Overview

ECB violations are regulatory infractions related to environmental standards and building codes in New York City, primarily arising from illegal constructions and non-compliance with permits. The article emphasizes that understanding and addressing these violations is crucial for real estate professionals, as unresolved issues can lead to significant financial penalties, decreased property values, and complications in real estate transactions.

Introduction

In the intricate world of New York City's real estate, understanding Environmental Control Board (ECB) violations is paramount for all stakeholders involved. These violations, which arise from non-compliance with environmental standards and building codes, can significantly disrupt property transactions and lead to severe financial consequences.

As the frequency of such infractions rises, real estate professionals must equip themselves with knowledge about common violations, their implications, and the necessary steps to address them.

From navigating the complexities of compliance certificates to contesting violations effectively, this article delves into the critical aspects of ECB violations, offering practical insights to help property owners safeguard their investments and ensure a smooth transaction process.

What Are ECB Violations? An Overview

ECB violations represent a critical aspect of regulatory compliance in New York City's real estate landscape. These infractions pertain to the Department of Environmental Protection's enforcement of and . Common causes of ecb violations include:

- Illegal constructions

- Non-compliance with building permits

- Neglect of required environmental assessments

In 2024, the frequency of ecb violations has become a pressing concern, as they can . must be attentive in identifying these breaches early in the process to ensure adherence and reduce possible legal consequences.

not only protects owners from penalties but also encourages a smoother transaction process, ultimately promoting adherence to the evolving NYC building code compliance regulations. A practical approach to resolving these issues can be found in the case study titled 'Steps to ,' which outlines several key steps for addressing ecb violations:

- Hiring professionals

- Correcting the issue

- Submitting a Certificate of Correction

- Attending hearings if necessary

- Paying any penalties

Following these steps allows property owners to effectively address ecb violations and avoid further complications.

Furthermore, the importance of is underscored by recent findings, such as the research report from November 2024, which identified the Czech Republic as the EU's most toxic country regarding care emissions. This highlights the global implications of environmental standards and the necessity for compliance in local contexts. Expert opinions, such as that of Gunter Verheugen, European Commissioner for Enterprise and Industry, emphasize the urgency of maintaining high environmental standards, stating, 'Even though the EU is a world leader in technology, it is being put on the defensive by the United States and Russia and that it only has about a 10-year technological advantage on China and India, which are racing to catch up.'

By understanding the common types of infractions and their implications, stakeholders can better navigate the complexities of the real estate market.

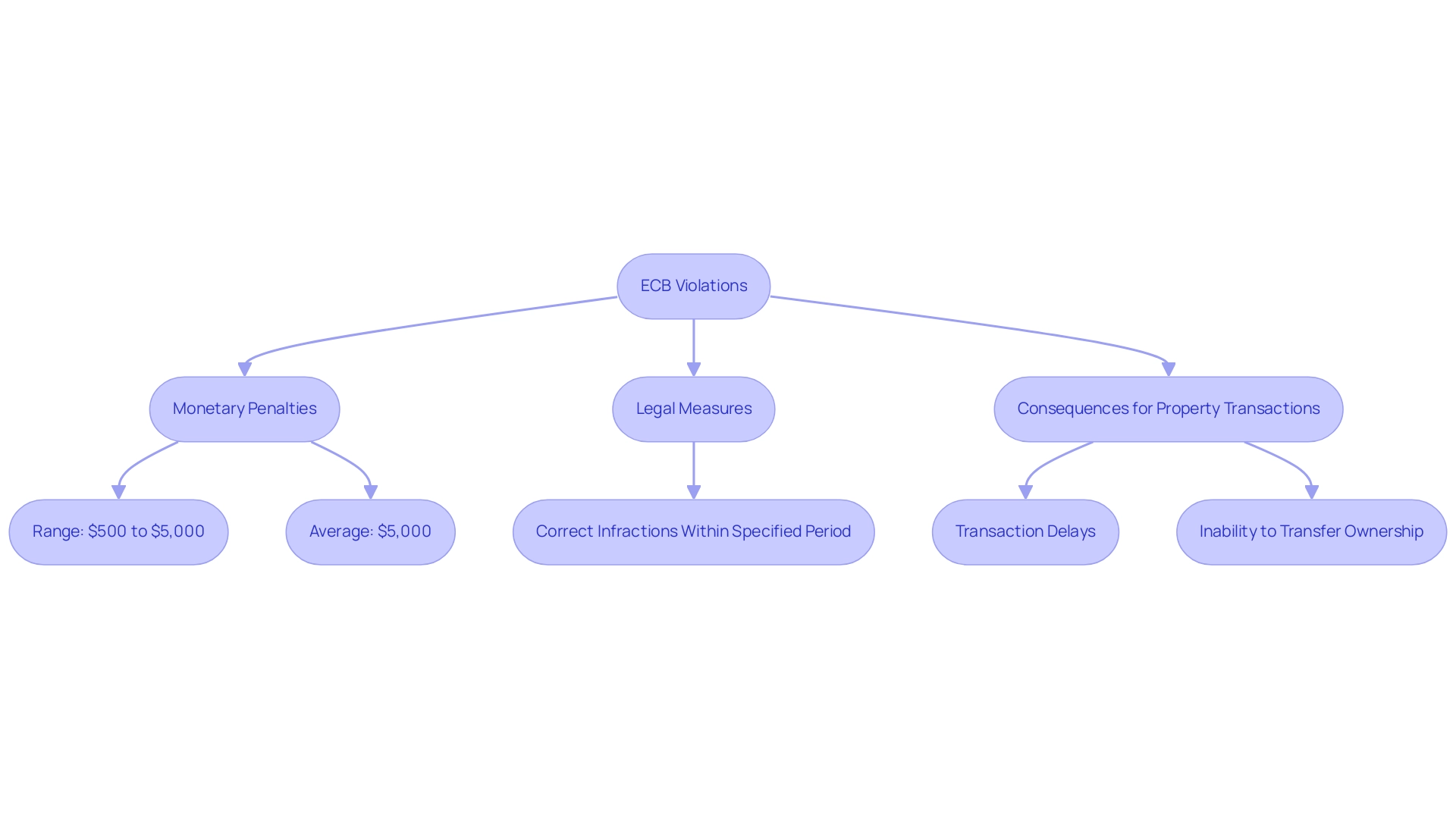

Understanding the Penalties for ECB Violations

Penalties for ecb violations exhibit considerable variation, largely influenced by the nature and severity of the infraction. can range from several hundred to thousands of dollars, with average monetary fines for these violations in 2024 estimated at around $5,000. This reflects the specific circumstances of each case.

Legal measures may also require that landowners correct infractions within a specified period, highlighting the urgency of adherence. Failure to address unresolved violations can lead to , including transaction delays or even the inability to transfer ownership altogether. As highlighted in the recent trials conducted by the SEC in FY 2024, which included landmark rulings against major entities for fraud, such as the permanent suspension of Benjamin Borgers and a multi-billion-dollar fraud case against Terraform Labs, the ramifications of regulatory failures extend beyond fines to broader legal consequences.

Sam Waldon, Acting Deputy Director of the Division of Enforcement, noted,

I could not be prouder of the dedicated and talented staff of the Division of Enforcement who work tirelessly to hold wrongdoers accountable, encourage adherence, and help promote investor trust in the markets.

This sentiment emphasizes the critical need for to thoroughly understand of ecb violations in order to .

How to Check for ECB Violations on Properties

can efficiently verify for ecb violations on sites by using the NYC Department of Environmental Protection's online database or the City of New York’s information portal. The procedure is straightforward and involves the following steps:

- website.

- Locate the ecb violations section.

- Input the address of the asset or block and lot number.

- Examine the results for any documented infractions, such as :

- Failure to maintain building facade

- Elevator system maintenance issues

- Work performed without a valid permit

By regularly conducting these checks, during and ensure adherence to regulatory compliance. Additionally, to address a DOB-ECB infraction involving ecb violations, owners should:

- Hire professionals

- Submit a Certificate of Correction

- Attend OATH hearings if necessary

- Pay any applicable penalties

Keeping informed about the in New York can improve efficiency and precision in this crucial aspect of .

As the ECB states, "The ECB releases for the first time statistics on insurance corporations’ written premiums, incurred claims and acquisition expenses," emphasizing the need for due diligence in property transactions.

ECB vs. DOB Violations: Key Differences Explained

are breaches that pertain to infractions related to , such as illegal dumping or improper management of hazardous materials. In contrast, DOB (Department of Buildings) infractions address issues related to building codes, including improper construction practices or failure to secure necessary permits. For instance, a landowner may encounter ECB violations for disregarding environmental regulations, which can result in substantial fines and remediation expenses.

Conversely, a DOB infraction could arise if construction deviates from approved plans, posing safety risks and legal repercussions. Grasping these differences is essential for real estate experts, as it directly affects adherence strategies and risk evaluations in real estate deals.

Recent news reveals that ECB violations related to building code breaches in NYC have been rising, which emphasizes the necessity of vigilance concerning conformity with both ECB and DOB regulations. According to the Comptroller's Office, ranges from annually, depending on growth rates and per diem adjustments. This economic landscape is further complicated by the forecasted decline in PIT and PTET collections by 5.2 percent in FY 2024, which could influence the and regulatory efforts.

Moreover, industry leaders emphasize that adherence to environmental standards is becoming increasingly critical, particularly in light of the , which may lead to ECB violations. As such, understanding the nuances between ECB and not only aids in compliance but also in navigating the financial implications associated with these regulations.

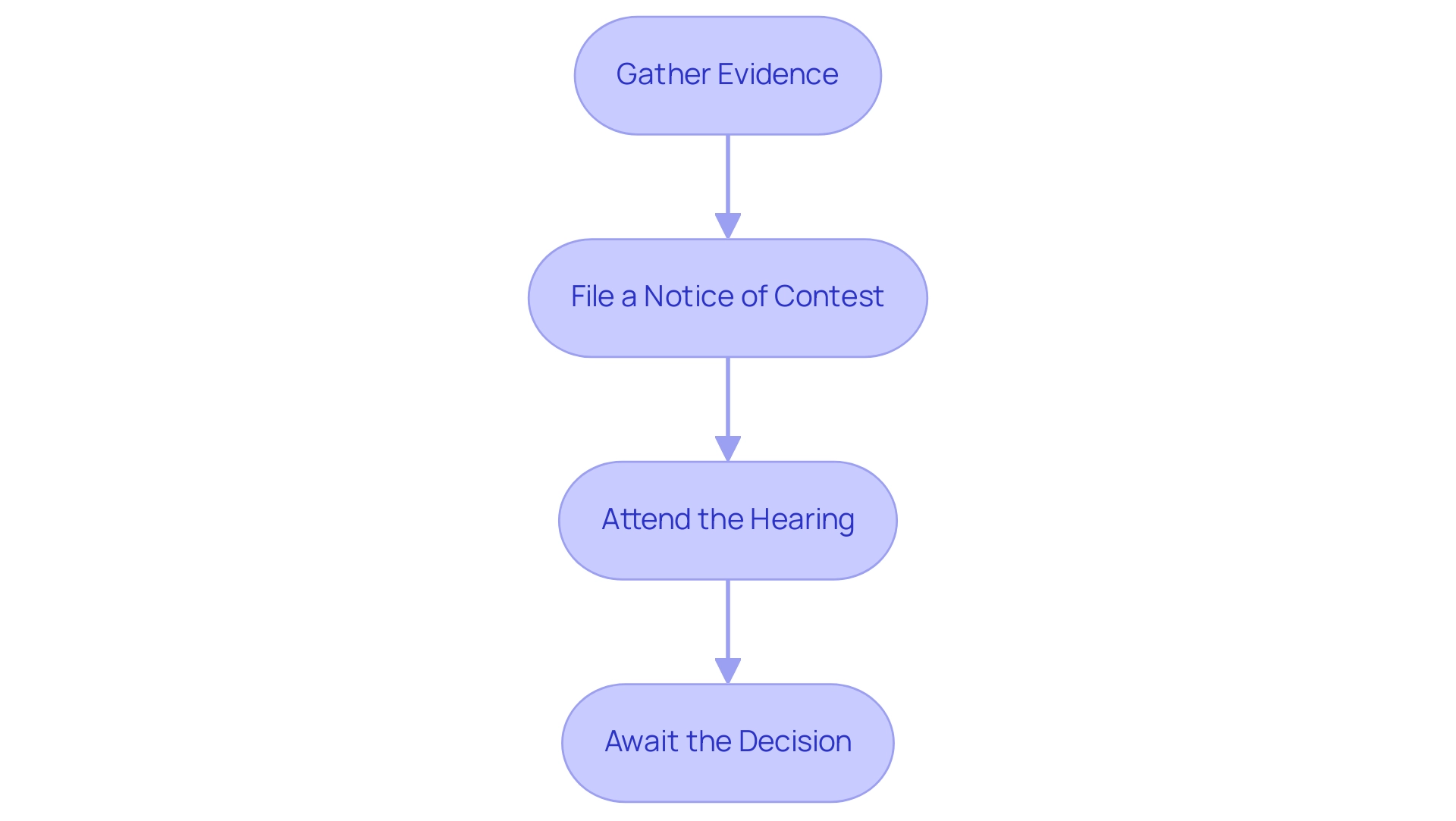

How to Contest an ECB Violation: A Step-by-Step Guide

requires a structured approach to ensure the best chance of success, especially in light of the current economic climate influenced by recent monetary policy changes. Here are the essential steps:

-

Gather Evidence: Begin by compiling all pertinent documentation that supports your case.

This may include photographs, witness statements, and relevant permits. Strong evidence is crucial, as it forms the backbone of your argument.

-

: Within the designated timeframe, submit a formal Notice of Contest to the ECB.

This document must articulate your reasons for contesting the infraction clearly and succinctly. Timeliness is key, as delays can adversely affect your case.

With , can be beneficial.

-

Attend the Hearing: If a hearing is scheduled, it’s vital to present your evidence in a clear and concise manner.

This is your opportunity to make your case directly to the adjudicators.

-

Await the Decision: After the hearing concludes, the ECB will issue a decision regarding your contest.

If successful, the infraction may be dismissed, thereby protecting the property owner from potential penalties.

Legal experts emphasize that ; for instance, firms that leverage advanced tools and technologies during the contest process can navigate complex regulatory obligations, particularly ECB violations, more effectively. As noted in the 2024 , , underscoring their importance in this context.

Recent data suggests an increased success rate for contested infractions in 2024, which may reflect broader economic conditions, such as the inflation rate in Zimbabwe being at 106.64 percent as of June 2021, highlighting the pressures on regulatory compliance. Furthermore, the case study on Armenia's monetary policy response illustrates how regulatory changes can impact challenging ECB violations, providing valuable insights into real-world implications of these processes.

The Importance of ECB Violation Compliance Certificates

The certificate for is an essential document that verifies the resolution of all regulatory violations associated with an asset. For real estate owners, this certificate is not just a formality; it is a crucial asset that shows adherence to . Research indicates that assets lacking this certificate may be viewed as unmarketable, resulting in .

As stated in a recent , the lack of adherence can lead to a decrease in investment and labor input, which may indirectly influence real estate values. the , with one expert stating, 'Without , clients face unnecessary risks in property transactions.' Furthermore, a case study titled 'Measurement Bias in The HICP: What Do We Know and What Do We Need to Know?' highlights how measurement biases can affect inflation evaluations, reinforcing the need for precise documentation. In today's competitive market, stakeholders must prioritize compliance certifications to ensure marketability and protect their interests.

Impact of ECB Violations on Property Sales

can have a profound , influencing various aspects of the transaction process. Properties encumbered with unresolved issues often experience a significant reduction in market value. Research indicates that assets with unresolved ECB issues can experience an average market value decrease of up to 20%.

This depreciation arises from buyer hesitance; potential purchasers are often cautious of the , including possible legal consequences and ecb violations. Moreover, obtaining funding can become more difficult for these assets, as lenders may enforce stricter criteria or deny loans entirely due to ecb violations. This can lead to delays in closing transactions, further complicating the sales process.

A relevant example is the City Council's , created in 2018, which identifies rent-regulated buildings at risk of tenant displacement based on various factors. This initiative prioritizes these buildings for city preservation programs, aiming to protect vulnerable tenants from displacement, illustrating the real-world implications of unresolved ecb violations. It is crucial for to before listing assets.

By doing so, they can provide informed guidance to clients, thereby mitigating risks and enhancing the likelihood of . As Valerie Samuel, founder of a consultancy, aptly stated, 'I’m thrilled to introduce our new NYC records service, designed to make accessing essential real estate records a breeze for realtors, developers, and owners.' This underscores the importance of , particularly when addressing the complexities of ECB violations.

Conclusion

Understanding and addressing Environmental Control Board (ECB) violations is crucial for anyone involved in New York City's real estate market. As outlined, these violations can stem from non-compliance with environmental standards and building codes, leading to significant financial penalties and complications in property transactions. Real estate professionals must stay informed about common violations, their implications, and the necessary steps to resolve them effectively.

The article emphasizes the importance of obtaining ECB Violation Compliance Certificates, which serve as vital documentation confirming that all regulatory issues have been addressed. Without this certificate, properties may be viewed as unmarketable, potentially leading to substantial financial losses. Furthermore, unresolved ECB violations can severely impact property values and hinder the transaction process, highlighting the need for proactive measures in compliance.

In conclusion, vigilance in monitoring and addressing ECB violations is essential for safeguarding investments and ensuring smooth property transactions. By prioritizing compliance and understanding the nuances of these violations, stakeholders can navigate the complexities of the market more effectively, ultimately leading to a more secure and prosperous real estate environment in New York City.

Frequently Asked Questions

What are ECB violations in New York City's real estate landscape?

ECB violations refer to infractions related to the enforcement of environmental standards and building codes by the Department of Environmental Protection in New York City.

What are common causes of ECB violations?

Common causes include illegal constructions, non-compliance with building permits, and neglect of required environmental assessments.

Why are ECB violations a concern in 2024?

The frequency of ECB violations has become a pressing concern as they can significantly impact real estate transactions, necessitating early identification by real estate experts to ensure compliance and reduce legal consequences.

What steps should be taken to resolve ECB violations?

The key steps to address ECB violations include: 1. Identifying the problem 2. Hiring professionals 3. Correcting the issue 4. Submitting a Certificate of Correction 5. Attending hearings if necessary 6. Paying any penalties.

What are the potential penalties for ECB violations?

Monetary penalties can range from several hundred to thousands of dollars, with average fines estimated at around $5,000 in 2024. Legal measures may also require landowners to correct infractions within a specified period.

What are the consequences of failing to address ECB violations?

Failure to address unresolved violations can lead to significant complications in property transactions, including delays or the inability to transfer ownership.

How do recent legal cases relate to ECB violations?

Recent trials, including landmark rulings against major entities for fraud, highlight the broader legal consequences of regulatory failures, underscoring the need for real estate professionals to understand the implications of ECB violations.

What is the importance of understanding environmental regulations in real estate?

Understanding environmental regulations is critical for stakeholders to navigate the complexities of the real estate market and ensure compliance, as highlighted by recent findings on environmental standards globally.