Overview

Homeowners can halt HOA foreclosure by actively engaging with their association, comprehending their rights, and investigating payment plans or legal remedies. Effective communication with the HOA, coupled with a solid understanding of local regulations, emerges as a crucial strategy. This knowledge empowers homeowners to tackle outstanding dues and adeptly navigate the foreclosure process, ultimately ensuring a successful resolution.

Introduction

In the intricate landscape of homeownership, comprehending the implications of Homeowners Association (HOA) foreclosure is essential for safeguarding one’s property and financial stability. As HOAs assert their authority in enforcing community rules and collecting dues, the risk of foreclosure escalates for homeowners who fall behind on payments.

Statistics indicate a significant number of foreclosure prevention actions taken in recent years, underscoring the necessity for homeowners to familiarize themselves with the foreclosure process and their rights within the HOA framework.

This article explores the complexities of HOA foreclosure, providing insights into:

- Legal rights

- Consequences of non-payment

- Effective strategies to avert the loss of one’s home

By equipping themselves with knowledge and proactive measures, homeowners can navigate these challenges and protect their investments in an increasingly regulated housing environment.

Understanding HOA Foreclosure: What Homeowners Need to Know

Homeowners Associations (HOAs) exercise substantial authority in enforcing community rules and collecting dues from residents. When property owners fall behind on these payments, they often seek guidance on how to stop HOA foreclosure, as the HOA can initiate repossession actions that typically commence with placing a lien on the property. If the debt remains unresolved, this can ultimately lead to property seizure.

In 2025, grasping the HOA property repossession process is increasingly critical, as statistics reveal a significant impact on homeowners. For instance, during Q1 2023, there were 58,268 recorded actions aimed at preventing home loss, which played a vital role in assisting over 6 million families in retaining their homes.

Homeowners must familiarize themselves with their HOA's governing documents, which delineate the specific procedures and rights associated with property repossession. This knowledge is essential for effectively navigating potential property loss situations, including strategies to stop HOA foreclosure. For example, in Oklahoma, where the rate of property repossession was one in every 6,147 households, understanding local HOA regulations can substantially influence outcomes.

Counties such as Nowata and Caddo reported the highest default rates per housing unit, underscoring the necessity of being proactive in addressing any dues owed to the HOA.

Expert insights emphasize that property owners should not underestimate the strength of their entitlements within the HOA framework. Real estate experts often stress that while HOAs possess the authority to impose regulations, property owners also retain rights that can aid in understanding how to stop HOA foreclosure. Many residents have successfully learned to halt HOA foreclosure by effectively communicating with their associations and seeking legal counsel when necessary.

As Rob Barber, CEO, noted, "It’s too early to know if 2025 will deviate from the general 2024 trends of a continued decline in property repossession activity," highlighting the importance of staying informed about current trends. By comprehending their entitlements and the specific processes outlined in their HOA's governing documents, homeowners can better understand how to stop HOA foreclosure and strengthen their position to avoid the repercussions of losing their property.

Legal Implications of HOA Foreclosure: Rights and Responsibilities

Homeowners confronting HOA repossession must grasp their legal entitlements, particularly when considering how to stop HOA foreclosure. These rights include the entitlement to receive proper notice of delinquency and the opportunity to challenge property seizure in court. Understanding the terms outlined in their HOA's governing documents is essential, as these documents delineate the association's authority to initiate legal actions.

With over 1 in 4 Americans now residing in an HOA, the implications of these regulations are profound. The growth of HOAs over the past 50 years underscores the importance of comprehending these rules and their impact on residents.

Homeowners must proactively address any disputes related to fees or assessments to effectively understand how to stop HOA foreclosure and avert potential property loss. Engaging with legal experts can provide critical insights into these entitlements and obligations, ensuring that property owners remain well-informed. Legal professionals emphasize the necessity of understanding one's rights during HOA property recovery scenarios, particularly regarding how to stop HOA foreclosure, as this knowledge is vital in managing disputes successfully.

As noted by Rocket Mortgage, "Many HOA fees have increased, along with inflation, causing some property owners to question if the value they’re receiving is worth the expense," highlighting the financial pressures that can lead to property loss.

Case studies indicate that active participation in HOA governance—evidenced by approximately 2.5 million individuals serving as board or committee members in 2021—demonstrates a commitment to community engagement. This level of involvement can significantly influence the outcomes of property disputes, as residents who are informed and engaged are better equipped to challenge unjust practices. By understanding their rights and responsibilities, property owners can learn how to stop HOA foreclosure and take decisive steps to safeguard their interests.

Consequences of Non-Payment: How Unpaid Fees Lead to Foreclosure

Failure to pay homeowners' association (HOA) fees can lead to significant financial consequences for residents. Initially, the HOA may impose late fees and interest, which can accumulate rapidly, exacerbating the financial burden. If the debt remains unresolved, the HOA has the authority to file a lien against the property, establishing a legal claim that must be satisfied before the property owner can sell or refinance their home.

In states like Colorado, HOAs possess a super lien status, allowing them to claim up to six months' worth of delinquent assessments, underscoring the financial implications for property owners.

Ongoing non-payment of HOA dues can lead to legal actions, permitting the HOA to sell the property to recover the owed amounts. It is crucial for property owners to understand how to stop HOA foreclosure, given that the HOA has the right to initiate foreclosure for unpaid dues even if they are current on their mortgage payments. As attorney Amy Loftsgordon states, "If you fail to pay association dues or assessments, it is important to know how to stop HOA foreclosure as the HOA might foreclose."

This dual obligation can create a precarious situation for property owners, as they may find themselves at risk of losing their property despite fulfilling their mortgage commitments.

Residents facing financial difficulties should engage in proactive communication with the HOA to learn how to stop HOA foreclosure. Participating in discussions on how to stop HOA foreclosure by establishing payment arrangements before legal actions begin can greatly reduce the risk of losing their home. For example, case studies have indicated that property owners who contact their HOAs to explore payment alternatives frequently achieve more advantageous results, circumventing the serious repercussions linked to losing their homes.

Homeowners are encouraged to take these proactive steps on how to stop HOA foreclosure in order to protect their interests.

In summary, the implications of unpaid HOA fees are profound, potentially resulting in the loss of property. Homeowners must remain vigilant about their financial obligations to their HOA and seek assistance early to navigate these challenges effectively. Furthermore, it is crucial to highlight that HOAs may lease a repossessed property on a short-term basis until the primary mortgage holder's process is finalized, which could result in additional issues for the property owner.

Effective Strategies to Prevent HOA Foreclosure: A Homeowner's Toolkit

Residents must prioritize the prompt payment of dues and foster open lines of communication with their association to halt HOA foreclosure. Statistics reveal that over 1 in 4 Americans reside in an HOA, highlighting the necessity of understanding these dynamics. A considerable percentage of property owners actively engage with their HOAs regarding dues, emphasizing the significance of this relationship.

In times of financial difficulty, property owners should consider discussing a payment plan, as research shows that effective payment agreements can significantly aid in understanding how to stop HOA foreclosure and reduce the risk of losing their home. Moreover, exploring financial assistance programs can provide essential support during challenging periods. Staying informed about the HOA's rules and regulations is crucial to prevent misunderstandings that may lead to foreclosure. Proactive engagement not only helps resolve payment issues but also cultivates a cooperative relationship with the HOA, which is vital for long-term success.

For example, case studies demonstrate that property owners who maintain consistent communication with their HOAs are more likely to negotiate favorable outcomes, such as reduced fees or extended payment deadlines. As David Bitton, co-founder at DoorLoop, noted, approximately 89% of residents believe that the members of their elected governing board work to serve the community's best interests, reinforcing the importance of trust and communication.

Looking ahead to 2025, the evolving landscape of HOAs, marked by increased financial transparency and the adoption of digital technologies, will further shape how property owners manage their obligations effectively. Homeowners are encouraged to advocate for budget transparency within their HOAs, as this can lead to long-term changes in fee structures and enhance overall community management. Furthermore, the shift towards sustainability and compliance requirements will challenge both boards and residents, making it essential for property owners to remain informed and engaged.

By implementing these strategies, property owners can learn how to stop HOA foreclosure and significantly mitigate the risk, ensuring a more stable living environment.

Negotiating with Your HOA: Payment Plans and Solutions

Homeowners experiencing financial difficulties must proactively engage with their Homeowners Association (HOA) to learn how to stop HOA foreclosure by exploring potential payment plans. Transparency is crucial during these discussions; property owners should clearly outline their financial situations and propose realistic repayment options. Many HOAs are willing to collaborate with residents to establish plans that permit gradual payments rather than demanding immediate full payment.

A study indicates that 57% of individuals living under HOAs express dissatisfaction, often due to rising fees, which can lead to financial strain. This context underscores the importance of negotiation. Documenting all agreements in writing is essential to ensure clarity and accountability for both parties.

Experts recommend approaching the HOA with a well-prepared proposal that includes a detailed budget and a timeline for repayment. Financial counselors emphasize that open communication can significantly enhance the likelihood of reaching a favorable agreement. In fact, statistics show that property owners who negotiate payment plans with their HOAs achieve a higher success rate when they present a clear plan and demonstrate a willingness to cooperate.

For instance, successful case studies reveal that individuals who engaged in constructive dialogue with their HOAs were able to negotiate payment plans that reduced their monthly obligations, enabling them to manage their finances more effectively. As HOA fees continue to rise—averaging between $300 and $400 monthly in numerous states, with Missouri averaging $469—understanding how to stop HOA foreclosure is essential for homeowners striving to avoid losing their homes. Furthermore, properties in an HOA sell for 5-6% more than similar homes not part of an HOA, highlighting the potential value of these communities despite the challenges.

With 71% of new constructions in the western region belonging to an HOA, and the ongoing trend of rapid suburban development in areas like Texas, the relevance of HOAs is more pronounced than ever. Homeowners must be equipped with the knowledge and strategies on how to stop HOA foreclosure by effectively negotiating with their HOAs to prevent losing their homes.

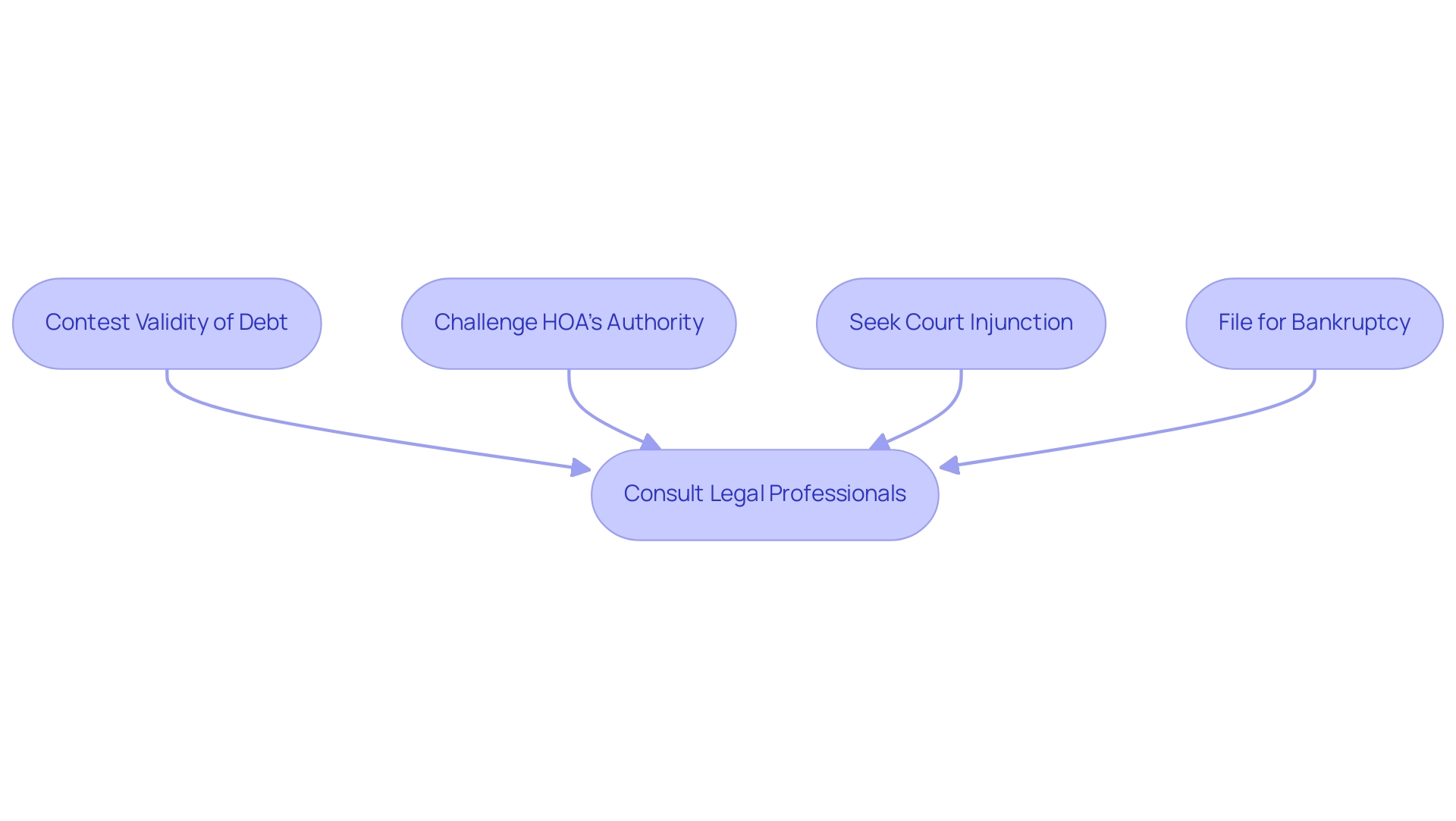

Exploring Legal Remedies: Options for Homeowners Facing Foreclosure

Homeowners facing HOA property seizure have several legal avenues to explore. They can:

- Contest the validity of the debt

- Challenge the HOA's authority to initiate the property seizure

- Seek a court injunction to pause the proceedings

Additionally, filing for bankruptcy may provide temporary relief from property seizure actions; however, understanding the complexities involved in such a decision is crucial.

Statistics indicate that a significant percentage of homeowners resort to bankruptcy as a strategy to avoid losing their homes, underscoring the urgency of seeking legal advice.

Legal experts emphasize the importance of consulting with professionals who specialize in HOA law to navigate these options effectively. For instance, a case study titled "Legal Strategies Against Default" outlines various legal tactics that borrowers can employ to defend against default actions, particularly focusing on the statute of limitations. If the statute of limitations expires during the repossession process, it cannot be raised as a defense, highlighting the significance of timing in repossession defenses.

As attorney Amy Loftsgordon points out, the Consumer Financial Protection Bureau (CFPB) has cautioned collection agencies and mortgage servicers against suing or threatening to sue to recover time-barred debt, further illustrating the legal context surrounding HOA property repossessions.

Furthermore, property owners have successfully disputed HOA property seizure actions by providing evidence that questions the validity of the debt or the HOA's power. Engaging with legal professionals can significantly enhance the chances of a favorable outcome, as they can provide tailored strategies based on the individual's specific situation. As the landscape of HOA property repossessions evolves, remaining knowledgeable about legal solutions and alternatives is crucial for residents aiming to safeguard their interests and assets.

State-Specific Guidelines for HOA Foreclosure: What You Should Know

HOA foreclosure laws exhibit considerable variation across states, making it essential for residents to grasp how to halt HOA foreclosure by thoroughly understanding their local regulations governing the foreclosure process. Key factors to consider include notice requirements, timelines, and specific resident entitlements. For example, in numerous states, an HOA is required to provide property owners with two consecutive 30-day periods to rectify any violations before pursuing legal action. This requirement highlights the necessity of timely communication and adherence to HOA rules.

As attorney Amy Loftsgordon advises, "Understand Colorado's newest HOA laws and eviction regulations, including property owner entitlements, eviction limits, and modifications to HOA procedures." This underscores the critical need for property owners to stay informed about their entitlements and the legal landscape.

Furthermore, some states offer enhanced protections for property owners facing mortgage default, such as mandatory mediation processes or specific thresholds that must be met prior to initiating repossession procedures. Legal experts stress that property owners should consult with a local attorney to clarify how to stop HOA foreclosure and to fully understand their rights within these state-specific guidelines. A case study from Colorado exemplifies that property owners can file civil lawsuits against HOAs for violations of mortgage laws, reinforcing the importance of legal counsel in navigating these complexities.

As of 2025, a notable percentage of states have instituted additional protections for property owners in default, reflecting a growing acknowledgment of the necessity for safeguards in the HOA default process. Understanding these nuances is vital for property owners navigating the complexities of HOA regulations, particularly regarding how to stop HOA foreclosure and ensuring they are adequately prepared to address any challenges that may arise during the repossession process.

Understanding the Right of Redemption: Can You Get Your Home Back?

Homeowners across various states possess a critical option of redemption, enabling them to reclaim their property after a sale by settling the outstanding debt within a designated timeframe. This redemption period varies significantly from state to state, underscoring the urgency for property owners to act swiftly if they intend to utilize this option. Notably, in judicial property repossessions in Massachusetts, property owners can recover their assets even post-sale, highlighting the necessity of comprehending local regulations.

Statistics reveal that as of February 2025, there were 32,383 properties in the U.S. with default filings, marking a 1.7% decrease from the previous year. States such as Delaware, Illinois, and Nevada reported the highest rates of property seizures, emphasizing the need for residents in these areas to remain particularly vigilant regarding their rights.

Prior to property repossession, most lenders offer loss mitigation options to borrowers facing difficulties with mortgage payments, including guidance on halting HOA foreclosure. However, applications for assistance must be submitted before the sale, providing homeowners with additional alternatives to consider before facing property loss.

The redemption process can serve as a vital lifeline for those seeking to halt HOA foreclosure after experiencing a loss of their home. Homeowners have successfully reclaimed their properties by paying the owed amounts, demonstrating how to stop HOA foreclosure, even when private companies were involved in the foreclosure process. This underscores the importance of recognizing that the opportunity to repurchase the home, often referred to as the 'statutory option of redemption,' is rooted in state statutes.

As attorney Amy Loftsgordon asserts, "The right to repurchase the home is called the 'statutory right of redemption' because the amount of time allowed to redeem and the right itself arises solely from state statutes."

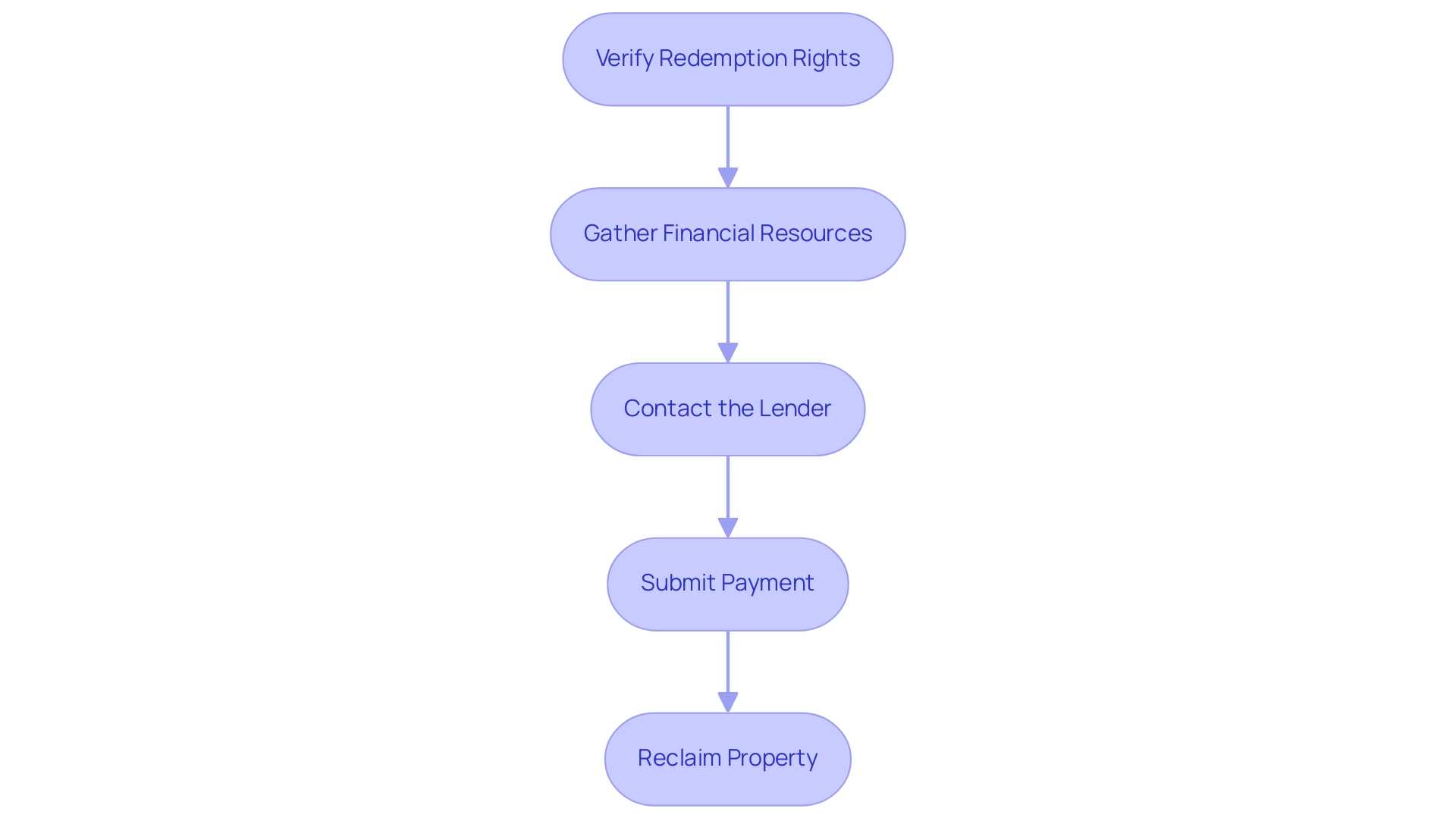

To effectively reclaim property post-foreclosure, homeowners should follow these steps:

- Verify Redemption Rights: Understand the specific redemption laws in your state, including the duration of the redemption period.

- Gather Financial Resources: Ensure you have the necessary funds to pay off the owed debt, including any additional fees that may have accrued.

- Contact the Lender: Reach out to the lender or the entity that conducted the foreclosure to express your intent to redeem the property.

- Submit Payment: Pay the required amount within the stipulated timeframe to reclaim your property.

Expert opinions highlight the importance of acting promptly. Legal professionals note that the right of redemption can provide a second chance for property owners, enabling them to regain ownership and stability. By understanding how to stop HOA foreclosure and navigating the redemption process, property owners can take proactive measures to protect their investments and secure their homes.

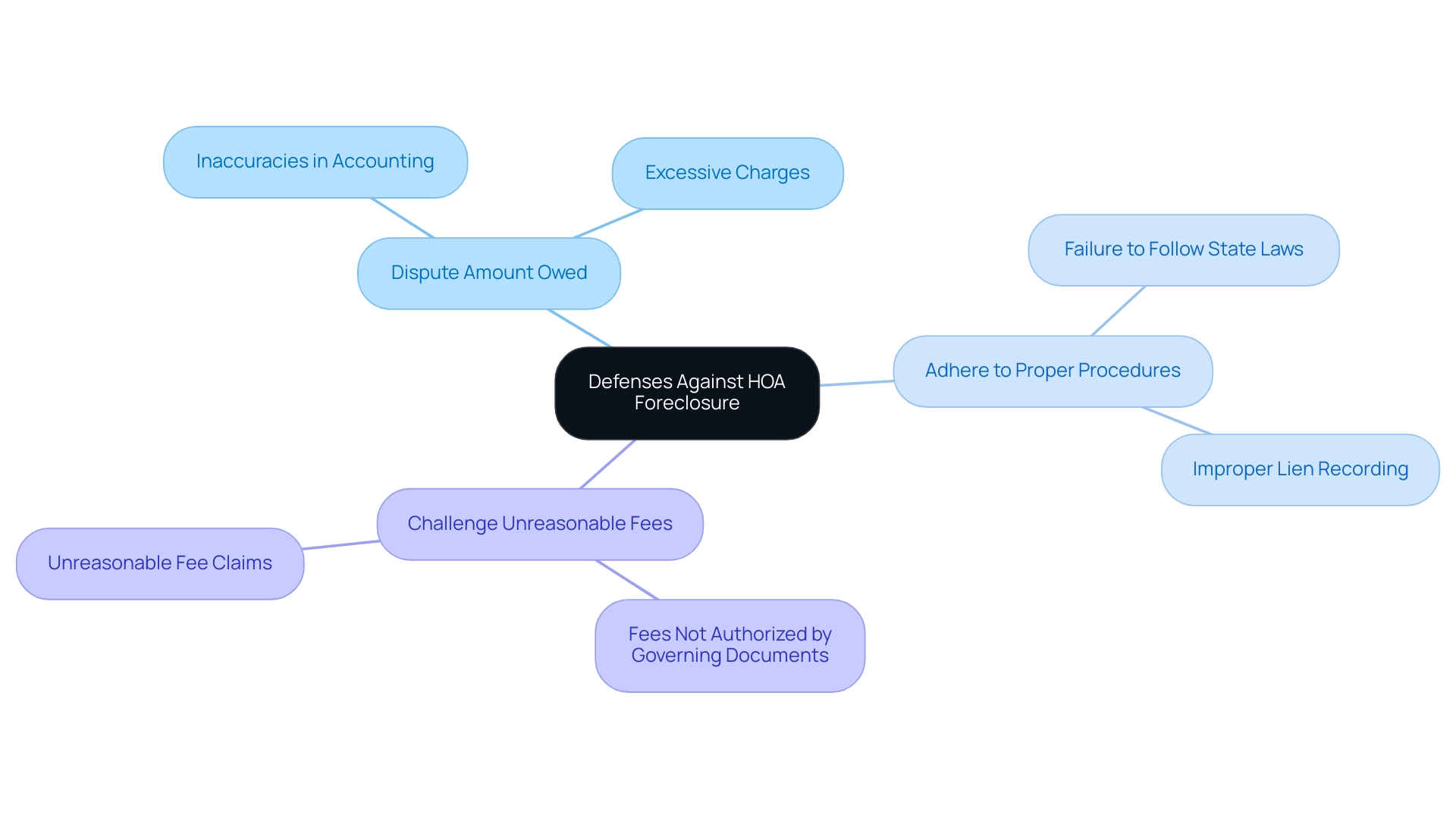

Defenses Against HOA Foreclosure: Protecting Your Home

Homeowners facing HOA property loss possess several potential defenses that can assist them in halting HOA foreclosure. Common strategies for stopping HOA foreclosure include:

- Disputing the amount owed due to inaccuracies in accounting.

- Asserting that the HOA did not adhere to proper procedures.

- Claiming that the fees imposed were unreasonable or not authorized by the governing documents.

For instance, property owners can argue that the HOA imposed excessive charges or failed to comply with state regulations concerning lien recording, which can significantly impact the legitimacy of the repossession action.

To effectively present their case in court, property owners should meticulously gather all relevant documentation, including payment records and correspondence with the HOA. Consulting with a legal professional is highly advisable for those seeking to understand how to stop HOA foreclosure, as these experts can provide insights into potential defenses and assist in navigating the complexities of the legal system. Legal professionals often emphasize that understanding how to stop HOA foreclosure necessitates knowledge of governing documents and state laws, which is crucial for mounting a successful defense.

As discussed in recent conversations, seeking legal advice is recommended for property owners to learn how to stop HOA foreclosure and explore possible defenses against losing their home.

Statistics indicate that a notable percentage of property owners have successfully disputed HOA fees, underscoring the importance of being informed and proactive. For example, property owners may utilize defenses based on procedural errors made by the HOA, which can lead to favorable outcomes in repossession cases. Moreover, a ruling from a small claims court can result in wage garnishments and a decline in the property owner's credit score, highlighting the stakes involved in HOA property loss.

In a recent case, the author expressed gratitude for a victory in an HOA dispute, emphasizing the significance of community support and shared experiences. By being well-prepared and informed, homeowners can significantly enhance their chances of successfully understanding how to stop HOA foreclosure. As David Acosta noted, "If there is enough interest, in a future post I will explore 12 different types of foreclosure plaintiffs and point to the vulnerability of their respective types of claims."

This insight encourages readers to remain engaged and informed about their rights and options.

Conclusion

Understanding the complexities of HOA foreclosure is essential for homeowners determined to protect their financial investments and property rights. This article emphasizes the necessity of familiarizing oneself with HOA regulations, recognizing legal rights, and promptly addressing unpaid dues. By proactively communicating and negotiating with their HOA, homeowners can often avert the severe consequences associated with foreclosure.

Furthermore, knowing the specific legal avenues available, including the right of redemption and potential defenses against foreclosure, empowers homeowners to take decisive action if they find themselves at risk. The importance of understanding state-specific guidelines further underscores the need for homeowners to remain informed about their local laws and regulations.

Ultimately, by equipping themselves with knowledge and actively engaging with their HOA, homeowners can navigate the challenges of HOA foreclosure more effectively. This proactive approach not only safeguards their homes but also fosters a healthier community dynamic, where cooperation and mutual understanding thrive. As the housing landscape continues to evolve, homeowners must stay vigilant and informed, ensuring they can maintain their rights and protect their investments in an increasingly regulated environment.

Frequently Asked Questions

What authority do Homeowners Associations (HOAs) have over property owners?

HOAs have substantial authority to enforce community rules, collect dues, and initiate repossession actions, which typically begin with placing a lien on the property for unpaid dues.

What can happen if a property owner falls behind on HOA payments?

If a property owner fails to pay HOA dues, it can lead to the HOA filing a lien against the property, and if the debt remains unresolved, it may ultimately result in property seizure through foreclosure.

Why is understanding the HOA property repossession process important for homeowners?

Understanding the repossession process is crucial as it helps homeowners navigate potential property loss situations and informs them of their rights and obligations related to HOA fees and assessments.

What rights do homeowners have regarding HOA foreclosure?

Homeowners are entitled to receive proper notice of delinquency and have the opportunity to challenge property seizure in court, as outlined in their HOA's governing documents.

How can homeowners proactively address issues related to unpaid HOA dues?

Homeowners should engage in proactive communication with their HOA, explore payment arrangements, and seek legal counsel if necessary to effectively manage disputes and avoid foreclosure.

What financial consequences can arise from failing to pay HOA fees?

Failure to pay HOA fees can lead to late fees, interest accumulation, the filing of a lien, and ultimately foreclosure, even if the homeowner is current on their mortgage payments.

What steps can homeowners take to prevent HOA foreclosure?

Homeowners can prevent HOA foreclosure by understanding their rights, communicating with their HOA about payment options, and being actively involved in HOA governance to influence outcomes.

How prevalent are HOAs in the United States?

Over 1 in 4 Americans now reside in an HOA, highlighting the significant impact these associations have on homeowners and the importance of understanding their regulations.

What are some common strategies homeowners use to stop HOA foreclosure?

Successful strategies include effective communication with the HOA, seeking legal advice, and participating in community governance to address disputes and negotiate payment plans.

What should homeowners do if they are facing financial difficulties related to HOA dues?

Homeowners should proactively reach out to their HOA to discuss payment arrangements and seek assistance to navigate their financial obligations effectively.