Introduction

Navigating the complexities of real estate transactions can be daunting, particularly when it comes to ensuring a secure investment. Title insurance emerges as a crucial safeguard for homebuyers and lenders alike, protecting against potential financial losses stemming from title defects. These defects can range from unpaid taxes to undisclosed heirs, each posing significant risks to property ownership.

As homebuyers embark on the journey of purchasing a property, understanding the intricacies of title insurance becomes essential—not only for peace of mind but also as a necessary component of the mortgage process.

This article delves into the importance of title insurance, the coverage it provides, and the common issues that can arise, equipping buyers with the knowledge needed to make informed decisions in their real estate endeavors.

What is Title Insurance and Why is it Essential for Homebuyers?

Title coverage is a form of policy that safeguards homeowners and lenders from monetary loss caused by issues in the ownership documentation of a real estate. Such defects may arise from various issues, including:

- Unpaid taxes

- Conflicting wills

- Previous liens against the asset

For home purchasers, understanding title insurance is essential as it offers reassurance that their investment is protected against possible legal claims or disputes concerning land ownership.

Furthermore, lenders frequently demand ownership protection, making understanding title insurance a crucial element of the home-buying procedure for obtaining a mortgage. Without ownership protection, purchasers could encounter substantial financial dangers after acquisition due to unexpected claims against their assets.

Understanding Coverage: What Title Insurance Protects Against and What It Doesn’t

Title coverage generally offers safeguarding against problems that may emerge from previous ownership, such as undisclosed heirs, fraud, or mistakes in public records. It also includes legal expenses associated with defending against claims made regarding the property. However, there are limitations; for example, ownership protection does not safeguard against future claims or problems that arise after the policy is provided, such as zoning disputes or environmental hazards.

Moreover, typical exclusions might encompass ownership concerns that the purchaser was aware of before acquiring the coverage. Comprehending these elements assists homebuyers in valuing the complete benefit of ownership protection and understanding title insurance, while also recognizing the significance of performing comprehensive ownership research prior to concluding their acquisition.

The Process of Obtaining Title Insurance

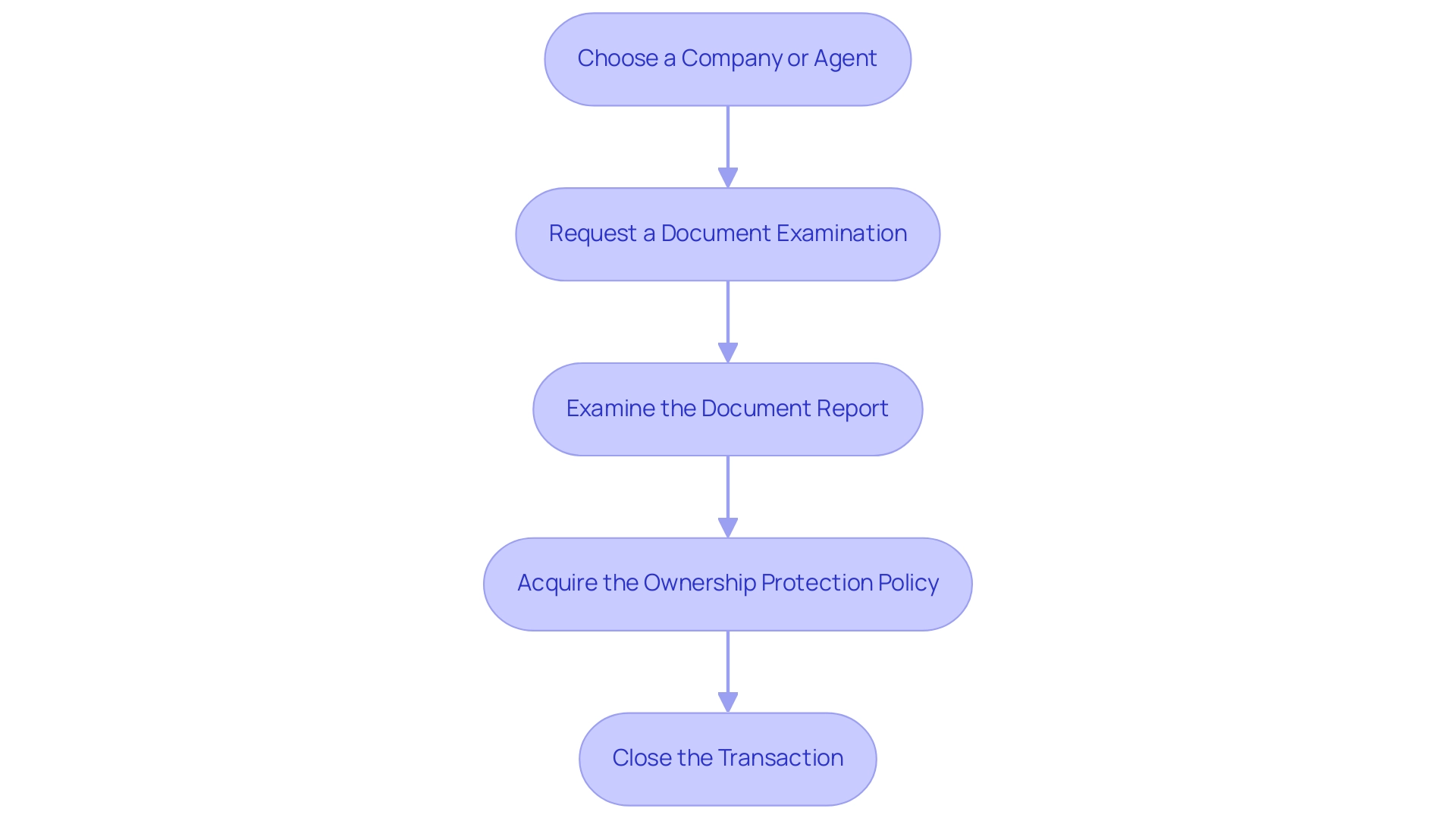

To obtain insurance for ownership, homebuyers typically follow these steps:

- Choose a Company or Agent: Research and select a reputable company or agent that specializes in ownership insurance.

- Request a Document Examination: Utilizing advanced digital interfaces, including a user-friendly search bar and a detailed table layout that lists various records, the firm will conduct a thorough search of public records, including an efficient review of Comanche County clerk records, to identify any concerns with the property ownership. This interface allows for full-text searches and leverages machine learning models to extract relevant information from documents.

- Examine the Document Report: Following the search, examine the document report that utilizes comprehensive and precise research, ensuring you comprehend any possible concerns that could influence ownership.

- Acquire the Ownership Protection Policy: Once content with the ownership report, you can buy the ownership protection policy, which will safeguard against any concerns that may occur in the future.

- Close the Transaction: The insurance premium is usually paid at closing along with other closing costs.

By following these steps and utilizing the refined processes of Harbinger Land, homebuyers can enhance their understanding of title insurance to secure the necessary protection for their property investment.

Common Title Issues and How to Resolve Them

In the realm of real estate transactions, several common title problems can significantly impact the buying process. Understanding title insurance is essential for homebuyers and professionals alike. Here are some of the prevalent challenges:

- Liens: Unresolved debts linked to the asset, such as unpaid taxes or contractor bills, can lead to claims against it. To mitigate this risk, it is imperative to ensure that all debts are settled before finalizing the purchase.

- Undisclosed Heirs: Previous owners may have heirs who were not disclosed during the sale, potentially complicating ownership. Conducting a thorough search of ownership can help identify these individuals and prevent future disputes.

- Errors in Public Records: Inaccuracies in property records can create significant complications for buyers. Working closely with a designation firm is essential to correct any discrepancies and guarantee clear ownership.

- Fraudulent Claims: Although rare, fraudulent claims can occur. Title insurance serves as a safeguard against such occurrences, but it is critical to report any suspicious activities promptly to mitigate potential risks. A relevant case emphasizing the significance of resolving ownership disputes is Georgia's lawsuit against MV Realty, where the state filed a complaint against the company for allegedly misleading consumers regarding a long-term listing agreement.

This case highlights the potential legal implications that can arise from unresolved ownership issues. Recent data reveals that expert professionals dedicate approximately 22 hours on average to close a standard transaction, while more complex transactions can take up to 45 hours. This emphasizes the intricate nature of insurance and the expertise required to navigate these common issues effectively.

Furthermore, ALTA's recent response to the CFPB's inquiry on mortgage closing costs emphasizes the critical role of professionals in ensuring transparency and efficiency in the mortgage process.

Furthermore, a survey revealed that 60% of homebuyers experience frustration during the mortgage process, frequently arising from these specific complications. By acknowledging the direct link between these common issues and buyer dissatisfaction, stakeholders can implement proactive measures to facilitate smoother transactions and enhance overall buyer satisfaction. As Robert Schmidt, a National Production Manager, emphasizes, fostering a deep understanding of title insurance ensures that both consumers and professionals can navigate the real estate landscape with confidence.

The Benefits of Title Insurance for Homebuyers

Title protection provides a multitude of benefits for homebuyers, making it an essential component of any real estate transaction. Among these benefits are:

- Peace of Mind: Buyers gain confidence in their investment, knowing they are safeguarded against unexpected ownership complications that could arise post-purchase.

- Financial Protection: Title coverage acts as a safeguard against potential monetary losses arising from flaws in the ownership document, ensuring that your investment remains secure.

The historical background of ownership disputes is emphasized by the case of Abe Lincoln's father, who lost a cabin along with 300 acres of land due to ownership complications, highlighting the serious consequences of neglecting ownership protection. Moreover, purchasers who forgo owner’s coverage may encounter considerable difficulties, as they could subsequently file a claim against their real estate agent for not adequately advising them on the significance of securing protection.

- Legal Defense: If an ownership dispute arises, ownership protection covers the legal expenses associated with defending possession, providing essential assistance during difficult periods.

- Transferability: One of the distinct characteristics of ownership protection is its transferability; when you sell your asset, the coverage can be conveyed to the new owner. This aspect not only enhances the appeal of your property but also assures potential buyers of existing protection.

Furthermore, it is essential to take into account the closing expenses related to ownership protection, which comprise taxes, lender charges, and ownership fees that homebuyers pay at settlement.

By understanding title insurance and considering these benefits, homebuyers can appreciate the critical role that it plays in safeguarding their investments and securing their financial futures.

Conclusion

Understanding title insurance is not merely an option for homebuyers; it is a fundamental aspect of securing a property investment. Throughout this article, the essential role of title insurance has been highlighted, emphasizing its protective benefits against potential title defects that could jeopardize ownership. From the financial security it provides to the peace of mind it instills, title insurance proves to be an indispensable ally in the real estate transaction process.

The exploration of coverage specifics reveals that while title insurance protects against various historical issues, it is crucial for buyers to recognize its limitations. This understanding empowers homebuyers to conduct thorough title research and approach the purchasing process with diligence. Additionally, the outlined steps for obtaining title insurance provide a clear pathway for buyers to follow, ensuring they are well-prepared to secure their investment.

Common title issues and their resolutions further underscore the importance of title insurance in navigating potential pitfalls during real estate transactions. By familiarizing themselves with these challenges, homebuyers can proactively address concerns, thereby enhancing their overall purchasing experience. The benefits of title insurance, including financial protection, legal defense, and transferability, reinforce its critical significance in protecting investments and facilitating smoother transactions.

In conclusion, title insurance is not just a policy; it is a crucial component of property ownership that safeguards against unforeseen challenges. Homebuyers are encouraged to prioritize this protective measure, ensuring their investments are secure and their ownership rights are upheld. By doing so, they can confidently embark on their real estate journey, equipped with the knowledge and assurance that title insurance provides.

Frequently Asked Questions

What is title insurance?

Title insurance is a policy that protects homeowners and lenders from financial loss due to issues with the ownership documentation of a real estate property, such as unpaid taxes, conflicting wills, or previous liens.

Why is understanding title insurance important for homebuyers?

Understanding title insurance is crucial for homebuyers as it provides reassurance that their investment is protected against potential legal claims or disputes regarding land ownership, which can lead to significant financial risks after purchase.

What are some common issues that title insurance protects against?

Title insurance protects against problems such as undisclosed heirs, fraud, mistakes in public records, and legal expenses related to defending against claims regarding the property.

Are there any limitations to title insurance coverage?

Yes, title insurance does not cover future claims or issues that arise after the policy is issued, such as zoning disputes or environmental hazards. It also typically excludes ownership issues that the buyer was aware of before obtaining coverage.

What steps should homebuyers follow to obtain title insurance?

Homebuyers should: 1. Choose a reputable title insurance company or agent. 2. Request a document examination of public records. 3. Examine the document report for potential concerns. 4. Acquire the ownership protection policy. 5. Close the transaction, paying the insurance premium at closing.

What are the potential title problems that can affect real estate transactions?

Common title problems include liens from unpaid debts, undisclosed heirs, errors in public records, and fraudulent claims. Addressing these issues is essential to ensure clear ownership and avoid complications.

What benefits does title insurance provide to homebuyers?

Title insurance offers several benefits, including peace of mind, financial protection against ownership documentation flaws, coverage of legal defense costs in disputes, and transferability of coverage to new owners when the property is sold.

What are closing expenses related to title insurance?

Closing expenses for title insurance include taxes, lender charges, and title fees that homebuyers need to pay at settlement.