Introduction

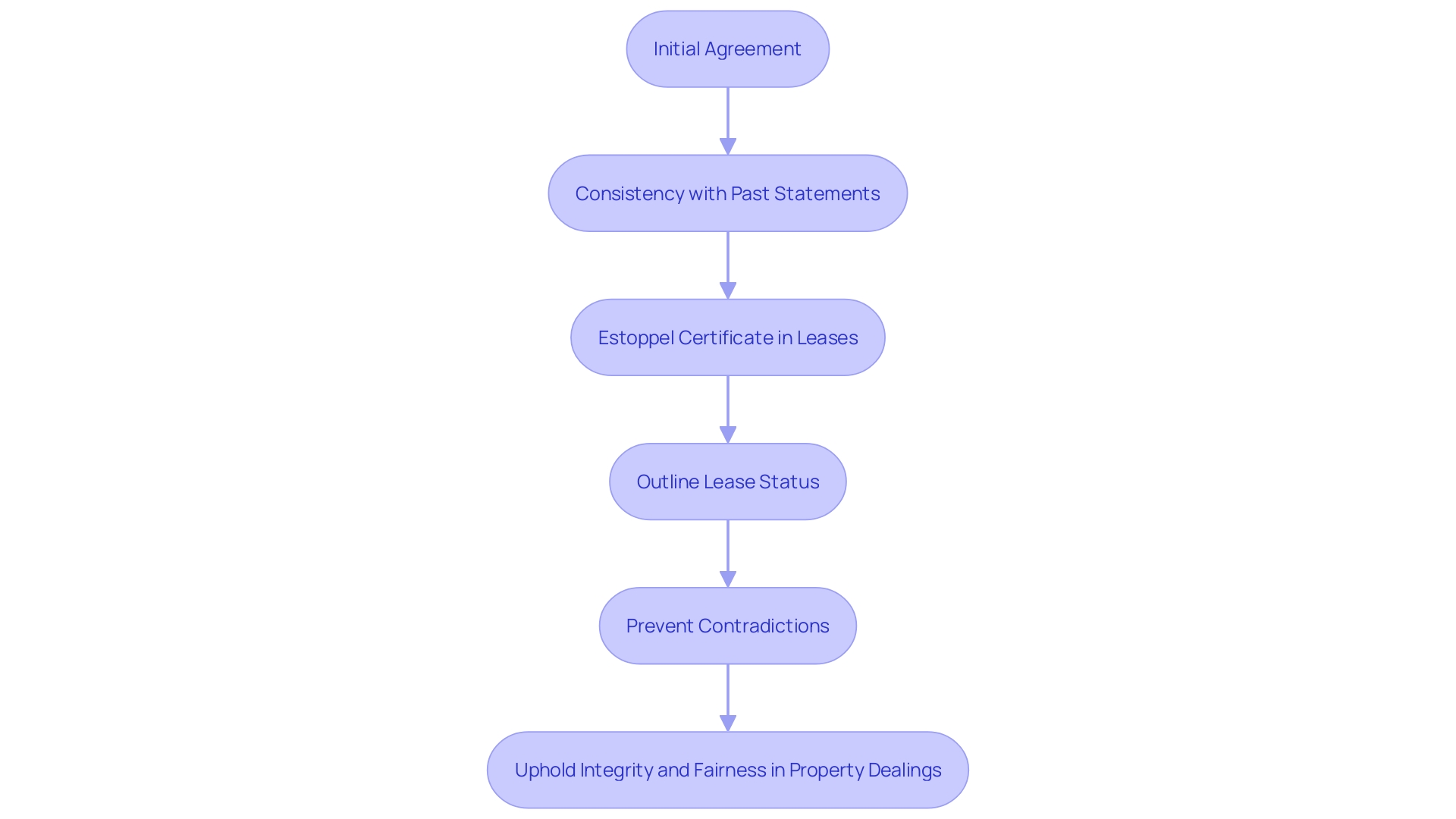

Estoppel, a legal safeguard in property dealings, plays a crucial role in upholding agreements and preventing unfair advantages. Grounded in consistency, estoppel ensures that past statements or commitments carry weight in current legal scenarios. In real estate, estoppel is particularly important in preventing disputes over property rights and ensuring transactional accuracy and fairness.

For example, estoppel certificates are used in lease situations to outline the status of the lease and prevent subsequent contradictions. By fostering trust and stability, estoppel holds parties accountable to their previous representations. In this article, we will explore the different types of estoppel in real estate, the significance of tenant estoppel and association estoppel, the key components of an estoppel letter, when and why estoppel letters are used, the benefits they offer, and the challenges and considerations involved in obtaining accurate estoppel letters.

These insights will provide a comprehensive understanding of estoppel's role in real estate transactions, ensuring informed and legally sound dealings.

Definition of Estoppel

Estoppel, a legal safeguard, plays a critical role in the realm of property dealings by upholding the and averting unfair advantages. It is grounded in the concept of consistency, where past statements or commitments carry weight in current legal scenarios. Particularly in , estoppel is instrumental in and ensuring transactional accuracy and fairness. A notable example is the use of , where the landlord outlines the status of the lease and any claims against the tenant, precluding any subsequent contradictions. This fosters trust and stability in real estate transactions by holding parties accountable to their previous representations.

Types of Estoppel in Real Estate

Understanding the nuances of is essential in , where various types can come into play, each with its unique implications. Equitable estoppel, for instance, emerges when an individual detrimentally relies on the actions or representations of another party. This reliance often occurs when a person believes in the accuracy of information or a commitment made by someone else, which later turns out to be false or misleading. A poignant example is when a tenant, like Carla B. Monteiro, might depend on the verbal assurance of a landlord's acceptance, only to face unexpected eviction, disrupting their sense of stability and security.

Promissory estoppel, another critical type, arises from a broken promise that causes harm. For example, a real estate developer might assure a homeowner, such as Orlando Capote, of preserving certain aspects of their neighborhood, leading the homeowner to make decisions based on this promise. If the developer retracts, the homeowner could suffer financial or emotional damage due to their reliance on the original commitment.

Additionally, estoppel by silence can have far-reaching consequences, such as when a party remains silent or fails to correct a misunderstanding. This inaction can lead to another's detrimental reliance, as seen in scenarios where property sellers do not disclose certain encumbrances, leading buyers to assume the property is free of liens or easements.

Real estate transactions, therefore, require vigilance and an in-depth to prevent disputes and ensure fair dealings, as reflected in the evolving market trends and the need for clear, legally sound transactions highlighted by like Savills.

Tenant Estoppel

In the realm of , tenant estoppel plays a pivotal role in clarifying the terms of tenancy agreements. An estoppel certificate, provided by the tenant, acts as a definitive record of the lease's terms and conditions, along with any pertinent details that might affect the property's sale or financing. This certificate is a legal acknowledgment that certifies the tenant's understanding and agreement of their at a given point in time.

Consider the case where fraudulent activity almost led to the illegal transfer of hotel ownership. This underscores the critical need for in property dealings. It's not simply about meeting the technical requirements for recording deeds but about ensuring the substantive accuracy and legitimacy of the property's title and associated leases. In this light, serve as a safeguard, verifying the lease details and preventing potential disputes or misunderstandings that could arise during major transactions such as property sales or refinancing efforts.

Real-world implications of these certificates are evident in the case of a rental property put up for sale, where the tenant's privacy concerns were addressed by the photographer during the marketing process. The estoppel certificate in such scenarios would be a tool for both the tenant and prospective buyers to understand the lease's impact on the property's value and condition. By offering a clear and current snapshot of the tenant's rights, these certificates assist all parties involved in making informed decisions.

Statistics from Savills, a global real estate service provider, emphasize the importance of expert advice and analysis in the commercial real estate sector. With a history spanning over 160 years and a presence across continents, the insights offered by such firms can be instrumental in managing and delivering projects that account for the nuanced aspects of property transactions, such as tenant estoppel certificates.

Association Estoppel (HOA Estoppel)

An association estoppel letter, also known as an HOA estoppel, is a critical document in real estate transactions within communities governed by Homeowners' Associations. This document, provided by the HOA, details essential information such as the association's financial status, including any outstanding fees or assessments owed by the property owner, and discloses any legal actions or violations that may affect the property. Such transparency is particularly important, as demonstrated by a case in Atlanta where a homeowner discovered a leak caused by the HOA's maintenance work, which led to significant water damage. The estoppel letter would disclose if such issues were pending resolution and could impact a buyer's or lender's decision-making process.

Moreover, the necessity of these letters is underscored by recent news reports illustrating the extensive reach of HOAs. For instance, in Texas, where 1 in 3 homes are part of an HOA, these associations wield the power to foreclose on homes for unpaid debts, as was the unfortunate experience of Finda Koroma, who faced eviction over a relatively small debt. This starkly highlights the to be fully informed of any financial liabilities associated with their prospective home.

The role of an HOA estoppel extends beyond . As evidenced by inquiries from real estate professionals, such as the request for financial details of an association's reserve funds, these documents provide a clear picture of an association's fiscal health and operational practices. Moreover, the estoppel can clarify the extent of an owner's responsibility for property maintenance, as the distinction between common areas and individual units can vary significantly between associations, affecting the type of homeowners insurance policy needed.

Real-world implications of association governance are seen in the allocation of community funds, like the 25% of a townhome association's budget directed towards landscaping without owner input, a decision-making process that is generally within the board's authority unless otherwise stipulated by governing documents. Therefore, the is not only about financial due diligence but also about and community obligations one is buying into, making it an indispensable tool for informed real estate transactions.

Key Components of an Estoppel Letter

Within a , an or letter is a critical document that conveys vital information to the involved parties. The content of this letter often encompasses the issuer's legal identification, the address of the property in question, the tenant's or association's name, and a clear declaration of the current lease or association status. Additionally, it details any outstanding dues or obligations and incorporates any other pertinent details that may influence the transaction. This document plays a pivotal role in confirming the veracity of such information and thereby, upholds the integrity of the real estate transaction process.

To illustrate, consider the scenario wherein a rental property occupied by a tenant, who has been dutifully caring for an elderly relative, is put on the market. In such a situation, an estoppel letter would serve to clarify the tenant's rights and obligations, ensuring that potential buyers are fully informed of the lease terms that will transfer with the property sale. This ensures transparency and avoids any miscommunication that could arise during the property's transition to a new owner.

Moreover, the importance of an estoppel letter is mirrored in recent , where a surge in existing home sales and shifts in buyer preferences have signaled a dynamic housing market. For instance, the February 2024 increase in existing home sales by 9.5% underscores the need for meticulous documentation in real estate transactions. The , by providing a snapshot of the property's legal and financial standing, becomes an indispensable tool for both buyers and sellers navigating this fast-paced market.

In essence, the Estoppel Certificate is a declaration that establishes trust and clarity in real estate dealings. It is not merely a formality but a significant legal instrument that safeguards the interests of all parties involved, ensuring a seamless and transparent transaction.

When and Why Estoppel Letters are Used

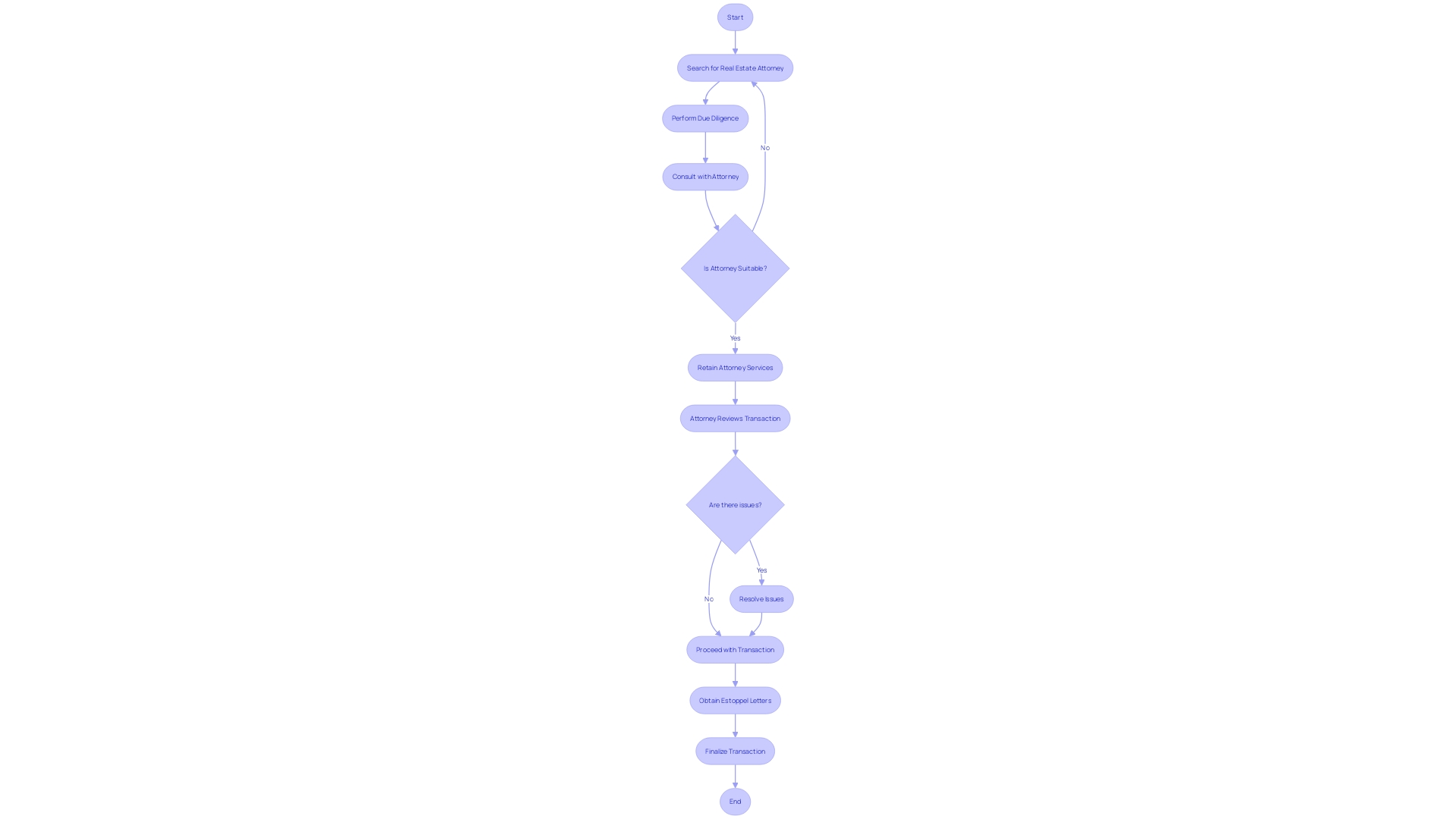

Estoppel letters serve as a protective measure in real estate dealings, where they confirm the veracity of assertions made by tenants or associations. Chosen by buyers or financial bodies during transactions, these documents act as a safeguard against or disputes, and any misrepresentation. In the context of , such as the case of Anabel and her daughter in a rental home put on the market, estoppel letters could clarify occupancy status and tenant rights, ensuring personal aspects like family photos aren't unjustly displayed online. , highlighted by experts for their deep understanding of real estate law and contract negotiation skills, often facilitate the creation and interpretation of estoppel letters. These legal professionals, located via simple online searches or through with a global presence, are crucial for comprehensive due diligence, offering peace of mind in complex transactions and preventing the kind of legal oversights that can lead to 'laughable' misunderstandings, as noted by legal professionals in case studies.

Benefits of Estoppel Letters

play an essential role in the realm of real estate, offering numerous advantages for all parties involved in . Providing a dependable source of information, these letters allow buyers, sellers, and lenders to make well-informed decisions anchored in current and precise data. For instance, in the intricate process of purchasing Akiya properties, clients rely heavily on accurate and detailed information to gauge the scope and costs of the project. The transparency afforded by is crucial in preventing disputes and litigations by delineating clear-cut rights and responsibilities, whether it's for tenants in manufactured housing communities—where 22 million Americans reside—or for associations.

Moreover, estoppel letters serve as a safeguard, particularly for buyers and lenders, by confirming the absence of hidden financial or legal challenges, which could otherwise jeopardize the transaction. This protective measure is exemplified in situations like the sale of rental homes, where personal details and privacy concerns are at stake during property listings. The clarity and assurance provided by estoppel letters underpin the seamless and forthright exchange of property ownership, as also reflected by the evolving industry trends and market dynamics in regions with a high concentration of mobile homes like Florida.

The significance of estoppel letters is further echoed in the advice of industry experts who recommend the involvement of to navigate the complexities of property transactions. Their expertise in state-specific real estate laws, contract review, and negotiation is integral to protecting the interests of clients in diverse scenarios, from individual homebuyers to large real estate firms facing organizational challenges. Backed by solid legal counsel and the strategic use of estoppel letters, stakeholders in the real estate market can confidently embark on transactions with a clearer understanding of their legal standing and financial exposure.

Challenges and Considerations

Navigating the complexities of real estate transactions requires attention to detail and a proactive approach, particularly when it comes to estoppel letters. These documents play a critical role in clarifying the status of leases or associations before a property changes hands. For instance, consider the case of a rental property listed for sale, where the current tenants' privacy concerns must be balanced against the needs of the selling process. It is essential that an estoppel letter accurately reflects such details to protect all parties involved.

Obtaining estoppel letters can be a meticulous process, demanding coordination among multiple stakeholders. This is especially true in , where each party's agreement is necessary to provide a clear picture of the property's legal standing. Market-leading experts from firms like Savills emphasize the to this endeavor. Real estate attorneys, with their , are often indispensable in ensuring that the estoppel letters are comprehensive and serve their purpose effectively.

The significance of thorough and accurate estoppel letters is underscored by the , which can involve substantial financial implications. As highlighted by industry analysis, the expertise of seasoned professionals is crucial in executing these documents correctly. It is not just a matter of legal compliance, but also of safeguarding investments and maintaining the integrity of the real estate market.

Conclusion

Estoppel is a crucial legal safeguard in real estate transactions, ensuring that past statements or commitments hold weight in current scenarios. It fosters trust and stability by preventing disputes and promoting fairness. Estoppel certificates play a key role in lease situations, outlining lease status and preventing contradictions.

Tenant estoppel is essential in commercial real estate, providing a definitive record of lease terms and conditions. These certificates clarify details that may impact property sales or financing, assisting all parties in making informed decisions.

Association estoppel, or HOA estoppel, is critical in transactions within Homeowners' Associations. These letters disclose financial status, outstanding fees, and any legal actions or violations. They offer transparency and enable buyers to fully understand their financial liabilities.

The key components of an estoppel letter include identification, property address, tenant or association name, and a clear declaration of the current status. These letters confirm information, uphold integrity, and ensure transparency.

Estoppel letters safeguard against hidden liabilities and misrepresentation. Real estate attorneys play a vital role in creating these letters, ensuring comprehensive due diligence and peace of mind in complex transactions.

Estoppel letters provide dependable information for well-informed decisions, preventing disputes and clarifying rights and responsibilities. They safeguard against hidden challenges and maintain market integrity. Real estate attorneys navigate complexities and ensure the strategic use of estoppel letters.

Obtaining accurate estoppel letters requires attention to detail and coordination among stakeholders. Thorough and accurate letters protect investments and maintain market integrity.

Learn how estoppel certificates can protect your lease agreements and prevent disputes.

Frequently Asked Questions

What is estoppel and why is it important in real estate?

Estoppel is a legal principle that prevents a person from going back on their word in a legal situation, where past statements or commitments are considered in current scenarios. It's important in real estate because it upholds the integrity of agreements, avoids unfair advantages, and prevents disputes over property rights, ensuring transactional accuracy and fairness.

What is an estoppel certificate?

An estoppel certificate is a document, typically used in lease situations, where a landlord outlines the status of the lease and any claims against the tenant. It serves to prevent any subsequent contradictions by holding parties accountable to their previous representations, fostering trust and stability in real estate transactions.

What are the different types of estoppel in real estate?

The main types of estoppel in real estate include equitable estoppel, promissory estoppel, and estoppel by silence. Equitable estoppel occurs when someone relies on another party's actions or representations to their detriment. Promissory estoppel arises from a broken promise that causes harm. Estoppel by silence happens when a party's failure to speak up or correct a misunderstanding leads to another's detrimental reliance.

What is tenant estoppel and how does it function?

Tenant estoppel is particularly relevant in commercial real estate transactions. It involves an estoppel certificate provided by the tenant, which is a record of the lease terms and any details that might affect the property's sale or financing. It confirms the tenant's understanding and agreement of lease obligations and rights, helping to verify lease details and prevent disputes.

What is an association estoppel letter, also known as an HOA estoppel?

An association estoppel letter, or HOA estoppel, is a document provided by a Homeowners' Association detailing vital information like the association's financial status, outstanding fees or assessments owed by the property owner, and any legal actions or violations that may affect the property. This transparency is crucial for buyers or lenders in making informed decisions.

What are the key components of an estoppel letter?

An estoppel letter typically includes the issuer's legal identification, property address, tenant's or association's name, current lease or association status, any outstanding dues or obligations, and other pertinent details that may influence a real estate transaction. It confirms the accuracy of information and upholds transaction integrity.

When are estoppel letters used and why are they necessary?

Estoppel letters are used during real estate transactions to confirm the accuracy of claims made by tenants or associations and protect against hidden liabilities or disputes. They are especially important for clarifying occupancy status and tenant rights, and are usually facilitated by real estate attorneys for comprehensive due diligence.

What are the benefits of estoppel letters in real estate transactions?

Estoppel letters provide a reliable source of information, allowing all parties to make informed decisions based on current and precise data. They help prevent disputes and litigations by clearly outlining rights and responsibilities and confirm the absence of hidden financial or legal challenges, ensuring a transparent and smooth exchange of property ownership.

What challenges and considerations are associated with estoppel letters?

Obtaining estoppel letters can be a meticulous and coordinated effort, especially in transactions involving multiple tenants or associations. The process requires attention to detail and the expertise of real estate attorneys to ensure the letters are comprehensive and effective. Proper execution of estoppel letters is crucial for protecting investments and maintaining market integrity.