Overview

This article examines the various types of liens in Colorado and their implications for real estate professionals. Understanding these liens—such as mortgage, tax, judgment, mechanic's, and HOA claims—is essential for navigating real estate transactions. These liens can significantly impact property ownership, marketability, and the ability to secure financing. Therefore, accurate title research is paramount for real estate professionals seeking to mitigate risks and enhance their clients' investment outcomes.

Introduction

In the intricate world of real estate, understanding liens is essential for both property owners and professionals navigating transactions. A lien represents a legal claim against a property and can originate from various sources, including mortgages, tax obligations, and court judgments. These claims not only serve as collateral for debts but also significantly influence property ownership and marketability.

Furthermore, as the landscape of real estate continues to evolve, the implications of liens become increasingly critical. They affect everything from property sales to refinancing opportunities. This article delves into the complexities of liens, exploring their types, consequences, and the vital knowledge real estate professionals must possess to effectively guide their clients through potential pitfalls.

What is a Lien? An Overview for Real Estate Professionals

A security interest represents a legal claim or right against an asset, functioning as collateral for a debt or obligation. In the realm of property, claims can emerge from various sources, including diverse types of liens in Colorado, such as loans, tax obligations, and judicial decisions. These claims are critical as they provide creditors with a legal entitlement to the assets until the associated debt is fully satisfied.

For real estate professionals, a thorough understanding of the types of liens in Colorado is indispensable, as these encumbrances can significantly influence real estate transactions and ownership rights. For example, assets encumbered by unresolved claims may pose challenges during sale or refinancing processes, as potential buyers often exhibit reluctance due to the existing financial obligations tied to the asset. Indeed, data indicate that 2% of For Sale By Owner (FSBO) sellers encountered difficulties in attracting potential buyers, a situation that can be exacerbated when claims are present.

Recent statistics reveal that in 2022, 66.1% of families owned their primary residence, underscoring the importance of clear title and claim status in maintaining asset value and ownership security. Furthermore, Anju Vajja, a research officer at the FHFA, noted that the quarterly National Mortgage Database provides valuable insights into outstanding first-lien mortgages, which are essential for understanding the landscape of real estate ownership. Additionally, case studies have demonstrated that house price appreciation has significantly enhanced home equity for homeowners who purchased or refinanced prior to the second quarter of 2022.

However, a hypothetical 10% decline in house values could push over 1.5 million homeowners into negative equity, highlighting the critical need to understand the types of liens in Colorado and their implications for ownership rights. Consequently, real estate experts must remain vigilant regarding the evolving landscape of claims and their impact on transaction activities.

General Liens vs. Specific Liens: Key Differences Explained

Claims in real estate are predominantly classified into two categories: general claims and specific claims. A general claim encompasses all of a debtor's assets, allowing creditors to seize any belongings owned by the debtor to satisfy unpaid obligations. A notable example of a general claim is a federal tax obligation, which can be applied to all assets owned by a taxpayer, potentially impacting their financial status across various holdings.

Conversely, specific claims are confined to a particular asset. A mortgage claim exemplifies this, as it is intrinsically linked to the asset that secures the loan. This distinction is crucial for real estate professionals, as it influences the enforcement of debts and the associated risks in asset transactions.

Recent updates suggest that federal agencies may intervene by covering state and local taxes on mortgaged assets if borrowers default on their obligations. This can lead to the establishment of federal tax claims, significantly affecting ownership and marketability. As John A. Yoegel, PhD, a certified real estate educator, notes, understanding these implications is essential for real estate experts navigating the complexities of property dealings.

Understanding the differences between general and specific claims is fundamental for effectively managing the intricacies of real estate transactions. For instance, unresolved claims on assets can result in severe consequences, such as foreclosure or repossession, particularly in scenarios involving mortgages and tax obligations on real estate. A case study on asset claim enforcement illustrates how creditors utilize various techniques, including foreclosure, to recover debts.

Property owners must address any encumbrances promptly to avert legal claims that could jeopardize their ownership rights.

Statistics indicate that the prevalence of general encumbrances, such as federal tax claims, continues to rise, underscoring the importance of awareness among real estate professionals. Expert insights reveal that a thorough understanding of these claims not only aids in risk assessment but also enhances strategic decision-making in real estate transactions. Furthermore, judgment claims arise when a court grants a creditor an interest in a debtor's assets following a ruling, empowering the creditor to execute the judgment through various methods, thereby further complicating the landscape of asset ownership.

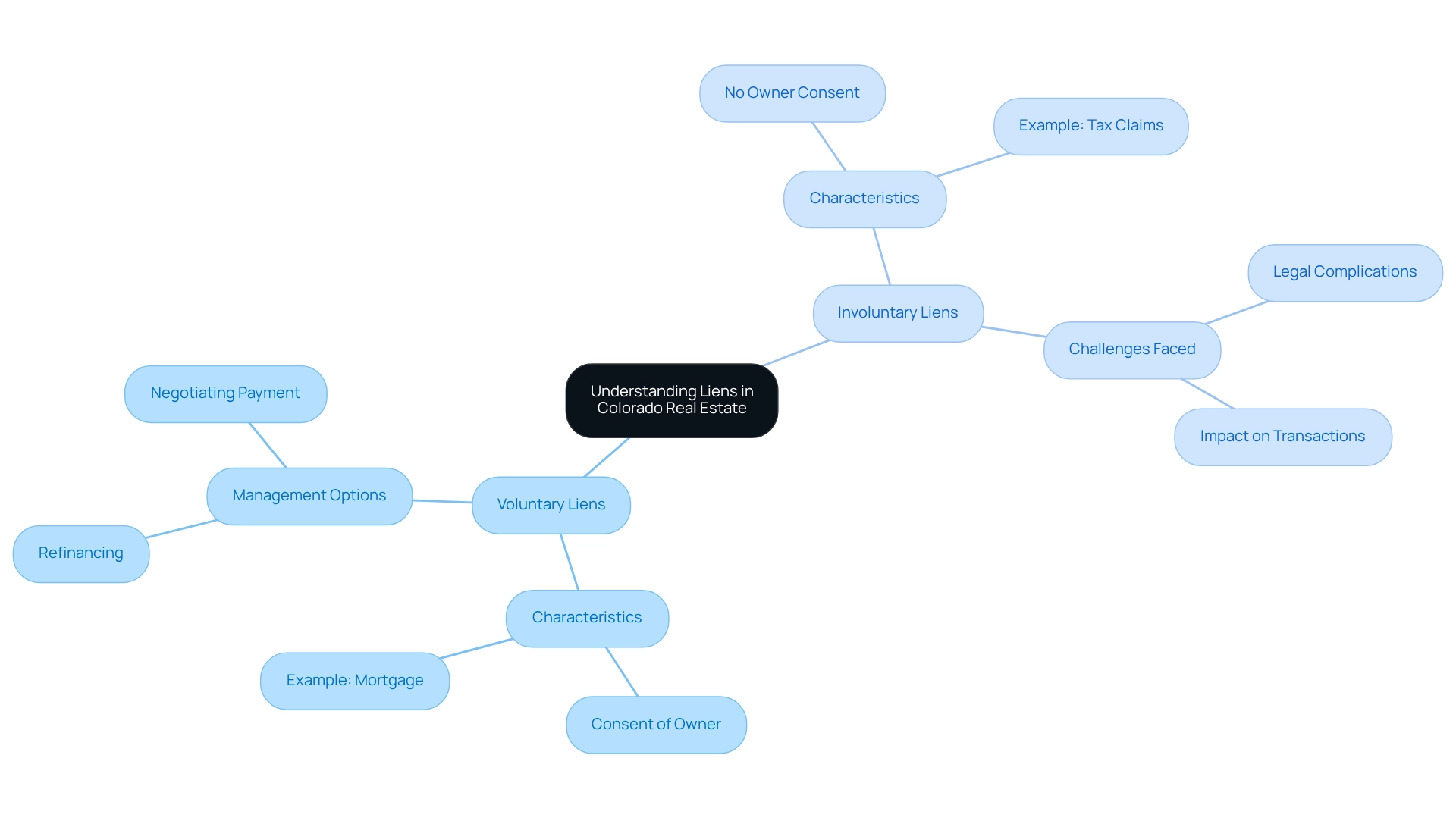

Voluntary vs. Involuntary Liens: What You Need to Know

Liens in real estate can be categorized into two primary types in Colorado: voluntary and involuntary. A voluntary claim is one that an asset owner willingly consents to, typically as part of a financing agreement. For instance, when a homeowner secures a mortgage, they grant the lender a voluntary claim on their asset, which serves as security for the loan. This type of claim is essential for facilitating transactions, as it reflects the owner's commitment to repay the borrowed funds.

In contrast, involuntary claims are enforced without the owner's approval, often arising from unpaid debts or legal rulings. Common instances include tax claims imposed by government agencies for unpaid real estate taxes and judgment claims stemming from court decisions against the owner. These involuntary claims can significantly impact a landowner's ability to sell or refinance their asset, as they must be resolved prior to any transaction proceeding.

Understanding the differences between these types of liens in Colorado is crucial for real estate professionals. For example, property owners facing voluntary encumbrances may have options to manage their obligations, such as refinancing or negotiating payment arrangements. Homeowners might consider consolidating their debts or seeking guidance from financial advisors to navigate their repayment strategies.

Conversely, those dealing with involuntary claims must confront more complex legal and financial challenges. Recent statistics indicate that a substantial percentage of homeowners encounter involuntary claims at some point, underscoring the importance of awareness and proactive management in real estate transactions.

Moreover, case studies reveal the ramifications of legal claims, which can occur automatically under specific regulations and hinder real estate transactions. The case study titled "Statutory Claims and Their Effects" illustrates how these claims can be imposed on assets without the owner's consent, highlighting the necessity for asset owners to address such issues before proceeding with sales or refinancing. It is also noteworthy that services can acquire assets in their existing state, even if they have demolition orders or Health Department violations, providing a practical context for professionals managing encumbered assets.

Realty experts must stay informed about the latest developments regarding encumbrances, including recent articles and news updates from 2025, to effectively advise their clients and mitigate potential risks associated with ownership. Additionally, responses to online inquiries are typically provided within 30-60 minutes, which can enhance the credibility of services offered in this field.

Different Types of Property Liens in Colorado: A Comprehensive Guide

In Colorado, property owners and real estate professionals must navigate several types of property liens, each carrying distinct implications for property transactions.

- Mortgage Liens: These liens are secured by the property itself and arise from loans taken to purchase real estate. They represent a significant financial obligation, and understanding their terms is essential for buyers and sellers alike.

- Tax Claims: Enforced by the government for overdue real estate taxes, tax claims can lead to foreclosure if not addressed. For instance, a residence valued at $40,000 was forfeited to cover $15,000 in taxes, costs, and fees, illustrating the financial consequences of tax obligations. Recent legislative changes have aimed to simplify the tax claim process, particularly following a recent US Supreme Court ruling, which introduced new procedures for managing overbids. This underscores the importance of remaining aware of tax responsibilities to prevent potential asset loss.

- Judgment Claims: These arise from court decisions against a landowner and can significantly affect the owner's capacity to sell or refinance their asset. They serve as a reminder of the legal obligations that can emerge from disputes and the necessity for thorough due diligence.

- Mechanic's Claims: Submitted by contractors or suppliers who have not received payment for work completed on the site, mechanic's claims ensure that service providers are compensated for their contributions. These claims can complicate real estate transactions if not resolved before finalization.

- HOA Claims: Homeowners' associations can impose claims on assets for unpaid fees or assessments. Given the increasing prevalence of community associations, understanding the implications of HOA claims is vital for preserving real estate value and ensuring compliance with community standards.

Grasping the types of liens in Colorado is essential for real estate experts, as they can significantly influence asset values and the ability to finalize transactions. Statistics indicate that a substantial proportion of real estate in Colorado is encumbered by mortgage claims, emphasizing the necessity for thorough analysis during valuations. Furthermore, case studies, such as the Residential Assessment Rate Study, illustrate how legislative changes can reshape the landscape of asset ownership and taxation, further highlighting the importance of staying informed on current laws and practices.

As Makenna X. Johnson, an associate in the rights group at Davis Graham & Stubbs LLP, observes, "Comprehending the consequences of ownership claims is crucial for managing transactions in the market successfully.

The Legal Process of Removing Liens: Steps and Considerations

Eliminating a claim from a property necessitates a systematic approach that real estate experts must grasp to effectively assist their clients. The process typically encompasses the following steps:

- Verify the Claim: Begin by confirming the validity of the claim. This involves checking for any discrepancies or errors that could render the claim invalid. Accurate verification is crucial, as it lays the groundwork for subsequent actions.

- Negotiate with the Lienholder: Engaging in direct negotiations with the lienholder can often yield favorable outcomes. Many lienholders are open to discussions that may lead to a payment plan or settlement, especially if the debtor demonstrates a willingness to resolve the issue.

- File a Release of Claim: Once an agreement is reached and the debt is satisfied, the claim holder is obligated to file a release of claim with the county clerk and recorder's office. This official document is essential for eliminating the encumbrance from public records, ensuring that the property title is clear.

- Seek Legal Assistance: If negotiations do not lead to a satisfactory resolution, it may be necessary to consult with a legal professional. Legal specialists can offer advice on additional options, including the possibility of initiating a lawsuit to challenge the claim. This step is particularly crucial in complex situations where the legitimacy of the claim is contested.

Understanding these steps is vital for real estate experts, as it enables them to manage claim issues efficiently. Recent statistics indicate that successful negotiations can significantly expedite the resolution process, with many cases being settled within weeks when approached correctly. Furthermore, the IRS must inform the taxpayer within 5 business days after submitting the initial Notice of Federal Tax Lien (NFTL) for a tax period, underscoring the importance of resolving tax issues promptly.

Nikki C. Johnson, Director of Collection Policy, notes that under IRC 6323(j), the IRS may withdraw the NFTL from the public record at any time if certain conditions are met. This highlights the significance of comprehending the legal structure related to claims. Case studies illustrate instances where claims were removed due to premature filings or procedural errors, emphasizing the necessity for thorough documentation and compliance with legal guidelines.

Moreover, real estate professionals should be aware that the deadline for requesting a hearing is generally within 45 days of the TC 582 date shown on IDRS, which may be extended under specific circumstances. Finally, it is important to recognize that intangible assets, such as stocks and bonds, can also be subject to federal tax claims, broadening the understanding of the types of claims that may affect investment assets. By remaining informed about the types of liens in Colorado and best practices for removing claims, professionals can provide invaluable assistance to their clients.

Consequences of Ignoring Liens: Risks for Property Owners

Ignoring a lien can lead to significant repercussions for property owners, which include:

- Foreclosure: Failure to address a tax lien or mortgage lien can prompt creditors to initiate foreclosure proceedings, ultimately resulting in the loss of the property. In Colorado, statistics indicate that unpaid claims, particularly the types of liens in Colorado, are a major factor in foreclosure, with a significant percentage of foreclosure cases directly associated with outstanding debts. For context, California recorded the highest number of foreclosure initiations in October 2024, with 2,915 assets flagged, emphasizing the broader implications of unpaid debts across states.

- Decreased Asset Value: Liens can obscure the title, complicating the sale process and potentially diminishing the market value of the asset. Properties encumbered with claims frequently receive reduced offers, as purchasers are cautious about the financial consequences.

- Legal Action: Creditors may resort to legal measures to enforce the claim, incurring additional costs and creating complications for the asset owner. This legal entanglement can further delay any potential sale or refinancing efforts.

- Challenges in Securing Funding: Lenders typically hesitate to finance assets with outstanding claims, greatly limiting the owner's choices for refinancing or selling. This limitation can hinder the owner's ability to leverage their investment effectively.

Real estate experts must emphasize the critical importance of promptly addressing claims related to types of liens in Colorado to mitigate these risks. A comparative examination of present and past foreclosure activity shows that although current foreclosure rates are considerably lower than during the Great Recession, the effect of unpaid debts continues to present a significant risk to homeowners. For example, in the first quarter of 2023, there were 58,268 documented foreclosure prevention measures, highlighting the continual necessity for vigilance in handling real estate obligations.

As Paul D. Lopez, Clerk and Recorder, highlights, 'These are wall maps, sized 55 x 40 inches,' underscoring the significance of having a clear view of land ownership and related claims. By actively managing claims, property owners can protect their investments and uphold the value of their holdings.

How Property Liens Impact Real Estate Sales: Insights for Professionals

Property encumbrances can significantly influence real estate transactions in various important aspects:

- Title Issues: These encumbrances create clouds on the title, necessitating resolution before a sale can proceed. Title firms will not provide clear titles if unresolved claims exist, complicating the transaction process. In Colorado, the property tax system's lack of a mechanism for property owners to recover surplus may further complicate these issues, potentially violating the Takings Clause and Excessive Fines Clause. This legal context is essential for real estate experts to comprehend as they address claims-related challenges.

- Negotiation Leverage: The existence of claims can function as a strong negotiation tool for buyers. They may utilize the presence of a claim to negotiate a lower purchase price or insist that the seller resolves the claim before closing. This dynamic can shift the balance of power in negotiations, making it essential for sellers to address any encumbrance issues proactively.

- Delays in Closing: The process of clearing claims often leads to significant delays in closing. These delays can disrupt the timelines for both sellers and buyers, creating frustration and uncertainty. Statistics suggest that homeowners' associations (HOAs) must inform owners about 45 days prior to filing a claim, which can extend the timeline if not handled efficiently. This notification requirement highlights the significance of prompt communication in property transactions.

- Financing Challenges: Buyers may face obstacles in obtaining financing if claims are present, as lenders generally demand clear titles to authorize loans. This situation emphasizes the significance of realty experts being proactive in recognizing and resolving encumbrance issues early in the transaction process to facilitate smoother closings.

Recent market insights from Steamboat Springs highlight the competitive nature of the housing market, where high median prices for luxury residences continue to attract buyers, particularly for vacation homes. Comprehending how encumbrances influence property transactions becomes increasingly essential for property professionals managing these intricacies. As highlighted in the Steamboat Springs/Routt County Market Insights, pricing strategies will be essential for sellers in this competitive landscape.

Moreover, ongoing legal developments, such as the City and County of Denver's recent complaint regarding the constitutionality of Colorado's tax system, further underscore the necessity for real estate professionals to remain knowledgeable about related issues that could affect their transactions in 2025. As David Anderson, a REALTOR, observed, there is an optimistic outlook in Pueblo and Pueblo West, which may affect local market dynamics and views concerning encumbrances.

Resources for Property Owners: Navigating Liens in Colorado

Property owners in Colorado facing encumbrance issues have access to an array of valuable resources designed to assist them in navigating these challenges effectively.

- Colorado Secretary of State: The Secretary of State's website serves as a crucial resource, offering comprehensive information on encumbrance filings and releases, along with necessary forms for encumbrance-related processes. This platform enables real estate owners to understand the legal structure surrounding claims and access vital documentation.

- Local Legal Aid Organizations: Numerous organizations across Colorado offer free or affordable legal support, empowering landowners to comprehend their rights and manage claim disputes effectively. These organizations play an essential role in ensuring that individuals have access to the legal assistance they require.

- Real Estate Attorneys: Engaging with a real estate lawyer provides owners with tailored guidance and representation suited to their specific circumstances. Lawyers can assist in navigating intricate legal challenges and represent their clients, ensuring that their interests are safeguarded.

- Title Companies: Title firms play a crucial role in performing comprehensive claim searches and providing advice on resolving outstanding claims before a real estate sale. Their expertise can assist landowners in recognizing potential issues early and taking proactive measures to mitigate risks related to claims.

- Parse AI: Utilizing advanced technology such as Parse AI can significantly enhance the efficiency of title investigation and claim management. By employing machine learning and optical character recognition (OCR), Parse AI aids title researchers in swiftly retrieving essential information from title documents, resulting in quicker and more precise claim resolutions. The example manager feature allows users to annotate single examples, facilitating information extraction from extensive sets of unstructured documents. This innovation not only streamlines the process but also offers considerable cost reductions compared to traditional title research methods. Effectively leveraging these resources can greatly assist landowners in addressing various types of liens in Colorado, ensuring they remain well-informed and supported throughout the process.

Recent statistics indicate that the usage of legal aid for property disputes in Colorado has been on the rise, reflecting an increasing awareness of available support options. Furthermore, landowners can utilize free online searches to obtain pertinent information related to their dispute issues. As of 2025, property owners are encouraged to leverage these resources to safeguard their interests and navigate the complexities of lien disputes.

Conclusion

Understanding the intricacies of liens is paramount for anyone involved in real estate, including property owners and professionals. This article highlights the types of liens—general, specific, voluntary, and involuntary—and their implications for property transactions. Each category presents unique challenges and risks, underscoring the necessity for real estate professionals to be well-versed in these concepts to effectively guide their clients.

The consequences of ignoring liens can be severe, ranging from foreclosure to decreased property value and legal complications. Proactive management of liens is essential to safeguard property ownership and ensure smooth transactions. The importance of clear titles cannot be overstated, as liens can obstruct sales and financing opportunities, ultimately affecting marketability.

Furthermore, this article emphasizes the resources available for property owners facing lien issues in Colorado. Engaging with legal aid organizations, real estate attorneys, and title companies can provide critical support in navigating these challenges. By leveraging these resources and staying informed about the legal landscape, property owners can better manage lien-related issues and protect their investments.

In conclusion, a comprehensive understanding of liens is not only beneficial but essential for success in real estate. As the market continues to evolve, staying informed about lien implications will empower professionals to make informed decisions and better serve their clients, ensuring that property ownership remains secure and transactions proceed smoothly.

Frequently Asked Questions

What is a security interest in the context of real estate?

A security interest represents a legal claim or right against an asset, functioning as collateral for a debt or obligation.

What types of claims can arise in Colorado property?

Claims can emerge from various sources, including liens such as loans, tax obligations, and judicial decisions.

Why is it important for real estate professionals to understand liens in Colorado?

Understanding liens is critical as they can significantly influence real estate transactions and ownership rights, potentially affecting the sale or refinancing of assets.

How can unresolved claims impact property sales?

Assets encumbered by unresolved claims may deter potential buyers due to existing financial obligations tied to the asset, making it challenging to attract buyers.

What percentage of families owned their primary residence in 2022?

In 2022, 66.1% of families owned their primary residence.

What are the two main categories of claims in real estate?

Claims are classified into general claims, which encompass all of a debtor's assets, and specific claims, which are confined to a particular asset.

Can you provide an example of a general claim?

A federal tax obligation is an example of a general claim, as it can be applied to all assets owned by a taxpayer.

What is a specific claim, and can you give an example?

A specific claim is linked to a particular asset, such as a mortgage claim that is intrinsically connected to the asset securing the loan.

How can federal agencies affect ownership and marketability of mortgaged assets?

Federal agencies may cover state and local taxes on mortgaged assets if borrowers default, leading to federal tax claims that can significantly impact ownership.

What are some consequences of unresolved claims on assets?

Unresolved claims can lead to severe consequences such as foreclosure or repossession, particularly in cases involving mortgages and tax obligations.

What is the role of judgment claims in real estate?

Judgment claims arise when a court grants a creditor an interest in a debtor's assets, allowing the creditor to execute the judgment through various methods, complicating asset ownership.

Why is it crucial for property owners to address encumbrances?

Property owners must address encumbrances promptly to prevent legal claims that could jeopardize their ownership rights.