Overview

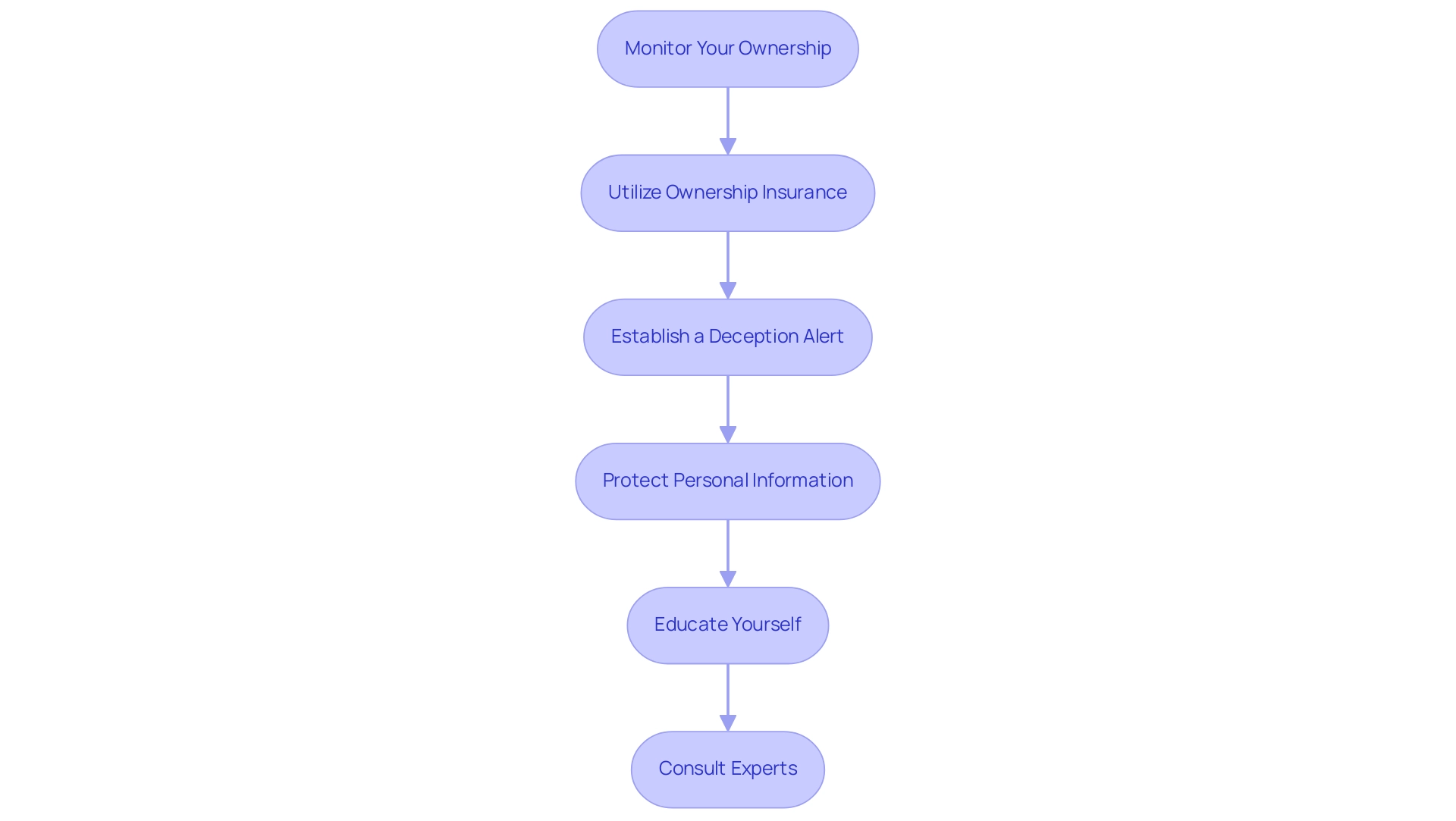

To secure your home title and prevent fraud, homeowners should implement strategies such as monitoring ownership records, utilizing ownership insurance, and safeguarding personal information. The article emphasizes that these preventive measures, along with technological solutions and expert consultations, are essential in countering sophisticated tactics used by scammers, thereby protecting homeowners' investments and rights effectively.

Introduction

In an age where homeownership is both a significant achievement and a potential target for criminals, understanding home title fraud has never been more critical. Scammers are increasingly sophisticated, employing tactics such as:

- Identity theft

- Forged documents

- Phishing scams

to unlawfully transfer property ownership. The alarming statistics from the FBI highlight the urgency of this issue, with millions of complaints filed annually. As homeowners navigate this complex landscape, implementing effective strategies to protect their titles is paramount. From utilizing technology and title insurance to consulting with experts, proactive measures can safeguard one of life's most valuable investments. This article delves into the intricacies of home title fraud, providing essential insights and actionable steps to fortify property rights against evolving threats.

Understanding Home Title Fraud: How Scammers Operate

Home title fraud is a serious issue that typically involves scammers posing as legitimate property owners in order to unlawfully sell or mortgage properties. These fraudsters often obtain personal information through data breaches or by accessing public records. With enough sensitive data, they can file fraudulent documents with the county clerk’s office, effectively transferring ownership without the actual owner's consent or knowledge.

The tactics employed in these schemes are varied and sophisticated, including:

- Identity Theft: Scammers steal personal information, allowing them to convincingly impersonate the property owner.

- Forged Documents: Creating fake deeds or legal documents enables them to falsely claim ownership of properties.

- Phishing Scams: Fraudsters utilize deceptive emails or phone calls to mislead homeowners into divulging sensitive information.

- Title Laundering: This tactic entails transferring assets through a sequence of transactions to conceal the actual ownership trail.

The concerning increase in these deceptive activities is highlighted by the FBI's (IC3), which has recorded over 8 million complaints of wire deception since 2000, with a 10% rise in 2023 alone, totaling 880,418 complaints. This translates to an , highlighting the urgent need for . Tyler Adams, Co-founder and CEO, emphasizes,

For real estate professionals, being isn't just smart—it's essential.

Additionally, recent instances, like the ongoing inquiry into purported , demonstrate that even established assets are at risk and relate to the wider context of the escalating national danger of wire deception. By comprehending these techniques and the wider context of home ownership deception, homeowners can more effectively acknowledge the vital significance of securing and applying protective strategies to safeguard their rights.

Essential Steps to Secure Your Home Title Against Fraud

To effectively from deception, consider implementing the following essential strategies:

- : Regularly review your estate's status by accessing records at your local county recorder’s office. Be vigilant for any unfamiliar transactions or modifications that could indicate fraudulent activity.

- in comprehensive , which offers protection against losses arising from defects in ownership, including instances of fraud. This policy serves as an essential safety net, ensuring you are protected if someone tries to make a claim over your assets. In fact, with $22 billion in net written premium in 2022, the importance of insurance in protecting property rights cannot be overstated.

- Establish a : Proactively place a deception alert on your credit report. This measure informs creditors to take additional steps in verifying your identity before allowing new accounts, thereby adding a layer of security against identity theft.

- Protect Personal Information: Take necessary precautions to safeguard your sensitive documents and personal information. Shred any paperwork that contains confidential data and employ robust passwords for your online accounts to prevent unauthorized access.

- Educate Yourself: Stay informed about the latest scams and tactics employed by fraudsters. is your most effective defense against becoming a victim.

- : Engage with a research specialist or a qualified real estate attorney to navigate complex ownership issues and ensure that your documentation remains clear. As Jeanette Quick, Deputy Assistant Secretary for Financial Institutions Policy, pointed out, it is vital for consumers to understand the costs and benefits of insurance related to property and the regulatory environment surrounding it.

Additionally, monitor the , such as the new research initiatives announced by the American Academy of Actuaries and the National Association of Insurance Commissioners, which aim to enhance independent assessments of the industry.

By following these strategies, homeowners can significantly reduce the risk of fraud related to home title, thereby .

Utilizing Technology for Title Protection

In today's digital environment, technology is essential in protecting your home title, especially as we move into 2024, a year expected to bridge the challenging period of 2022-2023 to recovery. Here are key strategies to leverage its power effectively:

-

Title : Sign up for thorough monitoring services that offer immediate notifications for alterations to your real estate documentation.

These services are crucial for detecting , enhancing your ability to respond swiftly to potential threats. As the demand for these services grows, it is essential to predict future capacity needs to ensure they can scale accordingly.

-

: Utilize secure cloud storage solutions to store critical documents related to your property.

This not only keeps your safe from unauthorized access but also ensures that you can easily retrieve necessary documents related to your home title when needed, effectively preparing for the changing landscape of protection.

-

Machine Learning Tools: Explore platforms that employ to scrutinize documents for discrepancies.

These advanced tools can identify irregularities and flag potential fraud before it escalates, making them invaluable in today’s fast-evolving real estate environment.

The capacity to expand these solutions will be essential as more property owners seek defense against ownership fraud.

-

: Implement OCR technology to transform scanned documents into editable and searchable formats.

This capability streamlines the review process, enabling efficient confirmation of ownership details and reducing the likelihood of oversight.

By integrating , property owners not only improve their capacity to oversee and safeguard their home title records but also establish clear expectations for the safety of their investment. As noted by industry experts, 'Dealing with a difficult client doesn't have to lead to conflict. Learn how to set clear expectations and maintain a harmonious relationship.'

This principle is particularly relevant in managing security effectively, as clear expectations around the use of technology can foster trust and transparency.

The Role of Title Insurance in Preventing Fraud

acts as an essential protection for homeowners, shielding them from financial loss related to due to that may not be disclosed during the initial search. The multifaceted role of insurance in deception prevention encompasses several key areas:

- Coverage for Past Issues: Title insurance not only safeguards against current claims but also covers issues related to home title stemming from previous ownership. This includes potential liens, unpaid taxes, or instances of fraud that may have occurred before the issuance of the policy.

- Legal Defense: In the event that a claim is filed against your ownership, insurance offers robust legal defense against challenges to your possession. This legal support is essential for maintaining your rights and ensuring that any disputes are resolved effectively.

- Peace of Mind: With the assurance that your investment is protected, homeowners can focus on enjoying their property without the looming anxiety of potential ownership disputes. This peace of mind is invaluable, particularly in today's environment where nearly 30 percent of insurers' losses arise from issues not discoverable through public records, as highlighted by Milliman. Furthermore, a study examining over 127,000 claims associated with policies issued between 2013 and 2022 underscores the importance of this coverage.

The financial ramifications of title-related fraud are significant, with the average for loan policies exceeding $194,000, while for owner's policies, it averages over $100,000 compared to average costs of $27,000 and $23,000 for other claims, respectively. Such statistics illustrate the necessity of as a protective measure in 2024, making home title an essential aspect of home ownership. Engaging with a reputable firm can further secure your investment and provide clarity on the protections offered.

Consulting with Title Research Experts

Collaborating with research specialists at Harbinger Land is crucial for property owners aiming to . Here are several compelling reasons to consider professional consultation:

-

Expert Analysis: Professionals at Harbinger Land conduct in-depth and accurate examinations of property records, adeptly identifying potential issues that may elude the average homeowner.

This thorough analysis is crucial in preventing future disputes over asset ownership and ensuring confident acquisition of land rights.

-

Tailored Solutions: Each property presents unique challenges; our experts provide personalized guidance suited to your specific situation. This personalization aids in applying the most effective protective measures to safeguard your investment and ensure clear chains of ownership.

Our curative services play a vital role in addressing any discrepancies, ensuring .

-

Navigating Legal Complexities: The can be daunting. Harbinger Land's experts clarify these complexities, ensuring homeowners are compliant with current regulations and understand their rights and responsibilities.

-

Continuous Support: Building a connection with a research expert encourages . This connection keeps you informed about any changes in ownership laws and alerts you to potential threats, empowering you to act swiftly if necessary.

Harbinger Land employs rigorous quality control measures throughout our ownership research process, enhancing the reliability of our findings. Additionally, we present our information in an easily digestible format, ensuring that clients can quickly understand and utilize the insights provided.

In light of the fact that —averaging a $305,000 equity stake per mortgage-holding household—consulting with experts in the field becomes even more critical. Their insights not only enhance your understanding of ownership security but also enable informed decision-making in protecting your property. Furthermore, as observed by the National Association of REALTORS®, , highlighting the significance of professional assistance.

With a and 66.1% of families owning their primary residence, the stability of homeownership in the U.S. further emphasizes the necessity of securing titles for a significant portion of the population.

Conclusion

Understanding the complexities of home title fraud is imperative for all homeowners, especially as scams become increasingly sophisticated. This article has outlined the various tactics employed by fraudsters, including:

- Identity theft

- Forged documents

- Phishing scams

These collectively pose a significant threat to property ownership. The alarming statistics from the FBI highlight the urgency of this issue, underscoring the need for heightened awareness and preventive measures.

To protect against home title fraud, homeowners must take proactive steps, such as:

- Regularly monitoring their title status

- Investing in title insurance

- Safeguarding personal information

Utilizing technology, like title monitoring services and secure digital document storage, further enhances the ability to detect and respond to fraudulent activities swiftly. Title insurance plays a crucial role in providing coverage against past issues and offering legal defense in the event of a claim, thus ensuring peace of mind for homeowners.

Engaging with title research experts is essential for navigating the complexities of property ownership. Their expertise can help identify potential issues and provide tailored solutions, ensuring a clear title and protecting one of life's most valuable investments. As the landscape of home title fraud continues to evolve, remaining vigilant and informed is crucial. By implementing these strategies, homeowners can fortify their property rights and secure their financial future against emerging threats.

Frequently Asked Questions

What is home title fraud?

Home title fraud involves scammers posing as legitimate property owners to unlawfully sell or mortgage properties by filing fraudulent documents with the county clerk’s office, often using stolen personal information.

How do scammers typically obtain personal information for home title fraud?

Scammers often obtain personal information through data breaches or by accessing public records.

What tactics do fraudsters use in home title fraud schemes?

The tactics include: 1. Identity Theft: Stealing personal information to impersonate property owners. 2. Forged Documents: Creating fake deeds or legal documents to falsely claim ownership. 3. Phishing Scams: Misleading homeowners through deceptive emails or calls to obtain sensitive information. 4. Title Laundering: Transferring assets through multiple transactions to hide the actual ownership.

How serious is the issue of home title fraud?

The issue is serious, with the FBI's Internet Crime Complaint Center recording over 8 million complaints of wire deception since 2000, including a 10% rise in 2023 alone, totaling 880,418 complaints.

What can homeowners do to protect their home ownership documents from fraud?

Homeowners can implement several strategies, including: 1. Monitor ownership status by reviewing local county records. 2. Utilize ownership insurance for protection against fraud-related losses. 3. Establish a deception alert on credit reports to enhance security. 4. Protect personal information by shredding sensitive documents and using strong passwords. 5. Educate themselves about the latest scams and tactics. 6. Consult with experts, such as real estate attorneys, for guidance on ownership issues.

Why is ownership insurance important?

Ownership insurance protects against losses arising from defects in ownership, including fraud, serving as a safety net for property rights.

What is a deception alert?

A deception alert is a measure placed on a credit report that informs creditors to take extra steps in verifying identity before allowing new accounts, providing additional security against identity theft.

How can homeowners stay informed about potential threats related to home title fraud?

Homeowners should stay updated on the latest scams and tactics used by fraudsters to effectively defend against becoming victims of home title fraud.