Introduction

In the intricate world of real estate, title insurance emerges as a vital shield for property owners, safeguarding their investments against unforeseen challenges. This essential coverage not only protects against potential title defects and ownership disputes but also plays a significant role in maintaining the stability of property transactions. As economic fluctuations and regulatory complexities continue to shape the landscape, understanding the nuances of title insurance becomes imperative for both seasoned professionals and new entrants in the market.

From the critical areas covered by standard policies to the meticulous processes of title searches and compliance, this article delves into the multifaceted nature of title insurance, highlighting its importance in ensuring secure and reliable property ownership. As the industry adapts to emerging trends and technological advancements, the insights provided here will equip stakeholders with the knowledge necessary to navigate the evolving real estate terrain confidently.

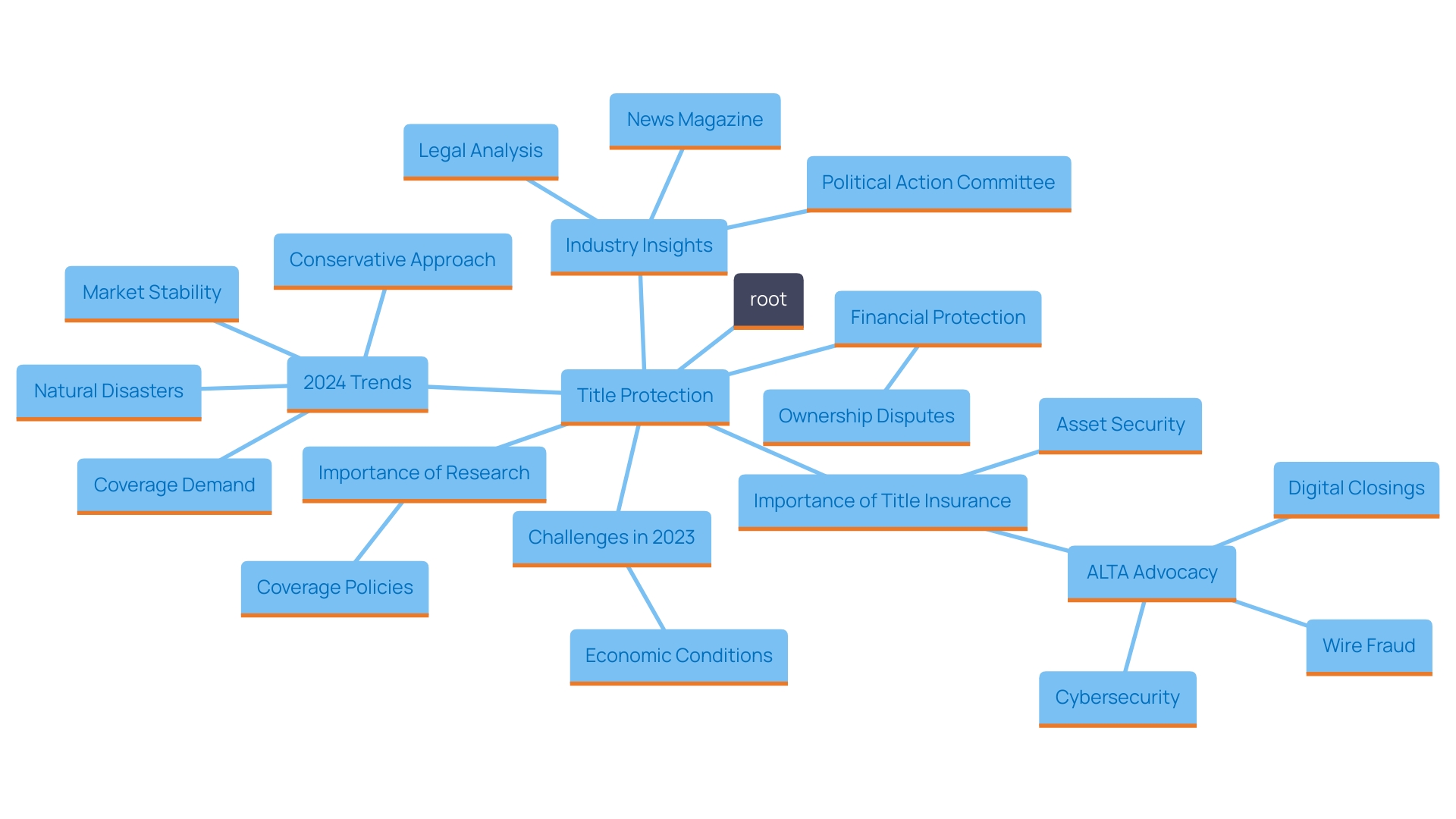

Understanding the Purpose of Title Insurance

Title protection is a vital safeguard for asset owners, intended to shield their investments from possible flaws in ownership or disputes. Its primary function is to offer stemming from undiscovered liens, claims from previous owners, or errors in public records. A property protection policy guarantees that the purchaser possesses legal ownership and that there are no concealed liabilities that could threaten their ownership.

For instance, WFG National Title Insurance Company in Florida has set a suggested maximum risk of $41,200,000, underscoring the significant level of protection provided. This figure emphasizes the essential significance of in sustaining asset security, particularly in varying economic circumstances.

Further insights from Hayley Sandoval, a 2024 summer associate at ArentFox Schiff’s NY office, highlight the involved in issuing property coverage policies. Sandoval highlights the essential role of thorough research in revealing possible ownership issues before they impact property owners, which is crucial for reducing risks.

Furthermore, the coverage sector encountered significant obstacles in 2023 because of elevated interest rates, which hindered real estate deals and resulted in a drop in premium income. This situation demonstrates the industry's flexibility and the continuing necessity for strong coverage. The effect of these economic conditions illustrates how essential it is for landowners to have thorough coverage, guaranteeing they are safeguarded even when market changes occur.

By serving as a safeguard, property coverage offers peace of mind to homeowners and lenders, knowing they are protected if any issues emerge after the transaction. The extensive coverage provided by ownership assurance plays a crucial role in safeguarding real estate possession and guaranteeing the stability of investments in the sector.

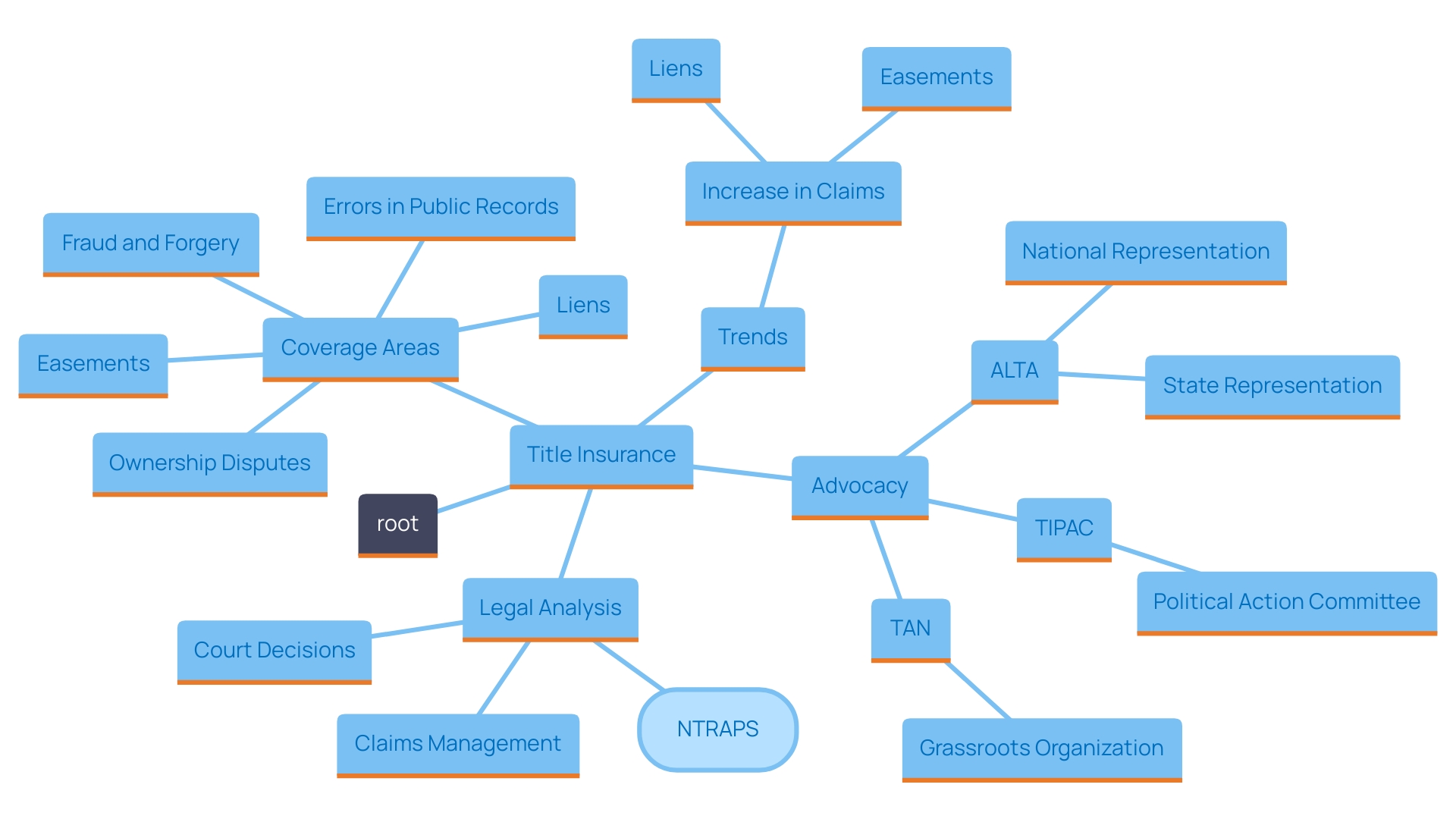

Key Coverage Areas in a Standard Title Insurance Policy

A typical coverage policy provides security across various essential domains, protecting landowners from possible legal and financial difficulties.

- Easements: These are rights that allow others to utilize a section of the land for particular purposes, such as utility access, which might not be apparent during a preliminary search of ownership. Easements can greatly affect land use and worth, making their inclusion in essential.

- Liens: These are arising from unpaid debts, like taxes on real estate or contractor payments. Title protection guarantees that such claims do not obstruct ownership or transfer of the asset.

- Ownership Disputes: This coverage safeguards against or other parties who may assert rights to the asset, thereby preventing potential legal battles over ownership.

- Fraud and Forgery: covers losses resulting from fraudulent actions or forged documents that could undermine ownership. This is essential for maintaining the integrity of ownership rights.

- : Mistakes in public records, such as misfiled documents or incorrect legal descriptions, can adversely affect property ownership. Title protection offers assurance that these errors will be corrected, safeguarding the owner's rights.

Recent statistics show that claims associated with liens and easements have increased by 15% over the past year, highlighting the significance of thorough property coverage. Understanding these enables to guide clients effectively, mitigating risks associated with real estate transactions.

For instance, Next Wave Title's recent appointment of a new business development officer is a strategic move aimed at enhancing market reach, illustrating the industry's commitment to addressing coverage areas that directly impact clients. Furthermore, the recent interest rate reduction, which concluded a two-year span of rate increases, is expected to impact the sector significantly, emphasizing the necessity for professionals to remain updated on such industry changes.

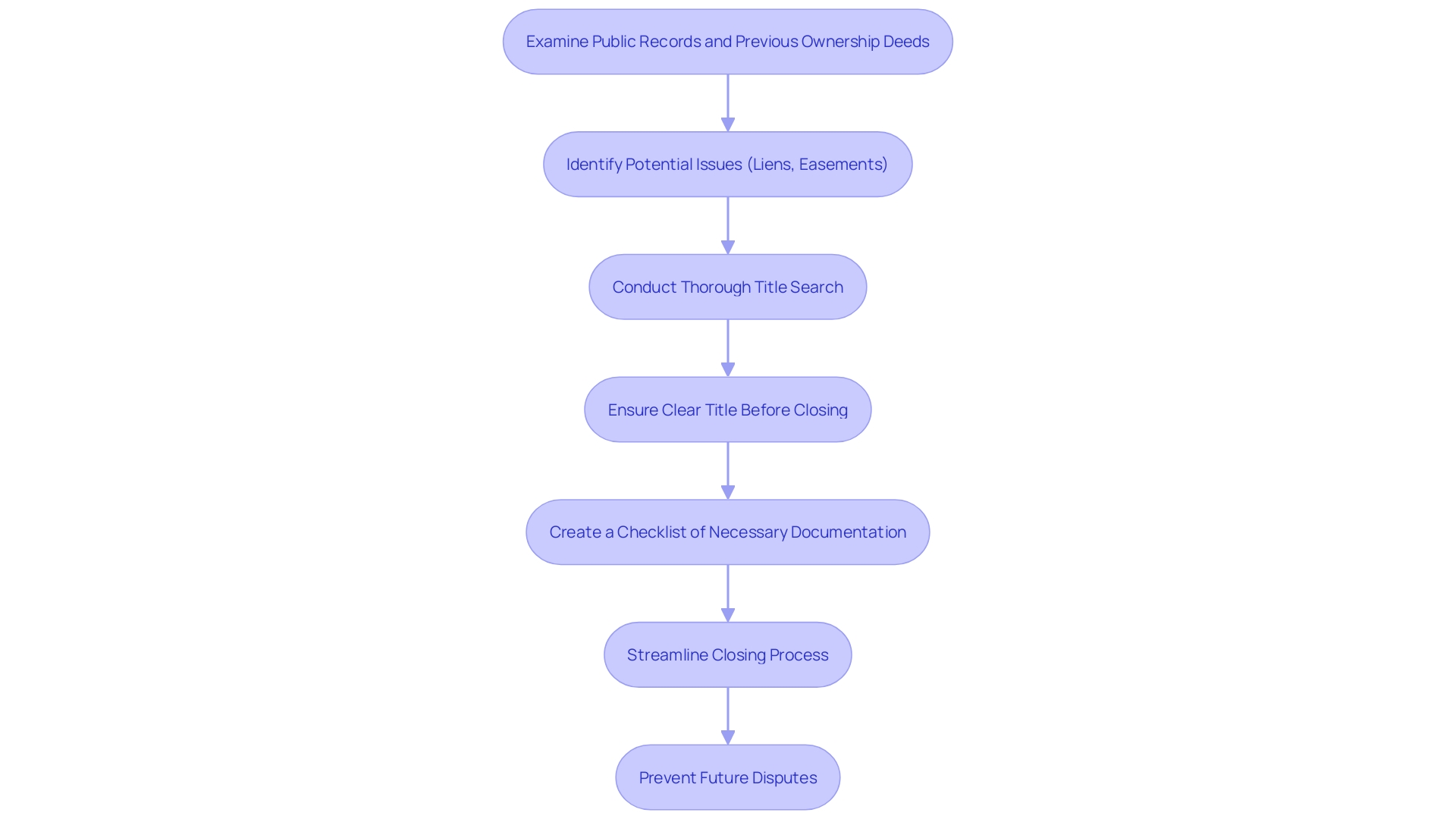

The Role of Title Searches in Title Insurance

Before an insurance policy is issued, a thorough examination is conducted to identify any existing issues related to the real estate. This intricate process includes examining public records, previous ownership deeds, and other pertinent documents to confirm that the ownership is clear and marketable. are vital in uncovering liens, easements, or .

Data indicate that exhibit a high success rate, with a substantial percentage of problems being recognized and addressed before transaction finalization. For example, recent data shows that:

- 85% of document reviews successfully identify potential issues that require attention.

- Projections for 2024 suggest a continued upward trend, with success rates expected to exceed 90%.

This diligence is vital, as it enables coverage providers to offer protection against unforeseen challenges after purchase, thus safeguarding the interests of both buyers and lenders.

Specialists in the area, including experienced document protection providers, stress that the importance of cannot be overstated. John Smith, a prominent insurance provider, states, "The comprehensiveness of a property examination is essential. It ensures that any encumbrances or disputes are addressed in advance, preventing future legal complications." The typical length of a document examination differs, but comprehensive reviews usually span from one to two weeks, based on the intricacy of the records involved.

Case studies have demonstrated the effectiveness of title searches in mitigating risks. For example, a recent case revealed an undisclosed easement that could have significantly impacted the asset's value had it not been detected. This easement not only complicated access to the land but also posed potential legal disputes with neighboring areas. By tackling such issues proactively, policy providers enhance the security and reliability of real estate transactions.

In summary, document searches are a critical element of the insurance process, identifying and resolving property issues to protect all parties involved. Their significance in ensuring clear and marketable ownership underscores their role in the stability and integrity of real estate transactions.

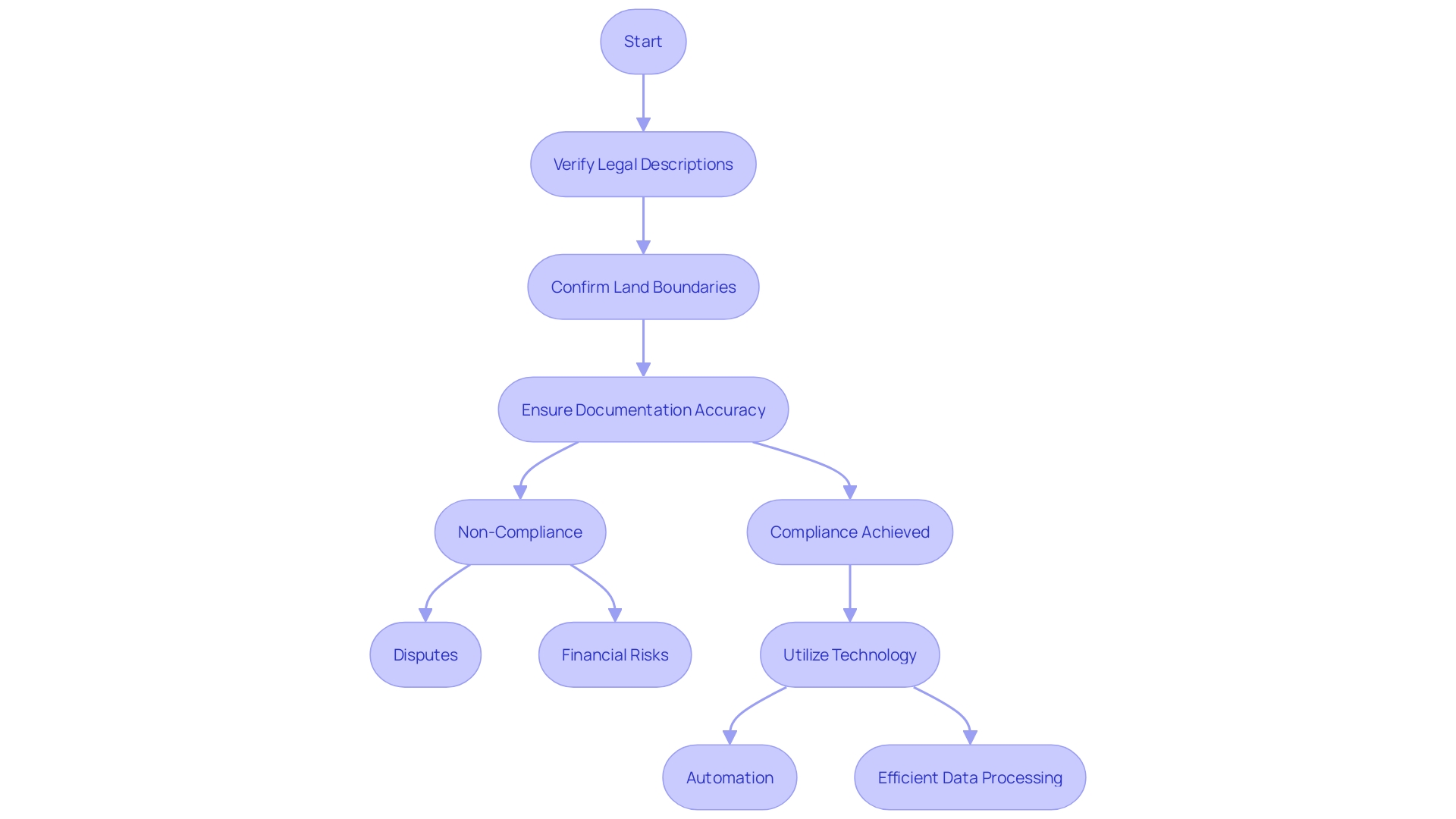

The Importance of Compliance in Title Research

Adhering to local and federal regulations is essential in the research process. Title researchers must meticulously follow established protocols, such as:

- Verifying legal descriptions

- Confirming land boundaries

- Ensuring the accuracy and completeness of all documentation

The risks of non-compliance are considerable; for example, failure to accurately document property boundaries can lead to disputes, resulting in and potentially invalid insurance claims. Such issues not only threaten the financial stability of property companies but also undermine the integrity of real estate transactions.

To tackle these challenges, Parse AI offers that accelerate document processing and research automation. Our platform utilizes cutting-edge OCR technology to read, label, and extract vital information, for landmen. With features like interactive labeling, researchers can efficiently customize data extraction, .

The urgency of maintaining rigorous compliance is underscored by the rising financial stakes in related sectors; for instance, global spending on cybersecurity products and services is predicted to reach $1.75 trillion from 2021 to 2025. This increase in cybersecurity funding mirrors the rising expenses of cybercrime, which can create a ripple effect on the real estate protection sector. Cybersecurity breaches can expose sensitive information, leading to legal ramifications and increased scrutiny from regulators, thereby emphasizing the necessity for stringent compliance measures.

By prioritizing compliance and leveraging technology, researchers not only enhance the reliability of their findings but also foster trust with clients and stakeholders. Compliance ensures that all legal standards are met, thereby safeguarding against legal complications and reinforcing the integrity of real estate transactions.

Emerging Trends in Title Insurance and Research

The coverage sector is experiencing a notable change with the implementation of like and . These cutting-edge tools are by automating the extraction of data from extensive documents, drastically reducing the time and effort required for . As experts increasingly adopt these innovations, they are observing significant enhancements in the precision of property examinations and enjoying quicker response times for issuing insurance policies.

The integration of machine learning, in particular, has been pivotal in within the industry. For instance, firms such as XYZ Title Insurance have effectively utilized machine learning algorithms to examine historical data, leading to a 30% improvement in precision for searches. By leveraging sophisticated data analytics, researchers can now identify potential risks and discrepancies much earlier in the process, leading to better decision-making and heightened compliance.

Moreover, the industry's adaptation to higher interest rates and reduced liquidity, prompted by the Federal Reserve's monetary policy adjustments, underscores the necessity of these technological advancements. As Demetrios Berdousis aptly notes, 'Price is a crucial factor influencing consumers' value perceptions,' and the efficiency gains from technology integration can help mitigate cost pressures. Case studies have shown that insurers, such as ABC Company, successfully adjusting their strategies to these economic shifts, demonstrating the critical role of technology in navigating contemporary challenges.

Looking ahead to 2024, the continued evolution of these technologies promises to further enhance the capabilities of researchers, ensuring sustained improvements in accuracy and efficiency. In summary, as the title insurance market is projected to expand at a CAGR of 7.93% and reach USD 84,756.6 million by 2027, the integration of advanced technologies will be essential in meeting the demands of a rapidly changing real estate landscape.

Conclusion

Title insurance is an essential protection for property owners, safeguarding against issues such as easements, liens, and ownership disputes. The rise in claims related to these areas emphasizes the necessity of securing comprehensive title insurance, particularly in fluctuating economic conditions.

Thorough title searches are critical in identifying potential issues before they escalate, thereby enhancing the integrity of real estate transactions. With a high success rate in uncovering problems, diligent title searches ensure that buyers are protected from unforeseen complications and maintain clear property titles.

Moreover, the integration of advanced technologies, including machine learning and automation, is transforming the title insurance landscape. These innovations streamline research processes and improve accuracy, enabling professionals to effectively navigate emerging economic challenges. Staying informed about these technological advancements is vital for industry stakeholders.

In conclusion, understanding the multifaceted nature of title insurance is crucial for all real estate participants. By recognizing the importance of comprehensive coverage, diligent title searches, and embracing technology, stakeholders can make informed decisions that protect their investments and support the stability of the real estate market. A commitment to robust title insurance practices remains fundamental to secure property ownership.

Frequently Asked Questions

What is the purpose of title protection?

Title protection is designed to safeguard asset owners by shielding their investments from potential ownership flaws or disputes. It provides financial protection against losses from undiscovered liens, claims from previous owners, or errors in public records.

How does title protection ensure legal ownership?

A property protection policy guarantees that the purchaser holds legal ownership and that there are no hidden liabilities that could threaten their ownership.

What are the main coverage areas provided by title insurance?

Title insurance covers several essential areas including: 1. Easements – rights allowing others to use part of the land. 2. Liens – legal claims against the property due to unpaid debts. 3. Ownership disputes – claims from previous owners or other parties. 4. Fraud and forgery – losses from fraudulent actions or forged documents. 5. Errors in public records – mistakes that could affect property ownership.

What recent trends have been observed in the title insurance sector?

There has been a 15% increase in claims related to liens and easements over the past year, highlighting the importance of comprehensive property coverage. Additionally, the sector faced challenges in 2023 due to elevated interest rates affecting real estate deals and premium income.

How is thorough research conducted before issuing a title insurance policy?

Before issuing a policy, a thorough examination of public records, previous ownership deeds, and other relevant documents is conducted to confirm clear and marketable ownership. This process typically takes one to two weeks.

What is the significance of compliance in title research?

Compliance with local and federal regulations is crucial to avoid disputes and ensure accurate documentation. Non-compliance can lead to expensive litigation and invalid insurance claims, threatening the financial stability of property companies.

How are technological advancements impacting the title insurance industry?

Technologies like machine learning and optical character recognition are revolutionizing the research process by automating data extraction from documents, improving the efficiency and accuracy of property examinations, and enabling quicker responses for insurance policy issuance.

What is the projected growth of the title insurance market?

The title insurance market is projected to expand at a compound annual growth rate (CAGR) of 7.93%, reaching approximately USD 84,756.6 million by 2027.