Introduction

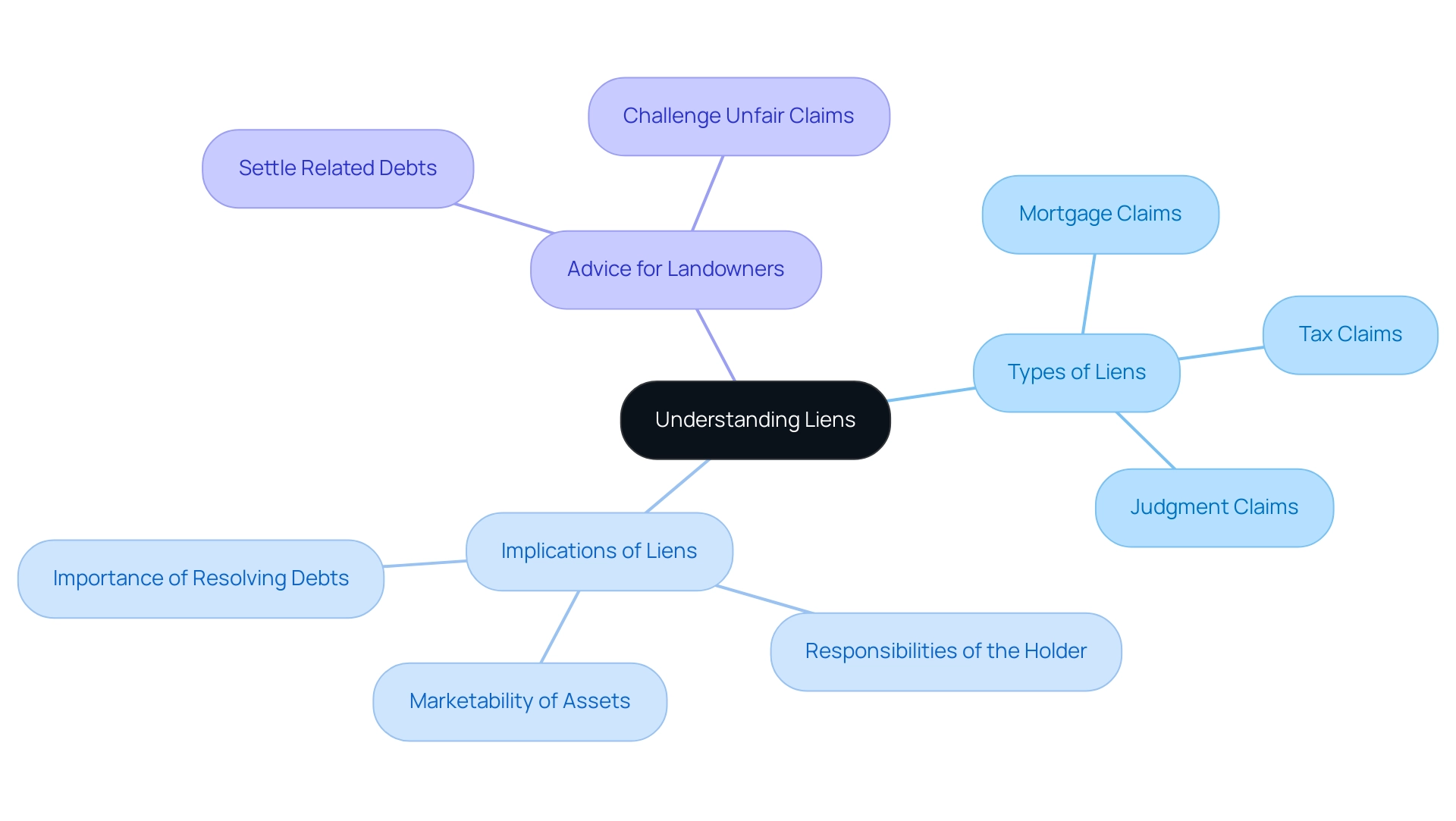

Understanding liens is crucial for anyone involved in real estate, as these legal claims can profoundly impact property ownership and marketability. A lien serves as a security measure for debts, and its presence can complicate transactions, hindering the ability to sell or refinance a property. With approximately 20% of U.S. properties encumbered by some form of lien, it is imperative for property owners and prospective buyers to grasp the nuances of various lien types, their implications, and the responsibilities tied to their resolution.

Recent regulatory changes aimed at streamlining the lien resolution process further highlight the importance of staying informed. This article delves into the definition and implications of liens, the responsibilities for their removal, methods for identifying and clearing them, and proactive strategies to prevent future encumbrances—equipping readers with the knowledge necessary to navigate the complexities of property ownership effectively.

Understanding Liens: Definition and Implications

A legal claim signifies an official interest in an asset, primarily functioning as collateral for a debt. The existence of a claim can considerably obstruct an owner's capacity to sell or refinance the asset until are settled. Different kinds of claims exist, including:

- Mortgage claims

- Tax claims

- Judgment claims

Each carrying unique implications for ownership. According to recent statistics, approximately 20% of real estate in the U.S. have some form of claim attached, affecting their marketability and value. It is crucial to grasp these implications, as they can directly influence the marketability of the asset and the responsibilities of the current holder.

For example, a tax claim places an obligation on the asset holder to resolve the related debt before any sale. Recent news emphasizes that in 2024, new regulations have been implemented to simplify the claim resolution process, making it essential for landholders to remain updated. Understanding the specific nature of a claim and its implications is crucial for determining accountability for its removal.

As Mr. Jenkins observes, to address encumbrance issues, landowners should settle related debts or legally challenge unfair claims. Furthermore, a case study on bankruptcy shows that in such situations, the primary claim on a property is recognized first, followed by later claims, highlighting the significance of prioritizing claim management. This understanding not only aids in navigating the complexities of real estate transactions but also protects valuable assets from potential financial pitfalls.

Who Is Responsible for Removing a Lien to Clear the Title?

The responsibility to eliminate a claim is primarily on the individual or entity that incurred the debt resulting in the claim. For example, when a mortgage claim is established, it is the borrower's duty to ensure the mortgage is satisfied to clear the title. In situations concerning tax claims, the individual must settle any outstanding taxes.

However, the responsibility can extend to third parties, particularly in scenarios involving mechanic's claims. For example, if a contractor submits a mechanic's claim due to unpaid services, the property owner must often negotiate directly with the contractor to reach a resolution.

Properties with outstanding debts face foreclosure rates that are 25% higher than those without such burdens, underscoring the importance of addressing these issues promptly. Interacting with legal specialists or property professionals, like those at Harbinger Land, can provide customized advice, making certain that all parties involved understand their responsibilities and the procedures for resolving different kinds of claims.

Harbinger Land offers thorough and precise ownership research, enabling clients to confidently secure land rights and assets. Their title remediation services specifically aid land and mineral holders in assessing ownership opinions and resolving any identified issues, such as those related to mechanic's claims and tax claims, ensuring a clear chain of ownership and precise leasing.

A recent case study illustrated how a real estate agent effectively managed a mechanic's claim situation with the help of Harbinger Land, facilitating communication between the owner and contractor, resulting in a mutually acceptable payment arrangement that resolved the claim and permitted the sale to proceed seamlessly.

As Alex Benarroche, legal counsel at Levelset, emphasizes, having a clear understanding of these responsibilities is vital for navigating the complexities of .

Steps to Identify Existing Liens on a Property

Identifying existing liens on an asset is a vital step in ensuring clear ownership and facilitating a smooth transaction. To effectively navigate this process, consider the following steps:

- : Begin by visiting your local county clerk or recorder's office, where detailed land records are maintained. Many jurisdictions now provide online databases, enhancing accessibility to these essential documents.

- Conduct a Title Examination: Engage examination services or hire a reputable company to perform a thorough search. This process is essential as it will uncover any documented encumbrances related to the asset, ensuring that all possible claims are recognized. For example, Deutsche Bank had a legal basis to assert a first-priority security interest in First River Energy's assets, highlighting the importance of a precise title search. As Daniel W. Lias, a Transactional Business Consultant, notes, "Due diligence searches are vital in identifying potential encumbrances that could impact ownership transfer."

- Check for Tax Obligations: Contact your local tax assessor's office to determine any outstanding tax obligations that may affect the property. Tax encumbrances can have significant implications for ownership transfer and should be addressed promptly.

- Review Court Records: Investigate local court records for any legal judgments or liens resulting from lawsuits. This step is essential, as unresolved legal matters can obscure ownership and complicate the transfer process.

- Consult with a Title Professional: If the process seems daunting, consider enlisting the expertise of a title professional. Their expertise can assist in navigating the complexities of claim identification and ensure that all potential issues are addressed effectively. Staying updated on recent developments, such as certain states permitting super priority claims to take precedence under specific conditions, is also crucial for remaining informed in this evolving field.

Furthermore, typical problems that may occur without an adequate ownership search include claims, encumbrances, and boundary disputes, which can obscure property rights and complicate the transfer of ownership. By systematically following these steps, you can identify existing claims and protect the integrity of real estate transactions.

Methods for Clearing a Lien from a Property Title

Removing a claim from a property title involves several strategic methods, each serving to address the underlying financial obligation effectively. Here are the primary approaches:

- Pay Off the Debt: The most direct method for clearing the claim is to pay off the outstanding debt that caused it. It's crucial to obtain a detailed payoff statement from the lienholder and ensure that the payment is made in full to avoid any lingering issues.

- Negotiate a Settlement: When full payment is not a viable option, negotiating a settlement with the lienholder can be beneficial. This often involves proposing a reduced amount, which may be accepted based on mutual interest. Documenting any agreements in writing is essential to safeguard against future disputes. Legal expert Jane Doe states, "A well-documented settlement can prevent future complications and misunderstandings."

- Obtain a Release of Claim: Once the debt has been settled, it's imperative to request a release of claim from the holder. This document acts as formal evidence that the claim has been satisfied, ensuring that all parties have clarity on the matter.

- File the Release with Public Records: After acquiring the release, promptly file it with the appropriate public records office. This step is essential for officially removing the claim from the property title and safeguarding the property’s marketability.

- Consult Legal Counsel: In cases where complexities arise, or if becomes challenging, seeking legal counsel is advisable. An experienced attorney can provide guidance on compliance with legal requirements and advocate for your interests throughout the removal process.

Recent statistics indicate that in 2024, the success rate for removal through negotiation has increased to 75%, reflecting a growing trend in effective settlements. As Donald Rumsfeld articulated, negotiations often hinge on each party's perception of reality, highlighting the importance of understanding the perspectives involved. This awareness can enhance the effectiveness of your approach to negotiating settlements for claims, especially considering recent legal changes that have streamlined the removal process, making it more accessible for owners.

Preventing Future Liens on Your Property

To effectively prevent future claims on your property, it is essential to adopt a multifaceted approach that encompasses several key strategies:

- Stay Current on Payments: Timely payment of all mortgage, tax, and utility bills is crucial. Delinquencies in these areas can lead to significant financial repercussions, including the enforcement of claims. Recent statistics indicate a notable rise in mortgage and tax payment delinquencies in 2024, with an increase of approximately 15% compared to the previous year, underscoring the importance of prompt payments.

- Maintain Clear Contracts: When engaging contractors or service providers, ensure that contracts are explicit and that payment terms are adhered to as agreed. Proper contract management is vital, as highlighted by THOMAS J. MADIGAN, who notes that owners must carefully evaluate the circumstances surrounding contract termination to mitigate business loss and potential disputes. Financial advisors suggest that clear contracts can prevent misunderstandings that may lead to disputes and eventual liens.

- Conduct Regular Asset Reviews: Frequently assess your asset’s title and financial responsibilities to identify any outstanding debts that may lead to encumbrances. This proactive approach can help avert future complications and safeguard your investment. Furthermore, grasping the possible effects of contractor disagreements on asset claims is vital, as unresolved matters can grow into financial obligations.

- Communicate with Lenders: In the event of financial challenges, it is imperative to engage in open communication with lenders. Addressing issues early can facilitate the exploration of alternative payment arrangements, thus avoiding defaults that might lead to liens. Experts suggest that real estate holders proactively discuss their financial situations to find manageable solutions.

- Consult Title Experts: Regular consultations with title experts can provide insights into potential risks and ensure compliance with , thus strengthening your position in the event of disputes. This aligns with the case study on owners’ responsibilities in contractor disputes, which emphasizes the importance of demonstrating good faith and adherence to dispute resolution procedures.

By implementing these strategies, property owners can significantly reduce the risk of future liens and maintain a stable financial standing.

Conclusion

Understanding liens is essential for anyone involved in real estate, as they pose significant implications for property ownership and marketability. This article has explored the various types of liens, including mortgage, tax, and judgment liens, and highlighted the responsibilities of property owners in addressing these encumbrances. With approximately 20% of U.S. properties affected by liens, it is crucial to recognize how these legal claims can complicate transactions and impact the value of real estate.

The process of identifying and clearing liens is pivotal for ensuring a clear title. Engaging in thorough title searches, consulting with professionals, and understanding one’s obligations are key steps in this journey. Additionally, the methods for clearing liens, such as negotiating settlements or paying off debts, require careful consideration and, when necessary, legal guidance.

As outlined, recent regulatory changes have aimed to simplify the lien resolution process, emphasizing the need for property owners to stay informed and proactive.

Ultimately, by adopting strategic measures to prevent future liens—such as maintaining timely payments, ensuring clear contracts, and conducting regular property reviews—property owners can protect their investments and navigate the complexities of real estate transactions with greater confidence. A thorough understanding of liens and their implications not only safeguards valuable assets but also enhances the overall stability of property ownership in today’s market.

Frequently Asked Questions

What is a legal claim in relation to assets?

A legal claim signifies an official interest in an asset, primarily functioning as collateral for a debt. It can obstruct an owner's ability to sell or refinance the asset until the underlying issues are resolved.

What are the different types of legal claims?

The main types of legal claims include mortgage claims, tax claims, and judgment claims, each carrying unique implications for ownership.

How prevalent are legal claims on real estate in the U.S.?

Approximately 20% of real estate in the U.S. has some form of claim attached, which can affect their marketability and value.

What are the responsibilities of an asset holder regarding claims?

The individual or entity that incurred the debt resulting in the claim is primarily responsible for eliminating it. For instance, a borrower must satisfy a mortgage claim, and a property owner must settle any outstanding taxes related to a tax claim.

How can claims affect property foreclosure rates?

Properties with outstanding debts face foreclosure rates that are 25% higher than those without such burdens, emphasizing the importance of addressing these issues promptly.

What steps can be taken to identify existing liens on an asset?

To identify liens, one can access public records, conduct a title examination, check for tax obligations, review court records for legal judgments, and consult with a title professional.

What are the methods for removing a claim from a property title?

The primary methods include paying off the debt, negotiating a settlement, obtaining a release of claim, filing the release with public records, and consulting legal counsel if needed.

What recent trend has been observed regarding the success rate of claim removal through negotiation?

In 2024, the success rate for removal through negotiation has increased to 75%, reflecting a growing trend in effective settlements.

What strategies can property owners adopt to prevent future claims?

Strategies include staying current on payments, maintaining clear contracts, conducting regular asset reviews, communicating with lenders, and consulting title experts regularly.