Overview

The article outlines a systematic approach to effectively clear unreleased mortgages. It emphasizes the importance of:

- Gathering necessary documentation

- Verifying mortgage status

- Submitting paperwork

- Troubleshooting common issues

This process is crucial for real estate owners to avoid legal disputes and financial liabilities. Unresolved loans can complicate property transactions and potentially lead to foreclosure, making it imperative for property owners to address these matters promptly.

Introduction

In the complex world of real estate, the shadow of unreleased mortgages looms large, complicating transactions and hindering property sales. Understanding how to navigate this intricate landscape is crucial for property owners and real estate professionals alike, as unresolved loans can lead to significant legal and financial ramifications.

Furthermore, with the number of new foreclosures on the rise, the urgency to clear these lingering debts has never been more pressing. What steps can be taken to ensure a smooth resolution, and how can one prevent the pitfalls that often accompany this process?

Understand Unreleased Mortgages and Their Implications

Unreleased loans arise when a loan is fully paid off, and understanding is important as the lien remains recorded in public records. This scenario can pose significant challenges for real estate owners, particularly when attempting to sell or refinance their properties while considering how to clear unreleased mortgages.

The implications of an unresolved loan are substantial; they can lead to legal disputes and financial liabilities. For example, if a property is sold without addressing the lingering loan, the new owner may inadvertently assume the debt, potentially resulting in foreclosure. In 2024, there were 174,100 new foreclosures reported, underscoring the risks associated with unresolved liens.

Consequently, it is imperative for and property owners to understand how to clear unreleased mortgages swiftly to avert complications and ensure seamless transactions. As industry experts emphasize, "Understanding the intricacies of loan releases is vital for maintaining asset value and facilitating successful transactions."

Recognizing the importance of timely actions in resolving pending loans is crucial for safeguarding both current and future property owners.

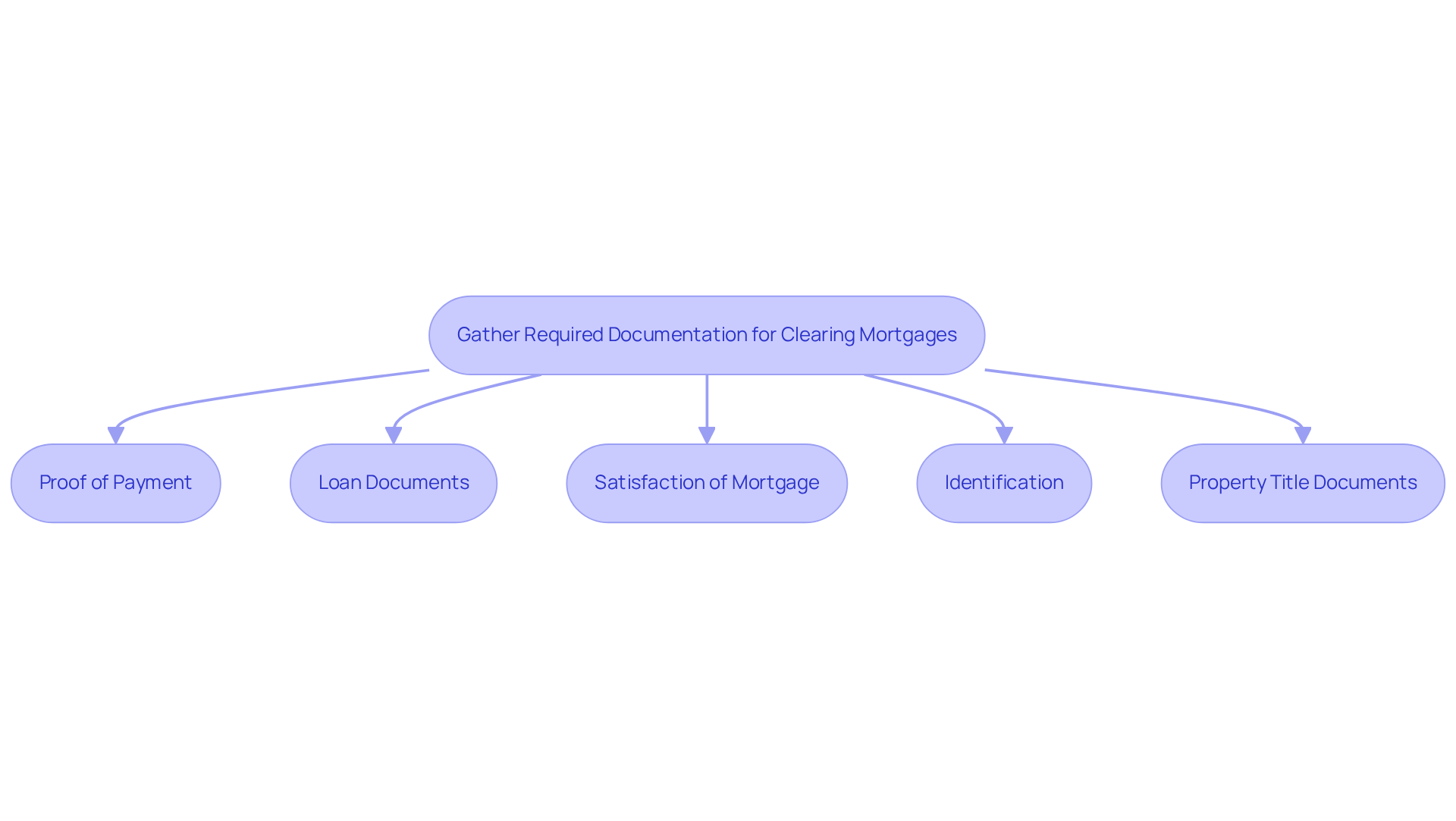

Gather Required Documentation for Clearing Mortgages

To clear , it is essential to gather several key documents that will facilitate the process:

- Proof of Payment: This includes receipts or statements indicating that the loan has been settled in full.

- Loan Documents: Acquire a copy of the original loan agreement and any modifications.

- Satisfaction of Mortgage: This document from the lender confirms that the mortgage has been satisfied. If the lender is defunct, you may need to file a petition to obtain this.

- Identification: Personal identification such as a driver's license or passport may be required.

- Property Title Documents: These documents prove your ownership of the property and may include the deed.

Having these documents ready will streamline the process and provide guidance on how to clear unreleased mortgages to help avoid delays.

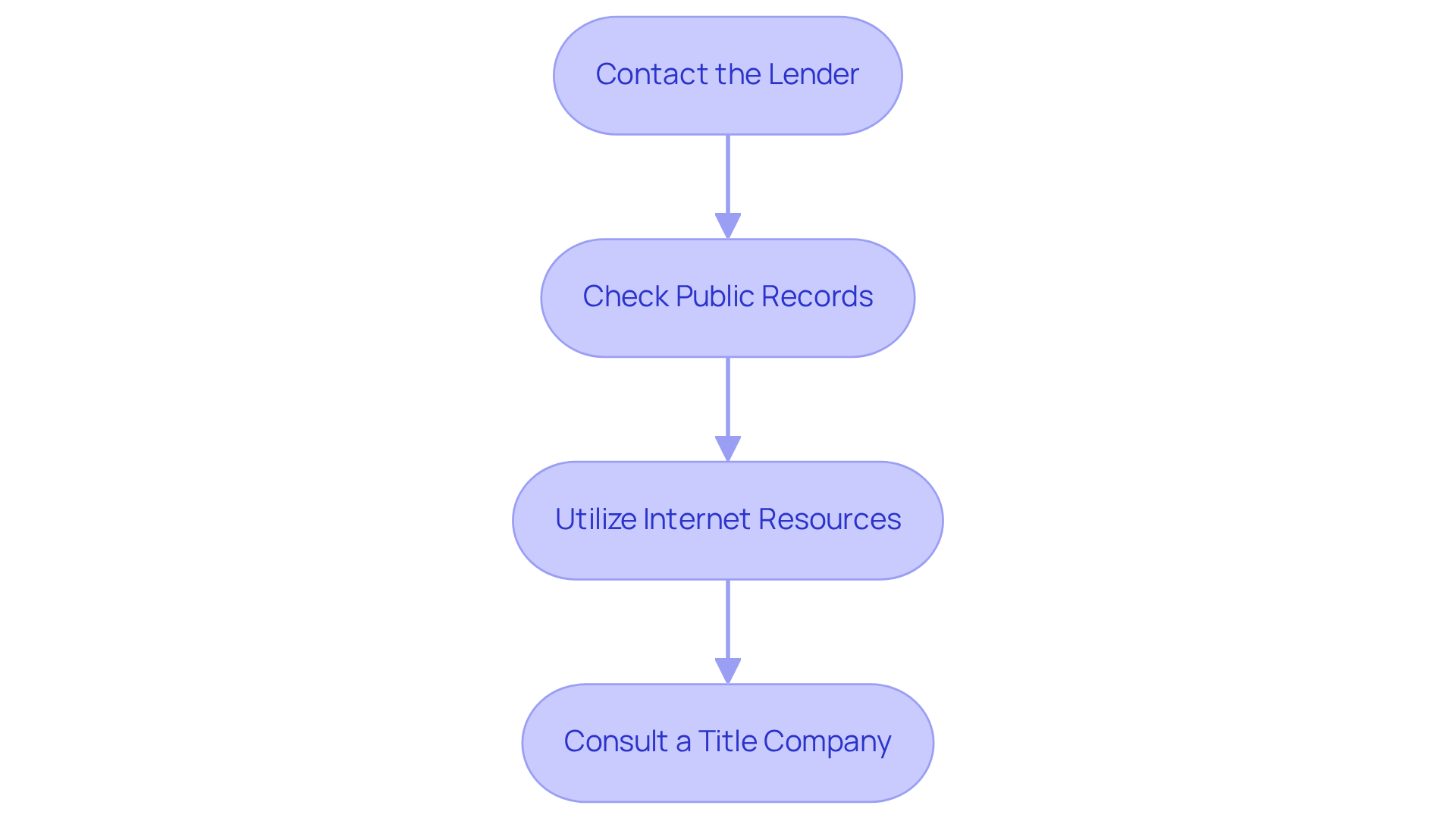

Verify the Status of the Mortgage with Relevant Authorities

To verify the status of an unreleased mortgage, it is crucial to follow these essential steps:

- Contact the Lender: Reach out to the original lender or their successor to confirm the loan status. If the lender is defunct, consult the FDIC or your state banking authority for assistance.

- Check Public Records: Visit your local county recorder's office or their website to examine the title history of the real estate. This will indicate whether the loan remains recorded.

- Utilize Internet Resources: Numerous states offer online databases that enable you to verify the status of loans and liens linked to your property, simplifying the validation procedure.

- Consult : If uncertainties arise, a title company can assist in confirming the loan status and provide insights into any potential issues.

This verification process is vital to ensure you understand how to clear unreleased mortgages before proceeding with any related paperwork. With only 2.0% of financed properties underwater as of Q4 2024, confirming the status of your loan can help you avoid complications in your real estate transactions.

Submit Paperwork to Clear the Unreleased Mortgage

Once you have gathered all necessary documentation and verified the mortgage status, you can proceed to submit the paperwork.

- Prepare Your Submission: Compile all required documents, ensuring they are complete and accurate. Include a cover letter explaining your request on . As noted by industry experts like Anthony Hitt, a well-organized submission can significantly expedite the process.

- File with the Appropriate Authority: Submit your paperwork to the local county recorder's office or the pertinent agency that manages loan releases in your jurisdiction. Ensure you follow any specific filing instructions they provide. Furthermore, according to recent statistics, filing fees for loan releases can differ significantly across states, with fees ranging from $10 to over $300 based on the location. Thus, it is essential to verify the specific requirements for your area.

- Pay Any Required Fees: Be prepared to pay any filing fees associated with the submission. Check the authority's website for fee schedules, as these can range from nominal amounts to several hundred dollars depending on the state.

- Request Confirmation: After submission, request confirmation of receipt and an estimated timeline for processing your request. This will help you track the progress of your application. As noted by successful real estate professionals, maintaining communication with the authority can facilitate a smoother clearance process.

- Examples of Successful Submissions: Consider reviewing examples of successful loan clearance submissions to understand best practices and common pitfalls. Learning from others' experiences can enhance your submission's effectiveness.

Following these steps will help ensure that your request on how to clear unreleased mortgages is processed efficiently.

Troubleshoot Common Issues in the Mortgage Clearing Process

During , several common issues may arise that can lead to significant delays and complications:

- Missing Documentation: Missing required documents can severely obstruct the clearing procedure. Research indicates that about 60% of loans close later than the target date set by lenders, often due to incomplete paperwork. If any required documents are missing, contact the lender or relevant authority immediately to obtain copies. Furthermore, clerical errors in public records can delay property sales by several weeks, emphasizing the importance of thorough documentation.

- Incorrect Information: Ensure that all submitted information is accurate. Discrepancies can lead to further delays, as lenders may require corrected documents or additional explanations. Legal complications can arise from clerical errors in public records, which can take weeks to resolve. As noted by industry experts, "Understanding title problems is essential for a successful real estate transaction."

- Long Processing Times: If processing times exceed expectations, follow up with the authority to check the status of your submission. Delays can occur if additional information is needed, and proactive communication can help mitigate these issues.

- Legal Complications: Legal challenges, such as disagreements over loan status or title issues, can complicate the clearing procedure. Consulting a real estate attorney is advisable to navigate these complexities. As highlighted by legal professionals, having a clear understanding of potential legal issues can prevent significant delays.

By being proactive and prepared for these common issues, you can learn how to clear unreleased mortgages more effectively, minimizing delays and ensuring a smoother transaction.

Conclusion

Understanding how to clear unreleased mortgages is essential for property owners and real estate professionals alike. These lingering debts can complicate transactions, leading to legal disputes and financial liabilities. By addressing unreleased mortgages promptly, individuals can safeguard their property interests and facilitate smoother real estate transactions.

This article outlines a clear, step-by-step approach to resolving unreleased mortgages. Key actions include:

- Gathering necessary documentation

- Verifying the mortgage status with relevant authorities

- Submitting the required paperwork

- Troubleshooting common issues that may arise during the process

Each of these steps is vital for ensuring that the mortgage is cleared efficiently and effectively, preventing potential complications down the line.

In a landscape where unresolved liens can lead to significant repercussions, taking proactive measures to clear unreleased mortgages is not just advisable; it is imperative. By understanding the implications and following the outlined steps, property owners can protect their investments and ensure that their real estate transactions proceed without unnecessary hurdles. Taking action now can save time, money, and stress in the future, reinforcing the importance of vigilance in managing property debts.

Frequently Asked Questions

What are unreleased mortgages?

Unreleased mortgages occur when a loan has been fully paid off, but the lien remains recorded in public records. This can create challenges for property owners, especially when selling or refinancing their properties.

What are the implications of having an unreleased mortgage?

The implications include potential legal disputes and financial liabilities. If a property is sold without addressing the unresolved loan, the new owner may inadvertently assume the debt, which could lead to foreclosure.

Why is it important to clear unreleased mortgages?

Clearing unreleased mortgages is crucial to avoid complications that can hinder property transactions. It helps maintain asset value and ensures that property owners and buyers are not burdened with unresolved debts.

What documentation is required to clear an unreleased mortgage?

The required documentation includes: - Proof of Payment (receipts or statements showing the loan is settled) - Loan Documents (original loan agreement and modifications) - Satisfaction of Mortgage (a document from the lender confirming the mortgage is satisfied) - Identification (personal ID like a driver's license or passport) - Property Title Documents (proof of ownership, such as the deed)

How can gathering the right documents help in clearing unreleased mortgages?

Having the necessary documents ready streamlines the process of clearing unreleased mortgages and helps avoid delays in resolving the issue.