Overview

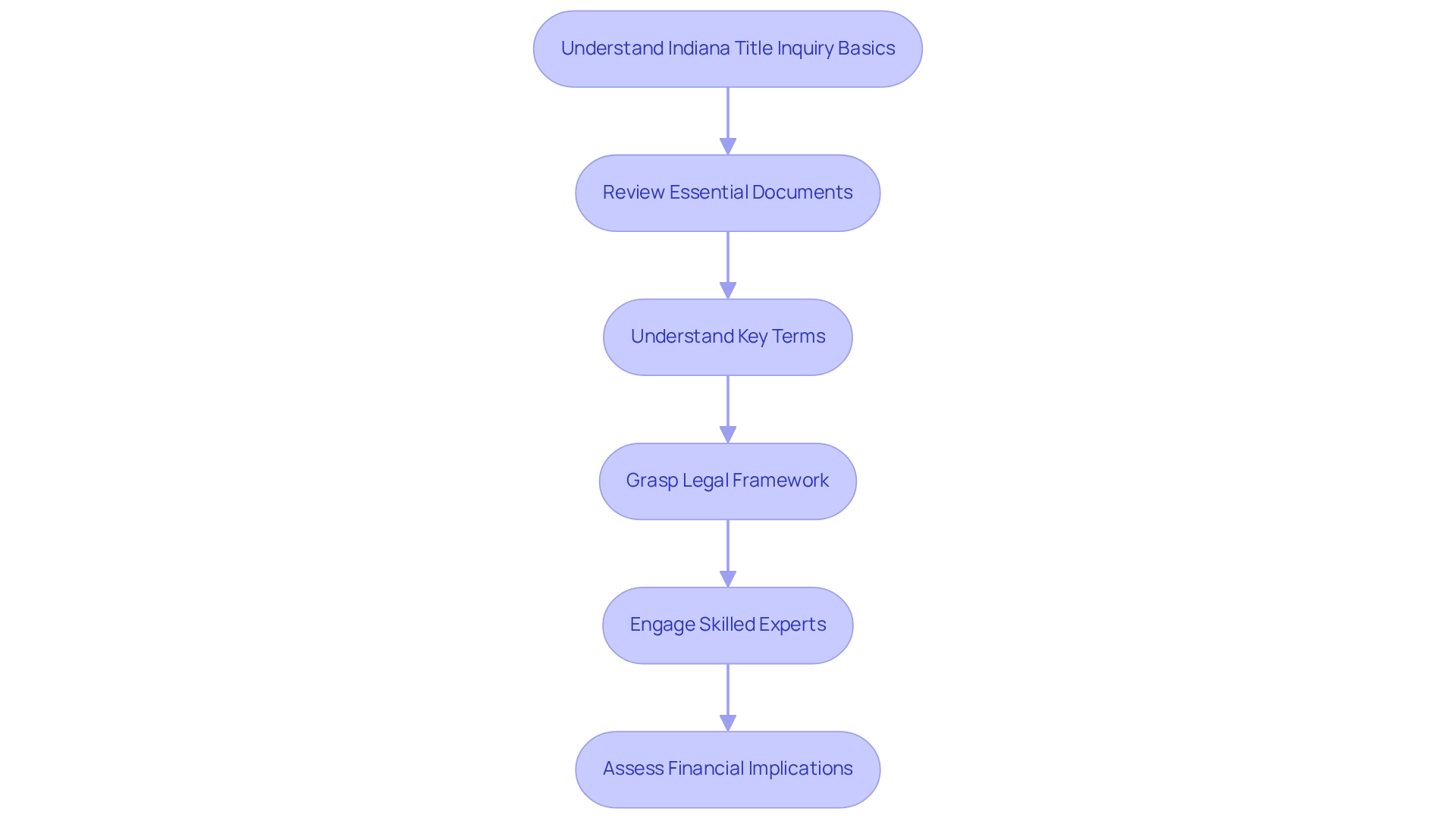

This article delves into mastering the Indiana title inquiry process, highlighting the critical role of understanding public records and engaging skilled professionals in the verification of property ownership. It articulates essential steps, tools, and common challenges encountered during the inquiry process. Consequently, readers are equipped with the knowledge necessary to navigate potential issues effectively, thereby reinforcing the reliability of the solutions offered.

Introduction

In the intricate world of real estate, understanding the title inquiry process is paramount for ensuring smooth transactions and safeguarding investments. In Indiana, this meticulous examination of public records not only verifies property ownership but also uncovers potential liens and encumbrances that could complicate a sale. As prospective buyers and real estate professionals navigate this complex landscape, the importance of engaging qualified experts and utilizing advanced tools cannot be overstated.

Furthermore, mastering essential terminology and leveraging technology for efficient data extraction are critical components of the title inquiry process. This crucial step empowers individuals to make informed decisions. With a comprehensive approach, including the examination of legal documents and a proactive stance toward potential challenges, both buyers and sellers can achieve clarity and confidence in their property dealings.

Understand Indiana Title Inquiry Basics

Mastering the process of investigations in the state begins with a thorough comprehension of what an Indiana title inquiry entails. This process is a meticulous examination of public records aimed at verifying property ownership and uncovering any liens or encumbrances. In this region, title searches are typically performed by title firms or lawyers for potential purchasers, emphasizing the necessity of involving skilled experts in this procedure.

It typically requires a review of essential documents such as:

- Deeds

- Mortgages

- Tax records

Understanding essential terms such as 'title defects,' 'liens,' and 'encumbrances' is vital, as these concepts are central to the investigation. Furthermore, grasping the legal framework governing property ownership in Indiana, including pertinent state laws and regulations, is essential. This foundational knowledge not only facilitates a smoother Indiana title inquiry process but also empowers real estate professionals to effectively navigate potential challenges.

As Reilly Dzurick, a Real Estate Agent at Get Land Florida, observes, "You can reduce expenses by comparing quotes from various providers, bundling services such as property searches and insurance, or negotiating with the seller to cover some of the charges."

Comprehending the financial implications is further demonstrated by the case study on insurance costs in Indiana, where such insurance generally ranges from $400 to $700, affected by factors such as property value and loan amount. This information assists purchasers in budgeting precisely and making informed choices concerning insurance for property ownership.

For experts working in St. Joseph County, Elkhart County, Marshall County, Kosciusko County, and Starke County, this thorough comprehension of the document examination process is crucial for successful real estate dealings.

Gather Necessary Tools and Resources

To effectively navigate the Indiana title inquiry process, gathering the right tools and resources is essential. Begin by performing an Indiana title inquiry through the state's public records, accessible via the Indiana Bureau of Motor Vehicles (BMV) and county recorder's offices. Utilizing online databases and specialized search services can significantly enhance your efficiency. Investing in advanced software that employs machine learning and optical character recognition will simplify the extraction of crucial data from document titles, enabling faster and more precise results.

Furthermore, create a checklist of essential documents, including:

- The deed

- Tax records

- Any previous ownership reports

This preparation not only saves time but also ensures that all relevant information is readily available. As the landscape of research evolves, leveraging technology and maintaining an organized approach will facilitate a smoother Indiana title inquiry process, ultimately enhancing your workflow and productivity.

According to Stats Indiana, the white population’s share of the region's total births fell from roughly 75% in 2016 to 68% by 2023, indicating demographic shifts that may impact property ownership trends. Utilizing resources like Stats Indiana provides valuable statistical insights that enhance your research. As Vanessa French, a Government Documents Intern, noted, "This research guide was created to assist in navigating the complexities of public records." Moreover, as Hoosier builders prepare for suggested tariffs that could raise material expenses, understanding the existing economic environment is essential for efficient property assessments. By combining these tools and insights, you can significantly enhance your research process.

Execute the Title Inquiry Process

To effectively execute the title inquiry process in Indiana, it is essential to adhere to the following steps:

- Identify the Asset: Gather the asset's legal description, including the parcel number and address, to ensure precise identification.

- Access Public Records: Utilize the Indiana BMV website or visit your local county recorder's office to retrieve land records. This access is crucial for verifying ownership and any encumbrances.

- Review Title Documents: Scrutinize the current title, previous deeds, and any recorded liens or encumbrances. Pay particular attention to discrepancies or unusual entries that may indicate potential issues.

- Conduct a Lien Search: Investigate any outstanding liens against the asset, as these can significantly impact ownership rights. This search can typically be performed through the county clerk's office or online databases, ensuring comprehensive coverage. If a lienholder refuses to release a lien, the debtor can file a civil action in court for resolution.

- Document Findings: Keep comprehensive notes of your discoveries, emphasizing any concerns that may need addressing before moving forward with a transaction. This documentation is essential for transparency and future reference.

- Consult Experts: If you come across intricate legal terminology or substantial discrepancies, seek assistance from a legal attorney or a conveyancing company. Their expertise can provide clarity and assist in navigating any challenges.

By adhering to these steps, you can manage the ownership investigation process with assurance, guaranteeing a comprehensive comprehension of the asset's ownership status. In the region, the average duration required for a document check can fluctuate, but efficiency is essential, particularly considering that insurance costs generally fall between 0.5% and 1% of the buying price. As Brené Brown noted, "The power of statistics and the clean lines of quantitative research appealed to me, but I fell in love with the richness and depth of qualitative research." This emphasizes the significance of both quantitative and qualitative methods in verifying ownership of real estate. Real-world instances, like the Indiana title inquiry process, demonstrate that a well-conducted examination can result in a high success rate in verifying ownership and addressing any potential issues.

Troubleshoot Common Title Inquiry Issues

Despite thorough preparation, challenges can arise during the examination process. Understanding these prevalent issues and employing effective strategies for troubleshooting them is crucial.

- Incomplete Records: Encountering missing or incomplete records necessitates reaching out to the county recorder's office. They may possess additional documents or can direct you on how to obtain the necessary information. Utilizing Parse AI's advanced machine learning tools can expedite the extraction of relevant data from unstructured documents, ensuring access to comprehensive records.

- Discrepancies in Ownership: When ownership details do not align with expectations, it is essential to verify the information with the seller and investigate any recent transactions that may not yet be recorded. Discrepancies in property ownership are common, particularly in a dynamic real estate market. Parse AI's research automation simplifies this verification process, enabling faster resolution of discrepancies.

- Outstanding Liens: Identifying liens requires consultation with a legal expert to understand their implications and explore resolution options. Negotiating with lienholders may be necessary before proceeding with the transaction. Parse AI can assist in identifying potential liens through its powerful document processing capabilities, ensuring you are well-informed before negotiations.

- Legal Language Confusion: Complex legal terminology can be daunting. Hiring a documentation specialist or attorney provides clarity and ensures precise interpretation of documents. Additionally, using Parse AI's tools can simplify the extraction of key information from legal documents, enhancing understanding.

- Delays in Processing: Should delays occur in obtaining records or responses, maintaining regular follow-ups and documenting communications is vital for facilitating timely resolutions. Parse AI's streamlined runsheet creation assists in monitoring communications and effectively documenting requests.

Furthermore, employing knowledgeable real estate lawyers or title firms greatly supports managing ownership issues, performing in-depth searches, and settling conflicts. By proactively addressing these common challenges and utilizing advanced tools like those offered by Parse AI, you can navigate the Indiana title inquiry process with greater efficiency and confidence. Awareness of potential obstacles, such as unresolved liens, boundary disputes, and undisclosed easements, allows buyers and sellers to take proactive measures to mitigate risks and ensure a smooth transfer of property ownership.

Conclusion

Mastering the title inquiry process in Indiana is essential for both buyers and real estate professionals to ensure successful transactions and protect investments. A thorough understanding of the basics—such as verifying property ownership and identifying liens—is crucial. Engaging qualified experts, utilizing advanced tools, and maintaining an organized approach significantly enhances the efficiency and effectiveness of the inquiry process.

The gathering of necessary tools and resources, including access to public records and leveraging technology, streamlines the process. By following a systematic approach to executing the title inquiry, individuals can confidently navigate the complexities involved, from identifying properties to documenting their findings. Awareness of common challenges, such as incomplete records and discrepancies in ownership, paired with strategies for troubleshooting, further empowers stakeholders in the real estate market.

Ultimately, a comprehensive title inquiry not only mitigates risks but also fosters informed decision-making. By prioritizing diligence and utilizing the right resources, buyers and sellers can achieve clarity and confidence in their property dealings, paving the way for successful real estate transactions in Indiana.

Frequently Asked Questions

What is an Indiana title inquiry?

An Indiana title inquiry is a meticulous examination of public records aimed at verifying property ownership and uncovering any liens or encumbrances.

Who typically performs title searches in Indiana?

Title searches in Indiana are typically performed by title firms or lawyers for potential purchasers.

What essential documents are reviewed during an Indiana title inquiry?

Essential documents reviewed during an Indiana title inquiry include deeds, mortgages, and tax records.

Why is it important to understand terms like 'title defects,' 'liens,' and 'encumbrances'?

Understanding these terms is vital because they are central to the investigation process and affect property ownership.

What legal knowledge is necessary for conducting a title inquiry in Indiana?

It is essential to grasp the legal framework governing property ownership in Indiana, including pertinent state laws and regulations.

How can one reduce expenses related to title inquiries and property insurance?

Expenses can be reduced by comparing quotes from various providers, bundling services, or negotiating with the seller to cover some charges.

What are the typical insurance costs for property in Indiana?

Insurance costs in Indiana generally range from $400 to $700, influenced by factors such as property value and loan amount.

Why is a thorough understanding of the document examination process important for real estate professionals?

It is crucial for successful real estate dealings, particularly in counties like St. Joseph, Elkhart, Marshall, Kosciusko, and Starke.