Overview

Title companies expertly manage closings through a systematic process that encompasses:

- Conducting thorough title searches

- Preparing essential legal documents

- Facilitating the seamless exchange of funds and ownership

This article meticulously outlines each step, underscoring the critical role of technology in enhancing both efficiency and accuracy throughout the closing process—from the initiation of escrow to the finalization of post-closing registrations. Furthermore, it highlights the significance of precise title research, the challenges encountered in the field, and the solutions that not only address these challenges but also offer substantial benefits to all parties involved.

Introduction

In the intricate world of real estate, title companies emerge as pivotal players, ensuring that property transactions unfold with precision and security. Their multifaceted roles encompass:

- Conducting thorough title searches

- Managing escrow funds

Ultimately, they safeguard the interests of both buyers and sellers. As the industry evolves, a pressing question arises: how can these companies harness technology to bolster their efficiency and accuracy in the closing process? By exploring this step-by-step approach, we not only uncover the essential functions of title companies but also the transformative impact of innovative tools on the future of real estate transactions.

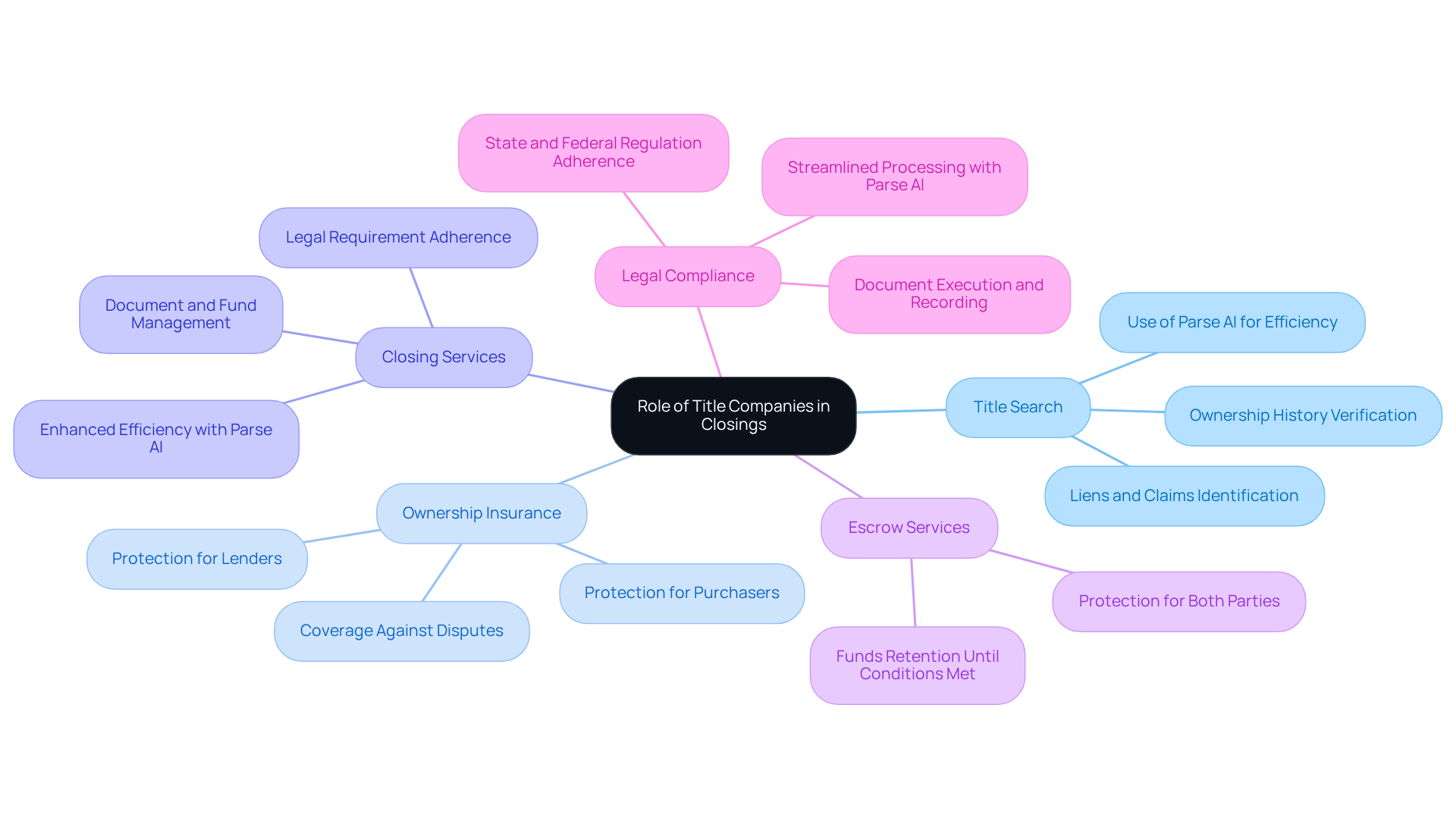

Understand the Role of Title Companies in Closings

Document services play a crucial role in real estate dealings, ensuring that are valid and free of liens. Their primary functions are multifaceted and essential:

- Title Search: Title firms conduct thorough investigations of public records to confirm ownership history and uncover any liens or claims against the property. This process is vital, as approximately 80% of real estate transactions involve these firms, underscoring their essential role in verifying property ownership. With Parse AI's advanced machine learning tools, document processing and analysis can be accelerated, enabling faster and more precise searches.

- Furthermore, they provide ownership insurance policies that protect both purchasers and lenders from potential disputes regarding property rights. This insurance is critical in safeguarding against unforeseen issues that may arise post-purchase, such as undisclosed liens or ownership claims.

- Closing Services: Title firms facilitate the closing process by managing the exchange of documents and funds between buyers and sellers, ensuring adherence to all legal requirements. This step is crucial for a seamless transaction, as it helps avert future legal complications. The integration of Parse AI's interactive document labeling enhances efficiency through customized data extraction.

- Escrow Services: Title firms often retain funds in escrow until all sale conditions are fulfilled, providing protection for both parties involved. This practice ensures that neither party is at risk until all contractual obligations are satisfied.

- Legal Compliance: Title companies guarantee that all documents are properly executed and recorded, complying with state and federal regulations. This compliance is essential to prevent legal issues post-closing, reinforcing the significance of their role in the transaction process. Enhanced courthouse document processing with Parse AI, including full-text search and machine learning extraction, streamlines runsheet creation, further supporting legal compliance.

emphasize the necessity of thorough property investigations, noting that a comprehensive search can prevent costly disputes and protect investments. The importance of ownership insurance is paramount in property ownership conflicts, providing reassurance for both purchasers and lenders alike.

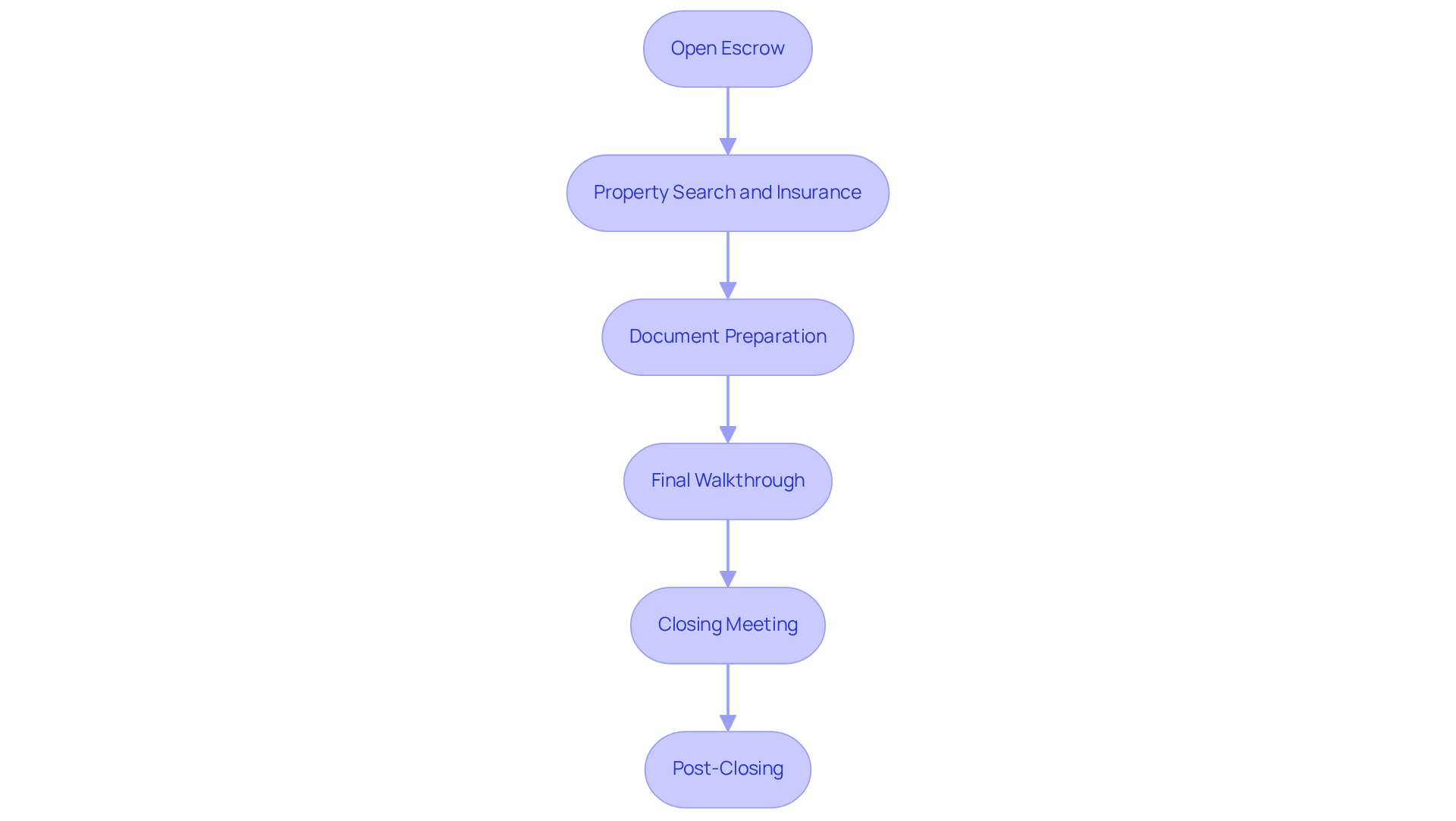

Follow the Step-by-Step Closing Process

The closing process typically involves several key steps:

- Open Escrow: Following the signing of the purchase agreement, an escrow account is established to securely hold the buyer's deposit and other necessary funds.

- Property Search and Insurance: The firm conducts a thorough property examination to confirm that the asset is free of liens, subsequently issuing an insurance policy to protect against potential future claims.

- Document Preparation: Essential legal documents are meticulously prepared by the firm, including the deed, settlement statement, and any supplementary paperwork required for the transaction.

- Final Walkthrough: Prior to closing, the buyer is encouraged to perform a final walkthrough of the property to ensure it meets the agreed-upon condition.

- Closing Meeting: All parties convene to sign the necessary documents, finalize the transaction, and transfer funds. The organization oversees how to ensure that all procedures are executed accurately.

- Post-Closing: After the closing, the deed company registers the new deed with the county and distributes funds to the seller and other involved parties.

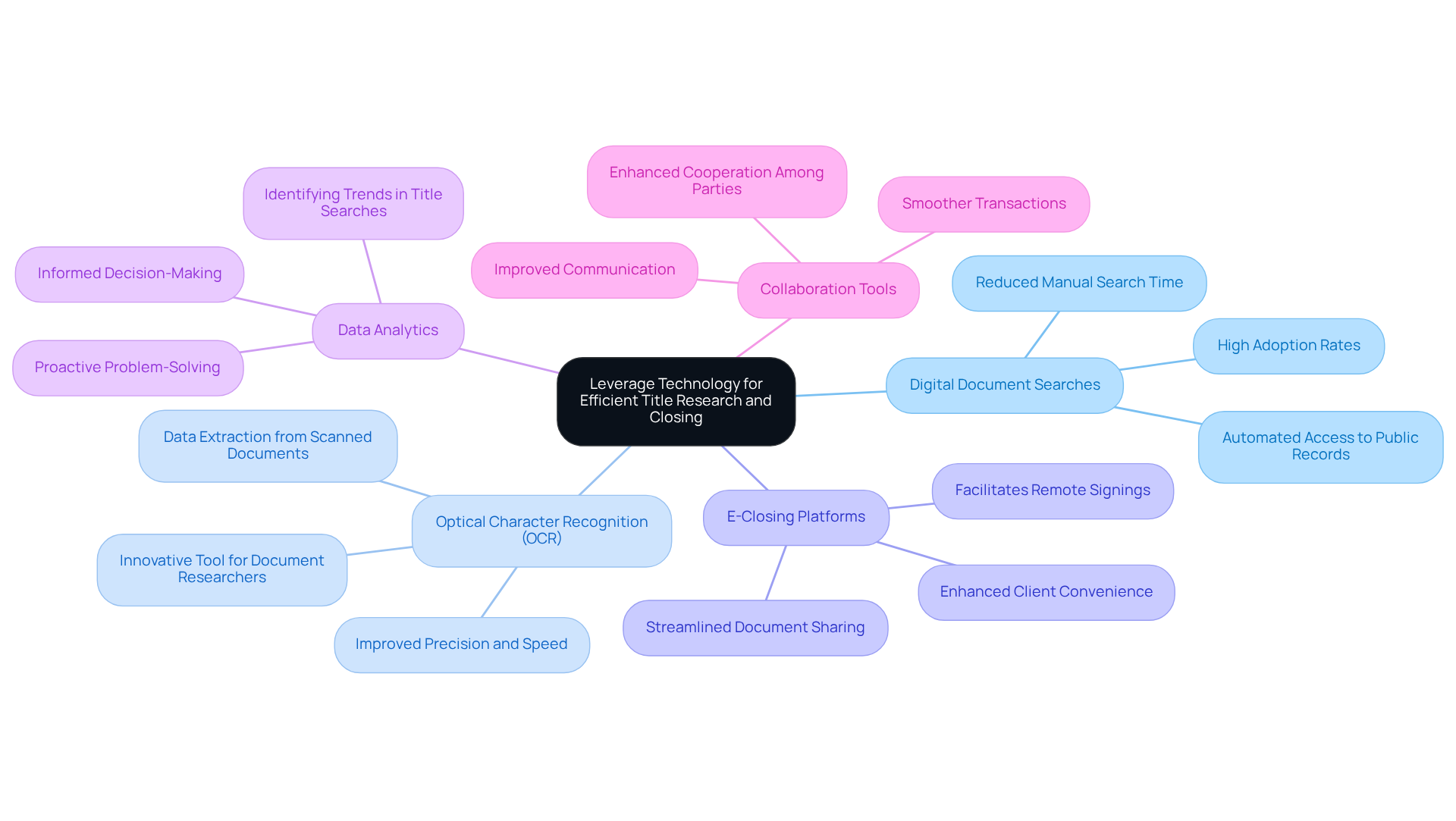

Leverage Technology for Efficient Title Research and Closing

Integrating technology into document research and closing processes significantly enhances efficiency and precision. Several effective strategies can be leveraged to harness this potential:

- Digital Document Searches: Implement software that automates the document search process, enabling rapid access to public records and substantially reducing the time spent on manual searches. Current adoption rates indicate that an increasing number of firms are embracing these digital solutions to enhance operations. According to Statista, 91% of companies are engaged in some form of digital initiative, underscoring the industry's shift towards technology.

- Optical Character Recognition (OCR): Utilize advanced OCR technology to extract data from scanned documents, simplifying the compilation and analysis of information related to titles. Recent advancements in OCR have improved precision and speed, making it an invaluable resource for document researchers. As Kendall Bird aptly states, "Imagination is more important than knowledge," highlighting the necessity for innovative tools in the industry.

- E-Closing Platforms: Adopt that facilitate remote signings and document sharing, thereby streamlining the closing process and enhancing client convenience. These platforms not only improve efficiency but also cater to the rising demand for flexible transaction methods. The digital transformation market is projected to grow significantly, with spending expected to reach $3.4 trillion by 2026.

- Data Analytics: Leverage data analytics tools to identify trends and potential issues in title searches, allowing for proactive problem-solving prior to closing. This analytical approach fosters informed decision-making and risk mitigation. As Gary Adler asserts, "At least 40% of all businesses will die in the next ten years if they don’t figure out how to change their entire company to accommodate new technologies."

- Collaboration Tools: Utilize project management and communication tools to enhance cooperation among all parties involved in the process. This ensures that everyone remains informed and aligned, ultimately leading to smoother transactions. The case study 'Parse AI: Revolutionizing Research on Property Ownership' illustrates how technology can transform research, enabling researchers to complete abstracts and reports more swiftly and accurately.

By integrating these technologies, title companies can not only enhance their operational efficiency but also improve how title companies manage closings, thereby positioning themselves competitively in a rapidly evolving industry.

Conclusion

The intricate role of title companies in managing real estate closings is paramount. They serve as a vital link in the property transaction process, ensuring that ownership records are accurate and devoid of encumbrances. Through meticulous title searches, provision of ownership insurance, and facilitation of the closing process, title companies safeguard the interests of both buyers and sellers, ultimately contributing to a smoother and more secure real estate experience.

Key functions of title companies include:

- Conducting property searches

- Preparing essential documents

- Ensuring legal compliance

These functions have been highlighted throughout the article. The step-by-step closing process illustrates how these firms orchestrate various elements to protect all parties involved. Furthermore, the integration of technology—such as digital document searches and e-closing platforms—enhances the efficiency and accuracy of these processes, showcasing the industry's shift towards innovation.

In conclusion, understanding the comprehensive services provided by title companies is essential for anyone involved in real estate transactions. Embracing modern technologies not only streamlines operations but also fortifies the security of property ownership. As the landscape of real estate continues to evolve, leveraging these advancements will be crucial for title companies to remain competitive and effective in safeguarding the interests of buyers and sellers alike.

Frequently Asked Questions

What is the primary role of title companies in real estate transactions?

Title companies play a crucial role in ensuring that property ownership records are valid and free of liens, conducting title searches, providing ownership insurance, facilitating closing services, managing escrow funds, and ensuring legal compliance.

What is involved in a title search conducted by title companies?

Title firms conduct thorough investigations of public records to confirm the ownership history of a property and uncover any liens or claims against it, which is essential for verifying property ownership.

How significant is the role of title companies in real estate transactions?

Approximately 80% of real estate transactions involve title companies, highlighting their essential function in verifying property ownership and preventing future legal complications.

What is ownership insurance, and why is it important?

Ownership insurance policies protect purchasers and lenders from potential disputes regarding property rights, safeguarding against unforeseen issues such as undisclosed liens or ownership claims that may arise after a purchase.

What services do title companies provide during the closing process?

Title firms facilitate the closing process by managing the exchange of documents and funds between buyers and sellers, ensuring adherence to all legal requirements to avert future legal complications.

What are escrow services provided by title companies?

Title firms often retain funds in escrow until all sale conditions are fulfilled, providing protection for both parties involved in the transaction until all contractual obligations are satisfied.

How do title companies ensure legal compliance during real estate transactions?

Title companies guarantee that all documents are properly executed and recorded in compliance with state and federal regulations, which is essential to prevent legal issues post-closing.

Why is thorough property investigation emphasized by real estate experts?

A comprehensive property investigation can prevent costly disputes and protect investments, making it a vital step in the real estate transaction process.

What technology is mentioned as enhancing the efficiency of title companies?

Parse AI's advanced machine learning tools are mentioned as enhancing document processing and analysis, enabling faster and more precise title searches and improving efficiency in legal compliance.