Overview

To buy vacant buildings for sale, potential buyers should follow a structured approach that includes researching property types, assessing financial implications, navigating legal requirements, making strategic offers, and planning post-purchase renovations. The article outlines these steps in detail, emphasizing the importance of thorough market analysis, financial planning, and legal compliance to ensure a successful and profitable acquisition process.

Introduction

In the realm of real estate, vacant buildings present both challenges and opportunities. As properties sit unoccupied, they can become a financial burden or a hidden gem waiting to be revitalized. Understanding the various types of vacant buildings—from residential homes to commercial properties—equips potential investors with the knowledge needed to navigate this complex market.

With vacancy rates fluctuating across regions and economic conditions impacting property values, recognizing the nuances of each category is crucial. This article delves into the essential aspects of vacant buildings, guiding readers through the process of researching, financing, and managing these properties to unlock their full potential.

Whether one is looking to invest or simply gain insights into the state of vacant real estate, a thorough grasp of the landscape can lead to informed and profitable decisions.

Understanding Vacant Buildings: Definitions and Types

Vacant structures, which are often listed as vacant buildings for sale, refer to properties that are unoccupied and not actively in use. They can be classified into several categories, each with distinct characteristics and implications:

-

Residential Vacant Buildings: This category encompasses single-family homes, multi-family units, and condominiums that currently lack occupants.

With the rate of vacant homes in the U.S. ranging from 4.5% in Worcester, MA, to a staggering 38.2% in Cape Coral-Fort Myers, FL, understanding this segment is crucial for potential buyers.

-

Commercial Vacant Properties: These include office buildings, retail spaces, and warehouses that are not generating income due to a lack of tenants.

Recent data indicates a challenging market for commercial real estate, as evidenced by a 7% decrease in asset values over the year leading up to May 2024, and a significant 20% decline over the past two years.

This decline reflects concerns about prolonged vacancy rates and the overall health of the market.

-

Industrial Vacant Buildings: This classification includes factories and manufacturing facilities that have ceased operations.

The ongoing economic shifts exacerbate the challenges faced by these assets, contributing to broader market declines.

-

Land with Structures: In some instances, land may contain abandoned or dilapidated structures, leaving it unoccupied.

This kind of asset frequently demands substantial funding for rejuvenation.

Comprehending these terms is crucial for purchasers as it helps them in recognizing the kind of vacant buildings for sale they aim to obtain and the particular aspects needed for each classification. As pointed out by Charlie Munger, we have many distressed office buildings, many distressed shopping centers, and many distressed other assets. There’s a lot of agony out there.

Additionally, it is important to note that Maine has recorded the highest gross vacancy rate in the nation for 11 of the past 12 years, highlighting the persistent challenges in certain markets.

Moreover, has risen as of January 2025, indicating current trends affecting unoccupied real estate and emphasizing the necessity for buyers to stay informed about the changing market landscape.

Initial Steps: Researching Vacant Properties

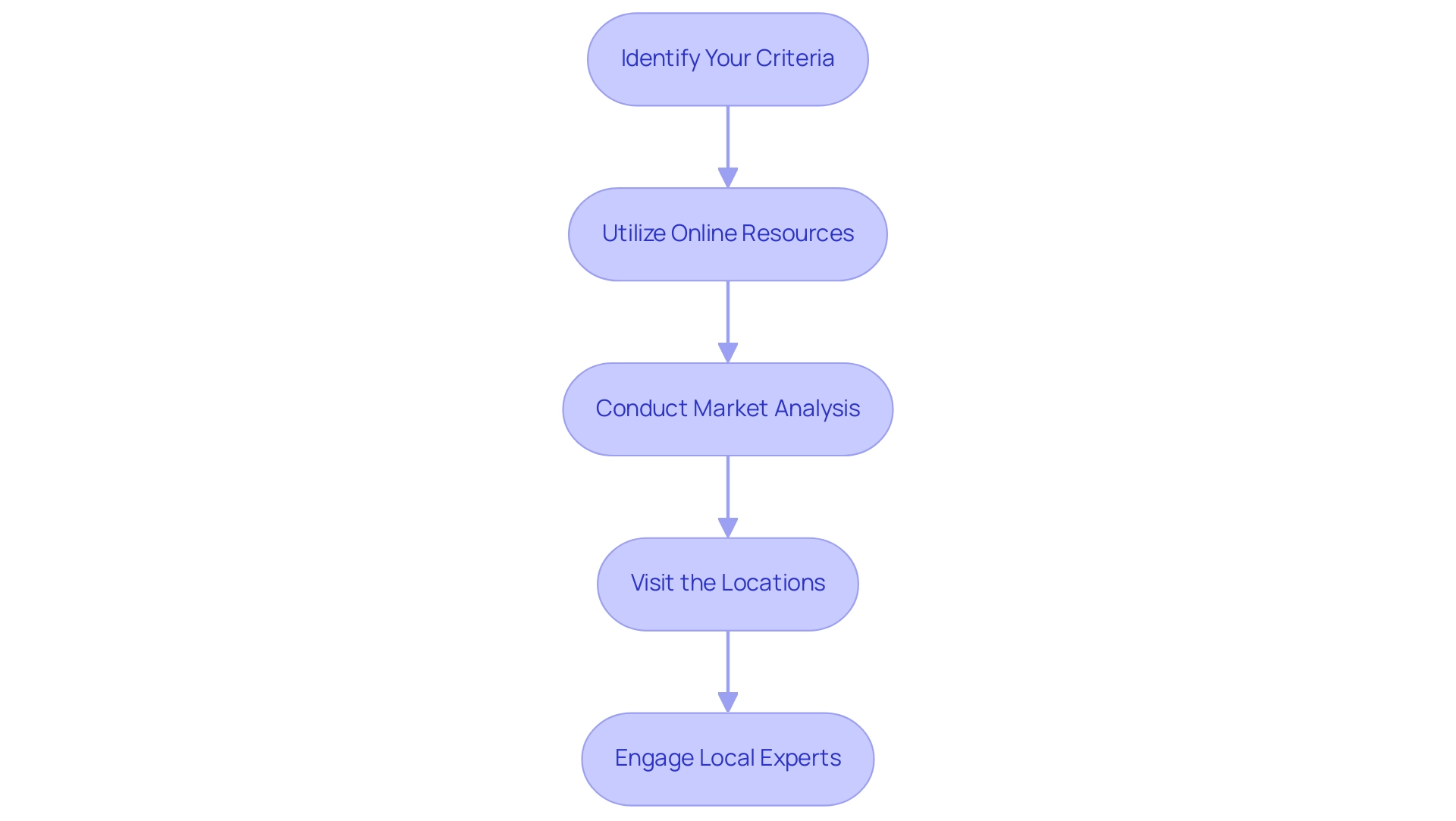

To effectively research unoccupied locations and make informed decisions, consider following these structured steps:

- Identify Your Criteria: Start by defining the specific type of unoccupied real estate you seek. Consider factors such as location, size, zoning regulations, and the intended use of the building.

- Utilize Online Resources: Leverage a variety of online platforms including real estate websites, local government databases, and specialized listing services. These resources can assist you in identifying vacant buildings for sale and provide essential details about each property.

- Conduct Market Analysis: Thoroughly analyze to gauge values, identify trends, and assess the demand for your targeted type of building. Notably, retail spaces currently showcase a historically low vacancy rate of just 4.1%, while malls have a higher vacancy rate of 8.6%, indicating a competitive market environment.

- Visit the Locations: Arrange physical inspections of the identified sites. This step allows you to evaluate the condition of the buildings and the surrounding area, enabling you to identify potential issues or advantages that may not be evident from online research.

- Engage Local Experts: Collaborate with real estate agents or title researchers who specialize in unoccupied spaces. Their expertise can provide valuable insights and help unveil hidden opportunities within the market. As noted by the National Association of Realtors, the industrial commercial real estate sector has experienced significant rent growth, demonstrating the potential for lucrative investments. Moreover, selling vacant buildings for sale can assist in preventing ongoing costs and maintenance issues, a factor that ought to be included in your research plan.

By following these steps, you can streamline your research process and enhance your ability to successfully identify and analyze unoccupied sites. For instance, consider the case study of homeowners who chose to sell their homes as-is, avoiding expensive repairs and receiving cash in hand, which illustrates the practical implications of researching and selling unoccupied real estate.

Financial Considerations: Costs and Financing Options

When evaluating the financial implications of acquiring vacant buildings for sale, several critical factors should be taken into account.

- Purchase Price: Conduct thorough research on comparable sales within the area to establish a competitive price for the asset. Understanding local market trends is crucial, especially as CoreLogic anticipates reconstruction costs to increase by up to 12% over the next 12 to 18 months.

- Improvement Costs: It is essential to estimate potential improvement expenses, including repairs and upgrades necessary to bring the property up to code and make it functional. for vacant buildings in 2024 are projected to vary significantly, with in-line store fit-outs averaging $147 per square foot nationally, peaking at $216 per square foot in Northern California, while the Midwest offers more budget-friendly options at $106 per square foot. Notably, new roofing and garage doors have a 100% cost recovery rate, which can significantly influence renovation budgeting.

- Ongoing Expenses: Be aware of recurring costs such as real estate taxes, insurance, and maintenance, which will accumulate post-purchase. These expenses can dramatically affect overall investment returns if not properly anticipated.

- Financing Options: Investigate a variety of financing avenues, including traditional mortgages, hard money loans, or specific government programs designed to encourage the revitalization of vacant buildings for sale. A tailored financing strategy based on your unique financial situation will help maximize your investment.

- Return on Investment (ROI): Evaluate potential ROI by estimating future rental income or resale value after improvements. This analysis is vital to ensure that the investment aligns with your financial objectives.

Roberta Pescow, a freelance writer with expertise in personal finance, emphasizes the significance of thorough financial planning in real estate investments, stating that careful consideration of improvement expenses and potential returns can make the difference between a profitable venture and a costly mistake. This is particularly relevant when considering the financial implications of renovation costs, as highlighted by CoreLogic's research methodology, which continuously analyzes various data points and market trends to ensure accurate cost data. By comprehending these financial elements, you can make informed choices that improve the feasibility of your unoccupied investment.

Navigating Legal Requirements: Title Verification and Compliance

Navigating the legal landscape when purchasing vacant buildings for sale requires a meticulous approach, encompassing several critical steps:

-

Title Verification: Begin with a comprehensive title search to confirm current ownership while revealing any liens or encumbrances associated with the asset. Given that land officials file millions of deeds and documents annually, this step is paramount to prevent future legal disputes.

Utilizing advanced tools from Parse AI, such as the example manager for quick annotation and title research automation capabilities, can significantly expedite this process, ensuring a clean title is essential before closing on any asset. Real estate attorneys play a crucial role in this process by identifying potential issues, thereby providing peace of mind during the transaction. Recent statistics indicate that approximately 30% of title searches reveal discrepancies that could complicate , underscoring the importance of this step.

-

Check Zoning Laws: Ensure that the intended use of the site aligns with local zoning regulations. Compliance with these laws is vital for the feasibility of your plans for the building. Understanding zoning law compliance statistics—such as the fact that nearly 40% of developers encounter challenges related to zoning regulations—can be beneficial in this regard, as it highlights common obstacles faced by developers.

-

Obtain Necessary Permits: If renovations or changes in use are planned, determine the required permits and ensure compliance prior to commencing any work. This procedural diligence is essential to avoid interruptions in your project timeline when dealing with vacant buildings for sale.

-

Consult with Legal Professionals: Engage with experienced real estate attorneys or title researchers who can decipher complex legal language and ensure all legal requirements are met before finalizing your purchase.

As noted by Deborah Tamburri, a satisfied client,

I contacted Sarah when I was facing tough legal issues... I would give Sarah top ratings across the board.

This underscores the value of knowledgeable representation in real estate transactions, particularly when navigating zoning laws and title verification.

Additionally, complications can arise from clerical errors in public records, such as misspelled names or incorrect legal descriptions, which can lead to delays and disputes. For instance, a recent case study emphasized how a simple clerical mistake postponed a real estate transaction by several weeks, demonstrating the necessity of accurate title verification to avoid legal issues and secure a clear title during transactions. Leveraging Parse AI's powerful title research automation and example manager can further streamline this process, allowing for confident land rights acquisition and enhancing the efficiency of real estate attorneys in their title verification efforts.

Making an Offer: Tips for Negotiation and Purchase

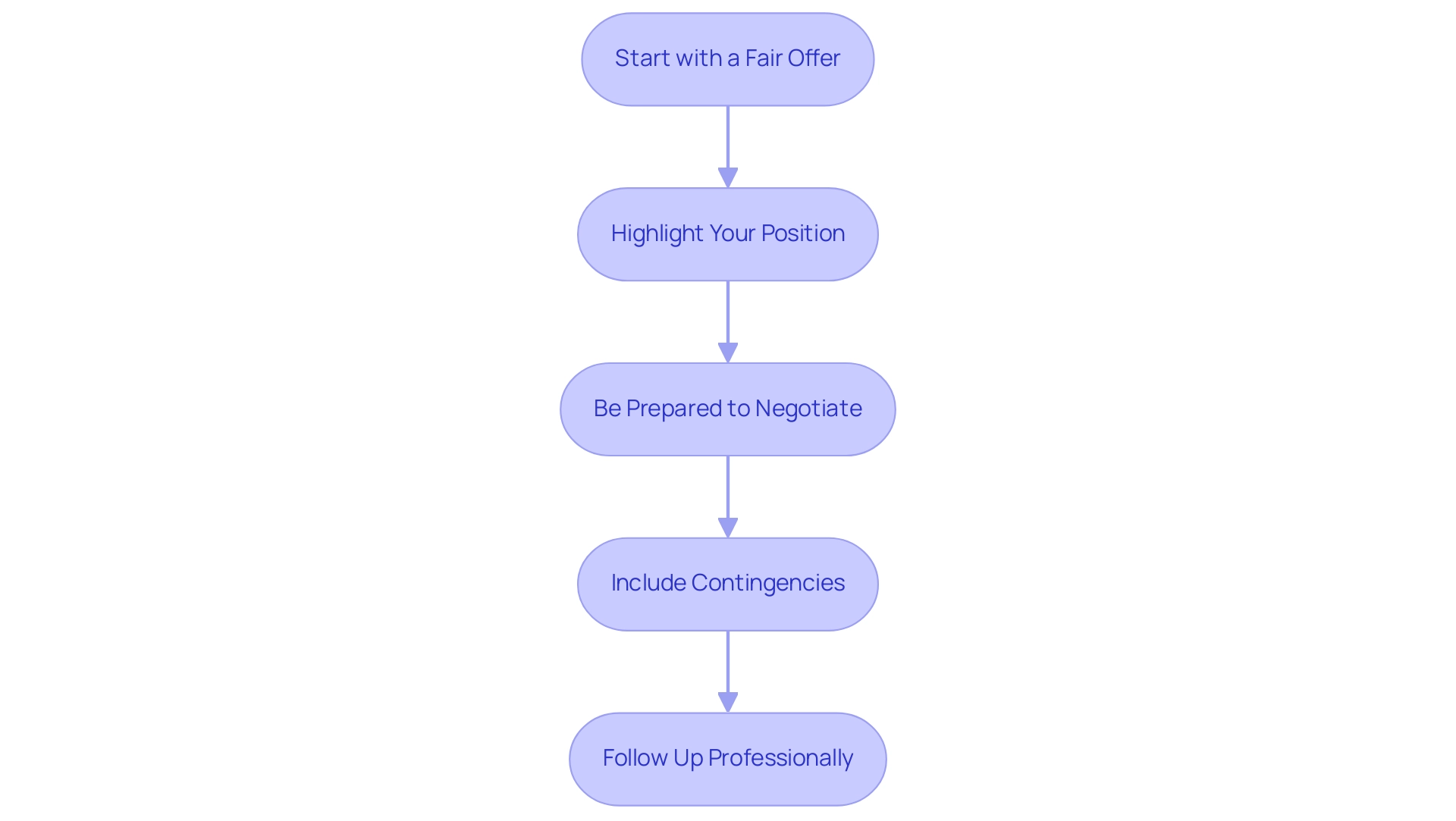

When making an offer on vacant buildings for sale, it is crucial to adopt a strategic approach to enhance your chances of success. Here are several essential tips to consider:

-

Start with a Fair Offer: Conduct thorough market research and evaluate the asset's condition to determine a reasonable initial offer.

Lowball offers can be detrimental, potentially alienating the seller and undermining your negotiation efforts. -

Highlight Your Position: Whether you are or have pre-approved financing, prominently presenting this information can significantly strengthen your offer.

Cash buyers often have an edge in negotiations, as they eliminate the uncertainty associated with financing.

For instance, consider the statistic that a house appraised at $275,000 sold for $330,000, demonstrating how cash offers can lead to favorable outcomes. -

Be Prepared to Negotiate: Enter negotiations with an understanding that counteroffers are common.

Flexibility is key; know your maximum price and be prepared to walk away if the terms do not align with your expectations.

As noted,A lawsuit is usually the worst, most stressful and most expensive way to solve anything, so I moved on

this reflects the importance of resolving negotiations amicably to avoid unnecessary conflict and stress. -

Include Contingencies: Adding contingencies to your offer, such as passing inspections or securing financing, can protect you during the buying process.

This not only safeguards your investment but also shows the seller that you are a serious buyer who is considering all aspects of the transaction. -

Follow Up Professionally: After submitting your offer, maintain open lines of communication with the seller or their agent.

This illustrates your ongoing interest and professionalism, which can favorably affect their view of your proposal.

Grasping these negotiation techniques, especially considering elements like future development potential, which can greatly improve perceived value, can result in more advantageous outcomes in the acquisition of vacant buildings for sale.

Post-Purchase Considerations: Renovation and Management Strategies

After acquiring vacant buildings for sale, it's crucial to implement a structured approach to maximize their potential. Here are key strategies to consider:

- Assess Renovation Needs: Begin with a comprehensive inspection of the property to pinpoint essential repairs and upgrades. Concentrate on updates that not only enhance safety but also improve the overall functionality and appeal of the space.

- Create a Remodeling Plan: Formulate a detailed remodeling plan that outlines the scope of work, budget estimates, and an achievable timeline. This roadmap is vital for keeping the project organized and ensuring it stays within financial limits.

- Hire Qualified Contractors: Engage reputable contractors for the remodeling. Research their background, check references, and confirm that they possess the necessary licenses and insurance to guarantee quality workmanship.

- Implement Management Strategies: If the goal is to rent the asset, establish robust management practices. This includes thorough tenant screening processes, regular maintenance schedules, and clear communication protocols to foster positive tenant relationships.

- Monitor Your Investment: Keep a close watch on all financial aspects, including improvement costs, rental income, and the overall asset value. This diligent monitoring ensures that your investment remains profitable and aligns with your long-term objectives.

Moreover, as the construction industry increasingly emphasizes climate-resilient infrastructure to mitigate risks associated with climate change, adopting such strategies can yield significant economic benefits. The World Bank underscores the importance of these investments, stating, "Proactive measures taken today can lead to greater returns down the line." With an estimated $1.8 trillion directed towards by 2030, the potential benefits could reach up to $7.1 trillion.

Therefore, integrating sustainability into your renovation plans not only supports environmental goals but also enhances your property's marketability and resilience. For instance, the case study on climate-resilient infrastructure highlights how such investments can not only safeguard against climate risks but also drive economic growth.

Conclusion

Vacant buildings present a unique landscape filled with both challenges and opportunities. Understanding the various types of vacant properties—from residential homes to commercial and industrial spaces—equips investors with the essential knowledge needed to navigate this complex market. By recognizing the specific characteristics and implications associated with each category, buyers can make informed decisions that align with their investment goals.

The process of researching and acquiring vacant properties involves strategic steps, including:

- Identifying criteria

- Utilizing online resources

- Conducting thorough market analyses

- Engaging local experts

Financial considerations, such as purchase price, renovation costs, and ongoing expenses, play a critical role in determining the feasibility and potential return on investment. Additionally, navigating legal requirements, including title verification and zoning compliance, is paramount to ensuring a smooth transaction.

Once the acquisition is complete, implementing effective renovation and property management strategies is vital for maximizing the building's potential. By assessing renovation needs, hiring qualified contractors, and monitoring financial performance, investors can enhance the value of their properties while fostering positive tenant relationships.

In conclusion, a comprehensive understanding of the vacant property landscape, coupled with diligent research and strategic planning, can lead to successful investments. As the real estate market continues to evolve, staying informed and adaptable will empower investors to unlock the hidden potential of vacant buildings and turn them into profitable ventures. Embracing this approach not only benefits individual investors but also contributes to the revitalization of communities and the overall health of the real estate market.

Frequently Asked Questions

What are vacant structures?

Vacant structures refer to properties that are unoccupied and not actively in use. They can be categorized into different types, including residential, commercial, industrial, and land with structures.

What types of residential vacant buildings exist?

Residential vacant buildings include single-family homes, multi-family units, and condominiums that currently lack occupants.

What is the current vacancy rate for residential properties in the U.S.?

The rate of vacant homes in the U.S. varies significantly, ranging from 4.5% in Worcester, MA, to 38.2% in Cape Coral-Fort Myers, FL.

What are commercial vacant properties?

Commercial vacant properties include office buildings, retail spaces, and warehouses that are not generating income due to a lack of tenants.

How has the commercial real estate market been performing recently?

The commercial real estate market has faced challenges, with a 7% decrease in asset values over the year leading up to May 2024 and a 20% decline over the past two years.

What are industrial vacant buildings?

Industrial vacant buildings are factories and manufacturing facilities that have ceased operations, facing challenges due to ongoing economic shifts.

What does 'land with structures' refer to?

'Land with structures' refers to land that contains abandoned or dilapidated structures, often requiring substantial funding for rejuvenation.

Why is it important for buyers to understand the different types of vacant buildings?

Understanding the different types of vacant buildings helps buyers recognize the specific characteristics and implications of each classification, aiding in informed purchasing decisions.

Which state has recorded the highest gross vacancy rate in the U.S.?

Maine has recorded the highest gross vacancy rate in the nation for 11 of the past 12 years.

What recent trend has been observed in U.S. foreclosure activity?

Monthly U.S. foreclosure activity has risen as of January 2025, indicating trends affecting unoccupied real estate.

What steps should one follow to research unoccupied locations effectively?

To research unoccupied locations, one should: 1. Identify criteria (location, size, zoning, intended use). 2. Utilize online resources (real estate websites, government databases). 3. Conduct market analysis (gauge values, identify trends). 4. Visit locations (evaluate building conditions). 5. Engage local experts (real estate agents, title researchers).

Why is it beneficial to engage local experts in the research process?

Engaging local experts can provide valuable insights and help uncover hidden opportunities within the market, improving the chances of successful investments.