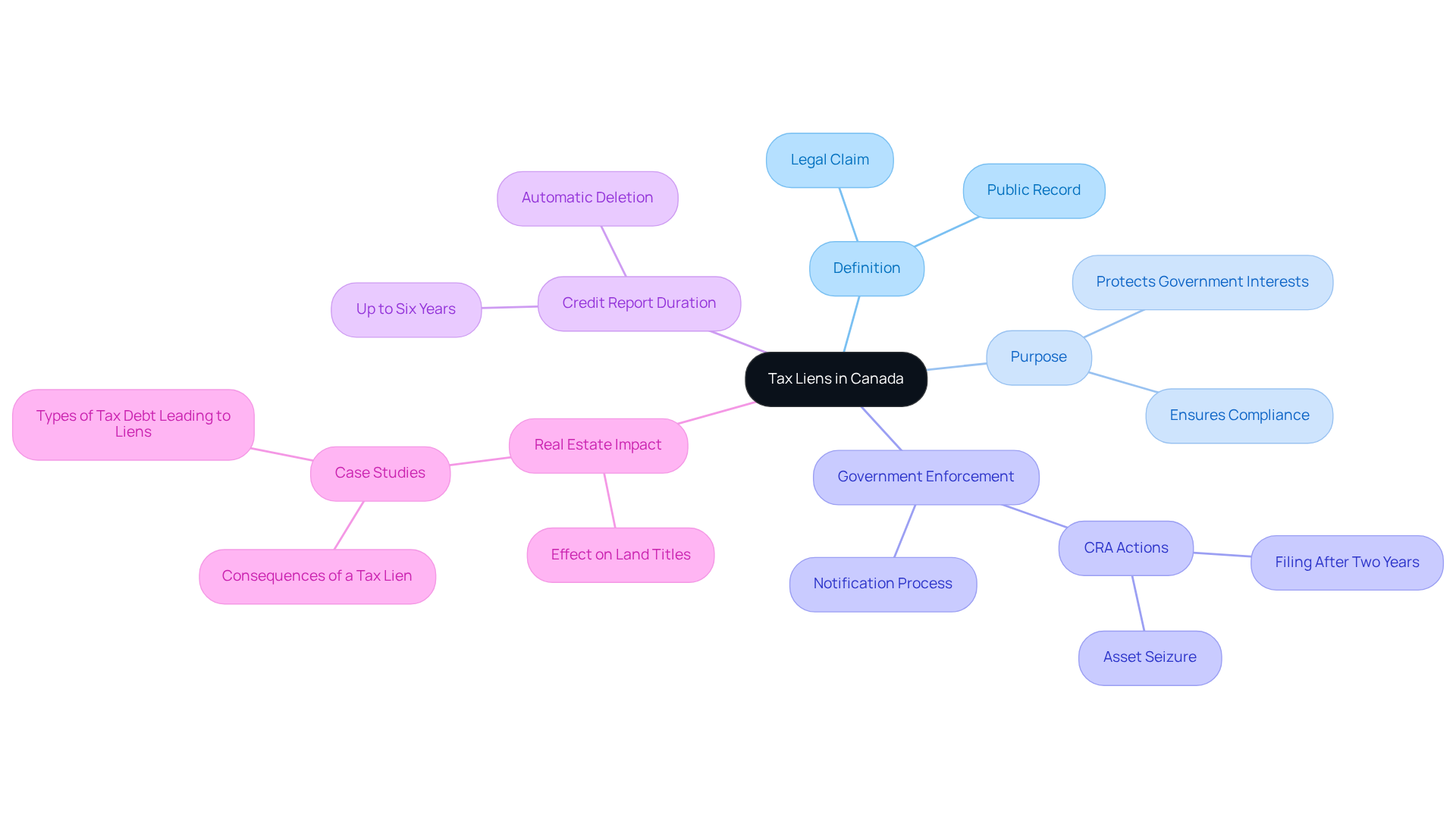

Define Tax Liens and Their Purpose in Canada

A represents a against a property due to unpaid taxes. This claim secures the payment of the tax debt, ensuring the government can recover owed amounts. are enforceable by various tiers of government, including municipal, provincial, and federal authorities. The primary objective of a tax claim is to protect the government's financial interests and . Once registered, the claim becomes a matter of public record, potentially affecting the owner's ability to sell or refinance the asset until the debt is resolved. Understanding the nature and consequences of is essential for , as it directly relates to the and ownership rights.

In Canada, tax claims may remain on a credit report for up to six years, after which they are automatically deleted. As financial author Sandra MacGregor notes, "A tax claim provides the government a legal right over your assets if you fail to make payment on an obligation." This statement underscores the necessity of addressing to avoid severe repercussions.

The Canada Revenue Agency (CRA) typically files a claim after two years of unpaid land taxes, which can lead to the confiscation and sale of the asset to recover owed amounts. This process highlights the critical importance for real estate experts to regarding the impact of tax liens on land titles, ensuring that all potential liabilities are identified in real estate dealings.

Real estate case studies illustrate the impact of tax liens on land titles, showcasing instances where assets were sold to satisfy tax debts, with proceeds allocated to resolving outstanding liabilities. Such scenarios further demonstrate the vital role tax claims play in property transactions and the overall market dynamics in Canada.

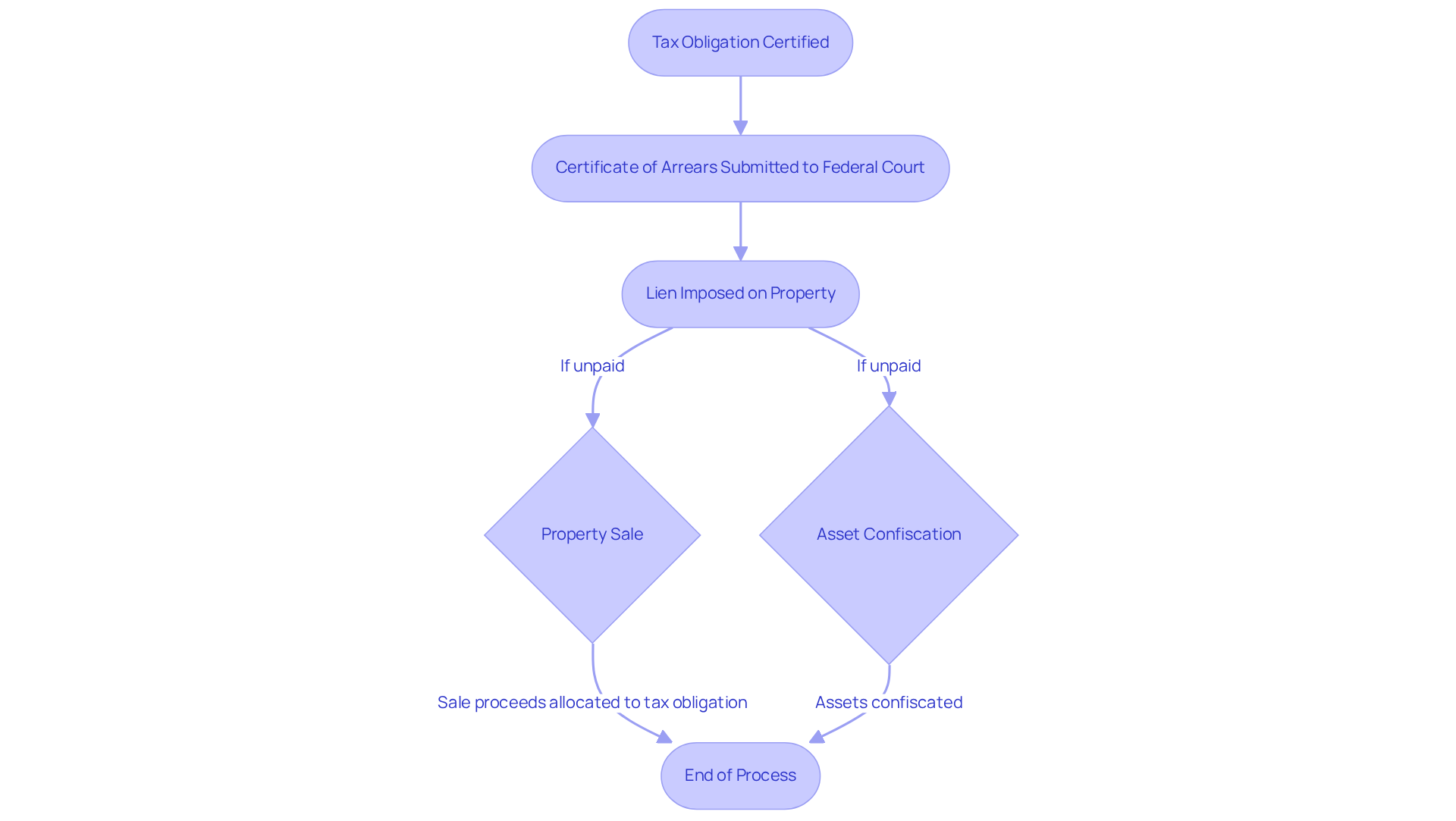

Explain How Tax Liens Are Registered and Enforced by the CRA

In Canada, the plays a crucial role in recording tax claims against individuals or businesses that fail to meet their s. The commences when the CRA certifies a tax obligation, typically by submitting a certificate of arrears in Federal Court. This certificate empowers the CRA to impose a lien on the taxpayer's property, which remains in effect until the obligation is fully settled or the property is sold, with the sale proceeds allocated towards resolving the tax obligation.

The CRA's enforcement capabilities are robust, enabling them to confiscate assets or initiate a tax sale if the obligation remains unpaid. In the previous year alone, the CRA recorded approximately 350,000 tax audits and review actions, underscoring their stringent collection methods. This includes a notable emphasis on sectors such as cash-only businesses and tax shelters, resulting in around 35,000 audits related to tax shelters.

Expert opinions highlight that the CRA's position as a grants it greater authority in collection efforts compared to conventional lenders. As Sean N. Zeitz articulates, "if a charge is imposed, the CRA can claim all earnings from the sale of the asset," emphasizing the urgency for owners to resolve tax debts promptly. Furthermore, homeowners facing a CRA obligation may address it swiftly with a , providing practical options to regain control of their financial situation. Understanding this enforcement procedure is essential for , as it can significantly impact and ownership rights, particularly through the on land titles, potentially complicating sales and refinancing options.

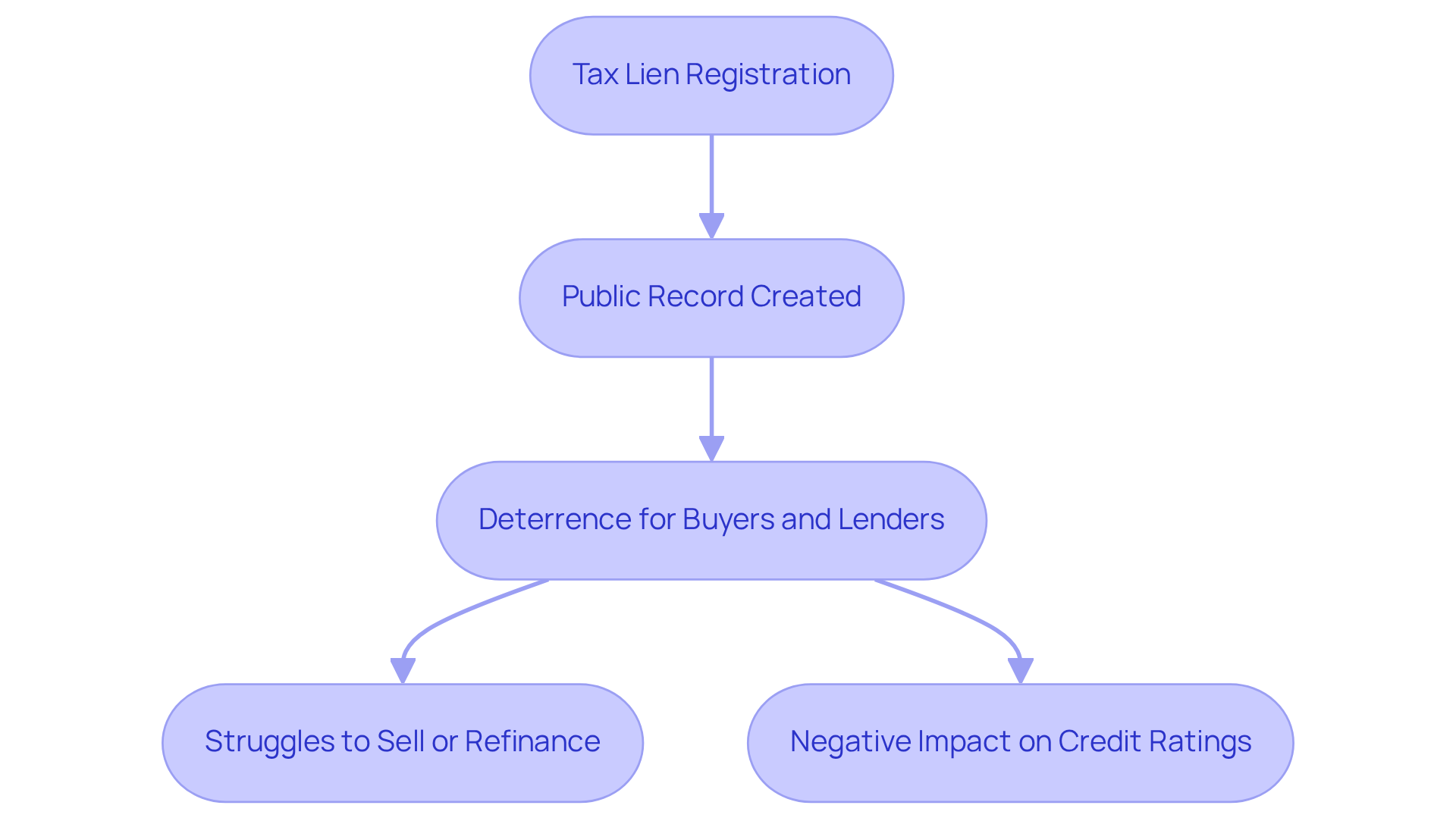

Analyze the Effects of Tax Liens on Property Ownership and Creditworthiness

The significantly affects real estate ownership and individual credit reliability. When a tax claim is registered, it becomes a , deterring potential buyers and lenders. Consequently, landowners may struggle to sell or refinance their properties because of the impact of tax liens on land titles until the claim is resolved.

Furthermore, tax encumbrances can negatively influence credit ratings, as they often signal financial distress. For real estate professionals, on land titles is essential, as it can affect an asset's marketability and a client's financial stability. Thus, conducting thorough title searches to identify any existing claims before proceeding with transactions is crucial.

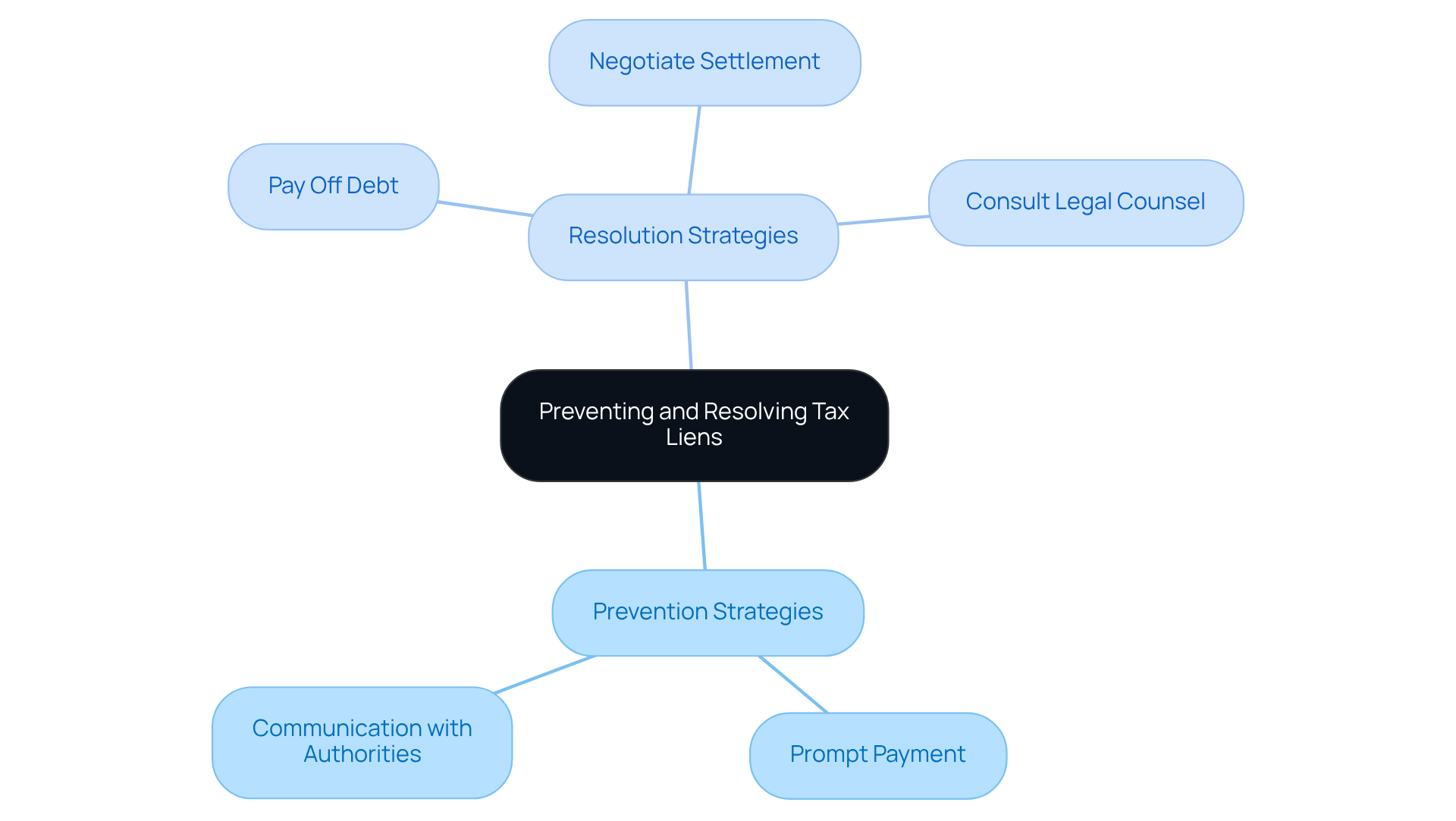

Outline Strategies to Prevent and Resolve Tax Liens

To prevent liens, must prioritize the of all dues and maintain transparent communication with revenue authorities. Should a tax obligation arise, it is essential to or seeking . play a crucial role in advising clients on tax obligations and the resulting from unpaid taxes. In cases where a tax claim has already been recorded, asset owners should explore resolution options, including:

- Paying off the debt in full

- Negotiating a settlement with the CRA

- Consulting legal counsel to contest the claim

By understanding these strategies, [property owners](https://blog.parseai.co/10-best-land-and-title-service-providers-for-efficient-research) can effectively mitigate the risks and the impact of tax liens on land titles, thereby .

Conclusion

Understanding the implications of tax liens on land titles is crucial for anyone involved in Canadian real estate. These legal claims, imposed by the government for unpaid taxes, not only secure the government's financial interests but also present significant challenges for property owners. The consequences of tax liens can hinder an owner's ability to sell or refinance their property; therefore, it is imperative to address tax obligations promptly to avoid further complications.

Throughout this article, several key aspects of tax liens have been explored:

- The registration and enforcement mechanisms by the Canada Revenue Agency (CRA) highlight the serious nature of tax claims and their priority over other creditors.

- The impact of tax liens on property ownership and creditworthiness illustrates the potential long-term effects on an individual’s financial health.

- Strategies for preventing and resolving tax liens provide practical insights for property owners, emphasizing the importance of proactive management of tax obligations.

Ultimately, navigating the landscape of tax liens requires a thorough understanding and timely action. Property owners are encouraged to stay informed about their tax responsibilities and seek assistance when necessary. By prioritizing tax compliance and exploring resolution options, individuals can protect their assets and maintain their financial stability amidst the complexities of tax liens in Canada.

Frequently Asked Questions

What is a tax lien in Canada?

A tax lien in Canada is a legal claim imposed by the government against a property due to unpaid taxes, securing the payment of the tax debt.

Who can enforce tax liens in Canada?

Tax liens can be enforced by various tiers of government, including municipal, provincial, and federal authorities.

What is the primary purpose of a tax lien?

The primary purpose of a tax lien is to protect the government's financial interests and ensure compliance with tax responsibilities.

How does a tax lien affect property owners?

Once registered, a tax lien becomes a matter of public record and can affect the owner's ability to sell or refinance the property until the debt is resolved.

How long do tax claims remain on a credit report in Canada?

Tax claims may remain on a credit report for up to six years, after which they are automatically deleted.

What happens if land taxes remain unpaid for two years?

The Canada Revenue Agency (CRA) typically files a claim after two years of unpaid land taxes, which can lead to the confiscation and sale of the asset to recover owed amounts.

Why is it important for real estate professionals to understand tax liens?

It is crucial for real estate professionals to understand tax liens because they directly impact land titles and ownership rights, as well as the overall dynamics of property transactions.

Can you provide examples of the impact of tax liens on property transactions?

Real estate case studies illustrate that assets may be sold to satisfy tax debts, with proceeds allocated to resolving outstanding liabilities, demonstrating the significant role tax claims play in property transactions.