Introduction

Navigating the complexities of lien removal is essential for property owners seeking to maintain clear title and safeguard their investments. A lien, which signifies a legal claim against a property due to unpaid debts, can arise from various sources, including mortgages, taxes, or contractor services. Understanding the intricacies of this process is vital, as it involves not only the identification of the lien type but also a series of strategic steps to effectively negotiate and fulfill obligations.

This article delves into the lien removal process, highlighting essential documentation, negotiation tactics, and post-removal considerations that empower property owners to reclaim their title and protect their interests in the real estate landscape.

Understanding the Lien Removal Process

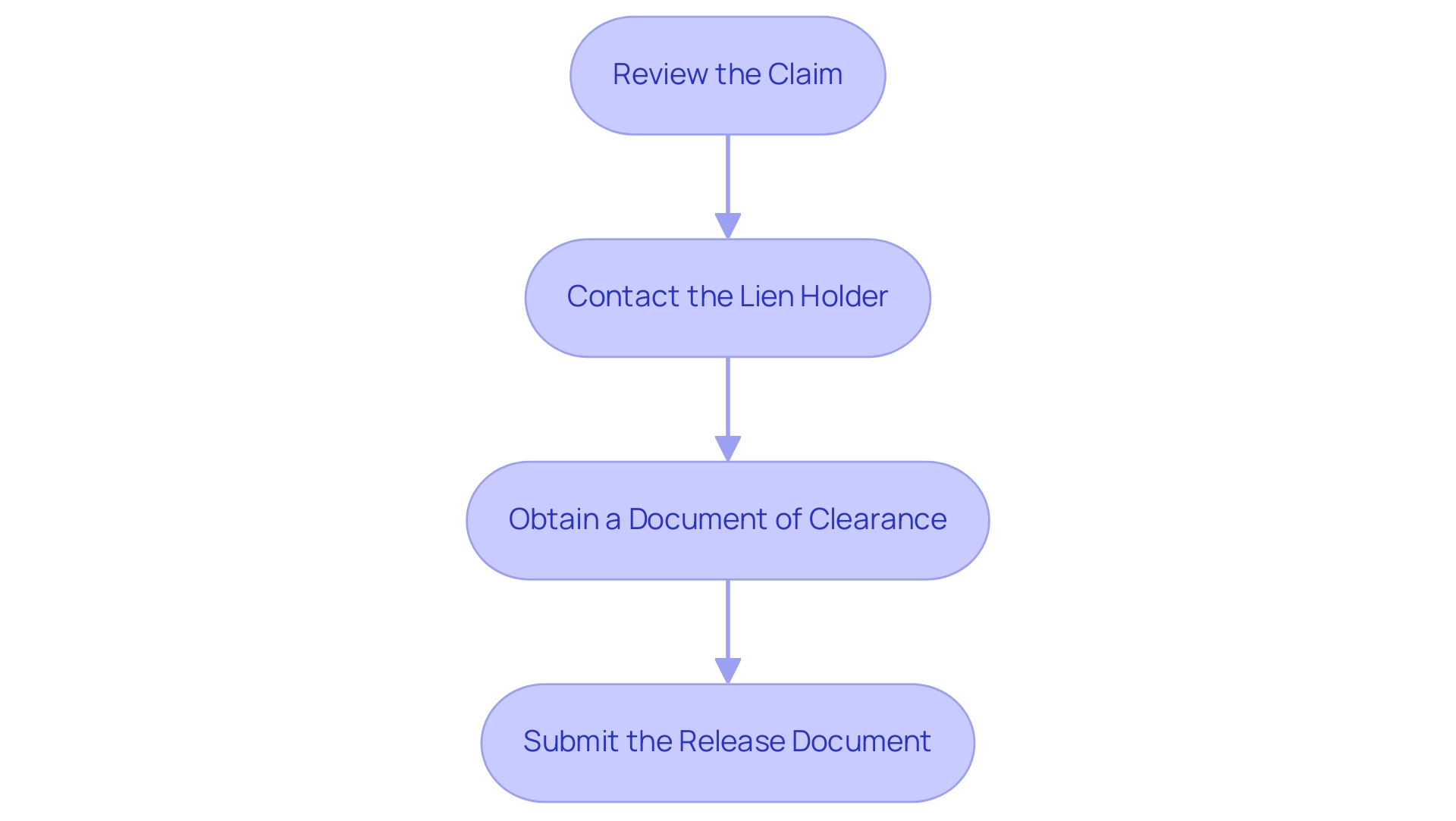

A charge signifies a legal assertion against an asset, usually resulting from unsettled obligations. Understanding the specific type of claim affecting your property, including a lien on title house, is crucial for initiating the removal process, as common varieties include mortgage claims, tax claims, and mechanics claims. The steps to effectively eliminate a claim are as follows:

- Review the claim: Begin by obtaining a copy of the claim document. This will help you understand its terms, including the total amount owed and any specific conditions attached.

- Contact the Lien Holder: Reach out to the entity that imposed the lien—be it a financial institution, a government agency, or a contractor. Participating in early communication can clarify options available for debt resolution.

- Negotiate Payment: If the claim arises from unpaid debts, work towards negotiating a payment plan or a settlement that is favorable for both parties involved. Effective negotiation can often lead to more manageable payment terms.

- Obtain a document of clearance: After meeting the payment obligations, request a clearance document from the holder. This document acts as evidence that the claim has been removed and your title is clear.

- Submit the Release Document: Lastly, submit the release document with your local county recorder’s office. This step is crucial to refresh public records and officially eliminate the lien on title house from your title.

It is significant to mention that claim transcription can happen under specific conditions, such as when relocating to a new county. These transcriptions must be completed within ten years of the original filing date and do not extend the statute of limitations, ensuring that any claims remain time-bound. Furthermore, it's important to mention that the denial rate, including pre-approval refusals, is 10.3% for White applicants, reflecting wider implications of claims and home ownership.

The case study on the illustrates that they can be transcribed between counties or from a county to the Office of the Minnesota Secretary of State if certain conditions are met, emphasizing the importance of understanding these processes.

Essential Documentation for Lien Removal

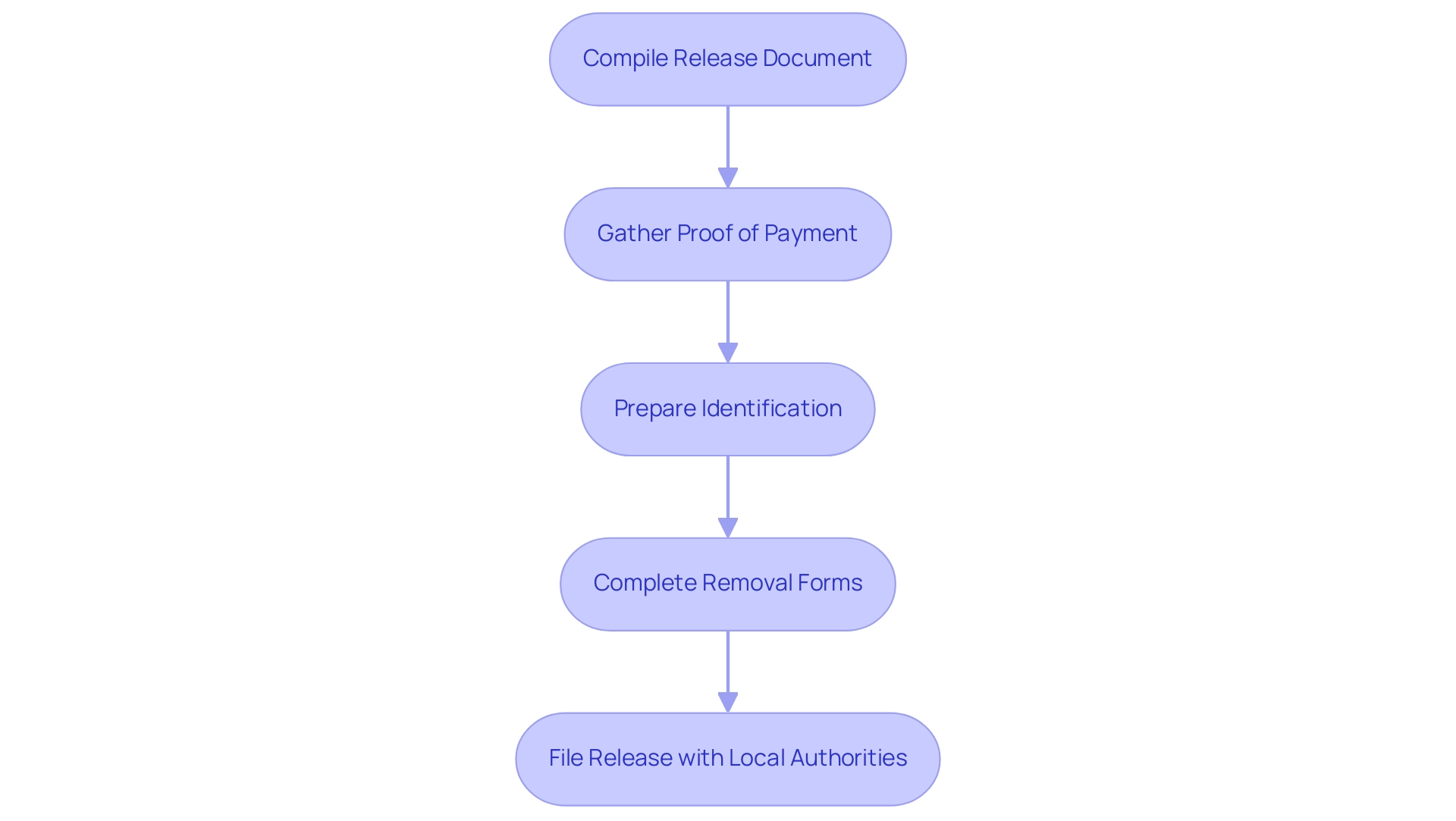

To effectively remove a claim from your property title, it is crucial to compile the following essential documents:

- Release Document: This official document, provided by the holder, serves as confirmation that the debt has been satisfied and that the claim is no longer enforceable.

- Proof of Payment: Retain copies of all receipts or bank statements that substantiate any payments made toward settling the debt, whether through negotiation or full payment.

- Identification: A government-issued ID is necessary to verify your identity when submitting the release. A copy of your property title deed may be required to establish ownership and specify the property affected by the lien on title house.

- Completed Removal Forms: Consult your local recorder’s office for any specific forms that must be filled out for removal, as requirements can vary by jurisdiction.

It is important to note that the priority of construction claims can vary significantly based on whether the project is new construction or an alteration. This distinction can influence the removal process, particularly in situations where multiple claims exist. According to recent statistics, successful removals with proper documentation can vary, and understanding priority rules is essential for effective management.

Recent news emphasizes that the timing of work can impact the priority of construction claims, which consequently influences how payments are allocated from foreclosure sales. Once you have gathered all required documentation, you may proceed to file the release with your local authorities. This step is vital to ensure your property title is cleared of any encumbrances, such as a , thereby safeguarding your ownership rights.

Negotiating with Lien Holders

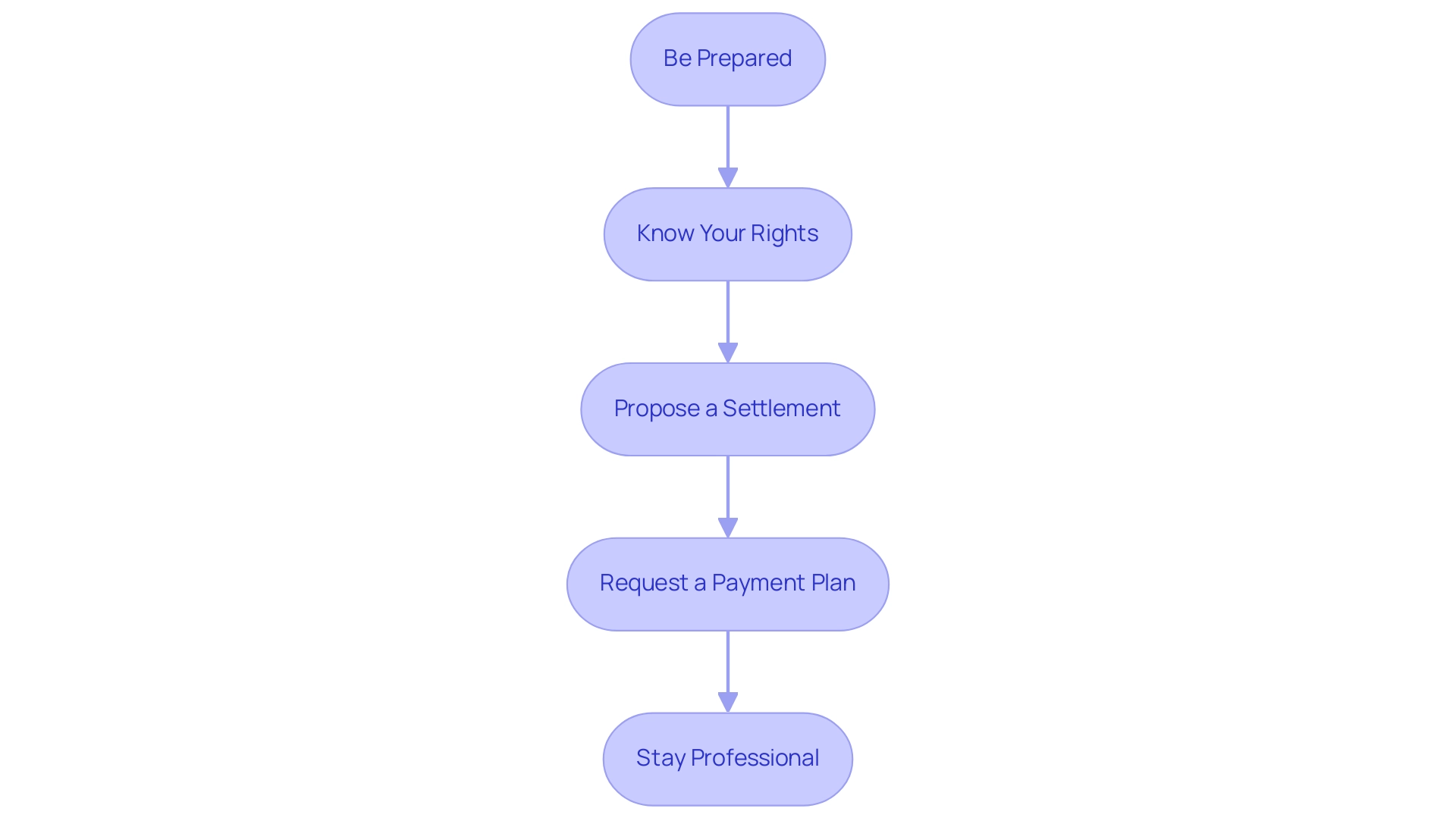

Negotiating with claim holders requires a strategic approach to enhance your chances of success. Here are crucial strategies to consider:

- Be Prepared: Before entering negotiations, compile all pertinent documentation, including the lien on title house, encumbrance document, proof of income, and financial statements that support your case.

This preparation will provide a solid foundation for your argument. - Know Your Rights: Understanding local laws regarding claims and debts is essential. Familiarity with these regulations can empower you and serve as leverage during negotiations.

For instance, administrative fees for release of claims are capped at $250, which can inform your negotiation strategy. - Propose a Settlement: Consider offering a lump-sum payment that is less than the total amount owed. Many claim holders may prefer to accept a reduced sum for a swift resolution, particularly if they face the risk of lengthy collection processes.

- Request a Payment Plan: If a lump-sum payment is unattainable, propose a structured payment plan to gradually settle the obligation. This can demonstrate to the creditor your commitment to resolving the debt while accommodating your financial situation.

- Stay Professional: Approach the negotiation with professionalism and composure.

Building a rapport with the creditor can encourage cooperative dialogue, potentially resulting in more favorable terms.

Additionally, be aware that towing-storage operators are required to use an approved third-party service to transmit all necessary notices, as mandated by the .

Grasping this compliance requirement can guide your negotiation strategies; for instance, highlighting that claim holders must follow these regulations regarding a lien on title house can enhance your position.

By employing these strategies, you can significantly enhance your prospects for successfully negotiating the removal of encumbrances.

Filing the Lien Release

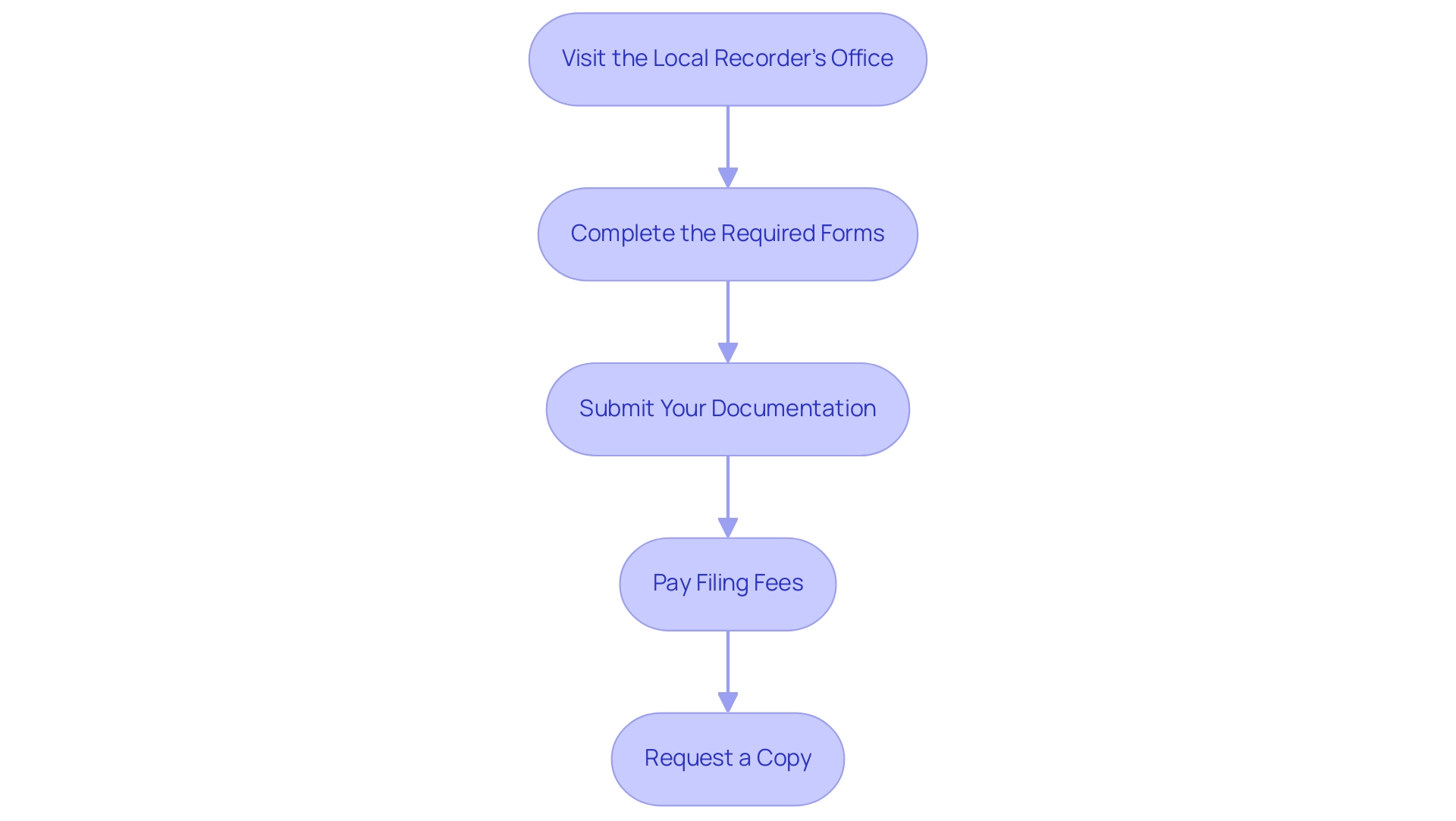

To effectively file a claim discharge, adhere to the following structured steps:

- Visit the Local Recorder’s Office: Begin by going to your local county recorder’s office, which is responsible for maintaining property deeds.

- Complete the Required Forms: Accurately fill out any necessary document for relinquishment. For instance, if the transfer is due to death and the total estate is worth $50,000 or less, you may need to use form SBD-10693.

- Submit Your Documentation: Present the completed document for discharge along with supporting materials, such as proof of payment and valid identification, to ensure a smooth filing process.

- Pay Filing Fees: Be prepared to pay any associated filing fees, which can vary significantly by location. It's advisable to check the specific fees for your county in advance.

- Request a Copy: After submission, ask for a stamped copy of the document for your records. This document acts as official evidence that the claim has been eliminated from public records.

It’s essential to understand that a claim is not related to a mortgage or land but pertains to the lien on title house as personal assets, which can influence how the asset is categorized legally. Furthermore, examine the case study of the acknowledgment of manufactured home ownership surrender, which demonstrates how release documents can result in the legal recognition of manufactured homes as real estate.

By carefully adhering to these steps and grasping the complexities of release documents, you enable the successful removal of the claim, thus clearing the ownership of your asset and improving its marketability.

Post-Lien Removal Considerations

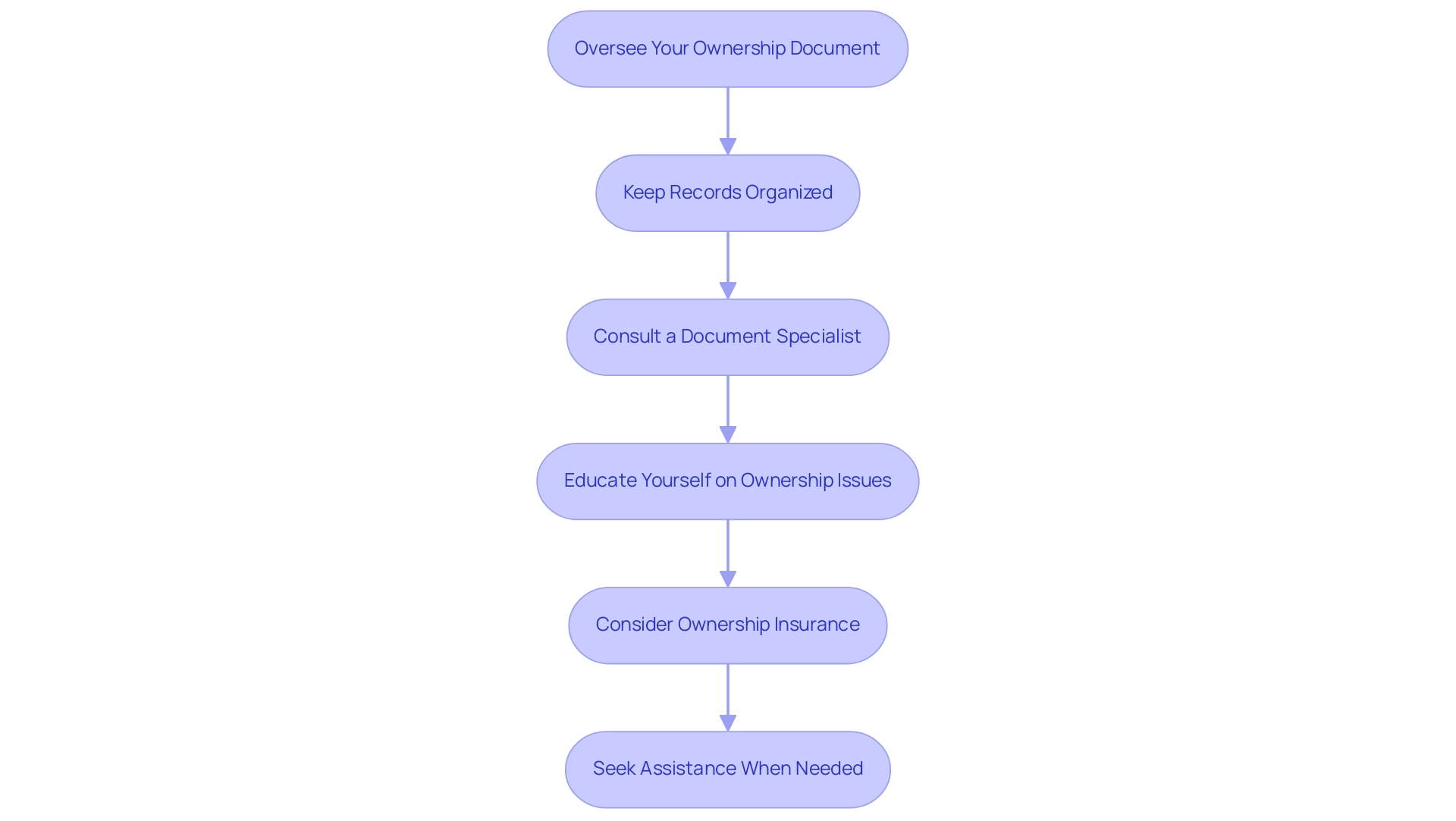

After effectively eliminating a claim from your asset documentation, it is crucial to take proactive steps to protect your holdings. Here are several key actions to consider:

-

Oversee Your Ownership Document: Frequently examining your ownership document is essential for detecting any new encumbrances or claims that might occur.

Studies indicate that approximately 60% of homeowners fail to monitor their property titles post-lien removal, which can lead to unexpected complications. By staying vigilant, you can address potential issues before they escalate.

-

Keep Records Organized: It is vital to maintain all documentation related to the removal process.

This includes the lien release and proof of payment. Having these records systematically organized will facilitate future reference and ensure that you have all necessary documentation readily available if questions arise.

-

Consult a Document Specialist: If you are contemplating selling your property or applying for a mortgage, engaging with a document specialist is highly advisable.

For instance, a homeowner who faced disputes during a sale was able to resolve the issue effectively by consulting their insurance agent, who provided clarity on the property's status. This thorough examination of your document is critical to confirm that it is clear and devoid of any lingering issues, which is essential for a smooth transaction.

-

Educate Yourself on Ownership Issues: Familiarizing yourself with the various types of ownership issues and liens is an important step in navigating potential challenges.

Understanding common pitfalls related to a lien on title house can empower you to make informed decisions and respond effectively should any complications arise.

-

Consider Ownership Insurance: To safeguard against possible future claims, acquiring ownership insurance is a wise choice. This insurance offers peace of mind and financial protection, ensuring that you are covered in the event of unforeseen disputes regarding your asset's title.

-

Seek Assistance When Needed: In the event of any , always reach out to your insurance agent or the insurance company directly, as their toll-free number is listed in the policy conditions. Additionally, for further assistance with complaints or inquiries, the Texas Department of Insurance is available to provide support.

Implementing these proactive measures will not only help you maintain a clear title but also safeguard your property against future complications.

Conclusion

Navigating the lien removal process is a critical endeavor for property owners aiming to secure their investments and maintain clear title. Understanding the specific type of lien is the first step in this journey, followed by a systematic approach that includes:

- Reviewing the lien

- Engaging with lien holders

- Negotiating settlements

- Filing a lien release

Each of these steps is crucial in ensuring that the lien is effectively removed, allowing property owners to reclaim their rights.

Once the lien is removed, it is imperative to take additional precautions. Regular monitoring of the property title, maintaining organized records, and consulting with title professionals are essential practices that can prevent future complications. Furthermore, educating oneself about potential title issues and considering title insurance can provide an added layer of protection against unforeseen claims.

In summary, a proactive approach to lien removal and post-removal considerations not only safeguards property ownership but also enhances the overall value of the real estate asset. By understanding the intricacies of the lien process and implementing strategic measures, property owners can navigate the complexities of real estate with confidence and security.

Frequently Asked Questions

What is a charge in relation to property?

A charge signifies a legal assertion against an asset, usually resulting from unsettled obligations, such as a lien on a house.

What are common types of claims that can affect property?

Common types of claims include mortgage claims, tax claims, and mechanics claims.

What are the steps to remove a claim from a property title?

The steps include: 1. Review the claim document. 2. Contact the lien holder to negotiate payment. 3. Obtain a document of clearance after fulfilling payment obligations. 4. Submit the release document to the local county recorder’s office.

What documents are necessary to remove a claim from a property title?

Essential documents include: 1. Release Document 2. Proof of Payment 3. Identification (government-issued ID and property title deed) 4. Completed Removal Forms

How does the priority of construction claims affect the removal process?

The priority of construction claims can vary based on whether the project is new construction or an alteration, influencing how claims are managed and removed.

What strategies can enhance success in negotiating with claim holders?

Key strategies include: 1. Being prepared with documentation. 2. Knowing your rights regarding claims and debts. 3. Proposing a settlement or payment plan. 4. Staying professional during negotiations.

What steps should be followed to file a claim discharge?

The steps include: 1. Visit the local recorder’s office. 2. Complete the required forms. 3. Submit your documentation. 4. Pay any filing fees. 5. Request a stamped copy of the document for your records.

What proactive steps should be taken after removing a claim?

Proactive steps include: 1. Overseeing your ownership document. 2. Keeping records organized. 3. Consulting a document specialist if selling or applying for a mortgage. 4. Educating yourself on ownership issues. 5. Considering ownership insurance. 6. Seeking assistance when needed for disputes.