Overview

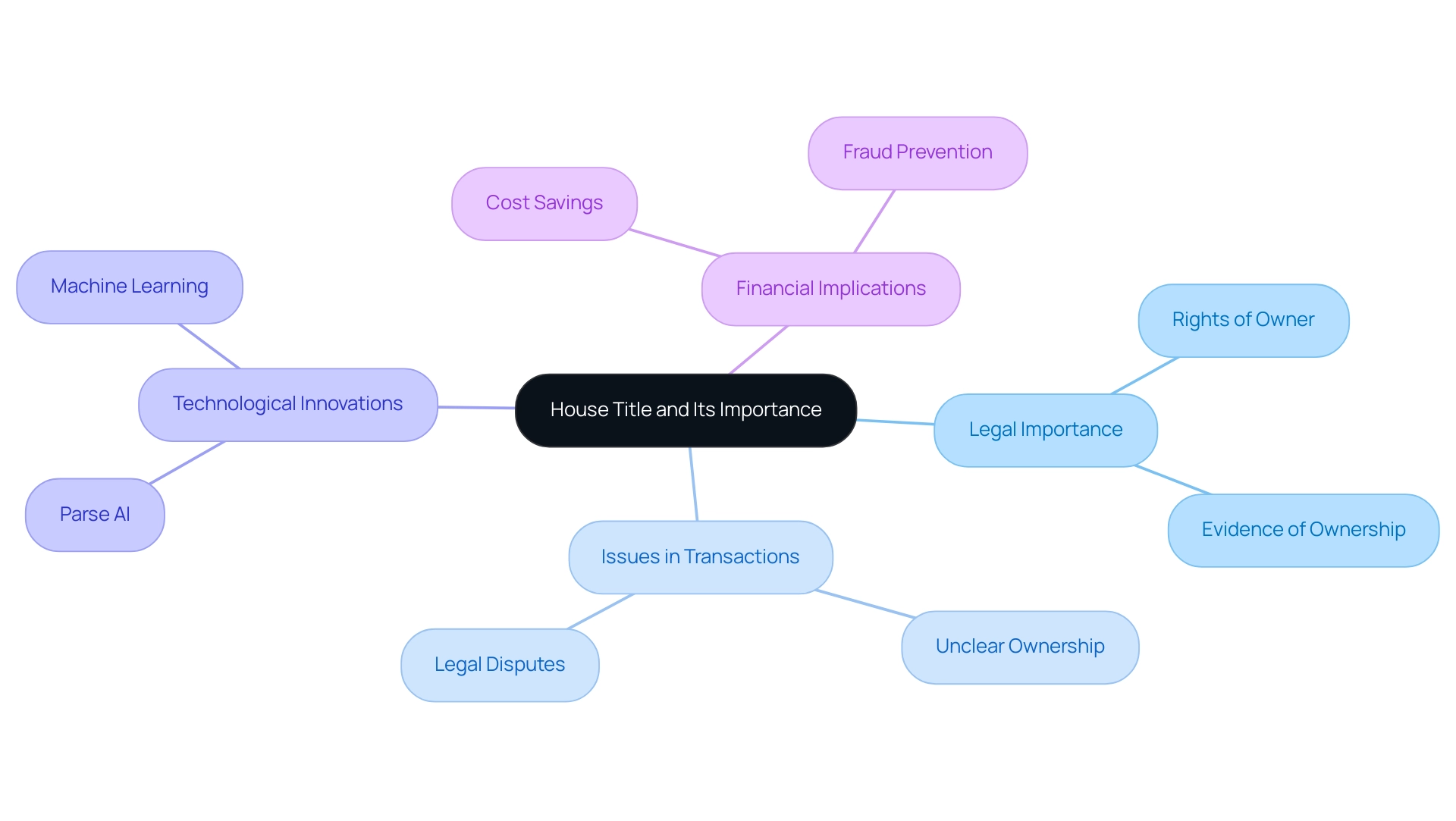

Understanding the title for a house is crucial for homeowners, as it serves as legal proof of ownership and outlines the rights associated with the property, thus preventing potential legal disputes. Clear ownership documents are essential to avoid costly issues during real estate transactions. Furthermore, statistics reveal that a significant percentage of transactions encounter problems due to unclear titles. This underscores the necessity for meticulous title research, highlighting the challenges faced and the benefits of ensuring clarity in ownership documentation.

Introduction

Navigating the intricate world of property ownership can indeed be a daunting task, particularly when it comes to grasping the pivotal role of house titles. This essential legal document not only establishes ownership but also safeguards against potential disputes that could jeopardize one’s investment.

As real estate transactions grow increasingly complex, issues surrounding unclear titles can lead to costly legal battles. Therefore, homeowners must be well-informed about the nuances of title ownership. From distinguishing between titles and deeds to recognizing the different types of property title ownership, this article delves into the critical aspects of house titles.

Furthermore, it offers practical strategies for protecting against fraud and outlines the importance of title insurance, ensuring homeowners can confidently navigate their real estate journeys.

What is a House Title and Why is it Important?

A house deed is an essential legal document that confirms possession of a property, outlining the rights of the owner, such as the ability to sell, lease, or alter the property. The importance of a property document extends beyond mere paperwork; it serves as undeniable evidence of ownership and is crucial in property dealings. In fact, approximately 25% of real estate transactions encounter issues related to unclear ownership documents, which can lead to costly legal disputes and delays, underscoring the necessity of having clear ownership.

The implications of lacking a clear designation are profound. Homeowners may find themselves embroiled in legal challenges that threaten their property rights, potentially resulting in financial losses and prolonged disputes. For instance, recent legal conflicts in 2025 have highlighted the complexities related to real estate ownership, stressing the importance of and clear records.

Specialist views emphasize that possessing a distinct title for a house is essential for successful property transactions. As noted by industry leaders, "In the digital age, wiring large sums of money to purchase property has become commonplace, but so have attempts to steal those funds – and they’re getting very deceptive." This statement illustrates the growing complexity of fraud in property transactions, making it imperative for homeowners and real estate experts to verify that ownership documents are clear and free of encumbrances.

Furthermore, case studies illustrate the essential role of property documents in real estate transactions. For example, Parse AI has transformed document research by employing machine learning and optical character recognition to simplify the extraction of essential information from documentation. This innovation not only expedites the process but also significantly reduces costs compared to conventional methods, allowing researchers to finalize abstracts and reports with greater accuracy.

The significant cost savings provided by Parse AI compared to traditional research methods further enhance its value in the industry.

In summary, understanding the nuances of the title for a house is vital for homeowners. It protects their investment and ensures a smooth transaction process, ultimately safeguarding their rights and financial interests in the property market.

Distinguishing Between Title and Deed: Key Differences Explained

In the realm of real estate, the terms 'title for a house' and 'deed' are often mistakenly used interchangeably; however, they signify distinct elements of asset possession. A deed represents the legal rights to possess and use a property, acting as a symbol of possession. Conversely, a deed is the tangible document that facilitates the transfer of ownership from one party to another. Essentially, the deed functions as the instrument that transfers ownership.

Understanding this distinction is crucial for homeowners and real estate professionals alike, as it can prevent confusion during transactions involving the title for a house. For instance, a search of ownership is a vital step in the purchasing process, revealing potential concerns such as judgments or liens against the asset. Statistics suggest that a comprehensive title search can uncover important issues that may influence rights, as it identifies concerns with possession and checks for judgments or liens against the asset.

Furthermore, the function of a deed in real estate possession cannot be overstated. A case study on the function of a deed illustrates that it must be signed by the seller to confirm the transfer of title and subsequently filed with local authorities. This process ensures that the deed is legally recognized, solidifying the new owner's claim to the property. The case study emphasizes that without proper execution and recording, the rights may not be legally recognized.

Widespread misunderstandings regarding ownership documents can result in difficulties in property transactions. For example, many believe that possessing a deed automatically grants them property rights, overlooking the importance of the title for a house. Real estate specialists highlight that grasping both concepts is crucial for navigating the intricacies of real estate effectively.

As Patrick Chism observes, "When he’s not writing, Patrick enjoys hiking, gardening, reading and making healthy foods taste like unhealthy foods," which reflects the diverse interests that can distract from the critical understanding of ownership rights.

Additionally, for homeowners navigating ownership issues, it is important to know that to remove an ex-spouse's name from a deed after divorce, is typically needed, requiring cooperation from the ex-spouse.

In summary, understanding the distinctions between ownership and deed is vital for anyone involved in real estate transactions. This knowledge not only helps in avoiding potential pitfalls but also empowers homeowners to make informed choices regarding their rights.

Types of Property Title Ownership: Who Holds the Title?

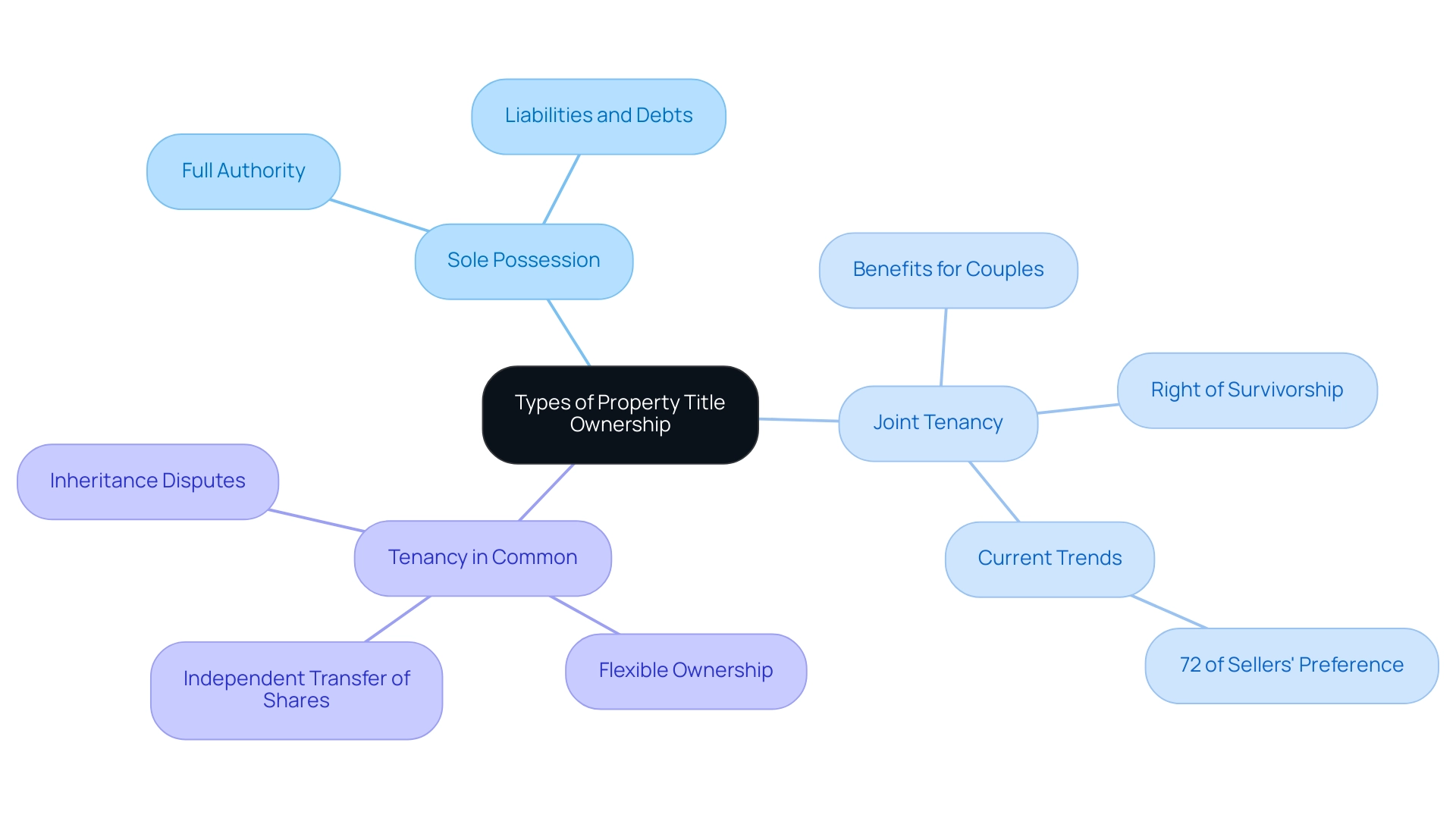

Property documents can be maintained in different formats, each with unique consequences for possession and inheritance. consist of sole possession, joint tenancy, and tenancy in common.

- Sole Possession: In this arrangement, a single individual holds the title to the asset. This kind of possession offers full authority over the asset, enabling the holder to make choices without requiring approval from others. However, it also means that the entire asset is subject to the owner's liabilities and debts.

- Joint Tenancy: This form of ownership allows two or more individuals to share equal ownership of the real estate, characterized by the right of survivorship. If one owner passes away, their share automatically transfers to the surviving owner(s), bypassing probate. This structure is particularly beneficial for couples or partners who wish to ensure that their assets remain within the family. Current trends indicate a growing preference for joint tenancy among couples, as 72% of sellers expressed a willingness to use the same agent again, suggesting a desire for continuity and trust in real estate transactions.

- Tenancy in Common: Unlike joint tenancy, tenancy in common permits multiple owners to hold shares of the property, which can be unequal. Each owner has the right to sell or transfer their share independently, making this arrangement flexible but potentially complex in terms of decision-making and inheritance. In cases of inheritance, the deceased owner's share is passed on according to their will or state law, which can lead to disputes among heirs.

Understanding these types of property rights is crucial for homeowners, especially in scenarios involving the title for a house, inheritance, or partnerships. For example, the Federal Reserve reported that in 2022, 66.1% of families possessed their primary residence, highlighting the significance of clear property structures to avoid potential conflicts during family transitions. As real estate professionals navigate these complexities, leveraging insights from experts can provide clarity on the best ownership structure for their clients' needs.

How to Protect Your House Title from Fraud and Theft

To effectively safeguard your house title from fraud and theft, implement the following strategies:

- Regular Monitoring: Consistently check your property records through your local land registry. This proactive approach allows you to quickly identify any unauthorized changes or suspicious activity.

- Invest in Ownership Insurance: Ownership insurance is a vital protection that provides coverage against losses arising from ownership defects or fraudulent claims. Its effectiveness in preventing financial losses from ownership fraud is well-documented, making it a wise investment for homeowners.

- Secure Personal Information: Exercise caution when sharing personal information. Ensure that all documents related to your property are stored securely to prevent unauthorized access.

- Utilize Title Monitoring Services: Consider subscribing to a title monitoring service that provides alerts for any changes in your title records. This service can be invaluable in detecting potential fraud early, allowing for timely intervention.

Recent statistics highlight the urgency of these measures; in 2022, losses from cyber-related property and rental fraud surpassed $145 million. Furthermore, a survey by Certified revealed that 54% of real estate professionals encountered at least one seller impersonation fraud attempt in the past six months, with 77% reporting an increase in such incidents. This alarming trend underscores the necessity for enhanced identity verification processes to protect property owners.

Additionally, a case in Detroit regarding alleged deed fraud currently in the courts serves as a stark reminder of the potential risks involved. Experts emphasize that without robust measures in place, the risk of ownership fraud will continue to escalate. As Jennifer Wauhob, the 2023 vice president of association affairs at the National Association of Realtors, noted, "It takes a team effort to protect the consumer and ensure we are working with people who are who they say they are in a transaction."

By adopting these protective strategies, homeowners can significantly reduce their vulnerability to property fraud and theft. The risks of falling victim to include significant financial losses, theft of personally identifiable information, complications in future real estate transactions, loss of licensing for organizations, damage to reputation, and potential penalties for regulatory noncompliance.

Changing Your House Title: A Step-by-Step Guide

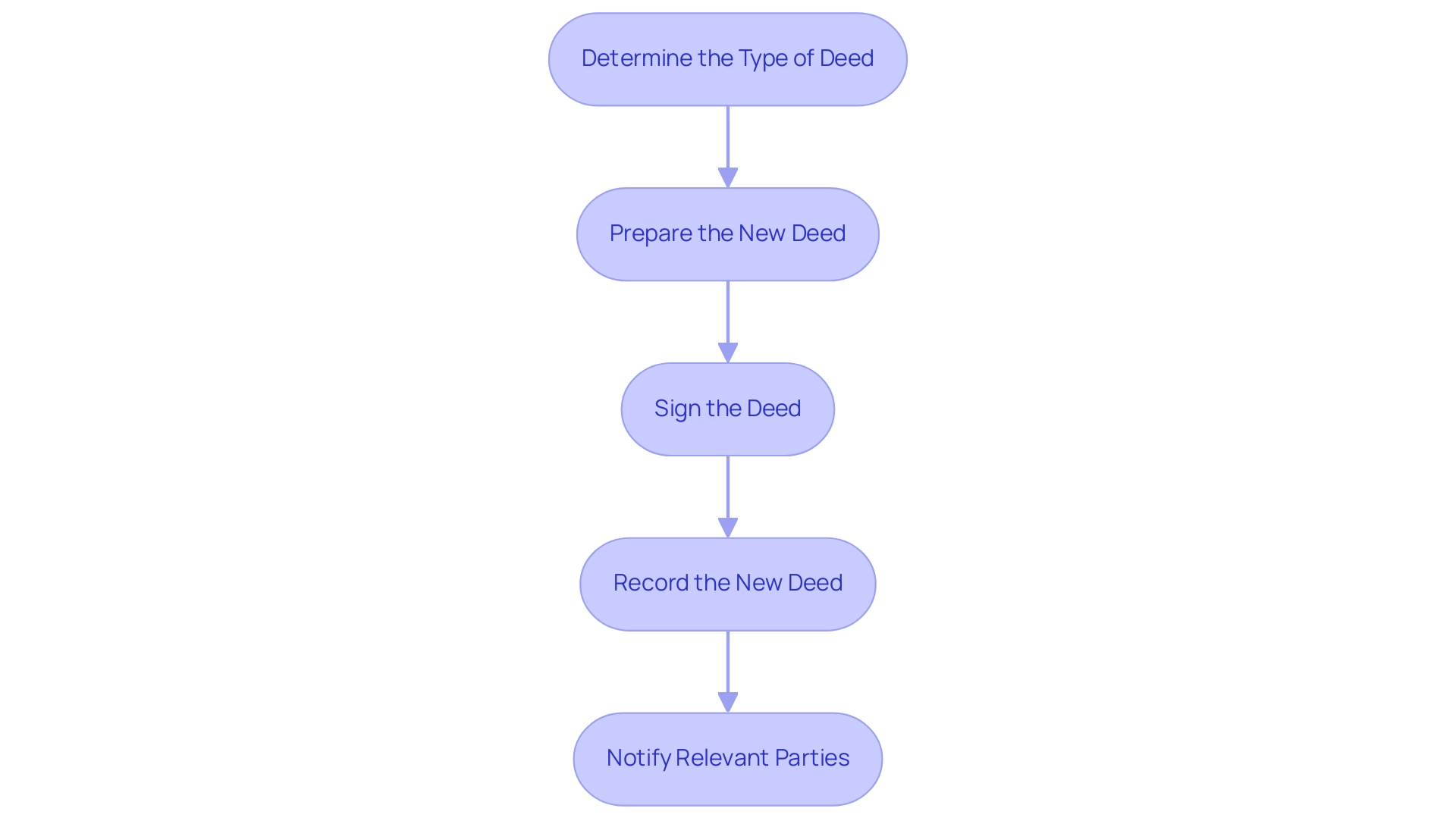

Modifying is a critical process that demands meticulous attention to detail. Here’s a comprehensive step-by-step guide to ensure a smooth transition:

- Determine the Type of Deed: The first step is to identify the appropriate type of deed for your situation. Common options include a quitclaim deed, which transfers the title for a house without warranties, and a warranty deed, which provides guarantees about the title.

- Prepare the New Deed: Draft the new deed meticulously. It must encompass the legal description of the asset, which can usually be located in earlier ownership documents, along with the names of both the existing and new owners. Accuracy is paramount to avoid future disputes.

- Sign the Deed: Once the deed is prepared, it must be signed in the presence of a notary public. This step is crucial as it verifies the identities of the parties involved and ensures that the signing is done voluntarily.

- Record the New Deed: After notarization, the next step is to record the new deed with your local county recorder's office. This action officially updates the public record and protects the new owner's rights to the title for a house.

- Notify Relevant Parties: Finally, inform any relevant parties about the change in ownership. This encompasses your mortgage lender, homeowners' association, and any other parties who may need to revise their records.

Common Challenges: Altering ownership documents can present difficulties, such as ensuring all legal requirements are fulfilled and addressing any existing liens or encumbrances on the asset. Recent changes in property ownership laws in 2025 have also introduced new regulations that may affect the process, making it essential to stay informed. Legal specialists highlight the significance of consulting with a property attorney during this process to navigate any complexities and ensure compliance with current laws.

Expert Opinions: As noted by Bankrate, the content created by their editorial staff is objective and factual, underscoring the importance of relying on credible sources when navigating the ownership change process.

Statistics: Recent data indicates that 72% of sellers would definitely use the same agent again, highlighting the value of professional guidance in realty transactions, including ownership changes. This statistic emphasizes the advantages of consulting with real estate experts during the ownership transfer process.

Case Studies: For example, a recent case study on for-sale-by-owner (FSBO) transactions showed that these sellers frequently encounter substantial difficulties, including pricing and marketing, which can complicate the ownership transfer process. In 2024, FSBO homes sold for an average of $380,000, compared to $435,000 for agent-assisted sales, underscoring the financial implications of navigating these processes without professional assistance.

By following these steps and being aware of the potential challenges, homeowners can effectively manage the process of altering their house ownership.

The Importance of Title Insurance in Real Estate Transactions

Title insurance serves as a critical policy designed to protect homeowners and lenders from financial losses due to defects in property ownership. Such defects may arise from outstanding liens, fraudulent claims, or inaccuracies in public records, potentially leading to significant legal challenges after purchase. The financial consequences of ownership defects can be dire; studies reveal that unresolved ownership issues can result in losses averaging tens of thousands of dollars for homeowners without insurance coverage.

By obtaining insurance for ownership, homeowners secure an essential layer of protection against these risks. This policy is usually acquired for a one-time premium paid at closing, providing lasting peace of mind. The importance of ownership insurance is further emphasized by recent statistics indicating a rise in claims related to ownership defects, with a considerable percentage stemming from undisclosed liens and ownership disputes.

In Iowa, for instance, the lender’s guaranty can extend up to $750,000 for a flat fee of $175, exemplifying the financial security that insurance offers.

assert that insurance not only protects individual homeowners but also plays a crucial role in facilitating seamless transactions. Without this safeguard, buyers may face financial ruin due to unforeseen ownership issues. A case study illustrates this point: a homeowner who purchased a house without ownership insurance faced over $50,000 in legal fees to address a lien that was not disclosed during the sale.

Moreover, the advancements introduced by Parse AI in research highlight how technology can improve the efficiency and accuracy of this process, ultimately benefiting both homeowners and lenders. Additionally, industry experts underscore that insurance is vital for maintaining the integrity of real estate transactions. Diane Tomb, CEO of the American Land Association, noted that while premium volumes have fluctuated, the commitment to protecting ownership rights remains steadfast.

This underscores the ongoing significance of insurance for property ownership in a dynamic market, ensuring that both homeowners and lenders are shielded from the financial repercussions of ownership defects.

Common Title Issues Homeowners Face and How to Resolve Them

Homeowners frequently encounter a range of typical ownership problems that can complicate real estate transactions. These challenges are significant and must be addressed to ensure a smooth process. They include:

- Liens from Unpaid Debts: Liens can arise when a seller has outstanding debts or taxes, creating against the title. Such liens must be resolved before a sale can proceed, as they typically cannot be removed until the associated debt is paid. This situation can significantly delay transactions and complicate the sale process.

- Errors in Public Records: Mistakes in public records, such as misspelled names or inaccurate descriptions of assets, can lead to disputes and confusion. These errors can hinder the ability to transfer ownership smoothly and may require legal intervention to correct.

- Boundary Disputes: Disagreements with neighbors over land lines can arise, often due to unclear or outdated surveys. These disputes can lead to costly legal battles and may require mediation or court intervention to resolve.

- Claims from Unknown Heirs or Previous Owners: In certain situations, claims may arise from unknown heirs or former owners who assert rights to the asset. This can create significant challenges in establishing clear ownership and may necessitate extensive legal research and documentation.

To effectively resolve these issues, homeowners should take proactive steps:

- Conduct a thorough title search to identify any potential problems before purchasing a property.

- Collaborate with a reputable firm that can provide expertise in navigating these complexities.

- Seek legal assistance when necessary, especially in cases involving disputes or claims that may require litigation.

Statistics indicate that fraud and forgery make up 21% of the total claims costs incurred by insurance companies, underscoring the importance of thorough research. Furthermore, as of 2025, homeowners are increasingly questioning the value and cost of insurance for ownership, despite its role in mitigating risks associated with these common ownership issues. As Oppenheim observes, "People believe that insurance for property transactions is a necessary evil to closing, an expense, but it has saved my clients a lot of money when something goes wrong."

Engaging with real estate experts can provide valuable insights into resolving property title disputes effectively, ensuring a smoother transaction process.

Conclusion

Understanding the complexities of house titles and their significance is paramount for any homeowner. This article has illuminated the essential role that house titles play in establishing ownership and protecting against legal disputes. From distinguishing between titles and deeds to recognizing the various types of property ownership, the insights provided equip homeowners with the knowledge necessary to safeguard their investments.

Furthermore, the importance of title insurance cannot be overstated. It serves as a critical safety net, shielding homeowners from potential financial losses stemming from title defects. With the rise of fraudulent activities in real estate, taking proactive measures—such as regular monitoring and investing in title insurance—becomes essential for protecting one’s property rights.

In conclusion, navigating the world of property ownership requires diligence and informed decision-making. By understanding the nuances of house titles, implementing protective strategies, and staying abreast of current regulations, homeowners can confidently engage in real estate transactions. This knowledge not only secures their investments but also fosters a more stable and transparent real estate market for all.

Frequently Asked Questions

What is a house deed?

A house deed is a legal document that confirms possession of a property and outlines the rights of the owner, such as the ability to sell, lease, or alter the property.

Why is having a clear property document important?

A clear property document serves as undeniable evidence of ownership and is crucial in property dealings, helping to avoid costly legal disputes and delays.

What are the potential consequences of unclear ownership documents?

Lacking clear ownership documents can lead to legal challenges that threaten property rights, resulting in financial losses and prolonged disputes.

What recent issues have highlighted the importance of clear property documents?

Recent legal conflicts in 2025 have emphasized the complexities related to real estate ownership and the necessity of comprehensive ownership searches and clear records.

How does fraud impact property transactions today?

The rise in digital transactions has made property purchases susceptible to fraud, making it essential for homeowners and real estate experts to ensure ownership documents are clear and free of encumbrances.

What role does technology play in property document research?

Innovations like Parse AI use machine learning and optical character recognition to simplify the extraction of essential information from property documents, expediting the process and reducing costs compared to traditional methods.

What is the distinction between a title and a deed in real estate?

A title represents the legal rights to possess and use a property, while a deed is the tangible document that facilitates the transfer of ownership from one party to another.

Why is a title search important in real estate transactions?

A title search is vital as it reveals potential concerns such as judgments or liens against the asset, which can affect ownership rights.

What must be done for a deed to be legally recognized?

A deed must be signed by the seller to confirm the transfer of title and subsequently filed with local authorities to ensure legal recognition of the new owner's claim.

What common misunderstanding do people have about ownership documents?

Many believe that possessing a deed automatically grants them property rights, overlooking the importance of understanding both the title and deed in real estate transactions.

What is needed to remove an ex-spouse's name from a deed after divorce?

A quit claim deed is typically required to remove an ex-spouse's name from a deed, which necessitates cooperation from the ex-spouse.

Why is it important for homeowners to understand the distinctions between ownership and deed?

Understanding these distinctions helps avoid potential pitfalls in real estate transactions and empowers homeowners to make informed choices regarding their rights.