Overview

The primary features of escrow management software for title companies encompass:

- Advanced document processing

- Cloud-based access

- Robust security measures

- Workflow automation

- Customizable reporting

- Integration capabilities

- User-friendly interfaces

- Mobile access

- Real-time tracking

- Effective customer support services

Each of these features significantly enhances operational efficiency, improves client satisfaction, and ensures secure and streamlined transaction processes within the title industry. Furthermore, the integration of these capabilities not only addresses the challenges faced by title companies but also positions them for success in a competitive landscape.

Introduction

In the fast-evolving landscape of real estate, title companies encounter mounting pressure to enhance operational efficiency and client satisfaction. The right escrow management software can serve as a pivotal solution, providing essential features that streamline processes, improve collaboration, and safeguard sensitive data. However, with a plethora of options available, how can firms pinpoint the most critical functionalities that will propel their success in a competitive market? This article explores ten essential features of escrow management software that every title company should consider to optimize their operations and elevate their service delivery.

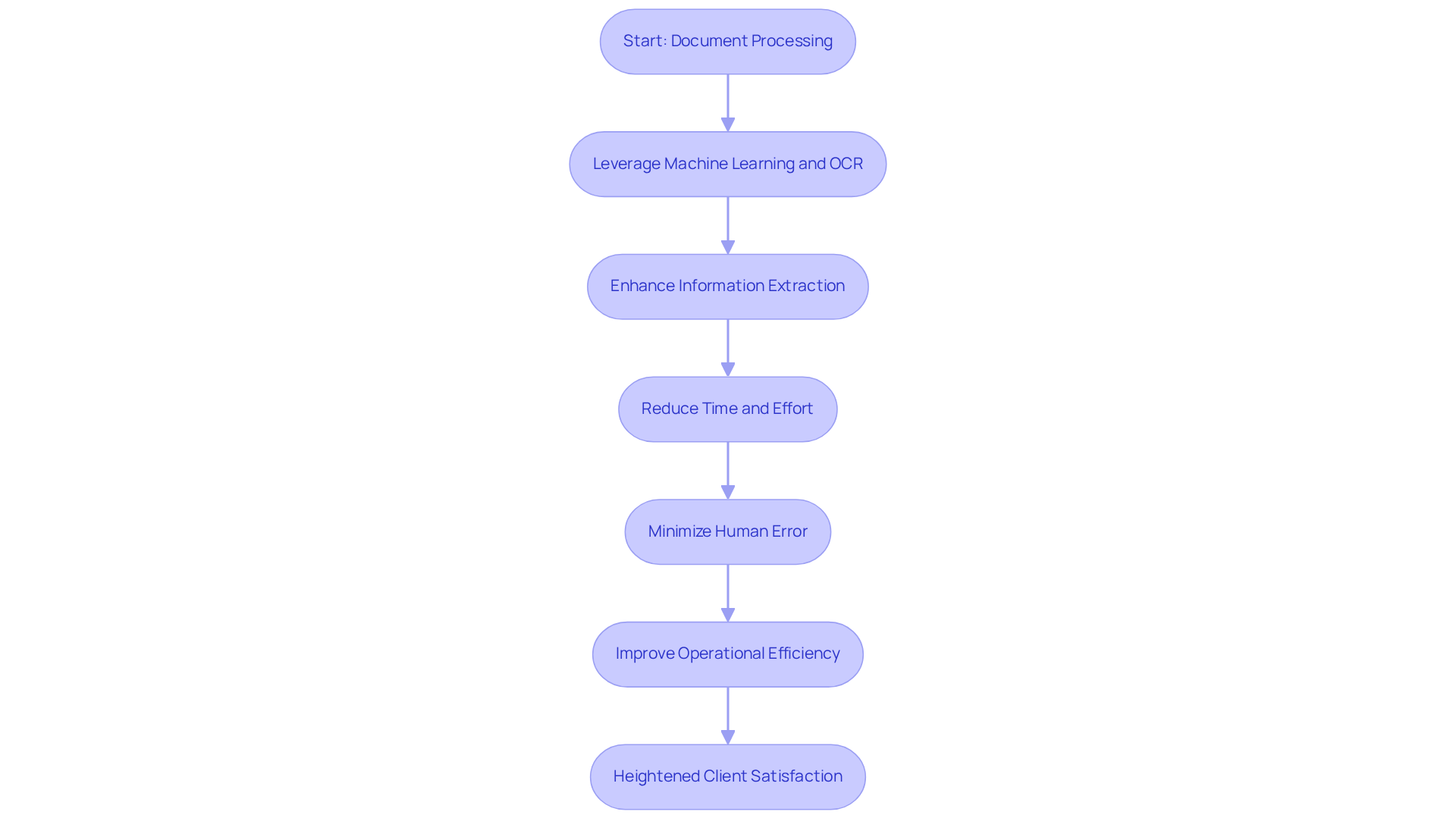

Parse AI: Automated Document Processing for Efficient Title Research

Parse AI leverages advanced machine learning algorithms alongside optical character recognition (OCR) to significantly enhance the extraction of essential information from extensive records. This cutting-edge technology drastically minimizes the time and effort researchers invest in , allowing them to focus on more complex tasks that necessitate human insight.

By automating paperwork processing, Parse AI not only elevates accuracy but also substantially reduces human error, establishing itself as an indispensable resource for title firms seeking to improve their operational efficiency through escrow management software for title companies.

Furthermore, the integration of OCR technology has been shown to decrease processing time by 50% or more, empowering organizations to handle larger volumes of materials with increased speed and reliability. As real estate firms progressively adopt OCR solutions, they are experiencing considerable enhancements in workflow efficiency and accuracy, ultimately resulting in improved service delivery and heightened client satisfaction.

Cloud-Based Access: Enhance Collaboration and Accessibility for Teams

Cloud-based access empowers title companies to securely store and manage files online, which enhances the effectiveness of escrow management software for title companies and facilitates real-time collaboration among team members, irrespective of their location. This capability significantly enhances productivity by ensuring that all users have , thereby promoting seamless teamwork.

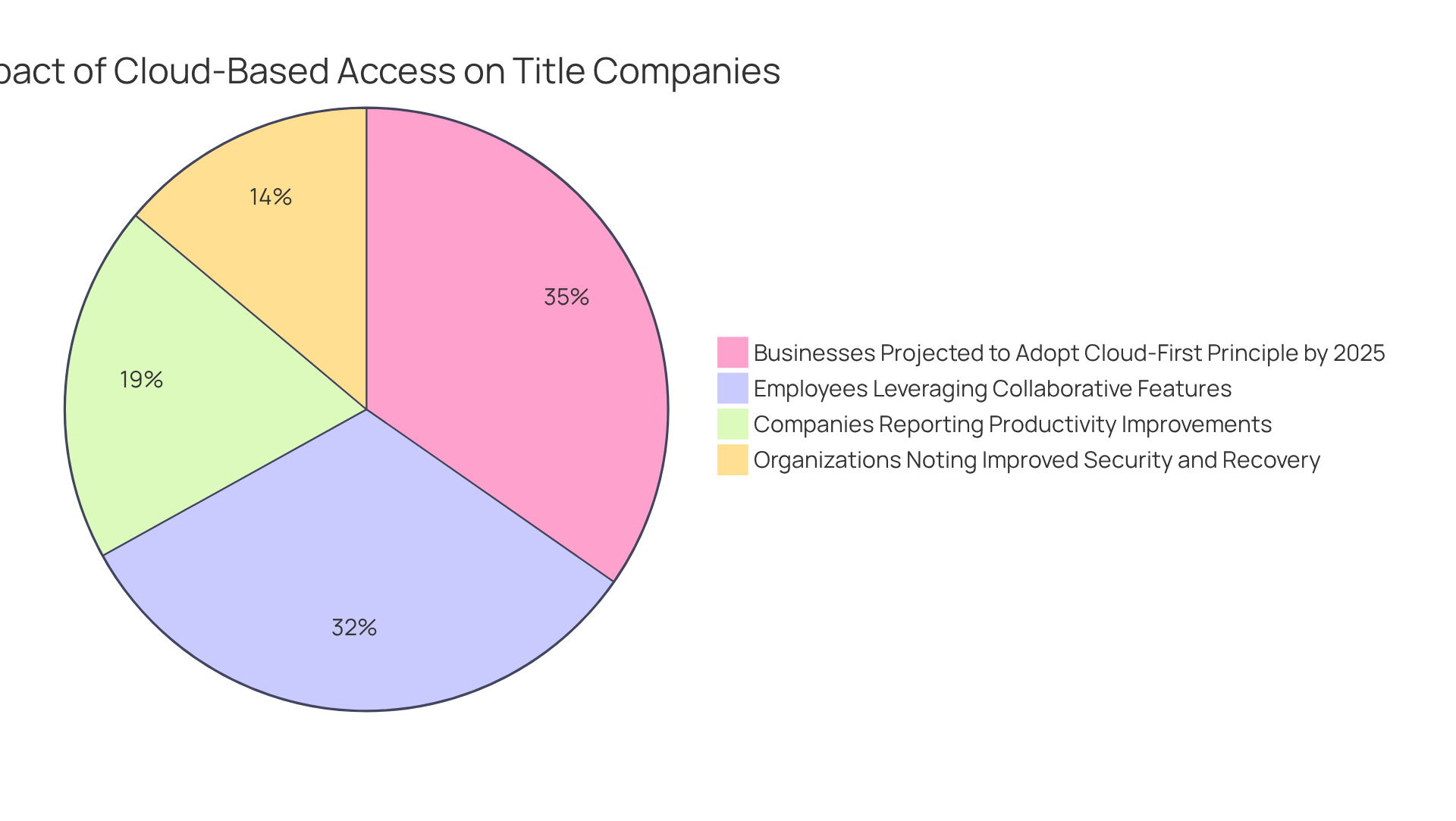

In fact, 79% of employees are leveraging information management systems with collaborative features to bolster teamwork. Furthermore, cloud solutions typically incorporate robust security features, protecting sensitive data while permitting easy access for authorized personnel. Notably, 34% of organizations identified improved data security and disaster recovery as the primary benefit of digitizing documents.

As remote work becomes increasingly prevalent, with 47% of companies reporting accelerated growth and productivity improvements stemming from digitization, the integration of cloud collaboration tools is crucial for professionals aiming to enhance operational efficiency and maintain a competitive edge. Additionally, it is projected that 85% of businesses will adopt a cloud-first principle in executing their digital strategies by 2025, underscoring the industry's shift towards cloud solutions.

Security Features: Safeguard Sensitive Data in Escrow Transactions

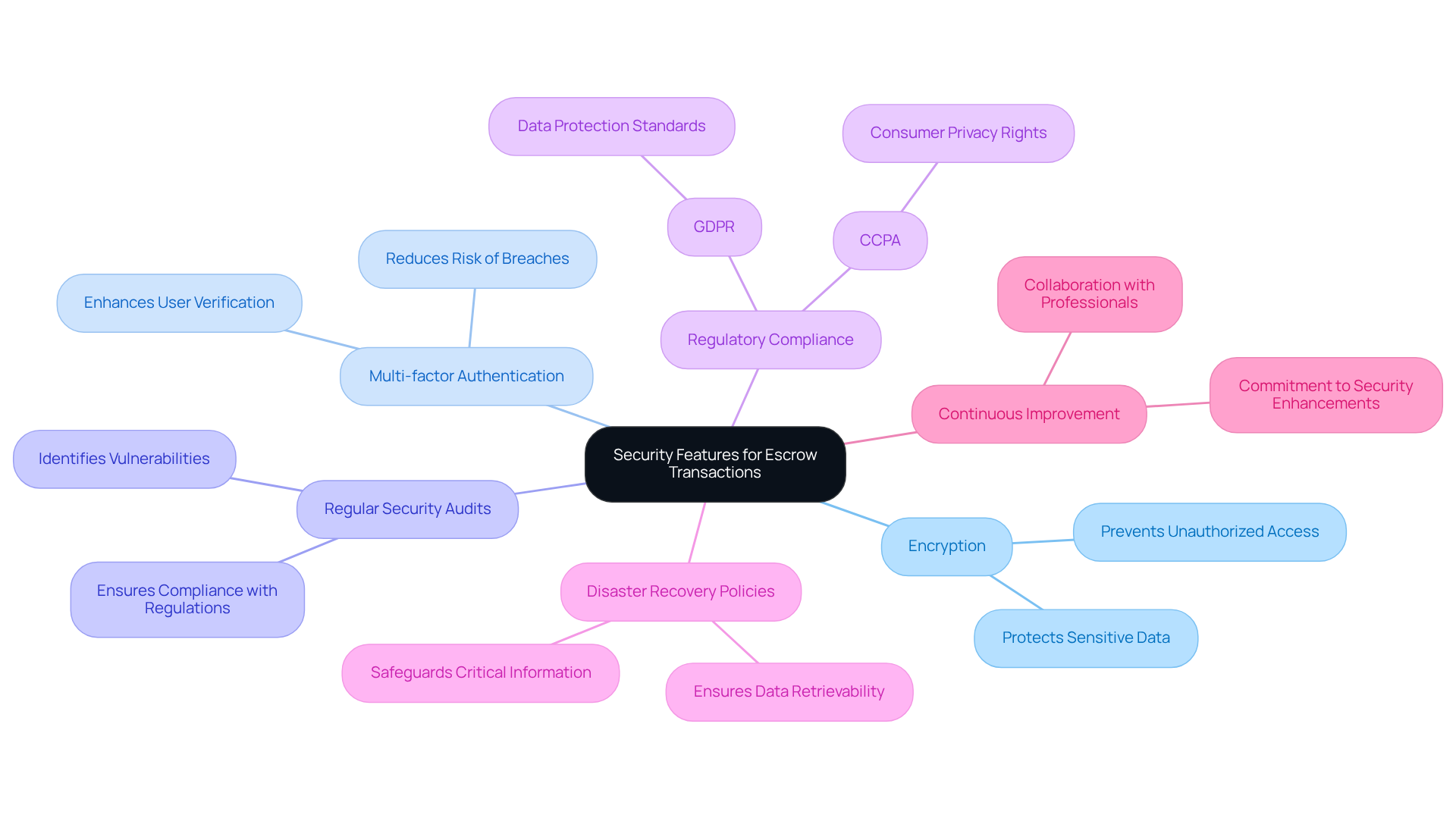

Effective escrow management software for title companies must incorporate robust security features, including:

- Encryption

- Multi-factor authentication

- Regular security audits

These measures are essential for protecting sensitive data from unauthorized access and cyber threats. Furthermore, adherence to industry regulations such as GDPR and CCPA is crucial to ensure that customer information is managed responsibly and securely. In addition, integrating is vital for businesses, as it guarantees that critical information remains safeguarded and retrievable in the event of unforeseen occurrences. By prioritizing these security measures and committing to continuous improvement—exemplified by solutions like Parse AI—firms can build trust with their clients and protect their reputations.

Workflow Automation: Streamline Processes and Reduce Errors

are essential for enhancing operations within real estate firms, facilitating everything from the preparation of materials to transaction monitoring. By automating repetitive tasks such as data entry and document generation, organizations can significantly reduce the risk of mistakes.

Studies indicate a decrease in human errors by up to 32% after implementing automation. This not only enhances accuracy but also enables staff to focus on more strategic activities that require human judgment.

Furthermore, automation improves transaction tracking, ensuring that deadlines are consistently met and that all parties involved are kept informed throughout the process. The integration of AI agents in these workflows can lead to an impressive 60-95% reduction in repetitive tasks, ultimately driving productivity and operational efficiency.

![]()

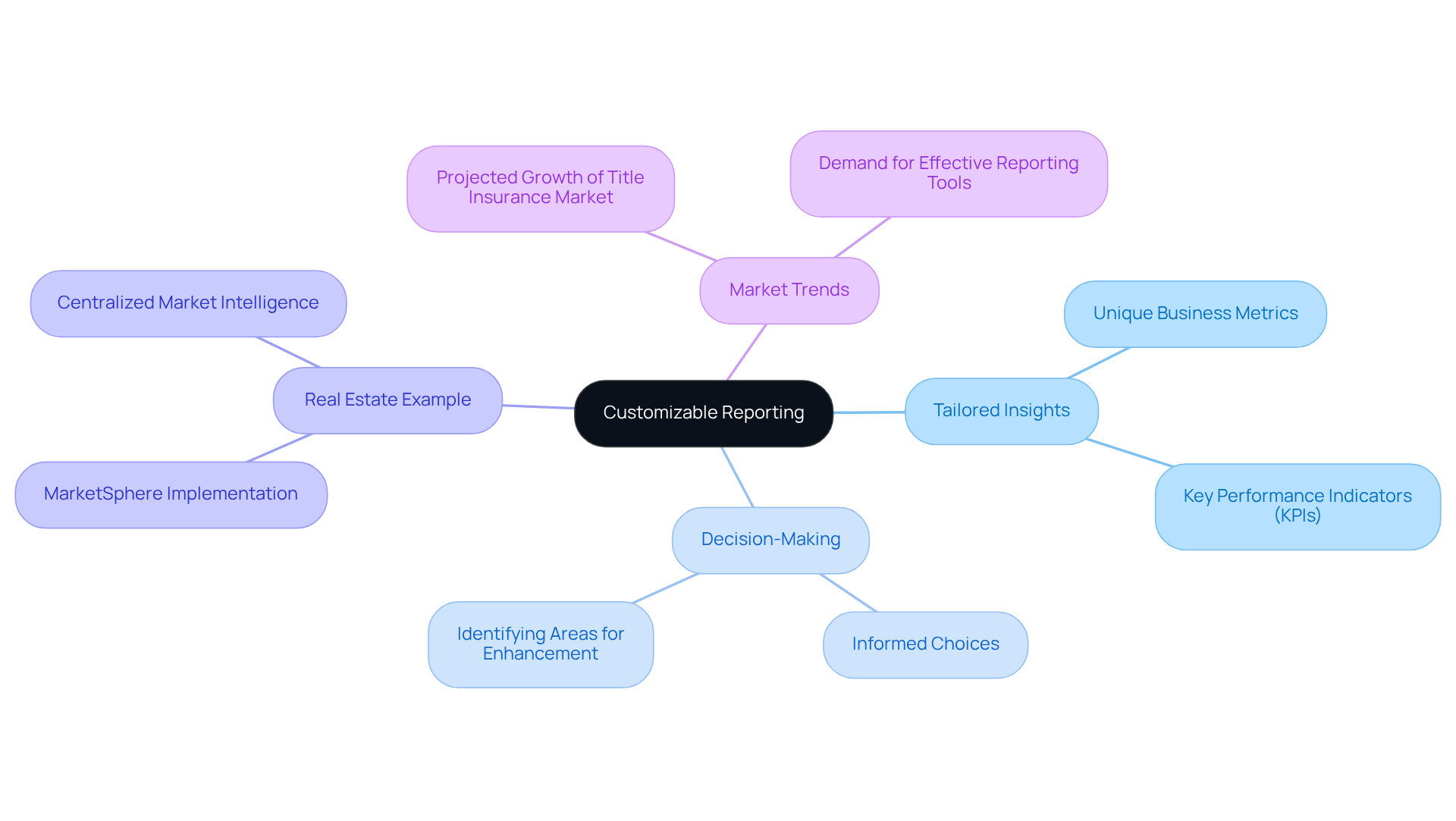

Customizable Reporting: Generate Tailored Insights for Better Decision-Making

Adaptable reporting tools empower organizations to generate reports that align with their unique business metrics and key performance indicators (KPIs). By tailoring these reports to their specific requirements, organizations can uncover valuable insights into their operations, customer interactions, and prevailing market trends.

As Aarti Dhapte, Team Lead - Research, observes, "Their expertise and their ability to drive the process forward was evident from the beginning," underscoring the critical role of informed decision-making in the real estate sector. This data-driven approach not only fosters informed decision-making but also assists in identifying areas for enhancement.

For example, the deployment of MarketSphere for JLL established a customized central repository of market intelligence, leading to a stable, centralized, and standardized method for searching, analyzing, and retrieving real estate market data. Consequently, service providers can enhance service delivery and elevate customer satisfaction, ultimately positioning themselves for success in a competitive landscape.

The integration of advanced analytics and reporting capabilities is increasingly essential, as organizations acknowledge the necessity for precise data to adeptly navigate the complexities of the real estate market. With the Title Insurance Market projected to expand from 4.15 billion USD in 2025 to 5.69 billion USD by 2034, the is set to rise.

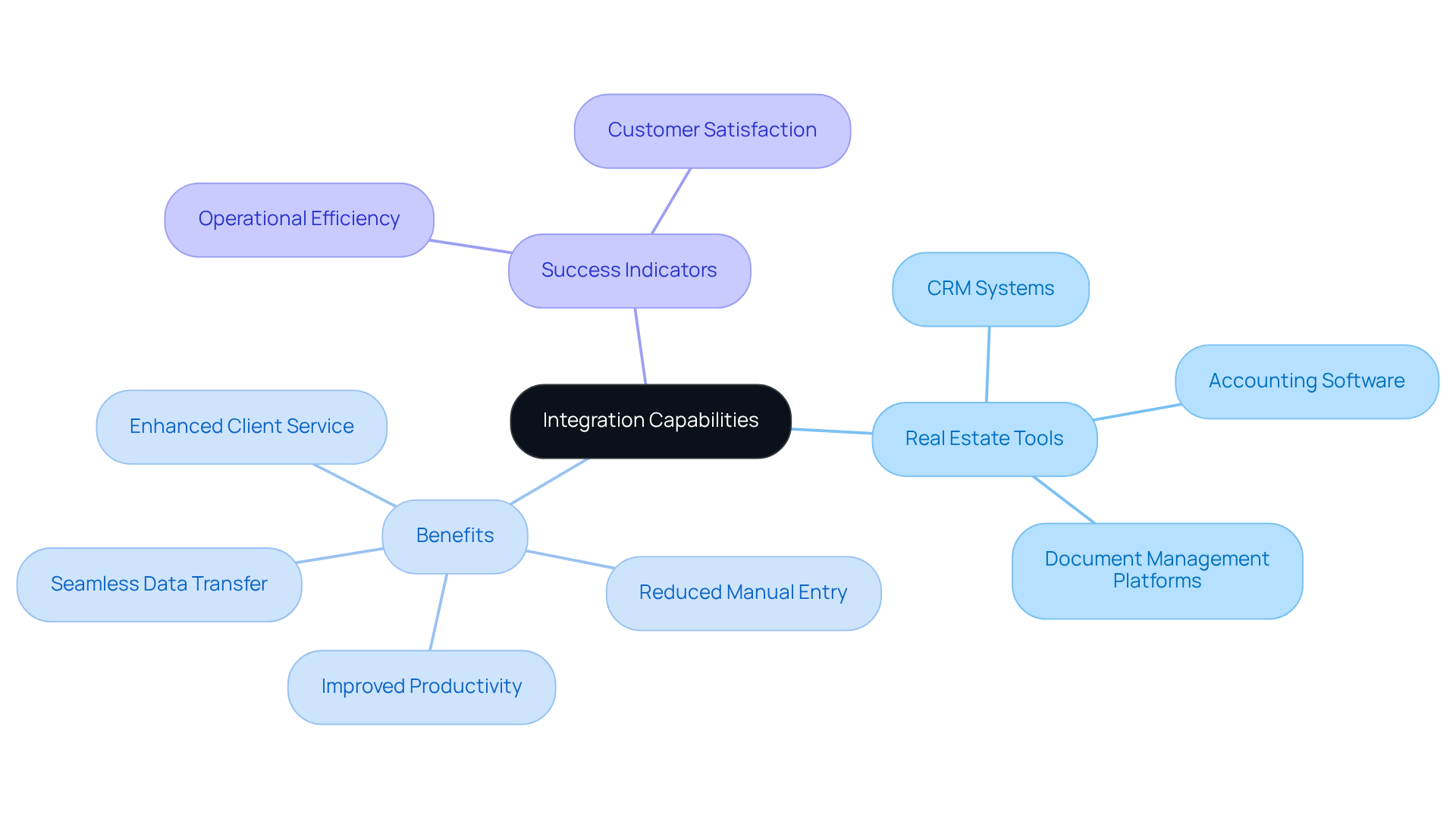

Integration Capabilities: Connect with Other Real Estate Tools for Efficiency

Effective escrow management software for title companies must provide robust integration capabilities with essential real estate tools, including CRM systems, accounting software, and document management platforms. This connectivity facilitates , significantly reducing manual data entry and minimizing the potential for errors. By incorporating different tools, firms can create a unified workflow that not only improves productivity but also enhances client service.

Furthermore, organizations that have embraced escrow management software for title companies indicate enhanced operational efficiency, with automation features enabling real-time updates and streamlined processes. AccuTitle, for example, achieved a remarkable three-year growth rate of 582%, highlighting the impact of effective integration on business success.

As Kurt Ott, a reputable figure in title technology, emphasizes, 'The capacity to link these tools is essential for title firms seeking to succeed in a competitive environment.' Consequently, this ultimately leads to better decision-making and increased customer satisfaction.

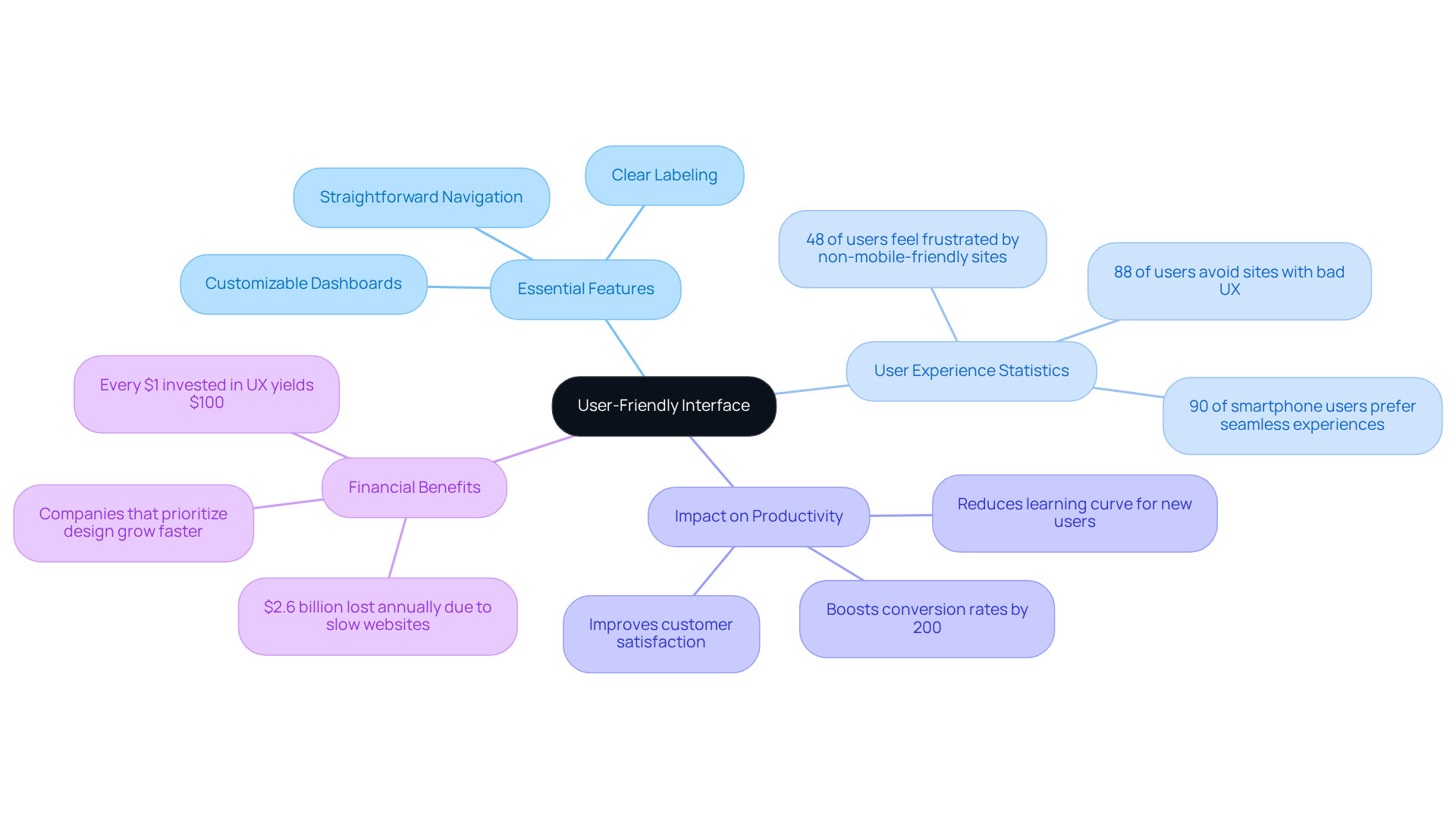

User-Friendly Interface: Ensure Ease of Use for All Team Members

A user-friendly interface is vital for escrow management software for title companies, allowing team members to navigate the system effortlessly and execute tasks efficiently. An intuitive design significantly reduces the learning curve for new users while minimizing frustration for seasoned professionals. Essential features such as customizable dashboards, straightforward navigation, and clear labeling foster a positive user experience. This emphasis on usability not only boosts productivity but also enhances customer interactions; 90% of smartphone users are more inclined to continue shopping if they appreciate a .

Furthermore, investing in intuitive design can lead to a remarkable increase in productivity, with well-designed interfaces boosting conversion rates by up to 200%. Additionally, every $1 invested in UX can yield a return of $100, underscoring the financial benefits of good UX design. As real estate companies increasingly recognize the importance of user-friendly escrow management software for title companies, they are better positioned to enhance both operational efficiency and client satisfaction.

Annemarie Bufe emphasizes that 88% of users are less likely to return to a site after a bad user experience, reinforcing the necessity for effective design. Consequently, Parse AI's commitment to improving efficiency aligns perfectly with the demand for user-friendly software in the title research process.

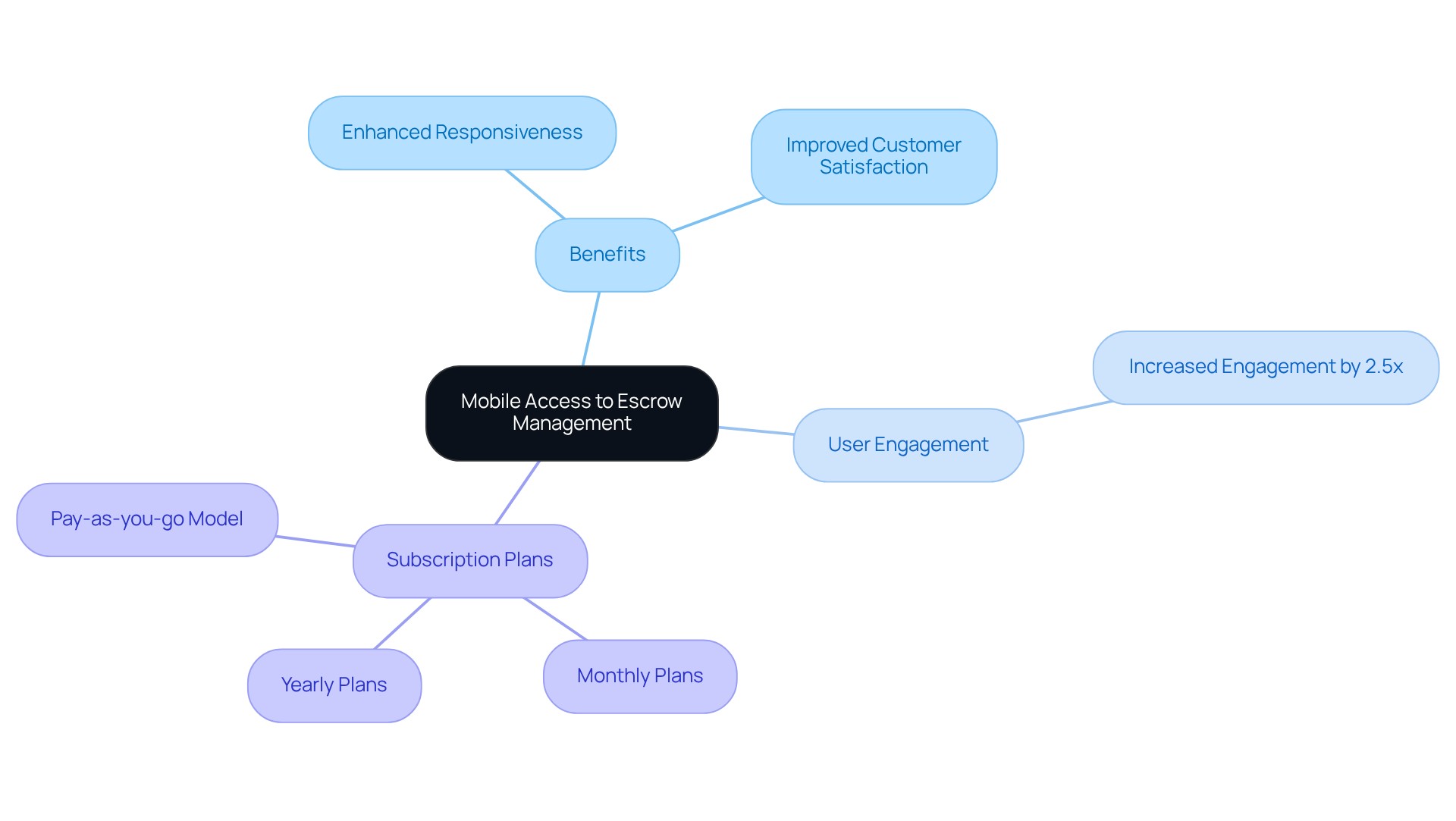

Mobile Access: Manage Escrow Processes Anytime, Anywhere

Mobile access to escrow management software for title companies empowers team members to oversee transactions and retrieve essential documents directly from their smartphones or tablets. This capability is crucial for who frequently work while traveling, enabling them to respond swiftly to customer inquiries and transaction updates. By facilitating mobile access, firms significantly enhance their responsiveness, leading to improved customer satisfaction.

In fact, real estate applications that prioritize mobile functionality can increase user engagement by 2.5 times compared to traditional platforms, underscoring the necessity of mobile solutions in today’s fast-paced market. Furthermore, Parse AI offers adaptable subscription choices, including:

- Monthly plans

- Yearly plans

- Pay-as-you-go model

This ensures that organizations can select the optimal solution for their needs. Our customer success team is readily available to assist users in choosing the most suitable subscription plan, thereby enhancing the overall user experience.

Real-Time Tracking: Enhance Transparency and Accountability in Transactions

Real-time tracking features in escrow management software for title companies empower organizations to monitor the status of escrow transactions at every stage, significantly enhancing transparency. This level of that all parties involved are well-informed about the transaction's progress, thereby minimizing the potential for misunderstandings or disputes.

By providing customers with access to real-time updates, title companies not only foster trust and confidence in their services but also cultivate stronger relationships. The capacity to monitor transactions in real-time is increasingly recognized as essential, especially with the use of escrow management software for title companies, as it directly correlates with enhanced customer satisfaction and loyalty, ultimately leading to a more effective and reliable transaction process.

Furthermore, the global escrow as a service (EaaS) market is projected to expand from approximately USD 2.88 billion in 2024 to USD 21.49 billion by 2033, underscoring the rising demand for secure digital transactions.

EaaS solutions that leverage blockchain technology can facilitate real-time tracking of assets and smart contracts, further bolstering transparency and efficiency. Additionally, clients can fulfill information and document requests within minutes on desktop or mobile, exemplifying the benefits of automation in enhancing client communication and overall experience.

![]()

Customer Support Services: Ensure Quick Resolution of Issues

Efficient customer support services are essential for firms that use escrow management software for title companies. The is vital; it can prevent disruptions in workflow and ensure that transactions proceed smoothly. Support options, including:

- Live chat

- Phone assistance

- Comprehensive online resources

empower users to efficiently find solutions to their problems. Furthermore, our customer success team is available to assist firms in selecting the most suitable subscription option for their requirements—be it:

- Monthly

- Annual

- Pay-as-you-go plans

By prioritizing customer support and providing tailored subscription solutions, title companies can significantly enhance user satisfaction and maintain operational continuity.

Conclusion

The exploration of essential features in escrow management software for title companies underscores the transformative impact of technology on the real estate sector. By integrating advanced tools such as automated document processing, cloud-based access, and robust security measures, title firms can significantly enhance efficiency, accuracy, and customer satisfaction. Collectively, these features empower organizations to navigate the complexities of escrow transactions with greater agility and reliability.

Key arguments presented throughout the article emphasize the critical role of automation in reducing human error, the necessity of secure data management, and the importance of customizable reporting for informed decision-making. Furthermore, the benefits of mobile access and real-time tracking highlight the growing demand for flexibility and transparency in today’s fast-paced market. Each of these elements contributes to a more streamlined workflow, enabling title companies to maintain a competitive edge while fostering trust and loyalty among clients.

In a landscape where technology continues to evolve, the adoption of comprehensive escrow management software is not merely an option but a strategic imperative. Title companies are urged to embrace these innovations, ensuring they are equipped to meet the challenges of the future while delivering exceptional service. Investing in the right tools and features will not only enhance operational efficiency but also position firms for sustained growth and success in an increasingly digital world.

Frequently Asked Questions

What is Parse AI and how does it enhance document processing?

Parse AI leverages advanced machine learning algorithms and optical character recognition (OCR) to improve the extraction of essential information from extensive records, significantly reducing the time and effort researchers spend on compiling abstracts and reports.

How does Parse AI impact accuracy and human error in document processing?

By automating paperwork processing, Parse AI elevates accuracy and substantially reduces human error, making it an essential resource for title firms looking to improve operational efficiency.

What effect does OCR technology have on processing time?

The integration of OCR technology can decrease processing time by 50% or more, allowing organizations to manage larger volumes of materials with greater speed and reliability.

How does cloud-based access benefit title companies?

Cloud-based access allows title companies to securely store and manage files online, enhancing collaboration among team members and ensuring immediate access to the most current information, which promotes seamless teamwork.

What percentage of employees utilize information management systems with collaborative features?

79% of employees are leveraging information management systems with collaborative features to improve teamwork.

What security features are essential for effective escrow management software?

Essential security features include encryption, multi-factor authentication, and regular security audits to protect sensitive data from unauthorized access and cyber threats.

Why is adherence to industry regulations important for escrow management software?

Adherence to regulations like GDPR and CCPA is crucial for the responsible and secure management of customer information.

What is the projected trend regarding cloud adoption in businesses by 2025?

It is projected that 85% of businesses will adopt a cloud-first principle in executing their digital strategies by 2025, indicating a significant shift towards cloud solutions.