Overview

The article presents an authoritative overview of HOA lien foreclosure, underscoring the necessity for homeowners to grasp the legal implications and processes at play. It asserts that neglecting to pay HOA dues can initiate foreclosure actions, which may profoundly affect homeowners' financial stability and credit ratings. This highlights the critical importance of timely payments and a thorough understanding of one’s rights throughout these proceedings.

Introduction

Navigating the complexities of Homeowners' Associations (HOAs) can be a daunting task for many homeowners, particularly when it comes to understanding the implications of HOA liens and the foreclosure process. An HOA lien represents a legal claim against a property for unpaid dues, presenting potential hurdles for homeowners seeking to sell or refinance.

With rising statistics indicating a significant number of homeowners affected by these liens, the urgency to comprehend their rights and responsibilities has never been greater. Furthermore, as the landscape of community governance evolves, so do the challenges, making it essential for homeowners to stay informed about the legal frameworks and potential consequences of HOA foreclosures.

This article delves into the intricacies of HOA liens, the foreclosure process, and the strategies homeowners can employ to protect their interests and navigate the often tumultuous waters of HOA governance.

What is an HOA Lien and How Does It Work?

An HOA claim represents a legal charge imposed by a homeowners' association (HOA) on a property when the resident neglects to pay dues or assessments. This claim acts as a security interest for the HOA, allowing them to recover any unpaid amounts. Once recorded, the claim becomes attached to the property, hindering the property owner's ability to sell or refinance until the outstanding debt is resolved.

Typically, the claim encompasses not only the overdue amounts but also any additional charges, interest, and legal fees incurred by the HOA during the recovery process.

Understanding the ramifications of HOA claims is vital for property owners, as failing to address these obligations can result in lien foreclosure actions initiated by the HOA. Recent statistics indicate that a significant number of property owners have been affected by HOA charges in the past year, underscoring the importance of timely payments. Notably, approximately 35% of respondents in a recent survey expressed concerns regarding the perceived high cost of , which can exacerbate non-payment issues.

For context, South Carolina boasts the lowest average HOA fees at $310 per month, while Florida averages $312 per month, highlighting the financial strain that can lead to liens.

Moreover, the landscape of HOAs has transformed significantly since the 1970s, when there were merely 10,000 communities with HOAs. By the 1990s, this figure surged, reflecting a burgeoning trend in community governance. As of 2021, around 2.5 million U.S. property owners were actively participating on HOA boards or committees, demonstrating a robust level of community involvement.

This engagement is essential, as real estate experts emphasize the need for property owners to be proactive in understanding HOA claims and their potential consequences. Effective resolutions of HOA claims often involve open communication between residents and their associations, alongside prompt payments to avert escalation.

Tony Mariotti notes that new properties within community associations are expanding most rapidly in the southern and western United States, indicating the increasing prevalence of HOAs and their implications for residents. By comprehending the intricacies of lien foreclosure, homeowners can adeptly navigate their responsibilities and safeguard their property interests, particularly considering the possible effects on property sales and refinancing.

The Legal Framework of HOA Foreclosures

The legal structure surrounding HOA lien foreclosure is intricate and varies significantly from state to state, shaped by both state laws and the governing documents of the HOA, particularly the Covenants, Conditions, and Restrictions (CC&Rs). Typically, an HOA must follow a series of established procedures to initiate lien foreclosure for property repossession. This process often begins with notifications to the homeowner, followed by the potential filing of a lawsuit and the pursuit of a court ruling.

Understanding the specific laws regulating HOA lien foreclosure and evictions in your state is crucial, as these regulations delineate the rights and obligations of both the HOA and the homeowner throughout . For instance, in 2024, there was a notable increase in HOA evictions initiated, reflecting broader trends in real estate and economic conditions. In fact, loan defaults began to rise in states and 205 metro areas in 2022, underscoring a growing concern within the housing market.

Legal professionals emphasize that homeowners should be proactive in comprehending these regulations to safeguard their interests. Furthermore, the regional prevalence of HOAs can significantly impact the dynamics of lien foreclosure. According to FCAR, there were 365,000 communities with HOAs in 2023, underscoring their prevalence and importance in the lien foreclosure process.

For example, in the western U.S., where 71% of new constructions are associated with HOAs, the ramifications of lien foreclosure can be particularly significant. Conversely, only 38% of new residences in the northeastern region are part of HOAs, highlighting a divergence in that may affect default rates and procedures.

As of 2025, changes to the legal framework governing HOA lien foreclosure continue to evolve, with state-by-state statistics revealing considerable variations in how these processes are managed. In Q1 2024, 10,052 properties were reclaimed, representing an increase from the previous quarter but a 20% decline compared to the prior year, illustrating the economic implications of property recovery as lenders navigate distressed assets. Homeowners and real estate professionals alike must stay informed about these changes to effectively navigate the complexities of HOA lien foreclosure.

Moreover, in the initial quarter of 2023, there were 58,268 documented actions to prevent home loss, assisting approximately 6,066,666 families in retaining their residences. This statistic provides a broader perspective on initiatives aimed at supporting property owners facing home loss.

Common Reasons for HOA Foreclosure Actions

Homeowners Associations (HOAs) typically initiate legal proceedings for various reasons, with being the most prevalent consequence of unpaid dues or assessments. Recent statistics reveal that a significant percentage of HOA defaults, which lead to lien foreclosures, stem from unpaid dues. This underscores the financial risks associated with neglecting these responsibilities. Additionally, breaches of community guidelines or policies—such as neglecting property standards or failing to adhere to the HOA's governing documents—can also trigger legal actions.

Even seemingly minor infractions can escalate into serious financial repercussions, including property loss, if not addressed promptly. For instance, enforcement actions taken by HOAs can result in substantial penalties, highlighting the importance of adhering to community standards. Specialists emphasize that understanding the factors behind HOA lien foreclosure is vital for residents to avoid potential drawbacks.

Moreover, the consequences of these actions extend beyond individual residents; they can affect property values and overall community stability. As the landscape of HOA governance evolves, it is crucial for property owners to remain informed about the common causes of HOA lien foreclosure to protect their investments and comply with community regulations.

Individuals facing potential property repossession should recognize that various measures, such as loan adjustments and payment deferrals, can help avert HOA lien foreclosure. In Arizona, for instance, a property owner is entitled to a minimum of $5,000 in damages against a party that improperly records a lien, along with attorneys' fees and costs. An additional $1,000 may be awarded if the party fails to release the erroneous lien within twenty days of a written request. Furthermore, under the Act, HOAs are required to accept partial payments, providing residents with more financial options.

The COVID-19 pandemic has further illuminated the broader context of financial strain that can lead to HOA lien foreclosure, as many residents faced increased economic challenges. Federal agencies can allocate up to $1,744 for each repossessed property, primarily for maintenance costs, underscoring the significant financial implications of such actions on a larger scale. Understanding these dynamics is essential for property owners to navigate the complexities of HOA governance and safeguard their investments.

The Foreclosure Process: Step-by-Step Guide

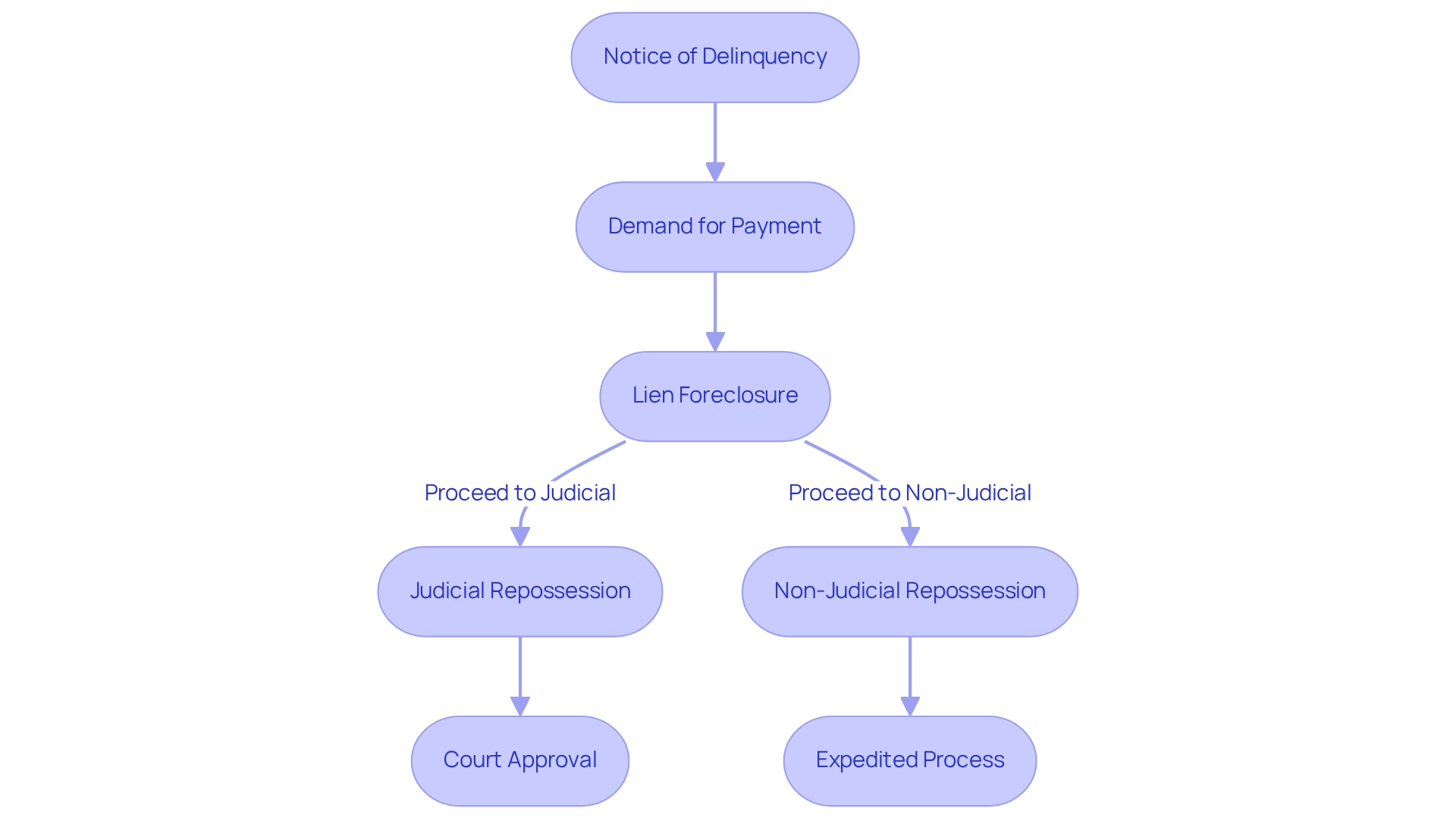

The repossession procedure initiated by a Homeowners Association (HOA) typically begins when a resident falls behind on their fees. Initially, the HOA sends a notice of delinquency, serving as a formal warning. Should the homeowner neglect to respond or settle the outstanding amount, the HOA will issue a demand for payment.

If the debt remains unpaid, the HOA may commence a lien foreclosure against the property, marking the initial legal action in the repossession process. Data on repossession filings in the U.S. from 2005 to 2023 reveals that the number of properties facing repossession has fluctuated, highlighting ongoing challenges in the housing market. Depending on state regulations, the HOA can pursue either judicial or non-judicial repossession proceedings. In a judicial repossession, the HOA must file a lawsuit, requiring court approval to advance the process.

This procedure can be protracted, often spanning several months to over a year, contingent on the court's schedule and case complexity. Conversely, non-judicial property repossession allows the HOA to bypass the court system, adhering to the procedures outlined in their governing documents. This method is generally more expedient, with timelines ranging from a few months to over six months, depending on state regulations. Homeowners must be acutely aware of the timelines involved in these proceedings, as they can vary significantly based on local laws.

For example, states like California have specific timelines for notices and hearings, while others may impose more lenient requirements. Recent changes in HOA property seizure procedures aim to simplify the process, reflecting an increasing awareness of the need for efficiency in addressing delinquent accounts.

Understanding the distinctions between judicial and non-judicial property seizures, such as lien foreclosure, is essential. Judicial repossessions often afford property owners more opportunities to contest the repossession in court, while non-judicial repossessions can lead to quicker outcomes but may limit the property owner's ability to challenge the process. Legal experts, including Amy Loftsgordon, emphasize the importance of being proactive in managing HOA dues to avert the challenges of property repossession, particularly since prevention initiatives have successfully assisted over 6 million families in retaining their homes during financial hardships in recent years.

Sam Ferguson, Vice President and Owner/COO of , underscores that understanding the implications of these procedures is crucial for homeowners facing financial difficulties. In summary, navigating the HOA property seizure process necessitates a clear comprehension of the steps involved, the timelines dictated by state laws, and the ramifications of judicial versus non-judicial proceedings. Homeowners are encouraged to remain informed and seek assistance if they face potential loss of their property.

Homeowner Rights During HOA Foreclosure

Homeowners possess several essential rights during the HOA lien foreclosure process. Primarily, they have the right to receive proper notice regarding property seizure proceedings, ensuring they are informed of any actions taken against their asset. Furthermore, property owners retain the right to contest the HOA lien foreclosure in court, a vital step in protecting their interests.

They may also seek a hearing to contest the amount due or question the legitimacy of the lien itself.

In numerous jurisdictions, including California, state law mandates that associations document within 21 days after payment is received. This timeframe underscores the significance of prompt communication and action from both property owners and associations. As legal expert Peter Aldous notes, accounts of property owners encountering difficulties during this process are 'all too common.'

Moreover, several states provide a redemption period, enabling property owners to settle their debts and reclaim their assets even after a sale has occurred.

Understanding these rights is crucial for property owners, particularly in light of recent legal cases that highlight the intricacies of HOA lien foreclosure sales. For instance, property owners can challenge court proceedings on mortgage defaults by presenting arguments such as debt disagreements or lack of notification. However, if assessments are owed and the association has adhered to legal procedures regarding HOA lien foreclosure, the options for defense may be limited.

Significantly, the majority of property repossession lawsuits conclude prior to a sale, allowing property owners to address outstanding assessments without forfeiting their assets.

Legal authorities emphasize the necessity of obtaining advice if property owners suspect their rights are being violated. Manning & Meyers provides legal counsel to HOAs and individuals facing housing challenges, encouraging those impacted to seek assistance. Engaging with experts can offer insight into the legal framework and help navigate the complexities of HOA property repossession processes, ensuring that property owners are well-prepared to assert their rights effectively.

Defending Against HOA Foreclosure: Possible Strategies

Homeowners facing the loss of property due to HOA lien foreclosure possess several effective defense strategies. A common approach involves disputing the amount owed, which can include challenging the accuracy of the HOA's accounting or asserting that certain fees are unjustified. In many states, HOAs cannot initiate property repossession unless a minimum debt amount or delinquency period is met, making it essential for property owners to understand these limits.

Furthermore, homeowners may argue that the HOA did not follow proper procedures during the lien foreclosure process, such as failing to provide adequate notice or adhere to stipulated timelines.

Another defense tactic is to challenge the legitimacy of the claim itself. Homeowners can assert that the charge was improperly recorded or that the HOA lacks the authority to foreclose based on violations of its governing documents. This may include claims that the HOA did not comply with its own rules regarding fee assessments or dispute resolutions.

Engaging legal counsel is crucial in situations involving HOA lien foreclosure, as an attorney can help formulate a robust defense strategy tailored to the specific circumstances of each case. Legal specialists frequently emphasize the importance of understanding the nuances of HOA rules and the implications of priority status, particularly under the 'first in time' principle, which can significantly impact the outcomes of HOA lien foreclosure actions. For instance, an analysis of priority claims reveals how homeowners' association charges can greatly influence property marketability and refinancing options, as they may take precedence over other claims, thus affecting the value and salability of the property.

Recent case studies demonstrate the effectiveness of various defense strategies. For example, property owners who successfully contested the legitimacy of due to procedural errors have achieved favorable outcomes, underscoring the importance of meticulous record-keeping and adherence to legal procedures. Moreover, the success rates of these defenses can vary, with certain strategies proving more effective in specific jurisdictions or under particular circumstances.

As TL Stahling notes, "This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional." Ultimately, property owners should proactively address disputes over fees or penalties through the internal dispute resolution process, as this can prevent escalation and lead to more favorable resolutions. By understanding their rights and the available defense strategies, property owners can navigate the complexities of HOA lien foreclosure actions more effectively.

Consequences of HOA Foreclosure for Homeowners

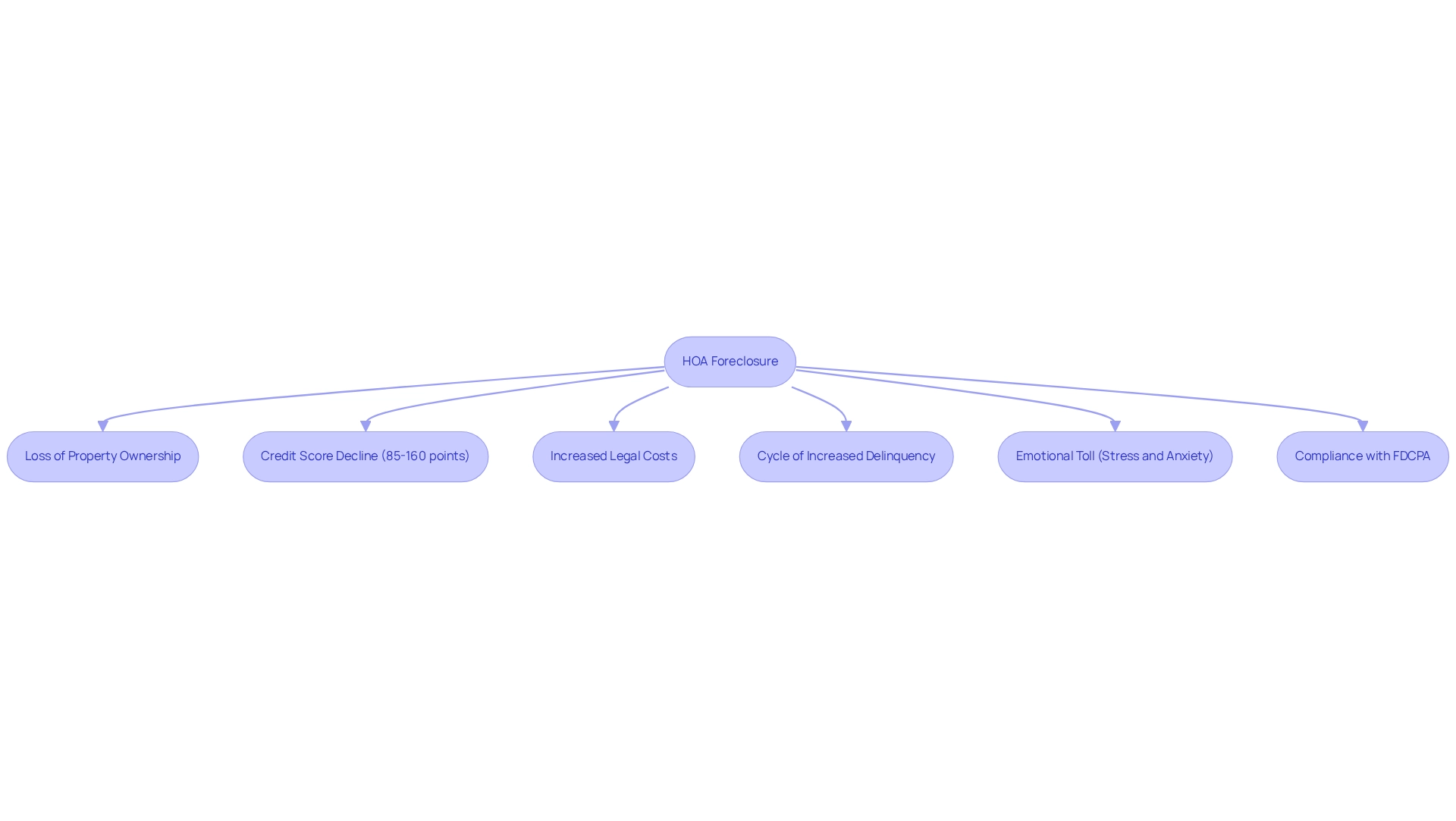

The outcomes of HOA lien foreclosure can be profoundly harmful for residents. The loss of property ownership necessitates that the resident vacate the premises. This loss is compounded by significant effects on credit ratings; research indicates that a property seizure can lower an individual's credit score by up to 160 points, severely obstructing their ability to secure loans or credit in the future.

As Fair Isaac summarizes, a repossession can lead to of 85 to 160 points, underscoring the serious consequences for property owners' financial futures. Furthermore, homeowners often encounter substantial legal costs during the HOA lien foreclosure process, exacerbating their financial strain. In fact, the average legal expenses associated with HOA lien foreclosure can reach thousands of dollars, worsening the already challenging situation for affected homeowners.

The repercussions extend beyond immediate financial loss. Homeowners may find themselves ensnared in a cycle of increased delinquency and restricted access to credit. Recent studies indicate that the delinquency rate for prime borrowers can double 8 to 10 years after losing their homes compared to five years earlier. This highlights the critical importance of managing HOA fees promptly and adhering to community guidelines to avert the severe consequences of HOA lien foreclosure.

Expert opinions suggest that the emotional toll of losing one's home can also be significant, with many residents experiencing stress and anxiety as they navigate the complexities of the process. Additionally, compliance with the Fair Debt Collection Practices Act (FDCPA) is vital, as it protects property owners from abusive collection tactics during this vulnerable period. Case studies illustrate that debt collectors for HOAs must adhere to the FDCPA, ensuring that residents are shielded from harassment and unjust collection practices.

For low-income families facing property loss, resources like Upsolve can provide essential assistance in resolving debt and improving credit. Overall, understanding these consequences is crucial for property owners to make informed decisions and take proactive measures in managing their HOA responsibilities.

What Happens After an HOA Foreclosure?

Following , residents frequently face significant challenges in recovery. In numerous jurisdictions, a redemption period is available, allowing property owners to settle their outstanding debts and reclaim their properties. This period can differ considerably; some states may offer as little as a few weeks, while others extend up to a year.

During this crucial time, homeowners must proactively understand their rights and options. If the property is sold at auction, homeowners may be entitled to any surplus funds generated from the sale after the debt has been settled. This can provide an essential financial buffer for those affected by home loss. Legal experts stress the importance of consulting with an attorney to explore potential claims against the HOA, especially in cases of wrongful HOA lien foreclosure or procedural violations.

Such claims can occasionally lead to favorable outcomes for property owners, including the opportunity to retrieve their assets or receive compensation in the context of an HOA lien foreclosure. Statistics reveal that a notable portion of property owners—approximately 30%—succeed in recovering their properties during the redemption period, underscoring the importance of prompt action. It is also vital to recognize that anti-deficiency protection does not apply to property waste as defined by A.R.S. Section 729(B), which can affect property owners' rights in specific situations.

For example, in the case of In re Goudelock, the court determined that condominium association assessments due after a bankruptcy filing are dischargeable, highlighting the complexities of these situations and the potential for recovery options. Furthermore, recent developments under the Servicemembers Civil Relief Act offer protections for servicemembers concerning mortgages and trust deeds, including the invalidation of sales or foreclosures executed during or shortly after military service. Understanding these nuances, along with the various recovery options available, is essential for homeowners aiming to mitigate losses and effectively plan for their financial future. As Tom Farley, chief lobbyist for the Arizona Association of Realtors, emphasizes, navigating these challenges necessitates informed action and awareness of one's rights.

Conclusion

Navigating the complexities of HOA liens and the foreclosure process is critical for homeowners. Recognizing that an HOA lien constitutes a legal claim against a property due to unpaid dues underscores the necessity of timely payments. Homeowners must remain vigilant about the various factors that can precipitate foreclosure, including unpaid dues and violations of community regulations. The legal framework governing these processes can differ significantly by state, making it imperative for homeowners to familiarize themselves with their rights and the specific regulations applicable to their circumstances.

The foreclosure process can indeed be daunting, as homeowners face the potential loss of property alongside significant financial repercussions. Nonetheless, homeowners retain essential rights throughout this process, including the right to contest foreclosures and pursue legal recourse. Effective defense strategies, such as disputing the amount owed or questioning the validity of a lien, empower homeowners to safeguard their interests.

Ultimately, the ramifications of HOA foreclosure extend beyond the immediate loss of property, impacting credit scores and financial stability for years to come. By grasping the intricacies of HOA governance and foreclosure processes, homeowners can take proactive measures to protect their investments and navigate potential challenges. Staying informed and seeking assistance when necessary can profoundly influence the effective management of HOA obligations and the protection of one’s home.

Frequently Asked Questions

What is an HOA claim?

An HOA claim is a legal charge imposed by a homeowners' association (HOA) on a property when the resident fails to pay dues or assessments. It acts as a security interest for the HOA to recover unpaid amounts.

What happens when an HOA claim is recorded?

Once recorded, the claim becomes attached to the property, preventing the property owner from selling or refinancing until the outstanding debt is resolved.

What does an HOA claim typically include?

An HOA claim typically includes overdue amounts, additional charges, interest, and legal fees incurred by the HOA during the recovery process.

Why is it important for property owners to understand HOA claims?

Understanding HOA claims is vital because failing to address these obligations can lead to lien foreclosure actions initiated by the HOA.

What recent statistics highlight the impact of HOA charges on property owners?

A significant number of property owners have been affected by HOA charges, with approximately 35% expressing concerns about the high cost of their HOA fees, which can lead to non-payment issues.

How do average HOA fees vary by state?

South Carolina has the lowest average HOA fees at $310 per month, while Florida averages $312 per month, indicating the financial strain that can lead to liens.

How has the landscape of HOAs changed over the years?

Since the 1970s, when there were about 10,000 communities with HOAs, the number has surged, with around 2.5 million U.S. property owners participating on HOA boards or committees as of 2021.

What role does communication play in resolving HOA claims?

Effective resolutions of HOA claims often involve open communication between residents and their associations, alongside prompt payments to prevent escalation.

How does the legal structure surrounding HOA lien foreclosure vary?

The legal structure varies significantly by state, influenced by state laws and the governing documents of the HOA, particularly the Covenants, Conditions, and Restrictions (CC&Rs).

What process must an HOA follow to initiate lien foreclosure?

An HOA typically must follow established procedures that begin with notifying the homeowner, potentially followed by filing a lawsuit and pursuing a court ruling.

What trends have been observed in HOA evictions?

There has been a notable increase in HOA evictions initiated in 2024, reflecting broader trends in real estate and economic conditions, with rising loan defaults in various states.

How prevalent are HOAs in the U.S.?

As of 2023, there were 365,000 communities with HOAs, indicating their significant presence and importance in the lien foreclosure process.

How does the prevalence of HOAs differ by region?

In the western U.S., 71% of new constructions are associated with HOAs, while only 38% in the northeastern region are part of HOAs, affecting default rates and procedures.

What changes are expected in the legal framework governing HOA lien foreclosure?

Changes to the legal framework continue to evolve, with considerable state-by-state variations in how these processes are managed.

What initiatives exist to support property owners facing home loss?

In Q1 2023, there were 58,268 documented actions to prevent home loss, assisting approximately 6,066,666 families in retaining their residences.