Overview

When a title company makes a mistake, it can lead to significant legal disputes, financial burdens, and even the potential loss of property for buyers. This underscores the critical importance of accurate title research. The article outlines the serious implications of such errors, including unexpected liabilities for unpaid liens. Furthermore, it emphasizes the necessity for meticulous research and quality assurance measures to prevent these costly mistakes in real estate transactions.

Introduction

The role of a title company in real estate transactions is pivotal, serving as the guardian of property ownership and a facilitator of smooth transfers. However, even the most diligent firms can falter, potentially leading to catastrophic mistakes that ripple through the lives of buyers and sellers alike.

What happens when a title company makes a mistake? From legal disputes to unexpected financial burdens, the implications are far-reaching and can jeopardize investments and ownership rights. Understanding these risks and exploring preventive measures is essential for anyone navigating the complex landscape of real estate transactions.

Define Title Company and Its Role in Real Estate Transactions

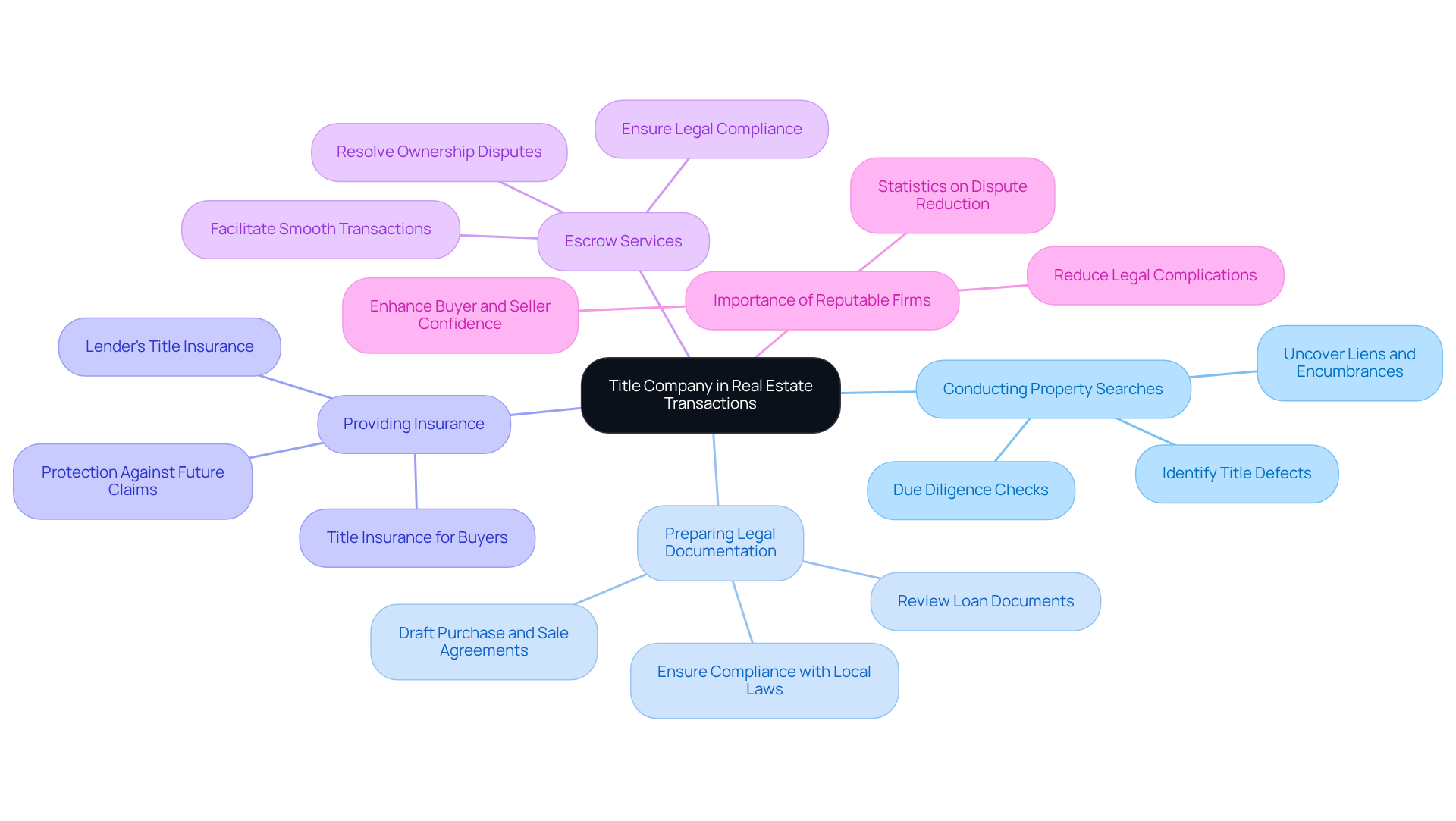

A designation firm is an essential entity in real estate transactions, tasked with confirming property ownership and facilitating the transfer of possession. Their primary functions include:

- Conducting thorough property searches to uncover any liens, encumbrances, or defects.

- Preparing vital legal documentation.

- Providing insurance to protect buyers and lenders from potential future claims.

Furthermore, as impartial intermediaries, escrow services are pivotal in ensuring that transactions proceed smoothly and legally, thereby safeguarding the interests of all parties involved. Their expertise is crucial in resolving disputes over ownership and ensuring adherence to local laws and regulations. According to industry specialists, the involvement of reputable firms significantly reduces the likelihood of legal complications, underscoring their importance in the ownership verification process. Statistics indicate that transactions involving ownership firms experience fewer disputes, further highlighting their critical role in the real estate sector.

Identify Common Mistakes Made by Title Companies

Clerical mistakes rank among the most frequent errors committed by firms, with issues such as name misspellings and inaccurate legal descriptions often leading to significant complications in ownership. These seemingly minor oversights can escalate into major disputes, particularly when they result in misinterpretations of property rights.

Furthermore, property firms may neglect existing liens or encumbrances, creating unforeseen financial obligations for purchasers. Complex title issues, including federal tax liens and code enforcement fines, can further complicate matters. The inability to sufficiently confirm the identities of all individuals involved increases the risk of fraud, especially in transactions concerning vacant land, which is a prime target for fraud due to neglected properties and remote owners.

As Jaylee Porcelli, a Senior Escrow Closer, observes, "Vacant land deals are particularly susceptible to fraud because of insufficient physical oversight." The consequences of these mistakes are significant, impacting not only the immediate deal but also the long-term ownership rights of the parties involved.

Consequently, it is crucial for firms in the industry to maintain strict standards of precision and care to mitigate these risks and facilitate seamless real estate dealings. Additionally, acquiring ownership insurance is recommended to protect against concealed flaws that might jeopardize property rights.

Examine the Implications of Title Company Mistakes

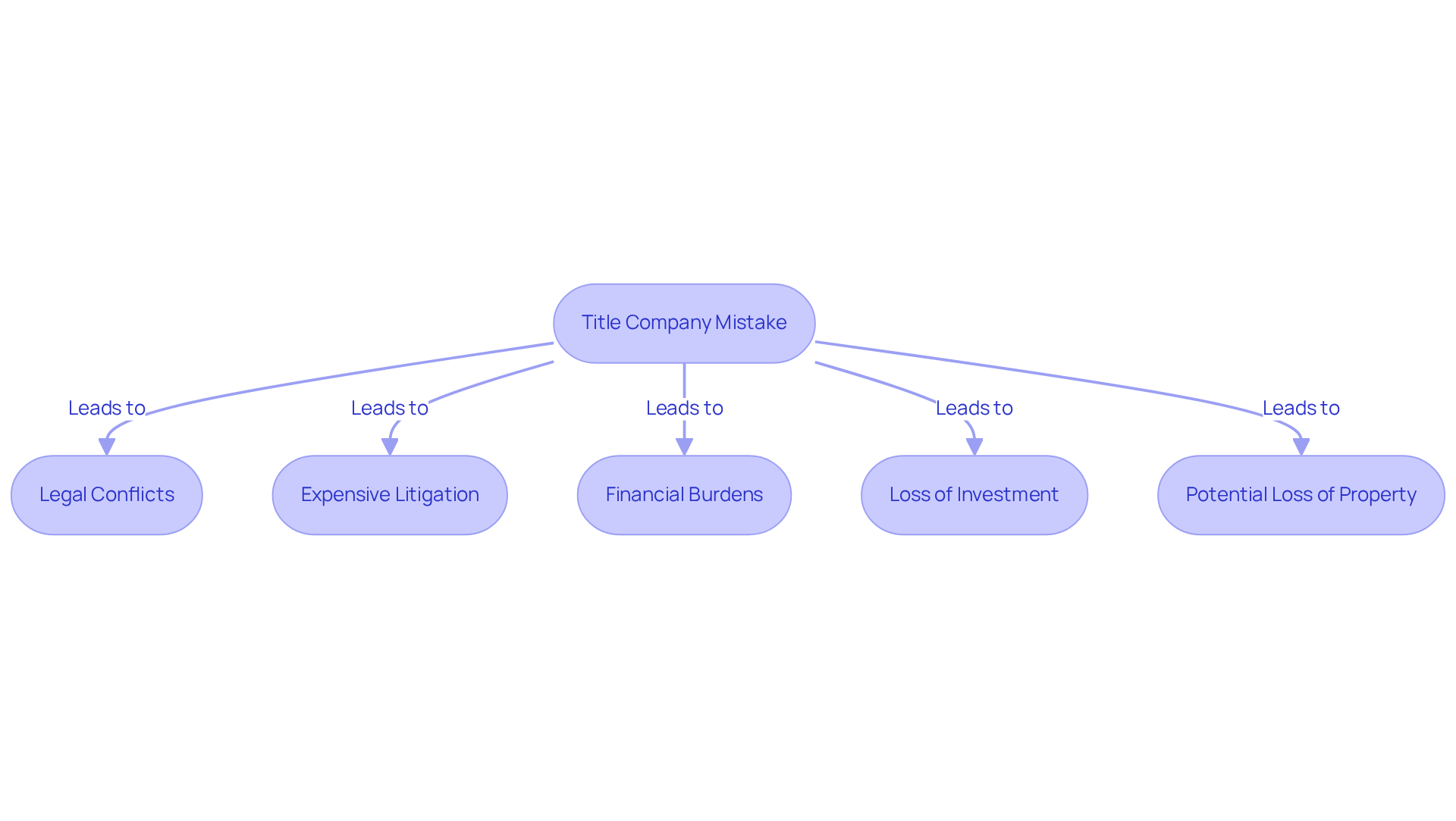

The substantial and extensive repercussions of errors committed by property firms illustrate what happens when a title company makes a mistake. Mistakes in research often lead to legal conflicts regarding ownership, highlighting what happens when a title company makes a mistake, which results in expensive litigation and prolonged delays in finalizing transactions. Buyers may unexpectedly find themselves liable for unpaid liens or encumbrances that were not disclosed, creating unforeseen financial burdens.

For instance, what happens when a title company makes a mistake regarding unresolved ownership defects can jeopardize the validity of a sale, potentially causing buyers to lose their entire investment. In extreme situations, what happens when a title company makes a mistake with an ownership document may even lead to the loss of the property itself.

According to industry specialists, the financial consequences of document flaws can be significant, underscoring the necessity of meticulous precision and thoroughness in research to ensure smooth and secure real estate dealings. Involving a trustworthy firm, such as Certified Title Corporation, is crucial to recognize and address these matters before they develop into significant legal obstacles.

Furthermore, purchasers risk forfeiting substantial sums, such as a $10,000 escrow deposit, if they cancel deals due to mistakes made by the agency. This situation emphasizes what happens when a title company makes a mistake, showcasing the critical importance of professional assistance in navigating potential pitfalls in real estate transactions.

Explore Solutions and Preventive Measures for Title Errors

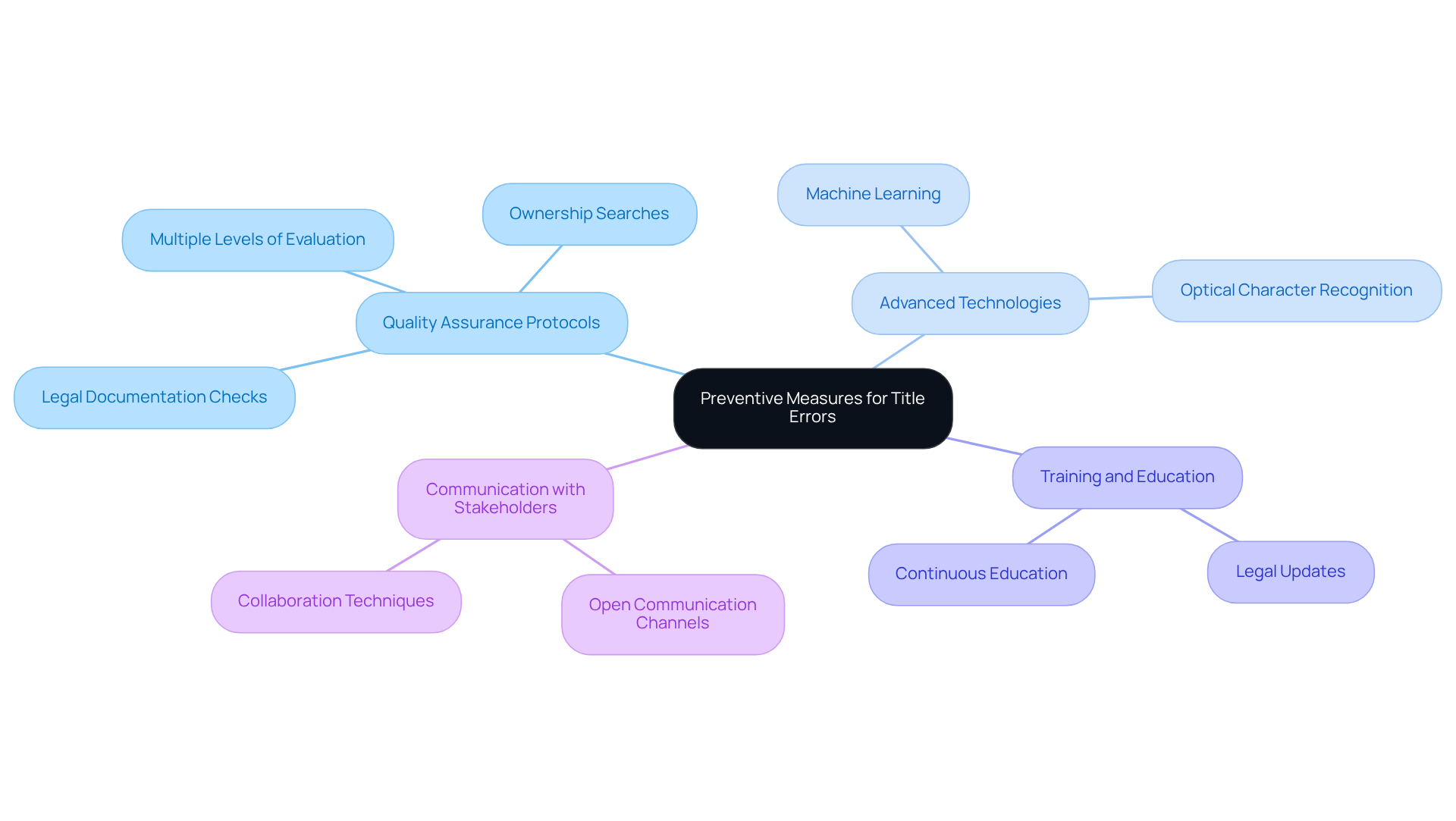

To mitigate the risks associated with ownership firm errors, a variety of solutions and preventive measures can be employed. Initially, property firms must establish stringent quality assurance protocols, incorporating multiple levels of evaluation for ownership searches and legal documentation. The integration of advanced technologies, including machine learning and optical character recognition, enhances the accuracy and efficiency of research, allowing for quicker identification of potential issues. Furthermore, regular training and continuous education for certification professionals are essential to keep them informed about legal developments and best practices. In addition, fostering open communication with clients and other stakeholders facilitates the early detection of discrepancies and nurtures a collaborative approach to issue resolution. By adopting these strategies, title companies can significantly diminish the likelihood of errors and bolster the overall integrity of the title research process.

Conclusion

In the realm of real estate transactions, the role of a title company is paramount, acting as a guardian of property ownership and ensuring smooth transfers. However, when a title company makes a mistake, the repercussions can be severe, affecting not just the immediate transaction but also the long-term ownership rights of all parties involved. Understanding the potential pitfalls and the importance of accuracy is crucial for anyone engaging in property dealings.

Throughout this article, various aspects of title company errors have been explored, including common mistakes such as:

- Clerical oversights

- Neglecting liens

- The risks of fraud, particularly in vacant land transactions

The implications of these mistakes can lead to costly legal disputes, unexpected financial burdens, and even the loss of property. Emphasizing the necessity for meticulous attention to detail and the implementation of quality assurance measures highlights how vital it is for title companies to uphold high standards in their operations.

Ultimately, the importance of engaging with reputable title firms cannot be overstated. By adopting advanced technologies, fostering continuous education, and maintaining open lines of communication, title companies can significantly reduce the likelihood of errors. For buyers and sellers alike, taking proactive steps to ensure the integrity of title searches and documentation is essential in navigating the complexities of real estate transactions and safeguarding investments.

Frequently Asked Questions

What is a title company?

A title company is an essential entity in real estate transactions responsible for confirming property ownership and facilitating the transfer of possession.

What are the primary functions of a title company?

The primary functions of a title company include conducting thorough property searches to uncover liens, encumbrances, or defects, preparing vital legal documentation, and providing insurance to protect buyers and lenders from potential future claims.

How do title companies act as intermediaries in real estate transactions?

Title companies serve as impartial intermediaries by ensuring that transactions proceed smoothly and legally, safeguarding the interests of all parties involved.

Why is the expertise of title companies important?

The expertise of title companies is crucial in resolving disputes over ownership and ensuring adherence to local laws and regulations, which helps to minimize legal complications in real estate transactions.

What impact do reputable title companies have on real estate transactions?

The involvement of reputable title companies significantly reduces the likelihood of legal complications and disputes, underscoring their importance in the ownership verification process.

Are there statistics that support the role of title companies in reducing disputes?

Yes, statistics indicate that transactions involving title companies experience fewer disputes, highlighting their critical role in the real estate sector.