Introduction

Title insurance serves as a vital safeguard for property buyers and mortgage lenders, shielding them from financial losses stemming from potential defects in property titles. As real estate transactions often involve significant investments, the assurance provided by title insurance is indispensable, offering protection against issues such as liens, encumbrances, and ownership disputes. This article delves into the intricacies of title insurance, exploring its coverage, the claims process related to liens, and addressing common misconceptions that can cloud property owners' understanding of this essential financial instrument.

By illuminating these aspects, property owners can make informed decisions to protect their investments and navigate the complexities of real estate ownership with confidence.

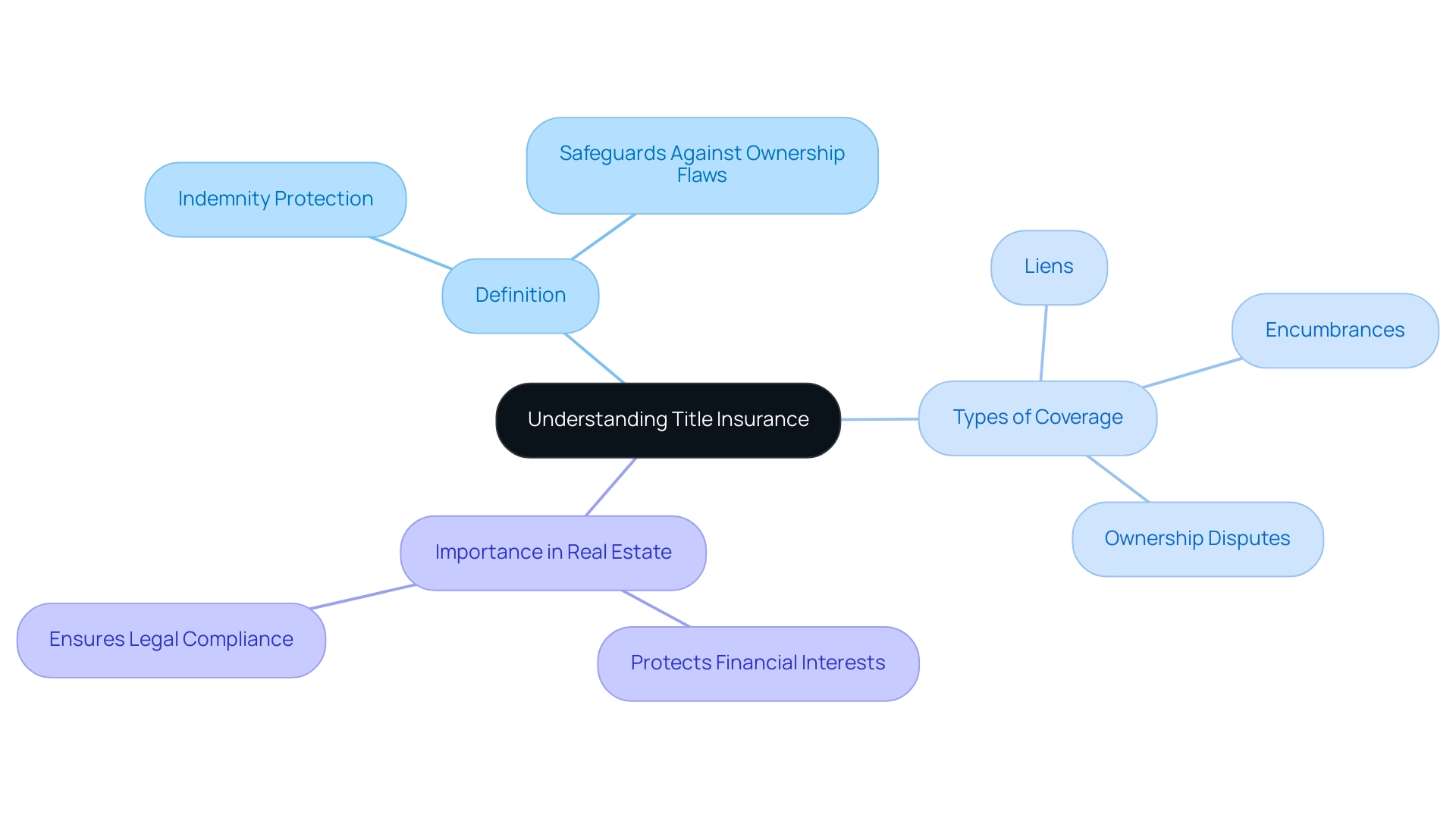

Understanding Title Insurance: Definition and Importance

Title coverage is a type of indemnity protection that safeguards real estate purchasers and mortgage providers from monetary loss arising from flaws in ownership rights. Such defects may include issues like liens, encumbrances, or disputes over ownership, prompting the inquiry of does title insurance cover liens. The significance of ownership coverage rests in its capacity to offer reassurance to property holders, guaranteeing that they are financially safeguarded against possible claims that may occur following the acquisition.

In real estate transactions, where substantial investments are at stake, having title protection is critical for safeguarding one's financial interests and ensuring compliance with legal requirements.

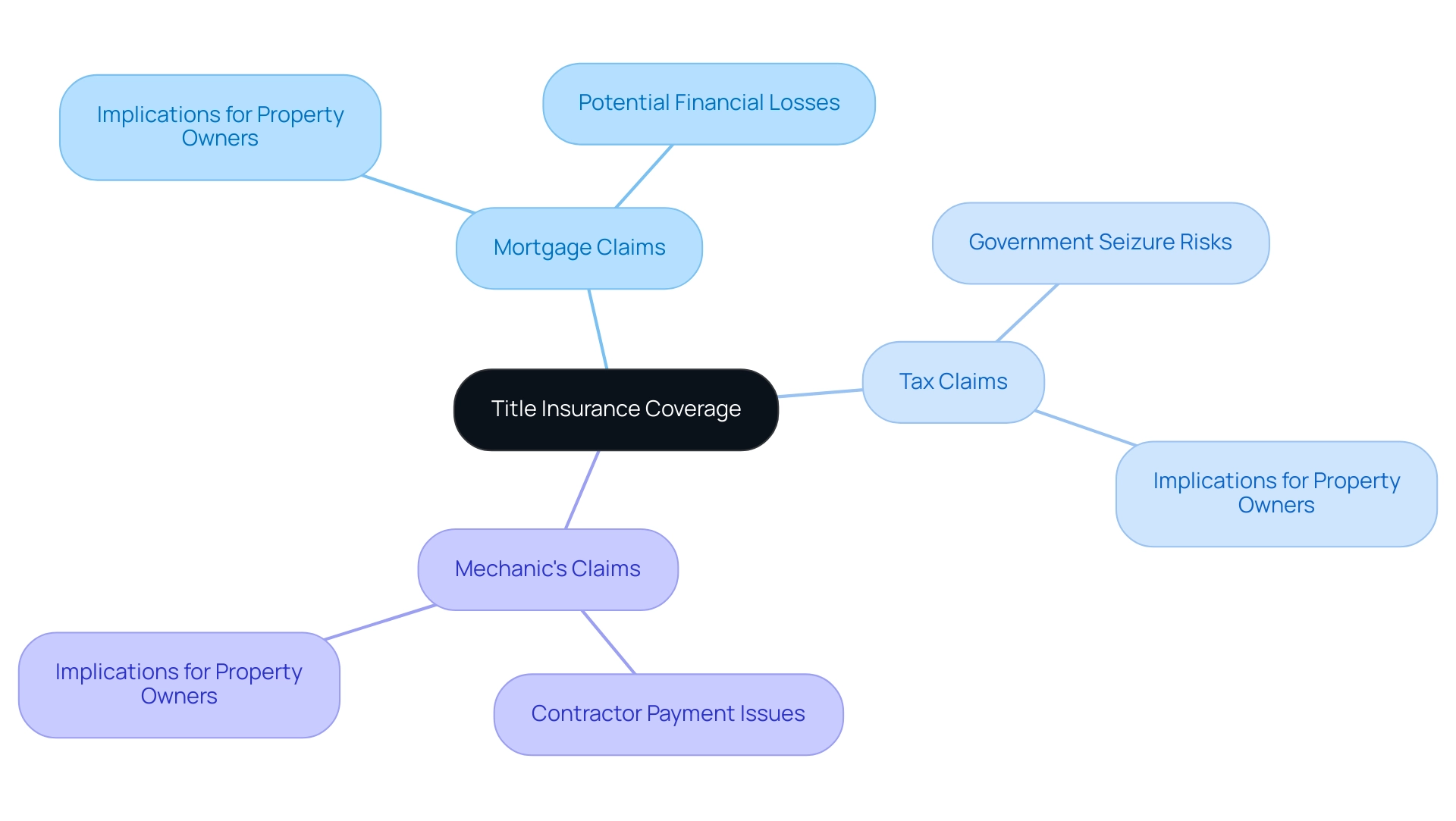

What Title Insurance Covers: Liens and Their Implications

A common question is, does title insurance cover liens, as it generally protects against various forms of claims, including mortgage claims, tax claims, and mechanic's claims? A mortgage encumbrance occurs when a borrower obtains a loan to buy real estate, which provides the lender a right against the asset until the loan is repaid. Tax claims arise when real estate taxes are not settled, permitting the government to seize the asset as security for the unpaid taxes.

Mechanic's claims can be submitted by contractors or subcontractors who have not received payment for services rendered on the site. The protection offered by deed coverage indicates that if a claim is filed against the asset due to any of these encumbrances, the coverage firm will defend the owner's rights and handle the expenses related to resolving the claim. This protection is crucial as it helps prevent financial loss and potential foreclosure, thereby providing essential security for landowners.

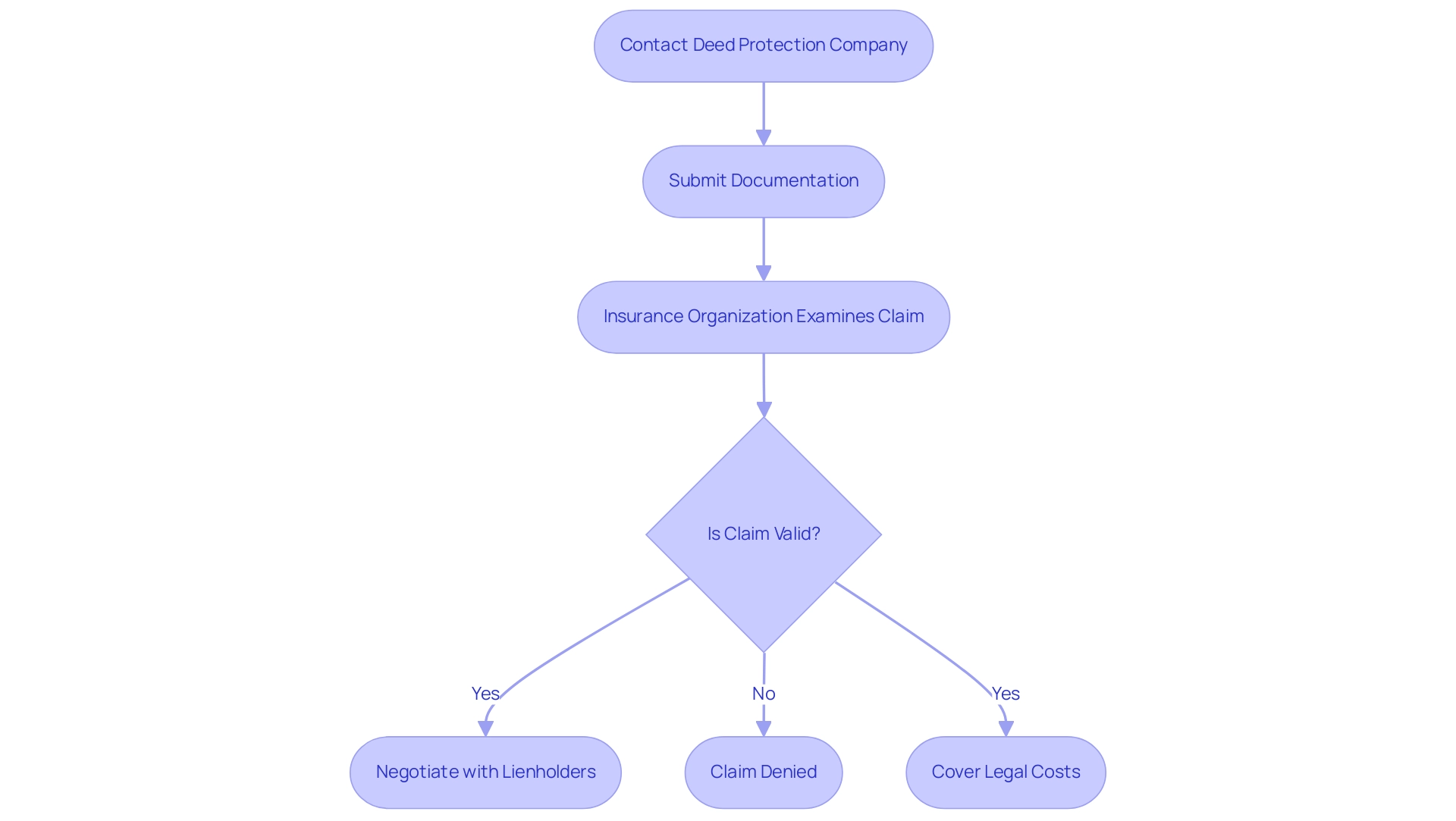

The Process of Title Insurance Claims Related to Liens

When a claim issue occurs, the property owner should quickly reach out to their deed protection company to start a request. The process usually starts with the submission of pertinent documentation, including the policy and any notices related to the lien. The insurance organization will then examine the claim, reviewing the ownership history and any relevant legal documents.

If the claim is valid, the insurer will work to resolve the issue, which may involve:

- Negotiating with lienholders

- Covering legal costs associated with defending the claim

As it raises the question of how does title insurance cover liens, it is vital for owners to comprehend that prompt communication with their insurance provider can greatly affect the result of a claim, guaranteeing they receive the coverage they are entitled to under their policy.

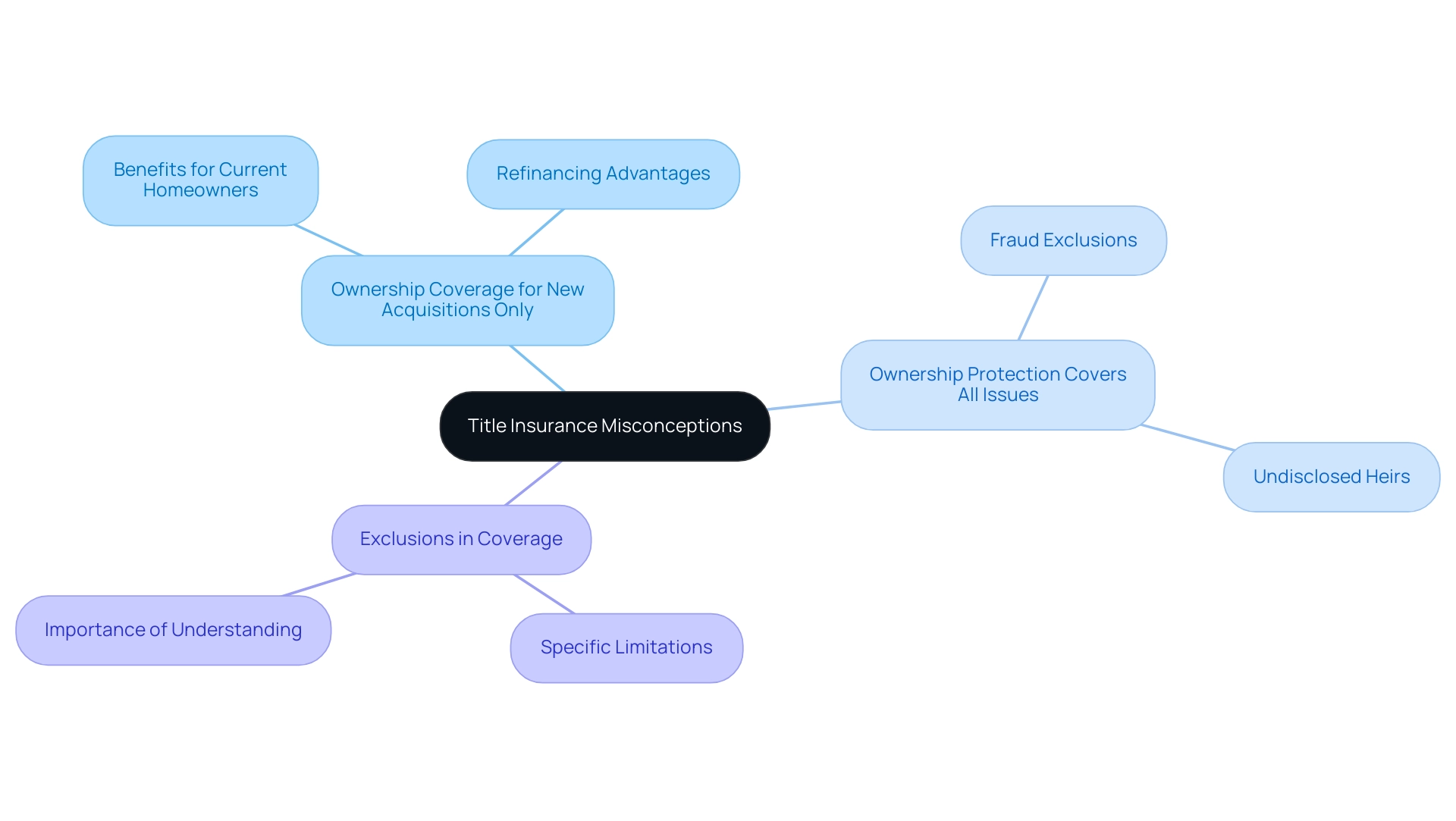

Common Misconceptions About Title Insurance and Liens

One prevalent misunderstanding is that ownership coverage is solely required for new real estate acquisitions. In fact, current homeowners can also gain advantages from property protection, especially if they are refinancing or if there are changes in ownership. Another misunderstanding is that ownership protection covers all possible concerns related to real estate.

While it provides extensive coverage, certain exclusions may apply, such as issues arising from fraud or undisclosed heirs. Grasping these subtleties is crucial for owners to make educated choices regarding their coverage requirements. By clarifying these misconceptions, property owners can better appreciate the value of title insurance, specifically in relation to the question of does title insurance cover liens and how it protects their investments against other title-related issues.

Conclusion

Title insurance plays an essential role in safeguarding property buyers and mortgage lenders from potential financial losses due to defects in property titles. By offering protection against various issues such as liens and ownership disputes, title insurance ensures that significant investments in real estate are secured. Understanding what title insurance covers, particularly regarding liens, is crucial for property owners to mitigate risks and navigate the complexities of property ownership effectively.

The claims process associated with title insurance is straightforward yet vital. Prompt communication with the title insurance company can significantly impact the resolution of claims related to liens. By understanding the necessary steps and providing relevant documentation, property owners can ensure they receive the protection they are entitled to, thereby preventing potential financial hardship.

Furthermore, addressing common misconceptions about title insurance is key to fostering informed decision-making. Many property owners underestimate the importance of title insurance for existing properties or assume it covers all possible issues. Awareness of these nuances can empower owners to make strategic choices that protect their investments against unforeseen title-related challenges.

In summary, title insurance is an indispensable tool for anyone involved in real estate transactions. By comprehensively understanding its coverage, the claims process, and addressing prevalent misconceptions, property owners can navigate the complexities of ownership with greater confidence and security. This knowledge not only protects individual investments but also enhances the overall integrity of real estate transactions.

Frequently Asked Questions

What is title insurance?

Title insurance is a type of indemnity protection that safeguards real estate purchasers and mortgage providers from monetary loss arising from flaws in ownership rights, such as liens, encumbrances, or disputes over ownership.

Does title insurance cover liens?

Yes, title insurance generally protects against various forms of claims, including mortgage claims, tax claims, and mechanic's claims, which are related to liens on the property.

Why is title insurance important in real estate transactions?

Title insurance is critical for safeguarding financial interests in real estate transactions, ensuring compliance with legal requirements, and providing reassurance to property holders against possible claims that may arise after acquisition.

What should a property owner do if a claim issue occurs?

The property owner should promptly contact their deed protection company to start a claim request, submitting relevant documentation such as the policy and any notices related to the lien.

What steps does the insurance organization take after a claim is submitted?

The insurance organization examines the claim, reviews ownership history and legal documents, and if the claim is valid, they may negotiate with lienholders and cover legal costs associated with defending the claim.

Who can benefit from title insurance?

Both new real estate purchasers and current homeowners can benefit from title insurance, especially during refinancing or changes in ownership.

Are there any exclusions in title insurance coverage?

Yes, while title insurance provides extensive coverage, certain exclusions may apply, such as issues arising from fraud or undisclosed heirs.

How can property owners better understand their title insurance needs?

Property owners should clarify misconceptions about title insurance and grasp its nuances to make informed decisions regarding their coverage requirements.