Overview

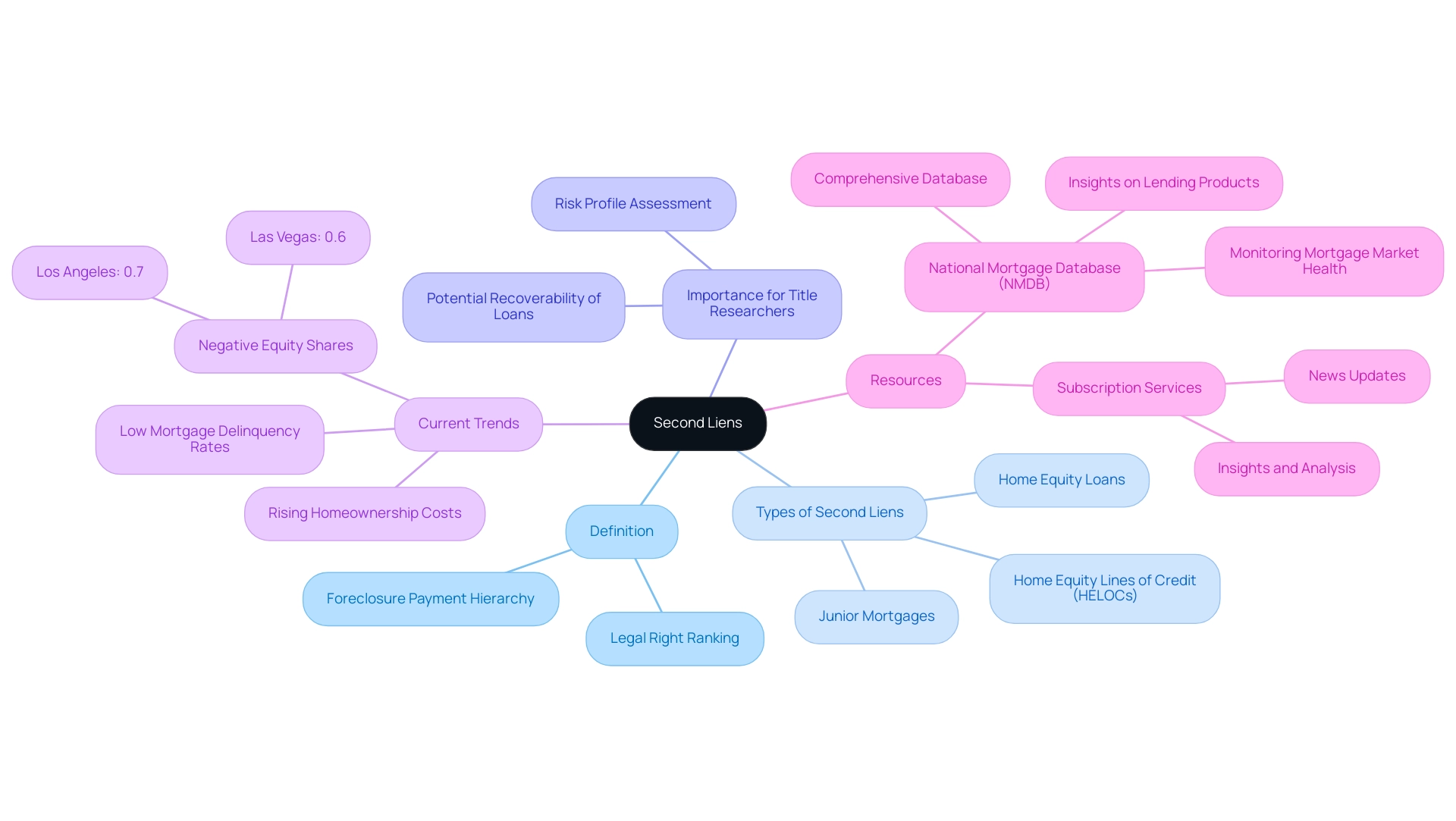

The article titled "Understanding Second Liens: A Comprehensive Tutorial for Title Researchers" focuses on the significance of second liens in real estate and their implications for title researchers. It explains that second liens, which include home equity loans and junior mortgages, are critical for understanding property ownership and risk during foreclosure, as they rank below primary mortgages and can affect the financial health of homeowners and the recoverability of loans.

Introduction

In the intricate world of real estate financing, second liens emerge as a pivotal element that can significantly impact homeowners and investors alike. These financial instruments, which rank below primary mortgages, offer unique opportunities and challenges in leveraging home equity for various purposes.

As homeowners increasingly tap into their property values, understanding the nuances of second liens becomes crucial for title researchers and industry professionals.

With the landscape of mortgage financing evolving, the implications of second liens are more relevant than ever, especially in light of rising homeownership costs and fluctuating equity levels across different markets.

This article delves into the definitions, types, legal frameworks, and best practices surrounding second liens, providing essential insights for navigating this complex territory.

Defining Second Liens: An Overview

An additional claim on a property, referred to as a second lien, signifies a legal right that ranks beneath the first claim, which is typically held by a primary mortgage lender. This hierarchical structure is essential; in the event of foreclosure, the primary creditor receives payment before any distributions are made to the secondary creditor. Second lien positions can take various forms, including home equity loans, home equity lines of credit (HELOCs), and junior mortgages.

For title researchers, comprehending this hierarchy is vital, as it directly affects the risk profile and potential recoverability of loans linked to the property. As Dr. Selma Hepp, Chief Economist for CoreLogic, notes, "Persistent home price growth has continued to fuel home equity gains for existing homeowners who now average about $315,000 in equity." This context emphasizes the importance of additional claims, particularly as the second lien becomes more relevant in the changing mortgage environment.

With Las Vegas and Los Angeles reporting negative equity shares at 0.6% and 0.7% respectively, grasping the dynamics of second lien claims becomes increasingly essential. Current trends suggest that mortgage delinquency rates stay low despite increasing homeownership expenses, emphasizing the importance of examining alternative financing structures like second lien and their effects on foreclosure situations. Moreover, the National Mortgage Database (NMDB) acts as an extensive resource, offering insights into lending products and the condition of the mortgage market, which can additionally inform title researchers about subordinate mortgage structures.

For those seeking to stay updated, subscribing to services that offer insights, analysis, and news can significantly enhance understanding of these evolving dynamics.

Types of Second Liens and Their Applications

Second lien claims in real estate can take various forms, each tailored to meet distinct financial needs. Key varieties include:

- Home Equity Loans: These loans leverage the equity built in a home, enabling homeowners to access substantial funds for various purposes, such as home renovations or debt consolidation, while using their property as collateral. This type of loan can effectively tap into the $34.9 trillion in real estate equity that American households hold, representing 72.4% of the total value of residential real estate assets in the U.S.

- Home Equity Lines of Credit (HELOCs): Unlike a traditional home equity loan which provides a lump sum, HELOCs offer a revolving line of credit that homeowners can draw from as needed, providing flexibility for expenses that may arise over time. This adaptability makes HELOCs a popular choice among homeowners looking for financial options that align with their varying cash flow needs.

- Junior Mortgages: These loans are taken out subsequent to the primary mortgage and can serve as an additional source of financing for homeowners. In 2024, the applications of junior mortgages have been notable, especially as homeowners capitalize on their equity gains—wherein the average U.S. homeowner saw an increase of approximately $28,000 in equity over the past year, with no states reporting losses. According to Molly Boesel, Principal Economist for CoreLogic, "The Federal Reserve reports that the number of credit-card and automobile-loan transitions moving into serious delinquency were above pre-pandemic levels, which could be a signal of increased financial stress for some Americans." This emphasizes the significance of comprehending secondary claims, including second lien options, as a possible assistance for homeowners encountering financial difficulties. Furthermore, VA loans, which totaled 97,669 or 5.9 percent of all residential property loans in Q3 2024, represent another significant option for homeowners seeking to leverage their property equity. Grasping these differences is vital for those studying ownership documents, as they can reveal possible complications when assessing property ownership and the effects of these alternative financing approaches on overall property worth.

Legal Framework Surrounding Second Liens

Second lien claims are subject to a complex web of legal statutes and regulations at both state and federal levels, necessitating diligent oversight by title researchers. Ensuring proper documentation is paramount, which requires verifying that each claim is accurately recorded within the appropriate jurisdiction. Given that the priority of encumbrances, particularly the second lien, plays a pivotal role in determining the enforceability of claims during foreclosure proceedings, a comprehensive understanding of this hierarchy is essential.

Moreover, recent legal modifications, especially those shaped by consumer protection laws, significantly impact the creation and management of additional secured loans. For example, under North Carolina law, several different service communications are subject to strict documentation requirements, including:

- Payoff statements

- Monthly statements

- Statement of fee letters

- Pre-foreclosure letters

This underscores the importance of compliance to safeguard consumer rights and enhance the integrity of the lending process.

Legal precedent, such as the Supreme Court's ruling in Halbert v. Michigan, which deemed the denial of appellate counsel to indigent defendants unconstitutional, illustrates the evolving landscape of legal standards that may similarly affect regulations regarding second lien financing. The case emphasizes the necessity for fair treatment in legal proceedings, which can be compared to the examination of regulations surrounding second lien financing. Moreover, the Supreme Court's decision in Stogner v. California, which deemed a California statute permitting prosecution after the statute of limitations had lapsed unconstitutional, further illustrates the continuous development of legal standards that influence different facets of law, including matters related to second lien claims.

As these laws keep evolving, title researchers must stay attentive in their practices to uphold both legal and ethical standards in the management of second lien claims.

Evaluating the Risks and Benefits of Second Liens

Second lien mortgages can serve as a valuable financial tool for homeowners seeking additional funds, as they often provide lower interest rates compared to unsecured loans and allow individuals to leverage their home equity for significant expenses. However, the associated risks cannot be overlooked. Failing to make payments can result in foreclosure, where creditors holding a second lien risk losing their investment if the property is sold at auction.

Understanding these dynamics is critical for title researchers, who must assess the financial health of properties meticulously. As noted by Molly Boesel, Principal Economist for CoreLogic:

Nationwide, the overall mortgage delinquency rate held steady in January, and the serious delinquency rate fell from a year ago. However, one-third of metros posted an increase in the overall delinquency rate from one year earlier, and a handful reported an increase in serious delinquency rates.

This understanding demonstrates the need for a thorough assessment of the risks associated with second lien financing. Moreover, data suggests that loans with a credit score of 620 encounter a considerably elevated misreporting rate, which can complicate the environment for subsequent claims. The study on documentation status further reveals that Low Doc loans showed higher misreporting rates compared to Full Doc loans, suggesting that documentation quality influences the precision of reporting.

Additionally, the findings suggest a comparable level of loan quality between the matched sample and the broader population, further emphasizing the need for careful analysis of these factors. Consequently, a comprehensive grasp of the consequences of a second lien and additional encumbrances in real estate is crucial for knowledgeable decision-making.

Leveraging Technology for Efficient Second Lien Research

The emergence of technology, especially machine learning and optical character recognition (OCR), has significantly transformed how individuals operate with second lien information. Advanced tools such as Parse AI provide powerful automation for document processing and research, enabling rapid analysis of extensive documents. With features like interactive labeling, full-text search, and the example manager for annotating documents, Parse AI efficiently extracts crucial data points and uncovers potential issues related to second liens, revolutionizing the research process.

A survey conducted in December 2023 revealed that 50% of companies believe AI will accelerate growth in the IT sector, reflecting a positive attitude towards technology adoption among title analysts. Furthermore, the U.S. Department of Defense's budget for AI R&D reached $1.1 billion in 2023, underscoring the significance of AI advancements in various industries, including real estate. This technological integration not only accelerates the research process but also enhances accuracy by significantly reducing the chances of human error.

As Ilya Sutskever, co-founder of OpenAI, notes, 'The evolution of AI tools is paving the way for more efficient workflows in various sectors.' Title experts who leverage innovations like Parse AI can streamline their workflows, focusing on complex analysis instead of the time-consuming task of data entry. The founders of Parse AI, with over 50 years of combined experience in energy, real estate, and technology, have developed this platform to address the specific challenges faced in confirming real property ownership.

The U.S. government's spending on AI has more than doubled from $1.5 billion in 2018 to nearly $3.3 billion in 2022, indicating a strong commitment to advancing AI research and development. Embracing such technologies enables individuals to adapt to the evolving demands of the industry while maximizing their overall efficiency.

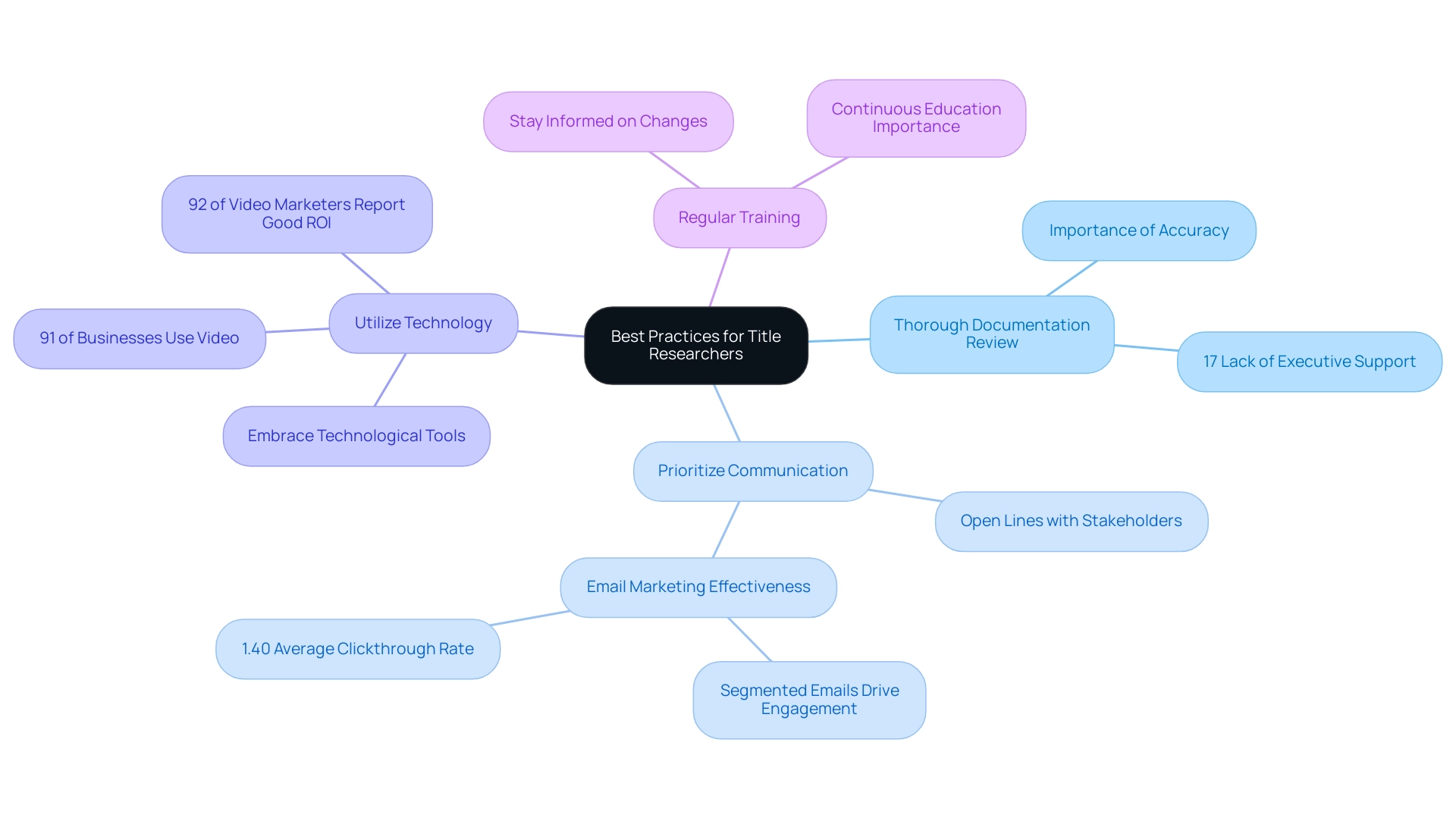

Best Practices for Title Researchers in Handling Second Liens

To effectively manage secondary interests, document investigators should adopt the following best practices:

- Thorough Documentation Review: It is essential to verify the accuracy of the claim documentation, ensuring that all records are current and complete. This step is crucial, particularly given that 17% of professionals cite a lack of executive support as a challenge in their roles. By emphasizing meticulousness in documentation, investigators can mitigate this challenge and reinforce their credibility.

- Prioritize Communication: Open lines of communication with mortgage lenders and property owners are vital. By clarifying any ambiguities surrounding secondary claims, title researchers can foster better relationships and facilitate smoother transactions. Expert opinions indicate that consistent interaction with stakeholders leads to more effective asset management. A relevant example can be drawn from email marketing strategies, where segmented emails drive significantly higher engagement rates, demonstrating that targeted communication can yield better outcomes.

- Utilize Technology: Embracing technological tools such as Parse AI can significantly streamline research processes, reducing manual errors and enhancing efficiency in management. The integration of technology is becoming increasingly important as 91% of businesses report using video as a marketing tool, and 92% of video marketers assert that video advertising provides a good ROI. This trend emphasizes the necessity for innovative approaches in all areas of business, including research on titles.

- Regular Training: Staying informed about legislative changes and technological advancements is critical. Consistent training sessions can provide professionals with the abilities required to maneuver through the changing environment of subordinate claims. Recent training programs have emphasized the importance of continuous education, ensuring that professionals remain proficient and knowledgeable.

By implementing these best practices, title researchers can adeptly maneuver the complexities associated with a second lien, ultimately improving their effectiveness and the overall success of their operations.

Conclusion

Second liens are essential in real estate financing, enabling homeowners and investors to leverage home equity while presenting specific risks. Understanding the hierarchy and types of second liens—such as home equity loans, HELOCs, and junior mortgages—is crucial for title researchers, especially as equity utilization rises in a fluctuating market.

Navigating the complex legal landscape surrounding second liens requires diligent oversight to ensure compliance with regulations that affect documentation and lien priority. This understanding is vital for managing foreclosure outcomes and protecting consumer rights.

While second liens offer advantages like lower interest rates and access to funds, they also carry risks of default and foreclosure. A careful evaluation of these risks is necessary, particularly in light of varying delinquency rates across metropolitan areas. The adoption of technology, especially AI tools, can streamline research processes and enhance accuracy, allowing professionals to focus on more complex analyses.

In conclusion, gaining expertise in second liens is imperative for title researchers and industry professionals. By implementing best practices, utilizing technology, and remaining informed about legal changes, stakeholders can effectively navigate the complexities of second lien financing. A proactive approach will empower professionals to address both the opportunities and challenges presented by second liens in the evolving real estate landscape.

Frequently Asked Questions

What is a second lien in real estate?

A second lien is an additional claim on a property that ranks beneath the first claim, typically held by a primary mortgage lender. In the event of foreclosure, the primary creditor is paid before any distributions are made to the secondary creditor.

What forms can second liens take?

Second liens can take various forms, including home equity loans, home equity lines of credit (HELOCs), and junior mortgages.

Why is understanding the hierarchy of liens important for title researchers?

Understanding the hierarchy of liens is vital for title researchers because it directly affects the risk profile and potential recoverability of loans linked to the property.

What recent trends have been observed in home equity?

Persistent home price growth has resulted in homeowners averaging about $315,000 in equity, which emphasizes the relevance of additional claims like second liens in the changing mortgage environment.

What is the significance of negative equity shares in cities like Las Vegas and Los Angeles?

Las Vegas and Los Angeles have reported negative equity shares at 0.6% and 0.7%, respectively, highlighting the importance of understanding second lien claims as they affect foreclosure situations.

How do home equity loans work?

Home equity loans leverage the equity built in a home, allowing homeowners to access substantial funds for purposes like home renovations or debt consolidation, using their property as collateral.

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit that homeowners can draw from as needed, providing flexibility for expenses over time, unlike a traditional home equity loan which provides a lump sum.

What are junior mortgages?

Junior mortgages are loans taken out after the primary mortgage, serving as an additional source of financing for homeowners, especially as they capitalize on their equity gains.

What is the current state of mortgage delinquency rates?

Current trends indicate that mortgage delinquency rates remain low despite increasing homeownership expenses, which underscores the importance of examining alternative financing structures like second liens.

How can the National Mortgage Database (NMDB) assist title researchers?

The NMDB offers insights into lending products and the condition of the mortgage market, which can inform title researchers about subordinate mortgage structures.

What resources are available for staying updated on second lien dynamics?

Subscribing to services that provide insights, analysis, and news can significantly enhance understanding of the evolving dynamics related to second liens.