Overview

Understanding the title of a property is paramount for real estate professionals. It confirms ownership and delineates the rights associated with the asset, significantly impacting transactions. A clear comprehension of property titles and their legal implications is essential, as it mitigates ownership disputes and enhances the overall efficiency of real estate dealings. This, in turn, safeguards the interests of both buyers and sellers.

Introduction

In the intricate world of real estate, understanding property titles is paramount for both buyers and professionals alike. A property title serves as the cornerstone of ownership, detailing rights and responsibilities while safeguarding against potential disputes. Statistics reveal that many transactions face challenges due to unclear titles; thus, the importance of mastering this subject cannot be overstated.

Furthermore, from the nuances of various title types to the critical role of title insurance, this article delves into the complexities surrounding property titles, offering insights and best practices that can help navigate the often turbulent waters of real estate transactions. By equipping oneself with this knowledge, stakeholders can not only protect their investments but also foster smoother, more successful dealings in the property market.

What is a Property Title and Why is it Important?

A real estate document serves as a critical legal instrument that confirms ownership of an asset, detailing the rights of the holder, including the capacity to sell, lease, or modify the asset. For real estate professionals, a comprehensive understanding of ownership documents is indispensable, as these documents form the foundation of all transactions. A distinct heading not only affirms that the owner possesses the legal entitlement to the asset but also ensures that it is free from disputes or claims by outside parties.

Data from the Home Mortgage Disclosure Act (HMDA) indicates that a significant percentage of transactions encounter challenges related to ambiguous ownership documents, underscoring the prevalence of ownership conflicts.

Recent developments in the real estate sector underscore the urgency of addressing ownership disputes proactively. For instance, the Standard & Poor's CoreLogic Case–Shiller Home Price Indices reveal trends in real estate values that can be profoundly influenced by ownership clarity. Properties with clear ownership tend to maintain or increase in value, whereas those embroiled in conflicts may see a decline.

Moreover, case studies, such as the one involving Veya, demonstrate how advanced deed tools can avert fall-throughs in real estate transactions. By ensuring that buyers are fully apprised of any potential issues related to a real estate asset prior to finalizing a purchase, this approach mitigates the risk of last-minute withdrawals and enhances buyer satisfaction. Industry experts emphasize that understanding ownership documents transcends mere legal formalities; it is a vital component of successful real estate dealings.

As Quarnelia Patterson from The Taylor Group Walzel Properties articulates, conducting thorough market analyses and utilizing reliable data sources are essential for informed decision-making. This insight accentuates the necessity for real estate professionals to prioritize transparency in asset ownership to safeguard their investments and facilitate smoother transactions. Furthermore, telecommunications companies leverage asset information for targeted marketing and infrastructure development, illustrating the broader implications of ownership clarity beyond real estate transactions.

Types of Property Titles: An Overview

The title of a property is fundamental to real estate transactions, and understanding the various types is crucial for professionals in the industry. Here are the primary types of property titles:

- Fee Simple: This signifies the most complete form of possession, granting the proprietor full rights to the asset, including the ability to sell, lease, or bequeath it. Fee simple title is prevalent, representing approximately 70% of real estate transactions, making it the most common title type.

- Leasehold: In this arrangement, ownership is granted for a specified period, after which the asset reverts to the landlord. Leasehold interests are frequently observed in commercial real estate, where businesses may lease assets for prolonged durations, generally spanning from 30 to 99 years.

- Joint Tenancy: This co-ownership structure allows each party to have equal rights to the property, along with the right of survivorship. If one owner passes away, their share automatically transfers to the surviving owners, simplifying the transfer process but requiring careful consideration in estate planning.

- Tenancy in Common (TIC): Unlike joint tenancy, TIC permits unequal possession shares among co-owners, and each party can sell or transfer their share independently. This structure is attractive to smaller investors, as it enables simpler transitions in control. A notable case study illustrates that TIC allows for flexibility in ownership, but it does not provide automatic inheritance rights, and shares are distributed according to state probate laws if an owner dies without a will.

- Community Asset: This title type is specific to married couples, where both partners possess the asset equally. Community asset laws differ by state, affecting how resources are allocated in the case of divorce or death.

Recent trends suggest a rising fascination with alternative control frameworks, such as partnerships in commercial real estate (CRE), which enable multiple parties to combine resources for investment in real assets. This collaborative approach can enhance investment opportunities while distributing risk among partners.

As Mark P. Keightley pointed out, "These documents were prepared by the Congressional Research Service (CRS)," highlighting the significance of comprehending the intricacies of real estate. Understanding the categories of property titles and their implications is crucial for real estate experts, as they directly influence deal processes, rights of possession, and investment strategies. By staying informed about these frameworks, professionals can better navigate the complexities of real estate and provide valuable insights to their clients.

Title vs. Deed: Key Differences Explained

The terms 'title' and 'deed' are frequently confused, yet they represent distinct concepts in real estate transactions.

Title denotes the legal right to own and utilize a property, embodying the concept of ownership and encompassing the rights and interests associated with the property. Deed, conversely, is a concrete legal document that enables the transfer of ownership from one party to another. For a deed to be legally binding, it must be properly executed and recorded.

Understanding the distinction between ownership documents and deeds is crucial for real estate experts. Misunderstandings can lead to substantial legal conflicts, especially in situations where claims to assets are disputed. Disputes often arise when buyers assume that a deed guarantees the title of a property, not realizing that the deed merely transfers ownership without ensuring the absence of liens or claims.

Statistics indicate that a considerable number of real estate disputes stem from these misunderstandings, with older adults and owners of vacant lots being particularly vulnerable to deed fraud. This highlights the necessity for professionals to be well-versed in both concepts. Furthermore, understanding the various types of deeds—such as General Warranty Deeds and Quitclaim Deeds—is crucial, as they offer differing levels of protection that can significantly impact the title of a property during transfers.

For example, a General Warranty Deed provides the highest level of protection by ensuring that the seller guarantees the title of a property, while a Quitclaim Deed offers no such assurances.

As highlighted by Bankrate, 'Our aim is to provide you with the best guidance to assist you in making wise personal finance choices,' which emphasizes the significance of grasping these differences in real estate dealings. Real estate experts must prioritize this knowledge to protect their clients' interests and navigate the complexities of ownership effectively. By doing so, they can mitigate common legal issues and enhance their overall service quality.

Common Title Issues and How to Resolve Them

Common title issues can significantly impact property transactions and include the following:

- Liens: These claims against the asset arise due to unpaid debts, such as mortgages or tax obligations. To resolve a lien, the owner must either pay off the debt or negotiate a settlement with the creditor. Statistics indicate that unresolved liens can delay real estate sales, making timely resolution crucial. Notably, a recent settlement of $22.7 million by Fidelity National Financial and First American Title Insurance Co. underscores the financial implications of unresolved title issues.

- Boundary Disputes: Conflicts over land lines frequently arise, particularly in densely populated areas. Resolving these disputes may require professional surveys to accurately determine boundaries or, in some cases, legal action to clarify ownership rights. A significant case involved two adjacent estates where a survey uncovered an encroachment, resulting in a negotiated agreement that satisfied both parties.

- Clerical Errors: Mistakes in public records, such as misspelled names or inaccurate descriptions of assets, can lead to disputes. Amending these errors usually requires submitting a corrective deed to the relevant authorities, ensuring that the public record accurately represents possession.

- Undisclosed Heirs: Claims from previously unidentified heirs can complicate control over assets. Legal assistance is often necessary to navigate these claims, which may involve probate proceedings to establish rightful ownership. The emergence of undisclosed heirs can cause considerable delays in real estate dealings, emphasizing the necessity of comprehensive title searches.

- Fraudulent Transfers: Instances where assets are sold under false pretenses present serious challenges. Correcting these situations typically requires legal measures to nullify the deceptive exchange and reinstate rightful ownership. The importance of ownership insurance is highlighted here, as it protects property holders from potential ownership disputes that may arise post-closing. As Sandy Gadow, author of 'The Complete Guide to Your Real Estate Closing', states, "A property insurance policy will be your best safeguard against those and many other ownership issues that may become known after you finalize your transaction."

Addressing these issues promptly is crucial for maintaining clear property titles and protecting ownership rights. Ownership insurance plays a vital role in this process, offering long-term protection against undiscovered ownership issues, as illustrated by the case study on its significance. Furthermore, employing Parse AI can lead to substantial cost reductions compared to conventional property research techniques, enabling real estate professionals to tackle these common ownership concerns more effectively.

Real estate experts must be proactive in recognizing and addressing these frequent ownership issues to ensure seamless transactions and protect their clients' interests.

Conducting a Title Search: Steps and Best Practices

Conducting a comprehensive search of a property title is essential for ensuring a smooth real estate transaction. The following key steps must be followed:

- Gather Information: Begin by collecting all relevant details about the asset, including its address, current owner, and any previous owners. This foundational information is crucial for an effective title search.

- Search Public Records: Access real estate records through the county recorder's office or utilize online databases. These records provide vital information about the asset's legal status and any recorded documents.

- Examine the Chain of Title: Diligently follow the history of possession of the asset. This step is critical to identify any breaks or discrepancies in ownership that could complicate the transaction.

- Check for Liens and Encumbrances: Investigate any claims against the property, such as liens, judgments, back taxes, or easements. Recognizing these problems at an early stage is crucial, as they must be addressed before the title of a property can be considered 'clean.' A case study on frequent ownership issues emphasizes how awareness of potential problems enables buyers to proactively tackle them, ensuring a smoother transaction process. Upon completion of the ownership search, an initial report is provided to the buyer, highlighting any concerns regarding the title that could influence the purchase.

- Document Findings: Maintain detailed records of your search and any issues discovered. This documentation is vital for transparency and can serve as a reference in case of disputes.

Best practices for conducting a title search include:

- Searching for at least 40 years of ownership history to uncover any potential issues.

- Verifying all findings with official documents to ensure accuracy.

Statistics suggest that the typical search for ownership can require between 10 and 14 days, especially for more intricate inquiries concerning older real estate. This timeframe underscores the importance of thoroughness in the process. As noted by industry experts, "This step can make or break your deal, so it’s vital that you do your homework ahead of time."

By adhering to these best practices, real estate professionals can significantly reduce the risk of errors and enhance the overall efficiency of their transactions.

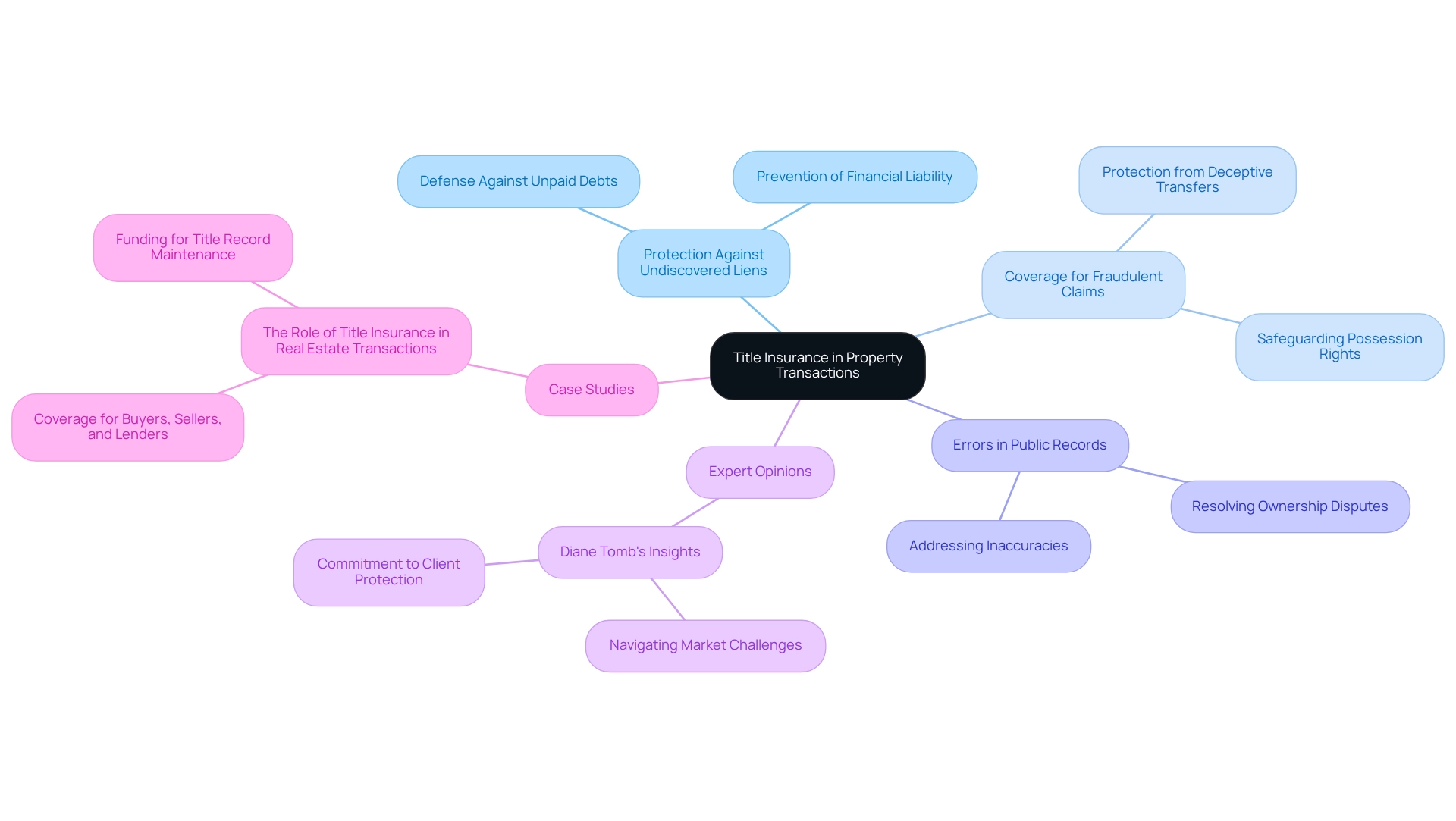

The Role of Title Insurance in Property Transactions

Title insurance serves as essential protection for buyers and lenders, safeguarding them from potential financial losses arising from defects in a property's title. This policy encompasses a range of issues, including:

- Undiscovered Liens: Title insurance defends against claims stemming from unpaid debts that may not be immediately visible, ensuring that buyers are not held accountable for the financial obligations of previous owners.

- Fraudulent Claims: The policy provides coverage for losses resulting from deceptive transfers or misrepresentations, which can jeopardize possession rights and lead to significant financial repercussions.

- Errors in Public Records: Title insurance also addresses inaccuracies in the recording of property documents, which can lead to confusion and disputes over ownership.

The importance of ownership insurance in real estate transactions, particularly concerning property titles, cannot be overstated. It not only delivers peace of mind but also functions as a financial safety net against unforeseen issues that may arise post-purchase. In fact, approximately 80% of real estate transactions include ownership insurance, underscoring its widespread acceptance and necessity within the industry.

Notably, as of 2008, the leading three insurance underwriters encountered financial challenges, highlighting the difficulties within the sector and the crucial role that such insurance plays in mitigating risks for buyers and lenders.

Expert opinions reinforce the significance of insurance for property ownership. As Diane Tomb, CEO of ALTA, stated, "Title professionals nationwide persist in steering their businesses through this difficult and unpredictable real estate cycle, committed to serving their clients, safeguarding ownership rights, and supporting their communities despite the unpredictability of the market." This assertion underscores the dedication of professionals in ensuring that property purchasers are shielded from potential defects that could lead to costly legal disputes or loss of property rights.

Furthermore, case studies illustrate that ownership insurance not only protects buyers but also facilitates smoother transactions by financing the necessary tasks to resolve and uphold ownership records. The case study titled "The Role of Insurance in Real Estate Transactions" delineates the essential functions of ownership protection, including the coverage it provides for various parties involved, such as buyers, sellers, lenders, and real estate professionals.

In conclusion, the title of a property represents a critical aspect of insurance for real estate transactions, offering vital protection for both buyers and lenders against the myriad risks associated with asset ownership.

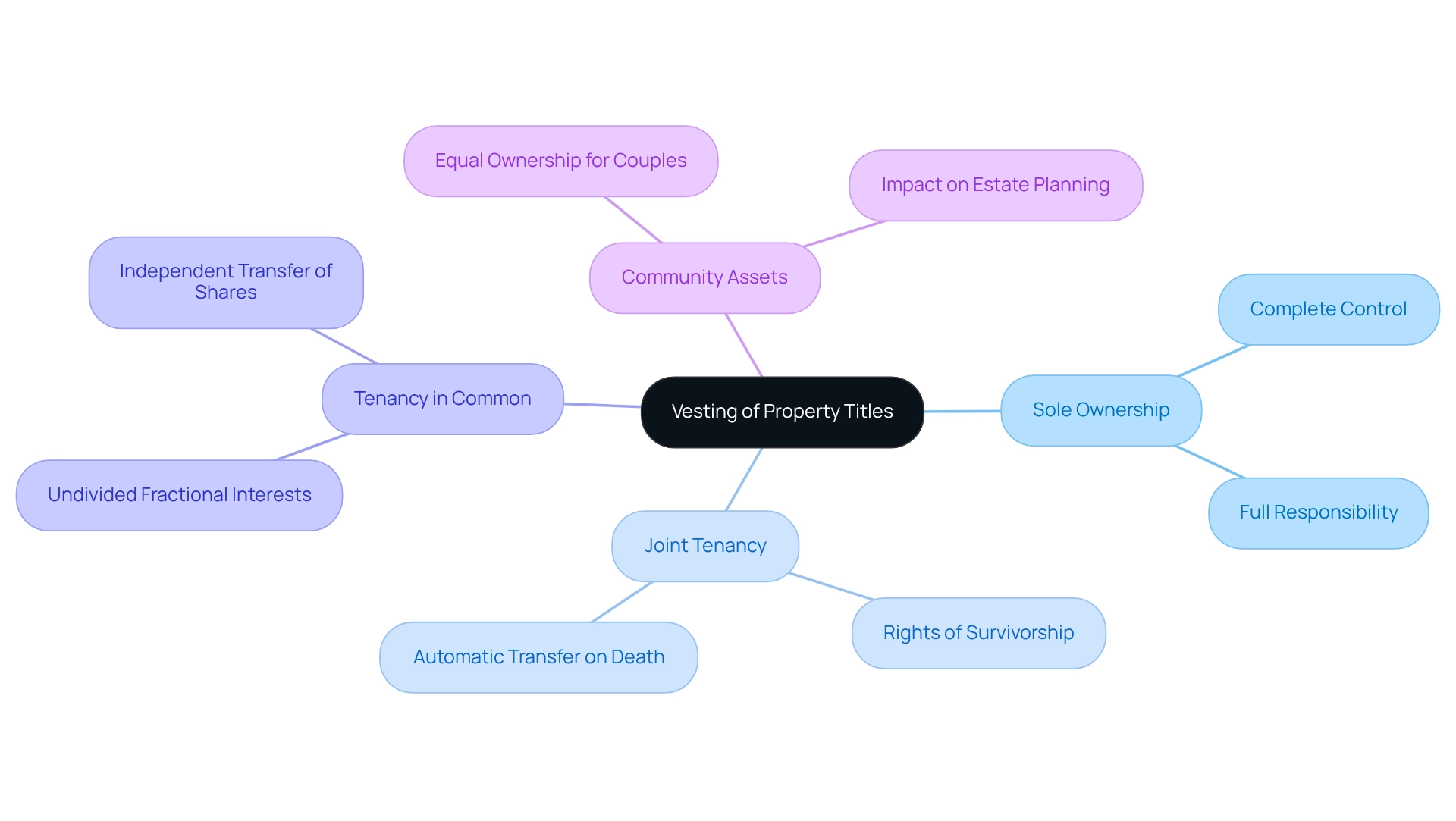

Proper Vesting of Property Titles: What You Need to Know

Vesting denotes the legal approach through which possession of an asset is maintained, playing a crucial role in defining clear rights and responsibilities. Proper vesting is essential for legal clarity and significantly impacts estate planning. The most common forms of vesting include:

- Sole Ownership: In this scenario, a single individual possesses the title of a property, granting them complete control and responsibility.

- Joint Tenancy: This form allows two or more individuals to share possession, typically with rights of survivorship. Upon the death of one owner, their share automatically transfers to the surviving owner(s).

- Tenancy in Common: Co-owners possess undivided fractional interests in the asset, which can be unequal in quantity or duration. Each owner can transfer their share independently, making this a flexible option for many.

- Community Assets: Frequently used by married couples, this arrangement ensures that both partners possess the assets equally, which can have substantial consequences for estate planning and asset allocation.

The selection of vesting type is vital, as it affects not only rights but also the simplicity of asset distribution upon an owner's death. Properties held in tenancy in common typically require probate for asset distribution, a process that can be lengthy and costly. In contrast, joint tenancy simplifies this process due to the right of survivorship.

Legal professionals emphasize the importance of selecting the suitable form of property to avoid potential legal and tax issues. The California Land Title Association recommends that real estate buyers thoughtfully evaluate the title of a property and their titling choices before finalizing. Consulting legal advice is essential if they are unaware of the most appropriate holding option for their circumstances.

Case studies demonstrate the practical effects of incorrect vesting. For instance, an asset held in exclusive control without a clear estate plan can result in complications and conflicts among heirs. Conversely, assets vested appropriately enable smoother transitions and reduce legal obstacles.

Grasping the subtleties of asset vesting is crucial for real estate professionals, as it directly influences estate planning and ownership rights. By ensuring proper vesting, individuals can safeguard their interests and streamline the process of asset transfer.

Legal Considerations in Property Titles: Navigating Complexities

Understanding the legal aspects of property titles is essential for real estate experts to manage dealings efficiently and protect their clients' interests. Key aspects include compliance with local laws, which is crucial for ensuring that property transactions are valid and enforceable. Non-compliance can lead to substantial legal consequences, including potential nullification of dealings. Monitoring HOA lien status through HOA Lien Reports is a vital part of this compliance.

Title defects, such as liens or claims from prior ownership, can complicate property title dealings. Real estate attorneys emphasize the importance of identifying these issues early in the process to avoid costly delays and disputes. Rande Yeager, president of the American Land Association, states, 'This clearly demonstrates the significance of a professional search in all real estate dealings, whether acquiring a new home or refinancing an existing mortgage.' Statistics indicate that a notable percentage of transactions are affected by title defects, underscoring the necessity for thorough title searches to ensure the integrity of property titles.

Furthermore, interpreting legal language is critical. The ability to read and understand legal documents related to real estate encompasses grasping the consequences of various clauses and conditions that may influence property rights and responsibilities.

Real estate experts must also be aware of the complexities surrounding ownership laws, as these can vary significantly by jurisdiction. For instance, compliance issues with local real estate regulations can create conflicts that not only influence the deal but also the long-term ownership of the asset. A case study analyzing the historical context of the registration system reveals how legal frameworks have evolved, often prioritizing asset value over individual rights, perpetuating structural inequalities rooted in racial violence.

In summary, a thorough understanding of these legal factors is crucial for real estate professionals to navigate the complexities of transactions successfully.

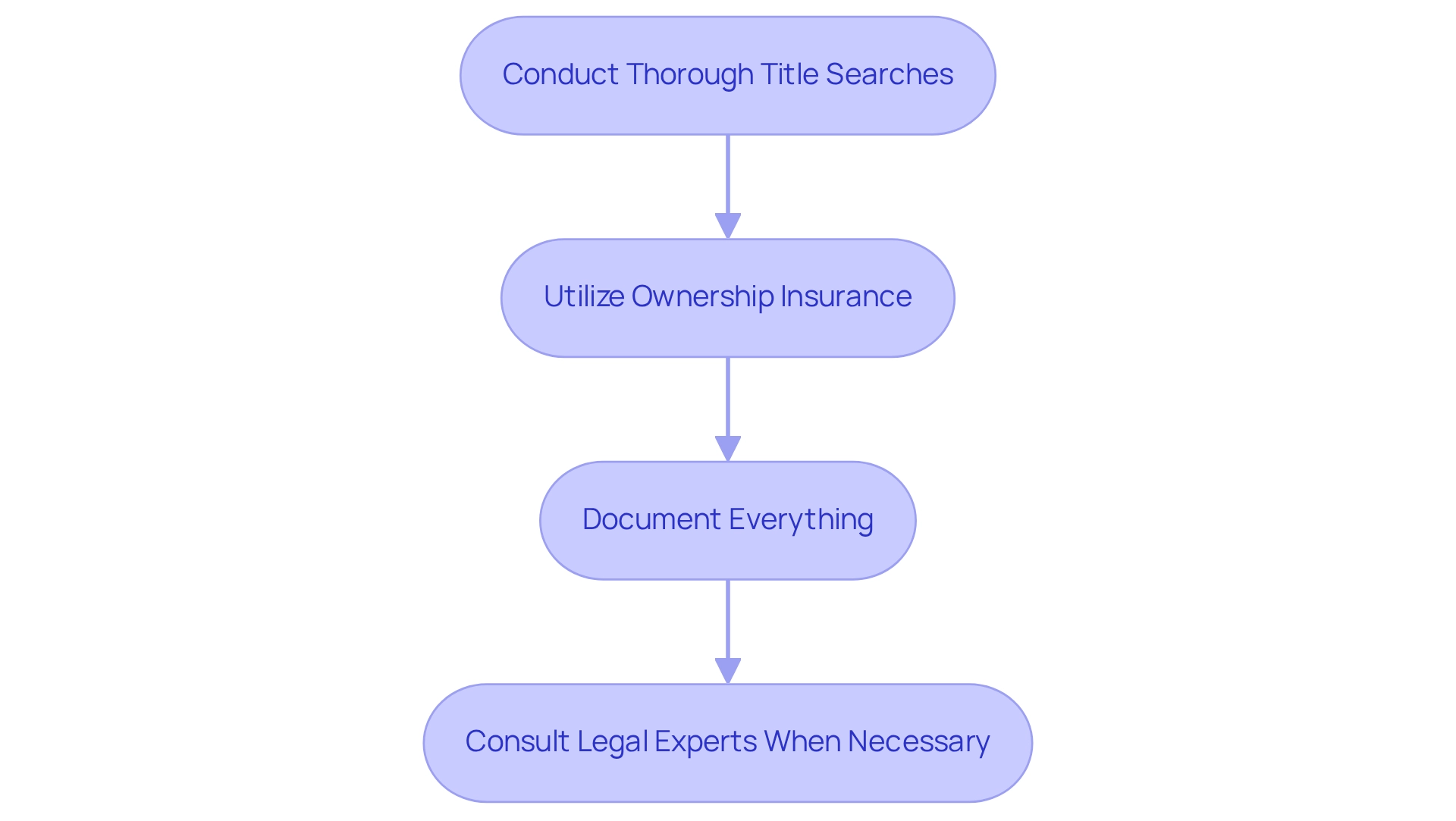

Best Practices for Managing Property Titles in Real Estate

To effectively manage property documents, real estate professionals must adopt best practices that ensure accuracy and compliance.

- Conduct Thorough Title Searches: Verifying ownership history meticulously and checking for liens or encumbrances is essential. A thorough search of property records can reveal vital information that influences the transaction's success. Examining affidavits can also provide crucial effective date information, ensuring all necessary details are covered for a precise search.

- Utilize Ownership Insurance: This insurance acts as a safeguard for clients against potential ownership defects, offering peace of mind and financial protection. It is vital in guaranteeing that all parties engaged in an exchange are protected from unexpected claims. Staying informed about legal changes in real estate law and regulations enhances compliance and empowers professionals to navigate complex legal landscapes, ultimately improving deal outcomes. Nations such as Denmark, New Zealand, and Norway have established effective asset registration systems through digitization, significantly decreasing transfer durations. This highlights the importance of adapting to technological progress in the sector.

- Document Everything: Keeping comprehensive records of all dealings and correspondence related to real estate is essential. This practice aids in transparency and serves as a valuable resource in case of disputes or inquiries.

- Consult Legal Experts When Necessary: Engaging with attorneys for intricate ownership issues ensures compliance and effective resolution of potential problems. Legal knowledge provides perspectives that improve the overall administration of ownership documents.

By following these best practices, real estate experts can enhance their efficiency and effectiveness in overseeing ownership documents, resulting in more successful dealings. For instance, the creation of a unified electronic land database in Russia has demonstrated how streamlined processes can decrease property transfer times by up to 22 days, underscoring the impact of effective ownership management practices. Furthermore, as seen in countries like Denmark and New Zealand, digitization and electronic registration have drastically reduced transfer times, emphasizing the importance of staying informed and adapting to technological advancements in the field.

As Todd Ortscheid, Chairman, President, & CEO, emphasizes, effective management of a property's title is crucial for successful real estate transactions.

Conclusion

Understanding property titles is essential for navigating the complexities of real estate transactions. This article has illuminated the various aspects of property titles, from the different types such as fee simple, leasehold, and community property, to the critical distinctions between title and deed. The importance of clear titles cannot be overstated, as unclear titles can lead to disputes that complicate transactions and diminish property values.

Title insurance emerges as a vital tool in safeguarding against potential risks associated with property ownership, providing peace of mind for both buyers and lenders. Furthermore, the necessity of conducting thorough title searches and understanding legal considerations is emphasized to mitigate common title issues, such as liens and boundary disputes. Adopting best practices, including maintaining detailed documentation and consulting legal experts, can significantly enhance the management of property titles.

In conclusion, a comprehensive understanding of property titles is not just beneficial but imperative for all stakeholders in the real estate market. By prioritizing title clarity and employing effective management strategies, real estate professionals can protect their clients' investments and contribute to smoother, more successful transactions. The knowledge gained from mastering property titles ultimately fosters a more secure and reliable real estate environment, benefiting everyone involved.

Frequently Asked Questions

What is the purpose of a real estate document?

A real estate document serves as a legal instrument that confirms ownership of an asset and details the rights of the holder, including the ability to sell, lease, or modify the asset.

Why is understanding ownership documents important for real estate professionals?

A comprehensive understanding of ownership documents is essential for real estate professionals as these documents form the foundation of all transactions and ensure that the owner possesses legal entitlement to the asset without disputes or claims from outside parties.

What challenges can arise from ambiguous ownership documents?

Ambiguous ownership documents can lead to ownership conflicts, which are prevalent in real estate transactions, as indicated by data from the Home Mortgage Disclosure Act (HMDA).

How can ownership clarity affect real estate values?

Properties with clear ownership tend to maintain or increase in value, while those with ownership conflicts may experience a decline in value, as shown by trends in the Standard & Poor's CoreLogic Case–Shiller Home Price Indices.

What role do advanced deed tools play in real estate transactions?

Advanced deed tools can help prevent fall-throughs in real estate transactions by ensuring that buyers are informed of any potential issues related to a property before finalizing a purchase, thus enhancing buyer satisfaction.

What types of property titles are commonly recognized in real estate?

The primary types of property titles include Fee Simple, Leasehold, Joint Tenancy, Tenancy in Common (TIC), and Community Asset.

What is a Fee Simple title?

A Fee Simple title signifies the most complete form of possession, granting the owner full rights to the asset, including the ability to sell, lease, or bequeath it.

How does Joint Tenancy differ from Tenancy in Common?

Joint Tenancy allows co-owners to have equal rights and includes the right of survivorship, while Tenancy in Common permits unequal shares among co-owners, and each party can sell or transfer their share independently.

What is the difference between a title and a deed in real estate?

Title refers to the legal right to own and use a property, while a deed is a legal document that facilitates the transfer of ownership from one party to another.

Why is it important for real estate experts to understand the distinction between titles and deeds?

Understanding the distinction is crucial to avoid misunderstandings that can lead to legal conflicts, particularly in situations where claims to assets are disputed.