Overview

The determination of who pays liens after foreclosure is fundamentally rooted in the hierarchy of claims.

- Senior liens, such as mortgage claims, take precedence over junior claims like second mortgages or judgment liens.

- Understanding this order is crucial for real estate professionals; the proceeds from a foreclosure sale are allocated based on this priority, which directly influences the financial responsibilities of buyers and sellers involved in the transaction.

- Consequently, accurate title research becomes paramount in navigating these complexities.

Introduction

In the intricate realm of real estate, a comprehensive understanding of liens is vital for effectively navigating property ownership and foreclosure processes. A lien—a legal claim against a property—can profoundly affect both buyers and sellers, determining the order of payments when debts are settled. As the foreclosure landscape evolves, the nuances of various types of liens—from mortgage and tax liens to judgment and mechanic's liens—become increasingly critical for real estate professionals.

With a significant percentage of properties encumbered by liens, grasping their implications can mean the difference between a successful transaction and a financial setback. This article explores the multifaceted aspects of liens, their hierarchical structure, and the responsibilities they impose on lenders and homeowners alike, offering invaluable insights for those engaged in real estate transactions.

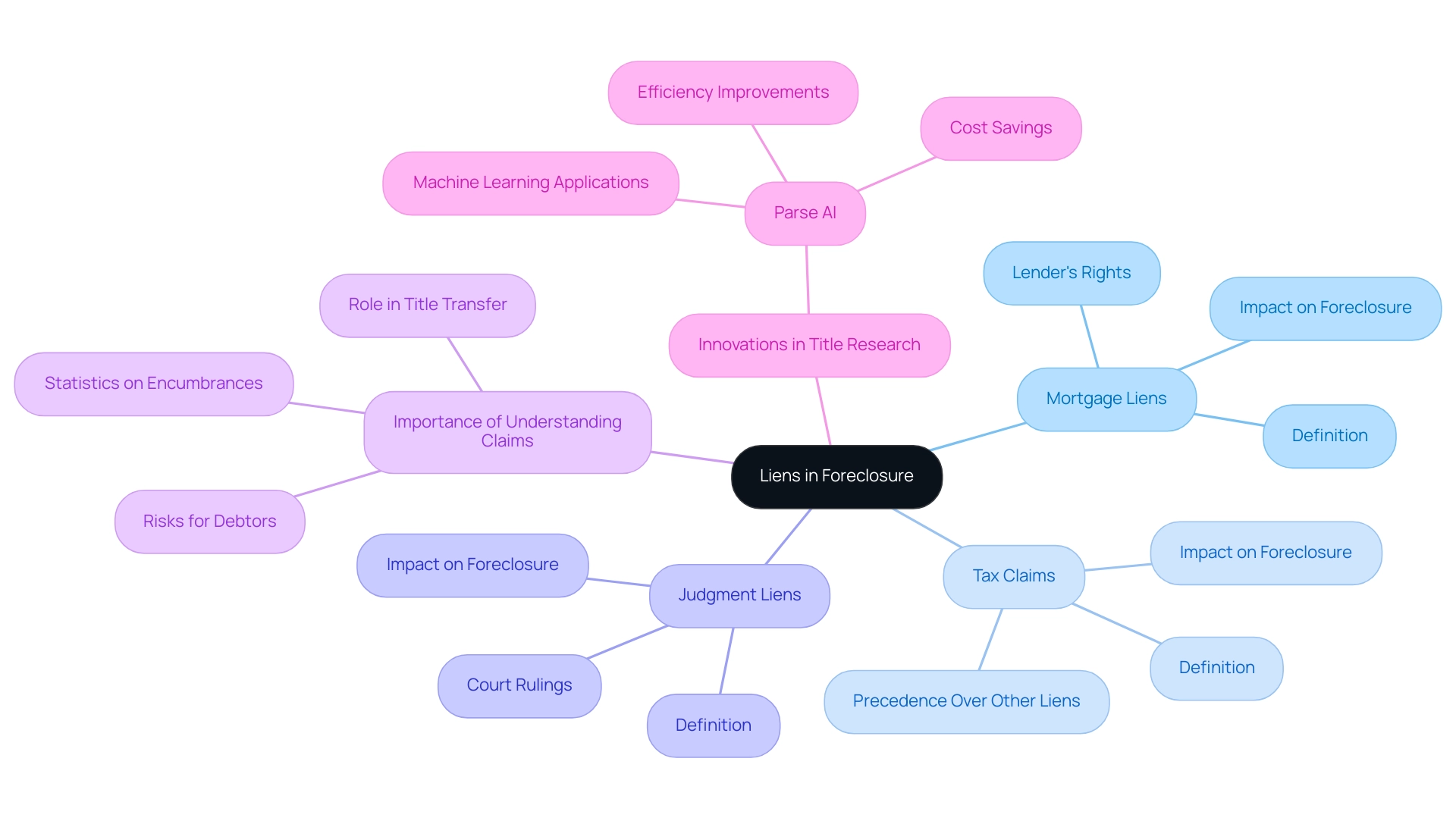

Understanding Liens: Definition and Importance in Foreclosure

or right against an asset is typically utilized as collateral to guarantee a debt. This claim can significantly impact property ownership, establishing a creditor's interest in the asset until the underlying obligation is satisfied. Understanding the nuances of claims is essential for real estate professionals, particularly concerning foreclosure.

As Dennis Madamba states, "A claim is a right or legal assertion to a certain asset owned by a debtor, often those utilized as security for a loan." There are several types of liens, each serving a distinct purpose:

- Mortgage Liens: These are the most common type of liens, created when a borrower takes out a loan to purchase property. The creditor retains a claim on the asset until the mortgage is settled.

- Tax Claims: Imposed by government entities when real estate taxes are unpaid, tax claims take precedence over other types of encumbrances, meaning they must be settled before any other assertions against the asset.

- Judgment Liens: These arise from court rulings against a debtor, allowing the creditor to claim the debtor's assets to satisfy the judgment.

The importance of claims in foreclosure is critical, especially when considering who pays liens after foreclosure. When an asset is foreclosed, it is vital to understand who pays liens after foreclosure, as creditors have a legal right to receive payment from the proceeds of the sale. This process can complicate title and ownership, particularly regarding the resolution of existing claims before the asset can be transferred to a new owner.

For instance, if a mortgage claim is not fulfilled, the lender maintains the right to recover the asset, obstructing the sale process and influencing the new owner's ability to obtain clear title. Furthermore, borrowers face the risk of losing their assets if they cannot fulfill the obligation tied to a claim, underscoring the importance of comprehending these rights in property transactions.

Current statistics indicate that a significant percentage of assets have some form of encumbrance attached, highlighting the necessity of understanding these claims in real estate dealings. For example, while the National Mortgage Database (NMDB) offers a 5 percent sample of mortgages, it emphasizes the prevalence of claims in ownership, noting that it is not a census of all mortgages.

In summary, claims are fundamental in the processes of asset ownership and determining who pays liens after foreclosure. They not only secure debts but also influence the transfer of title deeds, making it essential for realty professionals to navigate these complexities effectively. Additionally, platforms such as Parse AI are transforming title research by addressing the challenges linked to verifying real estate ownership, thereby enhancing management efficiency for real estate professionals.

The Hierarchy of Liens: Who Gets Paid First?

- The order of claims in property sales is crucial for understanding who pays liens after foreclosure when a property is sold to settle obligations. Typically, senior claims, such as first mortgages, take precedence over junior claims, which may include second mortgages or of credit. This hierarchy is vital for both buyers and sellers, particularly for those responsible for paying liens after foreclosure, as it directly influences the distribution of proceeds from a foreclosure sale.

- In a foreclosure scenario, grasping who pays liens after foreclosure is essential, as the proceeds from the sale are allocated according to the established priority structure. For instance, if an asset sells for $300,000 and there are two claims—one senior mortgage of $250,000 and a junior claim of $50,000—the senior claimant will receive the full amount due before any funds are distributed to the junior claimant. Should the sale proceeds fall short of covering the senior claim, the junior creditor may receive nothing.

Understanding who pays liens after foreclosure is critical for real estate professionals, as this knowledge influences the risk associated with acquiring foreclosed assets. Purchasers must recognize that acquiring a property with existing subordinate claims could lead to unforeseen financial obligations. Conversely, sellers must acknowledge that the presence of multiple claims can complicate the sale process and impact the final sale price.

- Statistics reveal that a significant percentage of loans enter foreclosure processes annually, with the year-end percentage reported at 1.5%. This statistic underscores the ongoing challenges in the market and highlights the importance of the priority hierarchy in property transactions.

- A case study from San Marcos illustrates the implications of priority in property development. The city embarked on two mixed-use affordable housing projects, funded through a combination of federal, state, and city resources, along with private-sector loans. The successful funding and subsequent infrastructure enhancements demonstrate how understanding the hierarchy of claims can lead to improved outcomes in community development initiatives. As Amanda Cadelago noted, although distinct areas and industry sectors commenced at different intervals, the aspiration to securely reinstate businesses and provide residents opportunities to thoughtfully navigate their communities was a shared motif influencing city leaders' decisions.

- Furthermore, the SEC's March 12, 2025, update to Rule 506(c) streamlines investor verification, which is vital for property professionals managing compliance in transactions. This regulatory change can ease compliance challenges and simplify online fundraising for issuers, making it particularly relevant for those engaged in property.

- In summary, the order of claims in repossession sales is a fundamental aspect that property professionals must navigate. By thoroughly understanding who pays liens after foreclosure and the implications of priority, they can make informed decisions that benefit both buyers and sellers in foreclosure situations.

Types of Liens Impacting Foreclosure Outcomes

-

Common Types of Claims: Understanding the various is crucial for professionals in the field. The most common types include:

- Mortgage Liens: These secured loans against the property grant lenders the right to foreclose if payments are not made. In the event of foreclosure, mortgage liens typically take precedence over other claims, meaning they must be satisfied first.

- Tax Liens: Imposed by the government for unpaid taxes, these liens can significantly influence foreclosure outcomes. Federal tax claims, for instance, can attach to assets even if they arise after the claim is filed; however, unrecorded transfers may prevent them from attaching if the taxpayer has divested all interest prior to assessment. Additionally, the Internal Revenue Code offers special protections for limited interests, granting them priority over federal tax liens.

- Mechanic's Liens: Filed by contractors or suppliers who have not been compensated for work performed on the property, mechanic's liens can complicate the foreclosure process, as they may need resolution before the property can be sold.

- Judgment Liens: These liens arise from court decisions and can attach to a property if the owner fails to pay a debt. They can hinder the sale of the asset during repossession, as they must be resolved to clear the title.

-

Impact on Repossession Processes: Each type of claim can significantly alter the repossession landscape. For example, mortgage claims generally hold precedence, indicating that any subsequent claims may be eliminated upon seizure. Conversely, tax claims can complicate matters, remaining attached to the asset even after the sale, potentially resulting in additional obligations for the new owner. Mechanic's and judgment claims can also delay the sale process, as they may require negotiation or settlement prior to the asset being sold. A pertinent case study involves the gift tax obligation, which arises automatically when a donor makes a gift liable for tax. This lien attaches solely to the property subject to the gift and can shift with the property if transferred, similar to the estate tax lien.

-

Strategies for Mitigating Risks: To navigate the complexities of liens in foreclosure, real estate professionals can implement several strategies:

- Due Diligence: Conduct thorough title searches to identify existing liens before proceeding with a transaction. This practice aids in comprehending the potential risks and liabilities associated with the property.

- Negotiation: Engage with lienholders to negotiate settlements or payment plans, particularly for mechanic's and judgment liens, facilitating smoother transactions.

- Title Insurance: Consider obtaining title insurance to safeguard against unforeseen claims or liens that may arise post-purchase, providing an additional layer of security.

By comprehending the implications of various types of liens and employing effective strategies, real estate professionals can better manage the risks associated with foreclosure processes.

Responsibilities of the Foreclosing Lender: Who Pays What?

- Lenders initiating the process bear specific responsibilities regarding payment obligations that must be adhered to during legal proceedings. These duties include ensuring that all pending claims are resolved to avert complications that may arise during or post-property seizure. Failure to manage these claims can lead to significant financial repercussions and legal challenges.

- Throughout , lenders typically oversee outstanding claims by conducting thorough title searches to identify any existing rights against the asset. This proactive approach allows lenders to prioritize which claims must be settled before the property can be sold. For instance, in judicial states, lenders may need to address liens as part of the court proceedings, whereas in non-judicial states, they may negotiate directly with lienholders. It is essential to recognize that most practices discussed apply to property repossessions in judicial states but should also be observed in non-judicial states if judicial intervention is sought.

- A notable case study titled 'Characterization of Losses from Property Repossession and Deed-in-Lieu' illustrates how lenders categorize losses from these transactions. If a lender is engaged in a lending trade or business, losses from property seizures are deemed ordinary losses, allowing for greater deductibility. Conversely, if the debts are classified as nonbusiness, they are treated as short-term capital losses, which impose stricter limitations on deductibility. This distinction underscores the importance of understanding security obligations and their financial implications.

- The consequences for lenders who neglect their security obligations can be dire. They may face legal action from lienholders and incur additional costs associated with determining who pays liens after foreclosure when resolving these claims. Furthermore, lenders must be cognizant of the tax implications of borrower defaults, particularly in the current economic climate characterized by rising interest rates. Grasping these dynamics is vital for effective risk management. For example, the typical duration required to resolve a property repossession case in Cuyahoga County decreased by 45% from the end of 2005 to 2007, highlighting the importance of prompt management of financial obligations.

- Expert insights reveal that lenders often employ various strategies to manage outstanding debts during property repossession. These strategies may include negotiating payment arrangements with creditors or prioritizing claims to facilitate the sale of the asset. By adeptly managing these obligations, lenders can mitigate risks and improve their recovery outcomes. As Richard Bogue, Senior Counsel, noted, 'The nine-month stay is slated to expire on December 31, 2012; after that date, the stay period is to revert to the SCRA’s original ninety days,' underscoring the necessity for leaders to remain informed about evolving regulations.

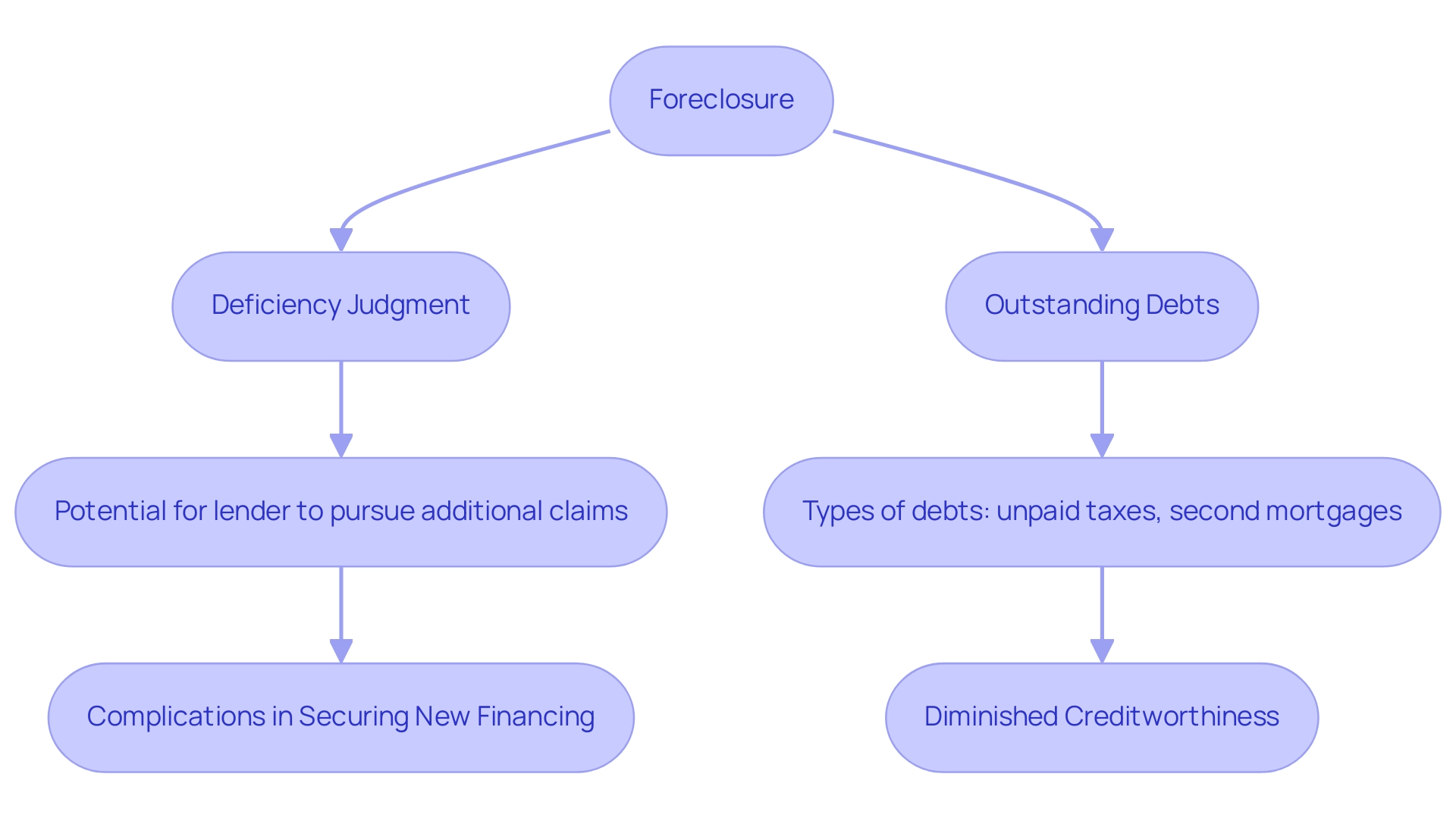

Homeowner Liabilities After Foreclosure: What You Need to Know

- Deficiency judgments arise when an asset is sold under duress for less than the remaining mortgage amount. For example, if a home sells for $300,000 while the mortgage balance stands at $350,000, the lender may pursue a deficiency judgment for the remaining $50,000. This legal action can significantly burden homeowners, leading to additional financial liabilities and adversely affecting their credit scores. Homeowners confronted with such judgments may find themselves responsible for substantial amounts, complicating their financial recovery.

- Outstanding debts following property seizure can severely hinder a homeowner's credit and overall financial condition. These claims, which encompass unpaid property taxes or second mortgages, remain attached to the property even post-foreclosure, raising the critical question of who bears the responsibility for liens after foreclosure. Consequently, homeowners may struggle to secure new financing or may encounter elevated interest rates due to their diminished creditworthiness. The repercussions can be enduring, impacting their ability to purchase another home or obtain favorable loan terms.

Homeowners facing deficiency judgments and outstanding obligations must take proactive measures to comprehend who pays liens after foreclosure. Consulting with a financial advisor or a property attorney can illuminate available options, such as negotiating with lenders or exploring bankruptcy as a means to discharge certain debts. Furthermore, understanding state-specific laws regarding deficiency judgments is vital, as certain states, such as California, offer anti-deficiency protections, although exceptions may still expose borrowers to liability.

- Case studies underscore the real-world impact of deficiency judgments on homeowners. For instance, an analysis of from the Home Mortgage Disclosure Act (HMDA) revealed trends in approval rates and loan sizes, indicating that homeowners with outstanding deficiencies encountered significant obstacles in securing new loans. Additionally, a recent study indicated that changes in Nevada's laws resulted in a decline in mortgage approval rates by approximately 3% for affected applications, highlighting the broader implications of legal frameworks on homeowner financial health. As Florian Oswald noted, "The views expressed here are those of the authors and do not necessarily represent those of the Federal Reserve Bank of Philadelphia or the."

- Statistics demonstrate that deficiency judgments can lead to substantial financial repercussions. Homeowners who experience these judgments frequently witness a marked decline in their credit scores, which can take years to recover. Understanding these dynamics is essential for homeowners to navigate the post-foreclosure landscape effectively.

Common Scenarios: Who Pays Liens After Foreclosure?

-

Case Studies of Payment Scenarios After Foreclosure: Understanding who pays liens after foreclosure and how financial claims are managed post-foreclosure is crucial for real estate professionals. For example, in a situation involving a federal tax claim, the claim remains enforceable until the assessed liability is satisfied, which generally permits the IRS up to ten years to collect. This is demonstrated by the case study on the duration of the federal tax obligation, emphasizing that the claim persists until the liability is resolved or becomes unenforceable due to the passage of time. If a property is foreclosed upon, the tax obligation may still be a priority claim against the property, affecting the distribution of proceeds from the sale.

-

Treatment of Different Types of Claims: Various types of claims, such as mortgage claims, tax claims, and judgment claims, are treated differently in foreclosure scenarios. Mortgage claims typically take priority over other claims, meaning they are paid first from the sale proceeds. In contrast, federal tax claims can have , allowing them to be paid before other obligations, which can complicate the distribution of funds. Moreover, the transformation rule may also impact a creditor's Purchase Money Security Interest (PMSI) in consumer goods if the debtor-taxpayer refinances or consolidates debts without acquiring new goods, further influencing the priority of claims.

-

Expert Analysis on Who Pays Liens After Foreclosure: In many cases, the responsibility for settling liens falls to the borrower; however, this can vary based on the type of lien and the foreclosure process. For instance, if an asset is sold at auction, the new owner may assume the obligation for specific claims, depending on state regulations and the type of claim. Real property professionals must be aware of these nuances to advise clients accurately. Understanding the superpriority for purchasers of money is crucial, as it allows money to flow in commerce without delays for searching for federal tax liens, emphasizing the importance of lien priority.

-

Navigating Lien Payment Scenarios: To effectively navigate lien payment scenarios post-foreclosure, real estate professionals should:

- Conduct thorough due diligence on the property’s lien history before purchase.

- Understand the hierarchy of liens and how they affect the sale process.

- Stay informed about state-specific laws regarding lien treatment in foreclosure.

- Collaborate with legal experts to clarify any complex lien situations.

- Utilize technology, such as Parse AI, to streamline the research process and ensure accurate information is gathered quickly.

By grasping the intricacies of lien treatment in foreclosure situations, including the implications of intangible property being subject to federal tax liens, real estate professionals can better protect their clients' interests and facilitate smoother transactions.

The Importance of Title Searches: Preventing Lien Issues

A title search represents a thorough examination of public records aimed at determining the legal ownership of an asset and uncovering any existing claims or encumbrances that could affect it. This process typically entails reviewing documents such as deeds, mortgages, and court records to verify that the title is clear and marketable. The importance of conducting a title search cannot be overstated, as it serves as a critical safeguard against potential legal disputes and financial liabilities arising from undisclosed claims.

Neglecting to perform a title search prior to purchasing a property can expose buyers, especially those who pay liens following foreclosure, to significant risks. For instance, purchasers who assume liens after foreclosure may inadvertently take on existing claims from previous owners, potentially leading to unexpected financial burdens. A recent study revealed that nearly 25% of property transactions encounter complications related to undisclosed liens, highlighting the necessity for comprehensive title searches.

Without this essential step, buyers may confront legal challenges, loss of ownership rights, or even foreclosure due to unpaid debts associated with the asset, raising the critical question of who pays liens after foreclosure.

As Andrew Senerchia, Attorney at Senerchia & Senerchia P.C. and President of Dimension National Title, asserts, "Through it all, Andrew remains driven by his parents’ example and the simple principle of working hard to achieve excellence in his chosen profession." This principle holds particular relevance in the realm of title searches, where diligence and expertise can avert costly oversights.

To mitigate these risks, real estate professionals should adhere to best practices during title searches. This includes:

- Utilizing advanced technology, such as machine learning and optical character recognition (OCR), as illustrated in the case study "," to streamline the search process and enhance accuracy. Parse AI's platform provides powerful title research automation capable of extracting critical information from title documents, significantly reducing time and costs compared to traditional methods.

- Collaborating with skilled title researchers who understand the intricacies of real estate records and can effectively identify potential issues.

- Regularly updating their knowledge of local laws and regulations that may influence title searches and land ownership.

- Meticulously documenting all findings to ensure transparency and provide a clear record for future reference.

By implementing these best practices and leveraging tools like Parse AI, real property professionals can substantially minimize the risks associated with property purchases and facilitate a smoother transaction process. Explore how Parse AI can revolutionize your title research approach and enhance operational efficiency.

Seeking Legal Guidance: Resources for Real Estate Professionals

-

Key Legal Resources for Property Professionals: Real property professionals can greatly benefit from various organizations and resources that specialize in encumbrance issues. Significant resources include the American Land Title Association (ALTA), which provides educational materials and advocacy for title professionals, and the National Association of Realtors (NAR), which offers updates on legal developments impacting . Furthermore, local bar associations frequently provide referral services, connecting professionals with lawyers skilled in related issues. LexisNexis, recently recognized as the Best Online Public Records Research Provider by the National Law Journal in 2024, serves as a valuable resource for accessing public records related to liens.

-

Choosing the Right Legal Counsel for Lien Matters: Selecting appropriate legal counsel for lien-related issues is crucial. Here are some essential tips to guide this process:

- Assess Experience: Seek attorneys who specialize in real estate law and possess a proven track record in handling lien disputes. Their familiarity with local laws and regulations can prove invaluable.

- Evaluate Communication Skills: Effective communication is paramount. Choose a lawyer capable of clearly explaining complex legal concepts and responsive to your inquiries.

- Consider Reputation: Research potential counsel through reviews, testimonials, and case studies. A lawyer with a strong community reputation can provide peace of mind.

- Discuss Fees Upfront: Understand the fee structure before engaging a lawyer. Clarity about expenses can prevent misconceptions in the future.

-

Staying Informed on Legal Rules and Regulations: The legal environment surrounding claims is continually evolving. Real property experts must remain knowledgeable about changes in legal claims and regulations to safeguard their interests. Regularly consulting resources such as legal journals, attending industry seminars, and participating in professional associations can ensure you stay up-to-date on relevant legal developments. For instance, understanding the implications of resolving a claim, as noted by experts, can have significant tax consequences, especially when negotiating a reduced payoff amount. Staying informed not only aids in compliance but also enhances strategic decision-making in real estate transactions. Furthermore, the case study titled 'Who Can Place a Lien on a House?' outlines the entities that possess the legal right to impose a claim on a property, including contractors, lenders, and taxing agencies, highlighting the potential for legal actions due to unauthorized claims. Additionally, car liens protect the dealership or finance until the vehicle is paid off or repossessed, illustrating the broader context of lien protections and their implications.

Conclusion

Understanding liens is essential for anyone involved in real estate, as they play a significant role in property ownership and foreclosure processes. The various types of liens—mortgage, tax, judgment, and mechanic's liens—each have unique implications that can influence the outcome of real estate transactions. Recognizing the hierarchy of liens is equally critical, as it dictates the order in which creditors are paid during foreclosure sales. Senior liens, such as first mortgages, typically take precedence over junior liens, impacting both buyers and sellers in their decision-making.

Furthermore, the responsibilities of foreclosing lenders and the potential liabilities homeowners face post-foreclosure underscore the complexities of managing liens. Homeowners may encounter deficiency judgments and lingering liens that can affect their financial recovery and credit status. By conducting thorough title searches and engaging legal expertise, real estate professionals can mitigate risks associated with undisclosed liens and navigate the intricacies of lien management effectively.

Ultimately, a comprehensive understanding of liens and their implications empowers real estate professionals to make informed decisions, protect their clients' interests, and facilitate smoother transactions. As the real estate landscape continues to evolve, staying informed about lien laws and leveraging technology can enhance operational efficiency and ensure compliance. It is imperative for all stakeholders to prioritize lien awareness in their practices.

Frequently Asked Questions

What is a legal claim against an asset, and how is it used?

A legal claim against an asset is typically utilized as collateral to guarantee a debt, impacting property ownership by establishing a creditor's interest in the asset until the underlying obligation is satisfied.

What are the different types of claims or liens mentioned in the article?

The article mentions three types of liens: Mortgage Liens, created when a borrower takes out a loan to purchase property; Tax Claims, imposed by government entities for unpaid real estate taxes; and Judgment Liens, arising from court rulings against a debtor.

Why is understanding claims important in foreclosure situations?

Understanding claims is critical in foreclosure situations because it determines who pays liens after foreclosure, influencing the distribution of proceeds from the sale and complicating title and ownership transfer.

How does the order of claims affect foreclosure sales?

The order of claims is crucial as senior claims, like first mortgages, take precedence over junior claims. This hierarchy dictates how proceeds from a foreclosure sale are distributed, with senior claimants receiving payment before junior claimants.

What happens if the proceeds from a foreclosure sale are insufficient to cover all claims?

If the proceeds from a foreclosure sale are insufficient to cover all claims, senior claimants will receive their full amount due first, and junior claimants may receive nothing if the sale proceeds fall short of covering the senior claim.

What statistics highlight the prevalence of foreclosure in the market?

Statistics indicate that a significant percentage of loans enter foreclosure processes annually, with a year-end percentage reported at 1.5%, underscoring ongoing challenges in the market.

How does understanding the hierarchy of claims benefit property professionals?

Understanding the hierarchy of claims helps property professionals navigate risks associated with acquiring foreclosed assets and informs sellers about the complexities that multiple claims can introduce to the sale process.

What recent regulatory change is relevant for property professionals managing compliance?

The SEC's update to Rule 506(c) on March 12, 2025, streamlines investor verification, easing compliance challenges for property professionals engaged in transactions and simplifying online fundraising for issuers.