Overview

This article emphasizes the critical steps necessary for clearing title liens in real estate transactions. It presents a systematic approach that encompasses:

- Conducting thorough title searches

- Obtaining lien releases from creditors

- Engaging legal professionals

- Maintaining clear communication

Each of these elements is vital for ensuring a smooth transaction and minimizing legal risks. Furthermore, accurate title research is paramount, as it lays the foundation for identifying potential challenges. By addressing these challenges head-on, stakeholders can implement effective solutions that ultimately lead to successful outcomes. Consequently, the outlined approach not only mitigates risks but also enhances the overall efficiency of the transaction process.

Introduction

In the intricate world of real estate transactions, the clearance of liens presents significant challenges that can derail deals and complicate ownership transfers. As property professionals navigate this complex landscape, the integration of advanced technologies like Parse AI revolutionizes title research, streamlining processes and enhancing accuracy. However, the journey to a clear title involves more than mere automation; it necessitates a comprehensive understanding of legal implications, effective communication, and meticulous documentation.

This article explores the essential steps for successfully clearing liens:

- Conducting thorough title searches

- Engaging legal experts

Ensuring that real estate professionals are well-equipped to overcome obstacles and facilitate seamless transactions.

Parse AI: Streamline Title Research with Advanced Automation

Parse AI harnesses advanced machine learning and optical character recognition to automate the extraction of critical information from title documents. This innovative technology drastically reduces the time needed for title research, enabling professionals to concentrate on more strategic tasks. By optimizing the process, Parse AI not only enhances precision but also minimizes the risk of human errors, establishing itself as an essential resource for property transactions requiring clearance.

As automation continues to transform the industry, it is vital to address societal concerns regarding the concentration of pretrained AI models among a limited number of vendors. Furthermore, AI's capabilities extend beyond mere efficiency; as noted by industry experts, AI can analyze data to identify potential buyers or renters, forecast market trends, and develop targeted marketing strategies.

However, it is imperative to remain vigilant about the privacy and data governance risks associated with AI implementation. In summary, the integration of these technologies is becoming increasingly crucial in the property sector.

Conduct a Comprehensive Title Search to Identify Liens

To effectively resolve title claims in real estate transactions, it is imperative to commence with a comprehensive title investigation utilizing public records. This investigation must encompass:

- Tax records

- Court documents

- Other pertinent filings

to uncover any existing claims on the property. Notably, statistics indicate that approximately 30% of properties have pending claims, underscoring the critical nature of this initial step. Leveraging advanced tools such as Parse AI can significantly expedite the search process, thereby minimizing the risk of overlooking vital claims. A meticulous title search not only clarifies the property's legal standing but also provides you with the steps in clearing title liens.

For example, Lien Management Services has illustrated that thorough due diligence in lending—by investigating various types of liens—streamlines the process and ensures that lenders possess a comprehensive understanding of a borrower's obligations prior to finalizing loan agreements. This approach is essential for navigating the complexities associated with encumbrance identification and management, particularly the steps in clearing title liens, given that federal tax encumbrances can be challenging to identify due to their documentation by local authorities.

As Peter Fife aptly notes, 'Message and data rates may apply,' highlighting the necessity of caution when identifying claims. Furthermore, it is crucial to recognize that IRS claims take precedence over other creditors, even if they have submitted UCC claims and established their interests.

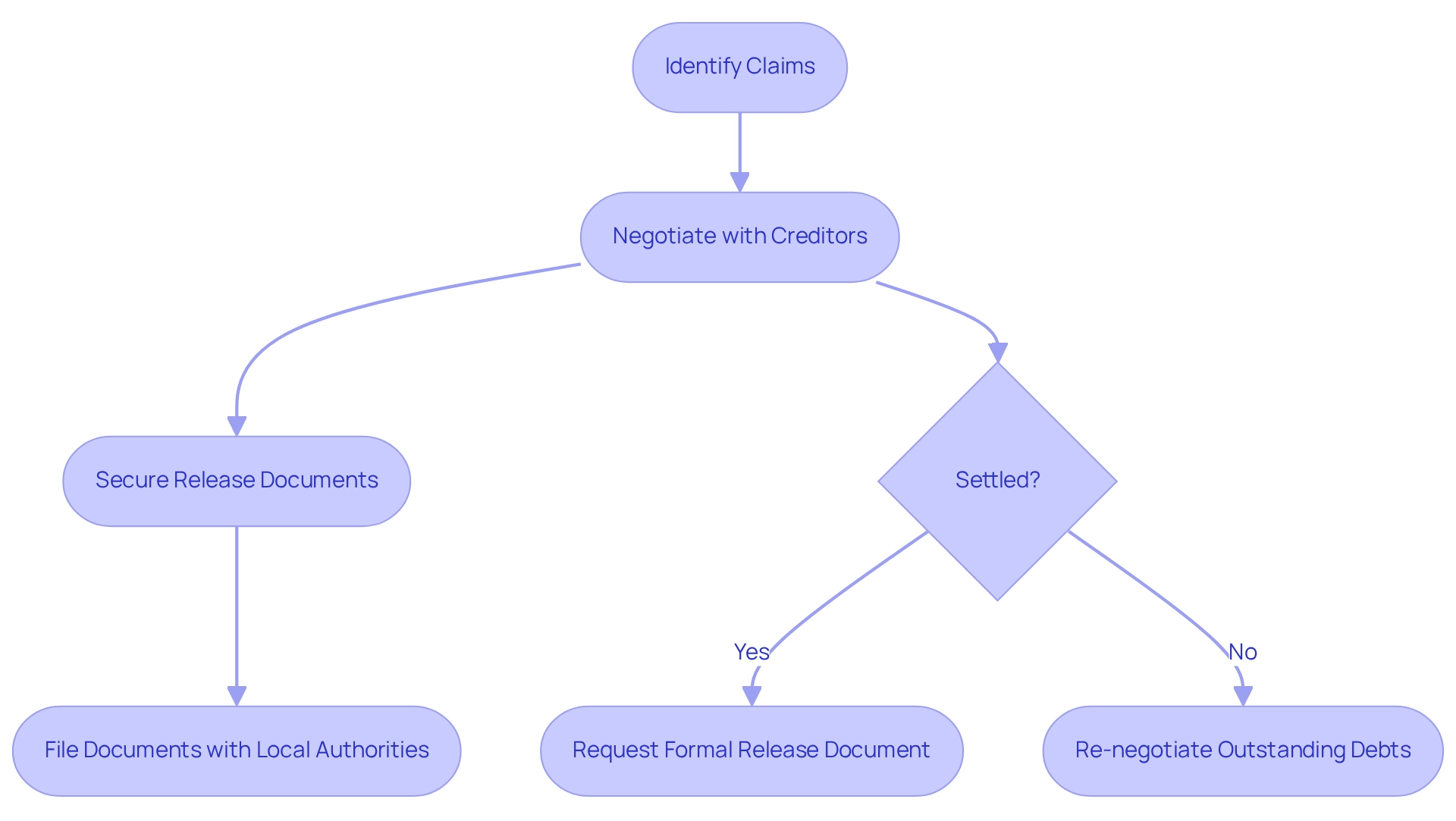

Obtain Lien Releases from All Relevant Creditors

Once claims are identified, the subsequent essential step is to obtain release documents from all pertinent creditors. This process often necessitates negotiation to settle any outstanding debts or disputes. Mechanic's claims, for instance, are submitted by contractors who have not received payment for work performed on a property and must be resolved before a sale can proceed. Furthermore, Texas law automatically imposes a tax claim on properties for unpaid state, county, school district, or city taxes, which real estate professionals must be aware of.

Effective negotiation tactics can significantly influence outcomes; for example, understanding the typical duration to secure release documents can aid in establishing realistic expectations. After reaching a settlement or making payment, it is crucial to request a formal release document. This document serves as proof that the creditor no longer has a claim on the property. As Nixon Daughtrey asserts, 'A partial release pertains to certain sections of the property,' underscoring the details involved in release agreements.

It is also advisable to ensure that these documents are promptly filed with the appropriate local authorities to update public records, thereby preventing future complications. In cases involving mobile or manufactured homes, documentation such as a lienholder's promissory note stamped 'PAID' is vital for proving loan payoff. By adhering to these guidelines and employing effective negotiation tactics, property professionals can successfully navigate the intricacies of release agreements, including the steps in clearing title liens, ensuring more seamless dealings and clearer property titles.

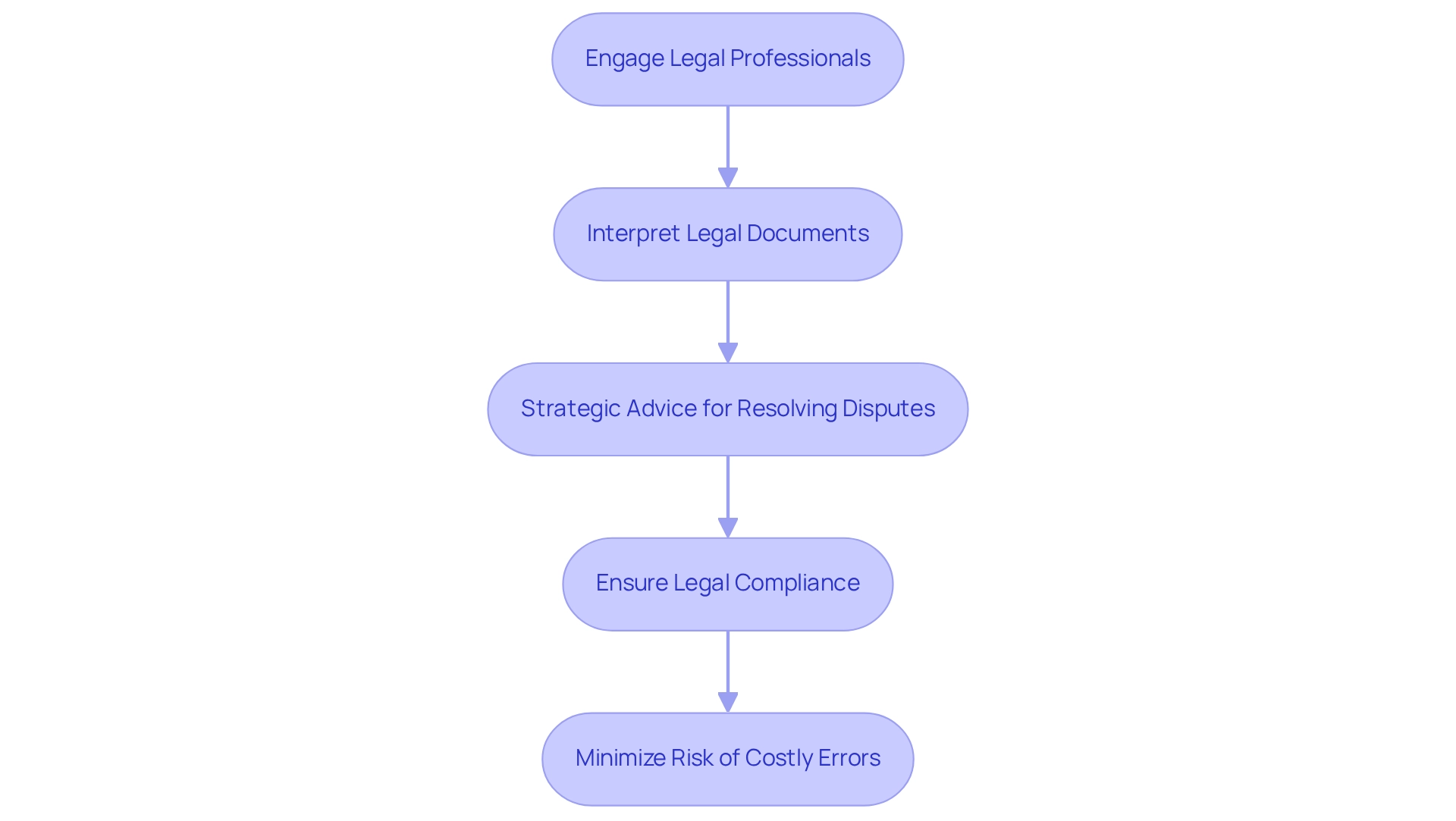

Engage Legal Professionals for Expert Guidance on Lien Clearance

Engaging legal experts specializing in property is essential for efficiently managing the steps in clearing title liens. Their expertise facilitates the interpretation of complex legal documents and offers strategic advice for resolving disputes. This guidance outlines the steps in clearing title liens to ensure compliance with all legal requirements, significantly minimizing the risk of costly errors.

In the realm of commercial property dealings, for instance, lawyers are pivotal in addressing zoning issues and negotiating leases, underscoring their critical role in navigating intricate legal matters. By leveraging the knowledge of legal professionals, real estate agents can streamline the claim resolution process, ultimately fostering smoother transactions for all parties involved.

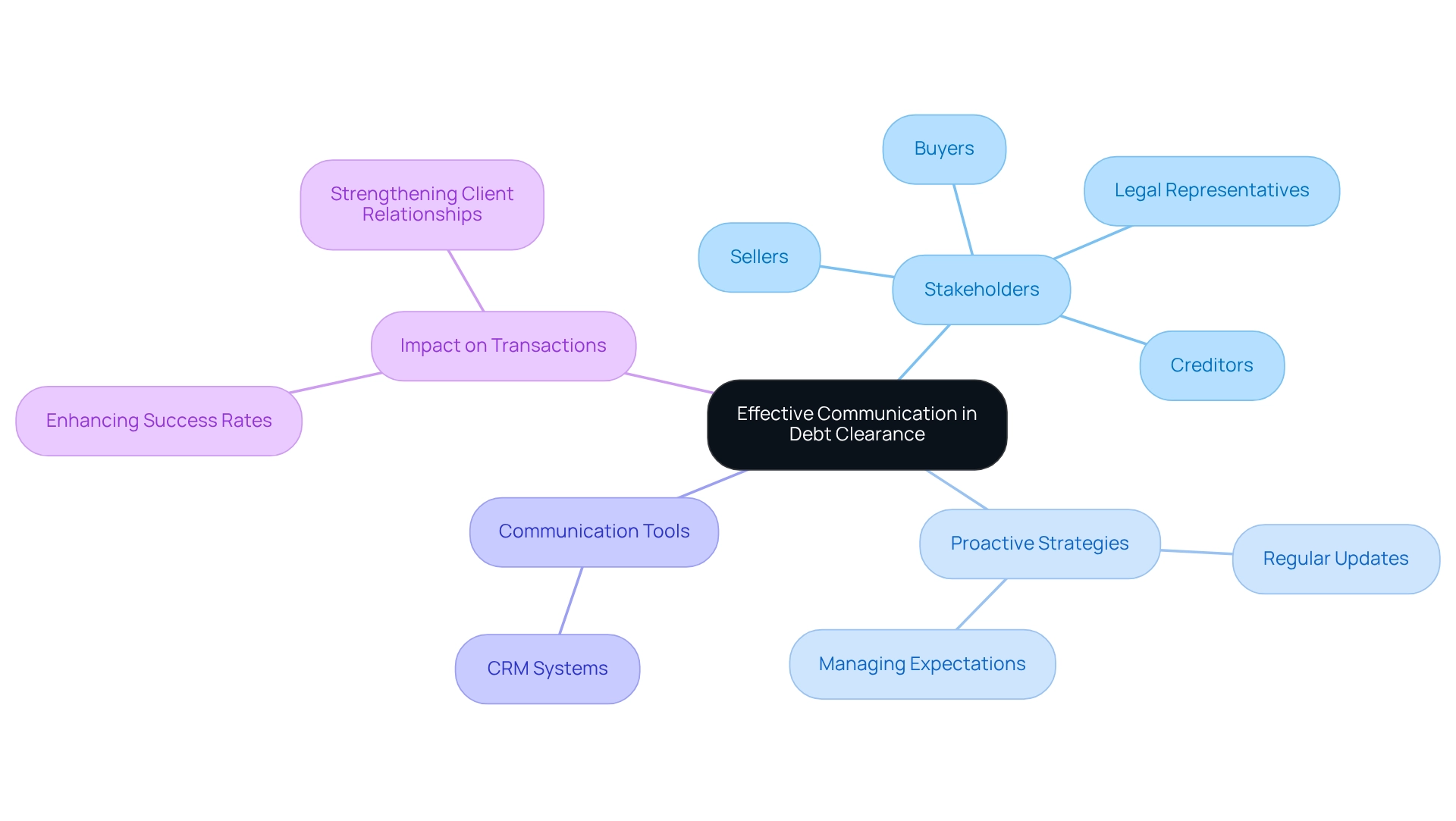

Communicate Clearly with All Parties Involved in the Transaction

Effective communication is paramount throughout the debt clearance process, engaging all stakeholders, including buyers, sellers, creditors, and legal representatives. Regular updates on lien releases and any emerging issues are essential for managing expectations and fostering trust. This proactive communication strategy mitigates the risk of conflicts and facilitates a more seamless experience.

Research indicates that communication failures significantly contribute to property deal failures, underscoring the need for clarity and consistency. By adopting structured communication practices, property professionals can enhance transaction success rates and strengthen client relationships.

Leveraging CRM systems can optimize communication efforts, ensuring that all parties remain informed and engaged throughout the process. As the real estate CRM market continues to expand, the integration of effective communication strategies will be vital in navigating the complexities involved in the steps in clearing title liens.

Should you have any questions or require assistance, please do not hesitate to contact us; we eagerly anticipate your response!

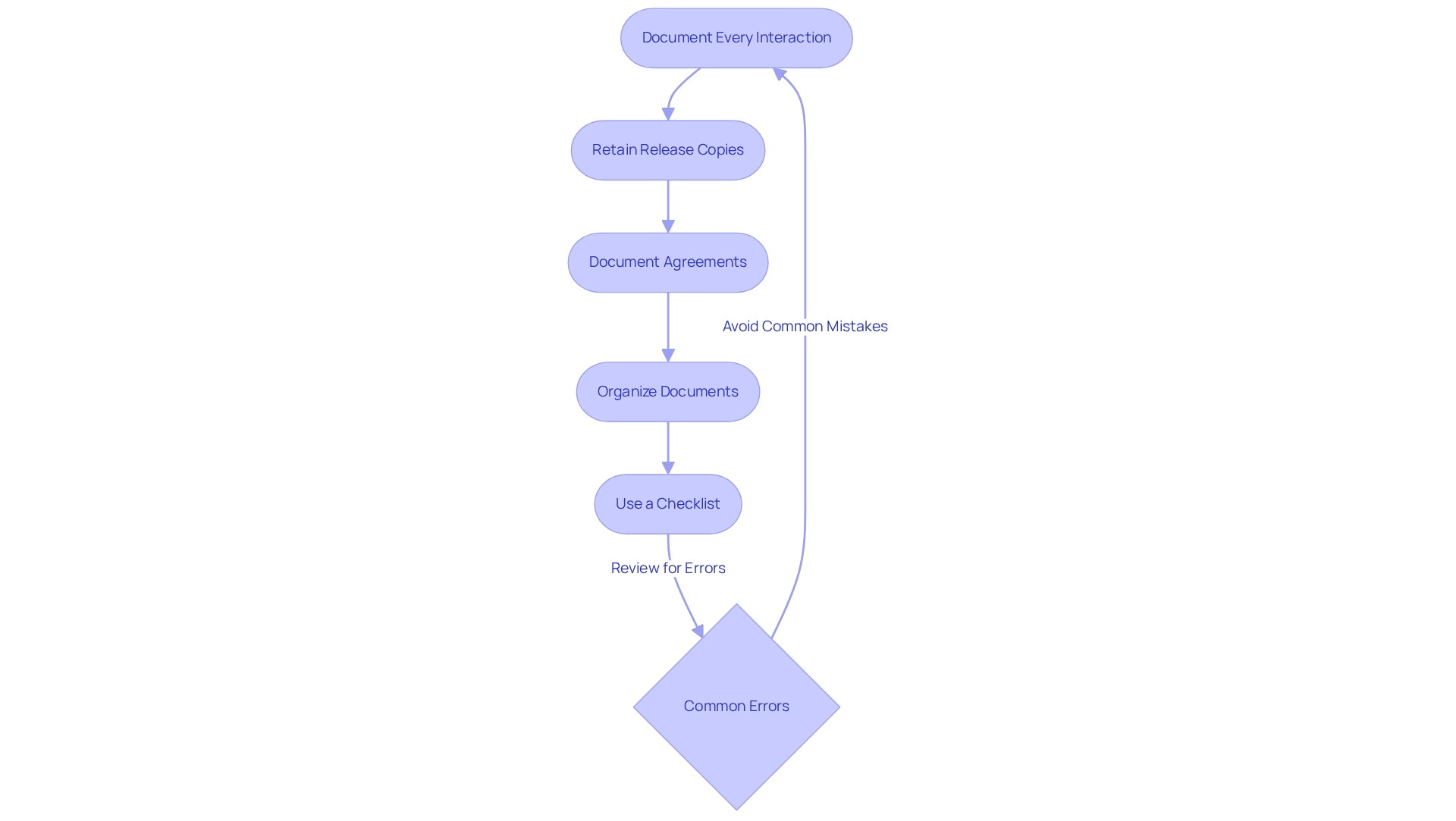

Document All Steps Taken in the Lien Clearance Process

Comprehensive documentation is essential throughout the steps in clearing title liens. This involves meticulously noting every interaction with creditors, retaining copies of release documents, and documenting any agreements made. Such thorough record-keeping establishes a transparent trail of actions taken and acts as a safeguard against potential disputes or legal challenges in the future.

As Jeremy Pollack states, "We’re passionate about helping to facilitate and rebuild relationships at work, at home, and in communities," underscoring the necessity of maintaining strong relationships through proper documentation. To facilitate easy access and review, ensure that all documents are systematically organized. Notably, 24% of workers report not experiencing any positive outcomes from unresolved disputes, which underscores how proper documentation can mitigate these adverse results.

Furthermore, steering clear of typical errors in managing waiver releases—such as failing to specify the scope of work and neglecting adequate documentation—can lead to smoother project completion. By emphasizing careful record-keeping and adhering to these best practices, real estate experts can enhance their operational efficiency and protect their interests in dealings.

As a practical suggestion, consider utilizing a checklist for the steps in clearing title liens to ensure that nothing is overlooked during the clearance process.

Verify All Liens Are Released and Title Is Clear

Before proceeding with the deal, it is essential to confirm the steps in clearing title liens to ensure that all claims have been formally lifted and the title is unencumbered. This requires checking public records to ensure that the claims releases have been filed and recorded appropriately. Recent data indicates that outstanding claims can impact approximately 30% of deals at closing, highlighting the importance of this verification process. Any discrepancies must be addressed immediately to prevent complications during the closing process. A clear title is vital for a successful real estate transaction, as it minimizes legal risks for sellers and facilitates smoother negotiations.

Best practices in this area include:

- Conducting thorough due diligence

- Seeking professional advice

These are essential steps in clearing title liens, as illustrated in the case study 'Best Practices for Navigating Liens in Real Estate.' By employing effective resolution strategies, such as collaborating with title agents and lenders, both sellers and buyers can mitigate potential delays and complications.

To verify release documents effectively, consider implementing a checklist that includes:

- Confirming the status of all claims

- Obtaining written confirmations of releases from relevant parties

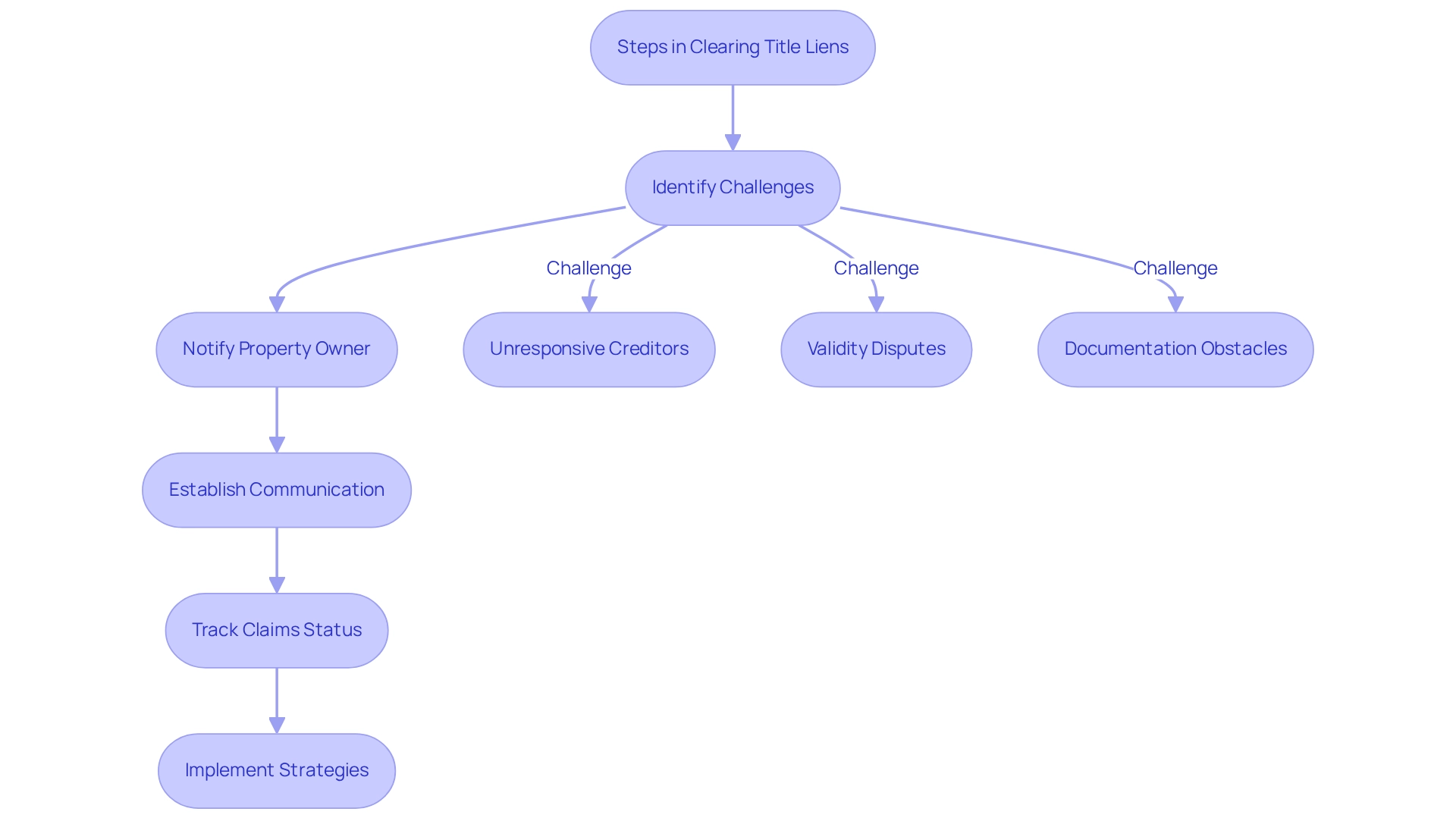

Anticipate and Address Challenges in the Lien Clearance Process

Foreseeing difficulties in the steps in clearing title liens process is essential for ensuring a seamless experience. Common challenges faced during the steps in clearing title liens include:

- Unresponsive creditors

- Disputes regarding the validity of claims

- Obstacles in obtaining necessary documentation

Statistics indicate that a significant number of lenders involved in property transactions may be unresponsive, which complicates the steps in clearing title liens. Notably, the county clerk is required to notify the property owner of a submitted claim statement within one business day, underscoring the importance of timely communication.

To effectively address these challenges, property professionals should develop proactive strategies, including:

- The steps in clearing title liens

- Establishing clear communication channels

- Utilizing technology to track claims statuses

For example, in situations where creditors are unresponsive, professionals can employ legal mechanisms to accelerate communication or explore alternative dispute resolution methods. Understanding the legal framework surrounding claims, including the steps in clearing title liens as outlined in Oklahoma's Trust Fund Statutes—which dictate that certain payments are held in trust for enforceable claims—can clarify the responsibilities of creditors and enhance negotiation leverage.

Expert insights reveal that one of the essential steps in clearing title liens is cultivating trust-based relationships with creditors, which can significantly enhance response rates and facilitate smoother negotiations. As Andrew Davis articulates, valuable content fosters trust-based relationships, serving as a powerful catalyst for revenue generation. By anticipating these potential challenges, property professionals can effectively implement the steps in clearing title liens to conserve time and reduce stress for all parties involved, ultimately resulting in more efficient transactions.

Understand the Legal Implications of Liens and Title Issues

Comprehending the legal consequences of encumbrances and title matters is essential for real estate experts. Liens can significantly impact property ownership and the ability to transfer title. Knowledge of applicable laws and regulations assists professionals in managing these complexities and ensuring adherence to the steps in clearing title liens during the clearance process. This expertise is vital for making informed decisions and protecting clients' interests.

Liens, which serve as claims against a property, can arise from various sources, including mortgages and homeowner associations (HOAs). For instance, when a homeowner obtains a mortgage, a claim is established on the property, remaining until the mortgage is fully settled. If payments are missed, creditors can claim the home, emphasizing the importance of understanding priority structures during sales.

Furthermore, property owners should be aware that HOAs are obligated to alert them approximately 45 days prior to initiating a claim. This notification timeframe is crucial as it enables property owners to take the necessary steps in clearing title liens before a claim is formally submitted, thus avoiding potential complications in property dealings. Legal professionals advise that property owners and contractors seek guidance from real estate lawyers to understand the steps in clearing title liens and examine their legal and financial options, particularly in significant transactions. As Robertson & Associates recommends, "Financial planning: Evaluate your financial condition and create a strategy to handle your debts and prevent future claims."

Familiarity with these legal frameworks not only aids in making informed decisions but also protects clients' interests, ultimately leading to more favorable transaction outcomes. As the landscape of property continues to evolve, remaining knowledgeable about the implications of claims and title matters remains a crucial element of effective property management.

Stay Informed on Best Practices for Lien Clearance

To enhance the process of clearing title liens, property professionals must remain vigilant regarding the steps in clearing title liens, best practices, and emerging trends within the sector. Participating in workshops, webinars, and professional networks is essential for ongoing education; these platforms provide valuable insights into the evolving landscape of property. This commitment to education not only boosts individual efficiency but also elevates the quality of service rendered to clients, facilitating smoother transactions.

As the property landscape evolves, particularly with the increasing complexity of title matters, staying informed is imperative. For example, the number of senior citizen developments is rising by several thousand each day, underscoring the necessity for professionals to adjust their strategies to meet shifting market demands.

By embracing continuous professional development and leveraging technology, such as the advancements offered by Parse AI, real estate professionals can navigate the complexities involved in the steps in clearing title liens more effectively. To further enhance your expertise, consider subscribing to industry newsletters or joining relevant online forums that discuss the steps in clearing title liens and best practices.

Conclusion

The journey to clearing liens in real estate transactions is multifaceted and demands a strategic approach. Conducting thorough title searches, engaging legal professionals, and maintaining clear communication with all parties involved enable real estate professionals to effectively navigate the complexities of lien clearance. Furthermore, the integration of advanced technologies like Parse AI enhances these processes, streamlining title research and reducing the likelihood of oversight.

Documenting each step of the lien clearance process is equally crucial, as it establishes a transparent record and protects against potential disputes. Verifying that all liens are officially released before closing is a fundamental practice that minimizes legal risks and ensures smoother negotiations. Anticipating challenges and addressing them proactively can save time and reduce stress, ultimately leading to more efficient transactions.

In an ever-evolving real estate landscape, staying informed about best practices and legal implications is essential for success. By continuously enhancing knowledge and leveraging technology, real estate professionals can facilitate seamless transactions and protect their clients’ interests. Prioritizing these strategies not only streamlines the lien clearance process but also contributes to a more reliable and trustworthy real estate market.

Frequently Asked Questions

What is Parse AI and how does it assist in title research?

Parse AI is an advanced technology that utilizes machine learning and optical character recognition to automate the extraction of critical information from title documents. It significantly reduces the time required for title research, allowing professionals to focus on more strategic tasks while enhancing precision and minimizing human errors.

What are the societal concerns associated with AI in the property sector?

Societal concerns include the concentration of pretrained AI models among a limited number of vendors and the privacy and data governance risks that come with AI implementation.

How can AI contribute to the property market beyond efficiency?

AI can analyze data to identify potential buyers or renters, forecast market trends, and develop targeted marketing strategies, providing valuable insights for property professionals.

What is the importance of conducting a comprehensive title search?

A comprehensive title search is crucial to identify any existing claims on a property, as approximately 30% of properties have pending claims. This investigation should utilize public records, including tax records and court documents, to clarify the property's legal standing.

How does Parse AI enhance the title search process?

Parse AI can expedite the title search process, minimizing the risk of overlooking vital claims, which is essential for resolving title claims effectively.

What steps should be taken to obtain lien releases from creditors?

After identifying claims, it is essential to obtain release documents from all relevant creditors, which may involve negotiation to settle any outstanding debts or disputes. A formal release document serves as proof that the creditor no longer has a claim on the property.

What types of claims should real estate professionals be aware of?

Real estate professionals should be aware of mechanic's claims from contractors for unpaid work and tax claims imposed automatically by Texas law for unpaid state, county, school district, or city taxes.

Why is it important to file release documents with local authorities?

Filing release documents with the appropriate local authorities updates public records and prevents future complications regarding property claims.

What documentation is needed for mobile or manufactured homes after a loan payoff?

A lienholder's promissory note stamped 'PAID' is vital for proving loan payoff for mobile or manufactured homes.