Overview

To ascertain whether a property has a lien, it is essential to undertake a thorough investigation. This involves:

- Gathering pertinent property details

- Visiting the county recorder's office

- Leveraging online databases to uncover any recorded claims

The article delineates a systematic approach for this inquiry, underscoring the necessity of meticulousness to mitigate risks associated with property transactions. It highlights prevalent issues that may emerge during the search and provides effective strategies for addressing them.

Introduction

Navigating the intricate world of property transactions necessitates a robust understanding of liens, which represent legal claims against assets and often complicate ownership and financing. Mortgage liens secure loans, while tax liens are imposed by governments for unpaid dues; each type presents distinct challenges and risks. Real estate professionals must be proficient in identifying and addressing these claims to protect their interests and those of their clients.

As the landscape of property ownership evolves, the need for meticulous lien searches becomes paramount—this essential step can reveal hidden liabilities and avert costly mistakes. This article explores the various types of liens, outlines the process of conducting thorough searches, and highlights common pitfalls to avoid, equipping readers with the knowledge to navigate this critical aspect of real estate with confidence.

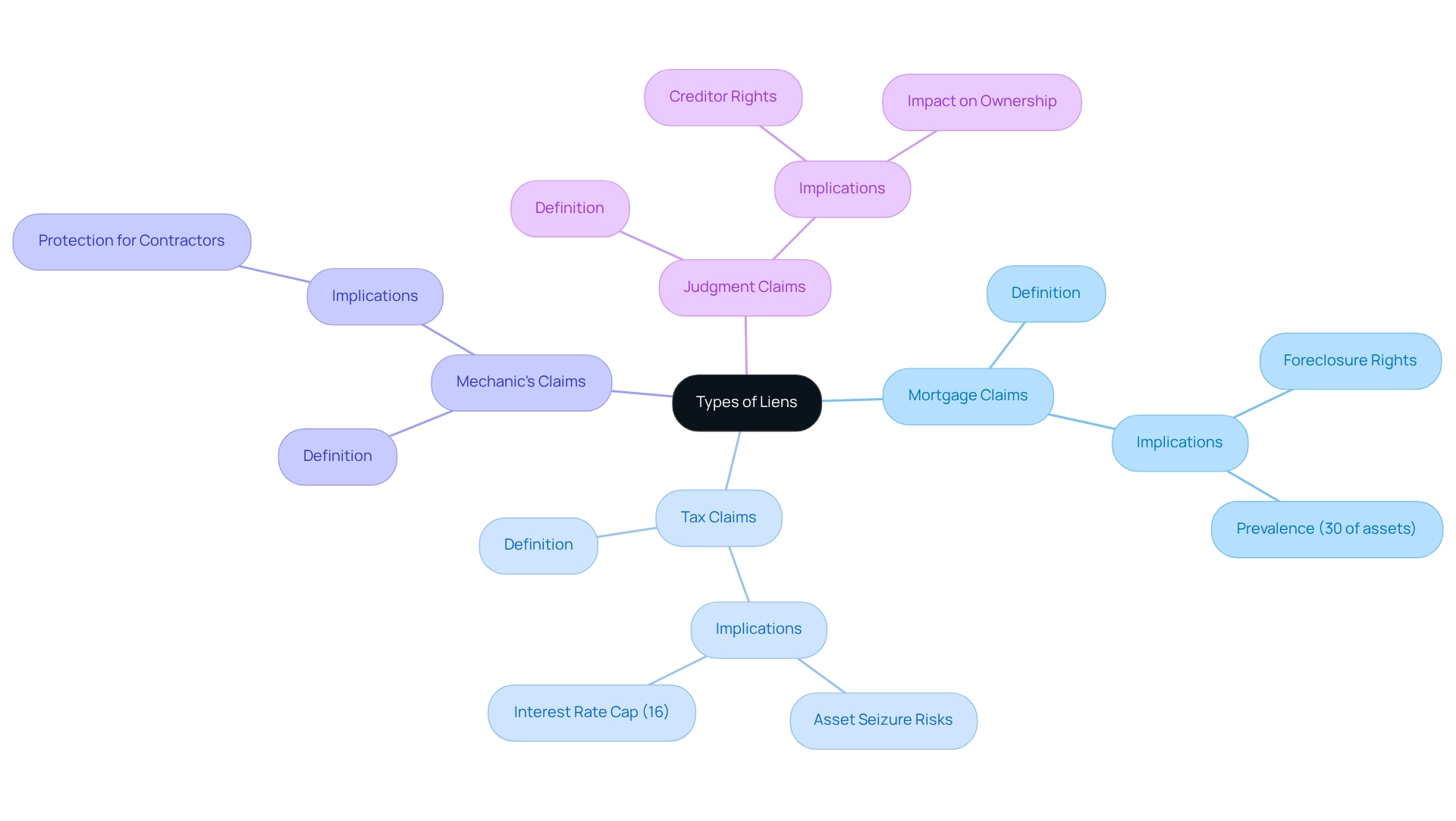

Understand Liens: Definition and Types

A legal claim signifies a right against an asset, serving as security for a debt. For real estate professionals, understanding the various types of liens is essential, especially when it comes to knowing how to check if property has lien to mitigate risks associated with property transactions.

- Mortgage Claims: These voluntary encumbrances are established by lenders when financing an asset. In the event of borrower default, lenders possess the right to foreclose, reclaiming the asset to recover their investment. As of 2025, approximately 30% of assets in the U.S. carry mortgage encumbrances, underscoring their prevalence in the real estate sector.

- Tax Claims: Enforced by governmental bodies for unpaid real estate taxes, tax claims can lead to asset seizure if not resolved. For example, in Maricopa County, Arizona, tax sale statistics indicate a maximum interest rate cap of 16%. This cap illustrates the financial repercussions for owners who neglect their tax responsibilities; failure to pay can result in significant financial loss and potential asset forfeiture.

- Mechanic's Claims: These claims are filed by contractors or suppliers who have not received payment for services rendered on a site. Mechanic's claims ensure that these parties can seek compensation directly from the owner, thereby protecting their financial interests.

- Judgment Claims: Resulting from court rulings against asset owners, judgment claims empower creditors to assert a right over the asset to satisfy unpaid obligations. This type of encumbrance can profoundly impact the ownership and marketability of real estate. Understanding how to check if property has lien is vital for assessing potential risks when acquiring or refinancing property. The National Tax Lien Association (NTLA) plays a pivotal role in educating property professionals about these complexities, advocating for informed decision-making among stakeholders in the property sector. Furthermore, case studies on , such as 'Risks and Rewards of Tax Encumbrance Investing,' underscore the importance of due diligence. Investors must remain cognizant of legal regulations concerning certificate expiration and foreclosure procedures to avoid pitfalls, emphasizing the necessity of comprehending claims in real estate dealings.

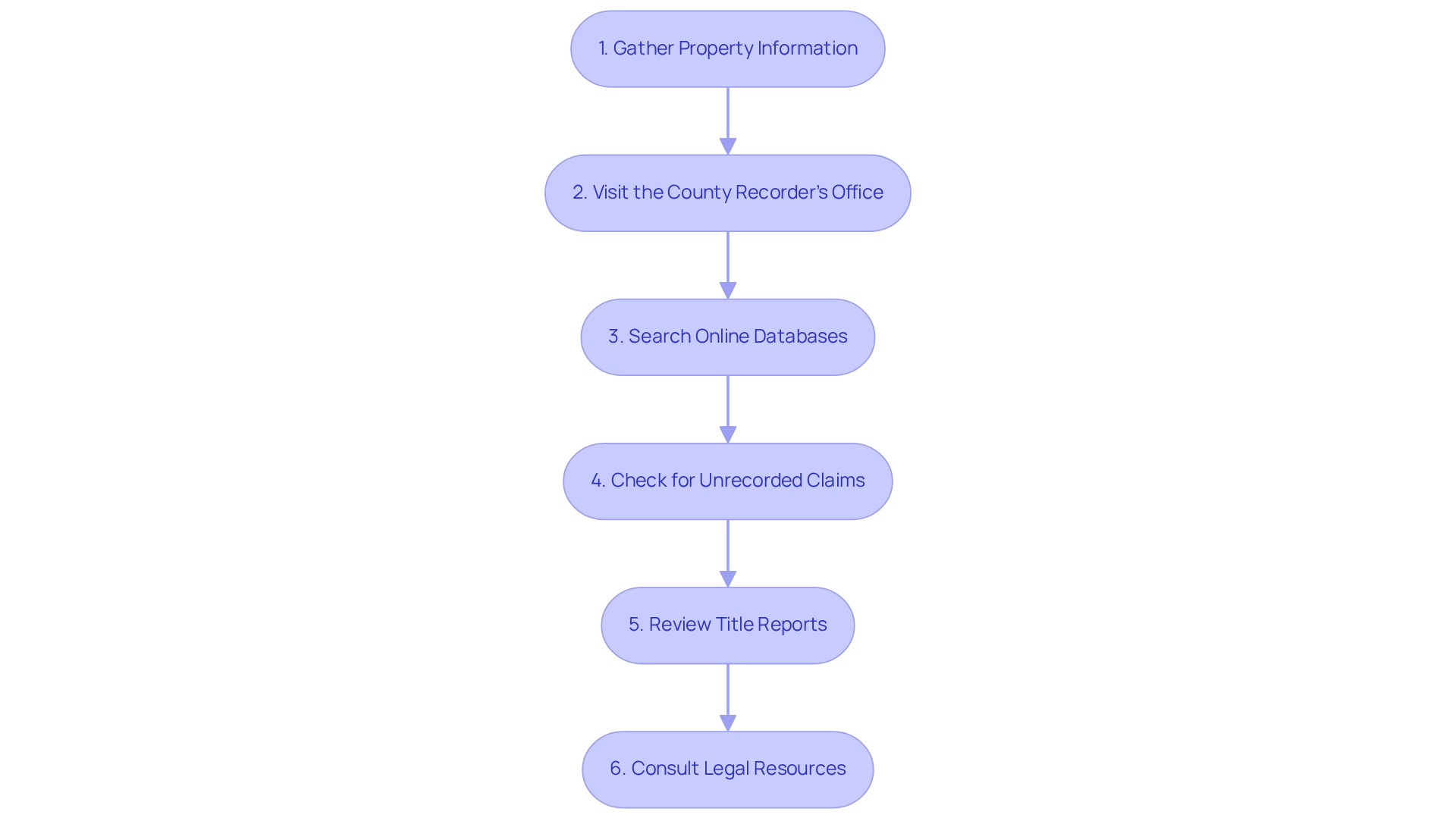

Conduct a Comprehensive Lien Search: Step-by-Step Process

To conduct a thorough title investigation, adhere to the following steps:

- Gather Property Information: Begin by collecting essential details, such as the property address, parcel number, and any relevant identifiers. Accurate information is crucial for effective searches.

- Visit the County Recorder's Office: Initiate your claim investigation at the county recorder, clerk, or assessor's office. By 2025, a significant percentage of counties will offer online search capabilities, enhancing accessibility.

- Search Online Databases: Utilize the online resources provided by the county or state. Input the property address and carefully examine the results for any recorded claims, including mortgage, tax, judgment, and HOA claims, which are typical types to consider.

- Check for Unrecorded Claims: Be aware that some claims may not be officially recorded. To uncover these, reach out to local organizations or employ specialized search services that can provide deeper insights. Parse AI's advanced machine learning tools, including the example manager, can expedite this process by automating document processing and enhancing the accuracy of information extraction.

- Review Title Reports: If available, obtain a title report from a reputable title company. This report can provide a comprehensive summary of any claims linked to the asset, ensuring you have all relevant information. With Parse AI's title research automation, you can extract critical information from title documents more efficiently, facilitating quicker and more accurate report generation.

- Consult Legal Resources: For complex issues or uncertainties, consulting a real estate attorney can offer valuable guidance and clarity on any legal implications. After completing a claim investigation, it is crucial to examine and resolve any discovered claims with legal or financial experts, especially when considering how to check if property has lien.

By following these procedures, you can conduct a comprehensive inquiry into any claims on the asset, thereby protecting your interests as a buyer or investor. The role of is essential in this process, as they assist in safeguarding purchasers and investors from potential financial risks. Furthermore, case studies, including the Military Request for Relief initiative, underscore the importance of addressing encumbrances proactively, providing supportive solutions for property owners facing financial challenges due to such claims. As Allison Werner, a Broker-Associate, aptly stated, "Your reputation as a realtor is truly the only asset you possess," emphasizing the importance of thorough property investigations for maintaining professional integrity.

Troubleshoot Common Issues in Lien Searches

When conducting a lien search, several common issues may arise that can complicate the process:

- Incomplete Records: A significant percentage of public property databases contain incomplete records, hindering accurate assessments. To mitigate this, it is essential to consult multiple sources, including online databases and local government offices, ensuring comprehensive coverage.

- Errors in Public Records: Mistakes in public records are not uncommon and can lead to significant confusion. Cross-referencing information against various sources is crucial, and obtaining a title report adds an additional layer of accuracy.

- Unregistered Claims: Some claims may remain unregistered in public databases, presenting a risk during transactions. Engaging with community organizations or employing specialized claim investigation services can reveal these concealed assertions, ensuring a more thorough inquiry.

- Complex Legal Language: The legal terminology found in documents can be challenging to interpret. If difficulties arise, seeking guidance from a real estate attorney or title professional is advisable to clarify uncertainties. As mentioned, "If you're uncertain about the intricacies of lien inquiries or require help in understanding the information revealed, it is recommended to seek advice from experts."

- Time Constraints: Tight deadlines can pressure the discovery process. To manage this efficiently, prioritize essential records initially and consider employing tools or engaging a professional service to expedite retrieval and ensure comprehensiveness.

By identifying these potential issues and utilizing effective troubleshooting strategies, you can enhance the efficiency and reliability of how to check if property has lien. For instance, properties with outstanding municipal fines or code violations can delay closings; therefore, involving municipal departments in your inquiries can proactively address these warning signs. This underscores the importance of conducting a thorough appraisal of the assets being offered as collateral, which is vital in real estate transactions. Furthermore, are recommended for their expertise and advanced technology, providing comprehensive and reliable results.

Conclusion

Understanding liens is crucial for anyone involved in property transactions, as they represent significant legal claims that can impact ownership and financial stability. The article details various types of liens—mortgage, tax, mechanic's, and judgment liens—each presenting unique challenges that necessitate careful consideration. By recognizing these types, real estate professionals can better assess risks and protect their clients' interests.

Conducting a comprehensive lien search involves a systematic approach, from gathering property information to consulting legal resources when necessary. The outlined step-by-step process emphasizes the importance of thoroughness in uncovering both recorded and unrecorded liens. Furthermore, utilizing technology and professional services enhances the accuracy and efficiency of this critical task, ensuring that all potential liabilities are identified.

Moreover, the article addresses common pitfalls encountered during lien searches, such as incomplete records, errors, and the complexities of legal language. By being aware of these challenges and employing effective troubleshooting strategies, individuals can navigate the lien search process more effectively. Ultimately, a meticulous approach to understanding and searching for liens can safeguard investments and uphold the integrity of real estate transactions, reinforcing the necessity of diligence in this essential aspect of property ownership.

Frequently Asked Questions

What is a legal claim in the context of real estate?

A legal claim signifies a right against an asset, serving as security for a debt.

Why is it important for real estate professionals to understand liens?

Understanding the various types of liens is essential for real estate professionals to mitigate risks associated with property transactions.

What are mortgage claims?

Mortgage claims are voluntary encumbrances established by lenders when financing an asset. If a borrower defaults, lenders have the right to foreclose and reclaim the asset.

What percentage of assets in the U.S. carry mortgage encumbrances as of 2025?

Approximately 30% of assets in the U.S. carry mortgage encumbrances.

What are tax claims and what can happen if they are not resolved?

Tax claims are enforced by governmental bodies for unpaid real estate taxes and can lead to asset seizure if not resolved.

Can you provide an example of tax claim repercussions?

In Maricopa County, Arizona, tax sale statistics indicate a maximum interest rate cap of 16%, illustrating the financial repercussions for owners who neglect their tax responsibilities.

What are mechanic's claims?

Mechanic's claims are filed by contractors or suppliers who have not received payment for services rendered on a site, allowing them to seek compensation directly from the property owner.

What are judgment claims?

Judgment claims result from court rulings against asset owners, allowing creditors to assert a right over the asset to satisfy unpaid obligations.

Why is it important to check if a property has a lien?

Checking if a property has a lien is vital for assessing potential risks when acquiring or refinancing property.

What organization plays a role in educating property professionals about liens?

The National Tax Lien Association (NTLA) plays a pivotal role in educating property professionals about the complexities of liens.

What should investors be aware of regarding tax encumbrance investing?

Investors must be cognizant of legal regulations concerning certificate expiration and foreclosure procedures to avoid pitfalls in tax encumbrance investing.