Overview

Automated lien detection tools are indispensable for title research, leveraging advanced technologies to enhance the accuracy and efficiency of identifying property claims. These tools significantly outperform traditional methods, achieving 35-40% higher accuracy and reducing processing times by 40-60%. Consequently, they become essential for real estate professionals aiming to streamline workflows and improve decision-making. The reliance on these innovative solutions underscores the critical need for precise title research in today’s competitive market.

Introduction

Automated lien detection tools are revolutionizing the landscape of title research. By leveraging cutting-edge technologies such as machine learning and optical character recognition, these tools uncover hidden claims with unprecedented efficiency. Integrating these innovations into their workflows allows real estate professionals to significantly enhance accuracy and reduce processing times, ultimately leading to substantial cost savings.

However, as the industry evolves, how can researchers ensure they effectively adopt these innovations while avoiding common pitfalls? This article explores the essential automated lien detection tools shaping the future of title research and offers insights into best practices for seamless integration and continuous improvement.

Understand Automated Lien Detection Tools

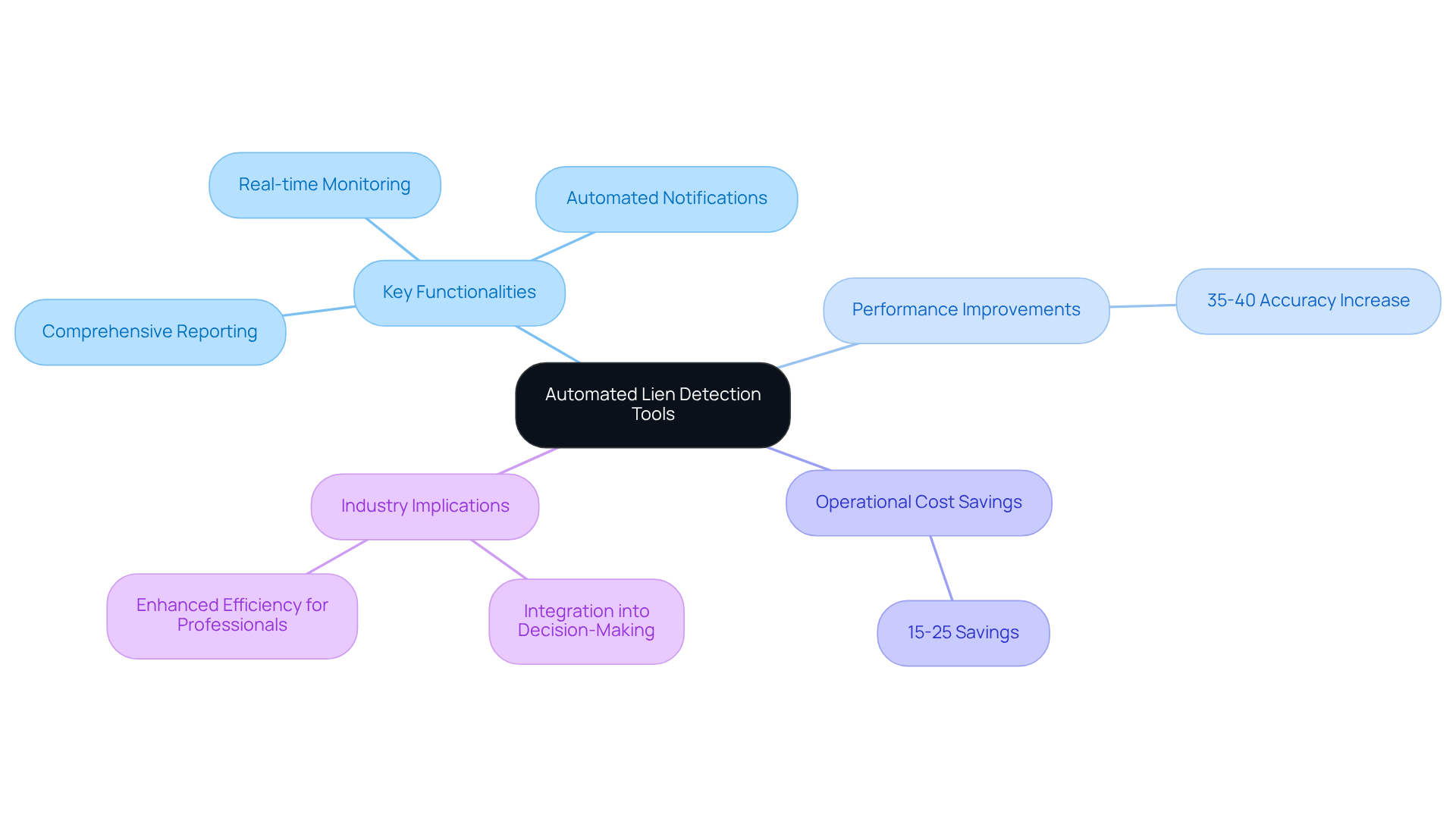

Automated lien detection tools utilize advanced technologies such as machine learning and optical character recognition to enhance the effectiveness of recognizing claims related to properties. These sophisticated automated lien detection tools can swiftly analyze extensive datasets from public records, empowering title researchers to uncover concealed claims that may otherwise go unnoticed. Key functionalities include:

- Real-time monitoring

- Automated notifications for newly filed claims

- Comprehensive reporting capabilities

The impact of machine learning on claim identification precision is profound; automated systems outperform traditional methods by 35-40% in accuracy during the fluctuating real estate market from 2020 to 2022. Furthermore, real estate investment firms that adopt automated data solutions have achieved operational cost savings of 15-25%. As industry leaders emphasize, the future of property research hinges on the ability to integrate automated lien detection tools and data analysis into decision-making processes, making these tools indispensable for real estate professionals seeking efficiency and reliability in their workflows.

Integrate Tools into Title Research Workflows

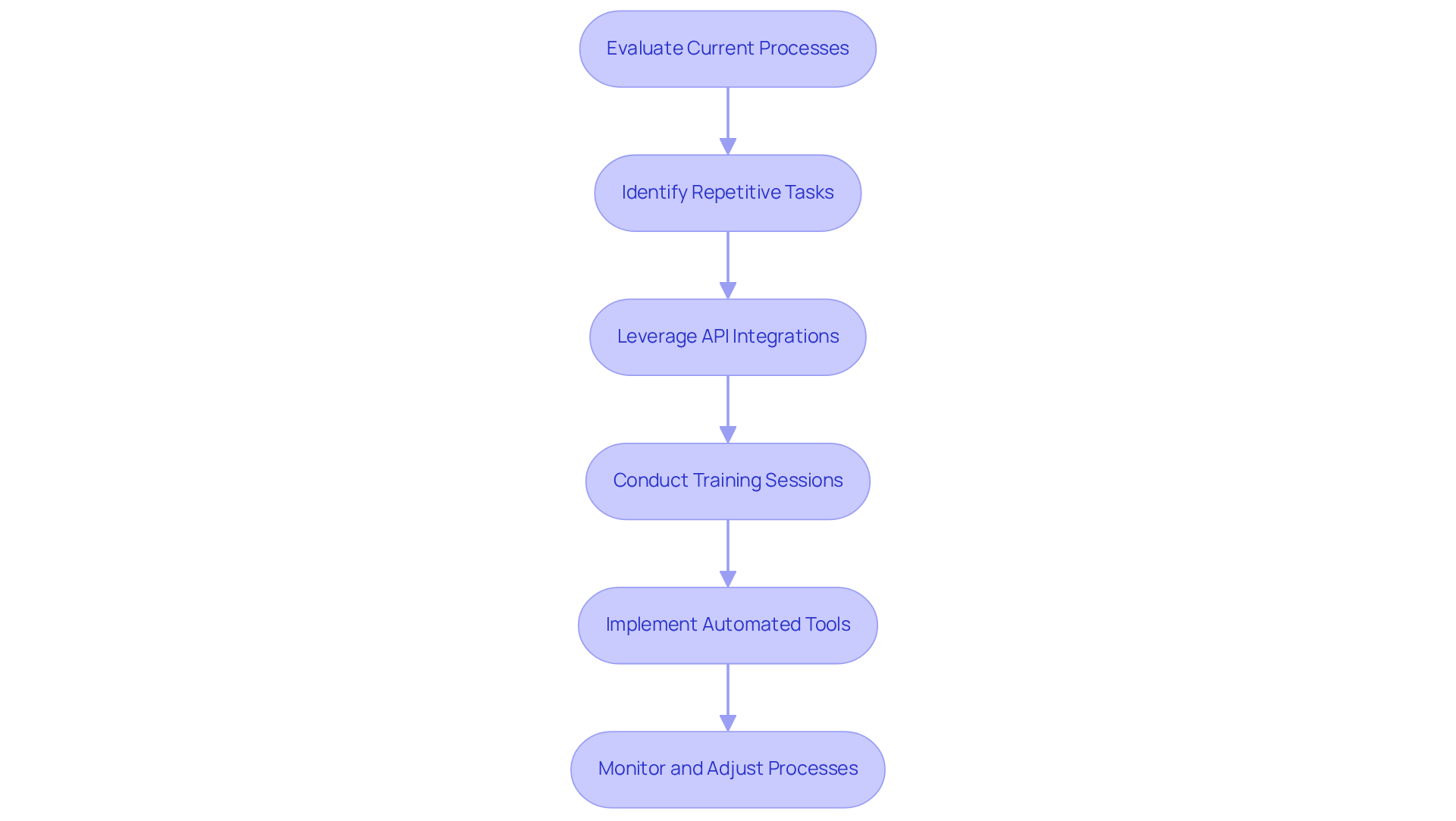

To effectively integrate automated lien detection tools into property research workflows, professionals must start by evaluating their current processes to identify areas where automation can yield significant advantages. This evaluation should involve mapping out workflows to emphasize repetitive tasks, such as data entry and lien verification, which are ideal candidates for automation with automated lien detection tools. Once these tasks are identified, researchers can leverage solutions that provide seamless API integrations with their existing software, facilitating a smoother transition. Training sessions are crucial to ensure team members are thoroughly familiar with the new resources, enabling them to utilize the technology for maximum effectiveness.

For instance, employing a platform like Qualia can substantially enhance the property search process by automating document management and claim searches, leading to a notable reduction in turnaround times. Organizations that adopt automated lien detection tools can save an average of 40-60% in processing time, allowing professionals to focus on higher-value tasks and boost overall productivity. Furthermore, it is vital to recognize that integrating solutions such as Parse AI can result in significant cost savings compared to traditional research methods. However, professionals must also be cognizant of common pitfalls in automation implementation, such as insufficient training or resistance to change, to ensure a successful transition.

Leverage Best Practices for Effective Lien Detection

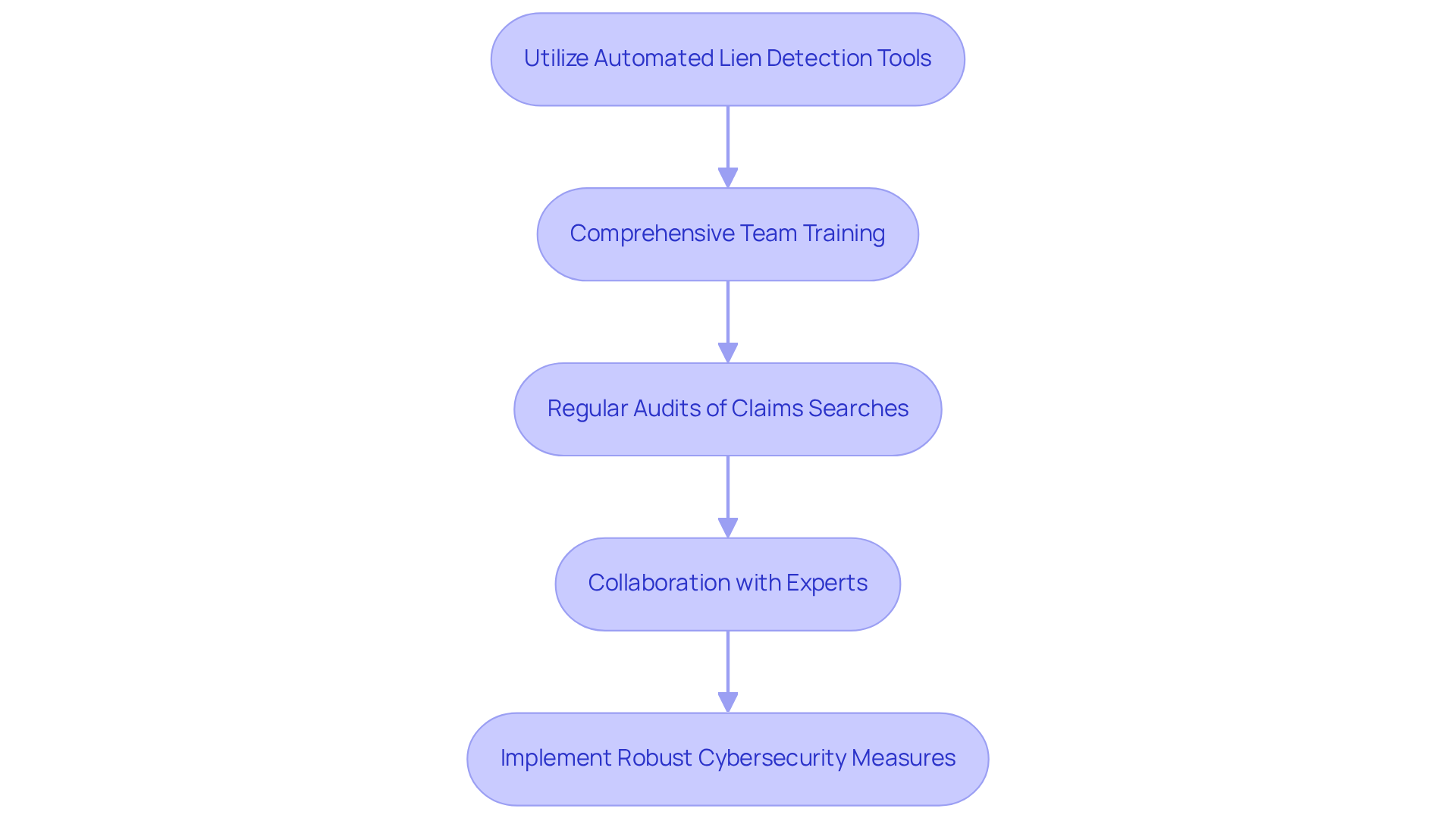

To achieve effective claim detection, title researchers must adopt several best practices. Initially, utilizing automated lien detection tools is crucial, as technology is continually advancing. Frequent software updates significantly enhance precision in property searches; companies have reported a 33% decrease in error rates and a 42% reduction in processing times after implementing AI-driven document analysis systems. Furthermore, comprehensive training for all team members on the effective use of these tools is essential. This training should encompass understanding the provided data and knowing how to respond to notifications regarding new claims.

In addition, establishing a routine for regular audits of claims searches is vital. These audits can uncover inconsistencies or overlooked claims, facilitating prompt corrective actions. For instance, one company improved its underwriting standards and reduced neglected claims by 25% within six months by utilizing automated lien detection tools for advanced trend analysis, demonstrating how these tools can automatically assess and extract critical information from vast amounts of documents.

Finally, collaborating with other experts in the field can offer valuable insights and strategies for enhancing claims identification processes, ultimately leading to safer and more efficient property transactions. It is also imperative to implement robust cybersecurity measures to protect sensitive information, ensuring that monitoring practices are not only effective but also secure.

Collaborate for Continuous Improvement and Adaptation

Ongoing enhancement in lien detection hinges on effective collaboration among research professionals, technology providers, and legal experts. Establishing regular forums or meetings to share experiences and challenges fosters innovative solutions and best practices. Furthermore, interacting with users of automated lien detection tools is essential; their insights can significantly aid developers in refining products to better meet the specific needs of title researchers.

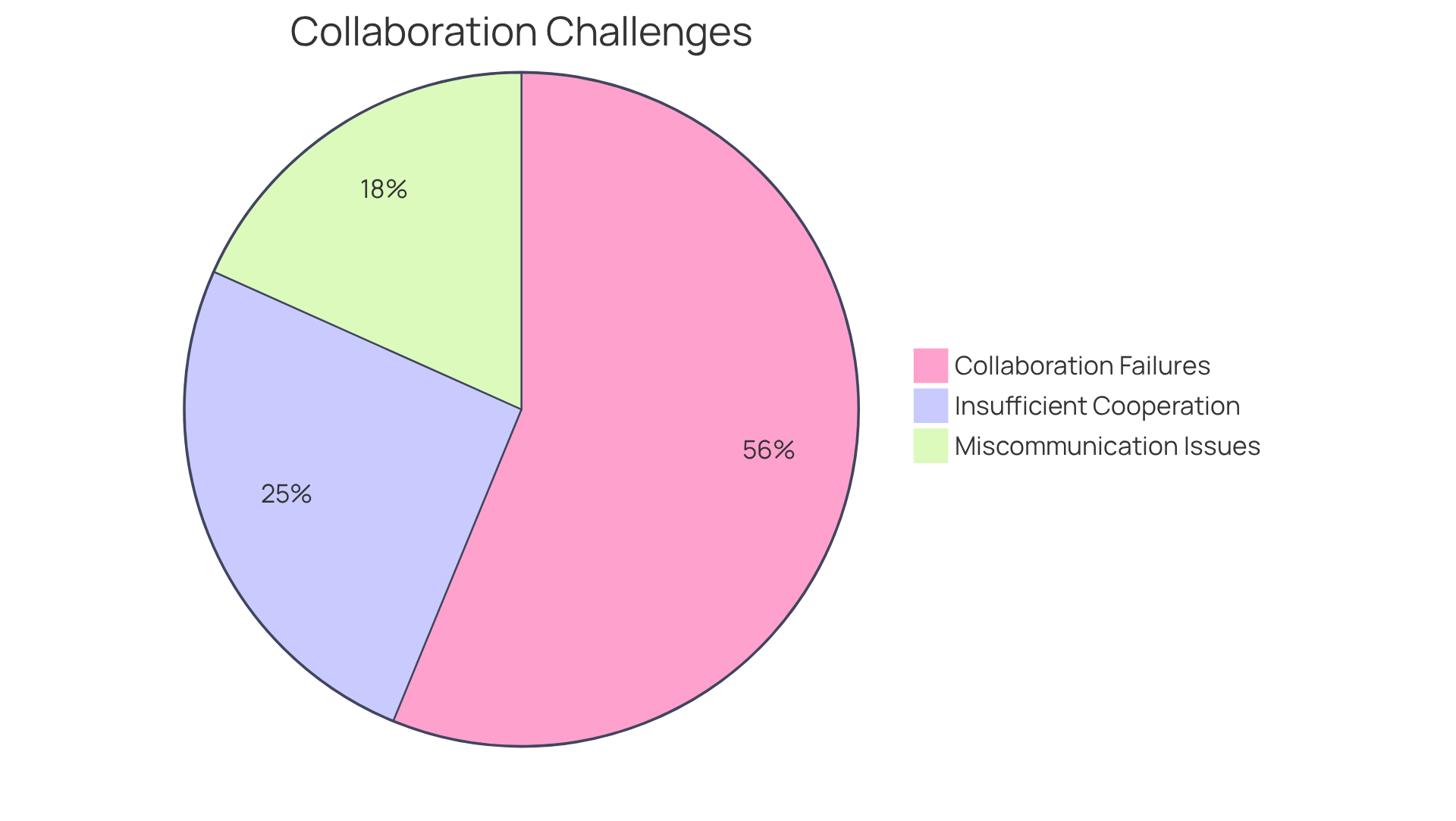

Data reveals that:

- 39% of staff believe individuals in their organization do not cooperate sufficiently.

- 86% of participants attribute a lack of workplace collaboration to organizational failures.

This underscores the critical role of user involvement in development. Participation in industry conferences and workshops provides valuable insights into emerging trends and technologies that can be seamlessly integrated into automated lien detection tools. Effective collaboration can enhance productivity by over 30%, making these events indispensable for staying informed.

By cultivating a culture of collaboration and adaptability, research teams can maintain their competitive edge in the industry, ensuring they utilize the most effective tools and practices available. However, it is crucial to remain vigilant about potential pitfalls; for instance, 28% of teams report that miscommunication leads to missed deadlines. By addressing these challenges, title research professionals can strengthen their collaborative efforts and achieve superior outcomes.

Conclusion

Automated lien detection tools signify a transformative advancement in title research, empowering professionals to navigate the complexities of property claims with enhanced accuracy and efficiency. By harnessing cutting-edge technologies such as machine learning and optical character recognition, these tools streamline workflows and significantly mitigate the risk of overlooking crucial claims, establishing their essential role for modern real estate professionals.

Throughout the article, key insights have been underscored regarding the integration and utilization of these automated tools. The benefits encompass:

- Real-time monitoring

- Improved accuracy in claim identification

- Substantial time savings in processing

Furthermore, the importance of training, collaboration, and continuous improvement in adopting these technologies has been emphasized, illustrating how organizations can optimize their operations and cultivate a culture of innovation.

In a rapidly evolving real estate landscape, embracing automated lien detection tools is not merely an option; it is a necessity for maintaining competitiveness. By prioritizing best practices, investing in team training, and fostering collaboration, title researchers can enhance their capabilities and ultimately drive more secure and efficient property transactions. The future of title research rests with those who are willing to adapt and innovate, ensuring they remain at the forefront of the industry.

Frequently Asked Questions

What are automated lien detection tools?

Automated lien detection tools are advanced technologies that utilize machine learning and optical character recognition to identify claims related to properties more effectively.

How do automated lien detection tools benefit title researchers?

These tools can quickly analyze large datasets from public records, helping title researchers uncover concealed claims that might otherwise go unnoticed.

What are some key functionalities of automated lien detection tools?

Key functionalities include real-time monitoring, automated notifications for newly filed claims, and comprehensive reporting capabilities.

How much does machine learning improve claim identification accuracy?

Automated systems using machine learning outperform traditional methods by 35-40% in accuracy.

What operational cost savings have real estate investment firms experienced by adopting automated data solutions?

Real estate investment firms have achieved operational cost savings of 15-25% by using automated data solutions.

Why are automated lien detection tools considered essential for real estate professionals?

These tools are indispensable for enhancing efficiency and reliability in workflows, as the future of property research relies on integrating automated detection and data analysis into decision-making processes.