Overview

The article presents an authoritative step-by-step guide on conducting a title search, underscoring the critical importance of verifying legal ownership and identifying any liens or encumbrances associated with a property. It begins by emphasizing the significance of accurate title research. Following this, it outlines essential steps such as:

- Gathering property information

- Examining public records

- Verifying ownership

- Utilizing advanced technologies

These steps are crucial for ensuring clear titles and protecting buyers from potential legal issues in real estate transactions. Furthermore, by following this comprehensive approach, stakeholders can navigate the complexities of property ownership with confidence, ultimately safeguarding their investments.

Introduction

In the intricate world of real estate, securing a property involves more than a mere handshake or signed contract. Central to this process is the title search—a meticulous examination of public records that confirms legal ownership and reveals any potential encumbrances that may threaten a buyer's rights. Given that approximately 80% of transactions require a title search, comprehending its complexities is essential for all parties involved.

As technology evolves, so does the title search process, incorporating innovative tools that enhance both accuracy and efficiency. This article explores the critical steps involved in conducting a thorough title search, the importance of identifying liens, and the protective role of title insurance, equipping readers with the knowledge necessary to navigate this vital aspect of real estate transactions with confidence.

Understanding Title Searches: An Overview

A title search is essential for conducting a thorough review of public records to determine the legal ownership of an asset. This process involves a meticulous examination of various documents, including deeds, tax records, and any claims or liens against the asset. The primary objective is to verify that the seller possesses the legal authority to sell the property, ensuring that no outstanding encumbrances could jeopardize the buyer's ownership rights. Thus, understanding how to conduct a title search is crucial for all parties involved in real estate transactions.

An extensive examination of ownership not only mitigates the risk of future conflicts but also safeguards against potential financial losses. Statistics indicate that a significant percentage of real estate transactions—often cited as around 80%—require an ownership examination to ensure clear titles and protect buyers from unforeseen claims. Furthermore, it is noteworthy that 2% of FSBO sellers encountered challenges in attracting prospective buyers, underscoring the obstacles present in the real estate market and the necessity of comprehensive ownership investigations.

Recent trends in highlight the increasing utilization of technology, such as AI-driven tools, which streamline operations and enhance precision. For instance, case studies demonstrate that real estate professionals who integrate technology into their workflows can significantly boost efficiency and meet the evolving demands of consumers, particularly younger home buyers who favor a more seamless online experience. Parse AI, for example, offers considerable cost savings compared to traditional research methods, making it an attractive option for real estate experts.

Moreover, professional insights underscore the critical importance of understanding how to perform comprehensive property searches. Real estate experts frequently emphasize that neglecting this step can lead to severe consequences, including ownership disputes and financial liabilities. As Amanda Farrell noted in a LinkedIn survey, many individuals in the industry possess diverse experiences, with 35% indicating they were born into the business while 41% felt they were 'deceived.' This highlights the importance of grasping the document review process.

As the real estate market continues to evolve, staying informed about the latest advancements in title investigations and insurance is vital for mitigating risks associated with real estate transactions. In summary, a property examination is not merely a procedural formality; it is a fundamental component of real estate dealings that ensures legal clarity and protects the interests of all parties involved.

Essential Steps in the Title Search Process

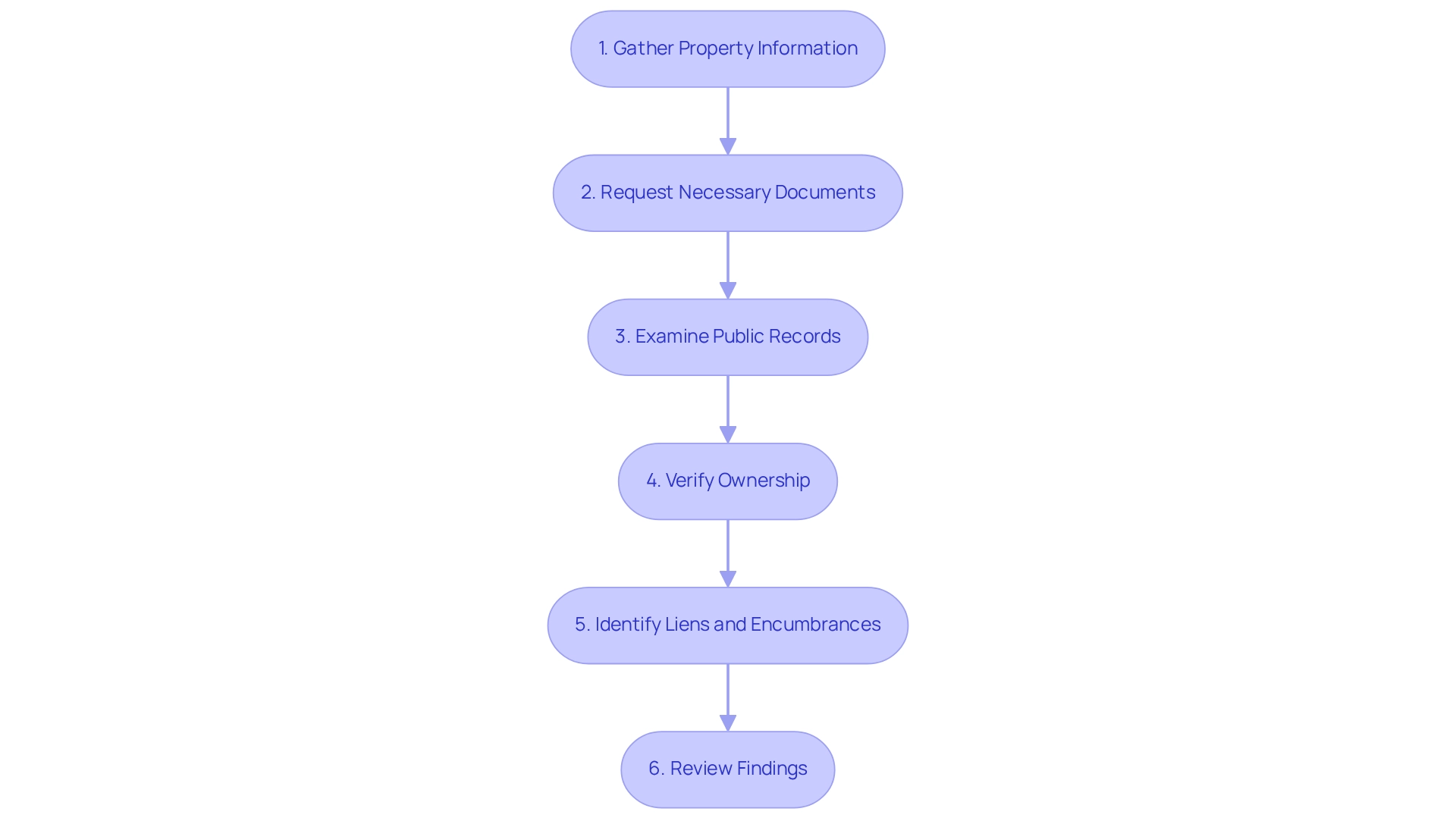

The document examination procedure is a fundamental aspect of real estate transactions, ensuring that ownership is clear and free from legal complications. The essential steps involved in conducting a comprehensive title search include:

- Gather Property Information: Begin by collecting detailed information about the property, including the address, legal description, and the name of the current owner. This foundational information is crucial for accurate searches.

- Request Necessary Documents: Acquire relevant documents from the county recorder's office or documentation company. This may encompass previous deeds, tax documents, and any current insurance policies, which are vital for understanding the asset's history.

- Examine Public Records: Conduct a meticulous review of public records to trace the asset's history. This includes analyzing previous deeds, tax assessments, and any recorded liens. In 2025, the average duration required for a complete document search is approximately 30 days, emphasizing the importance of efficiency at this stage.

- Verify Ownership: Confirm the current owner's legal right to sell the property by tracing the chain of ownership. This step is crucial to ensure that there are no unknown heirs or claims that could jeopardize the transaction. For instance, a case study involving unknown heirs illustrates how thorough ownership investigations can prevent conflicts by ensuring all possible heirs are aware and consent to the sale. As noted by Jane F. Bolin, Esq., "An ownership examination reveals if the asset you intend to purchase has mortgage liens on it," underscoring the importance of this verification step.

- Identify Liens and Encumbrances: Investigate any claims against the property that could impact ownership. This includes mortgage liens, tax liens, or other encumbrances that may not be immediately apparent but could pose significant risks post-transaction. Ownership insurance protects against unforeseen legal issues that may arise after the deal is finalized, highlighting the critical nature of a comprehensive ownership examination.

- Review Findings: Summarize the results in a detailed report, emphasizing any issues identified during the investigation. This report serves as a crucial document for both buyers and sellers, ensuring transparency and informed decision-making.

By adhering to these steps in , real estate professionals can enhance transaction efficiency and mitigate risks associated with ownership issues. Recent advancements in document examination technology, such as machine learning and optical character recognition, have further streamlined these processes, enabling quicker and more accurate results. Parse Ai's innovative approach exemplifies how technology can improve efficiency in documentation research.

A thoroughly conducted property investigation not only protects against unforeseen legal complications but also fosters confidence in real estate dealings.

Initiating the Title Search: Requesting Necessary Documents

To effectively initiate a title search, follow these essential steps:

-

Identify the Relevant Office: Begin by determining which county or municipality oversees the records for the area where the property is located. This step is crucial, as different jurisdictions may have varying processes and requirements.

-

Gather Required Information: Compile vital details about the property, such as the address, legal description, and any known previous owners. Having this information readily available will streamline the request process.

-

Submit a Request: Reach out to the county recorder's office or a document company to request the necessary documents. Common documents required for a title search include:

- Previous deeds

- Tax records

- Any existing liens or encumbrances

Timely access to these documents is vital, as it can significantly enhance the efficiency of . Utilizing advanced tools like those offered by Parse AI, including the example manager, can expedite this process, enabling quicker document retrieval and annotation from a large set of unstructured documents.

-

Pay Any Fees: Be prepared to cover any applicable fees for document retrieval, which can vary widely by location. Typically, charges for document recovery in property investigations can range from $50 to several hundred dollars, depending on the complexity of the request and the specific county's regulations. Furthermore, insurance premiums generally range from $500 to $3,500, a significant factor when planning for a search.

As you navigate the search process, staying informed about record access is crucial, as many counties are enhancing their digital platforms to facilitate online document requests. Parse AI was developed by a team of energy, real estate, and technology professionals with over 50 years of industry experience. The founders have encountered numerous challenges related to the time and resources required to confirm real property ownership.

Leveraging industry knowledge and connections, along with top-tier developers, Parse has created a platform designed to advance the sector into the future. By adhering to these steps and utilizing available resources, including the option to learn how to locate expert real estate agents across various U.S. cities and states, you can manage the search process more efficiently. Additionally, integrating Parse AI's machine learning tools can enhance your document processing capabilities, ensuring a more efficient and precise research experience.

Examining Property Records and Legal Documents

Once you have gathered the necessary documents, it is crucial to conduct a meticulous examination:

- Review the Chain of Title: Begin by tracing the ownership history of the asset through past deeds. Look for any breaks or irregularities in the chain that could signal potential issues. Understanding how to maintain a well-maintained chain of title is essential, as disruptions can lead to significant legal complications, including disputes over rightful ownership.

- Check for Liens: Identify any liens or encumbrances recorded against the asset. This includes mortgages, tax liens, and judgments. It is significant that a considerable percentage of assets have recorded liens, which can complicate transactions and influence the marketability of the real estate.

- Verify Legal Descriptions: Ensure that the legal description of the land aligns with current records. Discrepancies in legal descriptions can lead to ownership disputes, making it imperative to confirm accuracy. Invalid deeds, such as those signed by unauthorized individuals or those lacking proper authority, can create significant legal hurdles.

- Evaluate Real Estate Taxes: Examine tax records to verify that all real estate taxes have been settled and that there are no outstanding debts linked to the asset. Unpaid taxes can result in liens that may jeopardize the transaction.

In recent instances, ownership disputes have highlighted the importance of understanding how to conduct a comprehensive property record review. For example, problems arising from faulty deed signatures have resulted in expensive legal disputes, underscoring the importance of attention to detail in ownership research. As noted, $22.7 million was agreed to be paid to consumers by Fidelity National Financial and over alleged rebate activities, illustrating the financial implications of property issues.

Moreover, ownership insurance plays a crucial role in safeguarding against fraud, forgery, and other ownership issues, which can result in expensive legal disputes and loss of property. As Melissa Dittmann Tracey highlights, "Focusing on detail is the most crucial role a real estate expert can fulfill to assist in safeguarding their clients from property fraud."

By adhering to these steps meticulously, real estate experts can protect their clients' investments and reduce the risks related to ownership issues.

Verifying Title Against Public Records

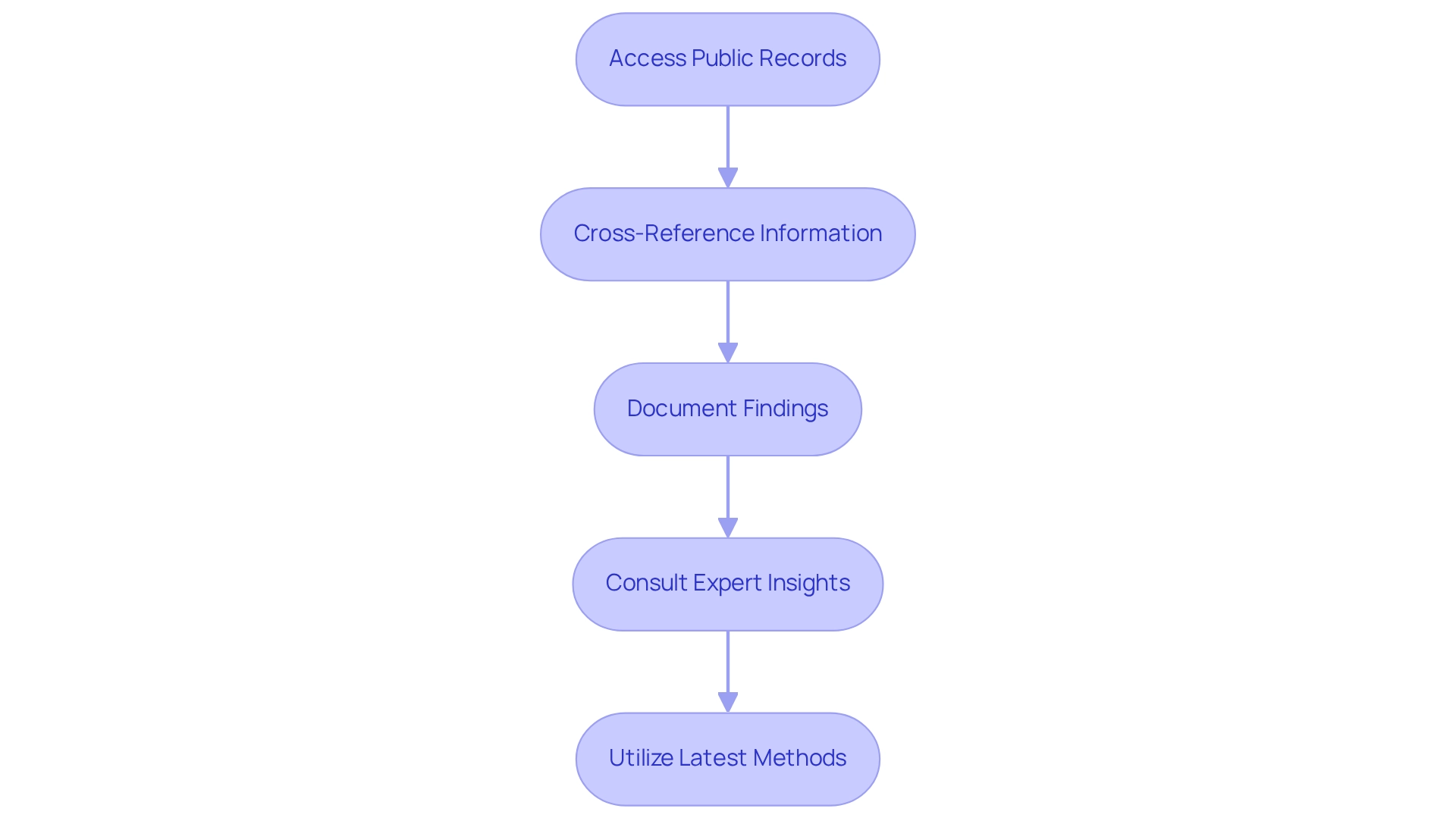

To effectively verify a property title against public records, adhere to the following comprehensive steps:

-

Access Public Records: Begin by visiting the local county clerk's office or utilizing their online portal. This will provide you with essential public records related to the property in question, including ownership history, legal descriptions, and any recorded liens or encumbrances.

-

Cross-Reference Information: Carefully compare the details obtained from your document search with the public records. Pay particular attention to the following:

- Ensure that the current owner's name aligns precisely with the title.

- Verify that the legal description of the property is consistent and accurate.

- Confirm that all liens and encumbrances are correctly documented and reflect the current status.

-

Document Findings: Maintain meticulous records of any discrepancies or issues identified during the verification process. Recognizing these inconsistencies is essential, as they need to be addressed before proceeding with the deal. For instance, discrepancies can include mismatched names, outdated legal descriptions, or unrecorded liens, which can significantly impact the transaction's validity. A substantial percentage of document searches reveal discrepancies, underscoring the importance of thorough verification.

-

Consult Expert Insights: Engaging with real estate attorneys can provide valuable perspectives on common discrepancies encountered during ownership verification. Sandra Khan, a professional at , emphasizes, "Being able to get current information on the people we are trying to locate is very important, and the information obtained by using comprehensive platforms is extremely helpful." Their expertise can guide you in understanding the implications of these discrepancies and the best practices for addressing them.

-

Utilize Latest Methods: Leverage advanced tools and technologies, such as machine learning and optical character recognition, to enhance the efficiency and accuracy of your verification process. Platforms such as PeopleMap demonstrate how extensive services can assist in validating ownership documents and steering clear of untrustworthy sources. These methods can streamline the extraction of relevant information from extensive documents, reducing the time and effort required for thorough verification.

By adhering to these steps, you can guarantee a comprehensive and precise title search to validate ownership documents against public records, ultimately protecting your transactions and improving your professional credibility.

Identifying Liens and Encumbrances

Identifying liens and encumbrances is a crucial aspect of conducting a title search, as these factors can significantly impact ownership. Here’s a detailed approach to effectively identify them:

-

Review Recorded Documents: Begin by meticulously assessing all recorded documents related to the asset. This includes:

- Mortgages: Verify existing mortgage agreements to understand tied to the property.

- Tax Liens: Investigate any outstanding tax liens, as these can lead to foreclosure if not addressed.

- Mechanic's Liens: Check for mechanic's liens, which may arise from unpaid work or materials provided for property improvements.

- Court Judgments: Look for any court judgments that may affect the property, as these can create additional encumbrances. It is also essential to ensure that deeds are valid, as improper signatures or lack of legal authority can render them invalid.

-

Check for Unreleased Liens: Confirm that all liens listed in the records have been properly released. Unreleased liens can pose significant risks to new owners, potentially leading to financial liabilities or legal disputes. Statistics indicate that approximately 15% of properties have unresolved liens, often highlighted in annual reports ordered at the state level, underscoring the importance of this step.

-

Consult Legal Resources: If any liens or encumbrances are identified, consulting legal resources or professionals can provide clarity on their implications. Expert opinions suggest that understanding the legal ramifications of these encumbrances is vital for ensuring a clear title.

-

Current Trends: Stay informed about current trends in lien identification, as advancements in technology and data analysis are improving the efficiency of this process. For instance, machine learning tools are increasingly being utilized to streamline the identification of liens, allowing for quicker and more accurate assessments.

-

Case Studies: Consider successful examples of lien identification in real estate dealings. A recent case emphasized how a comprehensive examination of ownership revealed a mechanic's lien that had been missed, averting possible financial loss for the buyer. Furthermore, ownership conflicts may occur when past owners or heirs have not been adequately considered in real estate dealings, often due to incorrect signing of deeds or hidden heirs. Such case studies highlight the importance of thorough ownership searches to reduce risks linked to real estate.

-

Understanding Charges: It is crucial to understand the implications of charges related to liens. According to Companies House, a charge is defined as: 'Security for the payment of a debt or other obligation that does not pass ‘ownership’ or any right to possession to the individual to whom the charge is given.' This definition emphasizes the importance of reviewing all charges when conducting a title search.

By following these steps, title researchers can effectively identify liens and encumbrances, ensuring a more secure and informed real estate deal.

Confirming Seller's Legal Ownership

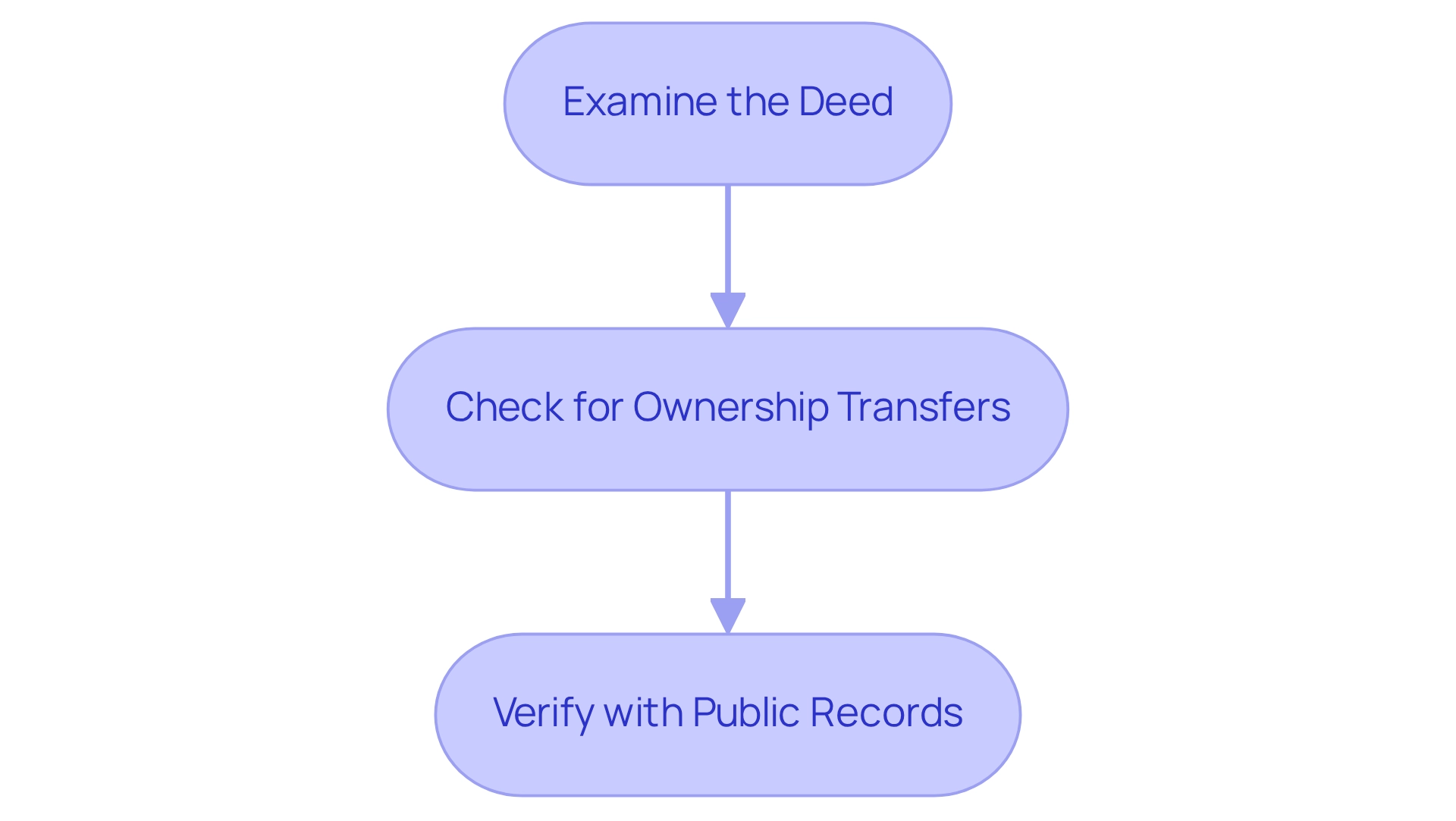

To confirm the seller's legal ownership, it is imperative to follow these essential steps:

- Examine the Deed: Begin by reviewing to ensure it is properly executed and recorded. The deed must clearly state the seller's name as the legal owner. Precise deeds are essential; statistics indicate that roughly 18% of deeds contain mistakes in seller information, complicating dealings and potentially leading to significant problems in property sales.

- Check for Ownership Transfers: Investigate any recent transfers of ownership that may not yet be recorded, including family transfers or sales that occurred shortly before the current transaction. Understanding these subtleties is crucial, particularly in For Sale By Owner (FSBO) deals, which represented 6% of home sales in 2024. FSBO sellers often face challenges, such as accurately pricing their home and navigating the paperwork, which can impact their ability to confirm ownership effectively.

- Verify with Public Records: Cross-reference the seller's information with public records to ensure consistency and accuracy in ownership claims. This step is critical, as discrepancies in ownership transfer can lead to legal complications. Specialists emphasize the importance of a detailed review during document investigations. Rande Yeager, president of the American Land Association, states, "This clearly demonstrates the significance of a professional examination of ownership in all real estate dealings, whether acquiring a new home or refinancing an existing mortgage."

By adhering to these steps, researchers can significantly mitigate the risk of errors, ensuring a smoother transaction process that ultimately leads to better outcomes for all parties involved. Furthermore, leveraging innovative solutions like Parse AI can provide substantial cost savings compared to traditional title search methods, thereby enhancing the efficiency of the title search process.

Reviewing Property Taxes and Assessments

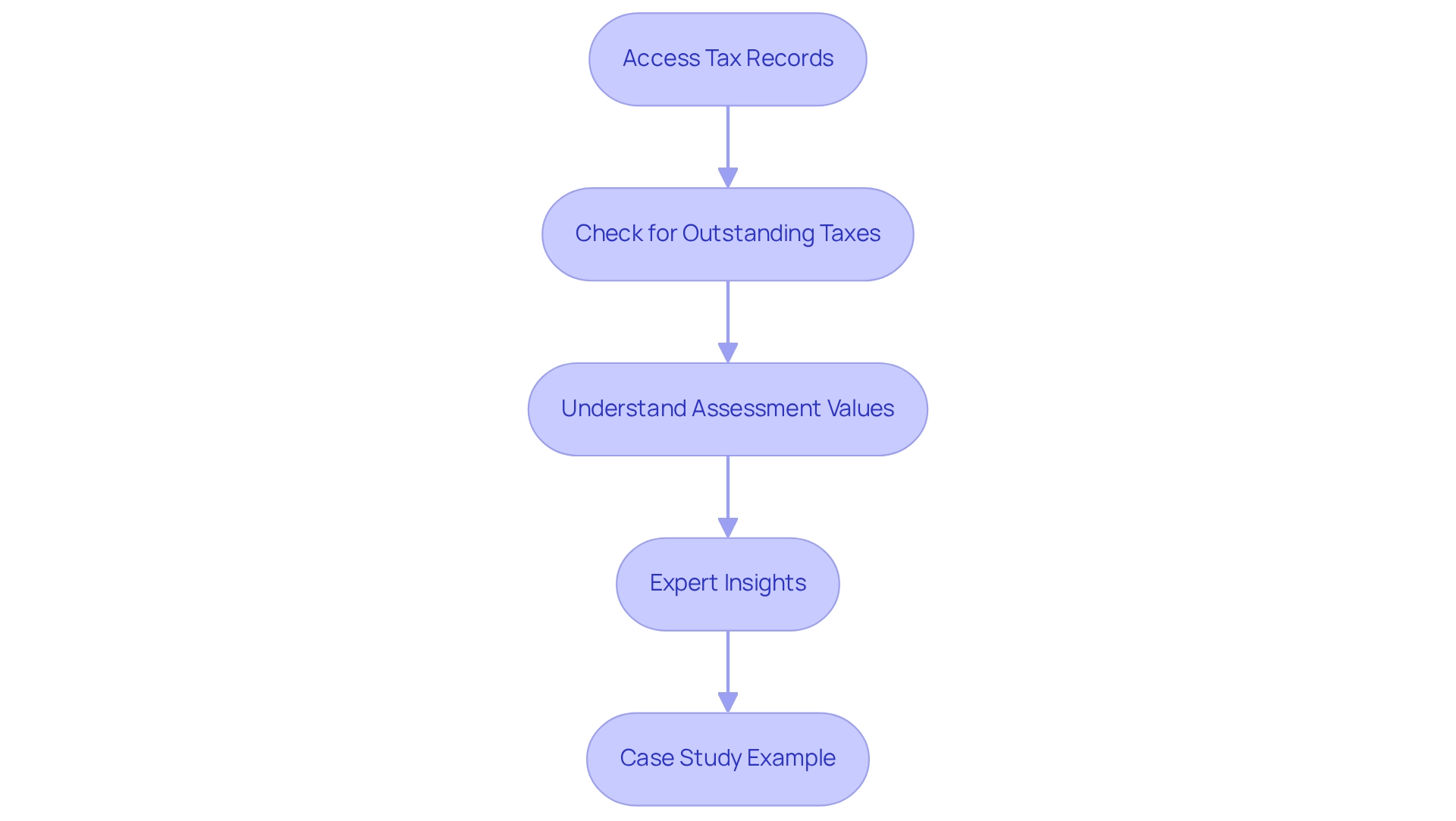

Examining taxes and evaluations is essential for comprehending the financial responsibilities associated with an asset. Here’s a detailed approach to conducting this review:

- Access Tax Records: Start by obtaining the most recent tax records from the local tax assessor's office or through their online portal. This guarantees you possess the most current details concerning the asset’s tax status.

- Check for Outstanding Taxes: It is crucial to confirm that there are no unpaid taxes due on the real estate. Unpaid taxes can result in liens, complicating or even derailing real estate transactions. In fact, approximately 10% of properties have outstanding taxes, underscoring the importance of this step. Additionally, be aware that BOE appeal forms must be filed and postmarked by June 2, with no exceptions for late submissions, emphasizing the need for timely action.

- Understand Assessment Values: Review the assessed value of the asset and compare it to the current market value. This comparison can reveal and inform negotiations. Real estate taxes are determined by multiplying the assessed value of an asset by the local tax rate. For instance, in 2025, the average real estate tax rate across various regions is expected to be approximately 1.1%, with certain areas, such as Kidder County, showcasing a remarkably low effective rate of 0.51%. Comprehending these numbers can offer perspectives on the financial environment related to the asset.

- Expert Insights: Tax assessors stress the significance of being aware of tax obligations related to real estate. As Aly J. Yale, a writer focusing on real estate, pointed out, "Comprehending your tax circumstances is crucial for making informed choices in real estate dealings." This insight underscores the necessity of thorough tax record analysis.

- Case Study Example: Consider the case of Ownwell, which assists homeowners in appealing their asset’s assessed value. By managing the appeal process, they help reduce tax burdens, demonstrating how professional assistance can lead to significant savings.

By following these steps, property researchers can effectively navigate the complexities of taxes and assessments, ensuring a smoother process.

Addressing Discrepancies and Title Issues

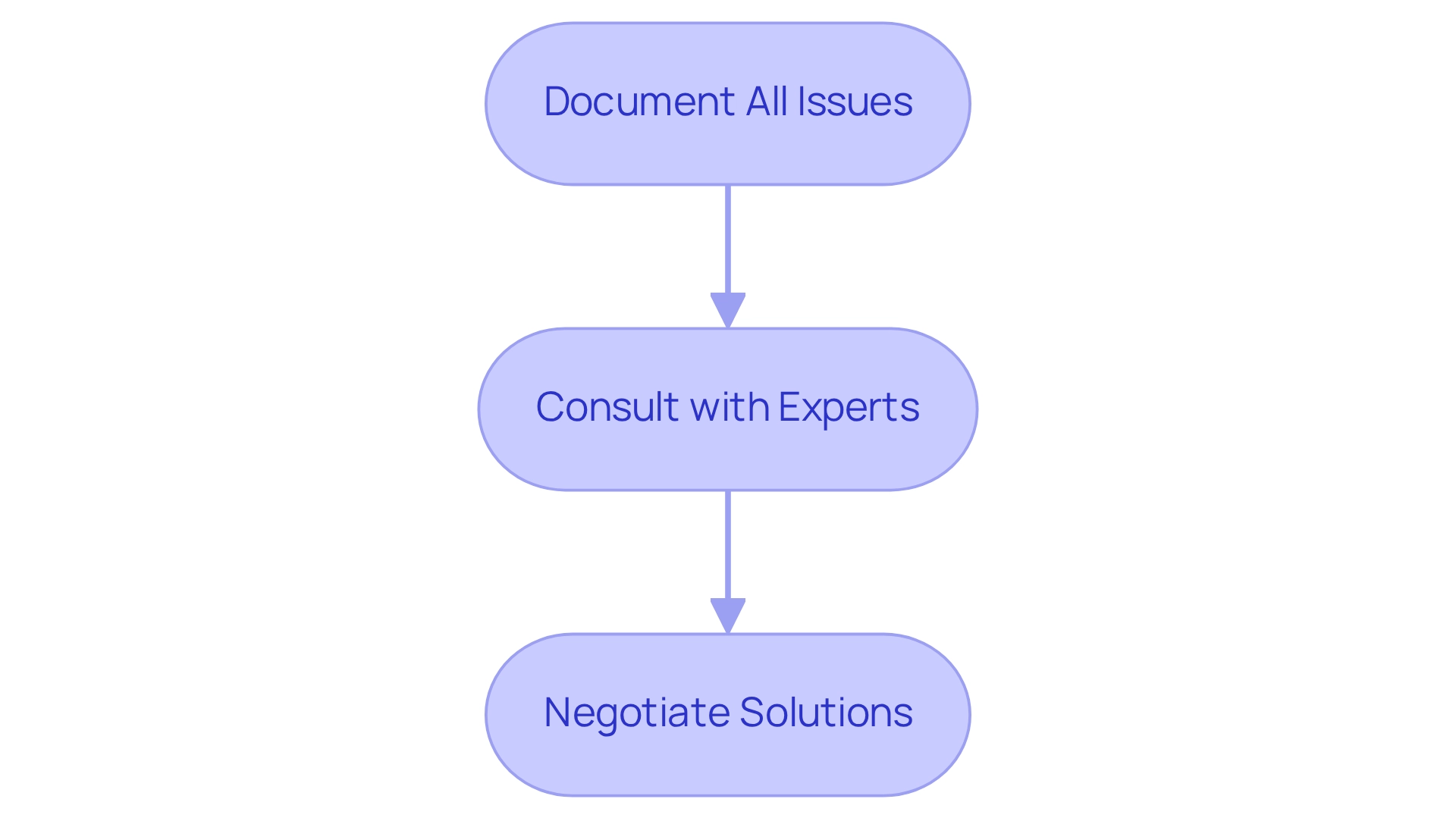

When discrepancies or ownership issues arise during a search, prompt action is crucial to ensure . Here are the essential steps to effectively address these challenges:

- Document All Issues: Maintain a meticulous record of any discrepancies identified. This should include specific details such as dates, the parties involved, and the nature of each issue. Thorough documentation not only aids in clarity but also serves as a reference for future discussions.

- Consult with Experts: Involving a real estate firm or a qualified attorney is crucial, particularly for intricate matters such as ambiguous ownership or existing liens. Their expertise can provide valuable insights and facilitate a more efficient resolution process. According to industry specialists, timely consultation can significantly decrease the average duration required to resolve ownership discrepancies, which is usually around 30 days but can prolong for weeks or even months if not addressed promptly. As Brian Williams, PhD, stresses, "Don't let this stat hinder you from prospecting on Monday, Tuesday, Friday, and the weekend," underscoring the significance of proactive involvement in addressing discrepancies.

- Negotiate Solutions: Collaborate with the seller to negotiate viable solutions for any identified issues. This may involve clearing liens, obtaining additional documentation, or even adjusting the terms of the sale. Effective negotiation can lead to a satisfactory resolution for all parties involved, minimizing delays in the transaction.

Furthermore, recent studies indicate that addressing ownership issues proactively can enhance resolution success rates, which hover around 70% when handled promptly. Comprehending the differing complexities that can emerge in ownership searches, as demonstrated by the case study on state regulations concerning insurance risk, can guide resolution strategies. By following these steps on title search how to, real estate professionals can more effectively navigate title discrepancies, ensuring that dealings proceed without unnecessary complications.

The Role of Title Insurance in Property Transactions

Title insurance serves as a vital safeguard for both buyers and lenders, protecting against potential claims related to property ownership. Understanding its importance is essential for anyone engaged in real estate transactions. Here’s a detailed overview:

- What is Title Insurance? Title insurance is a specialized policy designed to protect against financial losses stemming from issues in the ownership documentation. These defects may include undiscovered liens, ownership disputes, or errors in public records that could emerge only after the property purchase. This proactive measure ensures that buyers and lenders are shielded from unforeseen financial burdens.

- Why is it Important? The importance of title insurance cannot be overstated. It provides reassurance by addressing potential problems arising from the title search, enabling purchasers to proceed with confidence in their transactions. Recent statistics reveal that a significant percentage of real estate transactions—over 80%—involve title insurance, highlighting its critical role in the industry. Moreover, title insurance protects purchasers from possible ownership flaws, which can lead to costly legal disputes or loss of property rights. In a competitive landscape where rivalry in the insurance sector is heightened, understanding the significance of tailored coverage is paramount. As an analyst noted, "Price is a crucial factor influencing consumers' value perceptions. Insurers can add value by customizing their products to meet consumers' unique risk needs and situations."

- How to : Title insurance is typically obtained through a company specializing in this service during the closing phase of a real estate transaction. It is advisable for purchasers to discuss coverage options and associated costs with the title company to ensure they receive adequate protection tailored to their specific needs. This step is crucial, as appropriate coverage can significantly reduce risks tied to property ownership. Furthermore, advancements in property research, such as those introduced by Parse AI, are improving the efficiency and accuracy of title searches, thereby enhancing the overall significance of title insurance in today’s market.

In the current real estate market, characterized by intense competition and constant change, understanding the nuances of title insurance is more critical than ever. As the industry evolves to meet new challenges, including the increasing complexity of property transactions, title insurance remains a cornerstone of security for both buyers and lenders.

Conclusion

A thorough title search is indispensable in the real estate transaction process, serving as a protective measure that verifies legal ownership and identifies any potential encumbrances. By meticulously examining public records and relevant documents, parties can ensure they are engaging in a transaction free from legal complications. The critical steps outlined—from gathering property information to identifying liens—underscore the importance of diligence in this process.

Furthermore, the integration of technology, such as AI-powered tools, has revolutionized the title search landscape, enhancing both accuracy and efficiency. This evolution not only streamlines operations but also meets the expectations of modern homebuyers who seek a seamless experience. As the real estate market continues to grow more complex, the role of title insurance becomes increasingly vital, offering an essential layer of protection against unforeseen claims and legal disputes.

In conclusion, understanding the intricacies of title searches and the significance of title insurance equips buyers, sellers, and real estate professionals with the knowledge necessary to navigate property transactions confidently. By prioritizing these aspects, stakeholders can safeguard their investments and foster trust in the real estate market, ultimately paving the way for successful transactions.

Frequently Asked Questions

What is a title search and why is it important?

A title search is a thorough review of public records to determine the legal ownership of an asset. It is essential to verify that the seller has the legal authority to sell the property and to ensure there are no outstanding claims or liens that could jeopardize the buyer's ownership rights.

What steps are involved in conducting a title search?

The essential steps in conducting a title search include: 1. Gather Property Information 2. Request Necessary Documents 3. Examine Public Records 4. Verify Ownership 5. Identify Liens and Encumbrances 6. Review Findings.

How does a title search mitigate risks in real estate transactions?

A title search mitigates risks by ensuring that ownership is clear and free from legal complications, thus preventing future conflicts and financial losses. It helps confirm that there are no unknown heirs or claims against the property.

What role does technology play in the title search process?

Technology, such as AI-driven tools, enhances the efficiency and precision of title searches. It allows real estate professionals to streamline operations and meet the demands of consumers, particularly younger home buyers who prefer a seamless online experience.

What are the potential consequences of neglecting a title search?

Neglecting a title search can lead to severe consequences, including ownership disputes and financial liabilities. It is crucial to understand the document review process to avoid these issues.

What types of documents are typically required for a title search?

Common documents required for a title search include previous deeds, tax records, and any existing liens or encumbrances.

How much do title search fees typically cost?

Fees for document retrieval can range from $50 to several hundred dollars, depending on the complexity of the request and the specific county's regulations. Insurance premiums for title searches generally range from $500 to $3,500.

What advancements have been made in title search technology?

Recent advancements include the use of machine learning and optical character recognition, which streamline the document examination process and enable quicker, more accurate results.

Why is it important to stay informed about title investigations and insurance?

Staying informed about advancements in title investigations and insurance is vital for mitigating risks associated with real estate transactions and ensuring legal clarity in ownership matters.