Overview

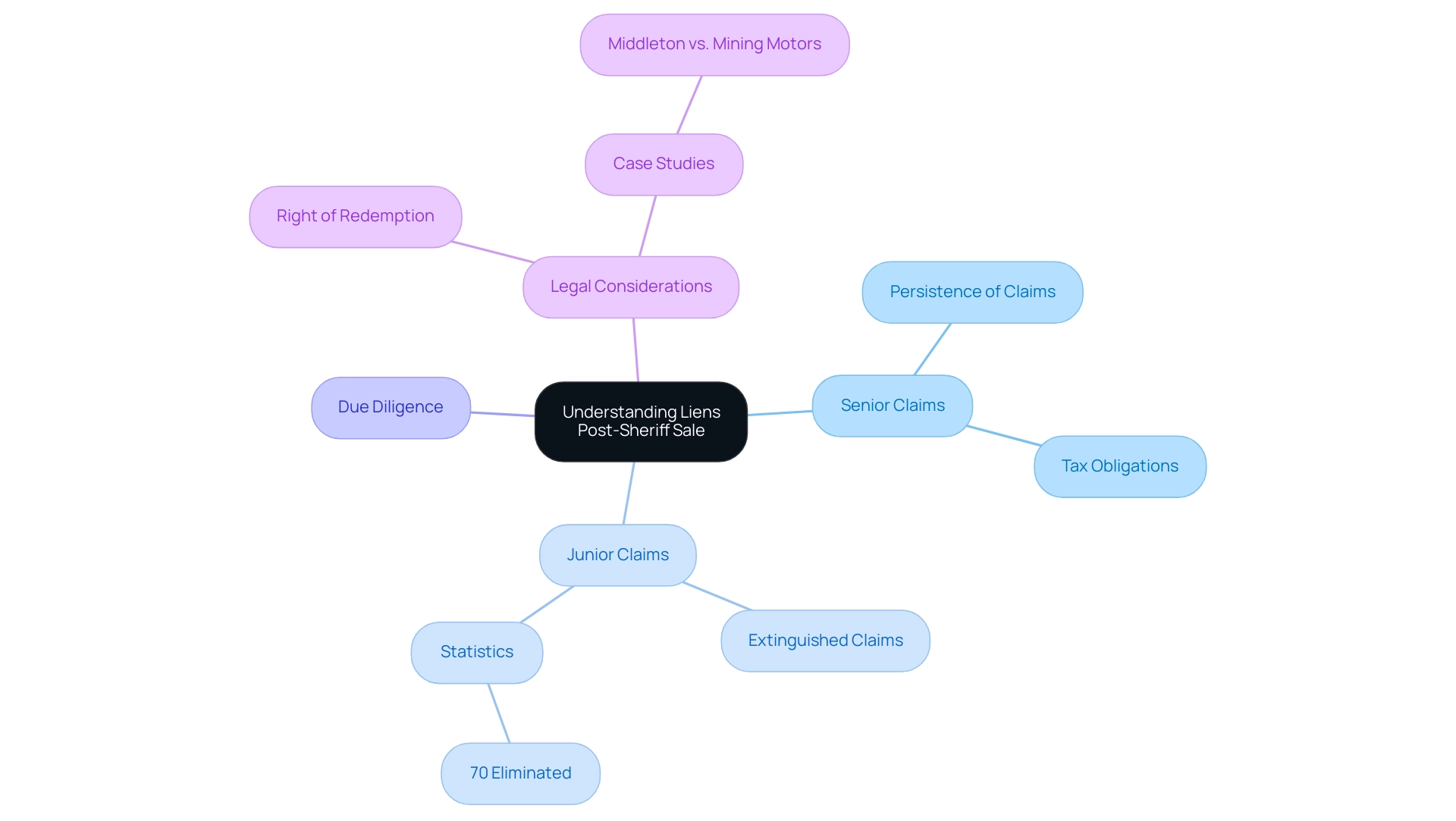

After a sheriff sale, junior liens are typically extinguished, while senior liens, including tax claims, often remain attached to the property. This situation can complicate ownership for the new buyer. The article provides a detailed explanation of lien priorities and the legal implications of these claims, underscoring the critical importance of conducting thorough title searches. Such diligence is essential to fully understand the risks and responsibilities associated with properties acquired at sheriff auctions.

Introduction

In the intricate world of real estate, understanding liens is essential for anyone looking to navigate property transactions successfully. These legal claims can significantly influence ownership rights and the transferability of properties. Therefore, it is vital for buyers and real estate professionals alike to grasp the different types of liens and their implications. From mortgages to tax liens, each category presents unique challenges and opportunities, particularly during sheriff sales where properties are auctioned to satisfy outstanding debts.

Furthermore, as the landscape of property acquisition evolves—especially with the growing interest from millennials in urban home purchases—the stakes are higher than ever. This article delves into the complexities of liens, the legal ramifications following sheriff sales, and the critical steps buyers must take to safeguard their investments in this dynamic market.

Understanding Liens: Definition and Importance in Real Estate

A legal claim or right against a property serves as collateral for a debt. In the realm of real estate, claims can originate from various sources, including mortgages, tax obligations, and judgments. It is essential for real estate professionals to understand the differences between various kinds of claims, such as voluntary claims—like mortgages—and involuntary claims—such as tax claims.

Understanding what happens to liens after a sheriff sale is crucial, as liens play a pivotal role in real estate transactions, particularly regarding the transferability of ownership. For example, a real estate asset burdened by a judgment claim cannot be transferred to a new purchaser until the claim is settled, demonstrating the substantial effect of such claims on real estate transactions. A case study on judgment claims illustrates this point: when a creditor successfully sues a debtor for non-payment, they can file a judgment claim against the debtor's assets, which serves as proof of the creditor's entitlement to the claim.

In most states, a seller with a judgment claim cannot transfer the title to a new buyer, emphasizing the essential nature of understanding claims in real estate transactions.

The dynamics of sheriff auctions, where assets are bid on to fulfill outstanding debts, further illustrate what happens to liens after sheriff sale. The priority of claims is crucial in understanding this process, as it determines the order in which creditors are compensated, making it a critical factor in the outcome of these sales. As noted by Lawrence Yun, chief economist for the National Association of Realtors, "The decline in confidence related to the direction of the economy coupled with the unprecedented measures taken to combat the spread of COVID-19... are naturally bringing an abundance of caution among buyers and sellers."

This caution can be influenced by the existence of claims on assets, affecting buyer sentiment and transaction results.

In 2025, the landscape of financial claims continues to evolve, with millennials showing a strong interest in urban home purchases—23% of this demographic expresses a desire to buy in urban hubs, compared to only 11% of Gen X, 8% of baby boomers, and 3% of seniors. This change in buyer demographics emphasizes the necessity for real estate experts to remain knowledgeable about the consequences of claims, ensuring they can manage the intricacies of ownership and transferability efficiently. Moreover, utilizing technology like Parse AI can provide significant cost savings compared to traditional title research methods, enhancing the efficiency of research and property ownership verification.

What Happens to Liens After a Sheriff Sale?

The handling of claims following a law enforcement auction is primarily determined by their rank. A sheriff's auction occurs at the conclusion of the foreclosure process, marking a pivotal moment in resolving outstanding debts. In the hierarchy of claims, those with higher priority are addressed first from the proceeds of the transaction.

Typically, junior claims—those recorded after the primary mortgage—are extinguished during this process, whereas senior obligations may continue to encumber the asset. Notably, tax claims often persist after property auctions, raising concerns regarding the fate of liens post-sheriff sale. This reality necessitates that purchasers remain vigilant about any overdue tax obligations that could impact their ownership rights.

Property owners generally have the right of redemption, allowing them to reclaim their property by settling the debt and associated expenses, although regulations vary by jurisdiction. In 2025, data indicates that approximately 70% of junior claims are eliminated during auction events, underscoring the importance of understanding claim priority. Legal experts stress the necessity of conducting thorough title searches prior to engaging in a sheriff sale.

As Senior United States District Judge John T. Copenhaver, Jr. noted, "The court makes no findings on foreclosure and priority concerning the Middleton Properties pending further briefing from Middleton and the United States," highlighting the complexities inherent in priority disputes.

Recent case studies, including the motions for summary judgment filed by Middleton and Mining Motors, exemplify the contentious nature of security interest treatment following a sale. Both parties argued that the auction conducted by the law enforcement officer did not constitute a non-judicial transaction requiring notification to the IRS, asserting that their interests in the assets were superior to the federal tax claims. The United States opposed these motions, contending that the tax transaction process was indeed a non-judicial transfer, and that its claims remain valid and enforceable against the properties.

In light of these dynamics, prospective purchasers must engage in comprehensive due diligence to fully comprehend what happens to liens after a sheriff sale before participating in an auction. This ensures they are well-informed about the potential risks and responsibilities associated with their acquisition.

Types of Liens and Their Treatment After Sale

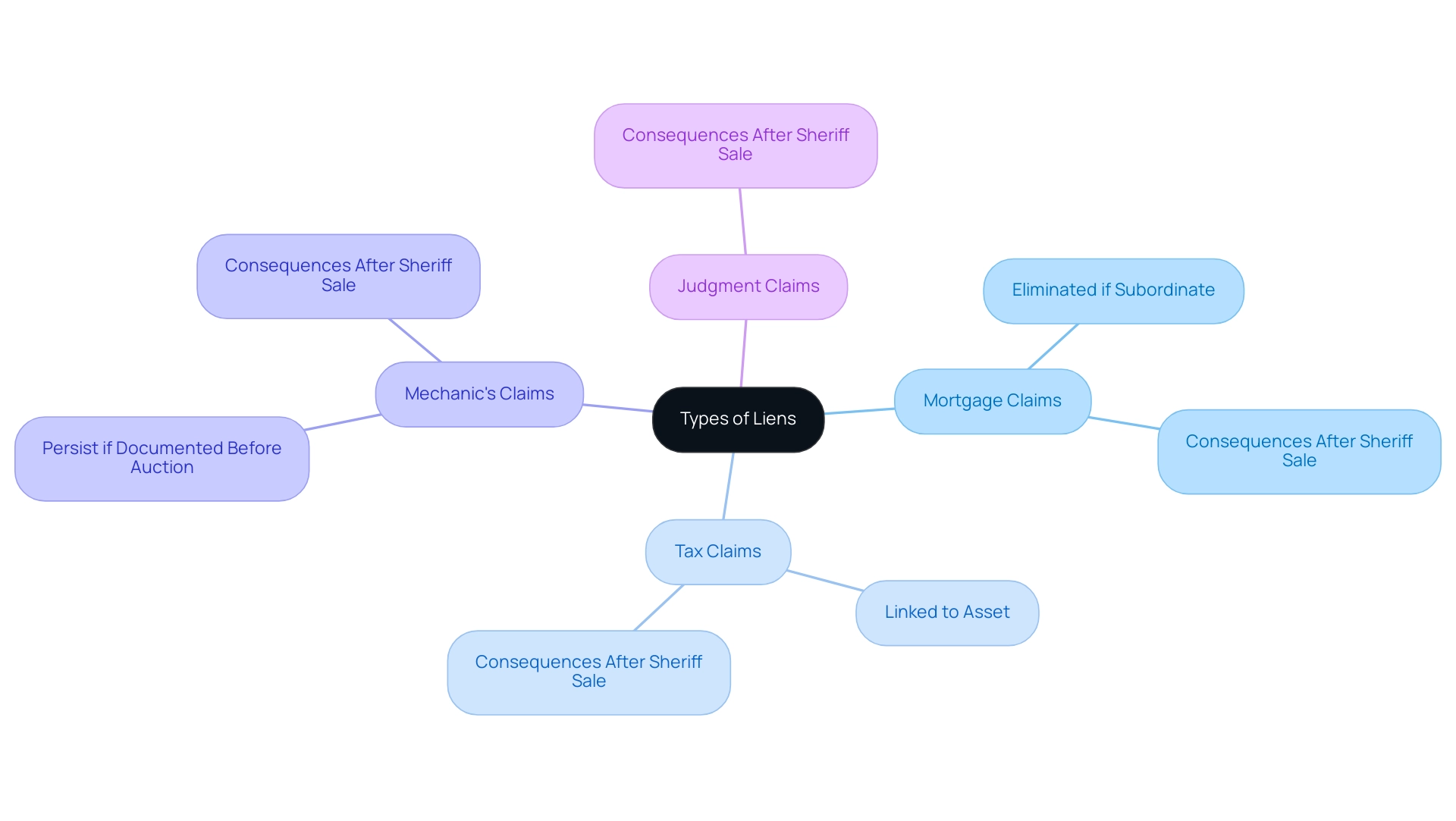

Claims in real estate can be categorized into several types, including:

- mortgage claims

- tax claims

- mechanic's claims

- judgment claims

Each category carries distinct consequences that relate to what happens to liens after a sheriff sale. For instance, mortgage claims are typically eliminated if they are subordinate to the charge being foreclosed.

In contrast, tax claims often remain linked to the asset after the sale, requiring the new owner to resolve these debts. Mechanic's claims, submitted by contractors or suppliers for unpaid labor, can also persist through the transaction if they were documented before the enforcement auction. Grasping these subtleties is essential for purchasers, as it enables them to assess what happens to liens after a sheriff sale and understand the potential risks and financial responsibilities linked to acquiring real estate at sheriff auctions.

Current trends suggest that property owners encountering foreclosure may opt to transfer their properties to nonprofit organizations, allowing them to continue as tenants at a reasonable rent. This shift emphasizes the evolving landscape of financial claims management and the significance of staying updated on the latest developments in real estate matters as of 2025. As Dan B., an LRS lawyer, emphasizes, "There is no charge to speak with one of our attorney referral counselors -- we’re here to help," underscoring the value of seeking professional guidance in navigating these complex issues.

Furthermore, it is crucial to acknowledge that administrative expenses related to the property transfer are estimated at $300, which can impact the overall financial factors for purchasers. Property owners also have the option to apply for a standard payment plan or other payment options to manage their debts effectively. Additionally, the incorporation of technology, as demonstrated by Parse AI, showcases how machine learning and optical character recognition can assist in verifying real estate ownership and comprehending claims, ultimately offering substantial cost savings compared to conventional methods.

Legal Implications of Liens in Sheriff Sales

The legal consequences of encumbrances in auction events are both significant and complex. When an asset is sold at a court auction, it is crucial to understand the fate of liens following a sheriff sale. Typically, junior liens are eliminated, while senior liens remain attached to the asset. This scenario can lead to considerable complications for buyers, who may inadvertently assume responsibility for outstanding debts.

For instance, in 2025, it was observed that if an asset is sold at a sheriff's sale, the new owner is entitled to charge the previous owner rent during the redemption period. This situation can further complicate the financial landscape for both parties involved.

The redemption period is a critical component of this process, allowing the original owner to reclaim the property by settling owed amounts. Buyers must be acutely aware of their rights and responsibilities during this timeframe. Legal expert Melissa Robbins Coutts from McCarthy & Holthus, LLP, emphasizes the importance of diligence in these transactions, stating, "In Rose Court, the borrower’s loan was in default for a decade before foreclosure was finally completed, and litigation over the foreclosure continued for many years thereafter in state, federal, and bankruptcy courts."

This underscores the potential for extended legal conflicts arising from unresolved claims, highlighting the need for buyers to remain vigilant.

Furthermore, recent legal cases in 2025 have underscored the necessity for buyers to conduct thorough due diligence regarding existing claims. For example, a briefing on new loss mitigation options discussed by the VA, FHA, and USDA revealed the complexities these programs introduce into the bankruptcy process, necessitating careful navigation by all parties involved. Purchasers must ensure that all claims are properly addressed to mitigate the risk of future legal conflicts, emphasizing the importance of understanding what happens to liens after a sheriff sale.

Additionally, it is essential to order a foreclosure title commitment no later than the Friday before a Wednesday foreclosure auction to facilitate timely and effective action. Moreover, the Supreme Court's decision in Loper Bright Enters. v. Raimondo may significantly influence the regulatory environment in the mortgage sector, adding another layer of complexity for purchasers navigating claims in public auctions.

What Buyers Need to Know About Liens at Sheriff Sales

Prospective purchasers at auction events must prioritize diligent research, particularly through extensive title investigations, to uncover any existing claims that could impact their investment. Understanding the implications of liens after a sheriff sale is vital, as certain obligations may persist even post-transaction, potentially complicating ownership rights. For example, the Servicemembers Civil Relief Act (SCRA) provides foreclosure protections to military service members, including a right of redemption, which can significantly influence the dynamics of ownership following a sale.

In this context, Parse AI's advanced machine learning tools transform document processing and title research automation, empowering title researchers to execute comprehensive and precise title searches. Features such as the example manager enable users to annotate documents swiftly, efficiently extracting critical information from title documents. This capability is essential for secure land rights acquisition, as it aids in identifying any encumbrances that may affect ownership.

Statistics indicate that a notable segment of buyers—9%—are unaware of commission laws, underscoring the imperative for informed decision-making in these transactions. This lack of awareness accentuates the critical need for potential buyers to consult legal and real estate professionals who can offer invaluable insights. As Randy Rodenhouse, an experienced investor, notes, "Usually a title company or RE attorney can help with title search."

This statement reinforces the importance of expert guidance, complemented by the functionalities of Parse AI, in navigating the complexities of liens and comprehending the status of liens after sheriff sales during property auctions.

Moreover, case studies, such as those evaluating the purchase of foreclosed homes in South Carolina, reveal the emotional and procedural challenges buyers encounter. These challenges can encompass the stress of maneuvering through the foreclosure process and the uncertainty of potential financial repercussions. Despite these obstacles, foreclosures can present substantial savings for those willing to invest the necessary time and effort to identify the right investment.

As purchasers prepare for auction events in 2025, current best practices underscore the necessity for thorough title searches facilitated by Parse AI's powerful platform, which not only automates information extraction but also ensures a clear title and safeguards their investment.

Risks and Benefits of Buying Properties with Liens at Sheriff Sales

Acquiring assets at sheriff sales with existing liens can be a double-edged sword, presenting both substantial opportunities and significant risks. On one hand, these assets are often available at considerable discounts, appealing to savvy investors seeking lucrative deals. However, buyers must exercise caution; understanding what happens to liens after sheriff sale is crucial, as outstanding liens—especially tax liens—can remain attached to the asset, potentially leading to unforeseen financial burdens.

In 2025, the landscape of property acquisition is increasingly influenced by the risks related to encumbrances. Recent data indicates that 1 in 4 Americans feel social pressure to buy a house, with 90% expressing a preference for ownership over renting, citing reasons such as easy maintenance and flexibility. This trend underscores the urgency for investors to navigate the complexities of claims effectively.

Comprehending the different categories of claims is essential for making informed buying choices. For instance, tax claims can carry significant implications, as they may require the new owner to settle outstanding debts before fully claiming ownership. This reality was emphasized in the case of Tennessee's redeemable tax deed transactions, where investors can earn a 10% interest rate during a one-year redemption period.

Tax Sale Resources has developed tools and financing options to assist investors in navigating this dynamic market, emphasizing the importance of being well-informed. Notably, it only takes a few weeks to secure the capital needed after applying for financing from Tax Sale Resources, providing crucial support for investors.

Expert insights also illuminate what happens to liens after sheriff sale and their financial effects. Brian Seidensticker, CEO of Tax Sale Resources, notes, "Discover how he transformed challenges into opportunities and built tools to simplify tax investing." This perspective reinforces the notion that while risks exist, they can be mitigated through proper research and strategic planning, particularly in the current market where investors face unique challenges.

Ultimately, buyers must weigh the potential for financial gain against the risks of assuming unwanted liabilities. Successful investments in properties with existing liens often hinge on thorough due diligence and a clear understanding of the associated costs. By approaching sheriff sales with a well-rounded perspective, investors can capitalize on the benefits while minimizing the risks.

Conclusion

Understanding liens is crucial for anyone involved in real estate transactions, particularly as the landscape evolves with changing buyer demographics and economic conditions. The types of liens—mortgages, tax liens, judgment liens, and mechanic's liens—each carry distinct implications that can significantly impact property ownership and transferability. This complexity is compounded during sheriff sales, where the hierarchy of liens determines which debts are settled and which remain attached to the property. Consequently, thorough due diligence is essential for prospective buyers.

The treatment of liens after sheriff sales highlights the necessity of conducting comprehensive title searches. Buyers must recognize that while junior liens may be extinguished, senior liens, especially tax liens, often persist, potentially leading to unforeseen financial obligations. Engaging with legal and real estate professionals is paramount to navigate these intricacies, ensuring that all potential risks are identified and understood before making any investments.

As the market attracts new buyers, particularly millennials interested in urban properties, staying informed about the evolving dynamics of liens is key. Leveraging technology, such as Parse AI, can enhance the efficiency of title research, providing significant cost savings and supporting informed decision-making. In conclusion, navigating the complexities of liens in real estate requires vigilance, knowledge, and professional guidance to successfully capitalize on the opportunities presented by sheriff sales while mitigating the associated risks.

Frequently Asked Questions

What is a legal claim or right against a property in real estate?

A legal claim or right against a property serves as collateral for a debt and can originate from various sources, including mortgages, tax obligations, and judgments.

What are the differences between voluntary and involuntary claims?

Voluntary claims, such as mortgages, are initiated by the property owner, while involuntary claims, like tax claims, are imposed by external entities without the owner's consent.

How do liens affect the transferability of ownership in real estate?

Liens can prevent the transfer of a real estate asset. For instance, a property burdened by a judgment claim cannot be transferred to a new purchaser until the claim is resolved.

What happens to liens after a sheriff sale?

The handling of liens after a sheriff sale is determined by the priority of the claims. Higher priority claims are addressed first, while junior claims may be extinguished, but senior obligations often remain.

What is the significance of claim priority in sheriff auctions?

Claim priority determines the order in which creditors are compensated from the proceeds of the auction, affecting the outcome for both buyers and sellers.

Can property owners reclaim their property after a sheriff sale?

Yes, property owners generally have the right of redemption, allowing them to reclaim their property by settling the debt and associated expenses, although this varies by jurisdiction.

What percentage of junior claims are eliminated during sheriff auctions?

Approximately 70% of junior claims are eliminated during auction events, highlighting the importance of understanding claim priority.

Why is it important for purchasers to conduct thorough title searches before a sheriff sale?

Conducting thorough title searches is crucial to understand the liens and claims against the property, ensuring purchasers are aware of potential risks and responsibilities associated with their acquisition.

How does the economic climate influence buyer sentiment in real estate transactions?

Factors such as a decline in confidence related to the economy and unprecedented measures taken during events like COVID-19 can create caution among buyers and sellers, influenced by the existence of claims on assets.

What demographic trend is observed in urban home purchases as of 2025?

Millennials show a strong interest in urban home purchases, with 23% expressing a desire to buy in urban hubs, compared to lower percentages among older generations.