Introduction

In the intricate landscape of real estate transactions, title insurance emerges as a fundamental safeguard, ensuring that buyers and lenders are protected against potential title defects that could jeopardize their investments. As the backbone of property ownership security, title insurance not only shields against past issues but also enhances the overall integrity of the transaction process.

From conducting meticulous title searches to managing the complexities of closing, title insurance companies play a crucial role in mitigating risks and fostering trust among all parties involved. This comprehensive exploration delves into the functions of title insurance, the various policy types available, and the essential processes that underpin secure real estate dealings, offering valuable insights for anyone navigating this vital aspect of property transactions.

Understanding Title Insurance: A Key Component of Real Estate Transactions

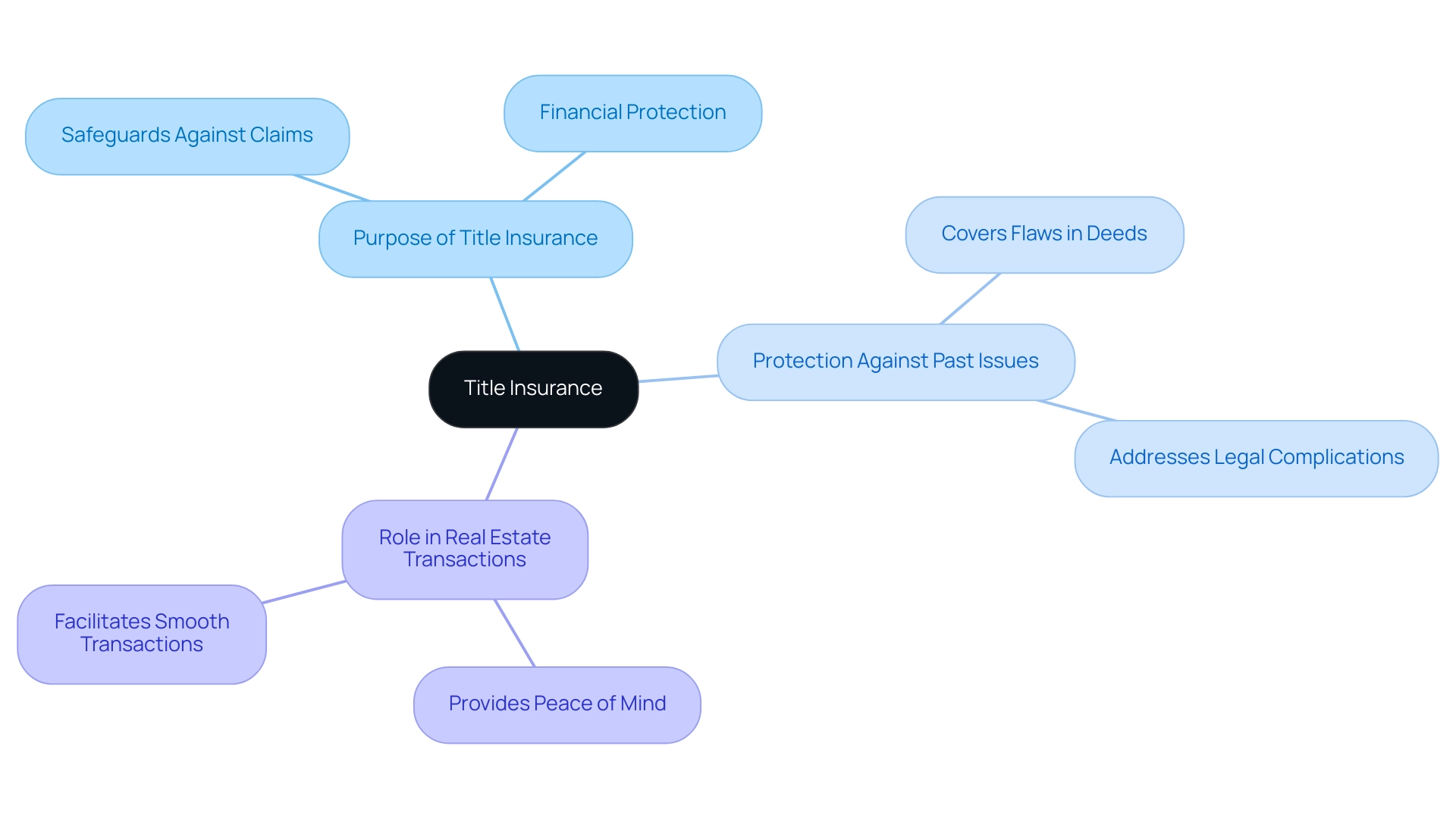

Title protection is a type of indemnity coverage that safeguards against monetary loss arising from flaws in a deed to a real estate. It provides protection for real estate purchasers and financiers against potential issues that may arise from claims against the property, illustrating what do title insurance companies do. Unlike other types of coverage that offer protection for future events, title protection safeguards against past occurrences, ensuring that the property being acquired is free from any legal complications.

This makes it a crucial element of real estate dealings, as it provides peace of mind to all parties involved by clarifying what do title insurance companies do.

The Role of Title Insurance Companies: Functions and Responsibilities

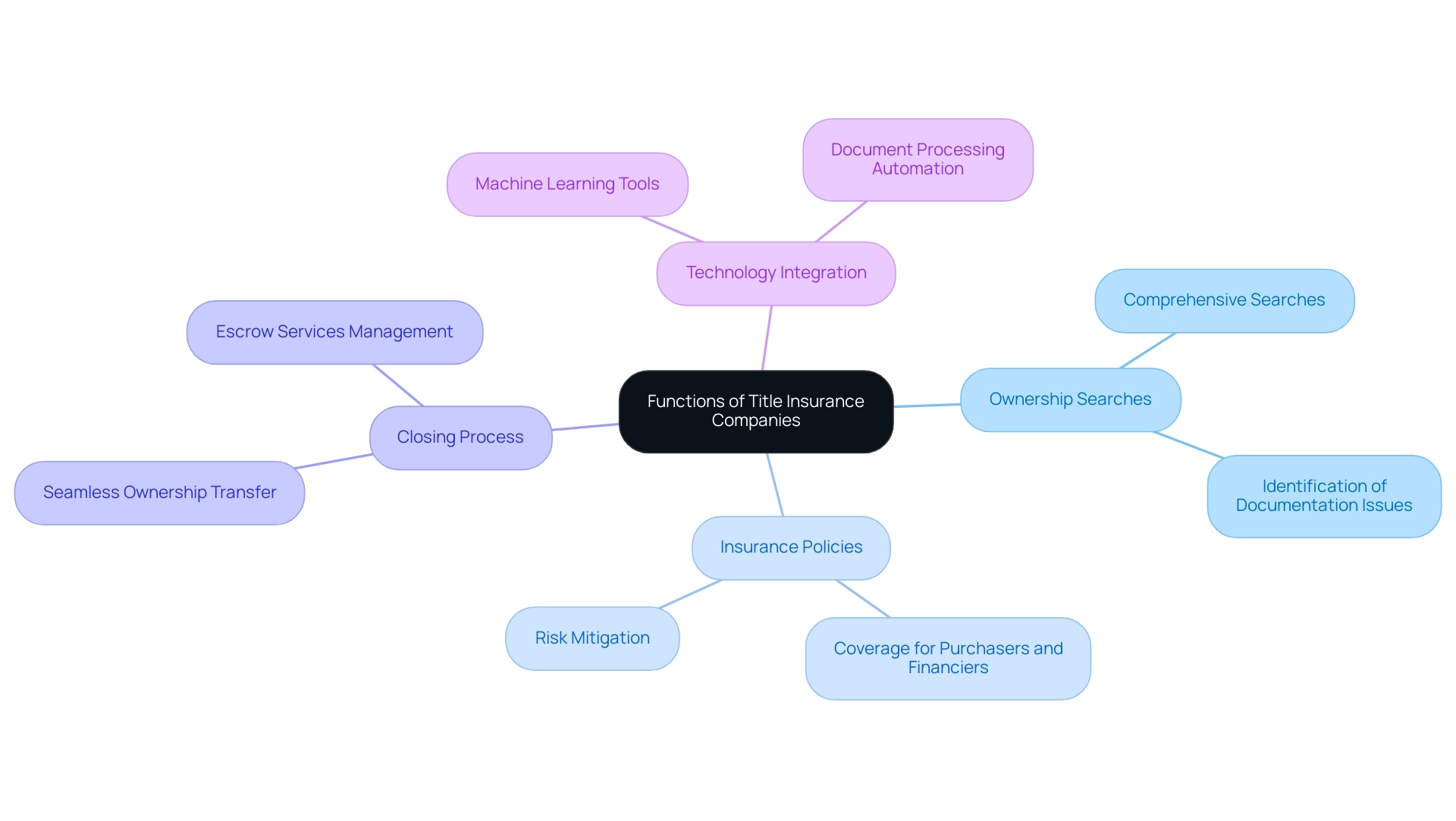

In the real estate transaction process, understanding what do title insurance companies do is essential as title guaranty firms perform several critical functions. These encompass:

- Performing comprehensive ownership searches to reveal any possible problems with the property documentation.

- Issuing insurance policies to safeguard purchasers and financiers.

- Overseeing the closing procedure, which highlights what do title insurance companies do to ensure a seamless transfer of ownership.

With the integration of advanced machine learning tools from Parse AI, companies can expedite document processing and enhance research automation.

Parse AI's capabilities, such as full-text search, OCR technology, and its innovative example manager, allow for efficient extraction of vital information from unstructured documents, streamlining runsheet creation. The example manager allows users to quickly annotate and extract information from a large set of documents, significantly enhancing the efficiency of research on titles. Furthermore, escrow firms manage escrow services, ensuring that funds are securely handled until all conditions of the sale are met.

Parse AI was created by a group of industry experts who encountered various obstacles in verifying real property ownership, utilizing their knowledge to establish a platform that enhances the ownership sector. By fulfilling these responsibilities, property protection firms, along with expertise from partners like Harbinger Land, play a vital role in mitigating risks and facilitating secure real estate transactions, leading to the question of what do title insurance companies do while fostering educational outreach on the benefits of domestic energy production.

Exploring Different Types of Title Insurance Policies

There are primarily two types of insurance policies:

- Owner's Insurance

Owner's Insurance safeguards the buyer's equity in the asset, ensuring that they are protected against any ownership defects that may occur after the acquisition. - Lender's Insurance

Lender's Title Insurance safeguards the lender's investment in the real estate, covering the loan amount in case of ownership issues.

Both policies are generally issued for a one-time premium and remain in effect for as long as the insured has an interest in the asset. Understanding what title insurance companies do with these policy types is crucial for real estate participants to ensure adequate protection.

The Importance of Title Searches in Protecting Property Rights

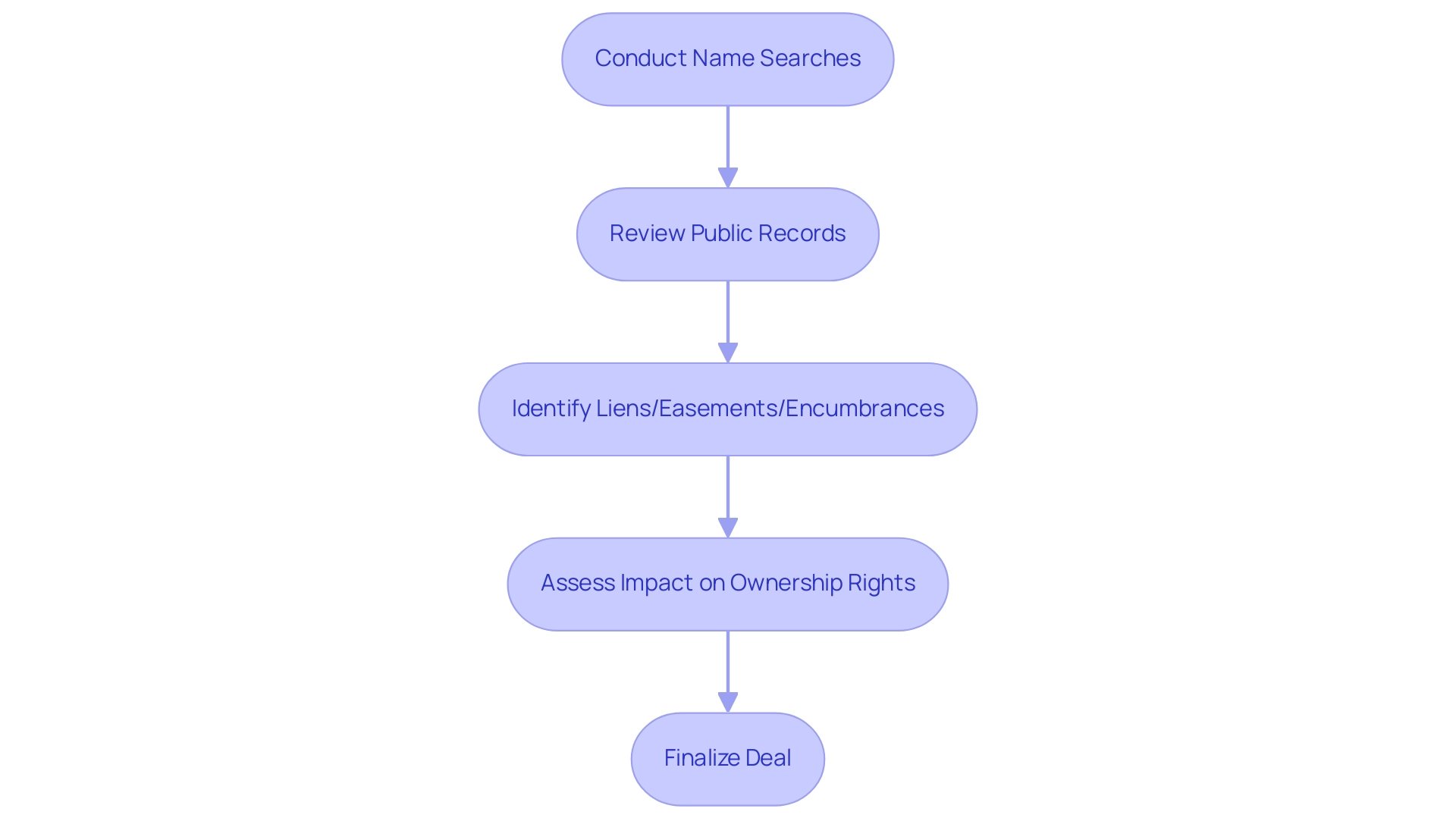

Name searches are an essential role of insurance firms, as they entail a thorough review of public records to confirm the legal ownership of an asset. This process helps identify any existing liens, easements, or encumbrances that could affect the buyer's rights. By revealing these possible problems prior to a deal being finalized, property investigations safeguard purchasers and lenders from subsequent conflicts and monetary setbacks.

The comprehensiveness of a property search can significantly influence the security of ownership rights and the overall success of real estate dealings.

Navigating the Closing Process: How Title Companies Ensure Secure Transactions

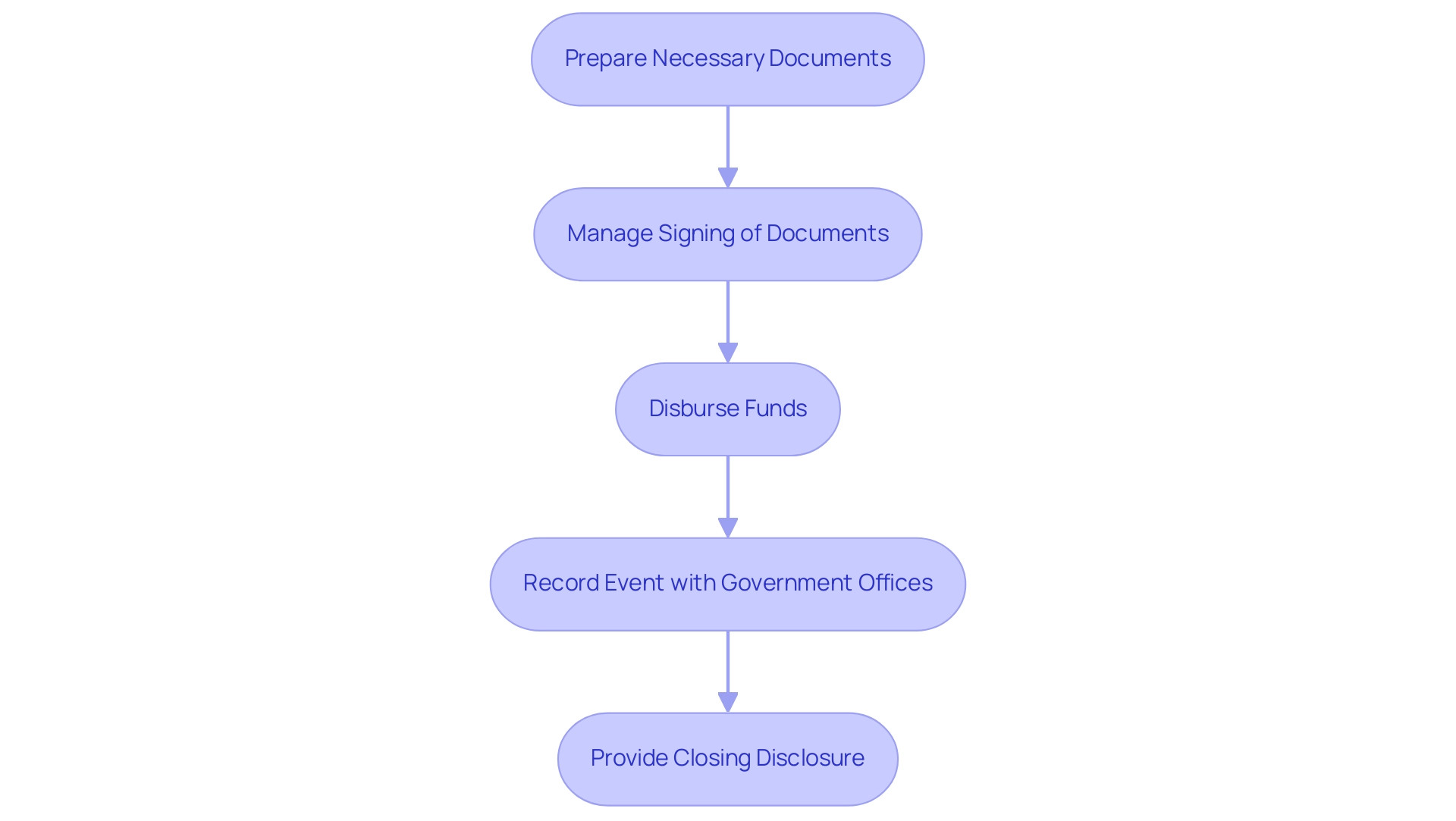

The closing process is the final step in a real estate deal, highlighting what title insurance companies do, as they play a pivotal role in ensuring that all necessary documents are prepared, funds are managed, and legal requirements are met. Title companies manage the signing of documents, disbursement of funds, and recording of the event with the appropriate government offices. They also provide a closing disclosure to all parties, outlining the financial aspects of the deal.

By managing these critical tasks, title companies exemplify what title insurance companies do, ensuring that transactions are executed securely, minimizing the risk of errors and protecting the interests of all parties involved.

Conclusion

Title insurance is a vital aspect of real estate transactions, offering crucial protection against potential title defects that could threaten the investments of buyers and lenders. This indemnity insurance ensures that all parties can navigate the complexities of property ownership with confidence.

Title insurance companies play an essential role by conducting thorough title searches, issuing policies, and managing the closing process to mitigate risks effectively. The integration of advanced technologies, such as those from Parse AI, further enhances the efficiency of title research, streamlining operations and bolstering trust in transactions.

Understanding the differences between Owner's Title Insurance and Lender's Title Insurance is imperative for real estate participants. Each policy type provides tailored protection, underscoring the importance of adequate coverage against title issues.

Additionally, the diligence in title searches and the careful handling of the closing process demonstrate the commitment of title insurance companies to protect property rights and ensure secure transactions. By fulfilling these responsibilities, they foster transparency and trust among all parties involved.

In essence, title insurance is not just a formality; it is a foundational component that strengthens the integrity and security of property ownership. For buyers, lenders, and real estate professionals, prioritizing title insurance is a strategic choice that helps prevent future disputes and financial losses, ultimately contributing to a more robust real estate market.

Discover how Parse AI can revolutionize your title research process—contact us today to learn more!

Frequently Asked Questions

What is title protection in real estate?

Title protection is a type of indemnity coverage that safeguards against monetary loss arising from flaws in a deed to real estate. It protects purchasers and financiers against potential issues that may arise from claims against the property.

How does title protection differ from other types of insurance?

Unlike other types of coverage that protect against future events, title protection safeguards against past occurrences, ensuring that the property being acquired is free from any legal complications.

What functions do title insurance companies perform?

Title insurance companies perform several critical functions, including conducting comprehensive ownership searches, issuing insurance policies, and overseeing the closing process to ensure a seamless transfer of ownership.

What are the two main types of title insurance policies?

The two main types of title insurance policies are: 1. Owner's Insurance, which protects the buyer's equity in the asset against ownership defects. 2. Lender's Insurance, which safeguards the lender's investment in the real estate.

How long do title insurance policies remain in effect?

Title insurance policies are generally issued for a one-time premium and remain in effect as long as the insured has an interest in the asset.

What is the importance of name searches in title insurance?

Name searches involve a thorough review of public records to confirm the legal ownership of an asset and identify any existing liens, easements, or encumbrances. This process helps safeguard purchasers and lenders from conflicts and monetary setbacks.

What role do title companies play in the closing process?

Title companies manage the closing process by preparing necessary documents, managing funds, ensuring legal requirements are met, and providing a closing disclosure to all parties involved.

How does technology, like Parse AI, enhance the functions of title insurance companies?

Parse AI enhances the functions of title insurance companies by expediting document processing and improving research automation through capabilities such as full-text search and OCR technology, making the extraction of vital information from unstructured documents more efficient.