Overview

The article delves into the mechanics of title verification, outlining its critical steps, inherent challenges, and innovative technological solutions. It underscores the vital role of meticulous title verification in real estate transactions, which is essential for establishing clear ownership and mitigating associated risks. Evidence of challenges such as incomplete records and discrepancies is presented, alongside advancements in technology—such as machine learning and OCR—that significantly enhance the efficiency and accuracy of the verification process.

Introduction

In the intricate world of real estate, the significance of title verification is paramount. This essential process acts as a safeguard, ensuring that property ownership is legitimate and devoid of hidden claims or liens that could jeopardize transactions.

As buyers and lenders navigate the complexities of property transfers, grasping the nuances of title verification becomes crucial. Furthermore, with advancements in technology, such as machine learning and optical character recognition, the landscape of title research is evolving, rendering it more efficient and accurate than ever before.

This article delves into the multifaceted aspects of title verification, exploring its significance, the step-by-step process, the challenges faced, and the innovative technologies that are reshaping the industry.

Define Title Verification and Its Importance

The process of involves a comprehensive review of public documents to establish rightful ownership of an asset and to uncover any claims or liens that may exist. Understanding how title verification works is crucial, as it ensures the seller possesses the authority to transfer ownership and that the asset is free of liens. Failing to conduct thorough ownership checks exposes purchasers to the risk of acquiring assets with unresolved issues, potentially leading to costly legal disputes and significant financial setbacks. In the realm of real estate, understanding how title verification works serves as a vital safeguard for both buyers and lenders, affirming that transactions are legitimate and secure. Recent findings indicate that understanding how title verification works is crucial in preventing potential legal and financial complications in property transactions. Furthermore, property owners are strongly encouraged to address any ownership discrepancies promptly to mitigate risks, underscoring the proactive approach necessary in ownership assessment.

As Jhonny Isakson noted, the real estate sector provides profound insights into community dynamics and governmental influence, underscoring the necessity of thorough ownership assessment in fostering trust and stability in real estate transactions. This connection highlights that understanding legal ownership is essential not only for individual transactions but also for the broader community.

Case studies, such as those showcasing Parse AI's innovative approach, demonstrate how leveraging machine learning and optical character recognition can streamline the ownership verification process. By addressing the challenges faced in traditional research methods, Parse AI enables researchers to complete abstracts and reports more efficiently. This not only enhances accuracy but also results in significant cost savings compared to conventional techniques, emphasizing the importance of adopting advanced technologies in research.

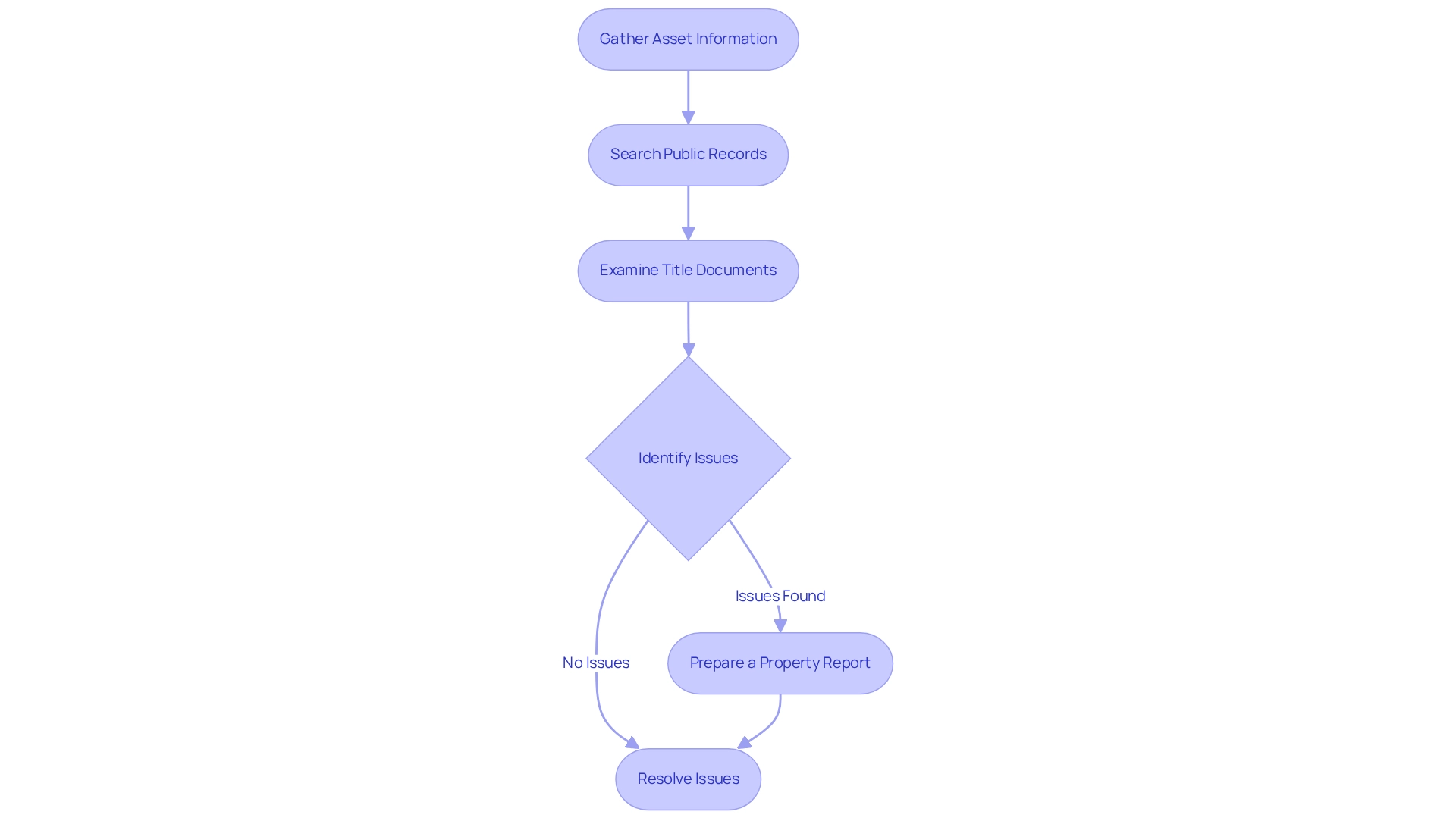

Outline the Title Verification Process

The verification procedure is crucial for ensuring clear ownership and demonstrates how title verification works, typically involving several key steps:

- Gather Asset Information: Begin by collecting essential details about the asset, including its official description, address, and current owner.

- Search Public Records: Access public records through local government offices or online databases to uncover the asset's ownership history, which includes prior owners and or encumbrances.

- Examine Title Documents: Review pertinent documents such as deeds, mortgages, and liens to confirm their validity and proper execution.

- Identify Issues: Scrutinize the documents for discrepancies, such as missing signatures, incorrect property descriptions, or unresolved liens that could impact ownership.

- Prepare a Property Report: Compile your findings into a comprehensive property report that details the ownership history and highlights any issues requiring resolution before proceeding with the transaction. This report is essential for negotiations, especially in complex cases like foreclosure mediation.

- Resolve Issues: Collaborate with legal experts to address any recognized concerns, ensuring that ownership is clear before finalizing the sale. Prompt resolution is vital, as homeowners may face eviction as early as 15 days following a ratified sale.

In 2025, the average duration for ownership confirmation has significantly improved due to technological advancements, with numerous transactions now completed in a fraction of the time previously required. Effective examples of document assessment in real estate dealings, particularly in intricate situations like foreclosure mediation, illustrate the efficiency of this process. By diligently following these steps, real estate professionals can enhance their workflow efficiency and mitigate risks associated with ownership disputes by understanding how title verification works.

Identify Challenges in Title Verification

The challenges in how title verification works can impede the efficiency and accuracy of real estate transactions.

- Incomplete Records: A notable percentage of public records are often found to be incomplete, complicating the establishment of a clear chain of ownership. Research suggests that roughly 30% of public records might be lacking, especially in assets that have exchanged ownership multiple times or have been passed down, leading to unresolved probate or heirship issues.

- Discrepancies in Information: Variations in names, addresses, or legal descriptions can create confusion and potential disputes. Such discrepancies may arise from clerical errors or changes in ownership over time, necessitating meticulous cross-referencing to ensure accuracy.

- Liens and Encumbrances: Existing liens or claims against a property can complicate the transfer process. Title researchers must identify and address these issues, which may involve negotiation or settlement, adding layers of complexity to the transaction.

Furthermore, the complex terminology found in property documents can pose challenges for individuals without a legal background. Misinterpretations of these documents can lead to significant errors, underscoring the need for professional expertise in navigating legal complexities.

- Time Constraints: The fast-paced nature of real estate transactions often imposes tight deadlines on document researchers. This urgency can increase the risk of oversight or errors, making it essential to implement efficient processes that maintain accuracy under pressure.

Addressing these challenges is crucial for understanding how title verification works to ensure . As Rande Yeager, president of the American Land Association, states, "This clearly demonstrates the importance of a professional search of property records in all real estate transactions, whether acquiring a new home or refinancing an existing mortgage." As the expectations of homebuyers evolve, particularly among younger generations seeking seamless online experiences, professionals in the field must adjust their services to meet these needs while reducing friction in the closing process. Recent conversations underscore the significance of recognizing and addressing typical problems during a property search to guarantee a successful foreclosure sale, further stressing the necessity for comprehensive document examination.

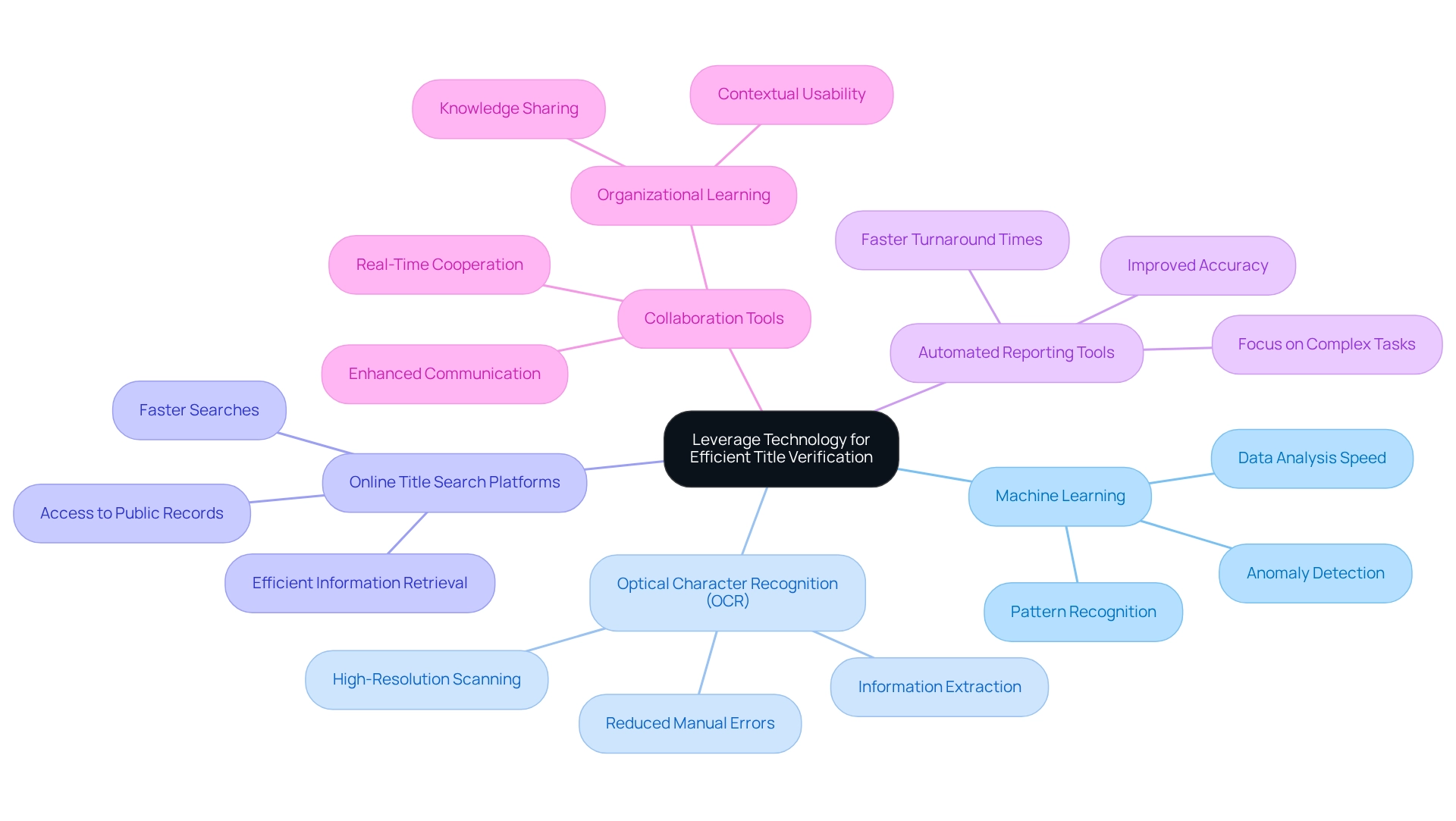

Leverage Technology for Efficient Title Verification

To enhance the efficiency of title verification, can leverage advanced technologies to understand how title verification works.

- Machine Learning: By utilizing machine learning algorithms, professionals can examine large datasets of document titles, effectively recognizing patterns and anomalies that may indicate potential issues. This approach significantly accelerates how title verification works and enhances the accuracy of the process.

- Optical Character Recognition (OCR): Implementing high-resolution OCR technology, particularly at 300 DPI or higher, allows for rapid digitization and extraction of information from physical documents. High-resolution scanning can lead to better OCR accuracy, reducing manual data entry mistakes and streamlining the workflow, making research more efficient.

- Online Title Search Platforms: Comprehensive online databases that aggregate public records simplify access to property information. These platforms allow faster searches and aid in the retrieval of crucial information, thus enhancing overall efficiency in how title verification works.

- Automated Reporting Tools: Utilizing software that automates the generation of reports can lead to faster turnaround times and improved accuracy. This technology reduces human error and enables researchers to concentrate on more intricate tasks.

- Collaboration Tools: Cloud-based platforms promote real-time cooperation among researchers, legal professionals, and clients. As NASA noted, "organizational learning takes place when knowledge is shared in usable ways among organizational members." This guarantees that all parties are informed and aligned throughout the validation process, enhancing communication and efficiency.

The incorporation of these technologies not only simplifies property authentication but also demonstrates how title verification works as part of a wider trend in real estate towards utilizing creative solutions for enhanced operational effectiveness. For example, the concepts explored in the case study named 'Design for Maintainability' emphasize the significance of creating systems with maintainability considered, which can result in lower maintenance expenses and in verification processes. As machine learning continues to evolve, its role in transforming title research will only grow, making it an essential component of modern real estate practices.

Conclusion

Title verification stands as a cornerstone in the real estate industry, ensuring that property transactions are secure and legitimate. By thoroughly examining public records, this process confirms legal ownership and uncovers any potential claims or liens that could pose risks to buyers and lenders. The importance of diligent title verification cannot be overstated; it not only protects individual transactions but also fosters trust and stability within the broader community.

The title verification process is systematic and includes essential steps such as:

- Gathering property information

- Searching public records

- Preparing comprehensive title reports

While advancements in technology have streamlined these processes, challenges such as incomplete records, discrepancies in information, and complex legal language remain prevalent. Addressing these obstacles is vital for successful transactions, as they can lead to costly disputes and delays.

Furthermore, embracing innovative technologies like machine learning and optical character recognition is pivotal for enhancing the efficiency of title verification. These tools not only expedite the verification process but also improve accuracy, allowing professionals to focus on more complex issues. As the real estate landscape continues to evolve, leveraging these advancements will be crucial in meeting the demands of modern buyers and ensuring smooth transactions.

In summary, the significance of title verification in real estate cannot be overlooked. It serves as a critical safeguard against potential legal and financial pitfalls, reinforcing the necessity for thorough and efficient practices. By embracing technology and addressing inherent challenges, real estate professionals can enhance their workflows, mitigate risks, and ultimately contribute to a more secure and trustworthy property market.

Frequently Asked Questions

What is the process of title verification?

The process of title verification involves a comprehensive review of public documents to establish rightful ownership of an asset and to uncover any claims or liens that may exist.

Why is understanding title verification important?

Understanding title verification is crucial as it ensures that the seller has the authority to transfer ownership and that the asset is free of liens, protecting buyers from acquiring assets with unresolved issues.

What risks do buyers face if title verification is not conducted thoroughly?

Failing to conduct thorough ownership checks exposes purchasers to the risk of acquiring assets with unresolved issues, potentially leading to costly legal disputes and significant financial setbacks.

How does title verification benefit the real estate sector?

Title verification serves as a vital safeguard for both buyers and lenders, affirming that transactions are legitimate and secure, which fosters trust and stability in real estate transactions.

What should property owners do if there are ownership discrepancies?

Property owners are strongly encouraged to address any ownership discrepancies promptly to mitigate risks associated with ownership assessment.

How can advanced technologies improve the title verification process?

Technologies such as machine learning and optical character recognition, as demonstrated by Parse AI, can streamline the ownership verification process, enhance accuracy, and result in significant cost savings compared to conventional techniques.