Overview

The article presents a comprehensive guide on how to perform a property lien search for free. It outlines a step-by-step process that includes:

- Gathering asset details

- Utilizing local government resources

- Consulting with title companies

Importantly, it emphasizes the necessity of conducting such searches to avoid financial losses and legal complications. Thorough investigations can safeguard real estate transactions and ensure informed decision-making, reinforcing the value of meticulous title research.

Introduction

Navigating the world of property ownership presents a complex endeavor, particularly in understanding property liens. These legal claims against a property, often arising from unpaid debts, can profoundly impact real estate transactions and ownership rights. Various types of liens—such as mortgage, tax, judgment, and mechanic's liens—each pose unique challenges and implications for both buyers and sellers.

As the real estate landscape evolves, awareness of these potential encumbrances becomes crucial for making informed decisions. This article explores the intricacies of property liens, underscores the importance of conducting thorough lien searches, and outlines strategies for effectively managing any liens that may arise. By equipping oneself with this knowledge, stakeholders can confidently and securely navigate the complexities of property transactions.

Understanding Property Liens: What You Need to Know

A real estate encumbrance signifies a legal assertion against an asset, typically stemming from outstanding obligations. Understanding the various categories of claims is crucial for real estate experts, as each can significantly impact a property lien search free and real estate transactions. The main classifications include:

- Mortgage Claims: These voluntary claims arise when an asset is financed through a mortgage. They represent the most common form of security interest and are vital for homebuyers, particularly given the growing popularity of government-backed mortgages that assist buyers with limited down payments. This trend contributes to an increasing share of in the market.

- Tax Claims: Imposed by the government for unpaid real estate taxes, these claims can lead to severe consequences, including foreclosure. They are often prioritized over other claims, making it essential for landowners to stay informed about their tax obligations.

- Judgment Claims: Resulting from court rulings against the landowner, these claims can emerge from various legal disputes, such as unpaid debts or damages awarded in lawsuits. They can complicate the sale or refinancing of an asset, as resolution is required before ownership transfer.

- Mechanic's Claims: Filed by contractors or suppliers who have not received payment for work performed on the asset, mechanic's claims can present significant challenges for asset owners. They ensure that individuals who contribute to enhancing an asset are compensated, thereby influencing the asset’s marketability.

Each claim category carries specific legal ramifications that can hinder the ability to sell or refinance the asset, underscoring the necessity of a property lien search free prior to proceeding. For example, a recent case study highlighted the complexities surrounding Medicaid claims, where certain states impose claims on homes occupied by survivors of deceased Medicaid beneficiaries. Although recovery is prohibited during the lifetime of specific relatives, the potential for future claims can create confusion and distress for surviving family members.

Understanding these nuances is essential for making informed real estate decisions.

Current data indicates that a substantial portion of assets in the U.S. are encumbered by mortgage claims, reflecting the ongoing reliance on financing in the housing market. Starting in 2025, the prevalence of various claims emphasizes the necessity for comprehensive investigations in real estate transactions, which may include a property lien search free. Additionally, LexID® identity linking technology guarantees 99% accuracy in linking reliability, highlighting the importance of precise claims searches.

Real estate professionals must stay abreast of recent changes in asset encumbrance regulations to navigate these complexities effectively. As Anju Vajja, a FHFA Research Officer, noted, the Mortgage Bankers Association (MBA) and Fannie Mae anticipate a slight decline in the Housing Price Index (HPI) by Q1 2024, with expectations of a modest recovery by the end of 2024, which could further influence the landscape of real estate claims.

Why Conduct a Property Lien Search? The Risks of Ignoring Liens

Conducting [ free](https://blog.parseai.co/how-to-conduct-a-free-property-lien-search-a-step-by-step-guide) is crucial for safeguarding against significant financial and legal repercussions. Neglecting such searches can lead to serious consequences:

- Financial Loss: Buyers may unwittingly inherit debts associated with the property, resulting in unforeseen expenses that can strain their finances. Recent statistics underscore the necessity of a property lien search free to uncover undiscovered claims that could lead to financial losses averaging thousands of dollars. As of 2025, there is a notable trend indicating a decline in across various market segments, yet the Government-backed segment remains significantly higher, appealing to homebuyers with limited down payment funds. This situation increases the risk of financial exposure from undisclosed claims.

- Legal Complications: Undiscovered claims often result in intricate legal disputes, complicating ownership transfers and potentially leading to costly litigation. A case study titled 'Homeowner Equity by Market Segments' reveals that homeowners who overlooked property searches faced legal battles that drained their resources and delayed property transactions. Joe Cardosi, a special agent in the FBI Newark field office, remarked, "Unfortunately, the title companies often bear the brunt of the financial loss in this fraud," highlighting the legal risks involved.

- Foreclosure Risks: In severe cases, unpaid claims can culminate in foreclosure, jeopardizing the buyer's investment. The financial implications of undiscovered claims are particularly alarming; as of 2025, trends indicate an increase in foreclosure cases linked to unpaid debts, emphasizing the necessity for vigilance.

By conducting a property lien search free, purchasers can gain a clear understanding of any financial obligations tied to the asset, thereby protecting their investment and ensuring peace of mind. Real estate specialists consistently stress that proactive obligation inquiries are essential in today’s market, where the risks of neglecting such responsibilities can lead to dire financial consequences.

Step-by-Step Process for Performing a Property Lien Search

To effectively conduct a lien inquiry using advanced tools like Parse AI, adhere to the following detailed steps:

- Gather Asset Details: Start by collecting essential specifics about the asset, including its address, legal description, and the current owner's data. This foundational data is crucial for conducting free and ensuring accurate results.

- Visit Local Government Offices: Engage with local government entities such as the county recorder, clerk, or assessor's office. Many counties now offer online databases that provide access to public records, simplifying the retrieval process.

- Explore Online Databases: Utilize online resources, including county websites and specialized record retrieval tools, to find related information. Utilizing Parse AI's advanced machine learning tools can significantly reduce the time spent on inquiries, as in areas like New York can take between 24 to 72 hours, while more complex assessments may extend to 10 to 14 days.

- Review Public Records: Carefully examine the public records for any recorded claims, mortgages, or judgments associated with the property. Identifying these encumbrances early is vital, and performing a property lien search free can help prevent impacts on the sale and necessitate corrective actions, such as drafting and recording a corrective deed. Comprehensive investigations, such as a property lien search free, are crucial to navigate real estate transactions with assurance.

- Request Copies of Documents: If any liens are discovered, promptly request copies of the relevant documents. Maintaining accurate records of these findings is essential for future reference and for addressing any potential issues.

- Consult a Title Company: For a more thorough examination and analysis of the findings, consider enlisting the services of a title company. Their expertise can provide additional insights and ensure that all potential issues are addressed, facilitating a smoother transaction process.

By following these steps and leveraging Parse AI's automated document processing capabilities, including the example manager for quick annotation and information extraction, title researchers can uncover potential issues early in the transaction process, ensuring a legally sound transfer of ownership. Proactive inquiries can avert issues during closing, ultimately conserving time and resources.

Where to Find Information for Your Lien Search: Resources and Tools

When conducting a property lien search, it is essential to utilize a variety of resources to ensure comprehensive results.

- County Recorder's Office: This serves as the primary repository for property records, including liens. Many county recorder's offices now offer online access to their databases, enabling efficient inquiries from anywhere. You will receive a password via e-mail within approximately one hour after application completion, emphasizing the efficiency of these resources.

- State and Local Government Websites: Official state websites often host valuable real estate records and obligation information, making them a reliable starting point for research.

- Online Real Estate Record Services: Platforms like Zillow and Redfin, along with local record checkers, provide user-friendly access to real estate records, including options for a property lien search free, improving the retrieval process.

- Title Companies: These specialized firms are skilled at performing comprehensive property investigations and can supply detailed reports on claims and other encumbrances, offering an additional level of assurance. Glen Lee, Chief Financial Officer, states, "Our commitment is to utilize the latest technology to provide the highest levels of service and support to citizens of the District of Columbia and customers around the world."

- Legal Aid Websites: Numerous legal aid organizations offer resources and guides that can help individuals in navigating the lien investigation process effectively.

Furthermore, leveraging Parse AI's advanced machine learning tools can significantly enhance the efficiency of . With features like full-text search and machine learning extraction, Parse AI simplifies the search process, ensuring that all relevant data is accurately captured. The example manager allows users to quickly annotate even a single example to extract information from a large set of unstructured documents, addressing the challenges faced by title researchers.

For example, homeowners can obtain copies of their deeds from the Clerk's Office, ensuring they have access to important documents related to their assets. This ultimately supports informed decision-making in real estate transactions, allowing title researchers to complete abstracts and reports faster and more accurately.

Common Challenges in Property Lien Searches and How to Overcome Them

Conducting presents several significant challenges that require careful navigation.

- Incomplete Records: Missing or incomplete records are a common issue. To mitigate this, it is essential to consult multiple sources, including local government offices and online databases, to cross-verify data. Engaging with municipal departments, such as building code enforcement and zoning offices, can uncover outstanding violations or fines early in the process, preventing delays in closing. Properties with unresolved municipal fines or code violations can hinder the closing process, necessitating that buyers address these issues before proceeding.

- Outdated Information: Property records may not always reflect the most current status. To ensure accuracy, confirm the latest information directly with the county office. This step is crucial, as unresolved municipal fines or code violations can significantly delay the closing process, requiring buyers to resolve these issues before moving forward.

- Complex Legal Language: The legal terminology found in real estate documents can be daunting. If you encounter confusing terms, it is advisable to consult a real estate attorney who can provide clarity and guidance, ensuring that you fully understand the implications of the documents.

- Fees for Access: Accessing certain records may incur fees. It is wise to anticipate these costs and budget accordingly, as they can accumulate during the process.

- Unknown Encumbrances and Easements: Be aware that unknown encumbrances and easements can limit property use and may involve claims from third parties. Comprehensive title investigations are essential to revealing these issues.

By acknowledging these challenges and applying proactive strategies, you can enhance the efficiency of your claim investigation, ultimately resulting in a smoother transaction process that includes a property lien search free of complications. As industry authority Gery Rodriguez-Albizu states, 'Conducting a comprehensive title review before finalizing a real estate sale can prevent numerous issues in the future.

Verifying Lien Information: Ensuring Accuracy and Reliability

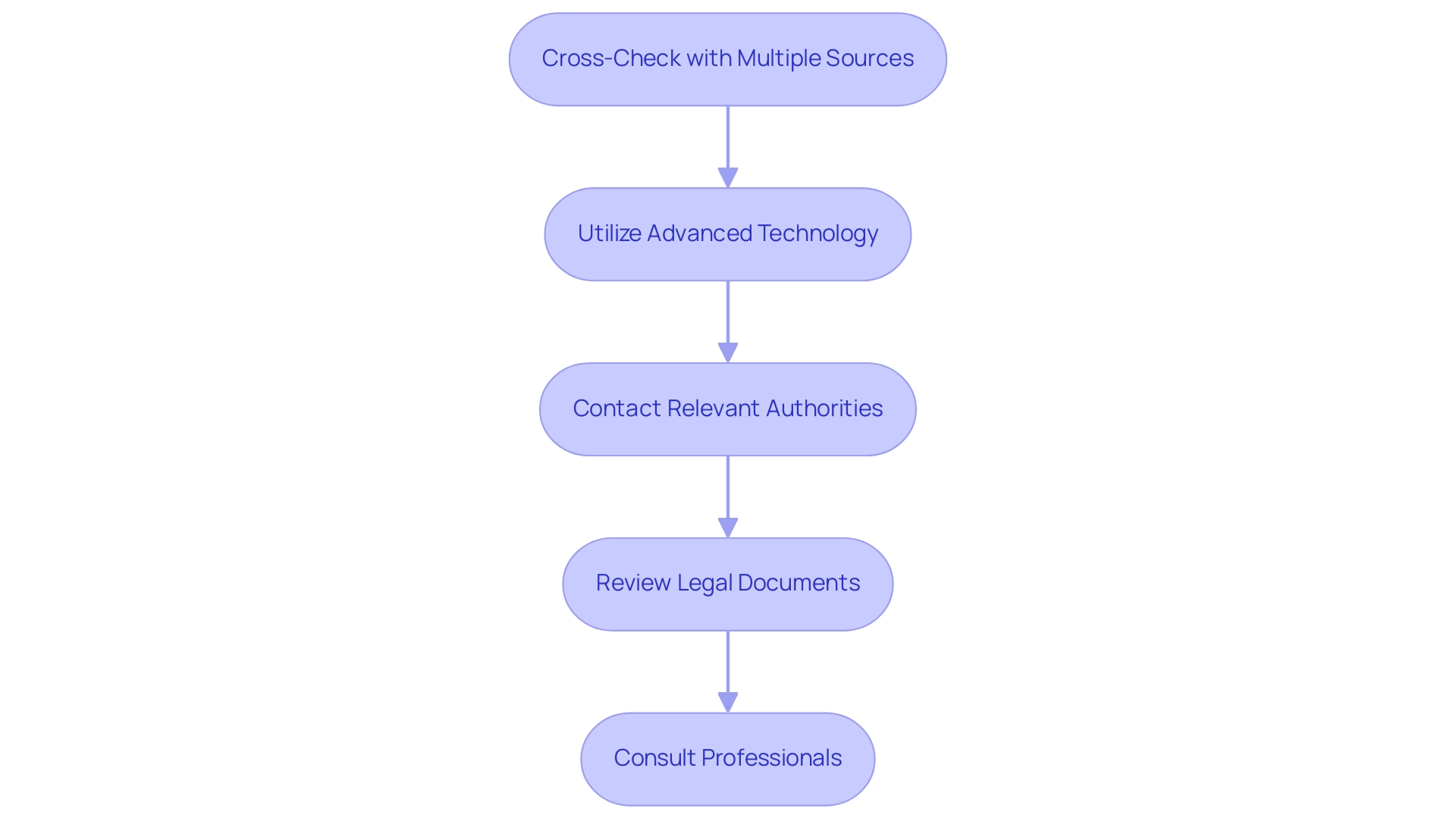

Confirming the precision of claim details is an essential step in the property lien search free process. To ensure the reliability of the data you gather, consider the following key strategies:

- Cross-Check with Multiple Sources: It is vital to compare details obtained from various databases and local offices. This practice not only helps identify inconsistencies but also enhances the overall accuracy of the data. Given that approximately 4.6 million individuals have more than one claim or judgment on file, cross-referencing becomes essential to avoid overlooking critical details.

- Utilize Advanced Technology: Leveraging platforms like Parse AI can significantly streamline the verification process. By employing advanced machine learning tools and optical character recognition (OCR), Parse AI swiftly gathers crucial details from title documents, enabling title researchers to confirm encumbrance data more effectively and precisely. This automation not only saves time but also reduces the potential for human error in data interpretation. Additionally, Parse AI's example manager feature enables users to annotate documents, further enhancing data extraction and accuracy.

- Contact Relevant Authorities: In cases where discrepancies arise, it is prudent to reach out directly to the county recorder or clerk's office. These authorities can offer clarification and verify the precision of the claim details, ensuring that you are utilizing the most trustworthy data accessible.

- Review Legal Documents: Thoroughly examine any legal documents related to the claim. Pay close attention to details such as dates, amounts, and the parties involved. This careful review can help uncover potential errors that may affect your real estate decisions.

- Consult Professionals: If there is uncertainty regarding the accuracy of the details, enlisting the help of a title company or legal expert can be beneficial. Their expertise can provide additional assurance and help navigate complex claims situations.

As noted by CT Corporation Staff, '[a] requirement that the tax claims identify a taxpayer with absolute precision would be unduly burdensome to the government’s tax-collection efforts' and that burden is on the other creditors to perform 'reasonable and diligent' searches. Implementing these verification strategies, especially with the assistance of Parse AI's innovative solutions, not only reduces the risk of future disputes but also ensures that you are equipped with , including the option of a property lien search free for informed real estate decisions. As the terrain of real estate ownership keeps changing, remaining cautious in confirming encumbrance details is more vital than ever.

What to Do If You Find a Lien: Next Steps and Considerations

Upon discovering a lien during your property search, it is essential to take a systematic approach to address the situation effectively.

- Evaluate the Claim: Start by determining the type of claim and the total amount owed. This assessment is critical, as it informs your strategy for resolution and helps you understand the potential impact on the property transaction.

- Contact the Lienholder: Initiate communication with the creditor or lienholder. Engaging in a dialogue can reveal options for resolution and may lead to a more favorable outcome.

- Negotiate Payment: If the claim is confirmed as valid, consider negotiating a payment plan or settlement. Many lienholders are open to discussions that can lead to a reduction in the amount owed or more manageable payment terms, facilitating a smoother transaction. Effective resolution strategies for judgment claims not only enhance your negotiating position but also contribute to smoother transactions in the real estate market.

- Consult a Real Estate Attorney: In situations where the claim is complex or disputed, it is prudent to seek legal counsel. As Carl E. Fumarola, a partner in , advises, "Internet subscribers and online readers should not act upon this information without seeking professional counsel." A real estate attorney can provide guidance on your rights and obligations, ensuring that you navigate the situation with a clear understanding of the legal implications.

- Document Everything: Maintain meticulous records of all communications and agreements related to the claim. This documentation will be invaluable for future reference and can protect your interests should any disputes arise later.

Furthermore, it is important to mention that the tax delinquency rate has decreased in recent years, according to CoreLogic, which may suggest a more favorable environment for resolution. In addition, utilizing technology such as Parse AI can aid in the resolution process by streamlining title research and offering substantial cost savings compared to conventional methods.

By following these steps, you can effectively manage the complexities associated with property liens, and conducting a property lien search free will help safeguard your investment and ensure a more seamless transaction process. If legal action becomes necessary, remember that a party obtaining an order compelling compliance with arbitration procedures is entitled to reimbursement of costs and attorneys' fees, which adds another layer of consideration to your approach.

Conclusion

Navigating the complexities of property liens is essential for anyone involved in real estate transactions. The various types of liens—mortgage, tax, judgment, and mechanic's liens—each carry distinct implications that can significantly affect property ownership and transactions. Understanding these legal claims empowers stakeholders to make informed decisions and avoid the pitfalls associated with unpaid debts.

The importance of conducting thorough lien searches cannot be overstated. Ignoring potential liens can lead to financial losses, legal complications, and even foreclosure risks. By employing a systematic approach to property lien searches, including leveraging advanced technology and consulting with professionals, buyers and sellers can safeguard their investments and navigate the real estate landscape with confidence.

Ultimately, being proactive in managing property liens and understanding their implications is crucial for ensuring smooth transactions and protecting financial interests. As the real estate market continues to evolve, maintaining vigilance and awareness regarding property liens will empower stakeholders to make sound decisions that contribute to successful property ownership and transaction experiences.

Frequently Asked Questions

What is a real estate encumbrance?

A real estate encumbrance signifies a legal assertion against an asset, typically stemming from outstanding obligations, which can significantly impact property transactions.

What are the main categories of claims related to real estate encumbrances?

The main categories include: Mortgage Claims (voluntary claims from financing through a mortgage), Tax Claims (imposed by the government for unpaid real estate taxes), Judgment Claims (resulting from court rulings against the landowner), and Mechanic's Claims (filed by contractors or suppliers for unpaid work on the asset).

How do mortgage claims affect homebuyers?

Mortgage claims represent the most common form of security interest and are vital for homebuyers, especially with the rise of government-backed mortgages that assist buyers with limited down payments.

What are the consequences of tax claims on property owners?

Tax claims can lead to severe consequences, including foreclosure, and are often prioritized over other claims, making it essential for landowners to stay informed about their tax obligations.

What complications can arise from judgment claims?

Judgment claims can complicate the sale or refinancing of an asset, as resolution of the claim is required before ownership transfer.

What are mechanic's claims and why are they significant?

Mechanic's claims are filed by contractors or suppliers who have not been paid for work performed on the asset, and they can present challenges for asset owners by affecting the asset’s marketability.

Why is conducting a property lien search free important?

Conducting a property lien search free is crucial to safeguard against financial losses, legal complications, and foreclosure risks associated with undiscovered claims.

What financial risks are associated with neglecting a property lien search?

Buyers may inherit debts tied to the property, leading to unforeseen expenses that can strain finances, averaging thousands of dollars in potential losses.

What legal complications can arise from undiscovered claims?

Undiscovered claims can result in intricate legal disputes that complicate ownership transfers and may lead to costly litigation.

What are the foreclosure risks linked to unpaid claims?

Unpaid claims can culminate in foreclosure, jeopardizing the buyer's investment, with trends indicating an increase in foreclosure cases linked to such debts.

What recent trends are impacting the real estate market and claims?

There is a notable trend indicating a decline in low equity mortgages, but the government-backed segment remains high, appealing to homebuyers with limited down payment funds, increasing the risk of financial exposure from undisclosed claims.