Overview

The significance of title verification in real estate is paramount, as it plays a crucial role in confirming legal ownership and ensuring that properties are devoid of claims or encumbrances that could obstruct transactions.

- Thorough title checks are essential; they safeguard buyers against legal disputes and financial losses.

- Furthermore, the risks associated with inadequate verification cannot be overstated.

- Employing advanced technologies enhances the efficiency and accuracy of the title verification process, ultimately providing a robust solution that benefits all parties involved.

Introduction

In the intricate world of real estate, the process of title verification serves as a crucial safeguard for both buyers and sellers. This essential procedure not only confirms legal ownership but also ensures that properties are free from encumbrances that could hinder a smooth transaction.

As the real estate landscape evolves, understanding the significance of thorough title verification becomes increasingly important. From mitigating legal disputes to leveraging cutting-edge technology, this article explores the multifaceted role of title verification in securing property transactions.

It highlights the risks associated with incomplete verification and the transformative impact of modern advancements in the field.

Define Title Verification and Its Role in Real Estate

The importance of is a vital procedure in property transactions, confirming the and ensuring it is free from encumbrances or claims that could obstruct ownership transfer. This process underscores the for safeguarding buyers against potential legal disputes and financial losses. By performing , real estate experts can verify that the seller possesses the legal authority to sell the property, thus establishing a .

Typically, this process entails a meticulous review of public records, including deeds, mortgages, and liens, to validate ownership authenticity and uncover any potential issues that may arise during the transaction. Recent statistics indicate that approximately 35.4% of marketing decision-makers in the U.S. identify misunderstandings about property value as a significant challenge in generating quality leads, underscoring the necessity of , which highlights the importance of title verification in real estate.

Moreover, recent legal disputes have highlighted the repercussions of inadequate ownership checks, further emphasizing the importance of title verification in real estate to prevent . Numerous success stories exist where has facilitated seamless transactions, reinforcing its role as a fundamental aspect of property dealings, underscoring the importance of title verification in real estate, especially as the property market evolves in 2025. Not only does it guarantee property ownership, but it also emphasizes the importance of title verification in real estate, fostering trust within the market and empowering professionals to navigate transactions with assurance. Engaging with real estate information can ignite meaningful discussions regarding market dynamics, further accentuating the in today’s real estate landscape.

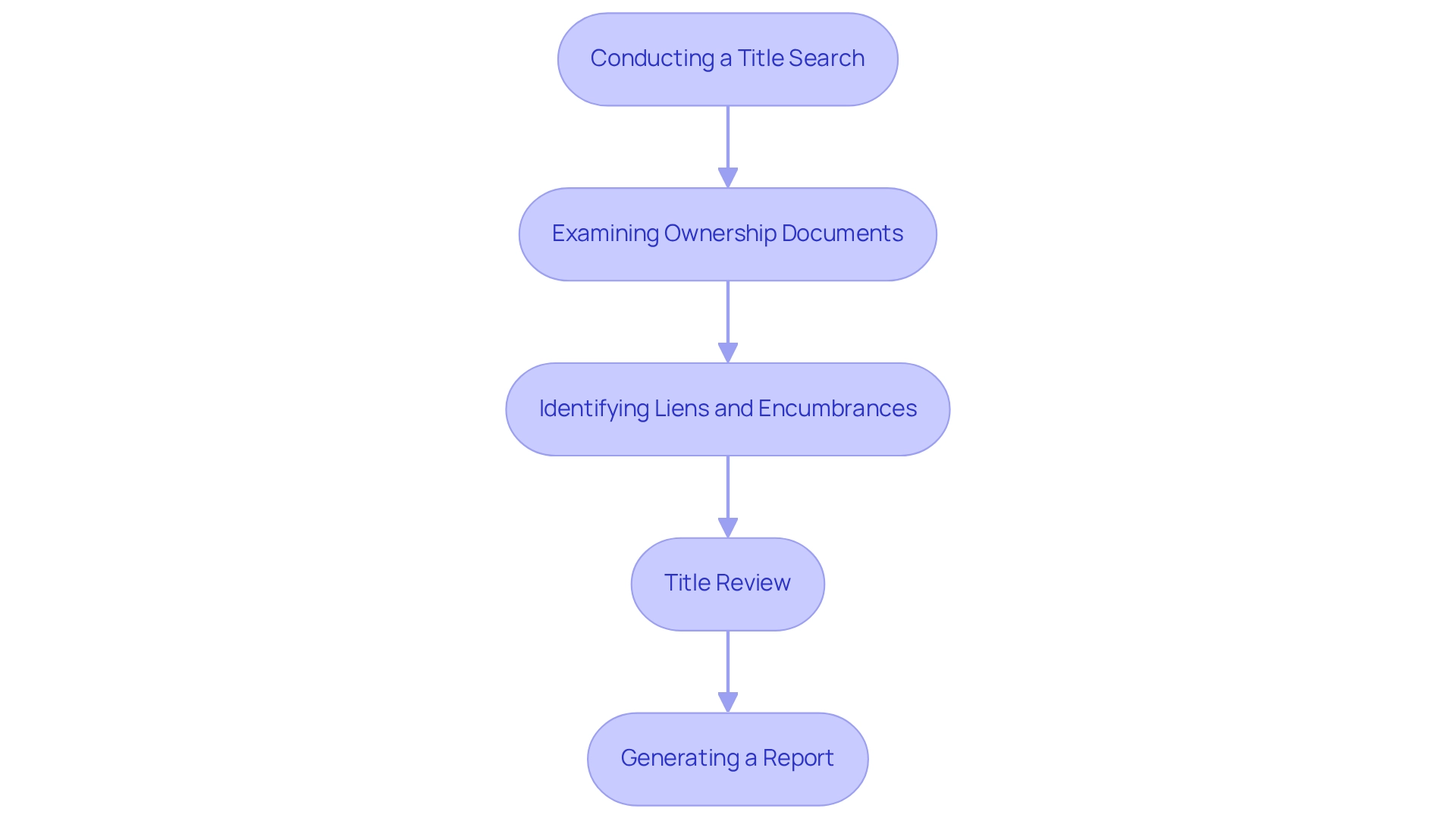

Explore the Title Verification Process: Searches and Examinations

The document verification process underscores the to ensure that property transactions are secure and legitimate. It consists of several crucial steps:

- : This foundational step involves searching public records to compile information about the property's history, including previous owners, liens, and any legal claims.

- : Ownership researchers meticulously review documents such as deeds, mortgages, and tax records to confirm that ownership is clear and free from encumbrances.

- : Any existing liens, such as unpaid taxes or mortgages, must be identified and resolved prior to the sale of the property. This step is critical, as unresolved liens can complicate or even halt transactions.

- Title Review: A comprehensive assessment of the gathered documents is performed to confirm the authenticity of ownership and to reveal any possible concerns that might affect the transaction.

- : Finally, a detailed report is created, summarizing the findings and outlining any issues that need to be addressed before finalizing the sale. This report serves as an essential resource for closing agents and attorneys, who frequently assist in selecting and obtaining insurance for ownership.

Recent trends indicate that the average time taken for property searches in real estate has decreased significantly due to . Many professionals now complete searches in a fraction of the time previously required. For example, the combination of machine learning and optical character recognition has simplified the review of document titles, enabling faster and more precise outcomes. Specific statistics indicate that the average search duration has decreased from several weeks to only a few days, highlighting the influence of these technological advancements.

Case studies emphasize successful document examination processes, illustrating how effective validation can enable smoother transactions. For instance, a recent retail development initiative demonstrated how a well-conducted document search and review process aided in obtaining a $4.2 million conventional loan. This underscores the [importance of title verification in real estate](https://proplogix.com/blog/infographic-2021-state-of-the-title-industry-report-highlights) financing. As Amanda Farrell observed, 'While many buyers still appreciate the in-person closing experience, offering additional consumer options is always beneficial,' highlighting the importance of document confirmation in improving during property transactions.

As the insurance sector develops, it remains crucial for professionals to stay informed about the latest validation procedures and trends to enhance their workflows and ensure adherence in an increasingly intricate market.

Identify Risks of Incomplete Title Verification and Consequences

The importance of in real estate is underscored by the significant risks posed by incomplete , which can lead to far-reaching consequences for transactions. Key risks include:

- Legal Disputes: Buyers may encounter if they acquire properties with undisclosed claims or liens, leading to disputes with previous owners or creditors. Furthermore, fraud can result in a designation being marked as unclear, complicating ownership claims.

- : Unexpected costs can arise from resolving , including expenses for clearing liens or legal fees associated with disputes. In fact, financial losses due to insufficient ownership verification can be substantial; for instance, in Q3 2016, 72 out of every 10,000 homes owned by were in foreclosure, highlighting the financial impact of ownership issues.

- Inability to Secure Financing: Lenders require a clear ownership document to approve mortgages; any ownership issues can jeopardize financing options, complicating the buying process.

- Marketability Concerns: Properties with unresolved ownership issues may encounter difficulties in future sales, obstructing the owner's capacity to profit from their investment.

- Loss of Investment: Ultimately, neglecting comprehensive document examination can result in the loss of both the property and the financial commitment made in it.

Tackling these risks in advance is crucial for protecting transactions and emphasizes the in real estate to uphold the integrity of the property market. Additionally, as illustrated in the case study titled "Addressing Title Disputes," handling disputes promptly and efficiently is crucial to protect clients' interests. With the typical home down payment in 2021 being $27,850, the stakes involved in real estate deals are substantial, highlighting the importance of .

Leverage Technology for Efficient Title Verification

Utilizing technology in document authentication significantly enhances both efficiency and precision. The cannot be overstated, particularly considering the challenges faced by organizations in this field. Key technologies include:

- Machine Learning: Advanced algorithms, such as those provided by Parse AI, swiftly analyze extensive data sets, uncovering patterns and discrepancies that may elude human researchers. This capability is essential, particularly as 35% of organizations have yet to embrace , emphasizing a . Furthermore, and interpretation, enabling researchers to finalize abstracts and reports more quickly and with greater accuracy.

- Optical Character Recognition (OCR): OCR technology facilitates the rapid digitization of paper documents, allowing researchers to efficiently extract relevant information from scanned files.

- Blockchain: By implementing blockchain technology, the recording of property transactions becomes secure and transparent, effectively reducing fraud risks and ensuring tamper-proof ownership records.

- Cloud-Based Solutions: Cloud technology fosters real-time collaboration among property researchers, real estate agents, and clients, streamlining communication and document sharing.

- Automated Document Searches: Software solutions, including those from Parse AI, can , significantly reducing the time needed for searches and minimizing human error.

The has demonstrated substantial improvements in workflow efficiency, showcasing the transformative potential of these technologies. By embracing these innovations, can enhance their operations, achieve cost savings, and recognize the importance of title verification in real estate to improve overall accuracy.

Conclusion

The process of title verification stands as a pivotal element in the realm of real estate, ensuring that property transactions are not only legitimate but also secure. By confirming legal ownership and identifying any encumbrances, title verification protects buyers from potential disputes and financial losses. The comprehensive steps involved—from conducting title searches to issuing detailed reports—underscore the necessity of this process in maintaining a clear chain of ownership.

Furthermore, the risks associated with incomplete title verification cannot be overstated. Legal disputes, financial losses, and challenges in securing financing are just a few of the potential consequences that can arise from neglecting thorough verification. The stakes are high; unresolved title issues can hinder marketability and ultimately lead to the loss of investment.

As the landscape of real estate continues to evolve, the integration of technology into title verification processes offers promising advancements. Tools like machine learning, optical character recognition, and blockchain are revolutionizing how title searches are conducted, making them faster and more accurate. By embracing these innovations, real estate professionals can streamline operations and enhance the overall consumer experience during transactions.

In conclusion, the importance of diligent title verification in real estate cannot be emphasized enough. It serves as a cornerstone for safe and successful property transactions, fostering trust and confidence in the market. As the industry progresses, staying informed about the latest verification processes and technological advancements will be crucial for all stakeholders involved in real estate transactions.

Frequently Asked Questions

What is the importance of title verification in real estate?

Title verification is crucial in property transactions as it confirms the legal ownership of a property and ensures it is free from encumbrances or claims that could obstruct ownership transfer. This process protects buyers from potential legal disputes and financial losses.

What does the title verification process involve?

The title verification process involves a meticulous review of public records, including deeds, mortgages, and liens, to validate ownership authenticity and uncover any potential issues that may arise during the transaction.

Why is clear ownership confirmation necessary in real estate?

Clear ownership confirmation is necessary because misunderstandings about property value can hinder generating quality leads. It ensures that the seller has the legal authority to sell the property and establishes a clear chain of ownership.

What are the consequences of inadequate ownership checks?

Inadequate ownership checks can lead to legal disputes and costly lawsuits, emphasizing the importance of thorough title verification to prevent such issues.

How does title verification contribute to trust in the real estate market?

Title verification fosters trust within the market by guaranteeing property ownership and empowering professionals to navigate transactions with assurance, which is essential as the property market evolves.

What role does title verification play in successful property transactions?

Diligent document validation through title verification facilitates seamless transactions and reinforces its role as a fundamental aspect of property dealings, ensuring legitimate property ownership.