Overview

Removing judgment liens from a property title requires adherence to a structured process. This process includes:

- Verifying the claim

- Paying off the debt

- Filing a release of claim with the county recorder's office

Furthermore, this article outlines the essential documentation needed and the common challenges encountered during this process. It emphasizes the importance of thorough preparation and proactive communication with creditors to ensure successful lien removal, ultimately reinforcing the reliability of the solutions offered.

Introduction

In the intricate realm of property ownership, judgment liens emerge as formidable obstacles, overshadowing the value and marketability of assets. These legal claims complicate real estate transactions and can result in severe financial repercussions, including foreclosure and tarnished credit ratings. This guide presents a thorough, step-by-step method for eliminating judgment liens, empowering property owners to reclaim their titles and safeguard their financial interests.

However, what occurs when creditors refuse to cooperate, or when documentation errors threaten to obstruct the process? Effectively navigating these challenges is essential for anyone aiming to successfully remove judgment liens from their property.

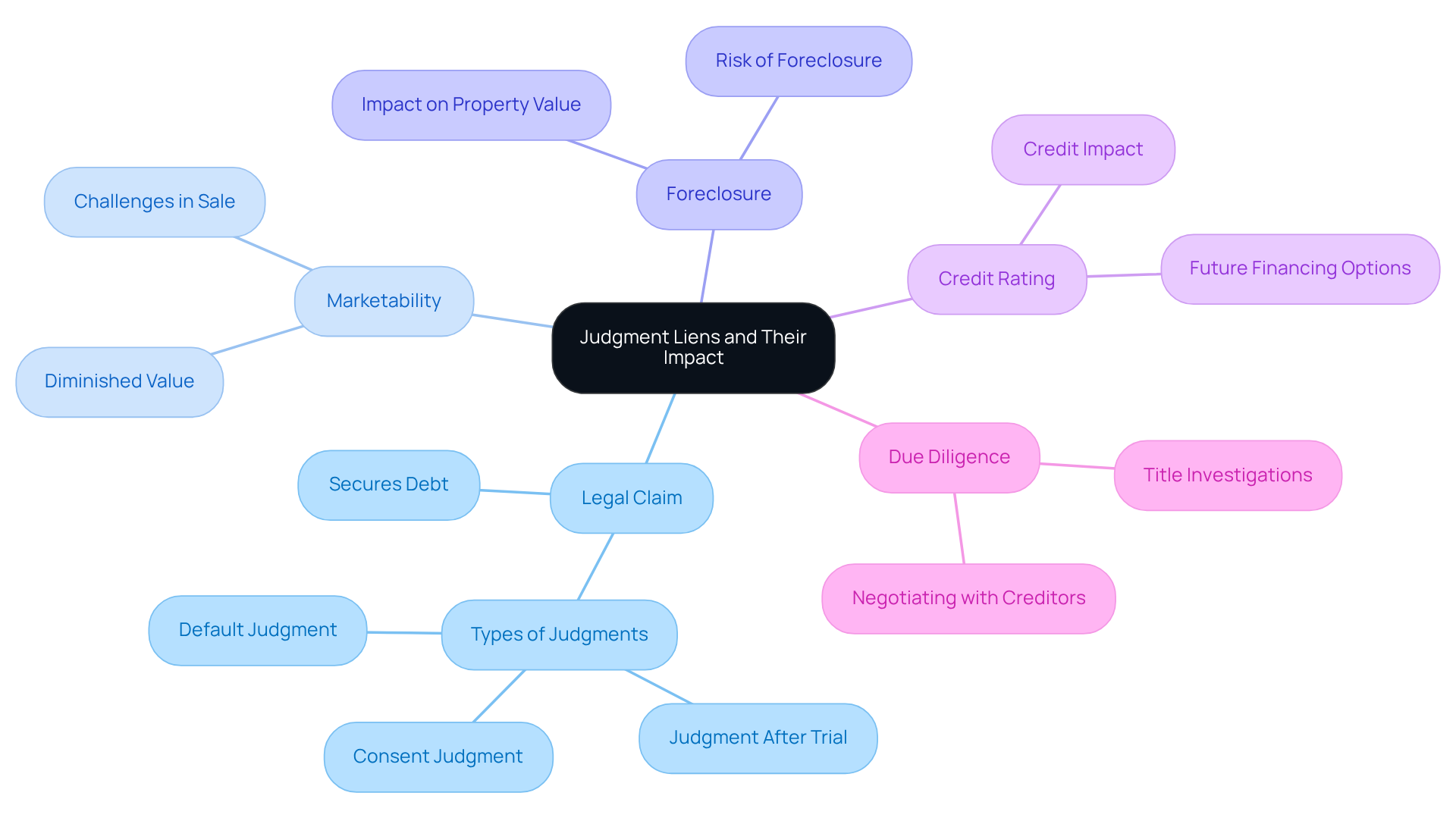

Understand Judgment Liens and Their Impact on Property

A legal claim represents an assertion against an asset, arising when a creditor prevails in a lawsuit against the owner. This claim secures the debt owed by linking it to the asset, complicating the sale or refinancing process significantly. Properties encumbered by legal claims often experience diminished marketability; prospective purchasers may be deterred by the financial obligations associated with these claims.

Furthermore, unresolved financial claims can lead to foreclosure, decreased real estate values, and negatively impact the owner's credit rating. Statistics indicate that a substantial portion of assets may be affected by such claims, underscoring the necessity of conducting thorough title investigations prior to any real estate transaction.

Understanding the essence of legal claims and their potential consequences is crucial for property owners, as it marks the initial step in the elimination process and in safeguarding their financial interests.

Prepare Required Documentation and Information

To effectively initiate the removal process, gathering all necessary documentation in advance is crucial. This preparation streamlines interactions with the court or creditor. Key documents include:

- Proof of Payment: Secure receipts or bank statements confirming that the debt has been settled. Acceptable forms of proof may include a lienholder’s promissory note stamped 'PAID' or a signed HUD-1 settlement statement.

- Court Documents: Collect all pertinent court rulings related to the claim, including the original judgment and any satisfaction of judgment documents that indicate the debt has been resolved.

- Correspondence with Creditors: Maintain documentation of all interactions with the creditor concerning the obligation. This includes settlement agreements and any requests for release of claims, which are crucial in demonstrating your case.

- Property Title Documents: Have a copy of the property title available to confirm the claim's existence and its specific details, such as the claimant's name and the amount due.

- Mobile or Manufactured Home Title: If relevant, ensure you possess a copy of the title or non-negotiable title for mobile or manufactured homes, as this is necessary for a release.

By ensuring that these documents are organized and easily accessible, you facilitate a smoother and more efficient removal process, minimizing potential delays and complications. Furthermore, remember that lenders must execute a release of the security interest and deliver it within three business days after payment clearance, as mandated by the Department of New York. Incorporating examples from case studies, such as the 'Car or Truck Release of Claims,' can further illustrate the documentation needed for successful removal of encumbrances. Quotes from authoritative sources can also enhance the credibility of your approach.

Follow the Step-by-Step Process to Remove the Lien

To effectively remove a judgment lien, adhere to the following steps:

- Verify the claim: Begin by confirming the validity of the claim. This includes examining court documents and the initial ruling for any inconsistencies that could render the claim invalid.

- Pay off the debt: If possible, settle the debt related to the claim. Ensure you obtain a receipt or proof of payment as documentation.

- Request a release of claim: Upon payment, reach out to the creditor to request a release of claim form. This document serves as official proof that the debt has been satisfied.

- File the release with the county: Submit the release form to the county recorder's office where the claim was initially filed. This action officially eliminates the claim from public records, which is crucial for understanding how to remove judgment liens from title.

- Follow up: After filing, check with the county office to ensure that the claim has been successfully removed from the property records.

Troubleshoot Common Issues in Lien Removal

While the process of removing a judgment lien can appear straightforward, several common issues may arise:

- Creditor Refusal: A significant challenge emerges when creditors refuse to provide a release of claim after payment. This refusal can lead to legal implications, as creditors may face liability if they do not comply with the self-release process outlined in Texas Property Code Sec. 52.0012. It is crucial to meticulously document all communications and consider seeking legal advice to explore your options. Notably, statistics indicate that nearly 30% of creditors may oppose lifting claims, underscoring the importance of proactive measures.

- Errors in Documentation: Precision is paramount when submitting release forms. Errors in names, dates, or amounts can result in unnecessary delays. Homeowners must adhere to the specific legal procedures outlined in Texas Property Code Sec. 52.0012 to self-release a claim. Verifying all documentation prior to submission can significantly reduce these risks and enhance the workflow.

- Court Involvement: Should a claim be disputed or if the creditor remains unresponsive, it may become necessary to file a motion in court to have the claim removed. Engaging a legal expert can provide valuable guidance throughout this intricate procedure, ensuring that all legal obligations are fulfilled and that the nuances of submitting a motion are fully understood.

- Time Delays: Prepare for potential delays in processing your release of claim. Understanding the specific timing and documentation requirements associated with the removal procedure is essential. Regular follow-ups with the county recorder's office can help you stay informed about the status of your filing and address any issues promptly.

By anticipating these challenges and knowing how to address them effectively, you can navigate the lien removal process with greater confidence and efficiency.

Conclusion

Navigating the complexities of judgment liens is essential for property owners aiming to protect their financial interests and uphold the marketability of their assets. This guide has offered a comprehensive step-by-step approach to understanding, documenting, and ultimately removing these legal claims from property titles. By adhering to the outlined procedures, property owners can empower themselves to reclaim their titles and mitigate the adverse effects of judgment liens.

Key insights discussed throughout the article underscore the importance of thorough documentation, including proof of payment and relevant court records, as well as the necessity of following a structured process for lien removal. Furthermore, being aware of common challenges—such as creditor refusal and documentation errors—can significantly streamline the journey toward lien resolution. Engaging with legal experts when disputes arise can further enhance the likelihood of a successful outcome.

Ultimately, the significance of removing judgment liens cannot be overstated. By taking proactive steps to address these encumbrances, property owners not only safeguard their financial standing but also enhance the potential for successful real estate transactions. The journey may be fraught with challenges; however, with diligence and the right approach, reclaiming property from judgment liens is an achievable goal.

Frequently Asked Questions

What is a judgment lien?

A judgment lien is a legal claim against an asset that arises when a creditor wins a lawsuit against the asset's owner, securing the debt owed by linking it to the asset.

How do judgment liens affect property sales?

Judgment liens complicate the sale or refinancing process of a property, as they diminish marketability and may deter prospective buyers due to the financial obligations associated with these claims.

What are the potential consequences of unresolved financial claims on property?

Unresolved financial claims can lead to foreclosure, decreased real estate values, and a negative impact on the owner's credit rating.

Why is it important to conduct title investigations before real estate transactions?

Conducting thorough title investigations is essential because a significant portion of assets may be affected by legal claims, which can impact the transaction and the buyer's financial interests.

What should property owners understand about legal claims?

Property owners should understand the essence of legal claims and their potential consequences, as this knowledge is crucial for eliminating these claims and safeguarding their financial interests.