Overview

Conducting a free property lien search is essential to safeguard investments in real estate, as it uncovers any undisclosed claims that could impose significant financial liabilities on the asset. The article supports this by outlining various methods for performing these searches, such as utilizing online databases and local government offices, while emphasizing the potential risks of acquiring properties with hidden liens that can lead to costly legal disputes.

Introduction

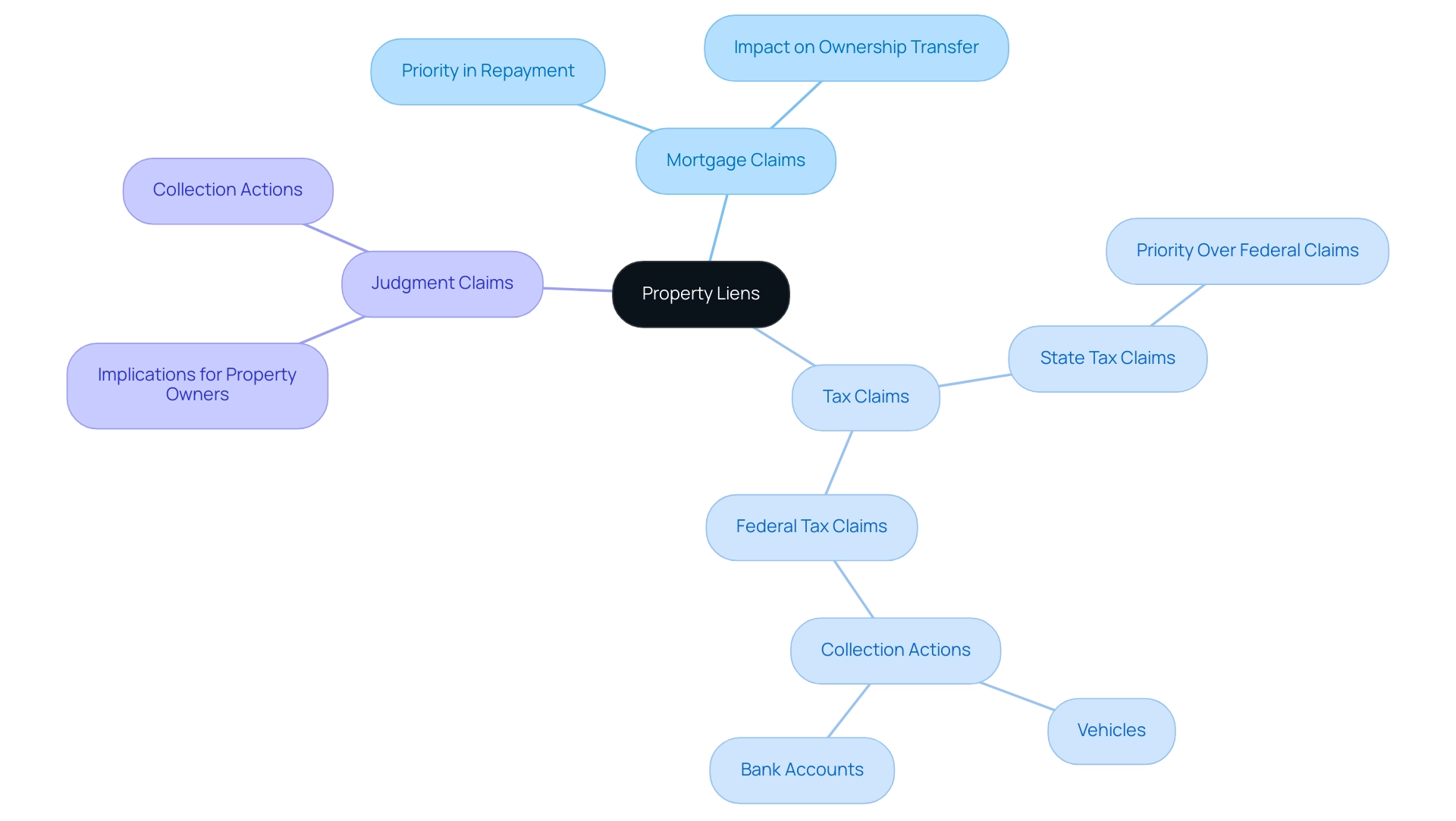

Navigating the complexities of property ownership requires a thorough understanding of liens, which serve as legal claims against real estate and can significantly affect ownership rights and transferability. Different types of liens—such as mortgage, tax, and judgment liens—each come with unique implications that can complicate property transactions.

For prospective buyers and current owners alike, the stakes are high; undiscovered liens can lead to unexpected financial burdens and legal disputes. As the landscape of property transactions continues to evolve, recognizing the importance of conducting comprehensive lien searches becomes paramount.

This article delves into the intricacies of property liens, the necessity of thorough searches, and the methods available to ensure informed decision-making when navigating real estate investments.

Understanding Property Liens: What You Need to Know

A legal claim serves as a legal entitlement against an asset, significantly influencing its ownership and transferability. Different kinds of claims exist, including mortgage claims, tax claims, and judgment claims, each having unique implications for landowners and potential purchasers. For example, mortgage claims generally hold priority in repayment orders during real estate transactions, indicating mortgage financiers are often paid first.

In contrast, certain state and local tax claims may supersede federal tax claims, should local law grant them priority. Recognizing these differences is crucial; claims can hinder real estate transactions or impose extra financial obligations on owners.

Statistics indicate that for claim removal under an active Delinquent Debt Investigation Agreement (DDIA), total unpaid balances of assessments and pre-assessed taxes must be $25,000 or lower. This financial limit is essential for owners as it directly affects their decision-making process when dealing with claims; surpassing this amount can complicate withdrawal efforts and extend financial responsibilities. Moreover, case studies, such as those concentrating on personal assets and federal tax claims, demonstrate that collection actions can be taken against various asset types, including vehicles and bank accounts.

For instance, a landowner with an outstanding federal tax obligation may find their vehicle subject to repossession if the debt remains unpaid, emphasizing the serious repercussions of unresolved claims. As Daniel W. Lias, a Transactional Business Consultant who works closely with law firms on due diligence investigations, states,

Understanding the nuances of claims is critical for .

This highlights the difficulties that real estate owners encounter; getting acquainted with these ideas prior to performing an inquiry will allow you to analyze the results more efficiently and grasp their significance for ownership.

Why Conducting a Lien Search is Essential for Property Transactions

Carrying out a free property lien search is not just recommended; it is a crucial measure in safeguarding your investment during any real estate transaction. Undisclosed claims can result in considerable financial obligations, including unpaid back taxes or unresolved debts that may burden the asset. For instance, on 01/01/2018 was 5.53%, underscoring the financial implications of these liabilities.

Without a thorough free property lien search, purchasers are at risk of acquiring assets encumbered with concealed liabilities, which could lead to expensive legal conflicts or even loss of ownership. A case study demonstrates this: when securing a mortgage or home equity loan, the homeowner consents to use their residence as collateral, permitting the lender to impose a claim on the asset. If payments are missed, both the mortgage lender and any additional lenders can claim the home, emphasizing the hierarchy of repayment upon sale.

A projected proportion of assets have hidden claims, emphasizing the importance of this preventative action. By conducting a comprehensive investigation that includes a free property lien search, you equip yourself with vital details concerning any claims on the property, enabling more secure and assured transactions. Furthermore, consulting tax practitioners familiar with specific jurisdictions can provide insights that enhance the understanding of tax sale processes and laws.

As noted by legal expert Carl E. Fumarola,

Internet subscribers and online readers should not act upon this information without seeking professional counsel.

This highlights the significance of seeking advice from informed experts to manage the intricacies of property claims efficiently.

Methods for Conducting a Free Property Lien Search

Conducting a free property lien search can be accomplished through several effective methods, enhanced by leveraging advanced tools like those offered by Parse AI:

- Online Databases: Utilizing websites such as county assessor or property appraiser portals is a straightforward way to access public records, including detailed claim information. These resources often include a free property lien search that is user-friendly and updated regularly, offering a dependable starting point for your inquiry.

- Local Government Offices: A visit to your county clerk's office or recorder's office can yield valuable property records. These offices maintain comprehensive public records and can assist you in navigating the documentation process.

- Public Libraries: Numerous public libraries provide access to real estate record databases, which can be essential for performing comprehensive inquiries. These resources frequently encompass and may assist in recognizing any current claims.

- Engaging with title companies can also be beneficial for performing a free property lien search. Certain firms offer complimentary initial inquiries or consultations, providing assistance through the claim process and aiding you in comprehending any intricacies in the asset's title history. Consulting a professional abstractor can clarify any complications in the property's title history, ensuring a more accurate understanding of potential liens.

Incorporating Parse AI’s advanced machine learning tools can further expedite document processing and interpretation, particularly through features like that extracts essential data efficiently. For instance, the example manager allows users to quickly annotate a single example, facilitating the extraction of information from large sets of unstructured documents. This capability is essential for improving the precision and pace of claims investigations.

As Jim Akin, a freelance writer based in Connecticut, notes, "With experience as both a journalist and a marketing professional, my recent focus has been in the area of consumer finance and credit scoring." This viewpoint highlights the significance of comprehensive investigations, which are facilitated and enhanced by the tools offered by Parse AI. Furthermore, while looking for UCCs that may involve intellectual assets (IP) as collateral is crucial, depending exclusively on standard UCC and statutory claims inquiries may not offer adequate detail concerning IP.

A typical UCC inquiry may only provide a general collateral description, necessitating further investigation into security agreements to fully understand the inclusion of IP in collateral. Each of these techniques functions as a crucial instrument in evaluating the status of an asset's claims, ultimately assisting in informed decision-making.

Step-by-Step Guide to Performing a Property Lien Search

To effectively conduct a property lien search, adhere to the following structured approach:

- Gather Property Information: Begin by collecting essential details, including the property address, parcel number, and the owner's name. This essential data is crucial for a precise inquiry. As noted by real estate expert Dave Chaffey, "Depending on your resources, there may be keywords where realistically you aren't competing for the top spot and it's good to acknowledge that." This principle applies to encumbrance searches as well, emphasizing the importance of thorough information gathering.

- Access Online Resources: Navigate to your local county's valuation appraiser website or utilize a reputable online database to access public records. These platforms usually contain important information about a free property lien search for real estate claims.

- Look for Liens: Enter the collected real estate details into the input fields available on the website. Carefully review the results of the free property lien search for any recorded claims, as they can significantly impact . Statistics indicate that successful property searches can prevent costly errors in transactions, underscoring the importance of diligence in this step.

- Request Records: If additional information is needed or if any claims are discovered, contact the local government office to request detailed records. This step is essential for gaining understanding of the nature of any claims and their effects on the asset by conducting a free property lien search.

- Record Discoveries: Carefully note any claims identified during your investigation, along with their possible effects on the asset in question. This documentation will be invaluable for future transactions and for advising stakeholders on the condition of the asset.

In a case study from 2024, FSBO transactions represented 6% of home sales, demonstrating that precise property investigations can greatly affect the success of such sales, where sellers frequently encounter difficulties in pricing and overseeing the sale process. By adhering to this extensive manual, you will guarantee a detailed examination of any claims against assets, thereby reducing risks and improving the quality of your title research.

Overcoming Challenges in Property Lien Searches

Conducting lien searches often involves navigating a labyrinth of challenges, such as incomplete records, outdated data, and barriers to accessing public databases. To effectively mitigate these issues, the following strategies are recommended:

-

Verify Sources: Rigorously cross-check information from multiple reputable sources to ensure accuracy.

This step is crucial, as the Cadasta Foundation highlights significant discrepancies in land records across various countries, emphasizing the need for reliable data. As Linda Foster, , notes, accurate data is paramount in ensuring effective research on real estate.

-

Stay Updated: Continuously monitor lien records, as assets frequently change ownership or acquire new liens. Regular updates are essential to maintaining the integrity of your research.

-

Seek Professional Help: For complicated cases, it is advisable to consult with a title company or real estate attorney. Their expertise can provide clarity and assist in navigating complex legal landscapes.

-

Utilize Technology: Employ advanced technologies such as machine learning and optical character recognition to streamline the retrieval process and enhance data accuracy. These tools can assist in addressing the data standardization challenges illustrated in a case study where inconsistent systems across counties resulted in misinterpretation of data, affecting downstream processes. The Cadasta Foundation has funded projects in various countries, including the Democratic Republic of the Congo and Malaysia, which illustrates the global context of these data challenges.

By recognizing these challenges and applying effective strategies, you can conduct thorough and precise property lien searches, ultimately leading to more informed decision-making.

Conclusion

Understanding property liens is crucial for anyone involved in real estate transactions. This article has explored the various types of liens, including mortgage, tax, and judgment liens, each carrying distinct implications that can significantly impact property ownership and transferability. The importance of conducting thorough lien searches cannot be overstated, as undiscovered liens can lead to unexpected financial liabilities and legal complications.

The methods for conducting effective lien searches have also been outlined, emphasizing accessible resources such as:

- Online databases

- Local government offices

- Title companies

By following a structured approach to gathering information, accessing public records, and documenting findings, property owners and buyers can mitigate risks associated with hidden encumbrances. Additionally, addressing challenges such as incomplete records and outdated information is vital for ensuring accurate and reliable search results.

Ultimately, navigating the complexities of property liens is essential for informed decision-making in real estate. By understanding the nuances of liens and employing effective search strategies, stakeholders can protect their investments and facilitate smoother property transactions. The proactive approach to lien searches not only enhances the security of ownership but also fosters confidence in the real estate market as a whole.

Frequently Asked Questions

What is a legal claim in relation to property?

A legal claim serves as a legal entitlement against an asset, affecting its ownership and transferability. Different types of claims include mortgage claims, tax claims, and judgment claims, each with unique implications for landowners and potential buyers.

How do different claims affect real estate transactions?

Claims can hinder real estate transactions or impose additional financial obligations on property owners. For instance, mortgage claims typically hold priority in repayment orders, meaning mortgage financiers are often paid first during real estate transactions.

What is the significance of the $25,000 limit in the context of claims?

For claim removal under an active Delinquent Debt Investigation Agreement (DDIA), total unpaid balances of assessments and pre-assessed taxes must be $25,000 or lower. Exceeding this amount can complicate withdrawal efforts and extend financial responsibilities for property owners.

What are the consequences of unresolved claims for property owners?

Unresolved claims can lead to serious repercussions, such as the repossession of assets. For example, a landowner with unpaid federal tax obligations may have their vehicle subject to repossession if the debt remains unpaid.

Why is it important to conduct a free property lien search?

Carrying out a free property lien search is crucial to safeguard investments during real estate transactions. Undisclosed claims can lead to significant financial obligations, including unpaid taxes or unresolved debts that burden the asset.

What risks do purchasers face without a thorough property lien search?

Without a thorough search, purchasers risk acquiring properties with hidden liabilities, which could result in expensive legal conflicts or loss of ownership.

How does a mortgage affect property claims?

When securing a mortgage, the homeowner agrees to use their property as collateral, allowing the lender to impose a claim. If payments are missed, both the mortgage lender and any additional lenders can claim the home, highlighting the hierarchy of repayment upon sale.

What role do tax practitioners play in understanding property claims?

Consulting tax practitioners familiar with specific jurisdictions can provide valuable insights into tax sale processes and laws, enhancing the understanding of property claims.

What should individuals do before acting on information regarding property claims?

Individuals should seek professional counsel before acting on information regarding property claims to effectively manage the complexities involved.