Overview

The article titled "Understanding Liens on Houses: An In-Depth Tutorial for Real Estate Professionals" focuses on the complexities and implications of liens on property transactions. It emphasizes that real estate professionals must understand the various types of liens—such as mortgage, tax, and judgment liens—as these can significantly affect property sales and ownership, highlighting the importance of due diligence and proactive management strategies to navigate these challenges effectively.

Introduction

In the intricate world of real estate, few concepts are as pivotal yet often misunderstood as liens. These legal claims can hold significant sway over property ownership, influencing everything from financing to the transfer of titles. As homeowners and real estate professionals navigate the complexities of property transactions, understanding the various types of liens—such as mortgage, tax, and mechanic's liens—becomes essential.

With a growing number of families owning their homes and the potential for liens to complicate sales, the stakes have never been higher. This article delves into the multifaceted nature of liens, exploring their historical context, legal implications, and practical strategies for resolution, equipping readers with the knowledge needed to effectively manage these critical elements in real estate dealings.

What is a Lien? A Comprehensive Definition

A lien on houses represents a legal claim or interest that a lender holds in a borrower's asset, which remains in effect until the debt is fully paid. This mechanism acts as collateral, enabling lenders to recover the asset in cases of default. Various situations, such as mortgages, unpaid taxes, or service debts, can lead to liens on houses, which can complicate the title and hinder the transfer of ownership.

For realty experts, a comprehensive grasp of claims, particularly liens on houses, is crucial, as they can greatly affect transaction processes. In 2022, for example, the consequences of encumbrances became increasingly relevant, considering that 66.1% of families possessed their primary residence, emphasizing the direct relationship between encumbrances and property values. Furthermore, enhancing risk management approaches through prompt access to security and civil judgment information is vital for assessing clients efficiently, further emphasizing the significance of claims and liens on houses in real property.

Furthermore, a case study from 2024 showed that the average home vendor, aged 63 with a median household income of $112,500, was supported by in 90% of deals, highlighting how encumbrances can influence sellers' experiences in the market. As noted in the 2024 Profile of Home Buyers and Sellers, 72% of sellers indicated they would use the same agent again, reflecting satisfaction that can be influenced by issues related to liens on houses. With ongoing updates in security laws and regulations, professionals must stay informed to navigate the complexities that claims introduce into property dealings.

Types of Liens: Understanding Their Implications

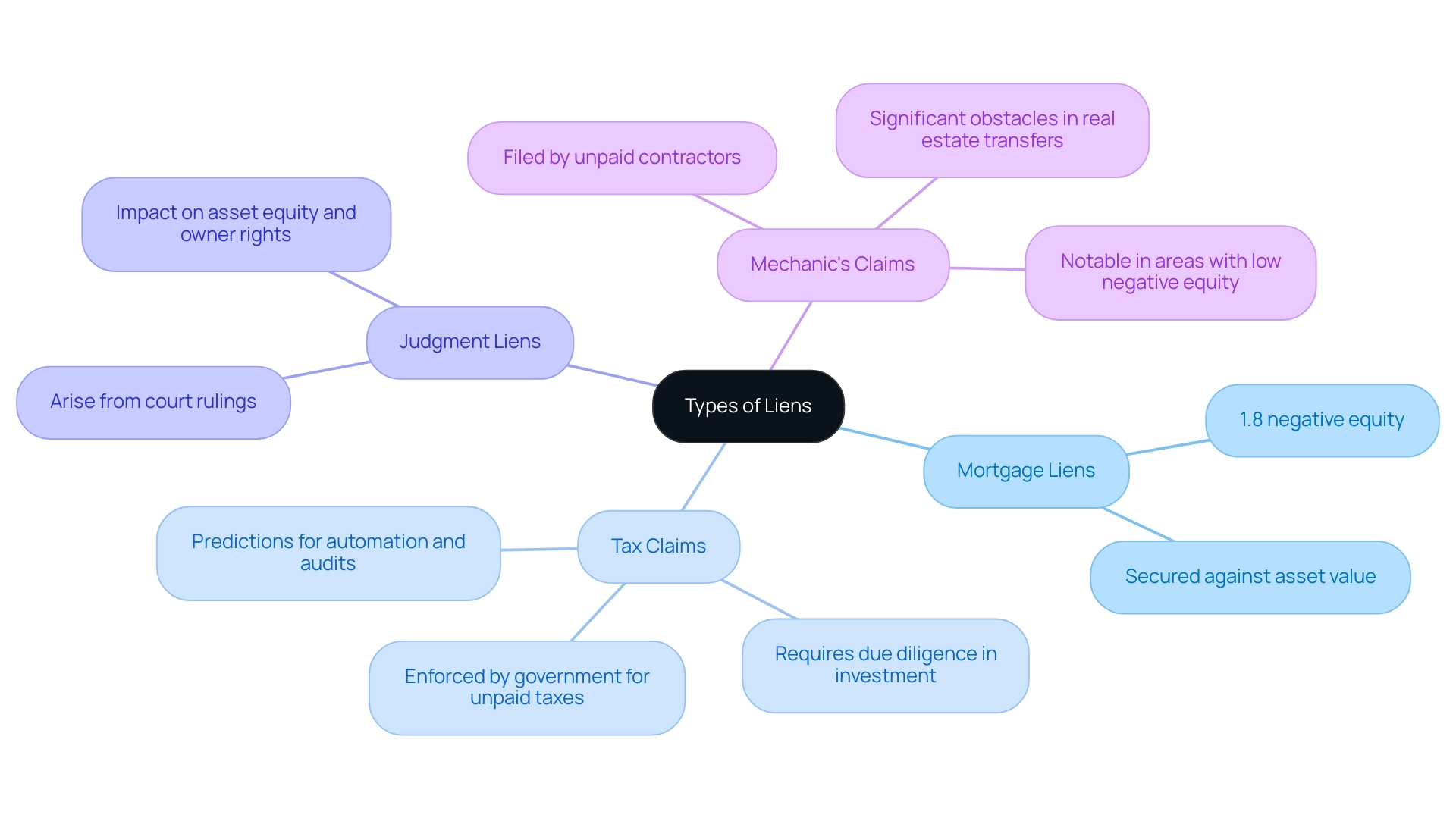

Different forms of claims, especially liens on houses, can greatly affect ownership and transactions, making it essential for real estate experts to understand their complexities. The primary categories include:

- Mortgage Liens: These are secured against the asset's value and are placed by lenders as a safeguard against borrower defaults. With only about 1.8% of homeowners with mortgages currently in negative equity, the prevalence of mortgage claims remains a critical aspect of real estate financing, particularly as asset values fluctuate.

- Tax Claims: Enforced by governmental organizations due to unpaid real estate taxes, tax claims can complicate transactions until they are settled. Experts foresee a technology-driven shift in tax management, with predictions of increased automation and audits, as highlighted in the case study titled "Predictions for Tax and Technology in 2024." This evolution emphasizes the importance of compliance and due diligence in managing tax claims, especially for those considering tax claim investments.

- Judgment Liens: These arise from court rulings when a creditor secures a legal judgment against an owner of real estate. Grasping judgment encumbrances is crucial, particularly when evaluating the possible impacts on asset equity and owner rights.

- Mechanic's Claims: Submitted by contractors or subcontractors who have not been compensated for services provided, mechanic's claims can create significant obstacles during real estate transfers. In areas such as Las Vegas, where the negative equity portion of mortgages is the lowest at 0.6%, the consequences of these claims are especially significant as real estate values attain new peaks.

Dr. Selma Hepp, Chief Economist for CoreLogic, states,

With home prices continuing to reach new highs, owners are also seeing their equity approach the historic peaks of 2023, close to a total of $305,000 per owner.

This context highlights the importance of comprehending different claims, including liens on houses, that can influence . By mastering these concepts, including the essential need for due diligence in tax claims investment, real estate professionals can navigate the complexities of asset ownership and sales with greater confidence.

The Legal Landscape of Liens: Historical Context and Significance

Liens on houses have a storied legal history, arising from the necessity to secure debts and maintain rights to assets. Originally created to safeguard creditors, the structure surrounding claims has experienced substantial development, particularly with regard to liens on houses, as numerous laws have been implemented to harmonize the interests of creditors and property owners. Each state in the United States has developed its own set of laws regarding claims, which include regulations on liens on houses, dictating the creation, enforcement, and resolution of such claims.

For instance, a claim in favor of individuals performing original construction labor takes precedence over previously recorded encumbrances, underscoring the priority of construction claims. This complex legal framework not only influences real estate dealings, including liens on houses, but also offers marketing prospects for contractors. For instance, contractors can focus on residences with underused PACE obligations for energy-efficient enhancements, potentially expanding their clientele and boosting real estate values.

Grasping these subtleties is essential for real estate experts, as it prepares them to manage real estate dealings efficiently and uphold adherence to changing legal obligations. Recent legal interpretations, such as those by Bloedorn Lumber Co., affirm that 'the existence of does not obstruct claims for unjust enrichment or quasi-contract recovery,' emphasizing the legal implications of construction claims in property transactions. Furthermore, the waiver of mechanic's rights, as illustrated in a recent case study, shows that while the right to file or enforce a mechanic's claim can be waived, any waiver made prior to the provision of labor or materials is considered null and void, safeguarding the rights of subcontractors and suppliers.

This emphasizes the significance for professionals to remain knowledgeable about current legislation and its implications for the practice.

The Impact of Liens on Property Sales: What Professionals Need to Know

Liens on houses can significantly influence real estate sales, often leading to delays in closing transactions or even halting sales if not properly managed. For instance, properties burdened by outstanding tax obligations typically require the owner to settle those debts before a sale can proceed. This reality underscores the importance of conducting comprehensive title searches to uncover any existing liens on houses.

Real estate professionals play a critical role in advising clients on how to navigate these issues effectively. By adopting a proactive method, they not only enable smoother exchanges but also protect their clients' interests. Recent trends suggest that properties affected by claims may experience significant delays; on average, these delays can prolong timelines by several weeks.

As Rob Barber, CEO at ATTOM, notes, "Home prices are stretching household budgets more and more, and mortgage rates have been going back up in recent months even as other forces put more upward pressure on prices." This underscores the intricate market dynamics that can influence seller returns, especially in secured situations. Additionally, statistics show that 72% of sellers express a willingness to work with the same agent again, emphasizing the critical value of knowledgeable guidance during complex transactions.

Moreover, the case study titled '' demonstrates that cities such as Las Vegas and Los Angeles, with low negative equity shares, show how encumbrances and equity trends can influence real estate sales. As the market changes, comprehending the consequences of claims, especially liens on houses, is crucial for property professionals seeking to enhance seller results.

Strategies for Removing Liens: Practical Solutions for Real Estate Transactions

Real estate experts have access to a variety of effective strategies for resolving claims, which can significantly streamline property transactions. By leveraging Parse Ai's advanced machine learning tools for document processing and title research automation, professionals can enhance their efficiency in handling challenges related to liens on houses. Here are several current best practices:

-

Negotiation: Engaging directly with creditors to negotiate payment arrangements is often a crucial step in resolving claims. This approach is particularly effective for judgment claims, as it can result in successful releases. As Judge Elizabeth Feffer, who presided over more than 500 civil bench trials, emphasizes, optimizing negotiation tactics is vital for resolving complex legal challenges in real estate.

Utilizing Parse Ai's interactive labeling and OCR technology can streamline the documentation involved in these negotiations, allowing for faster and more accurate information retrieval.

-

Payment Plans: Creating organized payment plans for outstanding debts enables clients to handle their financial obligations while gradually resolving claims. This approach not only reduces immediate financial pressure but also improves the chances of removal.

Parse can help track these plans efficiently, ensuring that all documentation is organized and accessible.

-

Waiver of Claims: Obtaining waivers from contractors or service providers is crucial to avoid mechanic's claims from being filed. This proactive measure safeguards clients from potential financial disputes and enhances the credibility of transactions.

By digitizing and automating the documentation process, Parse AI facilitates easier management of waiver documents, reducing the risk of errors and ensuring compliance.

-

Title Insurance: Advising clients to invest in title insurance serves as a protective measure against unexpected claim issues that may arise post-purchase. This layer of security is critical in mitigating risks associated with property ownership.

Parse AI’s powerful title research automation helps in recognizing potential risks sooner in the process, enabling informed decision-making.

To accelerate the sale of a home burdened by a claim, sellers can resolve the claim early, collaborate with a knowledgeable realty agent, contemplate selling to an investor, and collect essential documentation for negotiations. By implementing these strategies and utilizing Parse AI’s innovative platform, including the example manager for efficient document processing, real estate professionals can effectively guide clients through the challenges of liens on houses, ensuring smoother transactions and greater success rates.

Conclusion

Understanding liens is crucial for anyone involved in real estate, as these legal claims can significantly affect property ownership and transactions. The article has outlined the various types of liens, including:

- Mortgage liens

- Tax liens

- Judgment liens

- Mechanic's liens

It highlights their implications on property values and the importance of due diligence. With a historical context that underscores the evolution of lien laws, real estate professionals are equipped to navigate the complexities that these legal claims introduce into property dealings.

Furthermore, the impact of liens on property sales cannot be overstated. Delays in transactions and complications arising from outstanding debts necessitate comprehensive title searches and proactive strategies to resolve these issues. By employing effective negotiation techniques, establishing payment plans, and utilizing lien waivers, real estate professionals can facilitate smoother transactions and safeguard their clients' interests.

As the market continues to evolve, staying informed about lien legislation and utilizing advanced tools for document processing and title research will empower real estate professionals to manage lien-related challenges effectively. By mastering these concepts and implementing practical strategies, they can enhance their service offerings, optimize seller outcomes, and contribute to a more efficient real estate market. The understanding and resolution of liens are not just legal necessities but essential components of successful property transactions.

Frequently Asked Questions

What is a lien on a house?

A lien on a house is a legal claim or interest that a lender holds in a borrower's asset, which remains until the debt is paid in full. It acts as collateral, allowing lenders to recover the asset in cases of default.

What situations can lead to liens on houses?

Liens on houses can arise from various situations, including mortgages, unpaid taxes, or service debts.

Why is understanding liens important for real estate experts?

A comprehensive understanding of liens is crucial for real estate experts because they can significantly affect transaction processes and complicate property titles.

What percentage of families owned their primary residence in 2022, and how does this relate to liens?

In 2022, 66.1% of families owned their primary residence, highlighting the direct relationship between property ownership and the impact of liens on property values.

How do liens influence home sellers' experiences in the market?

A case study from 2024 indicated that liens can influence sellers' experiences, with 90% of home vendors aged 63 being supported by a realty agent, and 72% of sellers expressing satisfaction with their agents, often influenced by issues related to liens.

What are the main types of liens on houses?

The primary types of liens include: 1. Mortgage Liens: Secured against the asset's value by lenders. 2. Tax Claims: Enforced by governmental organizations due to unpaid real estate taxes. 3. Judgment Liens: Result from court rulings where a creditor secures a legal judgment against the property owner. 4. Mechanic's Claims: Filed by contractors or subcontractors for unpaid services.

What is the significance of due diligence in managing tax claims?

Due diligence in managing tax claims is essential, especially with predictions of increased automation and audits in tax management, making compliance critical for those considering tax claim investments.

How has the real estate market changed regarding equity and liens?

With home prices reaching new highs, owners are seeing their equity approach historic peaks, emphasizing the importance of understanding liens and their impact on asset equity and ownership rights.