Overview

The article provides an in-depth tutorial for homeowners on HOA foreclosure, explaining that it is a legal process initiated by homeowners' associations to reclaim properties due to unpaid dues or violations. It emphasizes the importance for homeowners to understand their rights and obligations, as well as the potential financial and community impacts of foreclosure, thereby highlighting the need for proactive engagement and awareness of local regulations to safeguard their investments.

Introduction

In the intricate world of homeowners' associations (HOAs), the power to enforce community standards can lead to significant consequences for homeowners, particularly when it comes to foreclosure. As associations gain the authority to place liens on properties for unpaid dues, the potential for HOA foreclosure looms large, threatening not just individual homeownership but also the fabric of entire communities.

With rising foreclosure rates and evolving regulations, understanding the nuances of this process has never been more critical. Homeowners must navigate a complex landscape of legal obligations, financial repercussions, and available defenses to protect their investments and maintain their rights.

This article delves into the mechanics of HOA foreclosure, the legal steps involved, and the long-term impacts on both homeowners and their communities, offering essential insights for those seeking to safeguard their homes and financial futures.

What is HOA Foreclosure and How Does It Work?

Homeowners' Associations (HOAs) wield significant authority in managing community standards, including the power to place liens on real estate, which can ultimately result in HOA foreclosure for unpaid dues or violations of community regulations. This legal mechanism can result in HOA foreclosure, which is a process that allows the association to reclaim assets through judicial action. Essentially, HOA repossession allows associations to recover outstanding assessments by selling the property at auction.

As noted by Rob Barber, CEO of ATTOM:

While property repossession activity has risen, seasonal factors may offer brief relief, but economic dynamics should be closely monitored as we move into 2025.

This warning emphasizes the importance for property owners to remain vigilant and informed about their rights and obligations within HOA structures. Comprehending the intricacies of the HOA foreclosure process is crucial for homeowners to avoid potential pitfalls and take proactive measures to safeguard their investments in an increasingly complex housing landscape.

Furthermore, it is noteworthy that regions such as the Far West, Southeast, Plains, and New England have shown the lowest property repossession rates, which could influence HOA policies in those areas. In Oklahoma, with a rate of one in every 6,147 households facing property loss, the implications of unpaid dues can be significant. Furthermore, South Dakota's case study demonstrates this point; despite possessing the lowest rate of financial property seizures in the nation, with just one seizure for every 26,210 housing units, counties such as Minnehaha, Pennington, and Codington encounter difficulties that could impact residents' rights and property values.

These insights emphasize the necessity for property owners to understand the potential repercussions of HOA foreclosure and the significance of staying informed about local regulations.

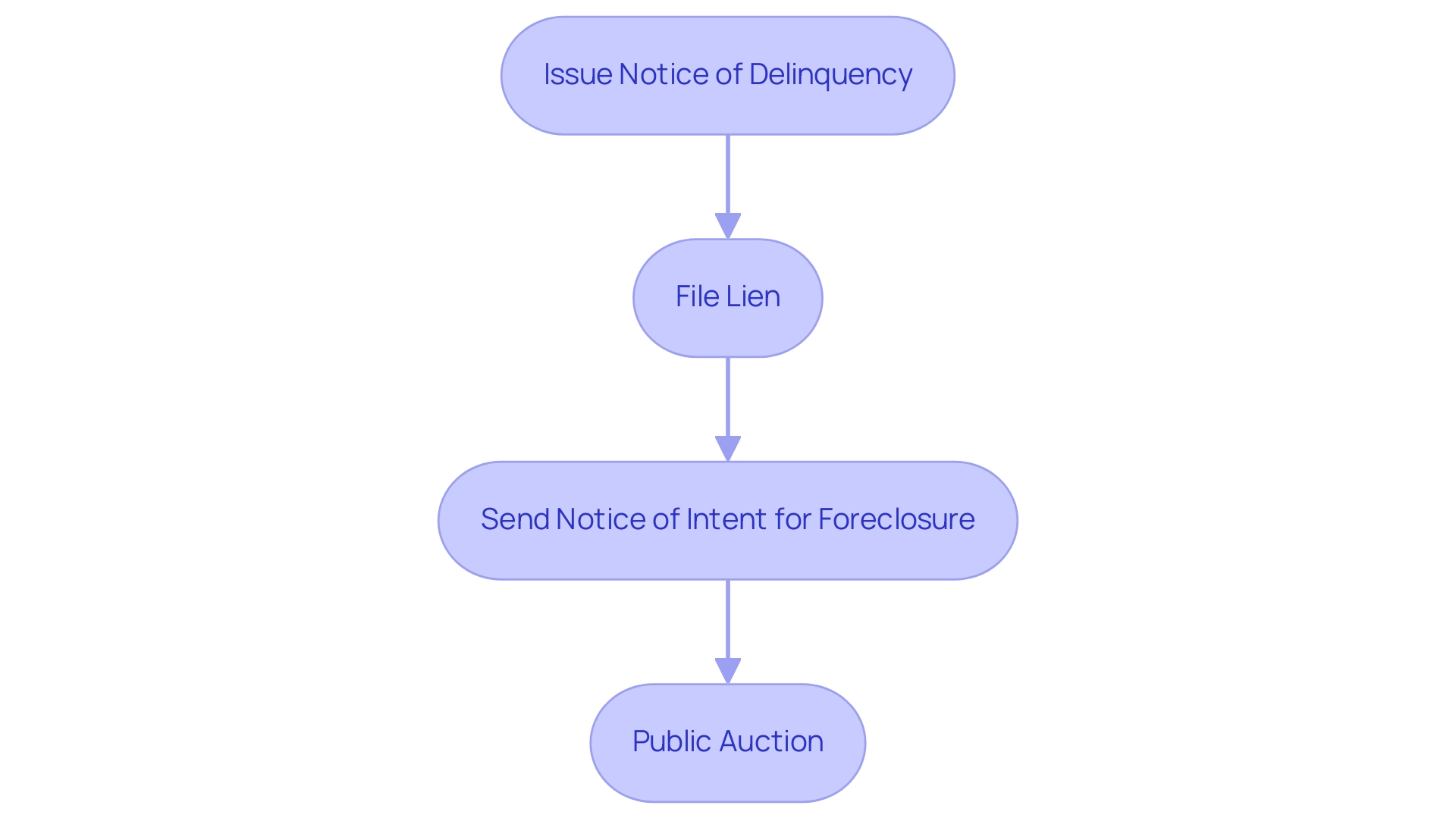

The Legal Process of HOA Foreclosure: Steps and Requirements

The legal proceedings surrounding a property owner in Florida begin with the association issuing a notice of delinquency related to HOA foreclosure. If payments remain outstanding, the HOA has the right to file a lien against the asset, effective from the date the association records the lien, as established under Fla. Stat. § 720.3085(1) and § 718.116(5)(a).

Following this, a series of notifications ensue, including a notice of intent for HOA foreclosure, which must adhere to strict legal timelines and requirements dictated by state law. Given the recent legislative updates affecting Florida HOAs in 2023, it is vital for homeowners to review these changes to prevent HOA foreclosure and remain compliant. As attorney Amy Loftsgordon advises, "If you're considering buying a home in an HOA or COA community in Florida—or you already live in one—take the time to familiarize yourself with state association laws and the community's governing documents."

This comprehension is essential as each state has distinct regulations overseeing the repossession process, often resulting in a public auction for the asset. Additionally, HOAs in Florida are responsible for maintaining common areas, which significantly impacts the overall quality and attractiveness of the community. Homeowners must be acutely aware of their specific state's laws to safeguard their rights and navigate this complex landscape effectively.

Financial Consequences of HOA Foreclosure for Homeowners

Homeowners confronted with HOA foreclosure often face severe financial repercussions, most notably the risk of losing equity in their properties. The burden of unpaid assessments can escalate quickly, leading to mounting legal fees that can average thousands of dollars. In fact, recent statistics indicate a troubling trend, with Massachusetts experiencing a staggering 45.6% increase in property seizure filings in 2023, affecting one in every 879 households.

This situation is compounded by the toll of losing a home on credit scores, which can drop significantly, hindering future loan or mortgage opportunities. It is important to recognize that HOA foreclosure usually occurs after multiple missed payments, providing property owners some time to seek solutions. As financial expert Ames Alexander aptly highlights,

One of the things is that it’s helpful to remember that some of the best stories start with questions.

This sentiment highlights the significance of property owners examining their financial circumstances and seeking information about their rights and alternatives in the repossession process. Additionally, the recent decrease in the Enterprises' REO inventory signals a shifting real estate market, which can further affect homeowners confronting property loss. Homeowners must prioritize timely payments and actively seek assistance if they encounter economic challenges to mitigate these dire consequences.

Defending Against HOA Foreclosure: Rights and Legal Options

Homeowners encountering HOA property loss possess a range of rights and legal options designed to protect their interests. They can:

- Challenge the legitimacy of the charges imposed by the HOA.

- Contest the legality of the HOA foreclosure process itself.

- Negotiate a feasible payment plan to address any outstanding dues.

It is important to note that for buildings with five or more dwelling units, a legible copy of the notice must be posted on the outside of each entrance and exit, which is crucial for residents to understand their rights regarding notification.

Seeking legal counsel is highly advisable, as attorneys can provide insights into potential defenses based on state law and specific property protections in place for 2024. As David Bitton, co-founder at DoorLoop, emphasizes, "Understanding your rights and seeking professional guidance is essential in navigating these complex situations."

For instance, residents in New York should be aware that to file a complaint against an HOA, they need to provide detailed information and supporting evidence to the New York Attorney General's office.

This process underscores the importance of transparency, as highlighted in the case study on HOA disclosure in real estate transactions, which mandates thorough disclosure of vital HOA information. Homeowners must act swiftly and proactively assert their rights to mitigate the risks associated with HOA foreclosure, ensuring they are well-informed about their options and the legal landscape surrounding property repossession.

Using Mediation to Resolve HOA Foreclosure Disputes

Mediation arises as a crucial approach for property owners involved in HOA foreclosure conflicts, fostering a structured setting for open dialogue and negotiation. This process involves a neutral third party who guides discussions between the property owner and the HOA to address HOA foreclosure, fostering an atmosphere conducive to reaching mutually beneficial agreements without resorting to litigation. Mediation can lead to practical outcomes, such as establishing payment plans or amending assessment terms, which can significantly assist property owners in navigating their financial obligations and ultimately prevent HOA foreclosure.

Engaging in mediation at the earliest stages of a dispute is particularly advantageous, as it often results in quicker resolutions, thereby alleviating both emotional stress and financial burdens. Recent trends indicate that mediation not only reduces the duration of disputes—often significantly shorter than the two to three years typical of litigation—but also minimizes the costs associated with increased insurance premiums and special assessments. The financial toll of litigation can dwarf the actual value of the dispute, with attorney's fees sometimes soaring well beyond the damages involved; for example, an award of $531,159 in attorney's fees was granted to an HOA member despite being found 25% negligent.

This stark statistic underscores the potential financial implications of litigation, reinforcing the argument for mediation as a cost-effective alternative. Furthermore, during mediation about HOA foreclosure, HOAs should communicate openly about the financial impacts of non-payment and explore all possible solutions while being flexible and fair. A case study on the cost implications of HOA foreclosure reveals that such disputes can be lengthy and expensive, often resulting in increased insurance premiums and special assessments for HOA members.

As Charles Dickens famously remarked,

It was the best of times, it was the worst of times,

aptly capturing the dual nature of mediation—offering hope for resolution amid the challenges of HOA disputes.

Long-Term Impacts of HOA Foreclosure on Homeowners and Communities

The long-term consequences of HOA foreclosure property seizures extend well beyond the individual homeowner, significantly affecting the community landscape. Studies show that mortgage defaults can result in a significant drop in neighborhood real estate values, causing impacted houses to experience reduced attraction. In fact, homes in HOAs have prices that are on average at least 4%, or $13,500, higher than comparable homes outside of HOAs, highlighting the financial effect on property values.

This decline can result in strained relations among residents, as financial pressures mount and community cohesion weakens. Additionally, the financial instability caused by property repossessions can lead to reduced funding for essential HOA services, further exacerbating the situation. Homeowners confronting property loss often experience emotional distress and long-lasting financial repercussions, which can ripple through the entire community.

Effective engagement between homeowners and their HOAs is crucial in these scenarios, particularly to prevent HOA foreclosure, as proactive communication fosters an environment that minimizes disputes and supports value retention. A study on the role of Homeowners' Associations in alleviating the impacts of mortgage defaults highlights that larger, resourceful HOAs are more skilled at reducing the negative externalities associated with HOA foreclosure, thereby preserving not just individual asset values but also the overall integrity of the community. This research suggests that these HOAs are more effective in diminishing the adverse externalities linked to nearby defaults, highlighting their essential role in preserving real estate values.

As State Rep. Naquetta Ricks noted,

We had to fight against a very large lobby,

showcasing the challenges communities face in advocating for their interests amidst the complexities of foreclosure dynamics. Furthermore, it is noteworthy that 52% of survey respondents reported landscaping as the most common amenity provided by HOAs, illustrating the role of amenities in maintaining property values.

Conclusion

Understanding the complexities surrounding HOA foreclosure is essential for homeowners aiming to protect their investments and maintain their rights. The article highlights the significant authority HOAs possess in enforcing community standards and the potential consequences of unpaid dues, which can escalate to foreclosure. From the legal processes involved to the financial ramifications, homeowners must be aware of their obligations and the implications of HOA actions.

Homeowners facing foreclosure have various rights and options available to them, including:

- Challenging charges

- Seeking mediation

Engaging in proactive strategies can help mitigate the risks associated with foreclosure, allowing homeowners to navigate these challenges more effectively. Mediation, in particular, emerges as a valuable tool for resolving disputes, offering a cost-effective alternative to litigation that can foster communication and lead to mutually beneficial agreements.

The long-term impacts of HOA foreclosure extend beyond individual homeowners, affecting community dynamics and property values. As foreclosures can lead to diminished appeal and strained relationships among residents, it is crucial for homeowners and HOAs to foster open communication and collaboration. By understanding the intricacies of HOA regulations and engaging in proactive measures, homeowners can work towards preserving not only their own financial futures but also the integrity of their communities.

Frequently Asked Questions

What authority do Homeowners' Associations (HOAs) have regarding property management?

HOAs have significant authority to manage community standards, including the ability to place liens on real estate for unpaid dues or violations of community regulations, which can lead to HOA foreclosure.

What is HOA foreclosure?

HOA foreclosure is a legal process that allows an association to reclaim assets through judicial action, enabling them to recover outstanding assessments by selling the property at auction.

What should homeowners be aware of regarding HOA foreclosure?

Homeowners need to understand their rights and obligations within HOA structures, as well as the intricacies of the HOA foreclosure process, to avoid potential pitfalls and protect their investments.

How do property repossession rates vary across different regions?

Regions such as the Far West, Southeast, Plains, and New England have shown the lowest property repossession rates, which may influence HOA policies in those areas.

What is the process for HOA foreclosure in Florida?

In Florida, the process begins with the HOA issuing a notice of delinquency. If payments remain outstanding, the HOA can file a lien against the property, followed by a notice of intent for HOA foreclosure, adhering to strict legal timelines and requirements.

Why is it important for homeowners in Florida to be aware of recent legislative updates?

Recent legislative updates affecting Florida HOAs in 2023 may impact homeowners' rights and obligations, making it essential to stay informed to prevent HOA foreclosure and remain compliant.

What resources should homeowners consider when living in an HOA or COA community in Florida?

Homeowners should familiarize themselves with state association laws and the community's governing documents to navigate the complexities of HOA regulations effectively.

What is the impact of HOAs on community maintenance?

HOAs are responsible for maintaining common areas, which significantly affects the overall quality and attractiveness of the community, impacting property values and residents' rights.