Overview

The article provides a critical comparison of grant deeds and warranty deeds, emphasizing that grant deeds offer limited buyer protection, whereas warranty deeds deliver comprehensive assurances against title defects and claims. This distinction is underscored by statistics that reveal a higher prevalence of title disputes associated with grant deeds.

Furthermore, expert advice highlights the necessity of selecting the appropriate deed type based on the buyer's needs and the complexities of the transaction. Such insights reinforce the importance of thorough title research, addressing potential challenges, and ultimately guiding buyers towards informed decisions.

Introduction

In the intricate world of real estate, the choice of property deed significantly influences the security and success of transactions. Understanding the nuances between grant deeds and warranty deeds is essential for both buyers and real estate professionals, as each type offers distinct levels of protection and implications for ownership transfer. Furthermore, statistics reveal a growing preference for warranty deeds in high-value transactions, highlighting the importance of informed decision-making. As the market evolves and technology transforms the industry, navigating these complexities becomes paramount for safeguarding investments and ensuring smooth property transfers.

Understanding Property Deeds: An Overview

Property titles are essential legal documents that facilitate the transfer of ownership of real estate from one party, known as the grantor, to another, referred to as the grantee. These documents not only serve as evidence of ownership but also play a pivotal role in the integrity of real estate transactions. Among the various types of documents, grant agreements and assurance documents are the most frequently employed, each providing unique levels of protection and rights to the purchaser.

Grasping the distinctions between the grant deed and warranty deed is essential for real estate experts. Grant documents typically provide limited guarantees regarding the title, ensuring that the property has not been sold to anyone else and that there are no undisclosed encumbrances. In contrast, warranty documents provide a more thorough level of protection, including assurances that the title is clear and that the grantor will defend the title against any claims.

Recent statistics indicate that in 2025, a significant percentage of real estate deals involve grant documents, with approximately 60% of agreements choosing this type due to its straightforward nature. However, warranty documents are increasingly preferred in high-value exchanges, where purchasers seek greater security, accounting for about 40% of the market.

In December 2024, all four U.S. regions experienced month-over-month declines in deals, with the West observing the most significant drop. This trend highlights the significance of comprehending in fluctuating markets, especially in high-risk regions like Florida and Arizona, where CoreLogic indicates the threat of price drop is quite elevated.

Case studies demonstrate the practical consequences of these decisions. For example, a recent deal involving a luxury asset in Florida employed a warranty document, which not only sped up the closing process but also offered the purchaser reassurance, indicating a rising trend among affluent buyers emphasizing safety in their investments.

Furthermore, expert insights highlight the significance of grasping real estate documents in the present market environment. As real estate dealings continue to evolve, especially with possible modifications in housing policies that could impact the market, professionals who are knowledgeable in the intricacies of grant deed versus warranty deed are better prepared to navigate complexities and safeguard their clients' interests.

Additionally, technology is revolutionizing real estate marketing and sales, with innovations like drone photography and virtual tours improving the efficiency of dealings. Homes featuring drone photography sell 68% faster than those without, and virtual home tours have increased by over 300% since 2020. This technological advancement pertains to the efficiency of title research and the role of Parse AI in optimizing the process, making it essential for industry professionals to remain informed about real estate document types and their implications in 2025.

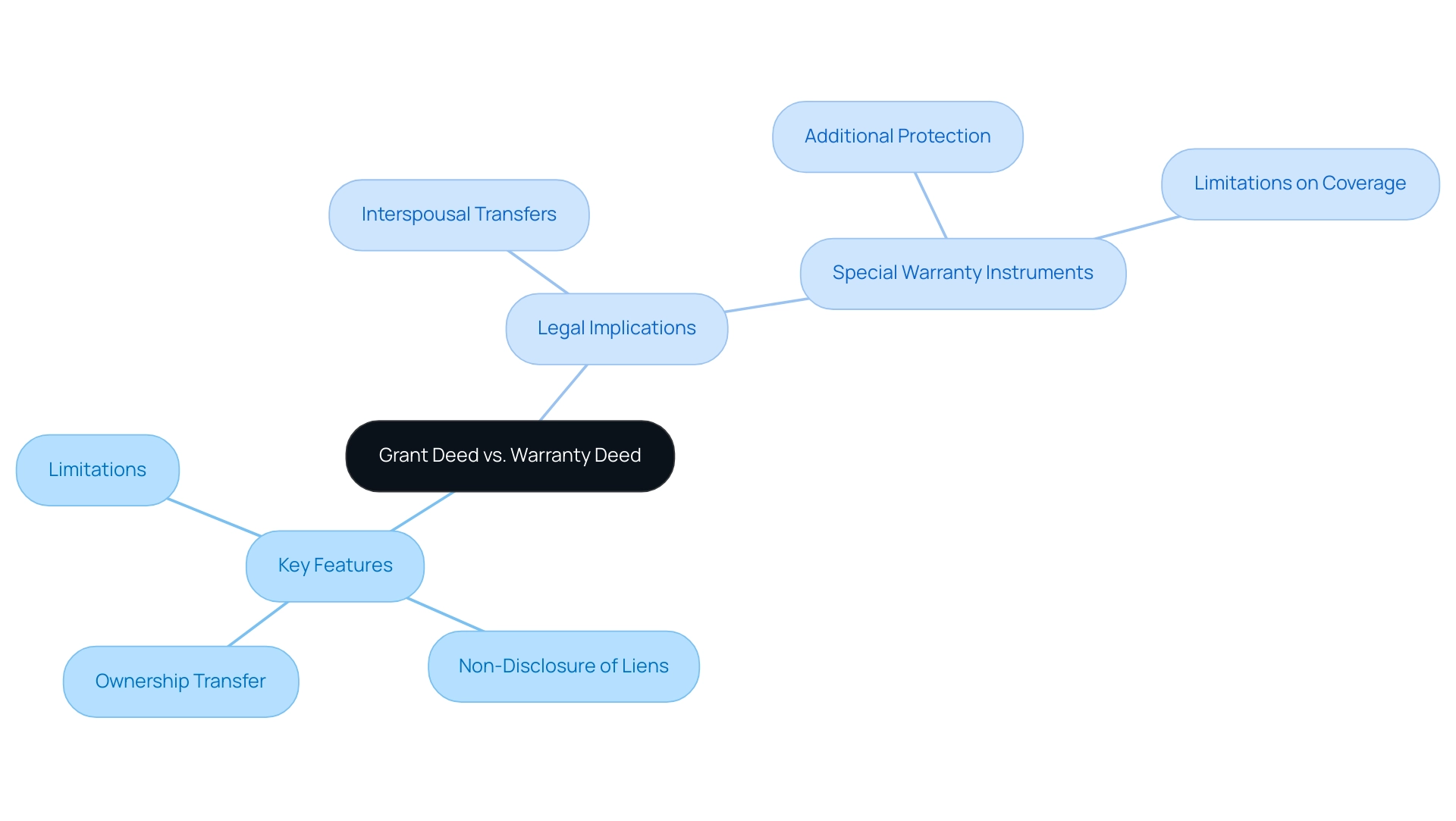

What is a Grant Deed? Key Features and Legal Implications

A grant document serves as a pivotal tool in real estate transactions, delineating the differences between and a warranty deed, as it facilitates the transfer of ownership from the grantor to the grantee. This type of document is characterized by two essential guarantees:

- That the grantor has not conveyed the property to any other party.

- That the property is free from undisclosed liens or encumbrances.

It is crucial to note that, in the context of grant deed versus warranty deed, grant documents do not provide protection against issues that may have arisen prior to the grantor's ownership, potentially leaving grantees exposed to unforeseen claims.

In 2025, the legal ramifications of utilizing grant documents remain significant. Real estate professionals must recognize that while documents like grant deed and warranty deed are prevalent, they may not offer the comprehensive security that buyers often seek. For instance, an interspousal transfer document is frequently utilized to shift ownership between spouses, particularly during divorce proceedings, showcasing the nuanced applications of grant documents in various contexts.

This statistic underscores the practical importance of understanding different property types in real estate transactions. Key points to consider include that liens are legal claims on a property that must be resolved before clear ownership can be transferred to the grantee. This highlights the necessity of comprehending potential encumbrances associated with grant agreements.

Case studies illustrate the practical implications of grant documents. A significant example is the application of a special warranty instrument, which offers additional security to the grantee by ensuring that the asset was free of legal encumbrances during the grantor's ownership. This type of document provides a heightened level of assurance regarding the property's title status, although it does not cover issues that arose before the grantor's tenure.

This comparison reinforces the importance of understanding the limitations of grant deed versus warranty deed documents. As real estate transactions evolve, it is advisable for professionals to collaborate closely with attorneys to navigate the complexities of grant deed and warranty deed. Legal experts stress the importance of thoroughly reviewing contracts, particularly in the discussion of grant deed versus warranty deed, to grasp the responsibilities of both the grantor and grantee. Matthew Dewoskin notes, "For example, if you’re purchasing a house, you’re the grantee because you’re the one receiving the rights from the grantor."

This diligence is essential in mitigating risks associated with ownership transfers. Statistics suggest that grant documents continue to be a favored option in real estate dealings, but their restrictions necessitate a cautious approach. Understanding the essential characteristics and legal implications of grant deed versus warranty deed is vital for real estate experts, enabling them to provide informed advice to clients and secure successful transactions.

Exploring Warranty Deeds: Definitions and Buyer Protections

serves as a robust legal instrument, providing purchasers with significantly greater security than the distinctions outlined between grant deed and warranty deed. This document guarantees that the grantor possesses clear title to the asset and has the legal authority to sell it. Title documents deliver three essential assurances:

- That the property is free from encumbrances;

- That the grantor will defend the title against any claims;

- That the grantor will compensate the grantee for any losses arising from title defects.

In 2025, the importance of title documents is underscored by their growing preference in real estate transactions, particularly as 66.1% of families owned their primary residence in 2022. This statistic highlights the rising demand for secure ownership, establishing legal documents as a crucial element in protecting purchasers. Real estate experts emphasize that utilizing guarantee documents can significantly mitigate risks associated with potential title disputes, making them a preferred choice for purchasers seeking reassurance.

It is vital to recognize that the relationship between document and title is often misunderstood; while a document conveys title, issues with one do not automatically affect the other. Furthermore, title insurance plays a complementary role alongside ownership documents, providing additional security for purchasers' financial interests in the event of ownership conflicts.

For instance, a recent case study involving for-sale-by-owner (FSBO) sellers, who represented 6% of home sales in 2024, revealed that those opting for ownership documents faced fewer challenges during the sale process. The average FSBO home sold for $380,000, in contrast to $435,000 for agent-assisted sales. This indicates that although FSBO sellers encountered obstacles, the application of guarantee documents facilitated smoother transactions and protected buyers by reducing the likelihood of title-related issues.

Experts in the field advocate for the use of guarantee documents, particularly when considering the differences between grant deed and warranty deed, emphasizing that they not only safeguard buyers but also enhance the overall integrity of real estate transactions. As Robert Moore advises, consulting with legal professionals prior to engaging in any real estate transaction is crucial to ensure the appropriate type of document is employed, especially in complex markets like Ohio. This expert insight reinforces the notion that title documents, in conjunction with title insurance, are indispensable tools for ensuring buyer protections in today’s real estate landscape.

Grant Deed vs. Warranty Deed: Key Differences Explained

The fundamental distinction between and a warranty deed lies in the level of protection afforded to the buyer. Grant deeds provide limited assurances, primarily confirming that the property has not been sold to another party and is free from undisclosed liens. Conversely, warranty deeds offer extensive protections, including guarantees against any claims or defects in the title, even those that predate the grantor's ownership.

Special conveyances, a specific category of guarantees, ensure protection against title flaws solely established by the grantor or seller, adding complexity to the decision-making process.

This distinction is particularly significant in 2025, as real estate professionals navigate an evolving landscape of buyer protections and title disputes, especially when considering grant deeds versus warranty deeds. Recent statistics indicate that title disputes related to grant deeds are notably more prevalent than those associated with warranty deeds, underscoring the importance of selecting the correct document type. For instance, a study revealed that properties conveyed through grant deeds experienced a 30% increase in title disputes compared to those transferred with warranty deeds.

This data emphasizes the necessity for real estate professionals to meticulously evaluate the risks involved in each transaction.

Moreover, it is essential for listing agents to verify that the offer to purchase accurately reflects the intended type of conveyance prior to the seller's signature. As Debbi Conrad, Senior Attorney and Director of Legal Affairs for the WRA, states, "Once the offer is drafted and submitted, the listing agent should confirm that the offer to purchase correctly identifies the intended type of conveyance before the offer is signed by the seller/client." This highlights the critical importance of accurately identifying the type of document in offers, as misidentification may necessitate counter-offers and complicate the closing process.

Expert opinions further illuminate these differences. Real estate authorities assert that understanding the nuances between grant deeds and warranty deeds is vital for mitigating potential legal issues. Industry experts note that the choice of documentation can significantly influence the buyer's security and the overall transaction process.

Additionally, case studies from various regions, such as Rhode Island, illustrate the practical implications of these distinctions. In Rhode Island, sellers are required to disclose substantial information about the property, including any health and safety hazards. This requirement can impact the decision to utilize a warranty deed, as purchasers may seek enhanced protection given the possibility of undisclosed issues.

The necessity for comprehensive disclosures further underscores the importance of selecting the appropriate document type to ensure adequate buyer protections.

In summary, the choice between grant deeds and warranty deeds is not merely a procedural formality; it is a critical decision that can influence the buyer's level of protection and the transaction's success. Real estate professionals must remain vigilant in ensuring that the document type accurately reflects the intended conveyance, as misidentification may necessitate counter-offers and complicate the closing process.

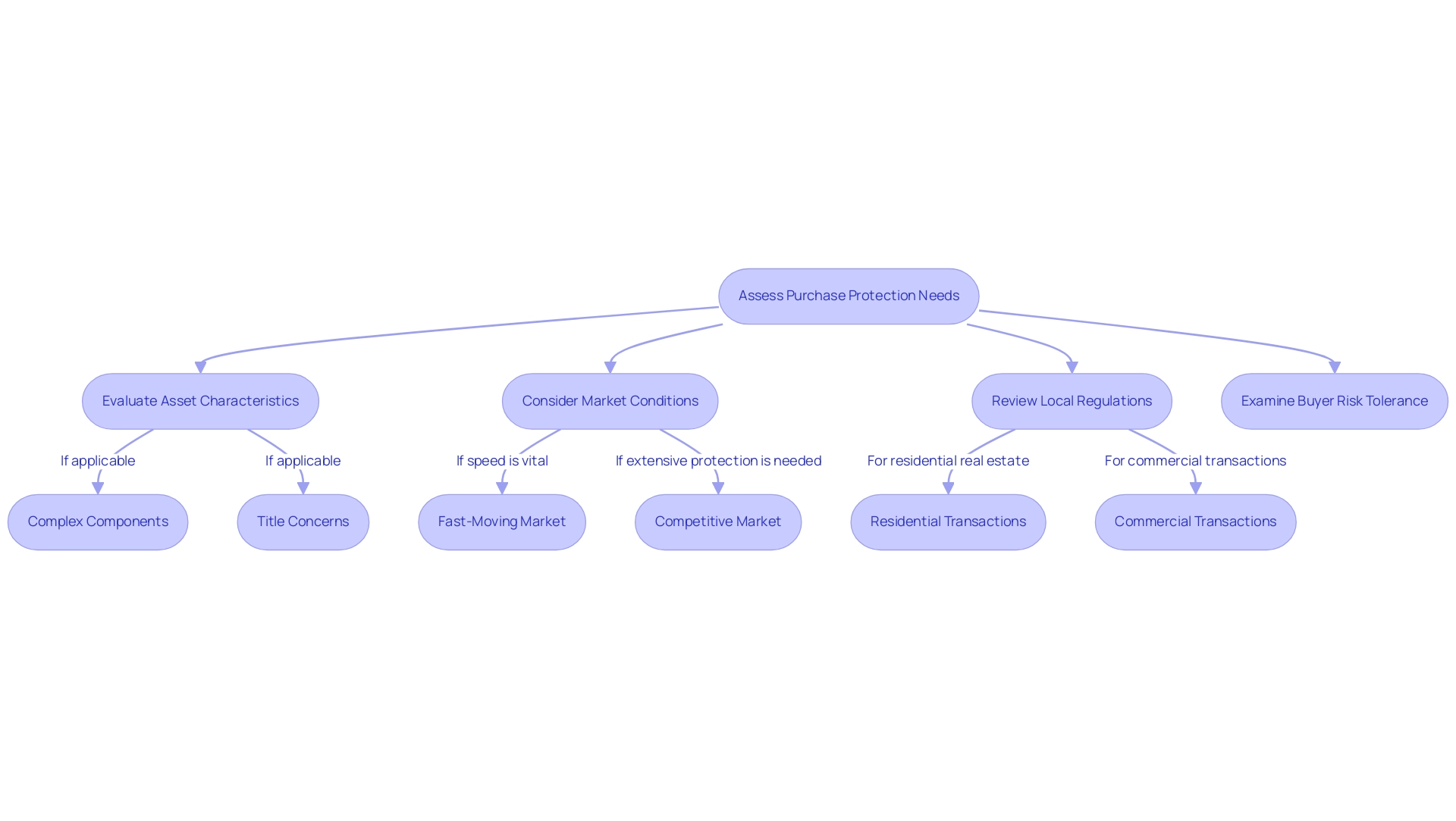

Choosing the Right Deed: Practical Considerations for Real Estate Transactions

When determining the choice between a grant deed and a warranty deed, real estate experts must assess several essential factors, including the sought by the purchaser, the characteristics of the asset, and the related risks. In 2025, buyer preferences indicate an increasing tendency towards warranty agreements for high-value deals, particularly in competitive markets where extensive protection is essential. For instance, when examining grant deeds versus warranty deeds, it becomes evident that assets with intricate components or potential title concerns are best safeguarded by warranty instruments, which provide enhanced security against future claims.

Conversely, in fast-moving markets where speed is vital, the choice between a grant deed and a warranty deed may suggest that a grant document suffices, especially for straightforward exchanges. Understanding local regulations and customs concerning land titles is crucial, as these can vary significantly by jurisdiction. For example, in certain regions, the distinction between grant deeds and warranty deeds is frequently recognized for residential real estate, while warranty documents are often preferred for commercial transactions.

Practical considerations also play a pivotal role in this decision-making process. Factors such as the buyer's risk tolerance, the property's title history, and the potential for future disputes should guide the selection of the legal instrument. The examination process must encompass the period from the earliest public records to the present to ensure all relevant title matters are addressed.

Expert guidance from seasoned specialists in the field underscores the importance of aligning the document type with the specific conditions of the deal. As Jerry Morris, a veteran in the title industry, aptly notes, 'the subtleties of each deal can greatly impact the suitable selection of document.'

Ultimately, the decision should reflect the buyer's needs and the unique characteristics of the property involved, ensuring that the selected deed provides the necessary protection and aligns with the strategic goals of the transaction. Furthermore, leveraging advanced technology, such as Parse AI, which collaborates with 258 partners to enhance title research, can offer significant insights and efficiencies in making these critical decisions.

Conclusion

Understanding the distinctions between grant deeds and warranty deeds is vital for anyone involved in real estate transactions. Grant deeds offer limited assurances—primarily confirming that the property has not been sold to another party and is free from undisclosed liens. In contrast, warranty deeds provide extensive protections, including guarantees against claims or defects in the title, even those arising prior to the grantor's ownership. This fundamental difference can significantly impact the security and success of property transactions, particularly in today's evolving market.

As the preference for warranty deeds grows, especially in high-value transactions, real estate professionals must remain vigilant in their understanding of these documents. Furthermore, statistics highlighting the increased likelihood of title disputes associated with grant deeds underscore the importance of selecting the appropriate deed type. By doing so, professionals can better safeguard their clients' interests and ensure smoother transactions.

In a landscape marked by fluctuating markets and technological advancements, the ability to navigate the complexities of property deeds is more crucial than ever. Real estate professionals should prioritize informed decision-making and continuous education regarding the implications of each deed type. Ultimately, the right choice between a grant deed and a warranty deed not only protects the buyer but also enhances the integrity of real estate transactions, paving the way for successful ownership transfers in a competitive environment.

Frequently Asked Questions

What are property titles, and why are they important?

Property titles are essential legal documents that facilitate the transfer of ownership of real estate from the grantor (seller) to the grantee (buyer). They serve as evidence of ownership and play a crucial role in ensuring the integrity of real estate transactions.

What are the main types of property title documents?

The most frequently employed types of property title documents are grant agreements and warranty documents, each providing different levels of protection and rights to the purchaser.

What is the difference between a grant deed and a warranty deed?

A grant deed provides limited guarantees about the title, ensuring the property hasn't been sold to anyone else and that there are no undisclosed encumbrances. In contrast, a warranty deed offers a more comprehensive level of protection, guaranteeing that the title is clear and that the grantor will defend the title against any claims.

What percentage of real estate deals involve grant documents versus warranty documents?

In 2025, approximately 60% of real estate agreements involved grant documents due to their straightforward nature, while warranty documents accounted for about 40% of the market, particularly in high-value exchanges where buyers seek greater security.

How have recent market trends affected real estate transactions?

In December 2024, all four U.S. regions experienced month-over-month declines in real estate deals, with the West seeing the most significant drop. This trend emphasizes the importance of understanding real estate documents in fluctuating markets, especially in high-risk regions like Florida and Arizona.

Can you provide an example of how the choice of document affects real estate transactions?

A recent deal involving a luxury asset in Florida utilized a warranty document, which expedited the closing process and provided reassurance to the purchaser, indicating a growing trend among affluent buyers who prioritize safety in their investments.

Why is it important for real estate professionals to understand property title documents?

As real estate dealings evolve, especially with potential changes in housing policies, professionals knowledgeable about grant deeds versus warranty deeds are better equipped to navigate complexities and protect their clients' interests.

How is technology impacting real estate transactions?

Technological innovations, such as drone photography and virtual tours, are improving the efficiency of real estate dealings. Homes with drone photography sell 68% faster, and virtual tours have increased by over 300% since 2020, highlighting the importance of staying informed about real estate document types and their implications.

What should real estate professionals consider when using grant documents?

Real estate professionals must recognize that while grant documents are common, they may not provide comprehensive security. Understanding potential encumbrances, such as liens, and the limitations of grant versus warranty deeds is essential for mitigating risks in ownership transfers.

What role do legal experts play in real estate transactions involving property titles?

Legal experts stress the importance of thoroughly reviewing contracts related to grant and warranty deeds to understand the responsibilities of both the grantor and grantee. Collaborating with attorneys helps professionals navigate the complexities of these documents and secure successful transactions.