Overview

The article compares grant deeds and deeds of trust, highlighting their distinct roles in real estate transactions, with grant deeds facilitating ownership transfer and deeds of trust securing loans through a three-party agreement. It emphasizes the importance of understanding these differences for property professionals, as each document serves unique legal purposes and implications that can significantly affect property rights and financing arrangements.

Introduction

In the intricate world of real estate, understanding the nuances of legal documentation is paramount. Grant deeds and deeds of trust serve distinct yet crucial functions in property transactions, each playing a significant role in the transfer of ownership and the securing of loans.

- While grant deeds assure buyers of a clear title and facilitate straightforward ownership transfers,

- deeds of trust introduce a three-party dynamic that offers lenders essential security in financing arrangements.

As the landscape of real estate evolves, with technological advancements and changing regulations, real estate professionals must navigate these complexities with precision. This article delves into the key features, comparative analysis, and common misconceptions surrounding grant deeds and deeds of trust, equipping readers with the knowledge necessary to make informed decisions in their property dealings.

Understanding Grant Deeds and Deeds of Trust

A grant instrument serves as a crucial legal document that facilitates the transfer of ownership of real property from one party to another, affirming that the grantor possesses the legal authority to execute such a transfer. This document includes warranties that assure the buyer the property is free from encumbrances, barring any specifically disclosed exceptions. Conversely, a trust agreement functions as a security instrument that involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee.

This deed secures a loan by temporarily transferring the legal title of the property to the trustee until the borrower fulfills their loan obligations. Comprehending the differences between a grant deed vs deed of trust is crucial for property professionals, especially considering the legal consequences that may arise from conflicts regarding ownership transfers. As David J. Willis, a lawyer and writer certified in both residential and commercial property law, observes, understanding these nuances is essential for effective navigation of property transactions.

Recent developments, such as jurisdictions adopting blockchain technology for tamper-proof digital property registries, underscore the evolving landscape of property documentation and the necessity for professionals to stay informed. Moreover, the average DAF account size at Single-Issue Charities was $234,674 in 2023, reflecting a 1.9 percent increase from the prior year, and the total payout from DAFs stood at 34.2 percent, suggesting financial trends that may influence property transactions. The case study on types of property documents illustrates that most transactions utilize private documents, with the choice of document type depending on the level of protection desired by the buyer and the guarantees offered by the seller.

Key Features of Grant Deeds

In property transactions, understanding the differences between grant deed vs deed of trust is crucial, as these grant documents possess various important attributes that provide legal clarity and protection for the parties involved. One of the primary attributes is the guarantee of a clear title, which assures the grantee that the property being conveyed is free from any undisclosed encumbrances. This assurance is strengthened by the inclusion of a habendum clause, which explicitly states the rights being transferred and the nature of the property granted.

Additionally, notarization stands as a critical requirement for grant documents, serving as a safeguard against fraud and ensuring the authenticity of the document. Each state has specific notarization requirements, which property experts must navigate to maintain compliance.

The significance of these features in relation to grant deed vs deed of trust cannot be overstated, as they serve not only to protect the grantee but also to reaffirm the grantor's intent to convey the property without reservations. Furthermore, when comparing grant deed vs deed of trust, it is noted that grant deeds often include covenants that address the conditions of the title, providing additional layers of security for the grantee. As pointed out by legal specialists, comprehending the concepts of grant deed vs deed of trust is essential for property professionals, as they play a critical role in protecting their clients' interests and enabling smooth transactions.

According to a recent survey, 57% of respondents indicated that their largest Federal award included indirect or administrative cost funding, emphasizing the significance of proper grant management in property transactions. As mentioned in the NIH Data Book, "In 2020, the success rate was 21%," highlighting the competitive nature of obtaining funding for property projects. Furthermore, a case study on Federal Government Awards shows that 40% of respondents consistently obtained Federal funding, with a median largest award of $615,000, highlighting the practical implications of grant deeds in facilitating property transactions.

In light of the evolving landscape of real estate regulations, staying informed about these key features is essential for effective practice and client advocacy.

Exploring Deeds of Trust: Structure and Function

Deeds of assurance serve as a critical mechanism for securing loans, and this relates to the concepts of grant deed vs deed of trust, as it involves the transfer of legal title of the property to a trustee, who holds it as collateral for the loan. This structure typically includes three key parties:

- The trustor (the borrower)

- The beneficiary (the lender)

- The trustee, who manages the property title

In cases of default, the trustee possesses the authority to initiate foreclosure proceedings, enabling the lender to recover their investment.

This framework is especially important as it distinguishes between grant deed vs deed of trust, which are instruments of security compared to conventional mortgages, where the borrower keeps the title while simply providing a lien to the lender. Comprehending these dynamics is crucial for property professionals involved in financing and lending processes. Significantly, recent data shows that in Q3 2024, there were 97,669 residential loans granted through the U.S. Department of Veterans Affairs (VA), demonstrating strong involvement with agreements in property financing.

Furthermore, a $2.15 million loan for a Coronado bridge loan generated 10.50% and was utilized to purchase a new business prior to listing a vacation rental for sale, emphasizing current trends in financing. According to Tammy Brunner, Register of Deeds,

The statistics in this report are derived from instruments recorded in the office of the Wake County Register of Deeds

underscoring the importance of accurate documentation in understanding market trends. Furthermore, a recent case study titled 'Seriously Underwater Mortgage Rates by Region' revealed that the Midwest and South regions exhibited the highest shares of seriously underwater mortgages, with Louisiana leading at 10.1%.

Such information emphasizes the regional differences in mortgage stability and the essential function agreements play in the overall property landscape. The report was initially released on January 3, 2025, and for further inquiries, contact information for the Register of Deeds is available.

Comparative Analysis: Grant Deed vs. Deed of Trust

The difference between grant deed vs deed of trust is crucial in real estate dealings, primarily due to their distinct purposes and roles. Grant documents enable the transfer of ownership and guarantee the recipient of the title's legitimacy, while agreements for securing financing create a connection between the borrower and lender. Specifically, grant documents involve two parties—the grantor and the grantee—whereas agreements of security introduce a third party: the trustee, along with the trustor (borrower) and recipient (lender).

Legal expert Leo J. Cushing, Esq., CPA, LL.M., succinctly articulates this by stating,

Based on the foregoing, it is clear that a life estate is a property interest and not an interest in a fiduciary arrangement as found by the court,

highlighting the critical nature of understanding these distinctions. In legal terms, the comparison of grant deed vs deed of trust shows that grant deeds safeguard the new owner by ensuring a clear title, while deeds of agreement outline the rights and responsibilities of both borrower and lender, which can be crucial in the event of default. Recent trends indicate a shift towards innovative solutions like the 'Lady Bird Deed,' particularly in the context of MassHealth eligibility regulations, yet these may be treated as revocable trusts for eligibility purposes.

Furthermore, the annual exclusion amount for gifts, currently set at $14,000 per year per donee, underscores the financial implications of property transfers. Furthermore, recent legal malpractice cases have emerged from failures to reserve a life interest in property transfers, highlighting the importance of comprehending these distinctions in practice. This comparative analysis of grant deed vs deed of trust is essential for real estate professionals navigating the complexities of documentation, ensuring they select the appropriate instrument for their transactions and understand the implications of each.

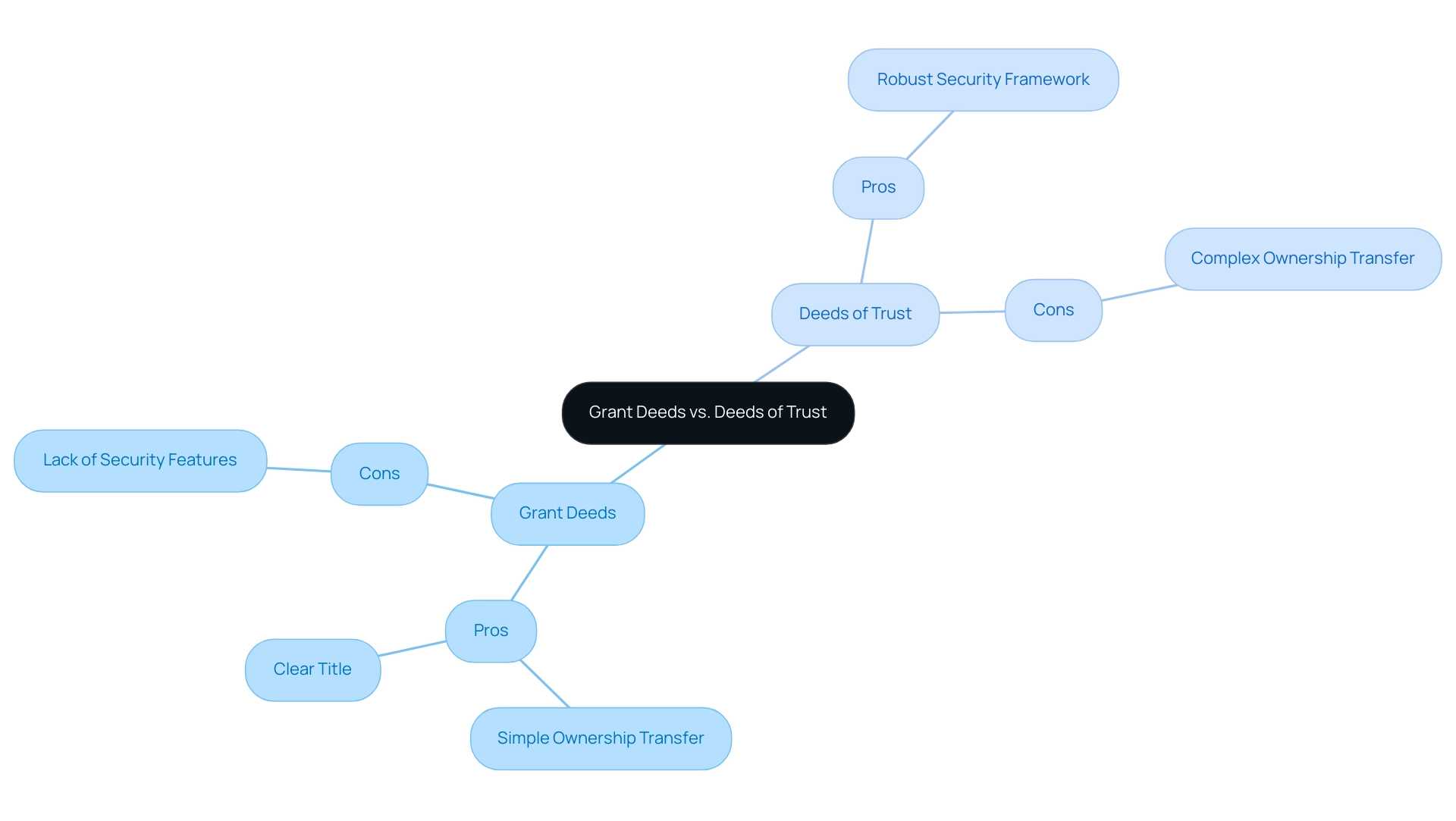

Pros and Cons: When to Use Grant Deeds vs. Deeds of Trust

When assessing the use of grant deed vs deed of trust documents, one of their main benefits is the straightforward transfer of property ownership, along with the assurance of a clear title. This simplicity makes them an attractive option in many scenarios. However, grant documents may lack the necessary security features that lenders require in financing situations, which could pose risks in the event of default.

In fact, recent statistics indicate that transactions secured by legal documents have a significantly lower default rate compared to those using grant instruments, underscoring the importance of security in financing. On the other hand, when discussing grant deed vs deed of trust, agreements of trust provide a robust framework for securing loans, thereby safeguarding lenders' interests effectively. Yet, this security comes with a trade-off: the ownership transfer process can become more complex.

As recent discussions suggest, the choice between grant deed vs deed of trust often hinges on the specific context of the transaction. Real property professionals must carefully balance the needs of buyers, sellers, and lenders when making this determination. For example, in discussions of grant deed vs deed of trust, agreements of security are often used in situations involving financing, where the lender's protection is crucial, while grant agreements may be more appropriate for simple ownership transfers, such as those that happen during divorce settlements or formation of estates.

Rhea de Aenlle, a privacy and data security attorney with over 25 years of experience, emphasizes the need for legal expertise in these transactions, as the complexities can significantly impact the outcomes for all parties involved. As the landscape of property ownership transfer methods evolves, understanding these nuances is crucial for making informed decisions. Specialists in real estate recommend that although grant documents may provide ease, the additional security of security instruments often warrants their application in more intricate dealings.

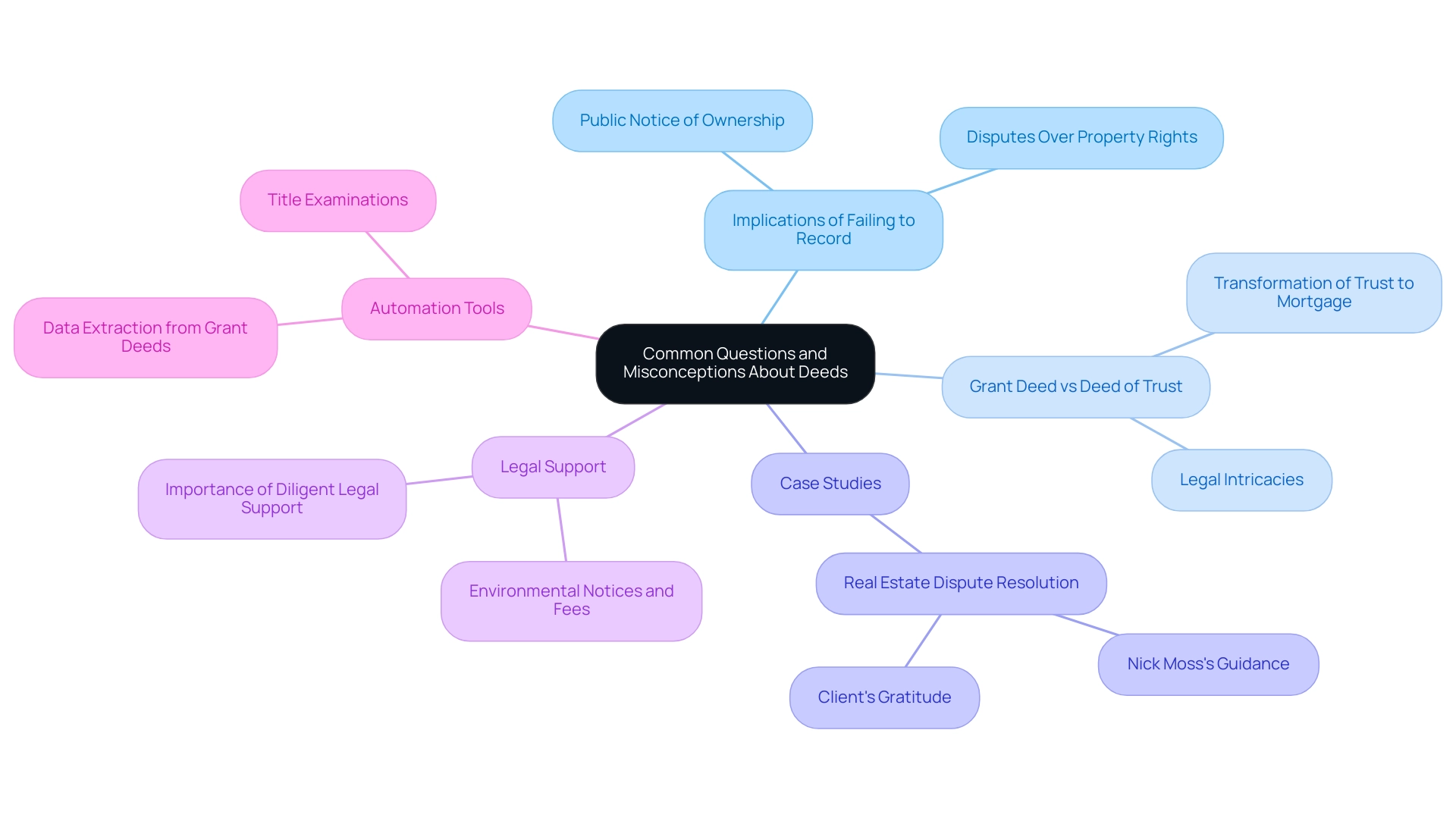

Common Questions and Misconceptions About Deeds

Common inquiries regarding grant documents and trust agreements often revolve around the implications of failing to record a grant document and the comparison of grant deed vs deed of trust in terms of converting a trust agreement into a mortgage. Recording grant documents is essential as it establishes public notice of ownership; neglecting this vital step can result in significant disputes over property rights. For instance, a client involved in a real estate ownership dispute expressed their appreciation for the guidance received, with Nick Moss stating,

I am impressed with how attentive Nick Moss has been in providing me with updates on my case.

This highlights the importance of diligent legal support in these scenarios. In fact, legal disputes related to unrecorded documents concerning grant deed vs deed of trust can have considerable financial repercussions, as evidenced by a client receiving $25,000 in attorney's fees from the opposing party. Additionally, the case study titled 'Real Estate Dispute Resolution' illustrates how Nick Moss provided valuable advice that led to a satisfactory resolution for his client.

Concerning the transformation of a trust agreement to a mortgage, although it is certainly feasible, the procedure is filled with legal intricacies that require careful management, particularly when considering the grant deed vs deed of trust. Furthermore, it is important to note that environmental notices and fees are part of the services offered by the Registrar-Recorder/County Clerk, underscoring the importance of recording deeds. By addressing these common questions, real estate professionals can demystify the documentation process, empowering them to offer informed advice to their clients and navigate the intricacies of property rights effectively.

Conclusion

Understanding the distinctions between grant deeds and deeds of trust is essential for anyone involved in real estate transactions. Grant deeds simplify the process of transferring ownership while providing assurances of a clear title, making them ideal for straightforward property transfers. On the other hand, deeds of trust introduce a three-party structure that secures loans, offering vital protection for lenders. Each serves its unique purpose, and real estate professionals must adeptly navigate these different instruments to safeguard the interests of their clients.

As the real estate landscape continues to evolve with innovations and legal changes, staying informed about the characteristics and implications of both grant deeds and deeds of trust is critical. Professionals who grasp these nuances can better advise their clients, mitigating risks and enhancing transaction efficiency. Understanding when to use each type of deed can significantly influence the outcome of property dealings, ensuring that the right balance is struck between ownership transfer and financial security.

In conclusion, whether dealing with a simple sale or a complex financing arrangement, recognizing the strengths and limitations of grant deeds and deeds of trust empowers real estate professionals to make informed decisions. This knowledge not only aids in smooth transactions but also fosters trust and confidence among clients, which is paramount in the intricate world of real estate.

Frequently Asked Questions

What is a grant instrument?

A grant instrument is a legal document that facilitates the transfer of ownership of real property from one party to another, confirming that the grantor has the legal authority to execute the transfer and assuring the buyer that the property is free from encumbrances, except for any specifically disclosed exceptions.

What is the purpose of a trust agreement?

A trust agreement serves as a security instrument involving three parties: the borrower (trustor), the lender (beneficiary), and the trustee. It secures a loan by temporarily transferring the legal title of the property to the trustee until the borrower fulfills their loan obligations.

Why is it important to understand the differences between a grant deed and a deed of trust?

Understanding the differences is crucial for property professionals as it can have significant legal consequences regarding ownership transfers and helps in navigating property transactions effectively.

What role does notarization play in grant documents?

Notarization is a critical requirement for grant documents as it serves as a safeguard against fraud and ensures the authenticity of the document. Each state has specific notarization requirements that property experts must follow.

What is the significance of a clear title in property transactions?

A clear title guarantees that the property being conveyed is free from any undisclosed encumbrances, providing legal clarity and protection for the parties involved in the transaction.

What are covenants in the context of grant deeds?

Covenants in grant deeds address the conditions of the title and provide additional layers of security for the grantee, reaffirming the grantor's intent to convey the property without reservations.

How have recent developments influenced property documentation?

Recent developments, such as the adoption of blockchain technology for tamper-proof digital property registries, highlight the evolving landscape of property documentation and the need for professionals to stay informed.

What financial trends may influence property transactions?

Trends such as the average DAF account size and total payout percentages from DAFs indicate financial dynamics that may impact property transactions, emphasizing the importance of proper grant management.