Overview

Title verification is the essential process of confirming legal ownership of a property through the examination of public records and historical documents. This verification is crucial in real estate transactions, as it ensures that the seller has the legal right to transfer ownership and that there are no outstanding claims against the property. Notably, approximately 25% of real estate transactions encounter ownership issues, highlighting the necessity of thorough investigations. Such diligence protects buyers from potential fraud and financial losses, reinforcing the importance of this process in safeguarding their investments.

Introduction

In the intricate world of real estate, the significance of title verification is paramount. This meticulous process acts as a safeguard for buyers, confirming legal ownership and revealing potential issues that could jeopardize property investments.

As the landscape of property transactions evolves, grasping the historical development and key components of title verification is essential for navigating the complexities of ownership claims. Statistics indicate that a substantial portion of transactions encounters title-related challenges; therefore, thorough searches and title insurance are critical in ensuring smooth and secure real estate dealings.

Furthermore, as technology continues to reshape the industry, the future of title verification promises to enhance efficiency and accuracy, further solidifying its role as a cornerstone of real estate transactions.

Define Title Verification and Its Importance

? It is a crucial process that confirms the by meticulously examining public records and historical documents. This confirmation is essential in real estate transactions because it answers [what is title verification](https://antonlegal.com/blog/common-title-problems-with-real-property), ensuring that the seller has the authority to transfer ownership and that no outstanding claims or liens exist against the property.

Understanding what is , as it protects purchasers from potential fraud, legal conflicts, and financial losses by ensuring that the ownership is clear and marketable. Recent statistics indicate that approximately 25% of real estate transactions encounter , underscoring the necessity of .

Furthermore, a Loan Policy of ownership insurance is often required by lenders prior to granting a loan, ensuring that what is title verification is established after a thorough search for possible issues. Without careful assessment of ownership, purchasers risk acquiring properties with hidden problems that may lead to expensive legal disputes later, highlighting the .

Case studies reveal that the most frequent remedial actions taken in response to ownership issues include obtaining releases for identified liens, such as mortgages and unpaid taxes, highlighting the proactive measures essential to address these challenges before property transactions can proceed.

Moreover, as noted by , a real estate lawyer can re-submit public documents to amend prior mistakes, highlighting what is title verification and the significance of comprehensive ownership checks. The emotional fulfillment of owning a home is also a major motivator for many, making it crucial to understand what is title verification to ensure a smooth transaction.

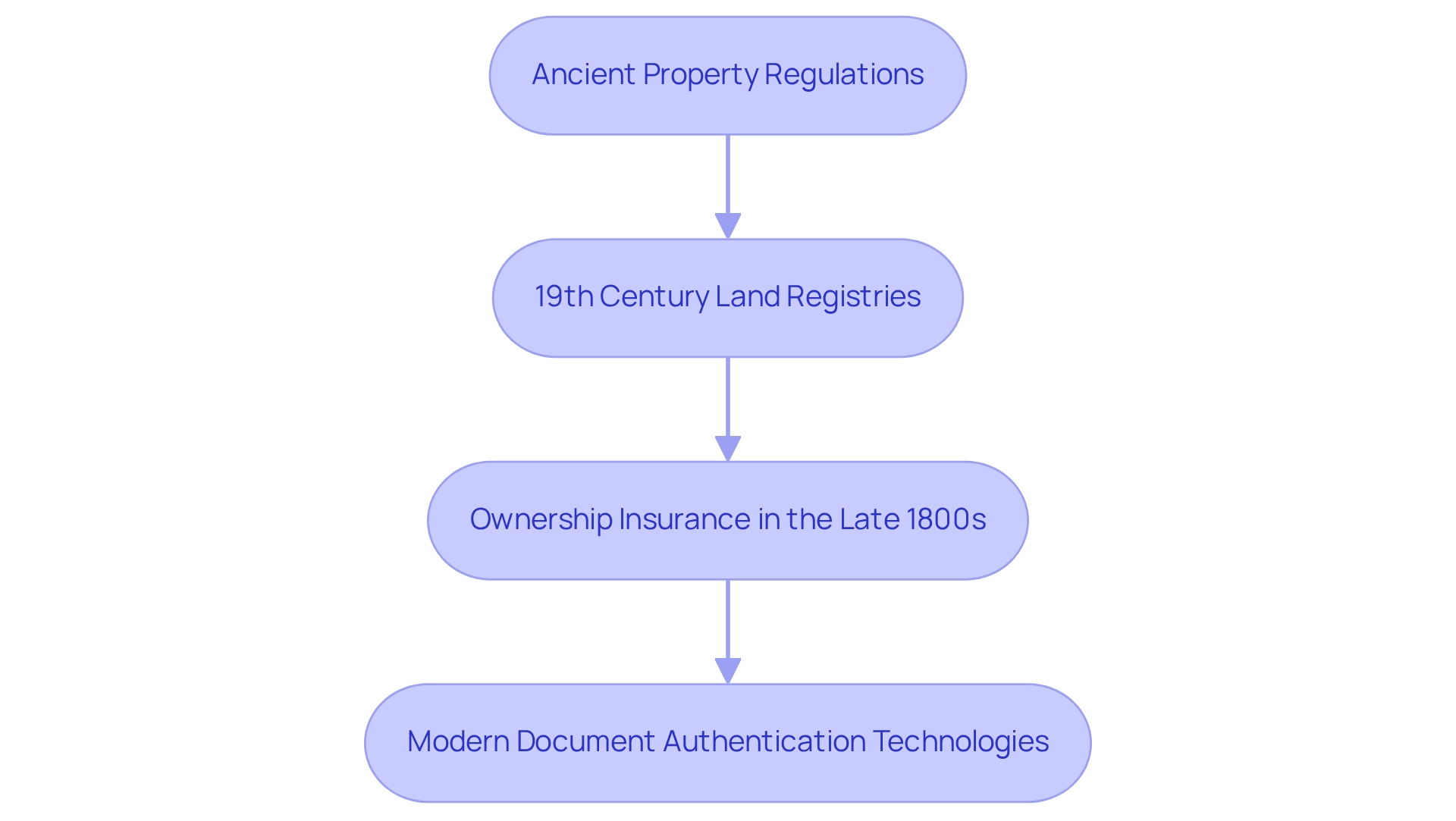

Trace the Historical Development of Title Verification

The roots of deed authentication can be traced back to , where ownership was frequently established through possession or verbal contracts. As societies progressed, the necessity for more structured processes became evident. In the 19th century, the creation of land registries in the United States marked a crucial progress in , allowing organized . This evolution was further reinforced by the introduction of ownership insurance in the late 1800s, which provided buyers with essential protection against potential defects in ownership.

A case study named 'The Evolution of Title Registries Across the U.S.' demonstrates how these registries adjusted to local circumstances while preserving their essential roles, emphasizing the differences in [ownership confirmation](https://blog.parseai.co/understanding-the-key-differences-between-lien-vs-title-in-real-estate) methods across various areas. Currently, document authentication has evolved into a complex procedure that utilizes , to greatly improve both precision and productivity.

The historical context of in supporting real estate markets and affirming jurisdictional claims, particularly concerning lands historically expropriated from Native nations. As Jean M. O’Brien notes, this history counters the dominant narrative of Native disappearance, emphasizing the importance of recognizing these historical injustices. Understanding is essential for comprehending the development of ownership assessment and its relevance to modern concerns related to property and sovereignty, particularly since the registry's primary role has been to and enslaved people.

Identify Key Components and Steps in Title Verification

Key components of document verification involve understanding what is , which includes the , identification of liens and encumbrances, and verification of the seller's authority to transfer ownership. The process typically unfolds through several essential steps:

- Request for : This initial step involves gathering necessary property information to commence the ownership investigation.

- Examine Property Records: A thorough review of deeds, mortgages, tax records, and court documents is conducted to establish a .

- Verify Heading Against Public Records: Findings are cross-referenced with public records to ensure their accuracy and completeness.

- Identify Liens and Encumbrances: This step examines for any outstanding claims that could potentially impact ownership, with statistics indicating that a significant percentage of property searches uncover such issues.

- : The last step entails gathering all discoveries into a thorough document that describes the condition of the ownership.

Each of these steps is vital for ensuring that the title is clear and free from defects, ultimately safeguarding the interests of all parties involved in the transaction. In competitive real estate markets, such as New York, accelerated property searches may be necessary to meet tight closing deadlines, although they incur additional expenses and require careful execution to prevent future legal issues. Based on industry insights, intricate properties with may take around 10 to 14 days for ownership verification. As noted by First National Insurance Company, "At First National Insurance Company, we take pride in our commitment to ." Furthermore, the effectiveness of local government offices can greatly influence document retrieval timelines, with some regions facing delays in processing requests. Understanding what is title verification and its components is crucial for real estate professionals aiming to streamline transactions and mitigate risks.

Explain the Significance of Title Verification in Real Estate Transactions

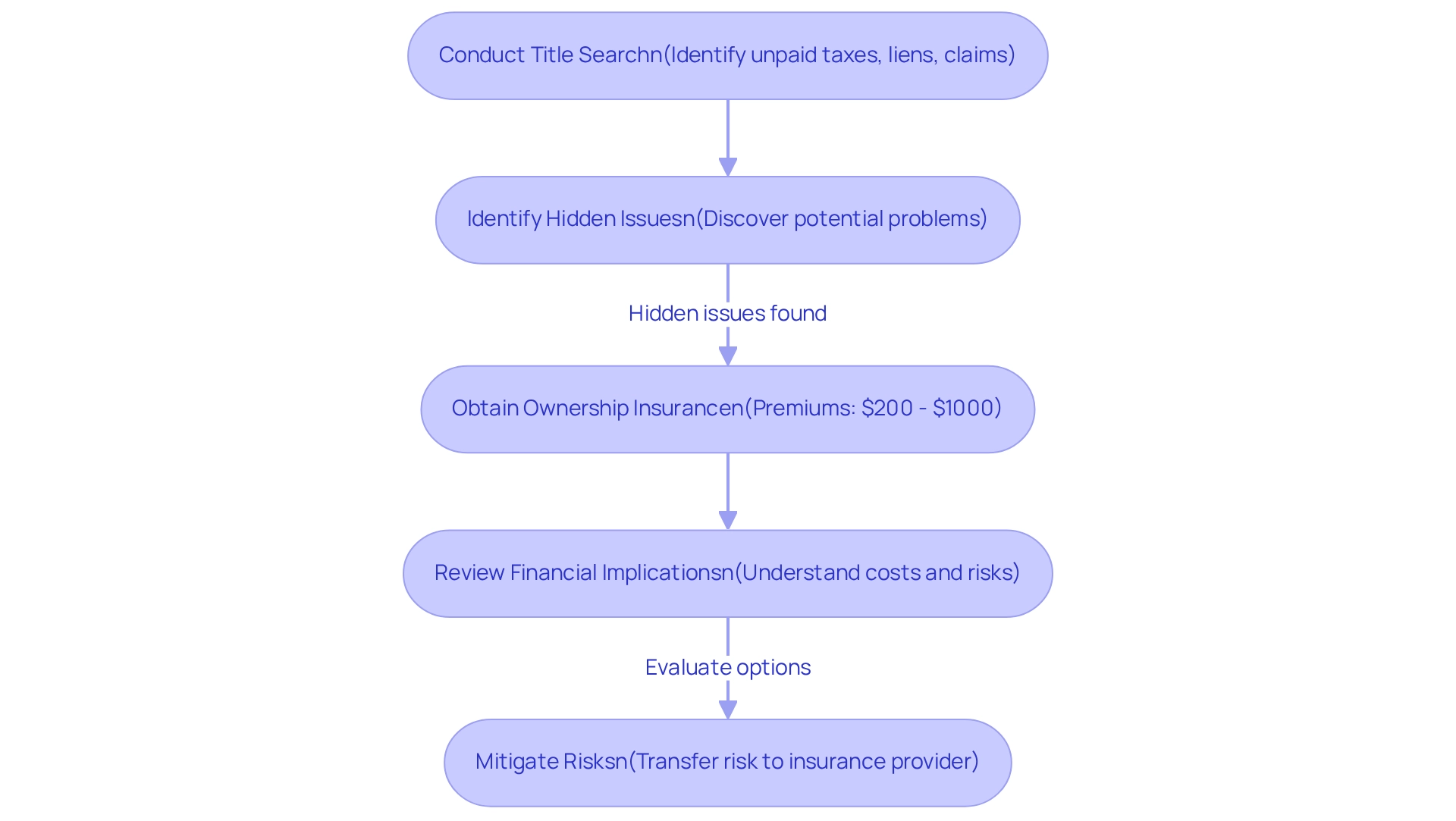

In real estate transactions, understanding what is is paramount for safeguarding investments and mitigating disputes. A comprehensive investigation can reveal hidden issues such as unpaid taxes, liens, or claims from prior owners that threaten the purchaser's ownership rights. For example, a buyer who neglects a meticulous document review might later discover a lien, resulting in unexpected financial responsibilities.

Statistics indicate that approximately 85% of purchasers secure after conducting a search, underscoring its critical role in protecting against potential legal complications. from $200 to over $1000, illustrating the financial ramifications of this essential protection. Furthermore, is often a prerequisite for obtaining ownership insurance, which offers additional safeguards against unforeseen challenges.

While for ownership insurance may breed skepticism among homebuyers, this statistic fails to capture the extensive efforts required to resolve ownership disputes. Another perspective suggests that forgoing ownership insurance could lead to significant losses should a property issue arise, emphasizing the importance of transferring that risk to an insurance provider.

In 2025, the evolving landscape of ownership insurance, driven by emerging technologies, enhances efficiency in ownership assessments and highlights the necessity of thorough inquiries. As noted by , owner's insurance protects against issues that even a diligent search may not reveal. Ultimately, understanding what is title verification not only streamlines the transaction process but also instills confidence in buyers, ensuring their investments are well-protected.

Conclusion

Title verification stands as a crucial cornerstone in real estate transactions, an aspect that demands unwavering attention. By meticulously examining public records and historical documents, this process not only confirms legal ownership but also uncovers potential issues that may threaten property investments. The historical evolution of title verification underscores its significance, transitioning from informal ownership claims to a structured, technology-enhanced process that effectively shields buyers from fraud and legal disputes.

Grasping the key components of title verification—conducting a title search, scrutinizing property records, and identifying liens—is imperative for successfully navigating the complexities of property ownership. Statistics reveal that a considerable percentage of transactions face title-related challenges, underscoring the necessity of diligent verification and title insurance for buyers. The financial repercussions of overlooking this essential step can be dire, potentially resulting in unexpected liabilities and costly legal entanglements.

As the real estate landscape evolves, the integration of advanced technologies in title verification promises to bolster efficiency and accuracy, reinforcing its indispensable role in securing property investments. Ultimately, a comprehensive title verification process not only safeguards buyers but also cultivates confidence in the real estate market, ensuring that ownership claims are both valid and secure. With appropriate measures in place, buyers can approach their transactions with assurance, knowing their investments are shielded from unforeseen complications.

Frequently Asked Questions

What is title verification?

Title verification is a crucial process that confirms the legal ownership of a property by examining public records and historical documents. It ensures that the seller has the authority to transfer ownership and that no outstanding claims or liens exist against the property.

Why is title verification important in real estate transactions?

Title verification is important because it protects purchasers from potential fraud, legal conflicts, and financial losses by ensuring that ownership is clear and marketable. It helps to avoid issues that could arise from unclear ownership.

What percentage of real estate transactions encounter ownership problems?

Approximately 25% of real estate transactions encounter ownership problems, which underscores the necessity of comprehensive property examinations.

What is a Loan Policy of ownership insurance?

A Loan Policy of ownership insurance is often required by lenders before granting a loan. It ensures that title verification is established after a thorough search for possible issues related to the property's ownership.

What risks do purchasers face without careful assessment of ownership?

Without careful assessment of ownership, purchasers risk acquiring properties with hidden problems that may lead to expensive legal disputes later.

What are common remedial actions taken in response to ownership issues?

Common remedial actions include obtaining releases for identified liens, such as mortgages and unpaid taxes, to address ownership challenges before property transactions can proceed.

How can a real estate lawyer assist with title verification?

A real estate lawyer can re-submit public documents to amend prior mistakes, highlighting the significance of comprehensive ownership checks in the title verification process.

What emotional aspect motivates people to understand title verification?

The emotional fulfillment of owning a home is a major motivator for many, making it crucial to understand title verification to ensure a smooth transaction.