Overview

The article serves as an authoritative guide on locating mortgage information for a property, underscoring its critical role in real estate transactions in 2025. It details various methods for accessing this information, including:

- Leveraging county clerk's offices

- Public records websites

- Advanced technologies like AI

These technologies not only facilitate efficient retrieval but also enhance the accuracy of loan data, thereby supporting informed decision-making within the property market.

Introduction

In the intricate world of real estate, understanding mortgage information is paramount for ensuring successful property transactions. As the landscape evolves in 2025, the significance of comprehensive mortgage knowledge is underscored by the increasing complexity of financial agreements and the pressing need for transparency.

Furthermore, from navigating essential documents to leveraging cutting-edge technology like AI for efficient retrieval, real estate professionals must stay ahead of the curve. As statistics reveal a growing familiarity with mortgage details among industry experts, the implications of this knowledge extend beyond mere transactions; they influence property values, ownership rights, and the overall dynamics of the housing market.

This article delves into the critical components of mortgage information, offering insights into effective access methods, essential documents, and the transformative role of technology in enhancing the research process.

Understanding Mortgage Information: A Key Component of Property Transactions

Understanding how to find mortgage information on a property is a crucial aspect of real estate transactions. This knowledge encompasses essential details about loans secured by properties, including the amount borrowed, interest rates, and repayment terms. For purchasers, vendors, and real estate experts, knowing how to find mortgage information on a property is vital for accurately evaluating property value and ownership rights. In 2025, the landscape of loan information continues to evolve, with public records providing transparency and accessibility for verification purposes.

This accessibility is particularly important as it helps mitigate potential disputes and fosters informed decision-making, especially regarding how to find mortgage information on a property throughout the transaction process. Historical data indicates that vacancy rates reached a low around 2.5% when loan rates doubled in the 1980s, emphasizing the enduring connection between loan conditions and property market dynamics. Recent statistics show that a significant percentage of real estate professionals—approximately 78%—are now knowledgeable about how to find mortgage information on a property, reflecting a growing awareness of its importance in property transactions.

This trend is additionally backed by expert views, including that of John Sim, Head of at J.P. Morgan, who remarked, "It’s clear that various elements of Trump's policy will influence the housing market," highlighting the necessity for specialists to remain knowledgeable about loan details. Furthermore, case studies from 2024 highlight the transformative impact of technology on the home buying process, where online searches have become the initial step for prospective buyers. This change has simplified access to loan details for real estate experts, enhancing their ability to assist clients efficiently, particularly in how to find mortgage information on a property.

Parse AI demonstrates this advancement by utilizing machine learning and optical character recognition technologies to simplify the process of verifying real property ownership and granting access to essential financial data. Moreover, through collaborative efforts with real estate and land experts, Parse AI continuously refines its tools to address pressing challenges in the industry. This results in measurable outcomes such as reduced research times and increased accuracy in title searches. Expert views emphasize the importance of understanding how to find mortgage information on a property, with numerous specialists claiming that it directly affects property value evaluations.

As the housing market continues to evolve, understanding how to find mortgage information on a property will remain a crucial element for success in real estate dealings in 2025.

Methods to Access Mortgage Information: Tools and Resources

To effectively access mortgage information, consider the following methods:

- County Clerk's Office: Begin by visiting or contacting your local county clerk's office, where loan records are typically filed. Many counties have embraced technology, providing online databases that facilitate public access to these records. The Parse AI platform enhances this experience with its advanced digital interface for searching county clerk records, particularly in Comanche County, which features a user-friendly layout with a search bar and comprehensive tables listing various records. This technological leap has significantly improved search efficiency, reflecting a growing trend toward transparency in property ownership. Furthermore, the platform automates run sheet creation, streamlining the process for title research directors and ensuring accurate documentation.

- : Take advantage of online platforms that aggregate public records. Websites dedicated to public records can provide a wealth of loan details, assisting users in understanding how to find mortgage information on a property. As of 2025, usage rates of these online databases have surged, with a reported 40% increase in users relying on digital resources for accessing loan data. The Parse AI platform utilizes machine learning to extract meaningful insights from documents, making the search process even more efficient and user-friendly.

- Real Estate Websites: Utilize popular real estate platforms such as Zillow or Realtor.com. These sites frequently contain financing information that illustrates how to find mortgage information on a property alongside property listings, simplifying the gathering of comprehensive details about a property’s financial background.

- Title Firms: Collaborate with title firms that specialize in performing comprehensive searches for loan records. Their expertise can save time and ensure accuracy, particularly when navigating properties with complex histories. The integration of advanced document processing through platforms like Parse AI can automate run sheet creation, thereby enhancing overall workflow and reducing manual errors.

- Professional Networks: Leverage your connections with real estate agents or financing specialists. These individuals may have access to proprietary databases and can provide insights or direct assistance in locating mortgage details.

Case Study Insight: The Kent County Levy Court's Property Records System exemplifies the effectiveness of public access to property data. This system enables users to search for properties using various criteria, offering detailed ownership details, sales prices, transfer dates, and assessment histories. Such clarity improves the availability of loan records for the public, demonstrating how platforms like Parse AI can be crucial in enhancing access to essential data, particularly in teaching how to find mortgage information on a property.

Expert Opinion: Title research directors emphasize the importance of utilizing county clerk's offices for mortgage records, noting that these offices are often the most reliable source for accurate and up-to-date information. One director stated, "County clerk's offices are invaluable for researchers, as they provide the most comprehensive and current data available, especially when supported by advanced tools like Parse AI, and they are essential for understanding how to find mortgage information on a property."

Broader Context: Additionally, the Census Bureau's expanded version of VEO, released on January 14, 2025, highlights employment outcomes for veterans, which may resonate with real estate professionals working with veteran clients. Understanding these outcomes can enhance the service provided to this demographic.

Additional Case Studies: Further case studies on accessing loan information through public records websites reveal that platforms like PropertyShark and RealtyTrac have successfully streamlined the process for users, offering detailed reports that include loan history and property assessments, thereby enhancing the overall efficiency of property research. The Parse AI platform's capabilities can further optimize these processes, making it an invaluable resource for title research directors.

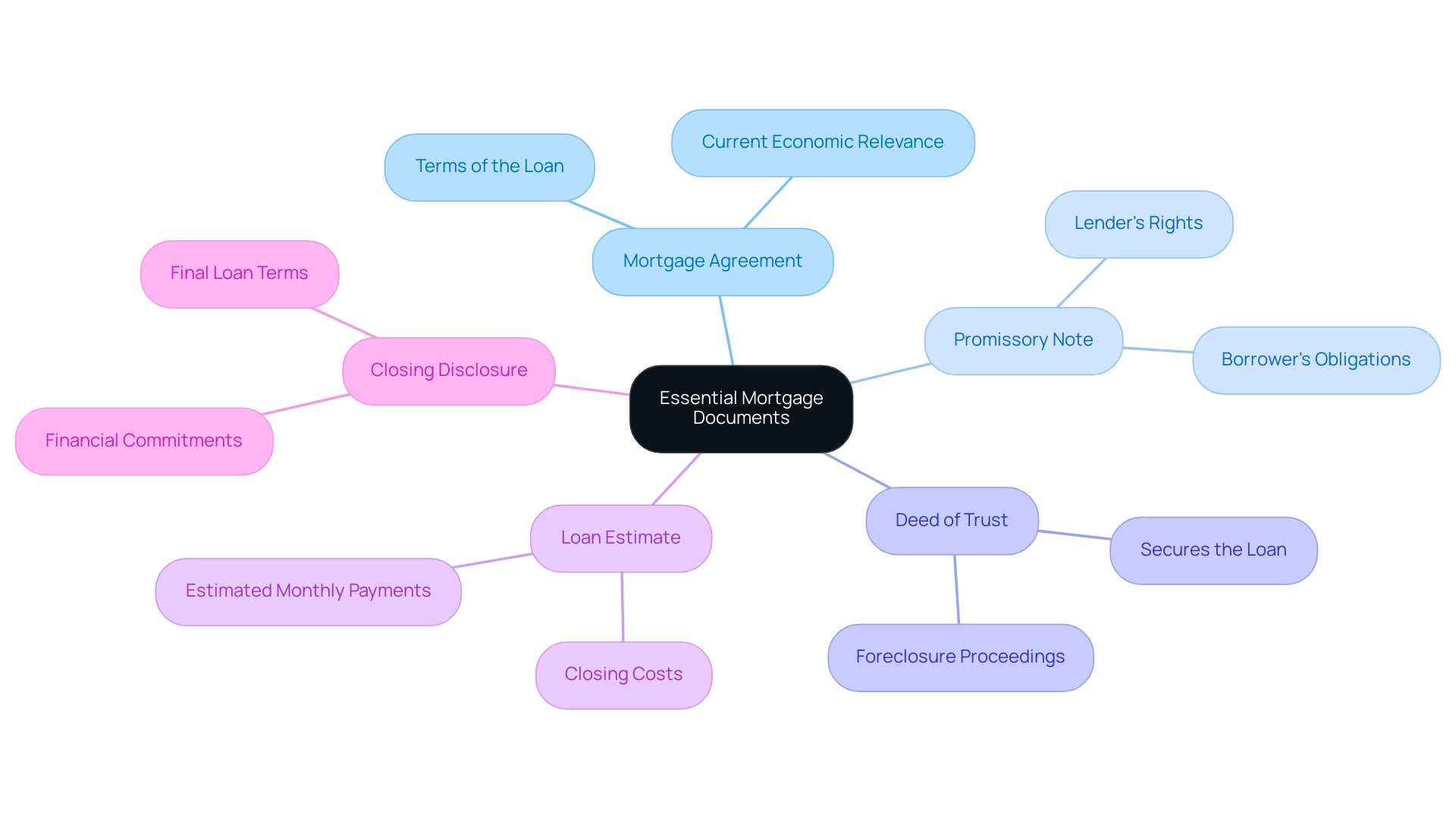

Essential Mortgage Documents: What You Need to Know

Essential loan documents serve as the foundation of real estate transactions, and understanding them is crucial for professionals in the industry. Here’s a closer look at these essential documents:

- Mortgage Agreement: This document delineates the terms of the loan, including the principal amount borrowed, the interest rate, and the repayment schedule. Given the current economic climate, where loan rates have remained stable despite fluctuations in short-term interest rates, grasping the nuances of these agreements is more important than ever. As Brad O'Connor, Chief Economist, noted, the housing market faces substantial obstacles, underscoring the necessity for clarity in loan agreements.

- Promissory Note: A legally binding document in which the borrower commits to repaying the loan according to specified terms. This note is critical as it outlines the borrower's obligations and the lender's rights, serving as a safeguard for both parties involved in the transaction.

- Deed of Trust: This document secures the loan by placing a lien on the property, which allows the lender to initiate foreclosure proceedings if the borrower defaults. With the loan delinquency rate rising by 0.2% from 2022 to 2023, the significance of comprehending this document cannot be overstated. Lawrence Yun, NAR Chief Economist, emphasizes that housing affordability remains a major challenge, further highlighting the need for clarity in these agreements.

- Loan Estimate: A standardized form that provides prospective borrowers with essential details about the loan terms, including estimated monthly payments and closing costs. This document is especially valuable in today’s market, where 90% of homebuyers prefer to manage their loans online, reflecting a significant shift towards digital services in the lending industry. The trends in indicate a move towards nonbank lending and digital services, leading to faster and more efficient customer experiences.

- Closing Disclosure: This document outlines the final terms of the loan and the costs associated with closing the transaction. Familiarity with the Closing Disclosure is vital, as it ensures that all parties are aware of their financial commitments before finalizing the deal.

Understanding these key loan documents is essential for anyone involved in real estate transactions, particularly as we approach 2025, when the landscape continues to evolve with tightening credit standards and economic shifts. As the lending industry adapts to these changes, professionals must stay informed to navigate the complexities of loan agreements and promissory notes effectively.

Leveraging Technology: How AI is Transforming Mortgage Information Retrieval

Artificial Intelligence (AI) is fundamentally transforming the landscape of loan data retrieval and processing, resulting in significant enhancements in efficiency and precision. Key advancements include:

- Automated Document Processing: AI-driven algorithms swiftly analyze and extract relevant details from loan documents. This automation drastically reduces the time traditionally spent on manual searches, enabling professionals to focus on more strategic tasks. Statistics suggest that machine learning-based marketing automation can lead to increased customer engagement and conversion rates, underscoring the potential advantages of AI in loan data retrieval.

- Optical Character Recognition (OCR): OCR technology is crucial as it converts scanned documents into editable and searchable formats. This capability streamlines the process of locating specific loan details and demonstrates how to find mortgage information on a property, thereby enhancing the overall efficiency of property research.

- Data Analytics: sift through extensive datasets to uncover trends and anomalies within loan details. This analytical power supports better risk assessment and informed decision-making, essential in the fast-paced real estate market.

- Integration with Research: Innovative platforms like Parse AI leverage machine learning to optimize research workflows. By simplifying access to financing details, these solutions empower title professionals to perform their tasks with enhanced speed and accuracy.

The impact of AI on loan data retrieval is highlighted by statistics indicating that automated document processing can lead to greater engagement and conversion rates in related areas. As the industry evolves, the integration of AI technologies is not merely a trend but a necessity for maintaining a competitive advantage in real estate operations. Furthermore, the rising regulatory oversight of AI in the U.S. presents challenges and considerations for its application in finance, particularly in loan data retrieval.

Case studies illustrate the effectiveness of AI in real-time applications, such as American Express' utilization of GPU-accelerated models for fraud detection, which has improved accuracy by up to 6%. This exemplifies AI's potential to enhance operational efficiency across various sectors, including loan research.

As we advance deeper into 2025, expert perspectives emphasize that the ongoing development of AI will continue to transform loan data retrieval, enhancing its efficiency and significance. As Taylor Cormier aptly states, "Let us harness the power of automation, not to replace the human touch, but to amplify it, to make it more effective, more impactful, and more meaningful than ever before." The commitment to harnessing automation in a manner that complements human expertise is essential for maximizing the benefits of these technological advancements.

Overcoming Challenges in Mortgage Information Research: Insights for Title Professionals

Title specialists encounter a myriad of challenges when conducting loan data research, significantly impacting their efficiency and accuracy. Key issues include:

- Incomplete Records: A staggering percentage of public records related to loans are often found to be incomplete or outdated. This results in substantial gaps in information, complicating the verification of property ownership and loan details.

- Complex Legal Language: The intricate legal terminology prevalent in loan documents presents a formidable challenge. Title experts require specialized knowledge to navigate these complexities effectively, which can hinder efficient research.

- Discrepancies in Data: Variations in mortgage information across different sources can create confusion. Inconsistent data necessitates that experts cross-reference multiple records to ensure reliability, complicating precise evaluations.

- Time Constraints: The fast-paced nature of imposes immense pressure on professionals to deliver prompt results. This urgency may lead to rushed research processes, potentially compromising the accuracy of findings.

- Technological Barriers: Access to advanced technology is inconsistent across the industry. Many individuals may lack the necessary tools or training to efficiently retrieve and analyze mortgage information, exacerbating the challenges faced in their research efforts.

According to recent statistics, 62% of insurance firms typically perform at least four curative actions per transaction, underscoring the frequency of challenges encountered by professionals. Addressing these challenges is crucial for enhancing the efficiency of title research. As Diane Tomb, CEO of the American Land Title Association (ALTA), noted, "And while the use of technology to research ownership issues has dramatically increased, it takes more than a click of a button to conduct a search."

The extent of research and remedial measures required from expert specialists to instill confidence in homeowners and lenders regarding ownership remains substantial. By investing in training and adopting innovative technologies, professionals can significantly enhance their ability to navigate incomplete records and complex data landscapes. For instance, platforms like Parse AI, utilizing machine learning and optical character recognition, streamline the extraction of essential information from document titles, facilitating quicker and more accurate research outcomes. As the Dallas/Fort Worth region emerges as the leading real estate market, the demand for effective research becomes increasingly apparent.

Furthermore, with regulatory priorities potentially shifting, it is essential for title professionals to remain informed and adaptable to maintain compliance and effectiveness in their research efforts.

Conclusion

Understanding mortgage information has become increasingly vital in the evolving landscape of real estate transactions. As highlighted throughout the article, a strong grasp of mortgage details—ranging from essential documents to innovative technology—empowers real estate professionals to navigate the complexities of property dealings effectively. The increasing accessibility of mortgage records through county clerk offices and online platforms illustrates a shift towards transparency that benefits all parties involved.

Furthermore, the integration of advanced technologies such as AI and machine learning is revolutionizing how mortgage information is retrieved and processed. These tools not only enhance efficiency but also improve accuracy, allowing professionals to focus on strategic decision-making rather than tedious data entry. The importance of understanding key mortgage documents, including the mortgage agreement, promissory note, and closing disclosure, cannot be overstated, especially as the market adapts to new economic challenges.

As the industry moves further into 2025, staying informed about mortgage information will be essential for success in real estate transactions. Embracing technology while maintaining a solid foundation of knowledge about mortgage practices will enable professionals to tackle challenges effectively, thereby fostering informed decision-making and driving positive outcomes in the housing market. The future of real estate hinges on a commitment to transparency and adaptability, ensuring that all stakeholders are well-prepared for the opportunities and challenges that lie ahead.

Frequently Asked Questions

Why is finding mortgage information on a property important?

Finding mortgage information is crucial for accurately evaluating property value and ownership rights, helping purchasers, vendors, and real estate experts make informed decisions during transactions.

What key details are included in mortgage information?

Mortgage information includes the amount borrowed, interest rates, and repayment terms associated with loans secured by properties.

How has the accessibility of mortgage information changed in 2025?

In 2025, public records have become more transparent and accessible, facilitating verification and helping to mitigate potential disputes during real estate transactions.

What percentage of real estate professionals are knowledgeable about finding mortgage information?

Approximately 78% of real estate professionals are now knowledgeable about how to find mortgage information on a property.

What role does technology play in accessing mortgage information?

Technology, particularly through platforms like Parse AI, has transformed the home buying process by simplifying access to loan details and enhancing the efficiency of title research.

What are some methods to access mortgage information?

Methods to access mortgage information include: 1. Visiting the County Clerk's Office for loan records. 2. Using public records websites that aggregate loan details. 3. Checking popular real estate websites like Zillow or Realtor.com. 4. Collaborating with title firms for comprehensive searches. 5. Leveraging professional networks with real estate agents or financing specialists.

How does the Parse AI platform improve the process of finding mortgage information?

Parse AI utilizes machine learning and optical character recognition technologies to streamline the verification of real property ownership and access essential financial data, reducing research times and increasing accuracy.

What is an example of a successful public access system for property data?

The Kent County Levy Court's Property Records System allows users to search properties using various criteria, providing detailed ownership details, sales prices, transfer dates, and assessment histories, enhancing public access to loan records.

What do experts say about the reliability of county clerk's offices for mortgage records?

Experts emphasize that county clerk's offices are invaluable for researchers, providing the most comprehensive and current data available for understanding mortgage information on properties.