Overview

Foreclosure liens on property emerge when a borrower defaults on mortgage payments, which empowers lenders to initiate legal proceedings to reclaim the asset and potentially sell it to recover debts. Understanding these liens is crucial for real estate professionals, as they can complicate transactions, deter buyers, and impact property values. This is particularly relevant in the context of escalating housing crises across various markets. The implications of foreclosure liens necessitate thorough title research, as they present significant challenges that must be navigated to safeguard interests and ensure successful transactions.

Introduction

In the intricate world of real estate, foreclosure liens emerge as significant players, often dictating the fate of properties and their owners. As borrowers grapple with mortgage defaults, these legal claims empower lenders to reclaim properties, setting off a chain reaction that complicates transactions and impacts market dynamics.

Statistics reveal a notable prevalence of foreclosure issues across various regions; thus, understanding the nuances of foreclosure liens is paramount for real estate professionals. From grasping the implications of multiple liens to navigating the complexities of the foreclosure process, this article delves into the critical aspects of foreclosure liens, equipping industry experts with the knowledge needed to guide clients through these challenging waters.

What Are Foreclosure Liens and How Do They Work?

When a borrower fails to make mortgage payments, a foreclosure lien arises against the property. This claim empowers the lender to initiate legal action, ultimately allowing them to acquire the asset. Upon repossession, the lender is entitled to sell the asset to recover the outstanding debt.

For real estate experts, understanding mortgage-related claims—particularly foreclosure liens—is crucial, as these assertions can significantly impact a property's market appeal. Properties encumbered by a foreclosure lien must have these issues resolved before any sale can proceed, complicating transactions and delaying closings. In 2023, California faced a rate of one in every 3,629 households experiencing home loss, ranking it 11th in the nation, while Oklahoma's rate was one in every 6,147 households, placing it 25th.

Such statistics underscore the prevalence of housing crises across various markets, especially in counties like Lake, Mendocino, Madera, Kern, and Shasta in California, which report the highest rates of home repossession.

Furthermore, the ramifications of foreclosure liens extend beyond mere legal concerns; they can deter potential buyers and depress real estate values. Recent evaluations indicate that a significant portion of assets affected by legal claims in 2025 is expected to influence market dynamics. Rob Barber, CEO of ATTOM, remarked, "While seasonal factors may slow things down briefly, we’ll be watching closely to see how these recent dynamics affect the market in the coming year."

This observation highlights the ongoing shifts in the market and their potential impact on real estate transactions.

Additionally, it is essential to recognize that 52 percent of non-homeowners reported that student loan expenses hindered their ability to save for a down payment, illustrating broader financial challenges that may lead to defaults. Real estate professionals must be equipped to navigate these complexities, ensuring they can effectively manage transactions involving properties with foreclosure liens. By comprehending the mechanics of these claims, professionals can better anticipate challenges and protect their clients' interests in real estate dealings.

The 'First in Time, First in Right' Rule: Establishing Lien Priorities

The 'first in time, first in right' rule stands as a cornerstone principle in priority, asserting that the sequence of recordings dictates precedence. In property repossession scenarios, this principle indicates that the foreclosure lien recorded first will take priority for payment from the sale proceeds. This understanding is crucial for real estate professionals, as it directly influences the distribution of funds during foreclosure proceedings.

In instances where a property is encumbered by multiple claims, the primary loan will be addressed before any secondary claims, which may include foreclosure liens, second loans, or judgment claims. This hierarchy can significantly impact the financial outcomes for all stakeholders involved. Recent statistics reveal that approximately 30% of defaults involve several claims, underscoring the importance of claim priority in such situations. Furthermore, it is vital to recognize that the statute of limitations for foreclosing a mortgage is fifteen years from the maturity date specified in the mortgage, providing essential context for foreclosure actions.

A landmark case illustrating this principle is Bank of New York Mellon v. Franklin Heights Condominium Association, where the court ruled that while the bank maintained priority over the pre-foreclosure segment of the claim, the post-foreclosure claim was prioritized for the creditor. This ruling not only clarified the application of the 'first in time, first in right' rule but also highlighted the potential for significant financial recovery for clients engaged in such disputes. As Dean M. Zimmerli noted, 'The exception to this mandatory-verse-optional advance rule lies in revolving lines of credit,' which emphasizes the complexities that can emerge in priority situations.

Understanding how the sequence of claim recording affects property recovery outcomes is essential for effective risk evaluation and negotiation strategies. Experts emphasize that real estate professionals must diligently verify claim positions and their implications, as this knowledge can lead to more favorable outcomes in intricate scenarios involving foreclosure liens.

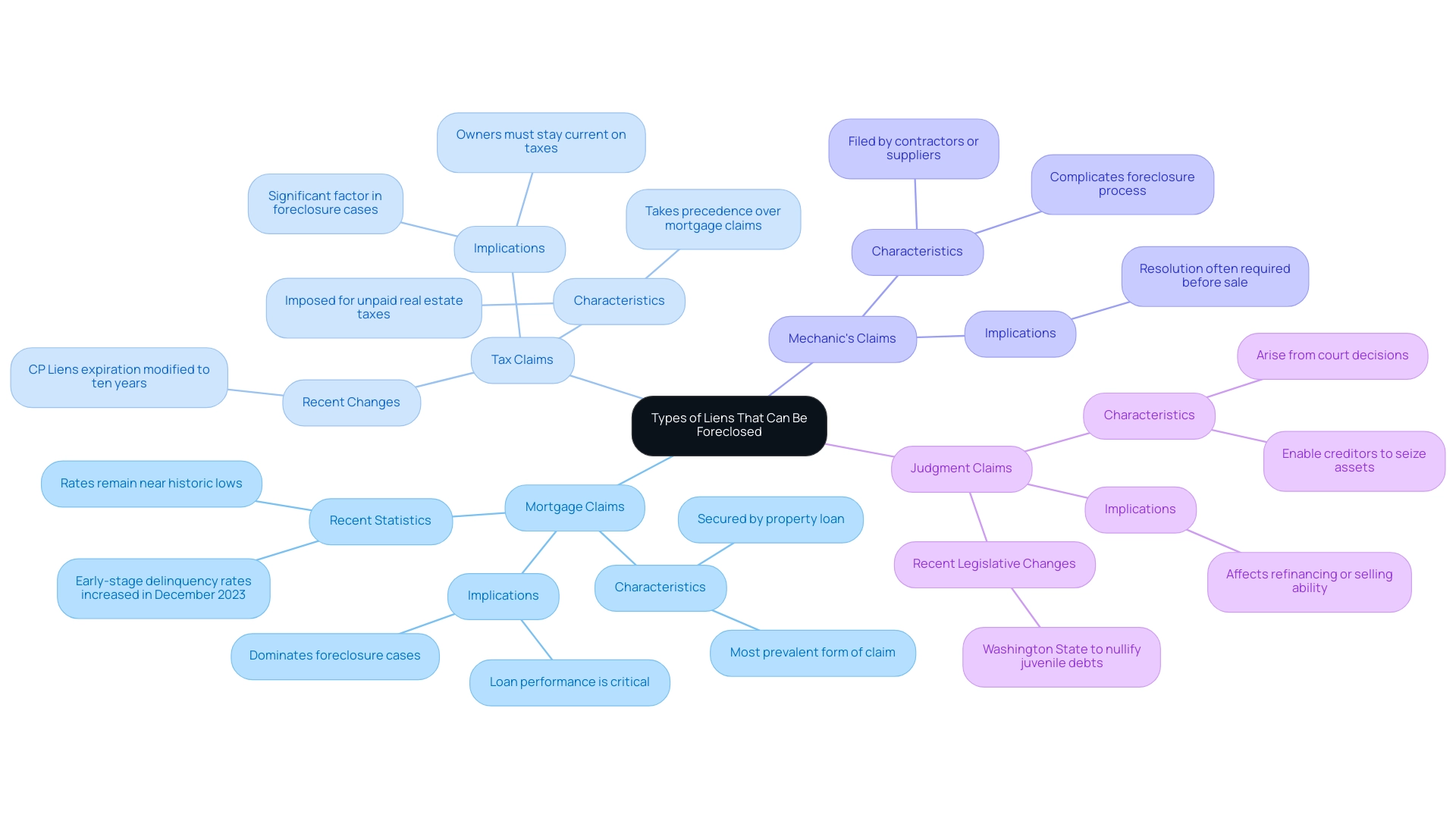

Types of Liens That Can Be Foreclosed: A Comprehensive Overview

In the realm of real estate, various types of claims can be foreclosed, each possessing distinct characteristics and implications.

Mortgage Claims represent the most prevalent form of claim, emerging when a borrower secures a loan to purchase property. As of early 2025, loan claims continue to dominate foreclosure cases, underscoring the ongoing significance of loan performance in the housing market. According to the CoreLogic Loan Performance Insights report, early-stage loan delinquency rates increased in December 2023 compared to one year earlier, yet remained near historic lows, indicating a complex landscape for loan performance.

Tax Claims, imposed by government entities for unpaid real estate taxes, can take precedence over mortgage claims. Recent statistics suggest that tax claims are a significant factor in cases involving a foreclosure lien on property, highlighting the necessity for owners to remain current on their tax obligations. The alteration of CP Liens expiration, effective September 2019, to ten years after the final day of the month in which the original certificate was obtained, further emphasizes the importance of understanding duration periods and their implications.

Mechanic's Claims are submitted by contractors or suppliers who have not received compensation for work completed on the site. These claims can complicate the foreclosure process, as resolution is often required before an asset can be sold.

Judgment Claims, arising from court decisions against the owner, enable creditors to seize the asset to settle debts. The implications of judgment claims can be profound, potentially affecting the owner's ability to refinance or sell the property. Recent legislative changes in Washington State, scheduled to take effect on June 30, 2025, will eliminate criminal justice debts owed by juveniles, potentially reshaping the landscape of judgment claims and their role in repossession processes.

Understanding the nuances of claims, such as the foreclosure lien on property, is crucial for real estate professionals, as each carries specific legal implications and procedures for repossession. Current statistics indicate that the proportion of home loans compared to tax claims in default cases remains an essential indicator for evaluating market stability. As of 2025, home loans constitute a substantial share of defaults, yet tax claims are gaining importance, reflecting broader economic patterns.

Real estate experts must stay updated on these changes, as they can directly impact property ownership and investment strategies. Case studies, such as Oklahoma's eviction rate of one in every 6,147 households, illustrate the diverse effects of different claim types across regions. Understanding these dynamics is essential for navigating the complexities of real estate transactions and ensuring informed decision-making.

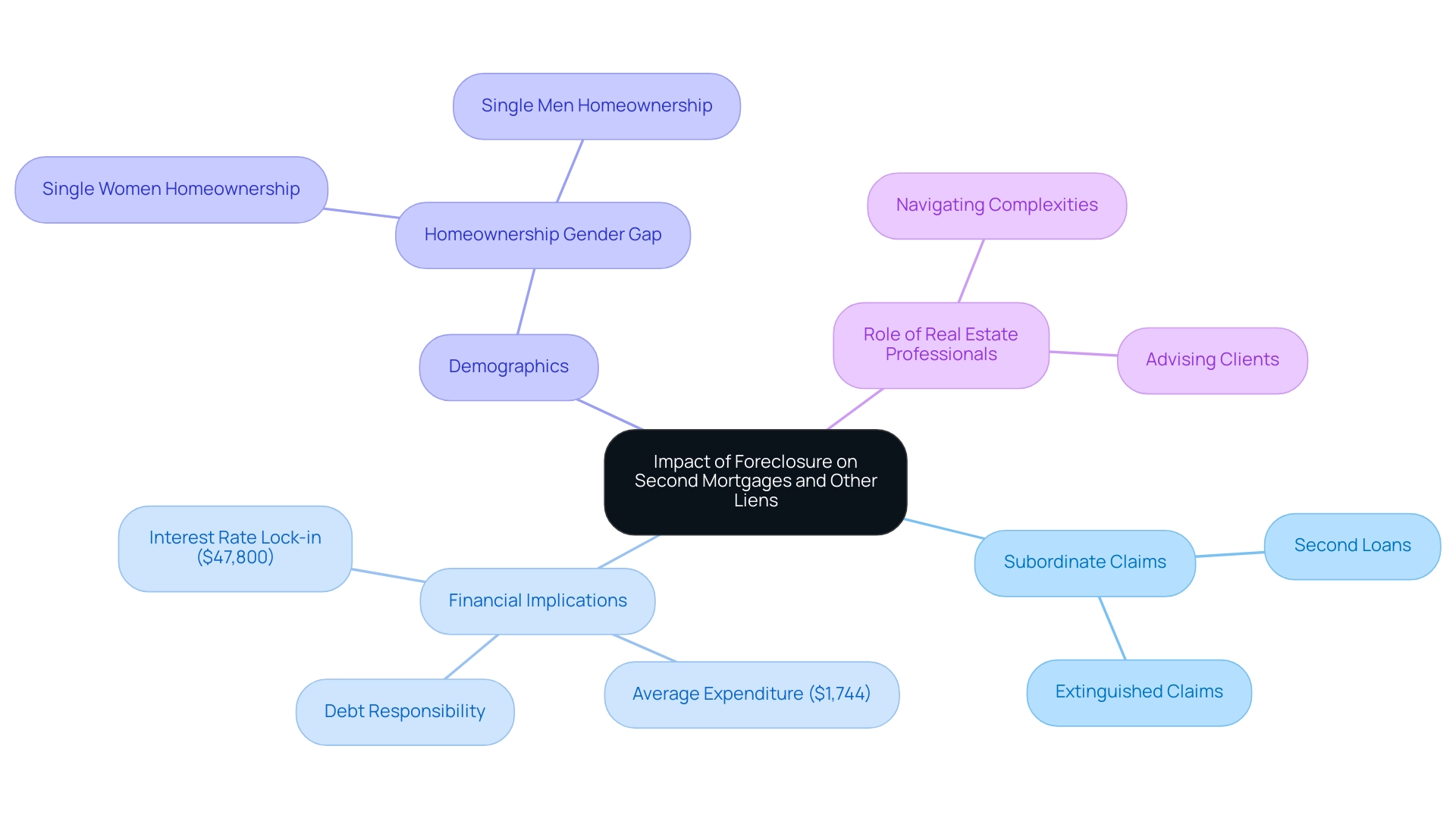

Impact of Foreclosure on Second Mortgages and Other Liens

In the realm of foreclosure liens on property, subordinate claims, including second loans, are typically extinguished unless specific exceptions are applicable. For instance, when a primary loan undergoes foreclosure, the holder of the secondary loan generally forfeits their claim to the property. Nevertheless, they retain the right to pursue the borrower for any outstanding debt, which can result in a foreclosure lien on property and considerable financial strain for homeowners burdened with multiple claims.

This scenario is particularly concerning, given that approximately 30% of second mortgage holders may face the loss of their homes in 2025, underscoring the precarious position many homeowners find themselves in.

The challenges intensify for those with multiple claims, as they may still bear responsibility for debts even after losing their assets. This situation highlights the critical importance of understanding the implications of property seizure, particularly the foreclosure lien on property, in relation to subordinate liens and borrower debt. For example, federal agencies report an average expenditure of $1,744 on maintenance for each post-foreclosed property, illustrating the financial burden that can emerge from such situations.

Moreover, the average interest rate lock-in effect for conventional loan borrowers was $47,800 in November 2024, signifying the substantial financial repercussions of default for borrowers.

Real estate professionals must be equipped to navigate these complexities, as they play a vital role in advising clients on the potential risks and outcomes associated with a foreclosure lien on property during repossession. A recent analysis revealed that the ramifications of property repossession on second mortgages extend beyond mere financial concerns; they also encompass demographic factors, as evidenced by the case study of the homeownership gender gap. This study revealed that single women are more likely to own homes than single men in 47 out of 50 states, reflecting evolving societal norms and financial independence.

Such demographic shifts can influence the dynamics of property repossession and the challenges faced by homeowners with multiple encumbrances.

Understanding these dynamics is essential for real estate experts, as they can provide invaluable insights to clients grappling with the complexities of multiple liens, such as a foreclosure lien on property, and the potential consequences of property loss. As Dan Shepard, an editor, emphasizes, "We thoroughly fact-check and review all content for accuracy," underscoring the significance of credible information in navigating these intricate issues.

Navigating the Foreclosure Process: Key Steps and Considerations

The repossession process is a structured series of steps that can lead to a foreclosure lien on property, significantly impacting both borrowers and lenders. Understanding these steps is crucial for real estate professionals navigating this complex landscape.

The process of default begins when the borrower fails to make their mortgage payments, prompting the lender to initiate legal action to establish a foreclosure lien on property. Following the default, the lender issues a formal notice to the borrower, indicating their default status and the potential consequences, including a foreclosure lien on property. The lender then files a lawsuit to initiate the process of placing a foreclosure lien on property, officially seeking to reclaim the property. A court hearing may be scheduled to evaluate the legitimacy of the foreclosure lien on property.

This step is critical, as it allows the borrower to contest the foreclosure lien on property if they believe it is unjust. If the court rules in favor of the lender, a foreclosure lien on property may be placed, leading to the asset being sold at auction to the highest bidder, often resulting in a significant loss for the original owner. Following the auction, if the property is sold due to a foreclosure lien on property, the former owner may face eviction if they do not vacate the premises voluntarily.

Recent changes in property seizure laws have introduced new protections for borrowers, emphasizing the importance of staying informed about evolving regulations related to foreclosure lien on property. In 2025, the average length of the property repossession process has been reported to be about six months, although this can vary based on different factors, including local regulations and the details of each situation.

Statistics show that proactive actions, such as regularly paying monthly loan dues, have assisted approximately 6,066,666 families in avoiding a foreclosure lien on property. This highlights the importance of timely intervention and the role of government and industry in providing support during economic challenges, particularly in cases involving a foreclosure lien on property. As highlighted by REsimpli, in the first quarter of 2023, there were 58,268 documented actions to prevent property loss, assisting numerous families in remaining in their residences.

Case studies indicate that economic challenges, such as increasing unemployment and inflation, can lead to higher rates of property loss and the risk of a foreclosure lien on property. This emphasizes the necessity for rapid-response systems like mortgage forbearance plans to stabilize markets during disruptions. Expert guidance from real estate attorneys underscores the necessity of understanding these key steps and the legal landscape surrounding foreclosure lien on property. By being well-prepared and knowledgeable, real estate professionals can better navigate the complexities of the property repossession process, including dealing with a foreclosure lien on property, ultimately assisting their clients in making informed decisions.

Additionally, Parse Ai's platform is designed to improve workflow efficiency and provide significant cost savings for real estate professionals, aligning with the industry's need for effective solutions in challenging times.

Enforcement of Non-Mortgage Liens in Foreclosure Scenarios

Non-mortgage claims, such as mechanic's claims and judgment claims, introduce significant complexities into the process of handling a foreclosure lien on property. While home loan claims typically have precedence, the enforcement of non-home loan claims can differ depending on their particular ranking. In a foreclosure auction, the earnings are initially distributed to meet the loan obligation.

Any surplus funds are then allocated to non-mortgage claims according to their established priority. For instance, tax claims can take precedence over mortgage claims, emphasizing the significance of comprehending claim hierarchy in real estate dealings. Statistics indicate that a significant portion of assets confronting repossession have non-mortgage claims, complicating the resolution process. Recent data suggests that non-mortgage claims are frequently upheld during property repossession, with numerous instances leading to disagreements regarding the allocation of sale proceeds. Indeed, assets with non-debt encumbrances have been shown to face increased rates of issues related to foreclosure liens on property, highlighting the necessity for real estate experts to remain attentive.

Furthermore, it is crucial to recognize that an NFOI -147, Non-Judicial Foreclosure, must be initiated on ICS at least seven calendar days before the sale date, which is a vital requirement in the enforcement of non-mortgage claims. A recent case study involving the adequacy of IRC 7425 notice illustrates these challenges. The court ruled that the non-judicial sale notice was considered adequate if it included specific information such as the name and address of the person submitting the notice, details of the property, and the terms of the sale. If the notice lacked required information, it was deemed inadequate. This case highlights the necessity for real estate professionals to be well-versed in the intricacies of property enforcement.

Expert insights from industry professionals further illuminate the complexities surrounding non-mortgage claims. Amy Loftsgordon, an attorney, remarked that "due to the super-priority of property tax claims, many mortgages grant the lender the authority to collect property taxes from the borrower." This dynamic can complicate outcomes related to property repossession, as it may affect the lender's recovery strategy. Understanding the enforcement methods for non-mortgage claims in repossession situations is essential, particularly in relation to foreclosure liens on property. These liens can be enforced through various legal avenues, including court proceedings and statutory requirements, which vary by jurisdiction. Real estate professionals must stay informed about local laws and related IRMs to navigate these complexities effectively. By doing so, they can better manage potential risks and ensure smoother transactions in the face of lien-related challenges.

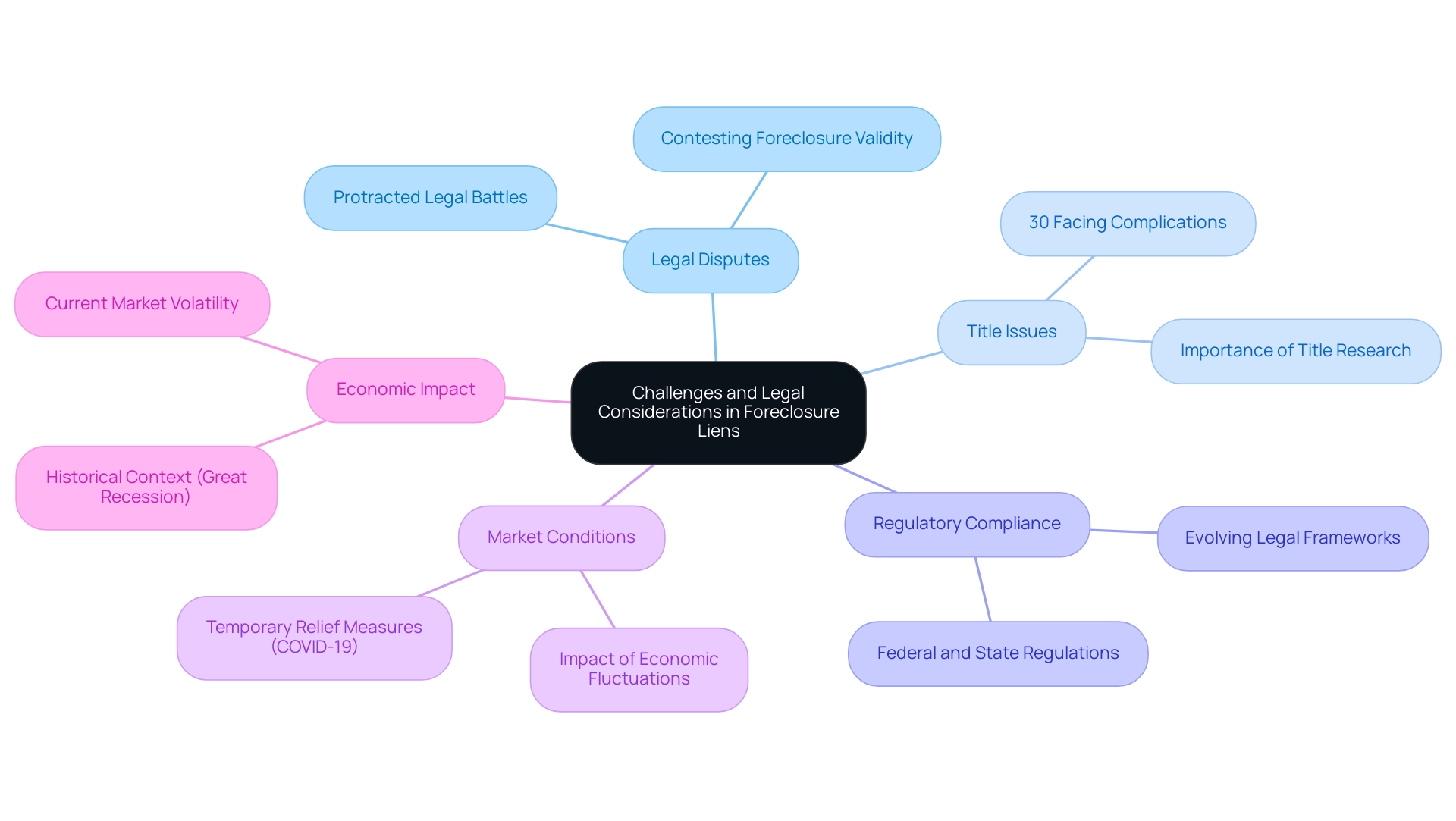

Challenges and Legal Considerations in Foreclosure Liens

Foreclosure presents a myriad of challenges that real estate professionals must navigate effectively.

Legal disputes often arise during the foreclosure process, as borrowers may contest the validity of the foreclosure lien on property. This can lead to protracted legal battles, complicating the resolution of the asset’s status and delaying potential sales. As noted by Timothy Dunne, "Foreclosure metrics can often reflect broader economic conditions, making it essential for professionals to stay informed."

Title issues are significant, with an estimated 30% of foreclosures in 2025 facing unresolved complications. These issues can severely hinder the marketability of properties affected by a foreclosure lien, making it essential for title researchers to conduct thorough investigations to identify and resolve any discrepancies. Historical context reveals that during the Great Recession, property repossession filings surged, exceeding two million annually, but began to taper off by 2015 as the economy improved. This backdrop underscores the importance of addressing title issues in the current landscape.

Furthermore, adherence to federal and state regulations is crucial in the property repossession process, particularly when a foreclosure lien is involved. Real estate professionals must stay informed about evolving legal frameworks to ensure compliance, as failure to do so can result in legal repercussions and financial losses.

Market conditions also play a pivotal role, as economic fluctuations significantly impact property values and the feasibility of selling foreclosed properties. The COVID-19 pandemic resulted in temporary relief measures that decreased property repossession filings in 2020, showcasing the volatility of the market. Comprehending these changes is crucial for real estate experts to manage the intricacies of distressed property transactions effectively.

By understanding these challenges, real estate professionals can provide informed guidance to clients, helping them navigate the complexities of property recovery transactions more effectively. This knowledge is vital for mitigating risks associated with legal disputes and title issues, ultimately enhancing the efficiency of the property repossession process.

The Role of Title Research in Managing Foreclosure Liens

Title research plays a crucial role in managing claims, serving as a thorough review of public records to identify all encumbrances and ownership assertions against a real estate asset. This meticulous process is essential for real estate professionals, as it helps uncover potential issues that could complicate the property repossession process, including:

- Current Claims: A comprehensive identification of all encumbrances on the asset is vital for establishing the order of priority and understanding possible liabilities that may arise, such as a foreclosure lien on property, during foreclosure.

- Ownership History: Examining the property's ownership background can uncover disputes or claims that may arise during legal proceedings, enabling professionals to tackle these matters proactively.

- Legal Compliance: Ensuring adherence to all legal requirements throughout the repossession process is critical for mitigating risks and safeguarding clients' interests.

Statistics underscore the importance of title research in repossession cases, highlighting that a significant percentage of repossessions reveal a foreclosure lien on property during title searches. In fact, recent data indicates that 46.7% of all active property repossessions are currently in the auction stage, emphasizing the urgency for accurate title assessments. Furthermore, the mortgage delinquency rate is currently 89% higher than at the end of 2019, illustrating the growing challenges in the property repossession market and the necessity for diligent title research.

Moreover, the integration of advanced technologies, such as those offered by Parse AI, revolutionizes the title research landscape. By utilizing machine learning and optical character recognition, title researchers can significantly enhance the efficiency and accuracy of their work. This technological advancement not only streamlines the title search process but also empowers real estate professionals to navigate the complexities of property repossession with greater confidence.

The Housing and Economic Recovery Act of 2008 supports land banking efforts for neighborhood stabilization, further illustrating the importance of title research in managing foreclosure liens on property and ensuring community stability. Case studies further illustrate the critical nature of title research in property management. For example, the Value Impact (VI) model was created to assess the anticipated effects on real estate values from defaults.

This model, which incorporates various stages of the repossession process, revealed substantial expected property value losses for candidate properties, emphasizing the need for strategic acquisition by community organizations to stabilize neighborhoods.

In summary, the importance of title research in managing a foreclosure lien on property cannot be overstated. By leveraging technology and thorough investigative practices, real estate professionals can uncover issues that may otherwise hinder the foreclosure process, ultimately leading to more informed decision-making and better outcomes for their clients.

Conclusion

Understanding the intricacies of foreclosure liens is essential for real estate professionals navigating the complexities of the market. Foreclosure liens signify a legal claim against a property due to mortgage defaults and significantly influence property values and marketability. As highlighted, the prevalence of multiple liens complicates transactions, emphasizing the necessity for professionals to be well-versed in lien priority and the types of liens that may arise during foreclosure.

The 'first in time, first in right' rule serves as a guiding principle in determining lien priority, affecting the distribution of funds during foreclosure sales. Real estate experts must remain vigilant and informed about the various types of liens, including:

- Mortgage liens

- Tax liens

- Mechanic's liens

- Judgment liens

As each carries distinct implications that can impact both borrowers and lenders. Furthermore, the foreclosure process itself involves a series of structured steps, from default to eviction, necessitating a comprehensive understanding to effectively advise clients.

In navigating these challenges, the role of title research becomes increasingly critical. Thorough examinations of public records reveal existing liens and ownership claims, helping professionals mitigate potential risks associated with legal disputes and title issues. The integration of advanced technologies has further enhanced the efficiency of title research, enabling real estate experts to address complexities with greater confidence.

Ultimately, as the landscape of foreclosure evolves, real estate professionals must equip themselves with the knowledge and tools necessary to guide clients through the intricacies of foreclosure liens. By doing so, they not only protect their clients' interests but also contribute to the stability and health of the real estate market.

Frequently Asked Questions

What happens when a borrower fails to make mortgage payments?

When a borrower fails to make mortgage payments, a foreclosure lien arises against the property, allowing the lender to initiate legal action to acquire the asset. The lender can then sell the property to recover the outstanding debt.

Why is understanding foreclosure liens important for real estate experts?

Understanding foreclosure liens is crucial for real estate experts because these claims can significantly impact a property's market appeal. Properties with foreclosure liens must have these issues resolved before any sale can proceed, complicating transactions and delaying closings.

What are the foreclosure rates in California and Oklahoma?

In 2023, California had a foreclosure rate of one in every 3,629 households, ranking it 11th in the nation. Oklahoma's rate was one in every 6,147 households, placing it 25th.

Which counties in California report the highest rates of home repossession?

Counties in California that report the highest rates of home repossession include Lake, Mendocino, Madera, Kern, and Shasta.

How do foreclosure liens affect real estate values?

Foreclosure liens can deter potential buyers and depress real estate values, influencing market dynamics and complicating transactions involving affected properties.

What financial challenges do non-homeowners face regarding down payments?

52 percent of non-homeowners reported that student loan expenses hinder their ability to save for a down payment, illustrating broader financial challenges that may lead to defaults.

What is the 'first in time, first in right' rule?

The 'first in time, first in right' rule states that the sequence of recordings dictates precedence in property repossession scenarios. The foreclosure lien recorded first will have priority for payment from the sale proceeds.

What happens when a property has multiple claims?

In instances where a property is encumbered by multiple claims, the primary loan will be addressed before any secondary claims, such as foreclosure liens or judgment claims, which can significantly impact financial outcomes for stakeholders.

What is the statute of limitations for foreclosing a mortgage?

The statute of limitations for foreclosing a mortgage is fifteen years from the maturity date specified in the mortgage.

Can you provide an example of a case related to foreclosure lien priority?

In the case of Bank of New York Mellon v. Franklin Heights Condominium Association, the court ruled that the bank maintained priority over the pre-foreclosure segment of the claim, while the post-foreclosure claim was prioritized for the creditor, clarifying the application of the 'first in time, first in right' rule.