Introduction

In the intricate world of real estate, title insurance plays a critical role in safeguarding property owners and lenders from potential financial setbacks associated with title defects. This protective measure extends beyond mere paperwork; it encompasses a range of issues, from ownership disputes and liens to public record errors and fraudulent claims. However, the landscape of title insurance is not without its pitfalls.

A comprehensive understanding of common exclusions—such as zoning issues, environmental hazards, and pre-existing conditions—is essential for effective risk management and informed decision-making. As the complexities of real estate transactions evolve, so too must the strategies employed by professionals in the field to navigate these challenges and ensure robust protection against unforeseen liabilities.

Understanding Title Insurance: What It Typically Covers

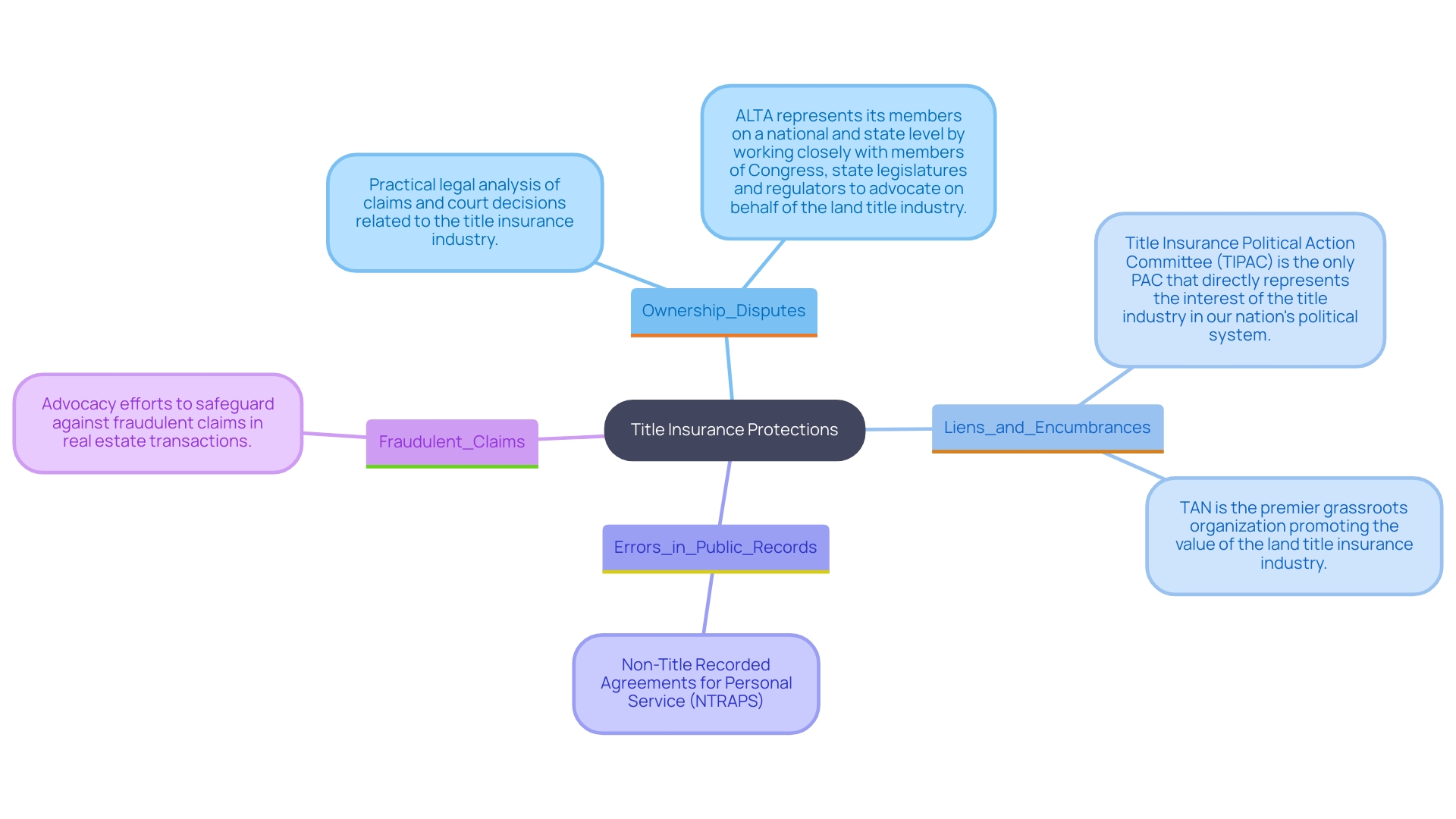

Title protection acts as a safeguard for real estate dealings, shielding landowners and lenders from possible losses arising from flaws in ownership. Typically, a title insurance policy covers issues such as:

- Ownership Disputes: Protection against claims from other parties asserting ownership of the asset.

- Liens and Encumbrances: Coverage against unpaid debts or obligations tied to the property, such as mortgages or tax liens.

- Errors in Public Records: Protecting buyers from inconsistencies in public ownership records that could impact property rights.

- Fraudulent Claims: Protection against losses stemming from deceitful actions, such as forged signatures on ownership documents.

Comprehending these essential safeguards establishes the foundation for identifying the restrictions and omissions inherent in policy coverage.

Common Exclusions in Title Insurance Policies

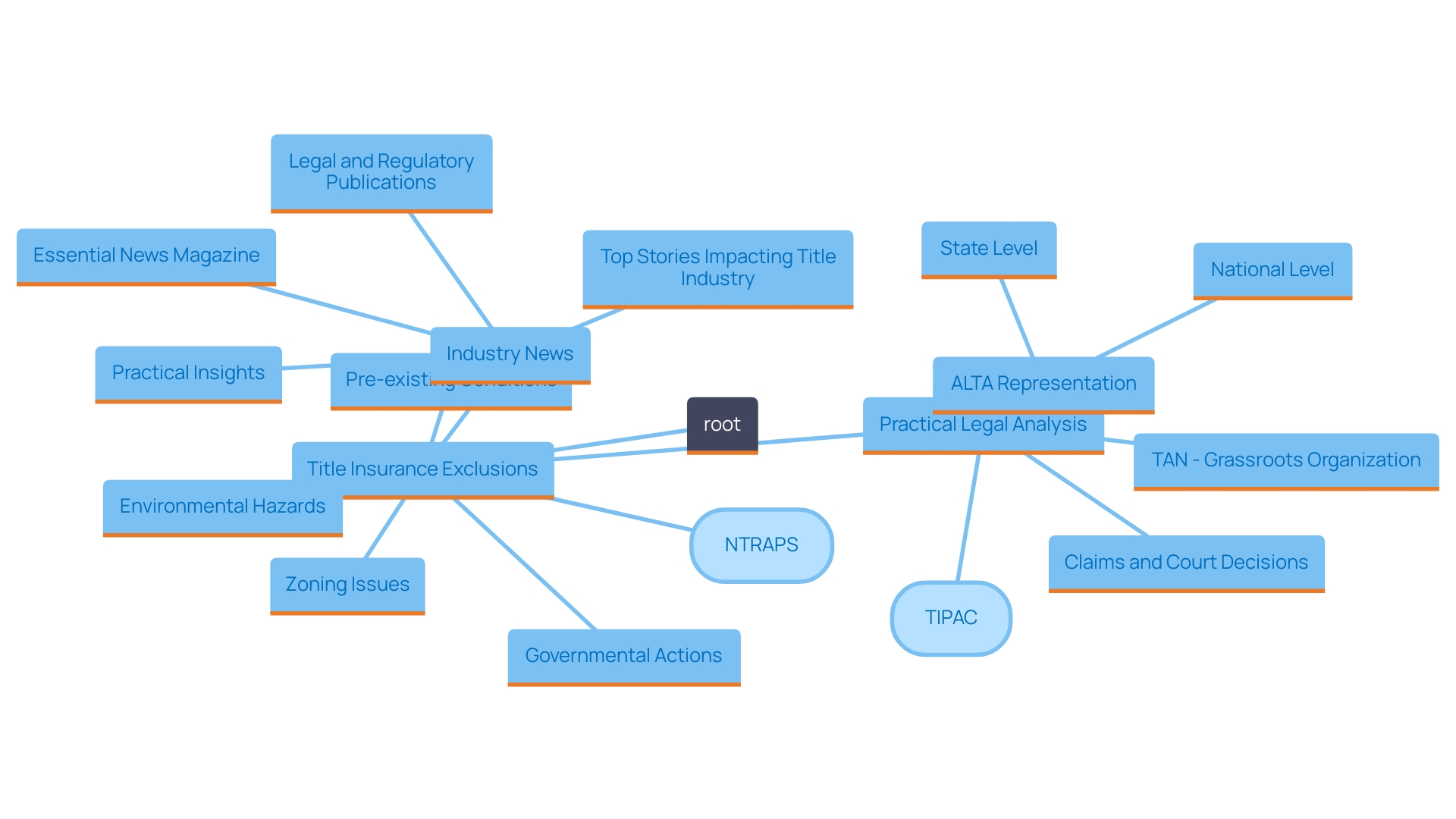

While title insurance provides significant protections, there are several common exclusions that policyholders should be aware of:

- Zoning Issues: Title coverage does not include issues stemming from or ordinances that may limit land use or development.

- Pre-existing Conditions: Issues that were known or should have been known by the buyer prior to the policy’s issuance are typically not covered.

- Environmental Hazards: Title protection typically does not include coverage for environmental problems, such as contamination or hazardous waste issues affecting the property.

- Governmental Actions: Losses resulting from governmental actions or regulations (such as eminent domain) are not safeguarded under standard ownership protection policies.

By comprehending these omissions, real estate experts can more effectively maneuver through the intricacies of ownership protection and ensure they adopt suitable actions to safeguard their interests.

The Importance of Understanding Title Insurance Exclusions

Understanding the exclusions in title insurance is paramount for several reasons:

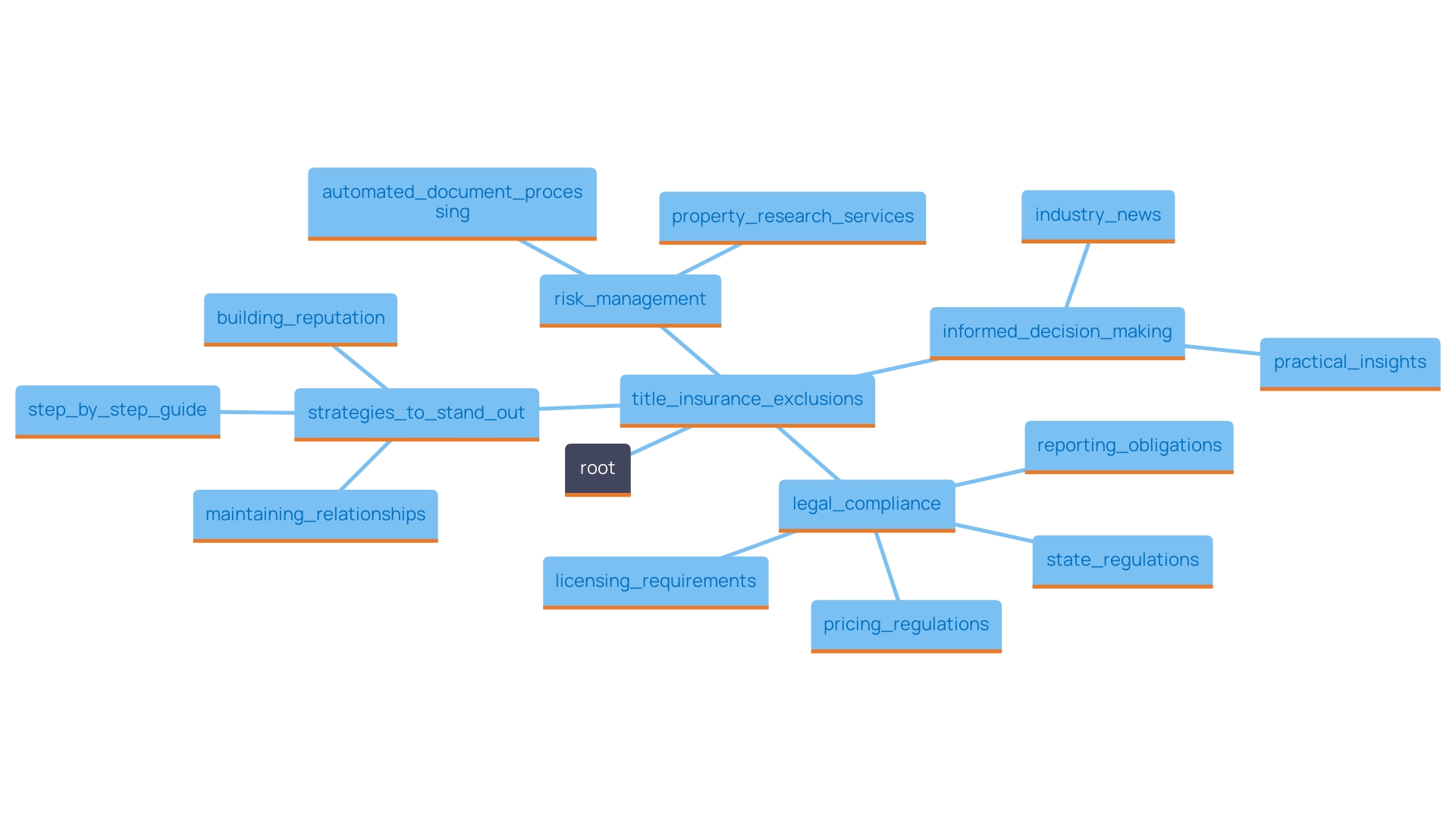

- Risk Management: Recognizing what is not included by ownership coverage enables landowners and lenders to proactively handle possible risks. For example, if a policy omits specific defects such as zoning problems or outstanding property taxes, stakeholders can pursue extra coverage or perform comprehensive research to lessen these risks. By recognizing these gaps, they can implement protective measures, ensuring that unforeseen issues do not jeopardize their investments. Leveraging automated document processing tools like ParmesAn, landmen can streamline the identification of these exclusions through advanced OCR technology that accurately reads and extracts vital information from documents.

- Informed Decision-Making: Understanding the constraints of coverage options is essential for making knowledgeable choices during real estate transactions. Recognizing that ownership protection may not address problems stemming from future claims can encourage stakeholders to allocate funds for contingencies. This knowledge helps them avoid surprises and allocate resources more efficiently, ultimately saving time and money. The interactive labeling features of the Parse platform enable users to customize data extraction, enhancing their ability to gather relevant information for better decision-making. For example, a landman can use the platform to extract specific details from a lease document, ensuring all necessary information is considered before proceeding with a transaction.

- Legal Compliance: Acknowledging and addressing the gaps in ownership insurance facilitates adherence to legal regulations. Failing to recognize exclusions related to environmental liabilities, for example, could result in significant legal repercussions. Utilizing the provided by Harbinger Land, clients can confidently acquire land rights by ensuring all necessary steps are taken to comply with statutory requirements, thus reducing the risk of legal complications.

For directors of document research, this understanding is essential for guiding their teams in conducting meticulous due diligence. Thoroughly considering all aspects of verification ensures comprehensive coverage and minimizes potential liabilities. By integrating insights from relevant case studies—such as how a company successfully navigated a dispute over ownership by addressing overlooked exclusions—professionals can better grasp how these principles apply in real-world scenarios, further enhancing their expertise and decision-making capabilities in commercial real estate transactions.

Strategies for Addressing Title Insurance Exclusions

To effectively address title insurance exclusions, real estate professionals can implement the following strategies:

- Comprehensive Due Diligence: Conduct thorough searches of ownership records and property histories to identify potential issues upfront.

- Legal Consultation: Engage legal experts to interpret complex statutes and regulations that may affect coverage for property ownership.

- Supplemental Coverage Options: Consider obtaining extra types of protection that may cover gaps left by standard policies, such as environmental coverage.

- Education and Training: Regularly update knowledge on policy regulations and exclusions through training programs and industry seminars.

These strategies can help title researchers and real estate professionals navigate the complexities of title insurance and enhance their overall efficiency and effectiveness in property transactions.

Conclusion

Understanding the intricacies of title insurance is essential for real estate professionals tasked with mitigating risks associated with property ownership. The article outlines the critical protections offered by title insurance, such as coverage against ownership disputes, liens, errors in public records, and fraudulent claims. However, it also emphasizes the importance of recognizing common exclusions, including zoning issues, pre-existing conditions, environmental hazards, and losses due to governmental actions.

Awareness of these exclusions is crucial for effective risk management and informed decision-making. By identifying what is not covered, stakeholders can take proactive measures to safeguard their investments, whether through additional insurance or thorough due diligence. This understanding not only aids in navigating potential pitfalls but also ensures compliance with legal requirements, thereby reducing the risk of future liabilities.

Implementing robust strategies—such as comprehensive due diligence, legal consultation, and ongoing education—can significantly enhance the effectiveness of title research and real estate transactions. As the landscape of real estate continues to evolve, equipping professionals with the knowledge and tools to address these challenges will be vital in securing property rights and fostering successful transactions. Ultimately, a thorough grasp of title insurance, including its exclusions and limitations, is indispensable for protecting both property owners and lenders in an increasingly complex market.

Frequently Asked Questions

What is the purpose of title protection in real estate?

Title protection acts as a safeguard for real estate dealings, shielding landowners and lenders from potential losses arising from flaws in ownership.

What issues does a title insurance policy typically cover?

A title insurance policy typically covers issues such as ownership disputes, liens and encumbrances, errors in public records, and fraudulent claims.

What are some common exclusions in title insurance coverage?

Common exclusions include zoning issues, pre-existing conditions known to the buyer, environmental hazards, and losses resulting from governmental actions.

Why is it important to understand the exclusions in title insurance?

Understanding the exclusions is important for risk management, informed decision-making, and legal compliance, helping stakeholders proactively handle potential risks and avoid surprises.

What strategies can real estate professionals use to address title insurance exclusions?

Strategies include conducting comprehensive due diligence, engaging legal consultation, considering supplemental coverage options, and participating in ongoing education and training.