Overview

The article "Mastering Lien Position 1: An Essential Guide for Title Researchers" underscores the critical nature of lien position 1 in real estate transactions and its implications for title researchers. It asserts that comprehending the hierarchy of claims is vital for assessing property marketability and mitigating risks.

- Properties with clear lien positions are inherently more attractive to investors.

- Conversely, those burdened with unresolved claims may encounter significant transactional challenges.

Introduction

In the intricate world of real estate, understanding lien positions stands as a cornerstone for effective title research. Lien positions dictate the hierarchy of claims against a property, influencing everything from marketability to financing options. As properties encounter an increasing number of liens, the implications for potential buyers and investors become more complex.

In 2025, the landscape is evolving; technology and regulatory changes are reshaping how title researchers navigate these challenges. By mastering the nuances of lien types, their legal frameworks, and best practices for conducting thorough searches, researchers can safeguard their clients' interests and enhance the efficiency of property transactions.

This article delves into the critical aspects of lien research, equipping professionals with the insights needed to thrive in a competitive market.

Understanding Lien Position: A Foundation for Title Research

Lien position 1 is a critical concept in real estate, representing the order of priority of claims against a property. For title researchers, a thorough understanding of security interests is vital, as it dictates which creditors have the first right to payment in the event of foreclosure or sale. Typically, the mortgage lender is the primary creditor and holds lien position 1, followed by subsequent claims such as tax claims or mechanic's claims.

This hierarchy is not solely academic; it has profound implications for marketability, especially regarding lien position 1 and financial obligations.

In 2025, the influence of claim status on real estate marketability is highlighted by recent data showing that assets with clear, prioritized claims are more appealing to prospective purchasers. A significant portion of the market is influenced by the perception of risk associated with multiple claims in lien position 1, which can deter investment. For instance, properties encumbered with several subordinate claims may face challenges in securing financing, as lenders often assess the risk based on the lien position 1 in the claim hierarchy.

Furthermore, with 26% of respondents planning to increase investment in Facebook in 2025, there is a broader trend of investors seeking clarity and stability in their investments, which extends to real estate.

Case studies from the developing insurance sector demonstrate the significance of claim positions. Companies such as First American Financial Corporation and Fidelity National Financial have reported significant growth, fueled by heightened demand for clarity in property positions. Investors Title Company has broadened its service options to incorporate comprehensive evaluations of lien position 1, recognizing that understanding these dynamics is crucial for document analysts.

Additionally, a positive sensitivity analysis shows that a 10% gain in home prices could result in a full category upgrade for rated classes, excluding those rated 'AAAsf'. This underscores the possible financial effects of lien position 1 on property values, emphasizing the necessity for ownership investigators to be knowledgeable in these issues.

Expert insights in 2025 stress that a thorough understanding of claim standings, particularly lien position 1, is essential for property investigators. As Aaron Cort, a notable figure in the real estate sector, points out, "People have such a high bar for what they act on these days, for both business and consumers." This sentiment illustrates the need for document analysts to provide precise and prompt information concerning claims to satisfy the expectations of real estate professionals.

In summary, the significance of lien position 1 for document investigators cannot be overstated. It not only influences the risk evaluation of ownership but also plays a pivotal role in the overall marketability of real estate assets, especially when considering lien position 1. As the landscape continues to evolve, staying informed about claim position dynamics will be essential for effective title research.

The Hierarchy of Liens: Establishing Priority in Property Claims

The ranking of claims is fundamentally governed by the 'first in time, first in right' principle. This principle establishes that the earliest recorded claim holds lien position 1 on an asset, taking precedence over subsequent assertions. For instance, if a mortgage is filed before a mechanic's claim, the mortgage lender will receive payment first in the event of foreclosure. This hierarchy is not merely a procedural detail; it significantly impacts lien position 1, which in turn affects investment risk and profitability for real estate professionals.

In fact, recent statistics indicate that approximately 30% of properties have various encumbrances. This underscores the necessity for thorough due diligence in identifying existing claims. Furthermore, in the case of liquidation, the total liquidation value will be distributed among the primary secured creditors based on their pro-rata share of the first secured debt. This emphasizes the financial implications of lien position 1 in the priority hierarchy.

Title researchers play an essential role in this process. They must meticulously analyze public records to determine the sequence of encumbrances and ensure that all claims are accurately represented. This diligence is crucial when guiding clients on the potential risks related to acquiring assets burdened by existing claims, especially concerning lien position 1. As Benjy Nichols aptly states, "Understanding property claims is crucial for successful real estate investing."

By mastering the complexities of priority claims, property analysts can offer invaluable insights that safeguard their clients' interests and improve the overall efficiency of real estate dealings. Additionally, Parse AI revolutionizes this process by utilizing machine learning and optical character recognition to streamline the extraction of claim information from title documents. This enables title researchers to manage claim data more efficiently and effectively.

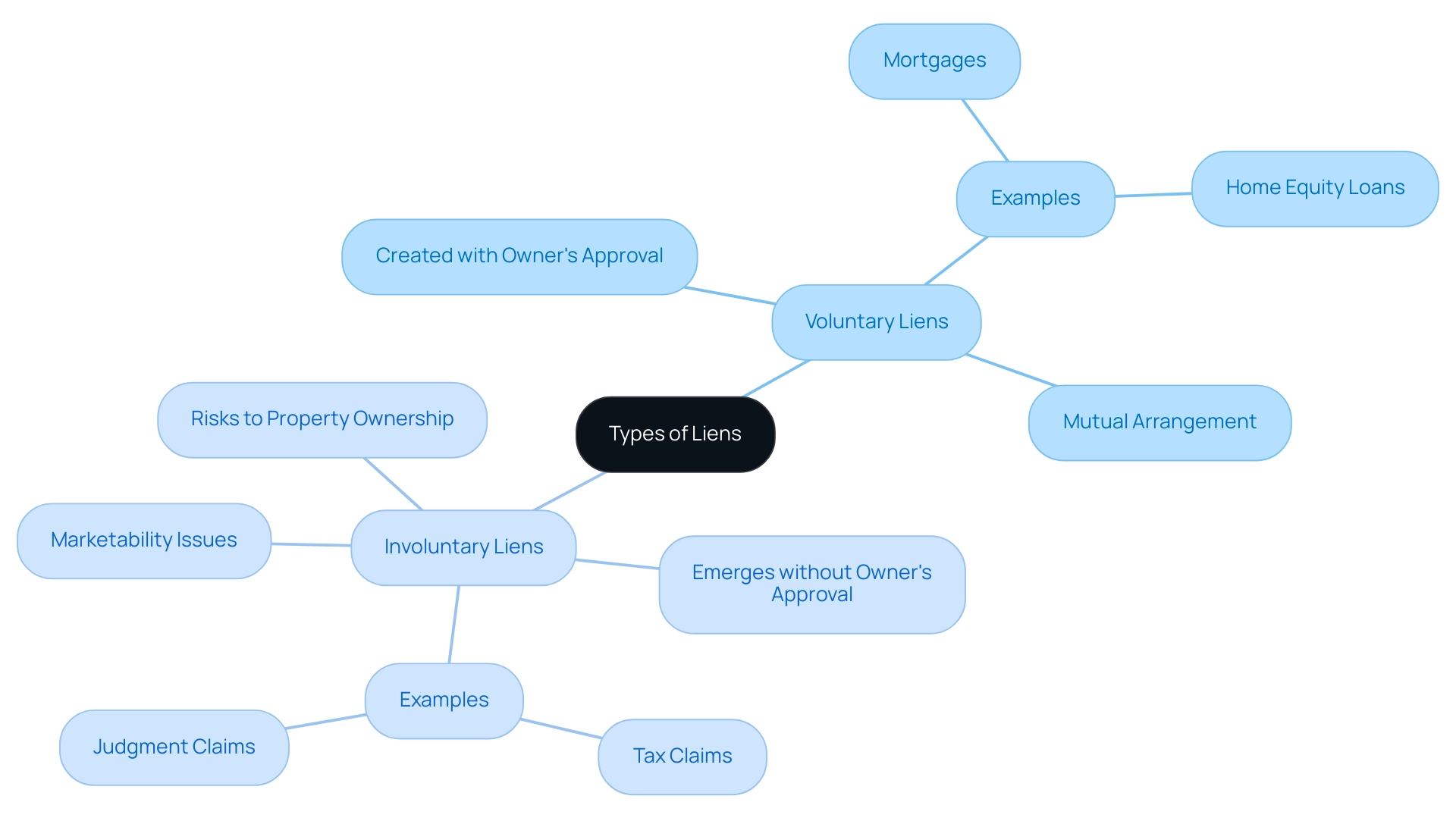

Types of Liens: Voluntary vs. Involuntary and Their Implications

Liens in real estate are primarily classified into two categories: voluntary and involuntary. Voluntary claims are created with the owner's approval, often found in mortgages or home equity loans. These claims demonstrate a mutual arrangement between the lender and the borrower, facilitating funding for asset acquisition or enhancement.

Conversely, involuntary claims emerge without the owner's approval, usually due to unpaid debts, such as tax claims or judgment claims. These claims can significantly complicate property ownership and transactions.

Understanding the implications of these distinctions is crucial for title researchers. Involuntary claims, in particular, pose significant risks. For instance, assets burdened by involuntary claims may encounter difficulties in the sales process, as prospective purchasers frequently avoid assets with outstanding claims.

Statistics suggest that assets with involuntary claims can face a considerable decline in marketability, with numerous purchasers finding it challenging to obtain financing because of these encumbrances. The complexity of claims is underscored by the 133 categories related to oil and gas identified by CourthouseDirect.com, highlighting the diverse nature of potential encumbrances.

Bill Gassett, Owner and Founder of Maximum Real Estate Exposure, emphasizes, "Understanding and addressing the impact of encumbrances on property sales is essential for navigating the complexities of real estate transactions." This viewpoint strengthens the need for property investigators to perform comprehensive due diligence early in the process to prevent issues that could dissuade potential purchasers.

A case study illustrates this point: a real estate agent discovered an involuntary claim late in the sales process, jeopardizing the transaction and leading to wasted efforts. This underscores the importance for document analysts to perform thorough due diligence early in the process to prevent issues that could discourage potential buyers.

In 2025, the prevalence of involuntary claims remains a pressing concern, with legal experts cautioning that unresolved claims can result in significant financial consequences for owners. The ramifications of these claims extend beyond mere ownership; they can influence the entire transaction process, making it crucial for title researchers to remain aware of the types of claims and their potential effects on real estate sales.

Legal Framework of Liens: Creation, Enforcement, and Compliance

Liens are established through a series of legal processes that necessitate proper documentation filed with the relevant government authority. A mortgage claim, for instance, is established when a borrower enters into a mortgage agreement, which is subsequently recorded by the lender with the county clerk. This process is not merely procedural; it is foundational to the legal framework governing property transactions.

In 2025, the legal environment surrounding claim establishment and enforcement has evolved, presenting significant implications for document analysts. With Parse AI's advanced machine learning tools, document processing becomes markedly more efficient, enabling title researchers to automate the extraction of critical information from legal documents. This innovation significantly reduces the time and effort traditionally involved in these methods. The example manager feature allows users to swiftly annotate even a single example, facilitating the extraction of information from extensive sets of unstructured documents, thereby enhancing overall process efficiency.

Enforcement of claims often necessitates legal action, such as foreclosure, to recover the debt owed. Recent statistics indicate fluctuations in foreclosure rates due to debt enforcement, underscoring the importance of understanding these processes. Title specialists must remain vigilant regarding the legal obligations for claim establishment and enforcement to ensure adherence and precision in their work.

Parse AI enhances this diligence through features such as full-text search and machine learning extraction, enabling researchers to navigate extensive collections of unstructured documents swiftly and facilitate runsheet creation. This capability helps prevent potential disputes and ensures that all parties involved in a transaction are fully aware of existing claims. Furthermore, the functionalities of Parse AI can lead to quicker and more precise completion of abstracts and reports, which is essential for effective research on relevant topics.

Legal professionals emphasize that adherence to the established legal framework is crucial for effective lien position 1 management. Recent regulatory changes have introduced new obligations for reporting persons, mandating the maintenance of records related to certifications and designation agreements for reportable transfers. Notably, FinCEN received 621 comments in response to the NPRM, with 164 unique submissions, highlighting the complexity of the regulatory environment.

These developments underscore the necessity for title specialists to stay updated on compliance requirements, as failure to do so could result in significant legal repercussions. Parse AI's tools are designed to assist individuals in navigating these changes, ensuring they can effectively meet new compliance obligations.

Moreover, case studies illustrate the practical implications of these legal frameworks. For example, the case study titled 'Requirements for Reporting Persons' outlines the obligations of reporting persons to file Real Estate Reports, ensuring that beneficial ownership information is accurately obtained and reported. This compliance not only aids in the enforcement of claims but also enhances the overall integrity of property transactions, particularly in establishing lien position 1.

With Parse AI's tools, individuals can utilize automated document processing to keep pace with these changes, further supporting their compliance efforts. The anticipated annual economic effect of $200 million or more from the final rule further emphasizes the significance of these regulatory changes.

In summary, a thorough understanding of the legal processes for creating and enforcing claims is indispensable for title researchers. By staying informed about recent legal changes and utilizing advanced solutions like those offered by Parse AI, they can effectively navigate the complexities of management, ensuring their work supports the integrity of real estate transactions. As noted by Apple, 'The above developments and the work we do to assist investigations uphold this fundamental commitment,' reinforcing the importance of compliance in this evolving landscape.

Conducting Effective Lien Searches: Best Practices for Title Researchers

Conducting effective property searches necessitates adherence to several best practices that enhance both accuracy and efficiency. Title investigators should commence by gathering comprehensive property information, including the legal description and ownership history. This foundational step is crucial for understanding the context of any potential claims.

Next, investigators must perform extensive searches of public records at the county level to identify any documented claims. The integration of technology, particularly machine learning and optical character recognition, has revolutionized this process. These tools automate the extraction of data from extensive collections of documents, significantly reducing the time required to compile information.

In fact, utilizing such technology can enhance search efficiency by as much as 50%, enabling property examiners to concentrate on analysis rather than data entry.

It is also essential to acknowledge that environmental claims may be imposed on real estate involved in environmental clean-up efforts, highlighting the necessity for title researchers to be diligent in their inquiries. To ensure the accuracy of findings, it is vital to cross-reference multiple sources. This practice not only verifies the presence of claims but also aids in comprehending their lien position and potential effects on property ownership.

Consulting with legal experts can further mitigate risks associated with misinterpretation of claim data.

Furthermore, comprehending local regulations and remaining updated on changes can assist in avoiding future claims and safeguarding real estate investments from unexpected issues. Non-consensual claims, such as federal and state tax claims, may have different naming protocols, and the IRS can file under names not reflected in UCC searches, thereby securing lien position in certain cases.

By adopting these best practices, title researchers can effectively reduce risks and ensure that all claims are accurately identified and addressed. As the landscape of claim research continues to evolve, embracing technology and maintaining rigorous standards will be key to success in this critical area. As Maria Harutyunyan observed, 'Adapting to new techniques and tools is essential for staying competitive in research on claims.

Impact of Liens on Property Transactions: Risks and Considerations

Liens, particularly lien position 1, are pivotal in shaping real estate transactions, often complicating ownership transfers and influencing financing options. In 2025, it was reported that assets encumbered by unresolved claims can face transaction delays of up to 30%, significantly impacting closing timelines. For instance, a property burdened with a tax claim may be deemed ineligible for certain financing options, as lenders typically require an unobstructed ownership document to confirm lien position 1 prior to loan approval.

This requirement underscores the necessity of thorough claim discovery during the title research process. During this phase, it is essential to consider transaction details, gather reliable data, and comprehend applicable state laws. Moreover, unresolved claims can present substantial risks in real estate transactions concerning lien position 1. Title specialists must effectively communicate these risks to clients, ensuring they grasp the potential consequences of existing claims on their transactions.

By providing clear insights into how claims can affect property values and financing choices, title researchers empower clients to make informed decisions, ultimately aiding them in avoiding costly pitfalls. Expert opinions highlight that understanding lien position 1 is vital for navigating the complexities of real estate transactions. As noted by industry professionals, proactive claim management can mitigate risks and expedite the closing process, ensuring a robust lien position 1. Daniel W. Lias, a Transactional Business Consultant, emphasizes the importance of a well-structured search strategy, stating, "To learn more about how CT Corporation can help with your search strategy, contact a CT representative."

By leveraging advanced technologies, such as those offered by Parse AI, professionals can enhance their efficiency in identifying and resolving claim issues, thereby safeguarding their clients' interests and facilitating smoother transactions. The case study titled 'Parse AI: Revolutionizing Title Research' illustrates how Parse AI addresses challenges associated with claim discovery, enabling title professionals to finalize abstracts and reports more swiftly and accurately, ultimately resulting in significant cost reductions compared to traditional methods. Furthermore, insights from the Global PropTech Confidence Index highlight the latest trends in the real estate sector, further emphasizing the importance of remaining informed about legal implications in property transactions.

Challenges in Lien Research: Navigating Discrepancies and Legal Complexities

Title researchers face significant challenges in their field, particularly when navigating discrepancies in public records, outdated information, and intricate legal terminology. As of 2025, the landscape of security interest research has become increasingly complex, necessitating a systematic approach to verify the accuracy of findings. This involves cross-referencing multiple sources and consulting with legal experts to clarify any ambiguities.

Recent statistics reveal that discrepancies in public records for claims have become more prevalent, underscoring the imperative for diligence in research practices. Title researchers are encouraged to leverage advanced technologies, such as machine learning and optical character recognition, to streamline their processes and enhance accuracy. These innovations not only expedite the research process but also mitigate the risk of errors that can arise from manual data entry.

Furthermore, staying informed about evolving claims laws and regulations is crucial for compliance and effective research. Engaging with case studies that illustrate the challenges faced by peers in the industry can provide valuable insights. For instance, organizations that have embraced AI technologies report significant improvements in their ability to manage property research efficiently, highlighting the transformative potential of these tools.

The case study titled 'Embracing the Future of AI' emphasizes that leaders are encouraged to set bold AI commitments and focus on human-centric development to unlock AI's transformative potential in research.

Experts in the field assert that the responsibility of ensuring accurate lien investigations, particularly concerning lien position 1, often falls on those conducting searches, who must perform 'reasonable and diligent' inquiries to mitigate risks associated with discrepancies. As noted by CT Corporation Staff, the duty to recognize and resolve these discrepancies rests significantly on the shoulders of document examiners. By proactively addressing these challenges, title researchers can enhance the reliability of their work, ultimately benefiting their clients and facilitating smoother real estate transactions.

Conclusion

Understanding lien positions is paramount for title researchers navigating the complexities of real estate transactions. An in-depth exploration of lien types, their implications, and the evolving legal landscape reveals that a solid grasp of this subject is essential for safeguarding client interests. The hierarchy of liens, adhering to the principle of 'first in time, first in right', underscores the critical nature of accurate lien identification and prioritization. This understanding is vital, as properties encumbered by multiple liens can deter potential buyers and complicate financing options.

Furthermore, the distinction between voluntary and involuntary liens highlights the varying risks associated with property ownership. Title researchers must be vigilant in their due diligence to avoid the pitfalls that unresolved liens can create, particularly in the current market where such issues can lead to significant transaction delays. The integration of advanced technologies, such as machine learning and optical character recognition, has revolutionized the efficiency of lien searches, enabling researchers to provide timely and precise information to their clients.

As the real estate landscape continues to evolve, staying informed about regulatory changes and leveraging innovative tools will be key to maintaining compliance and enhancing research accuracy. By adopting best practices and embracing technological advancements, title researchers position themselves to navigate the intricate world of liens effectively, ensuring smoother transactions and protecting the interests of all parties involved. In conclusion, a comprehensive understanding of lien positions not only empowers title researchers but also contributes to the overall stability and integrity of property transactions in an increasingly competitive market.

Frequently Asked Questions

What is lien position 1 in real estate?

Lien position 1 refers to the order of priority of claims against a property, indicating which creditor has the first right to payment in the event of foreclosure or sale. Typically, the mortgage lender holds lien position 1.

Why is understanding lien position 1 important for title researchers?

A thorough understanding of lien position 1 is vital for title researchers because it determines the priority of claims, affecting the risk evaluation of ownership and the marketability of real estate assets.

How does lien position 1 influence real estate marketability?

Properties with clear, prioritized claims are more appealing to buyers. Multiple claims in lien position 1 can deter investment and make it challenging to secure financing, as lenders assess risk based on this hierarchy.

What principle governs the ranking of claims in lien position?

The 'first in time, first in right' principle governs the ranking of claims, meaning the earliest recorded claim holds lien position 1 and takes precedence over later claims.

What percentage of properties have various encumbrances?

Approximately 30% of properties have various encumbrances, highlighting the necessity for thorough due diligence in identifying existing claims.

What role do title researchers play in understanding lien positions?

Title researchers analyze public records to determine the sequence of encumbrances and ensure all claims are accurately represented, which is crucial for assessing potential risks in real estate transactions.

How can technology assist title researchers in managing claim data?

Technologies like machine learning and optical character recognition, as utilized by Parse AI, help streamline the extraction of claim information from title documents, allowing title researchers to manage data more efficiently.

What are the financial implications of lien position 1 in liquidation scenarios?

In liquidation, the total value will be distributed among primary secured creditors based on their pro-rata share of the first secured debt, emphasizing the financial significance of lien position 1.

What insights do experts provide regarding the importance of claim standings?

Experts stress that understanding claim standings, particularly lien position 1, is essential for property investigators to meet the high expectations of real estate professionals and investors seeking clarity and stability.